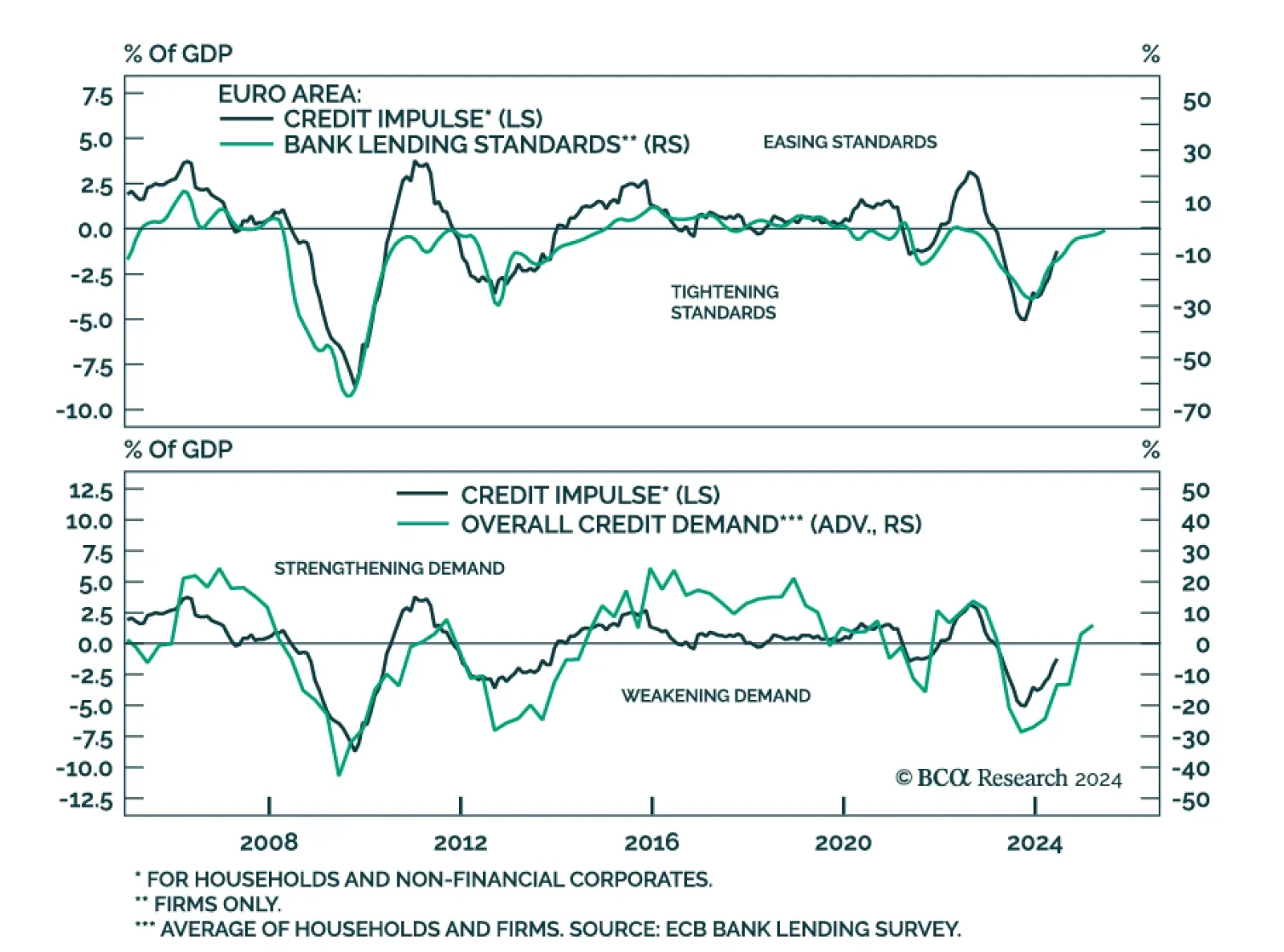

Banks reported an increase in loan demand from both firms and households in the European Central Bank’s Bank Lending Survey, marking the first rise since 2022. This demand increase occurred as lending standards for firms…

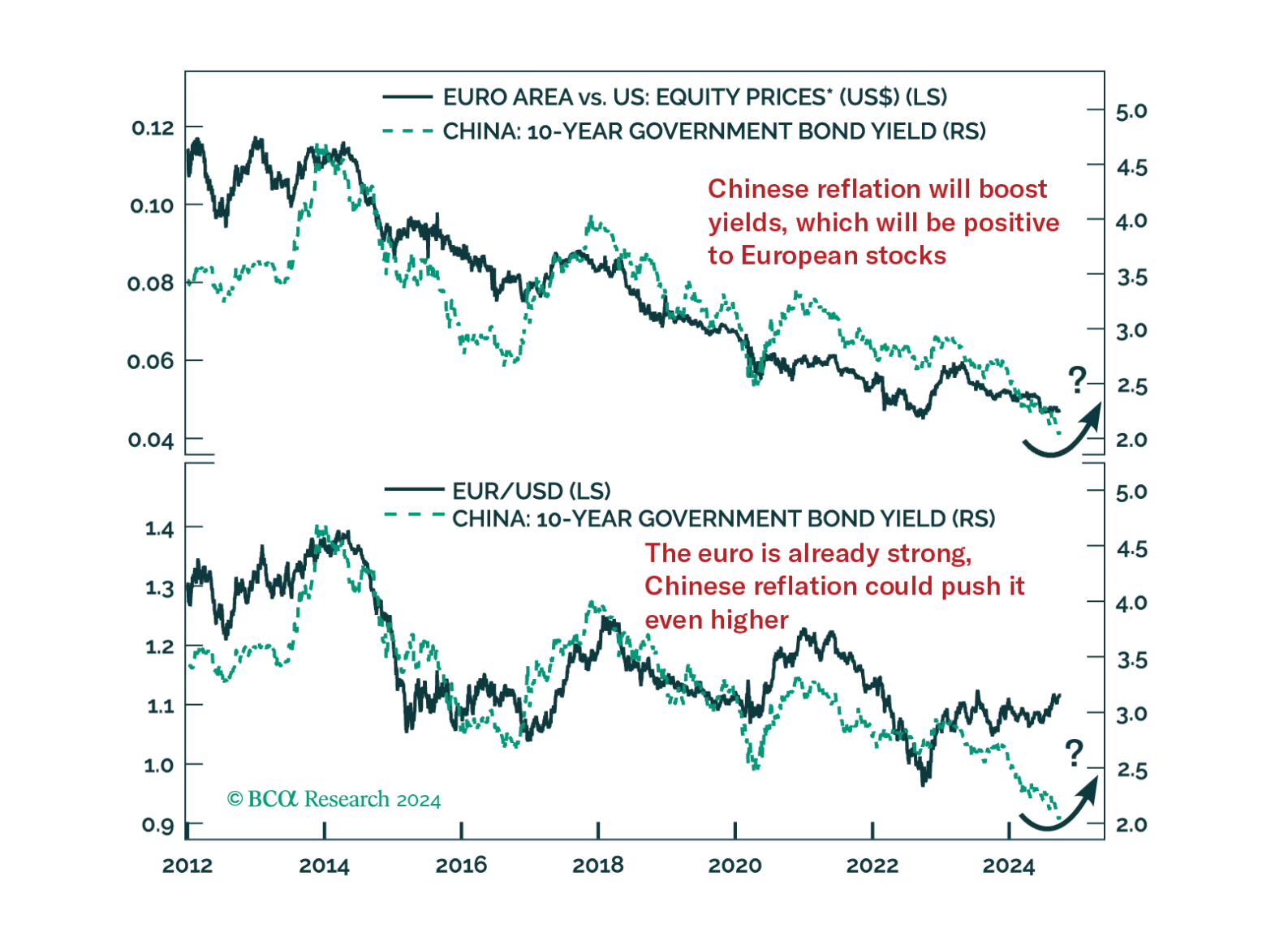

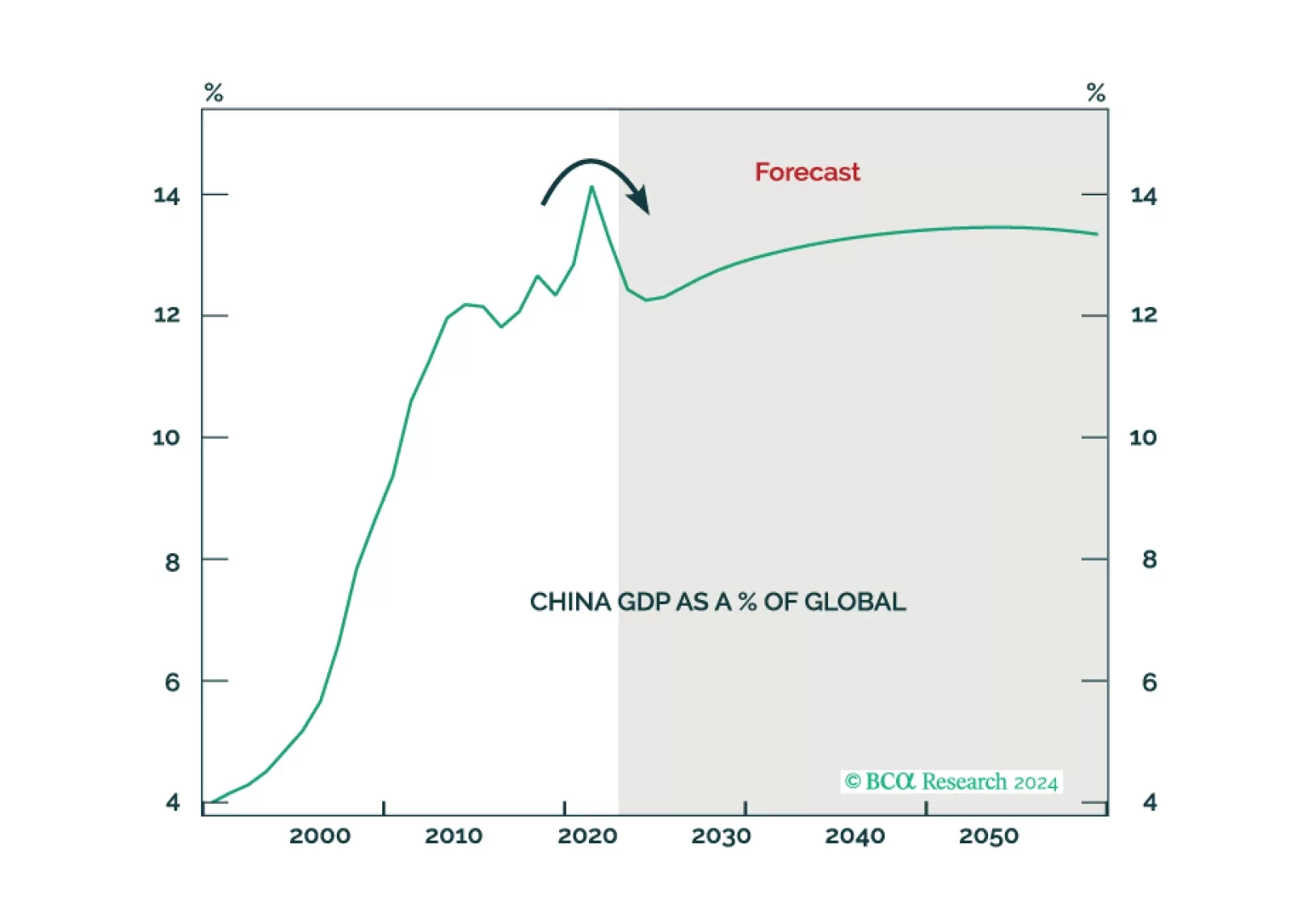

China’s Politburo announcement is likely to lead to a repricing of China’s growth in the near-term. Read how investors can hedge against this potent threat to our defensive investment stance.

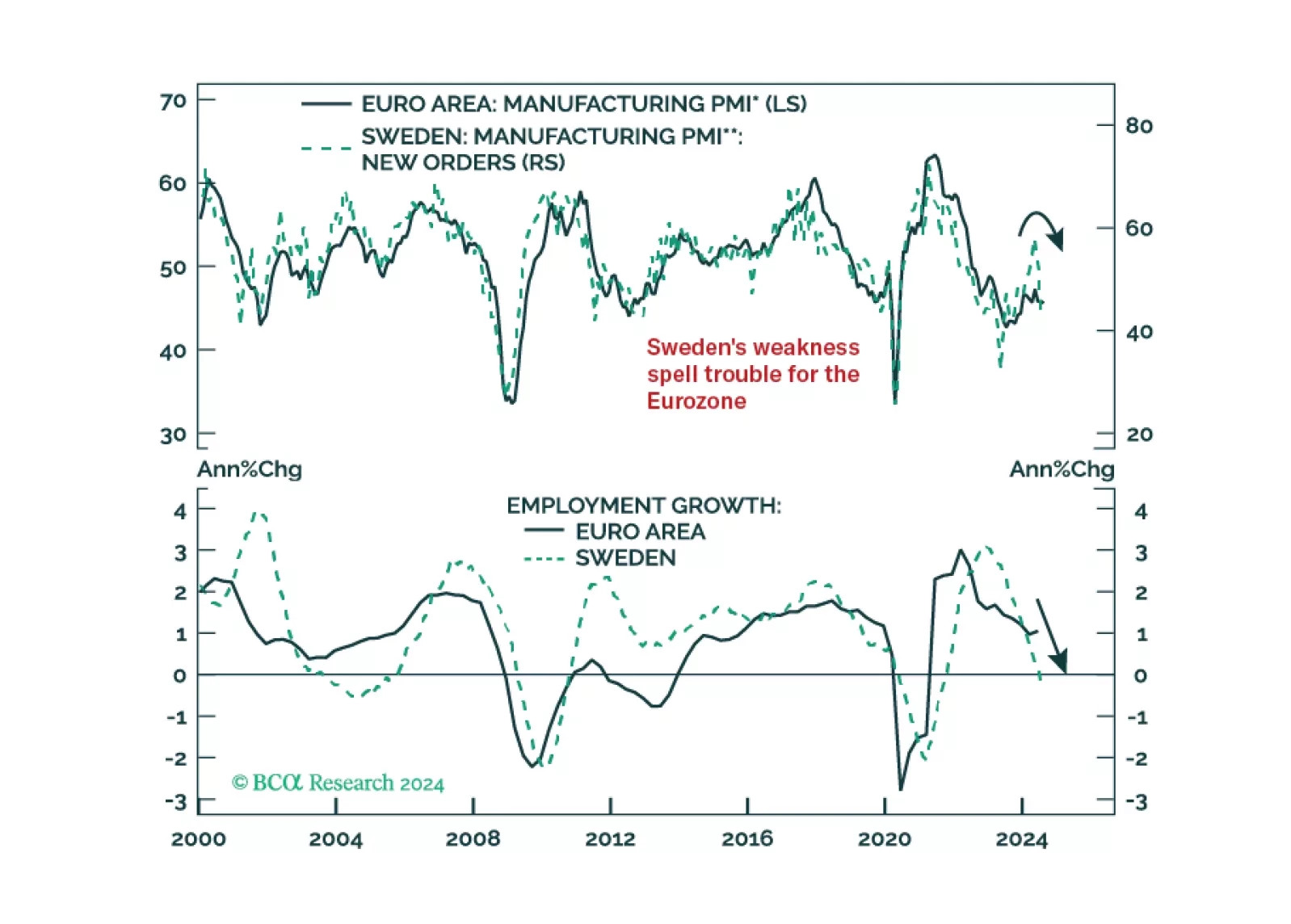

Our negative stance on European growth and assets is not devoid of risks. To gauge whether these risks warrant upgrading our growth outlook, we monitor Sweden closely. So, what is the current message from this Nordic economy?

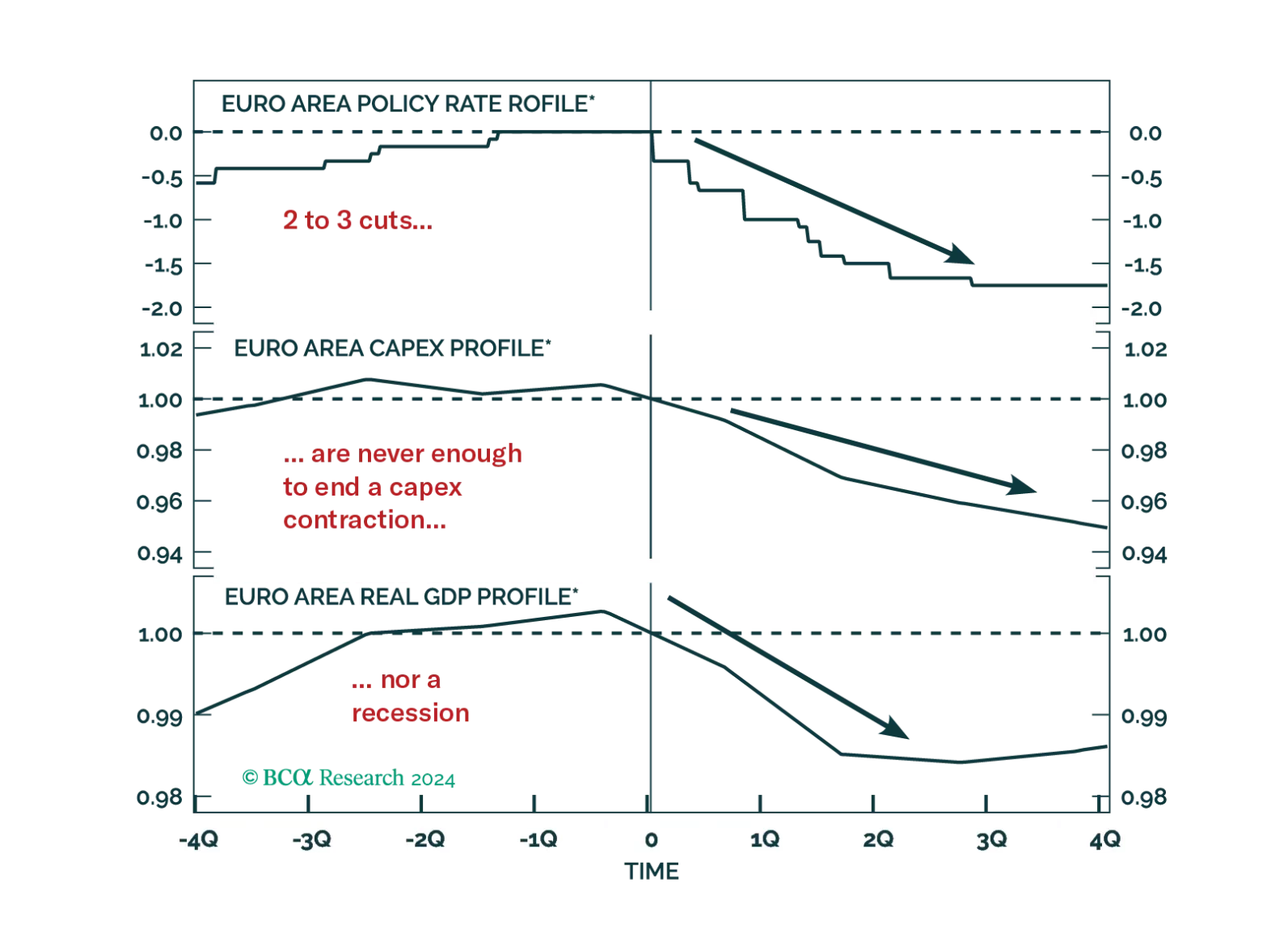

Investors hope that the ECB rate cuts priced into the curve will be sufficient to achieve a soft landing in Europe. History argues against this view, but will this time be different?

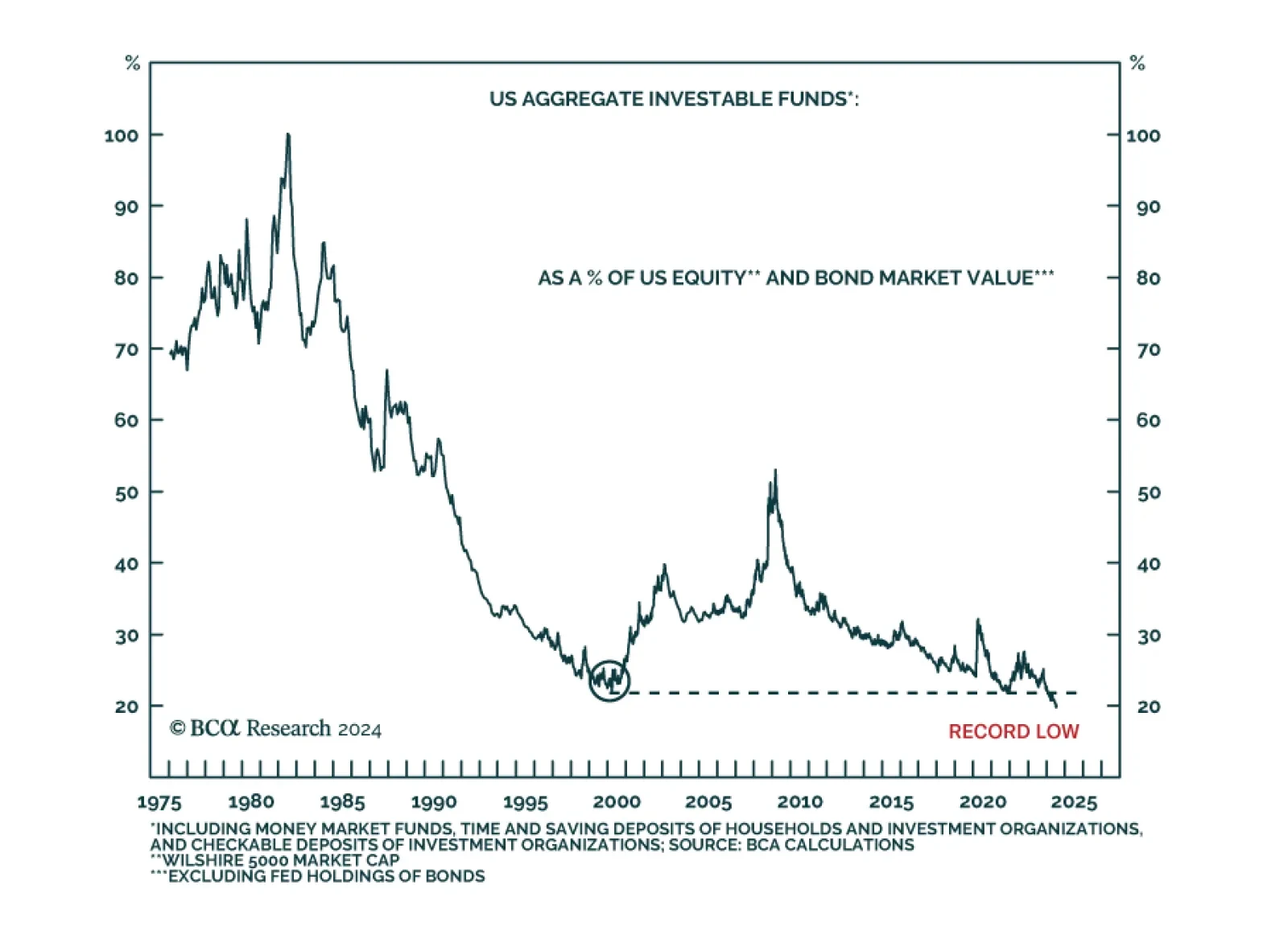

According to BCA Research’s Emerging Markets Strategy service, there is little firepower left to sustain the US equity rally much further. The ratio of aggregate investable funds of US households and investment…

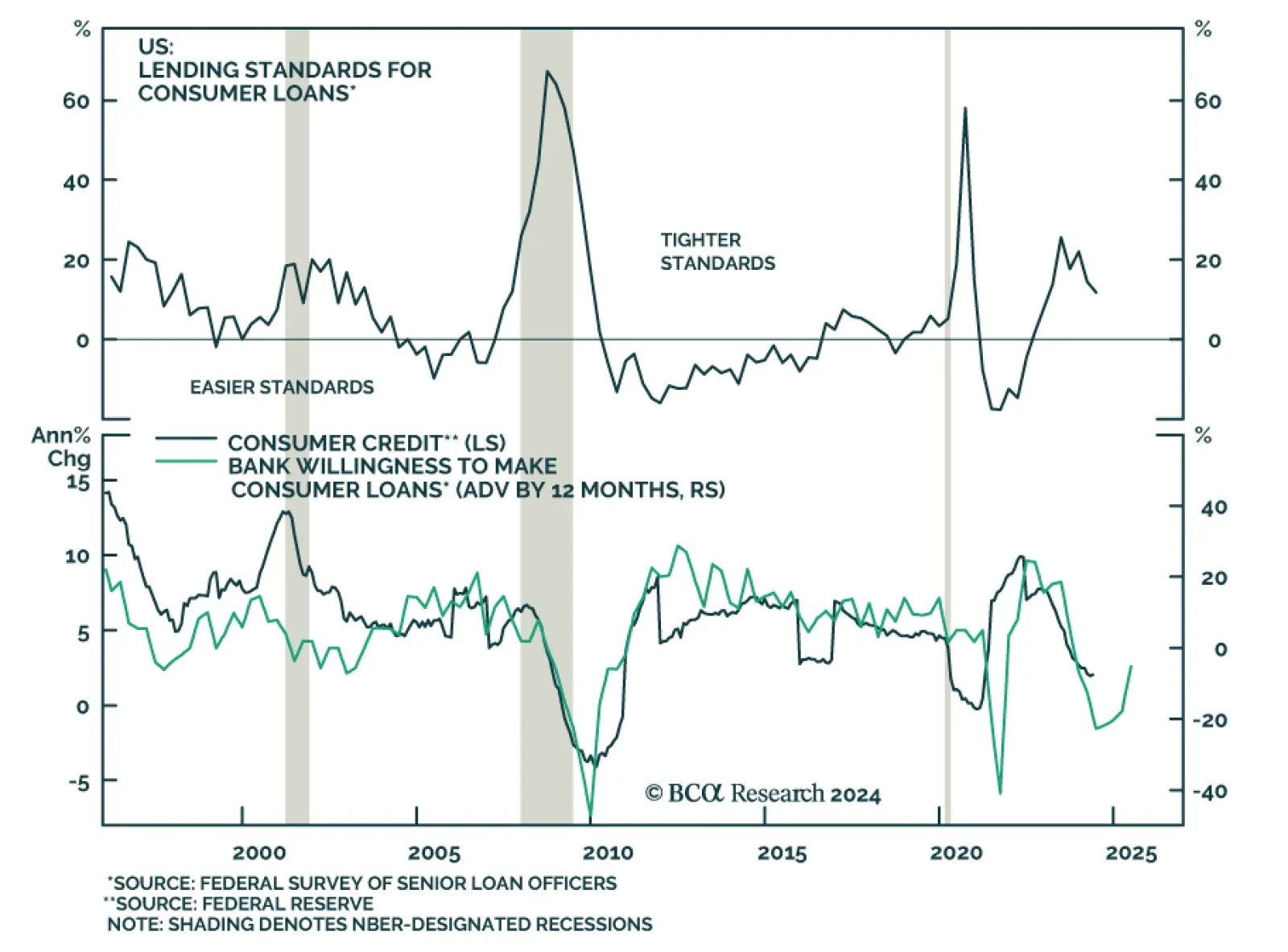

Total consumer credit rose by USD 11.4 billion in May (to USD 5,065 billion outstanding) from a slightly upwardly revised USD 6.5 billion increase in April, surpassing expectations of a smaller increase. Notably, revolving credit…

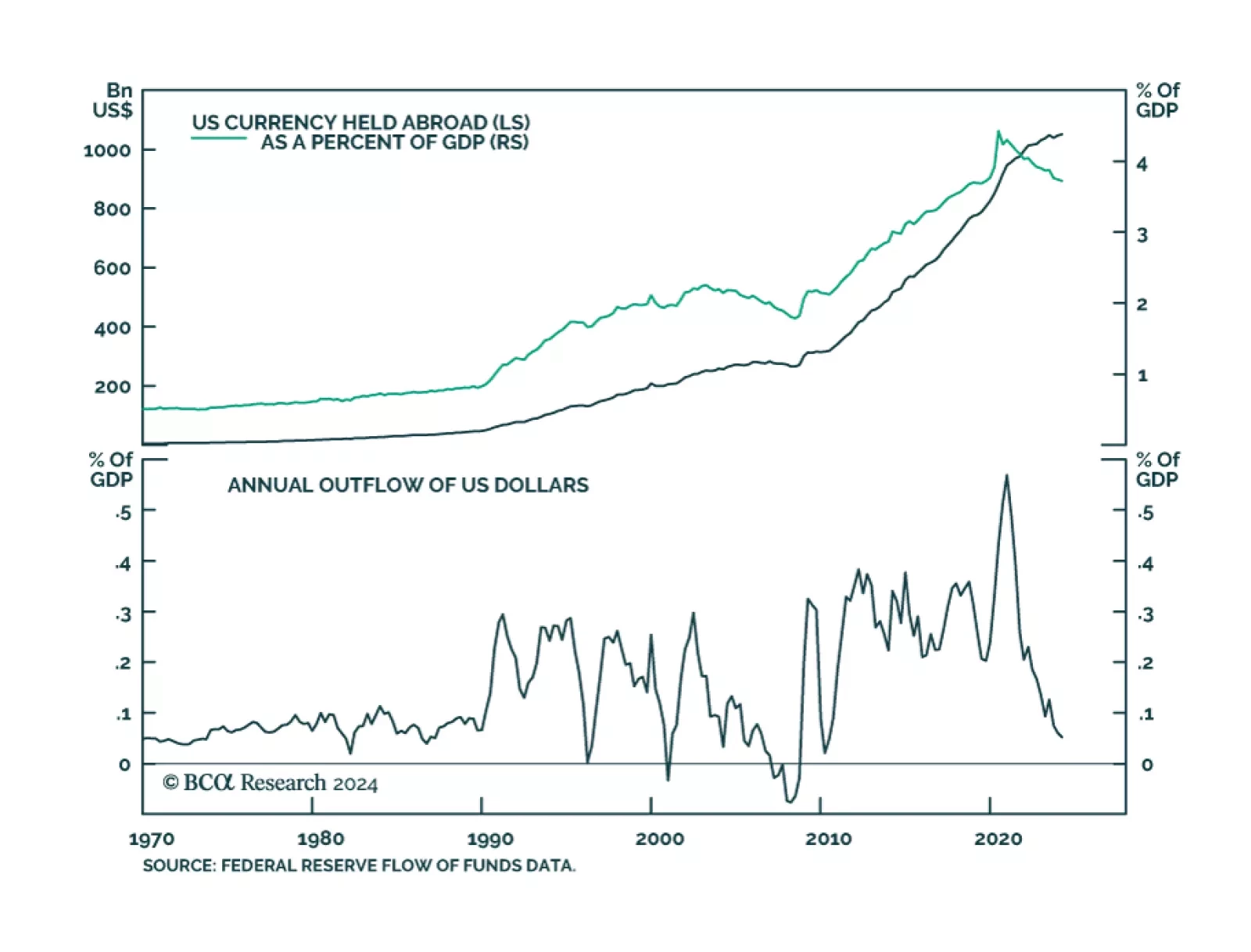

According to BCA Research’s Foreign Exchange Strategy service, shrinking dollar liquidity often coincides with financial market crises and also leads to an appreciation in the currency, as the premium foreigners are willing…

US dollar liquidity has been shrinking, which has important ramifications for global asset prices, including currencies. In this report, we delve into the process of dollar liquidity creation and the outlook for currencies over the…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…