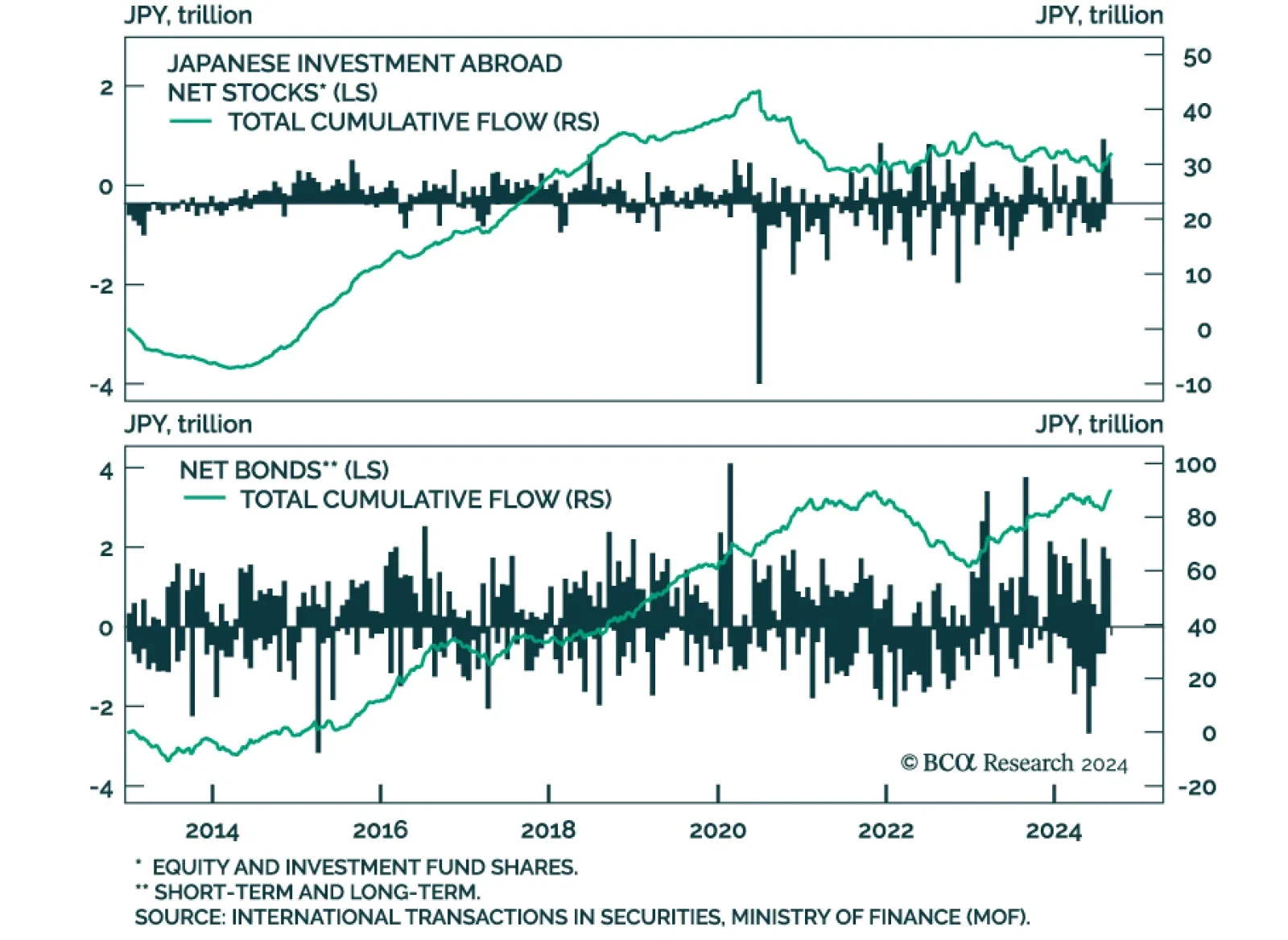

According to BCA Research’s Foreign Exchange Strategy and Global Investment Strategy services, most carry investors have covered their positions. Away from day-to-day noise, the longer-term trajectory of yen exchange rates…

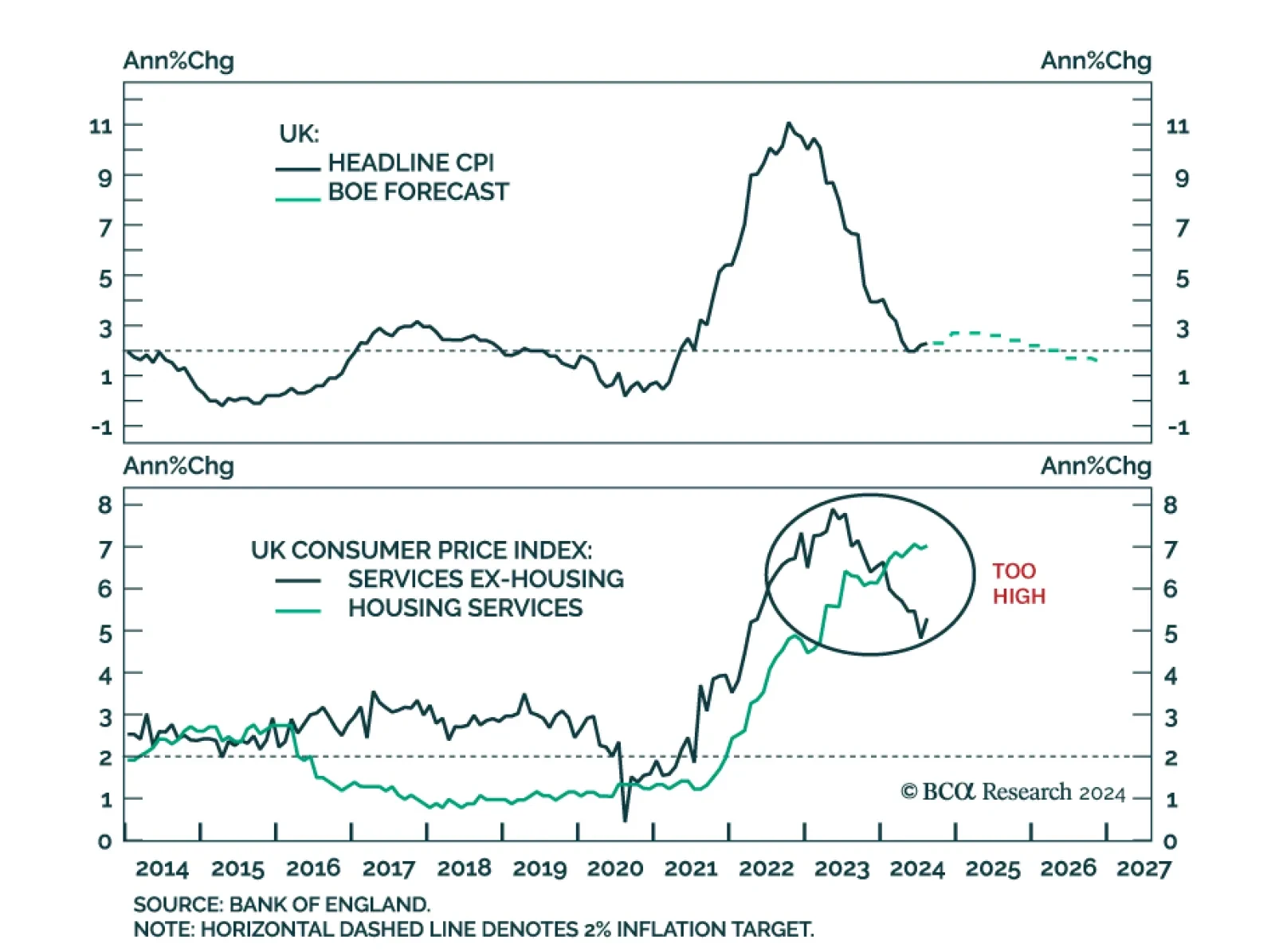

UK headline CPI grew at a stable 2.2% y/y in August, though the core measure accelerated from 3.3% to 3.6%, in line with expectations. An 11.6% annual increase in airfare largely drove core CPI higher, while offsetting…

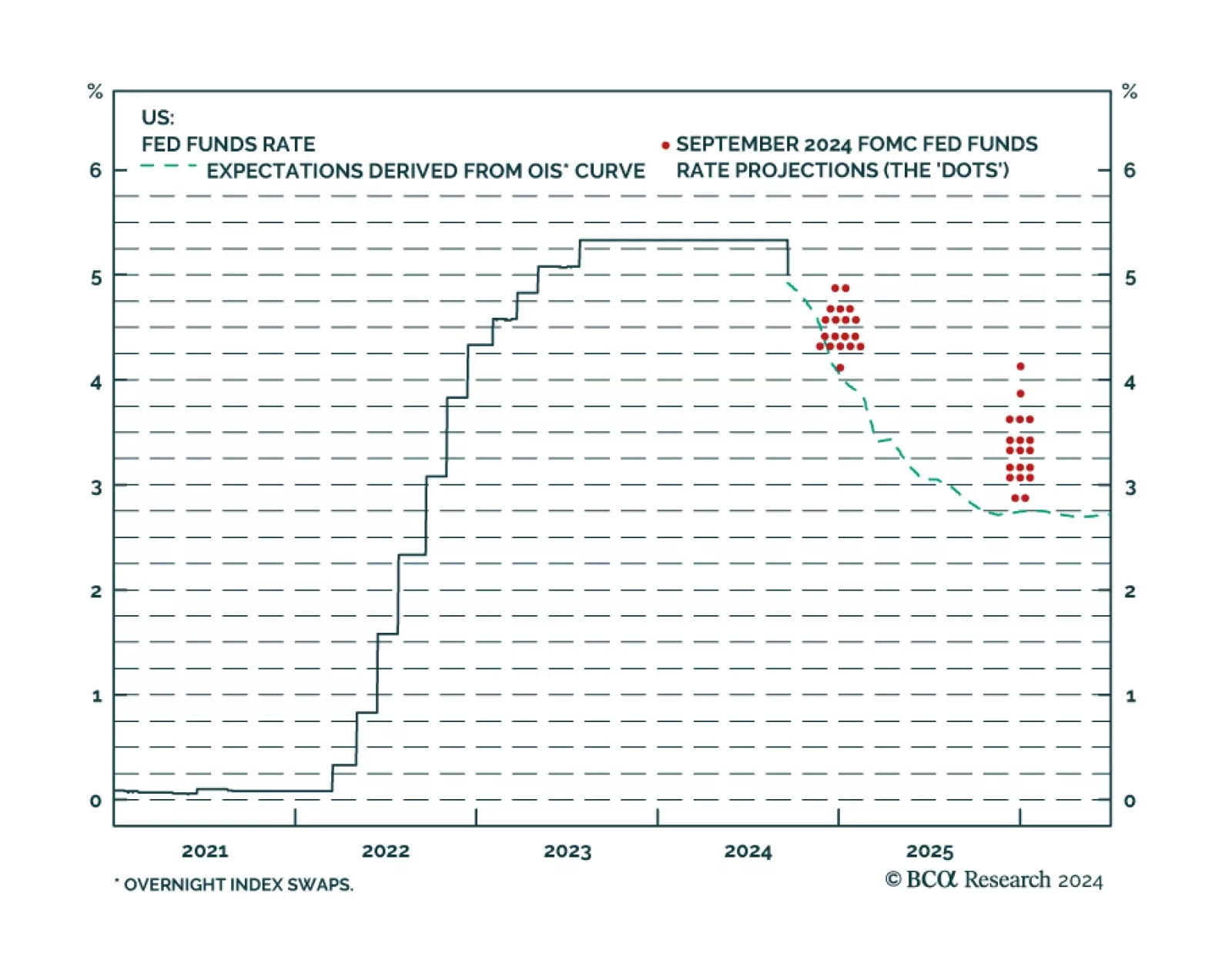

The Fed started its easing cycle with a bang, cutting the policy rate by 50 basis points in September, above consensus expectations but in line with odds embedded in the futures and OIS curves. Our US Bond strategists had…

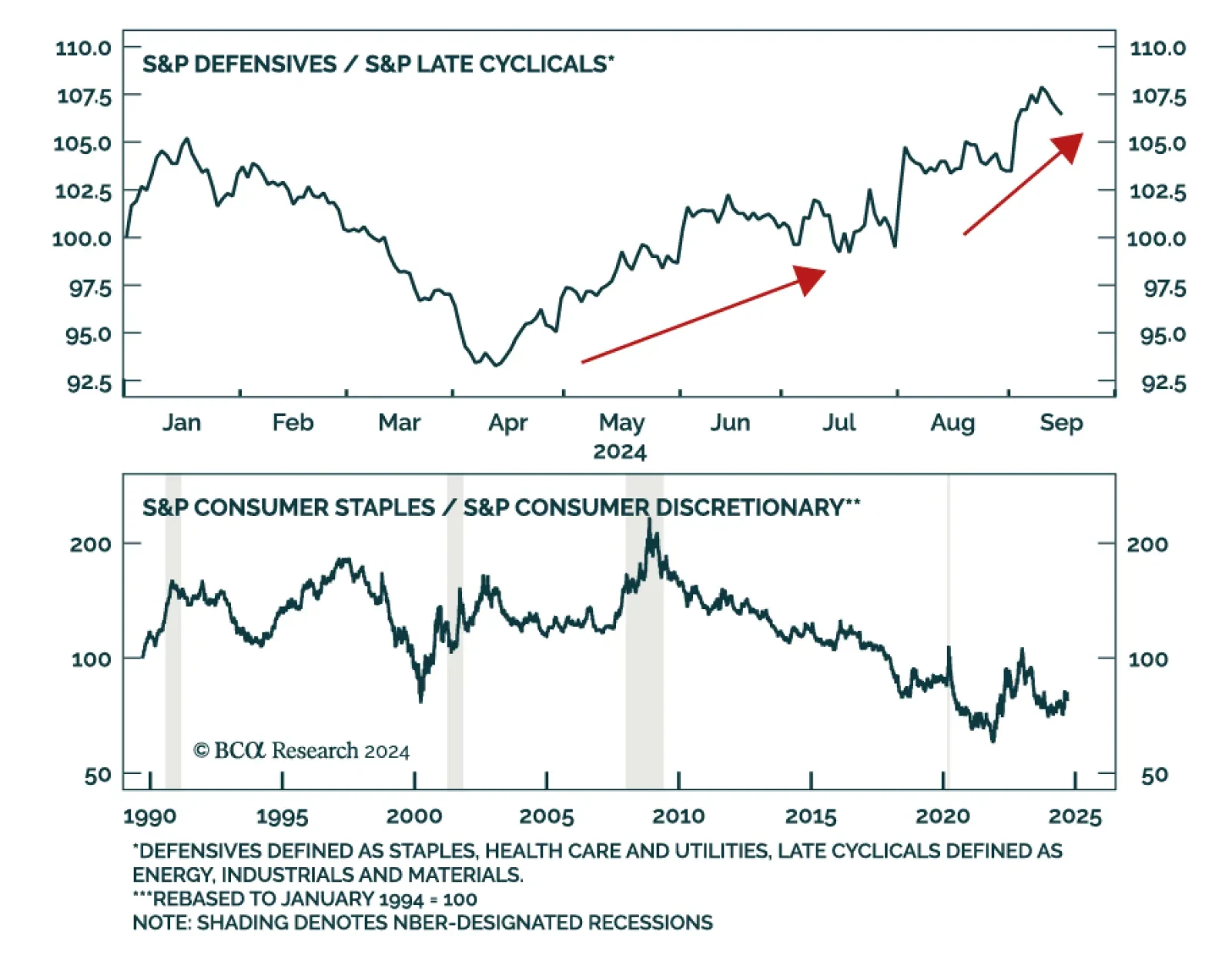

Stocks are a forward discounting mechanism and routinely top before recessions begin, even if they typically do not swoon until the recession has taken hold. According to BCA Research’s US Investment Strategy service, if…

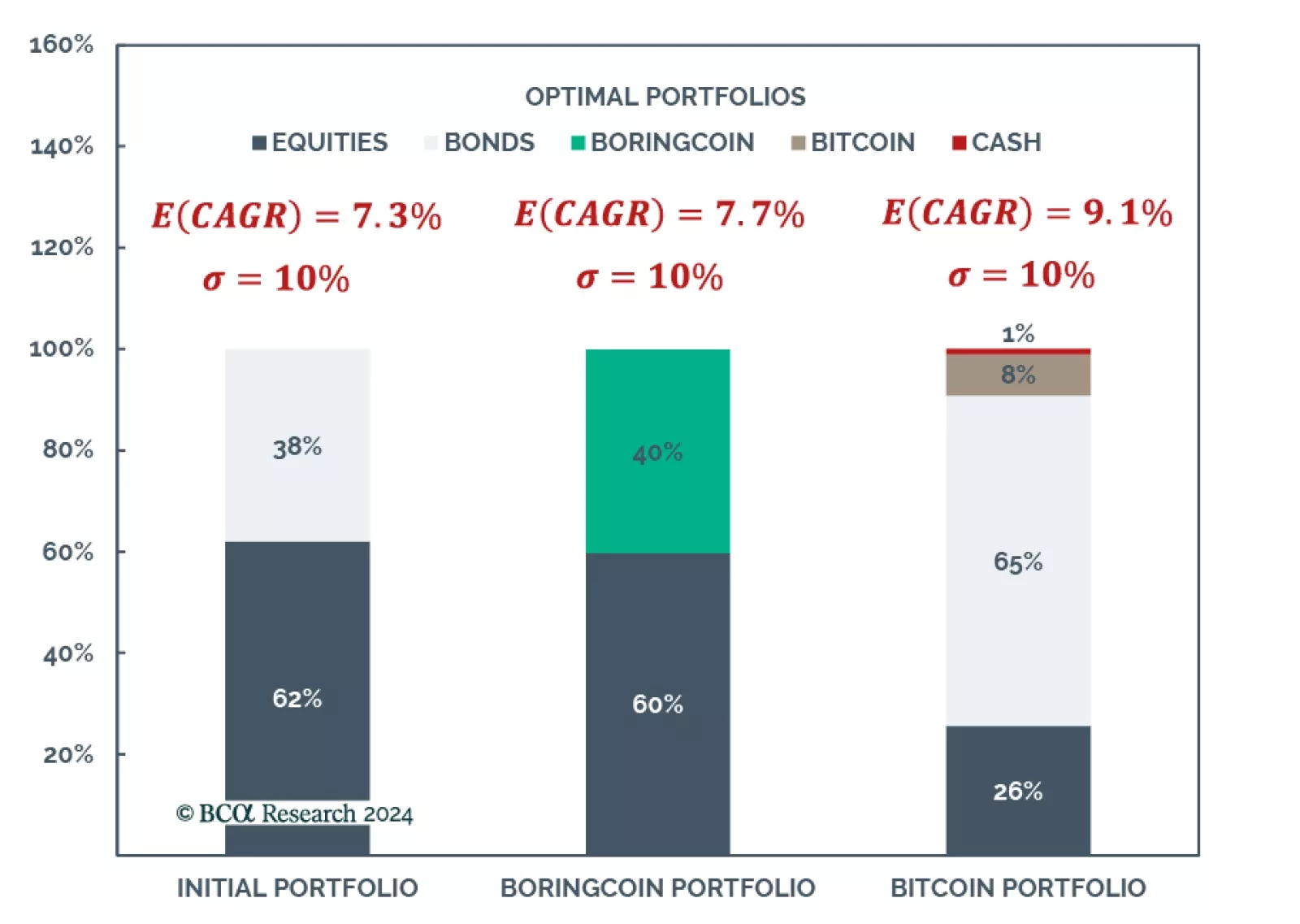

According to BCA Research’s Global Asset Allocation Strategy service, a common objection to buying Bitcoin raised by traditional investors is that it is too volatile. In the past it has been argued that this is irrelevant,…

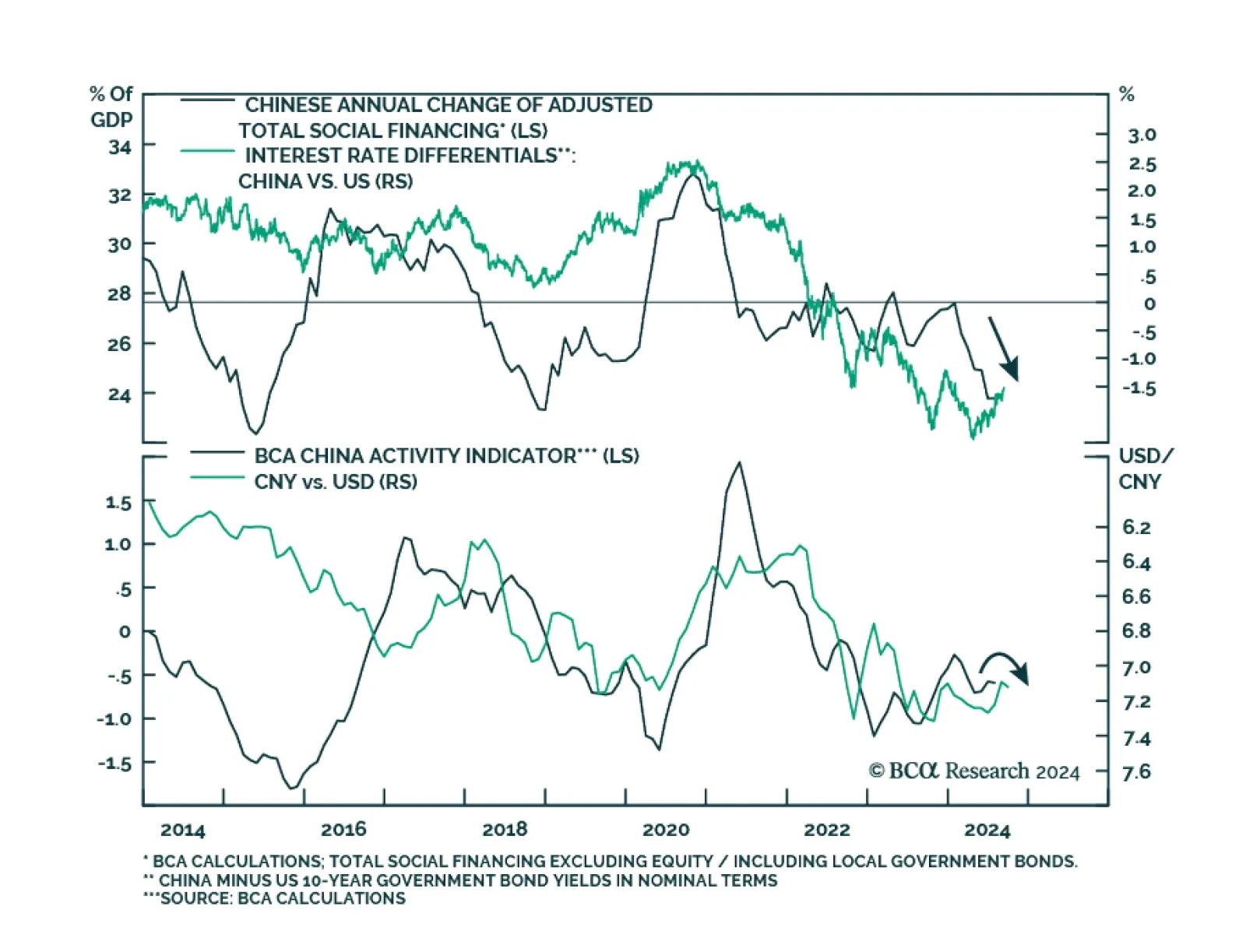

According to BCA Research’s China Investment Strategy service, the Fed’s upcoming rate cut will temporarily alleviate some of the downward pressure on the RMB, but beyond the short term the USD will likely rebound in…

Following a 12-year-long bear market, Greek equities have returned a whopping 186% in EUR terms from their 2016 lows. The Greek macroeconomic backdrop has indeed improved. Since 2021, Greece’s nominal GDP growth has…

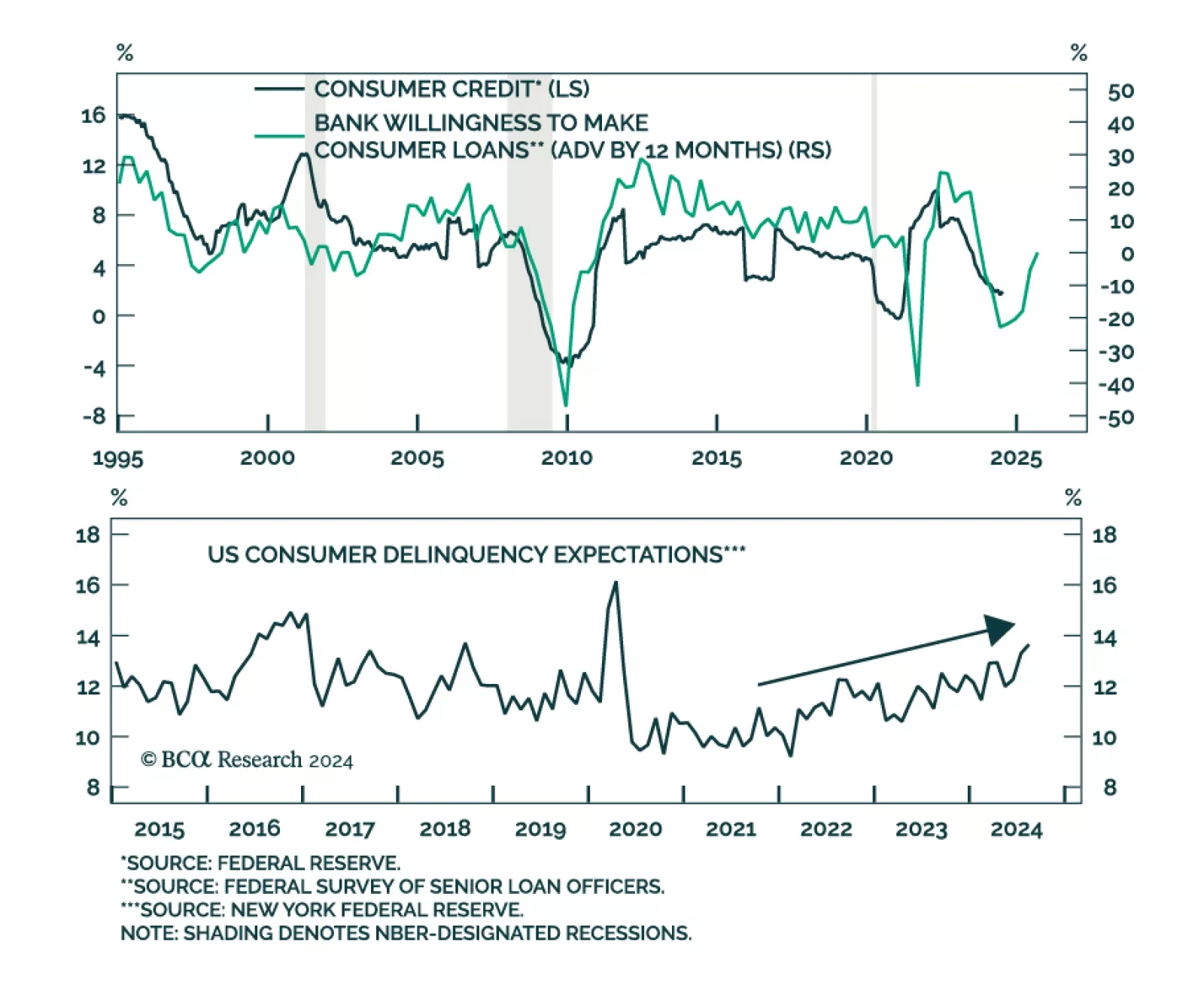

Consumer credit rose by USD 25.5bn in July (to USD 5,093.7 bn outstanding), more than twice the expected growth. However, revisions suggest that June’s consumer credit growth was slower than initially reported (USD 8.9bn to…

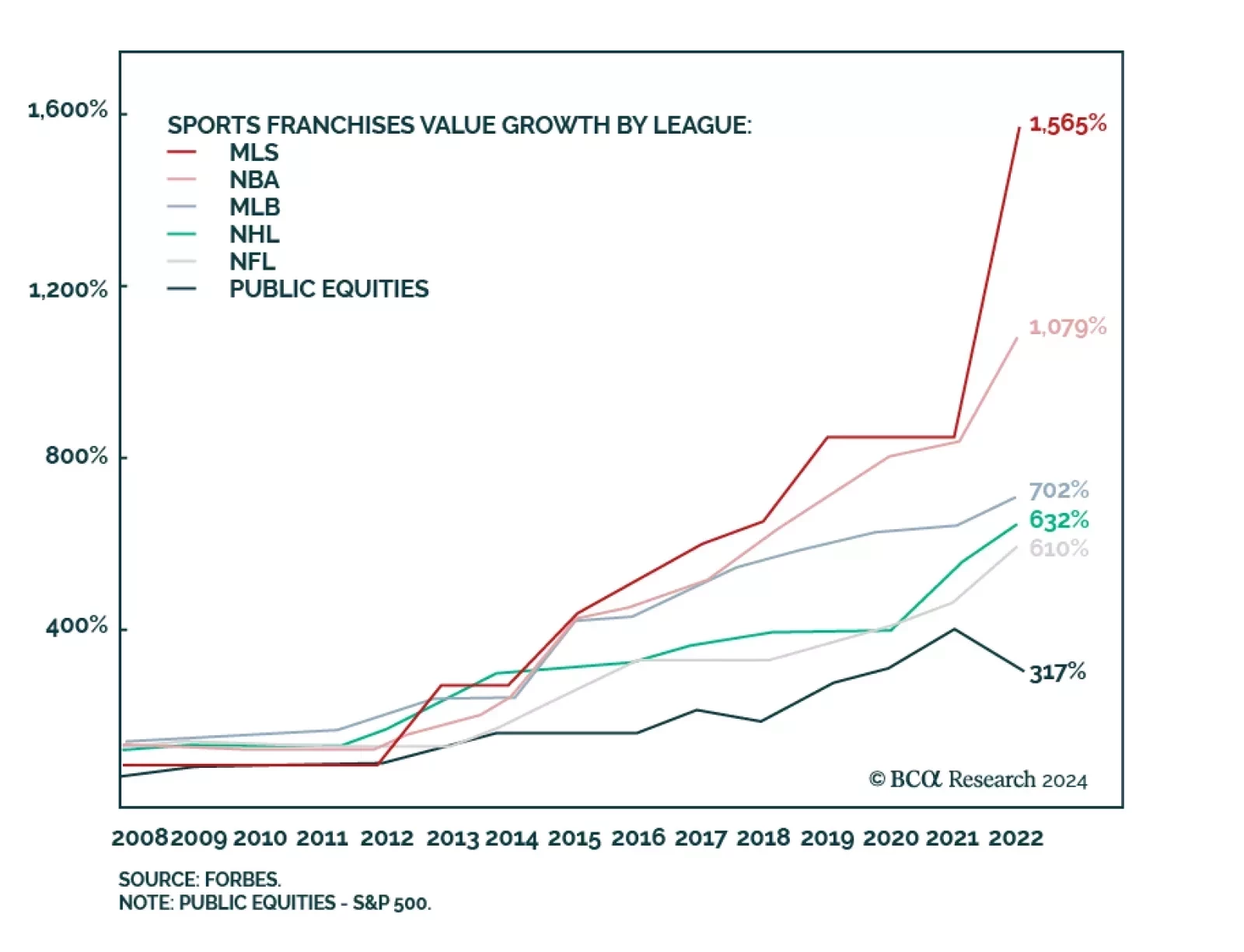

According to BCA Research’s Private Markets & Alternatives service, the Sports Franchise market presents a compelling opportunity for Private Equity due to its strong growth potential, evolving business models, and…

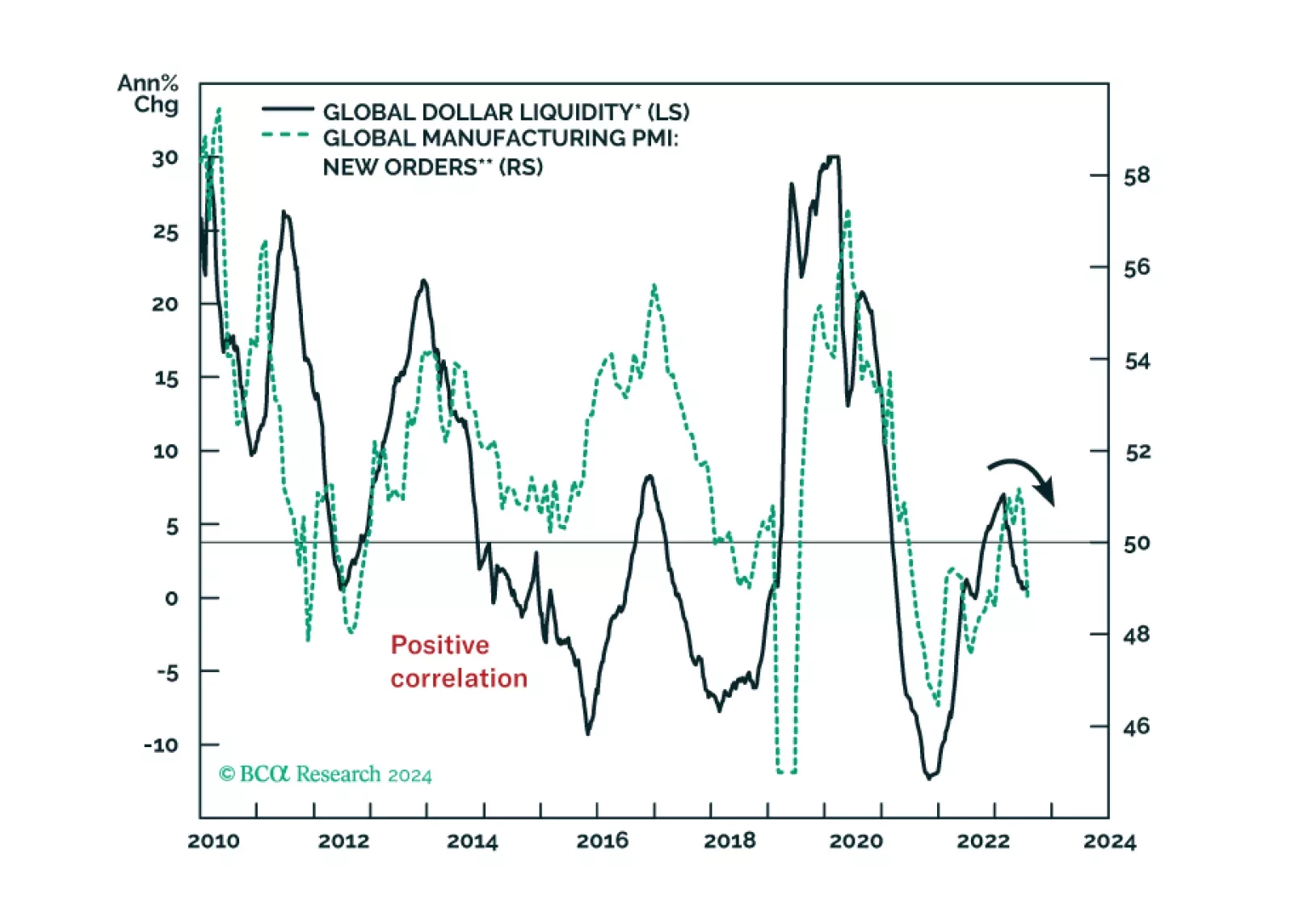

The undercurrents of global financial markets signal deteriorating global growth conditions. There is little cash on the sidelines in the US, the Euro Area, and Japan. If the budding bear market resembles the 2000-2003 one, EM stock…