Highlights Geopolitical conflicts point to energy price spikes and could add to inflation surprises in the near term. However, US fiscal drag and China’s economic slowdown are both disinflationary risks to be aware of. …

Highlights There is a high risk of a global demand shortfall in 2022. This is because consumer demand for services will remain well below its pre-pandemic trend… …while the recent booming demand for goods is crashing…

Highlights The 26th Conference of the Parties (COP26) will open this weekend in Glasgow, Scotland, amid a global crisis induced in no small measure by policies and regulations that led to energy-market failures. Price-distorting…

In lieu of next week’s report, I will be presenting the quarterly Counterpoint webcast titled ‘Where Is The Groupthink Wrong? (Part 2)’. I do hope you can join. Highlights If a continued surge in the oil price…

Highlights The surge in energy prices going into the Northern Hemisphere winter – particularly coal and natgas prices in China and Europe – will push inflation and inflation expectations higher into the end of 1Q22 (Chart of…

Highlights Gold prices will continue to be challenged by conflicting information flows regarding US monetary policy; higher inflationary impulses from commodity prices and supply-chain bottlenecks; global economic policy uncertainty,…

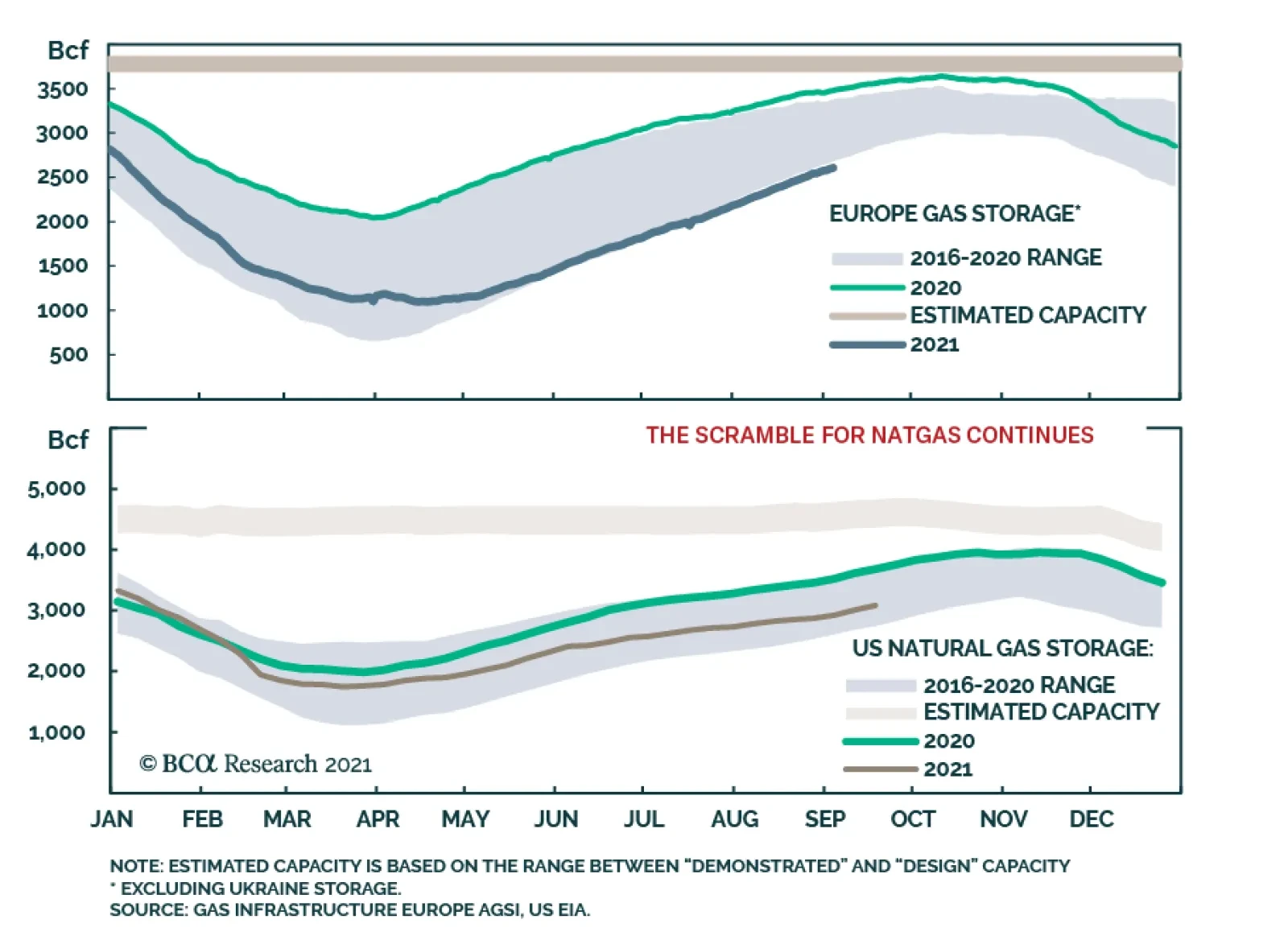

BCA Research’s Commodity & Energy Strategy service concludes that the ultimate path global gas prices will take is at maximum uncertainty at present. The current heated – no pun intended – competition for natgas going into…

HighlightsThe power shortage in China due to depleted coal inventories and low hydro availability will push copper and aluminum inventories lower, as refineries there – which account for roughly one-half of global capacity – are shut to…

Highlights Asian and European natural gas prices will remain well bid as the Northern Hemisphere winter approaches. An upgraded probability of a second La Niña event this winter will keep gas buyers scouring markets for supplies…

Highlights The odds of a stronger recovery in EM oil demand next year are rising, as vaccines using mRNA technology are manufactured locally and become widely available.1 This will reduce local lock-down risks in economies relying on…