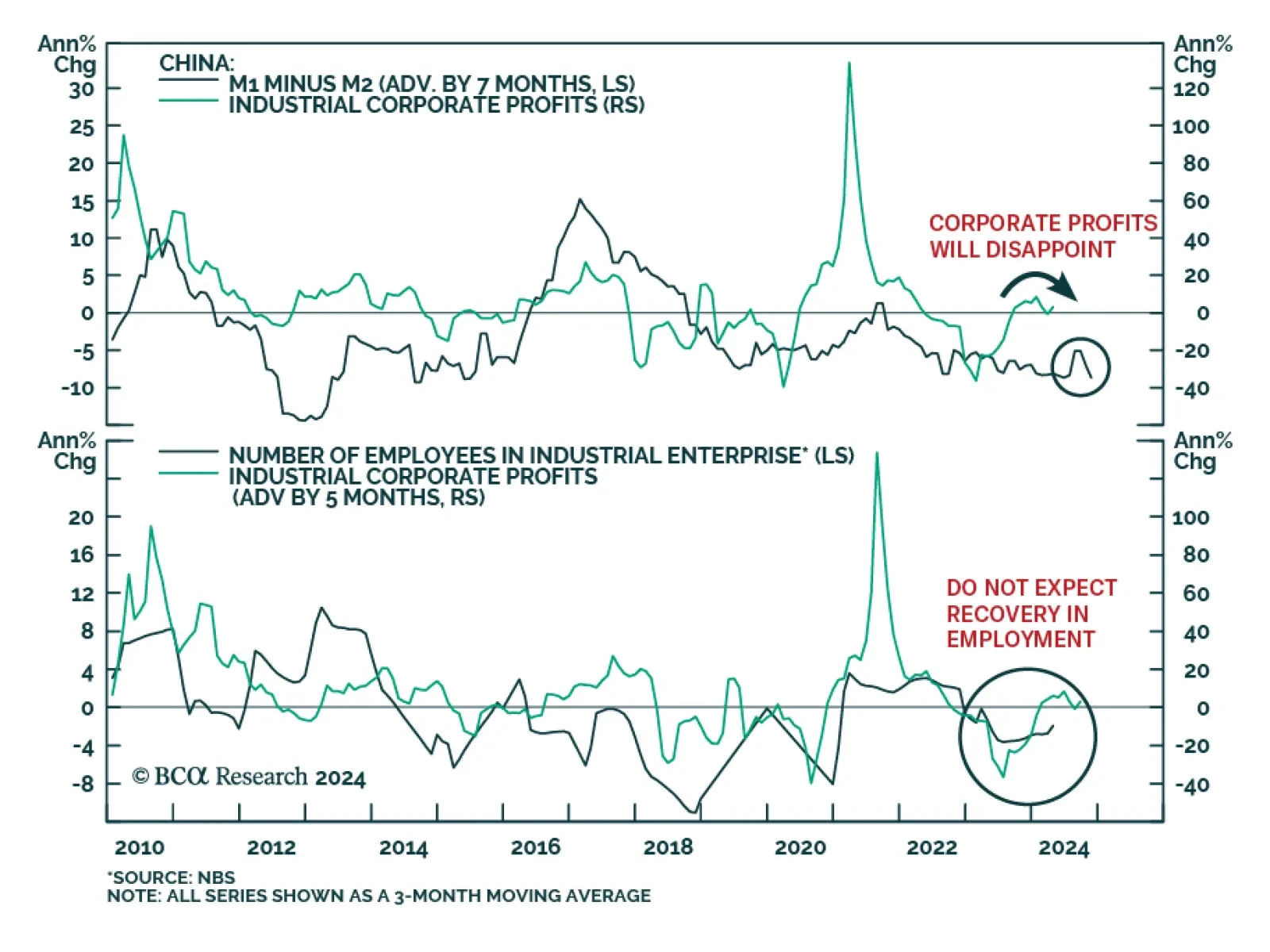

Chinese new loans grew from CNY 10.2 tr to CNY 11.1tr in May, disappointing expectations of CNY 11.3tr. Year-to-date aggregate financing also came short of anticipations, growing from CNY 12.7tr to CNY 14.8tr. Notably, the…

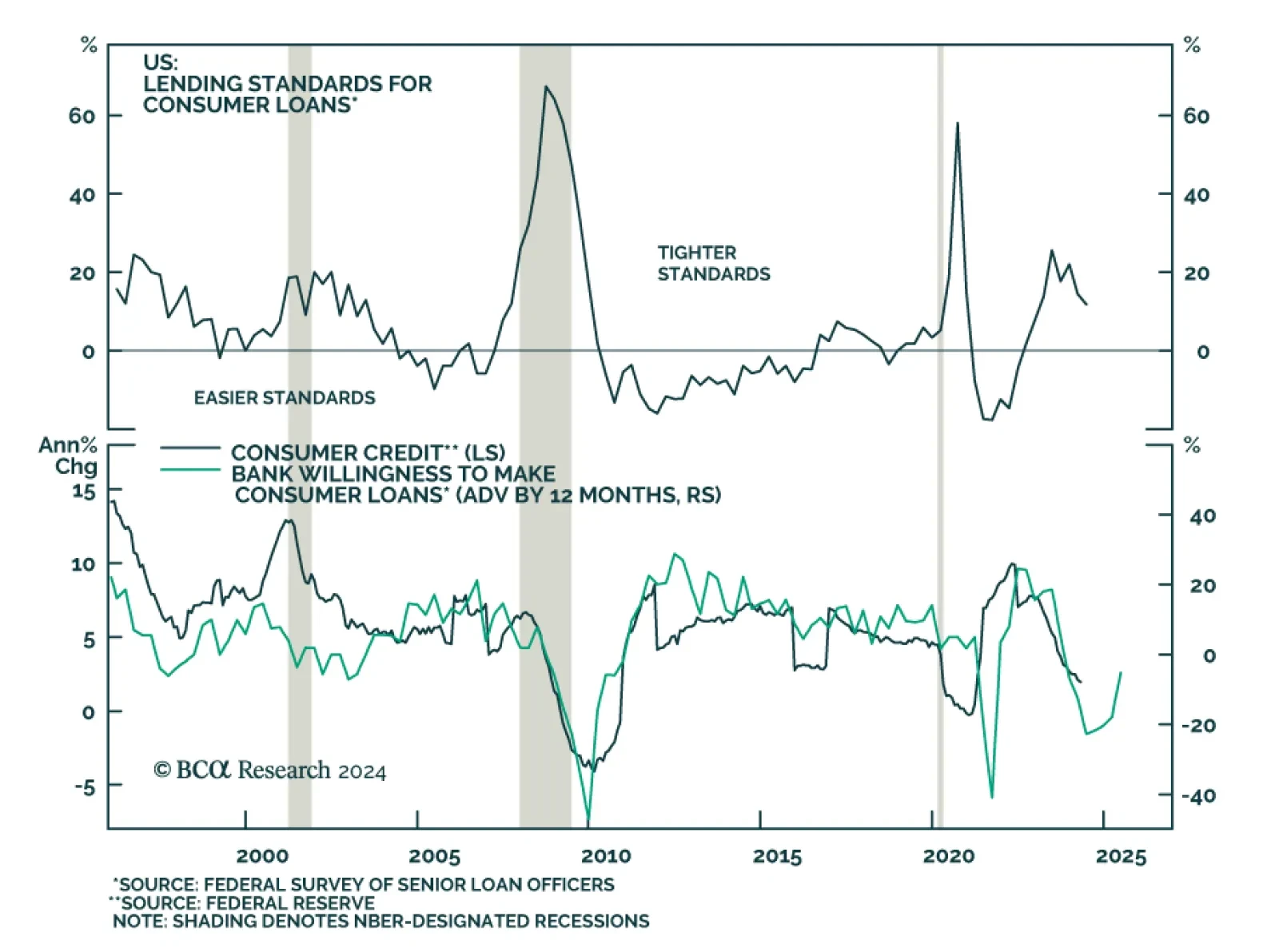

Total consumer credit rose by USD 6.4 billion in April (to USD 5,053 billion outstanding), from a USD 1.1 billion decrease in March (a large downward revision to the USD 6.3 billion rise initially reported) and significantly shy…

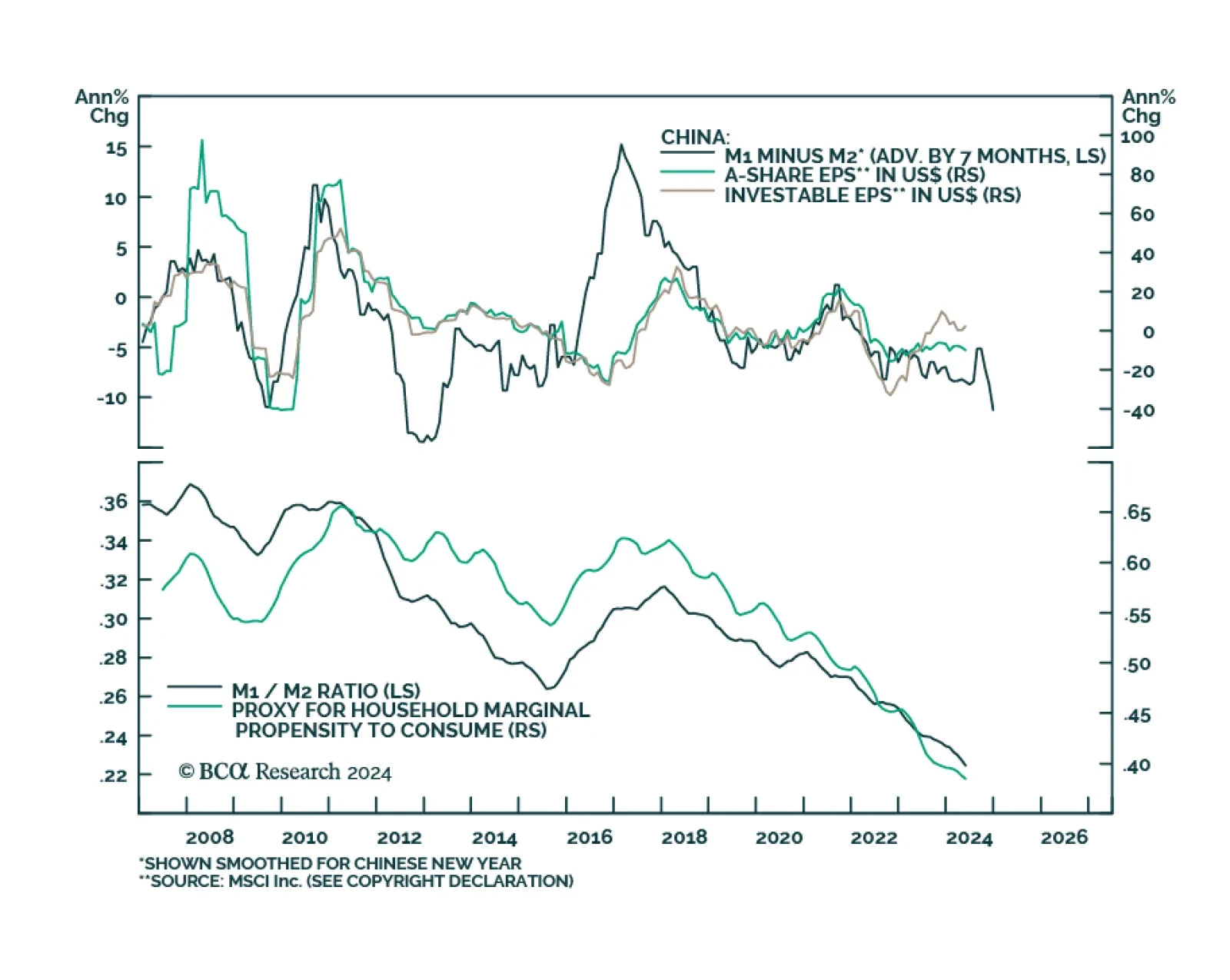

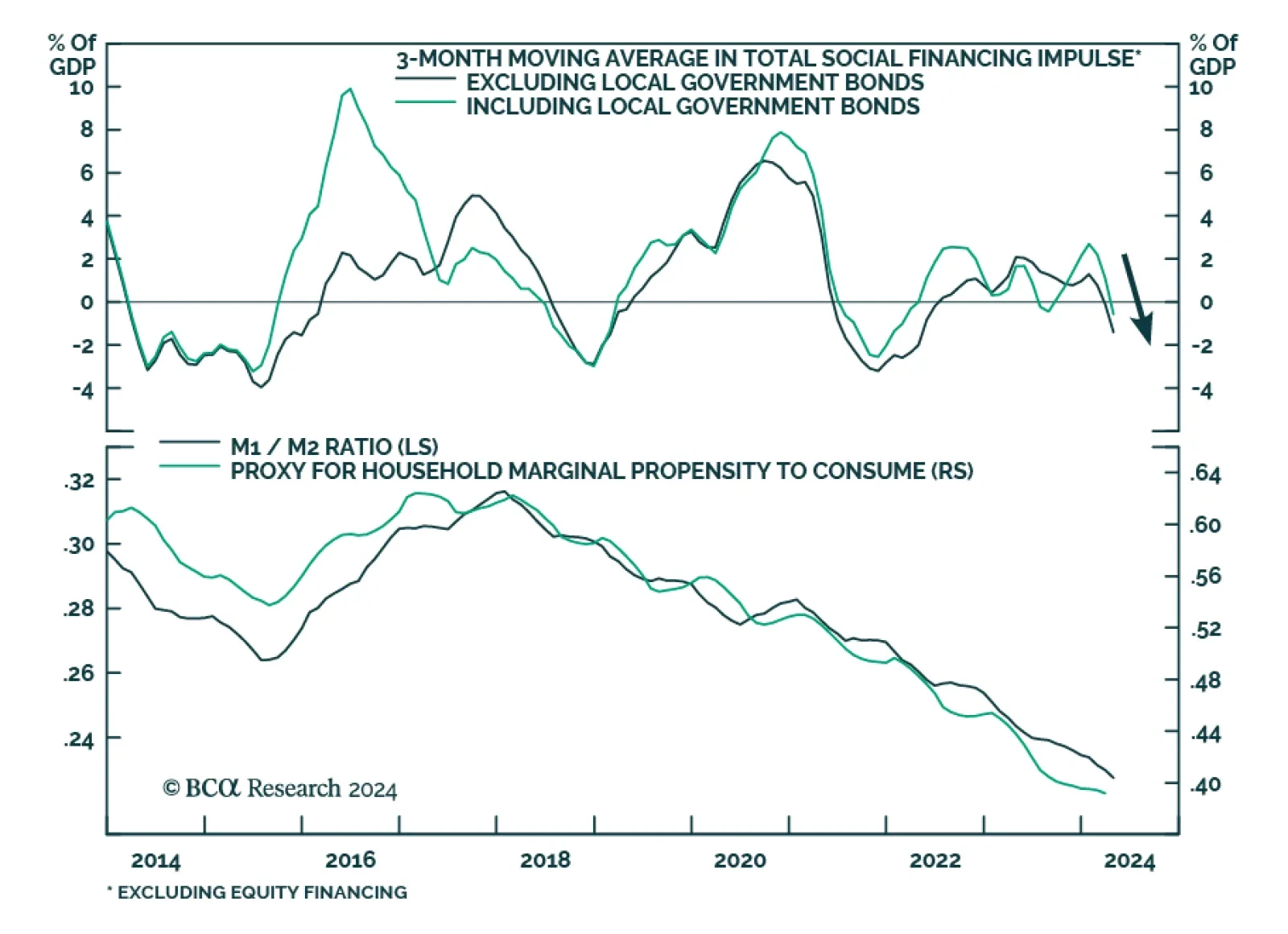

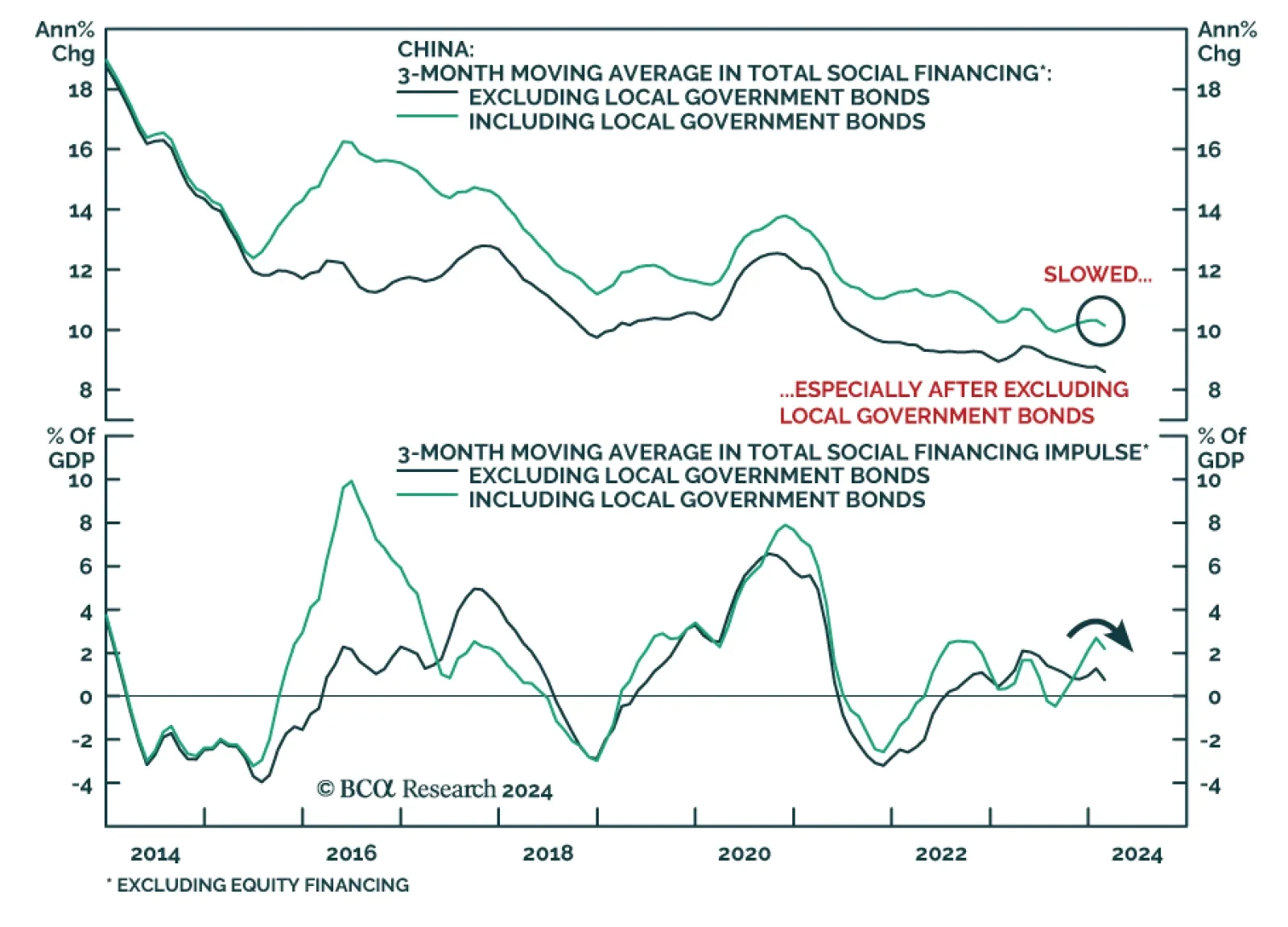

As in many other countries, China’s cyclical consumption growth is primarily driven by labor market conditions, income, and borrowing. BCA Research’s China Investment Strategy service maintains the view that these…

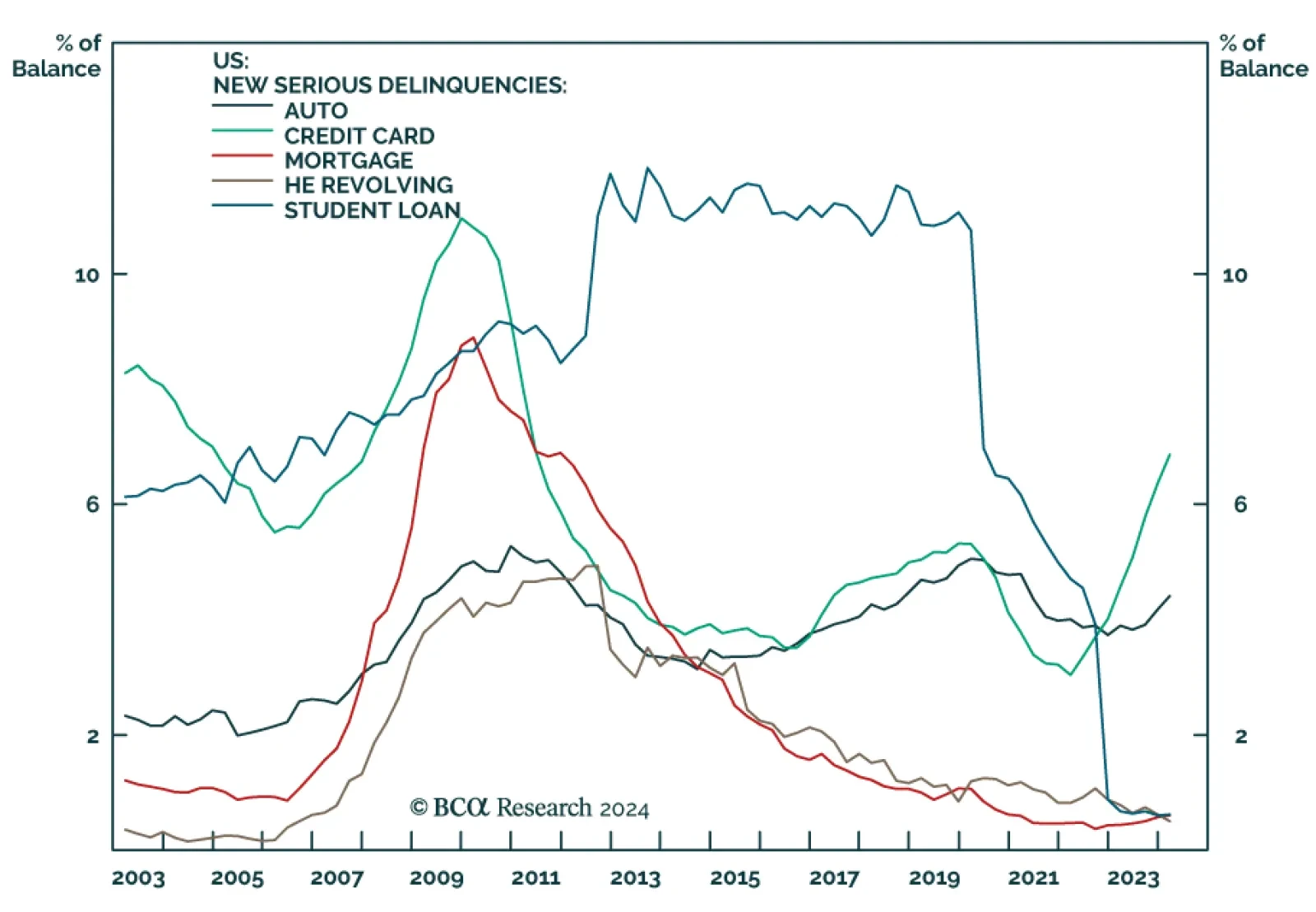

The New York Fed Quarterly Report on Household Debt and Credit indicates that US household debt rose 1.1% q/q in Q1 to $17.7 trillion. Higher mortgage, home equity loan and auto loan balances drove the bulk of the Q1 increase,…

Chinese aggregate financing, a broad measure of credit, declined on a YTD basis, from CNY 12.9tr to CNY 12.7tr in April, disappointing expectations that it would grow to CNY 13.9tr. Moreover, new loan growth missed expectations (…

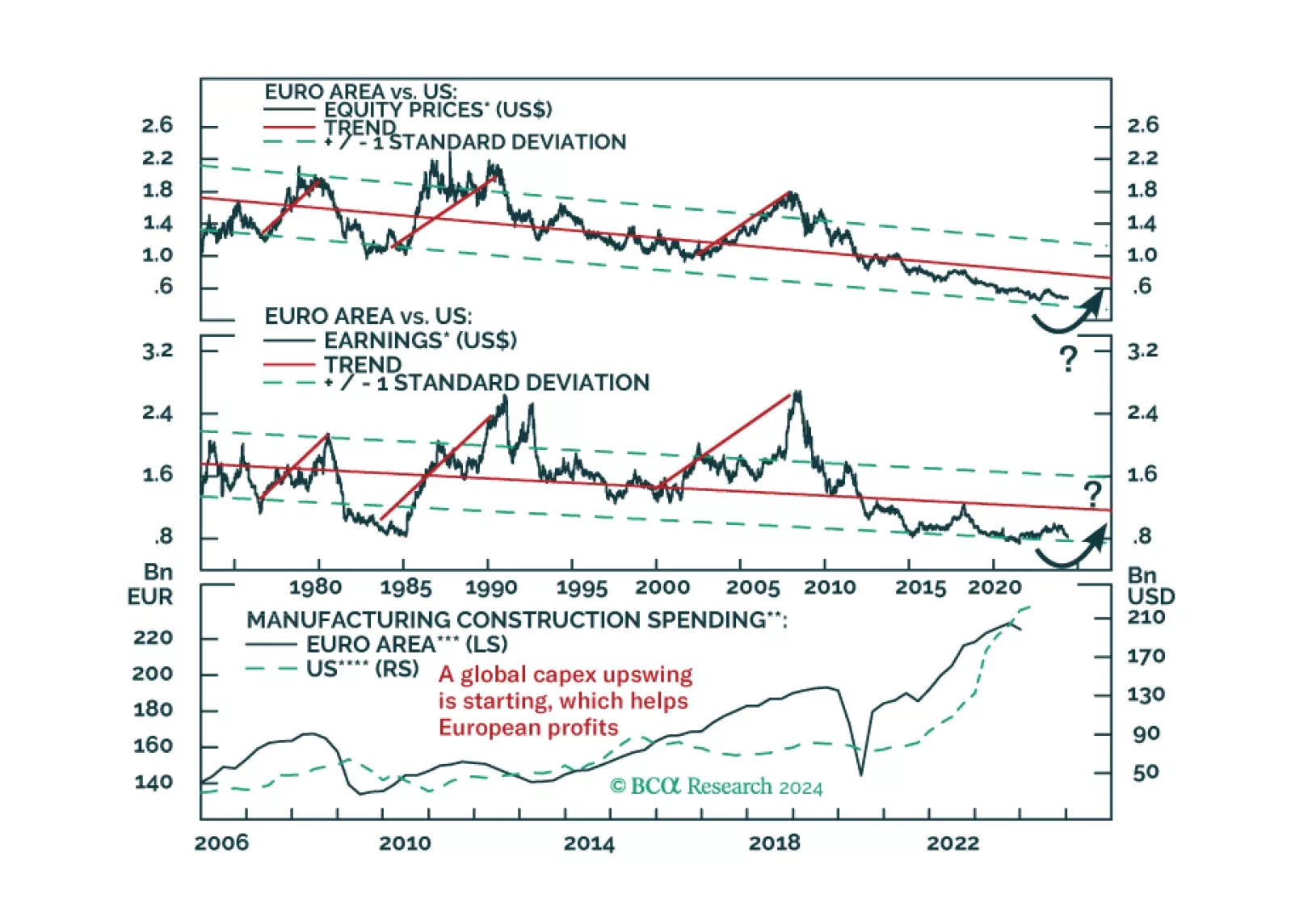

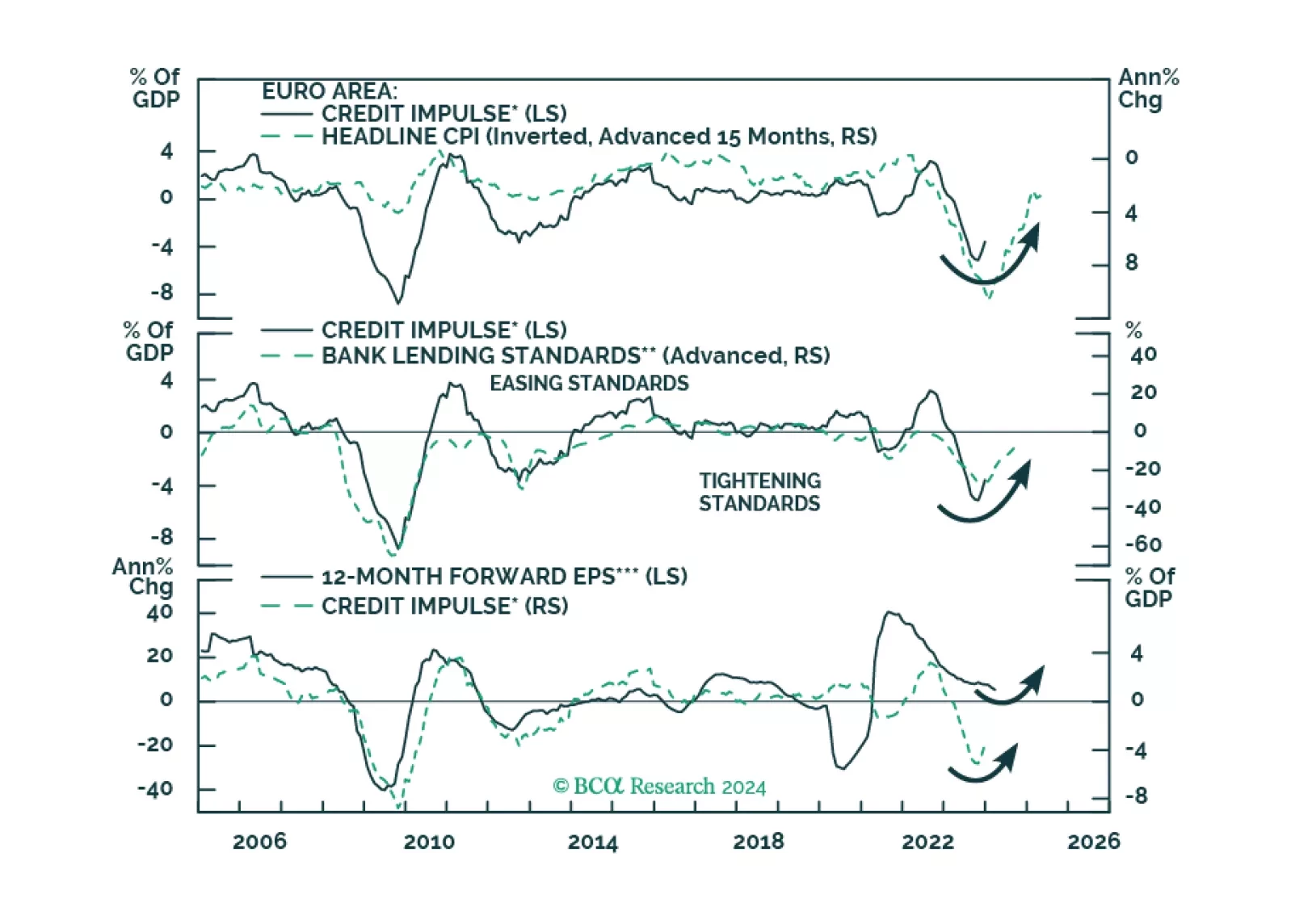

Europe credit flows are stabilizing, hence a major drag on the region’s growth will dissipate. What does this development imply for European equities?

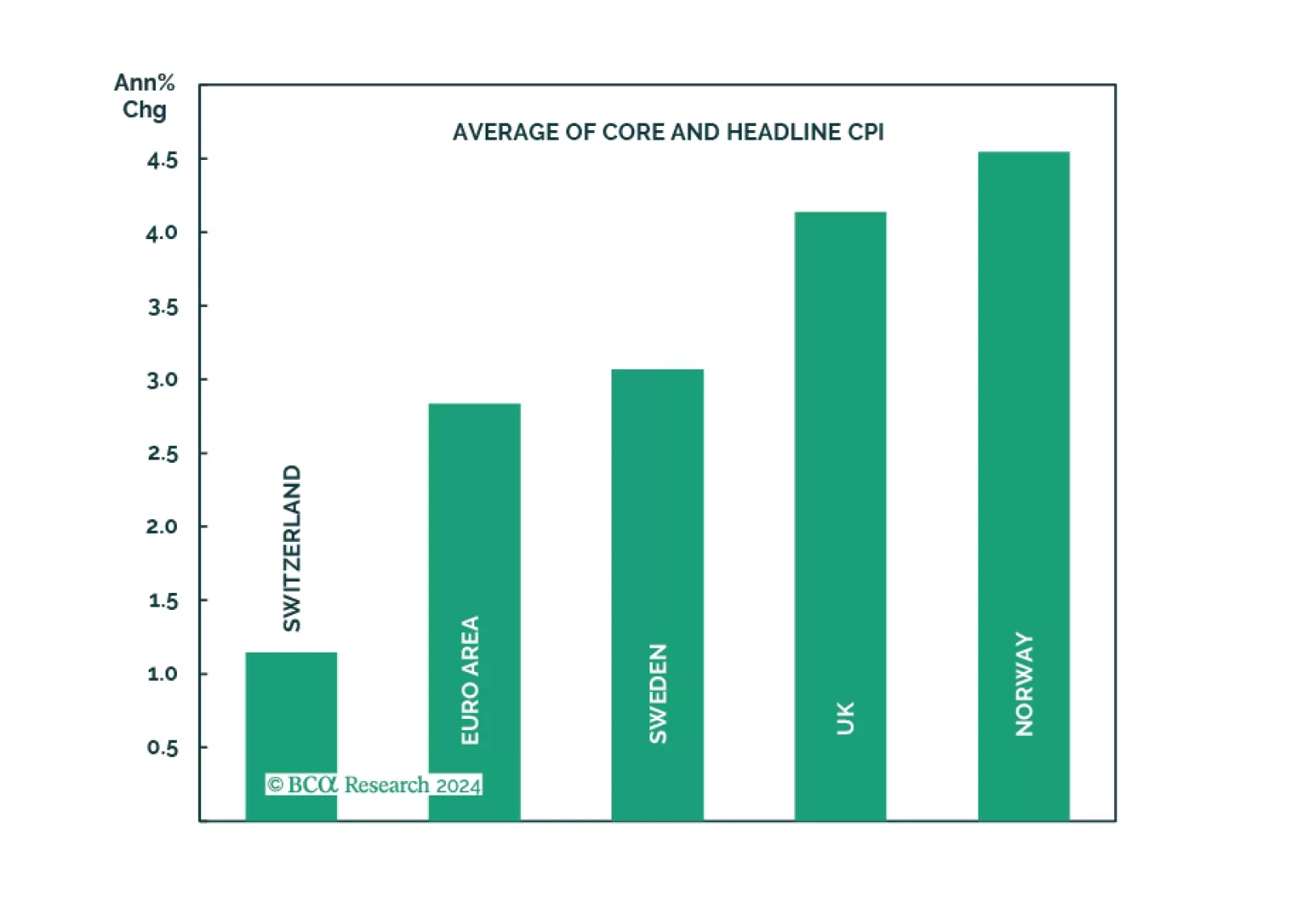

Does the recent surprise rate cut by the Swiss National Bank augur other dovish surprises among major central banks in Europe?

Chinese private sector credit demand remained weak in February, sending a negative signal about domestic economic conditions. Total social financing growth slowed from a record CNY6.5 trillion in January to CNY1.56 trillion,…