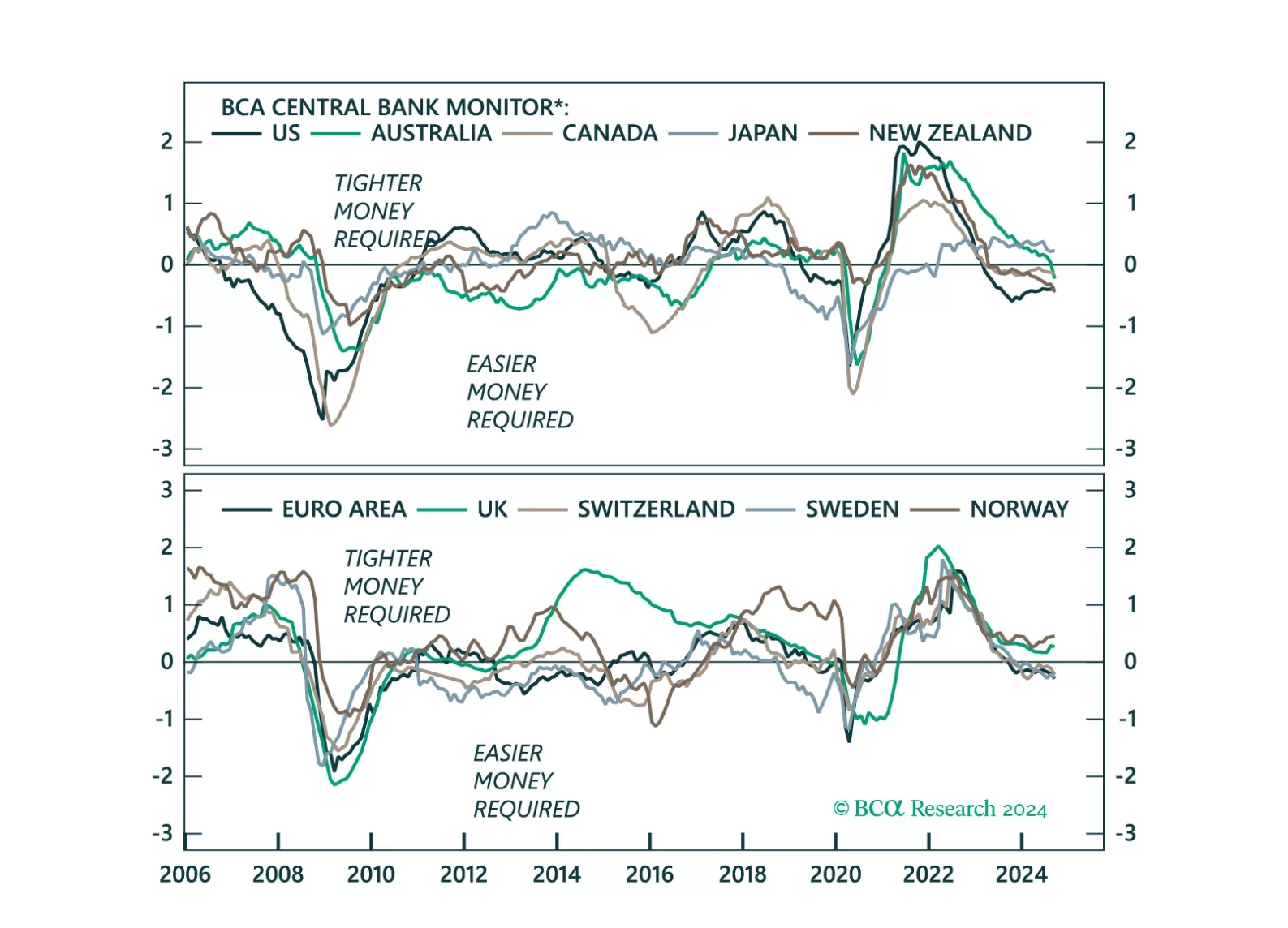

This week, we update our Central Bank Monitors (CBMs), that help us calibrate how monetary policy should be adjusted in developed-market economies. Our conclusion is that while overall, easier monetary settings are required, there a…

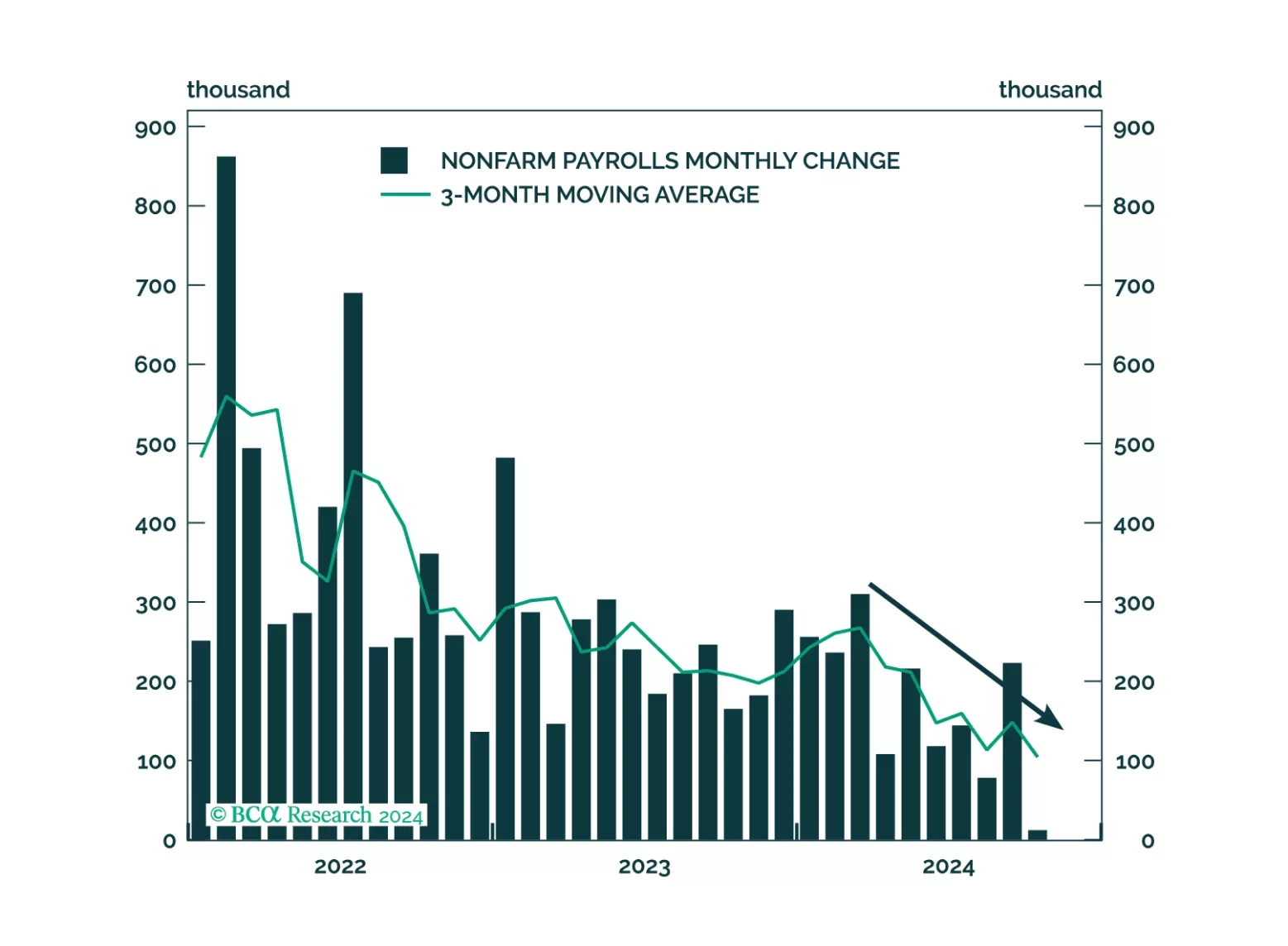

The force of the post-election momentum leads us to believe we could be stopped out of our defensive positioning before the week is out, but we still believe in our recession call. If we are eventually stopped out, we will seek a…

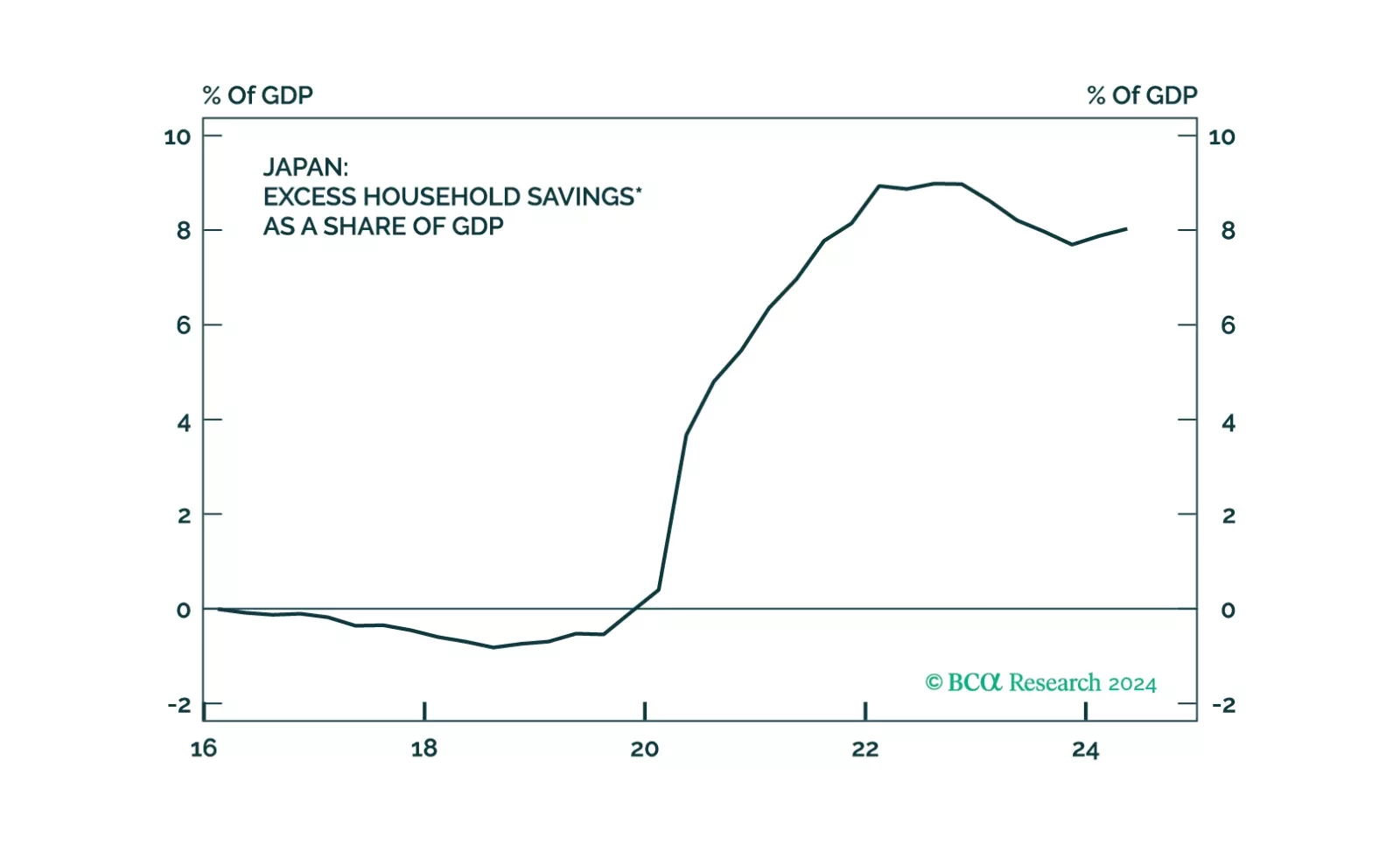

The latest Bank of Japan meeting did not alter our high-conviction views of being long the yen and underweight JGBs.

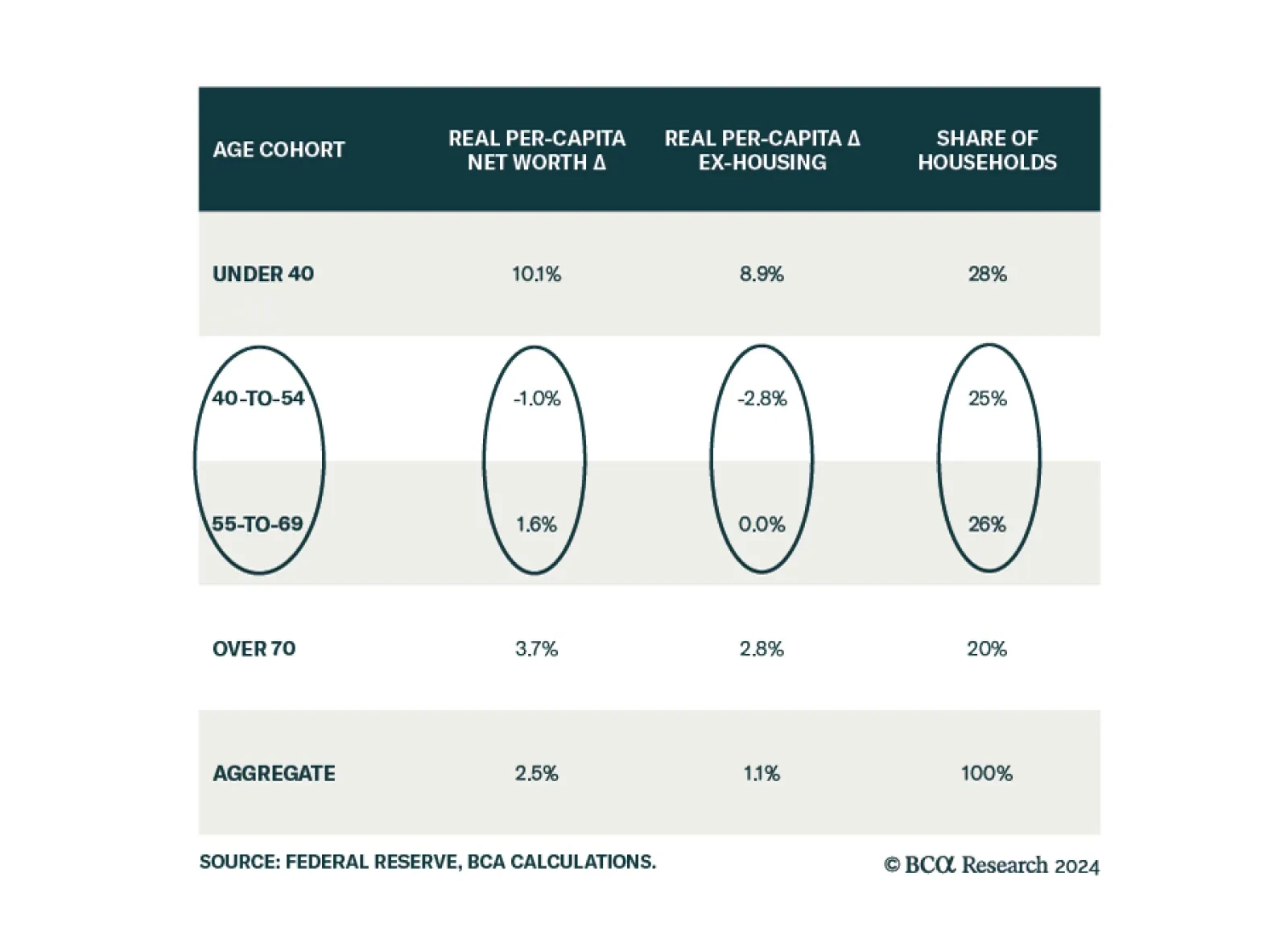

As US consumers remain one of the few engines of global growth, our US Investment Strategy colleagues took a deep dive on consumer trends, augmented with comments from US banks’ earnings calls. Middle-aged consumers have…

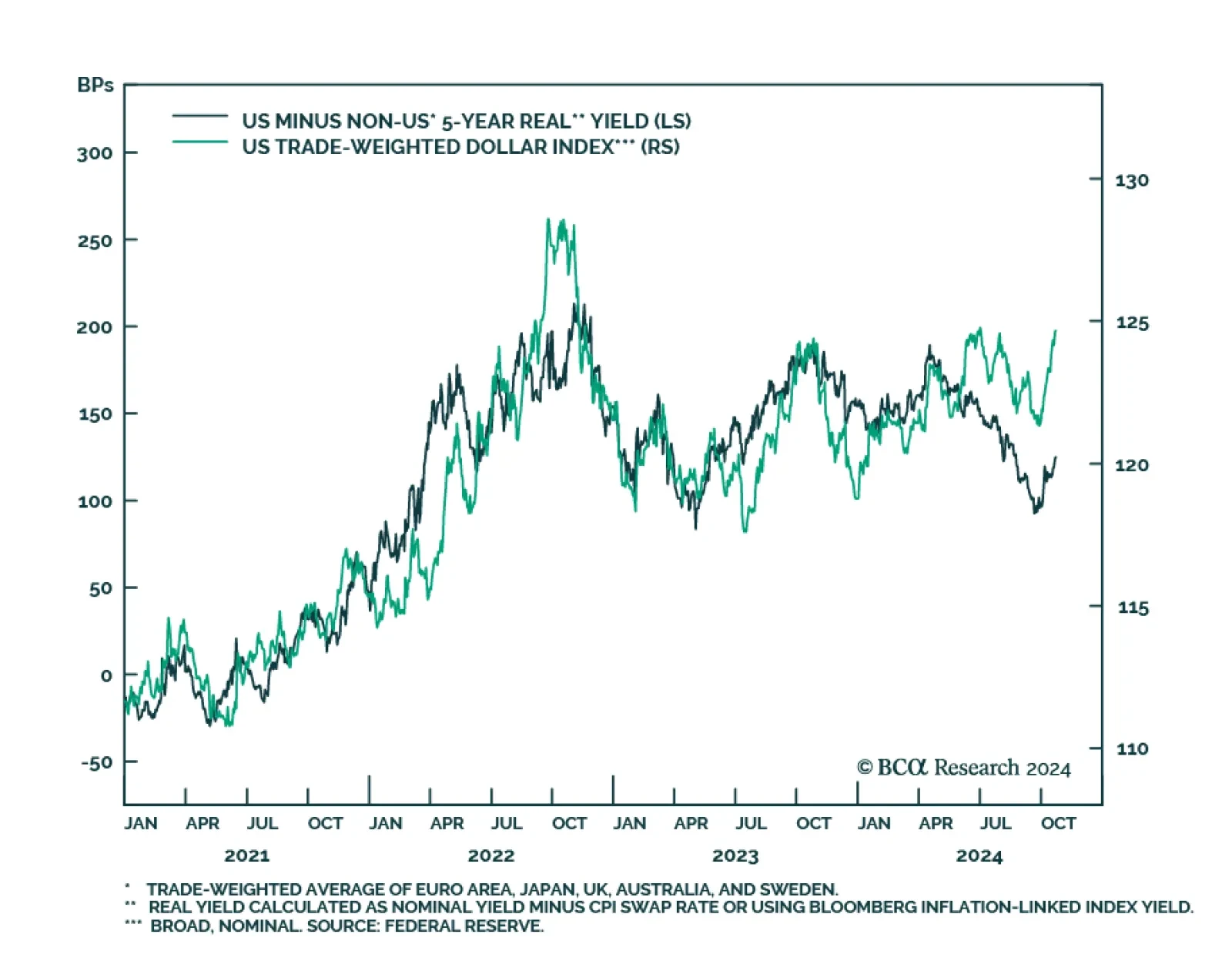

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

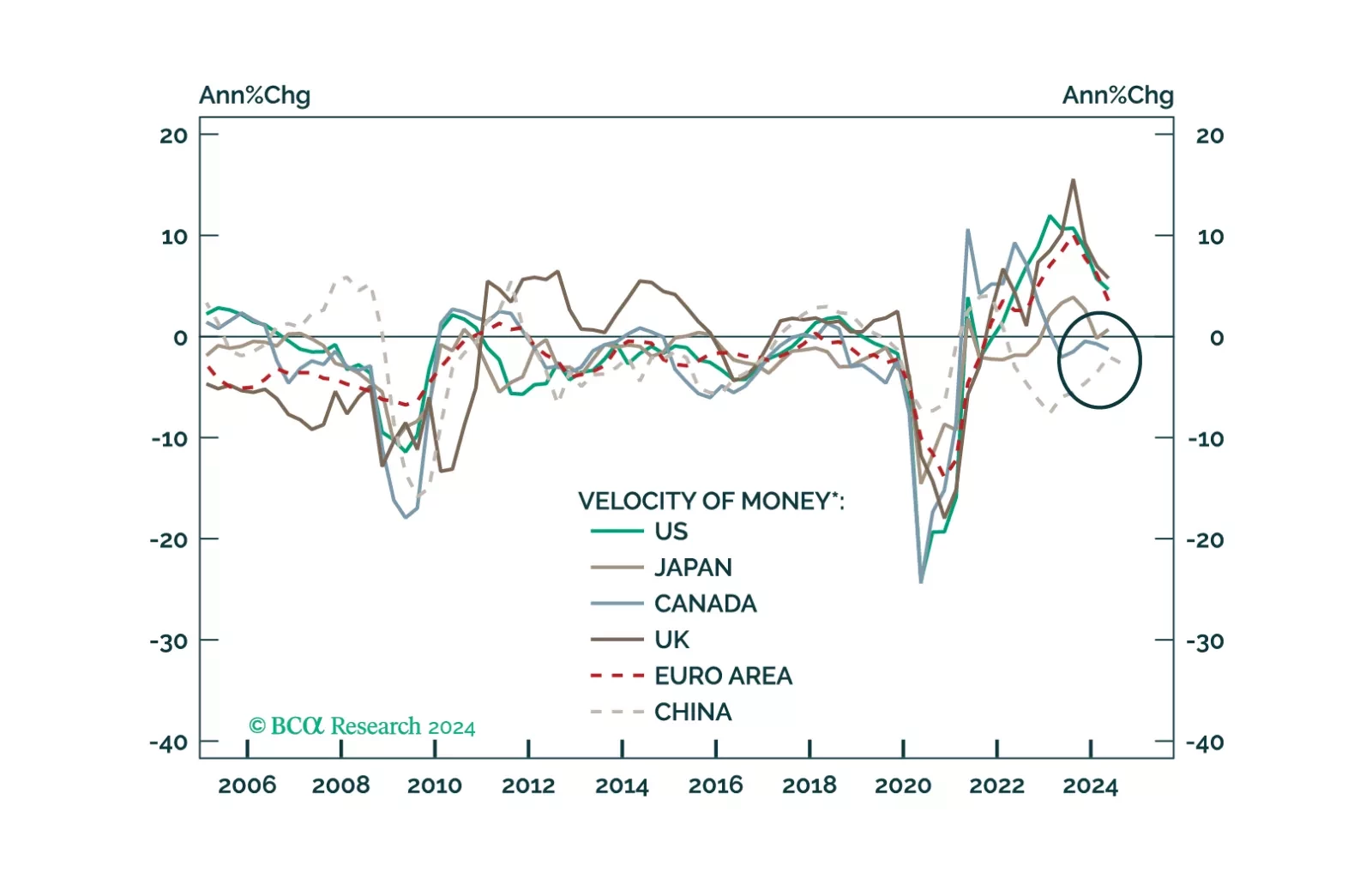

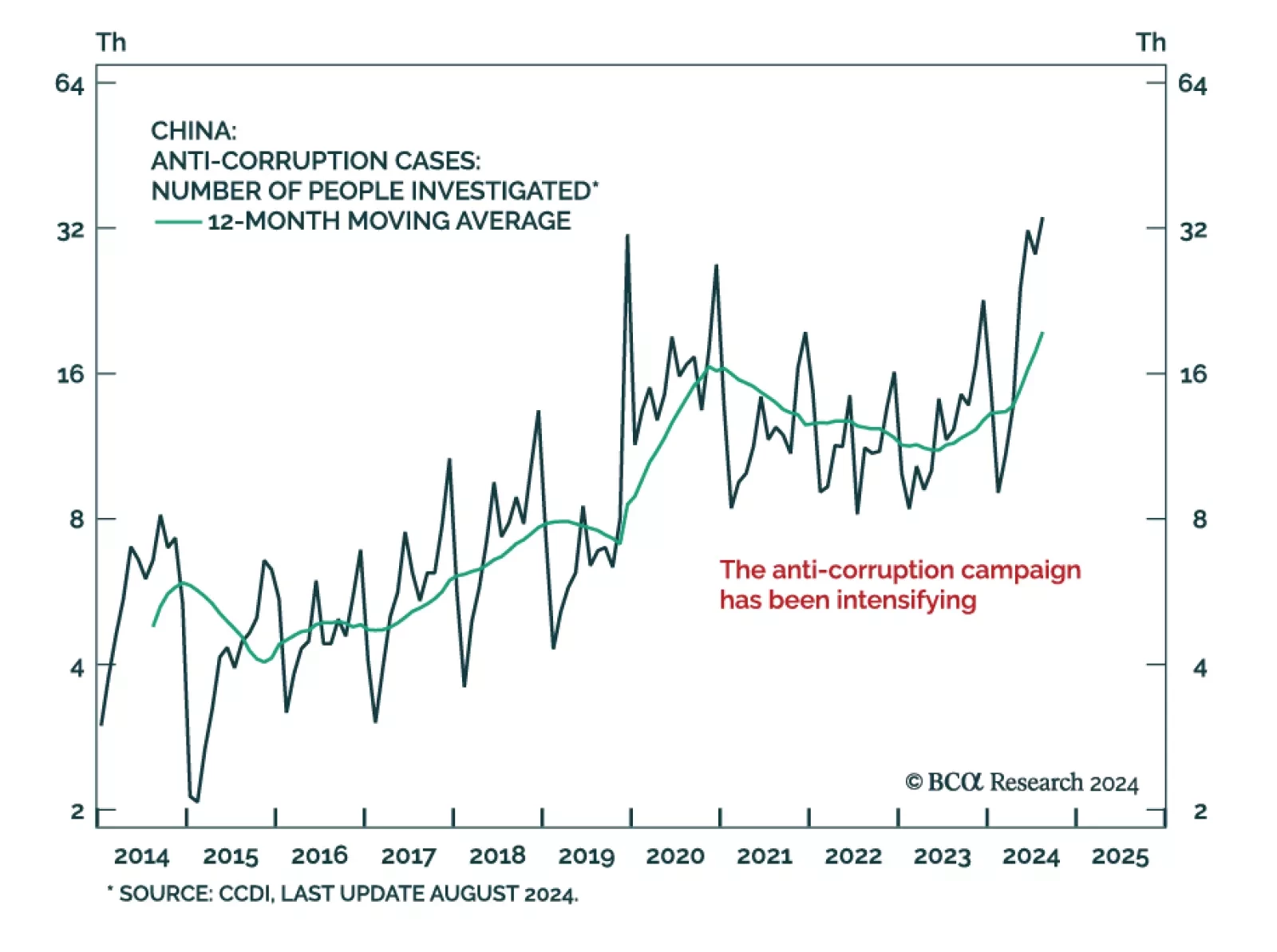

While moving in the right direction, China’s latest stimulus measures are falling short of the mark to reflate the economy. The latest rumors extend this trend. News agencies reported discussions of a CNY 10 trillion…

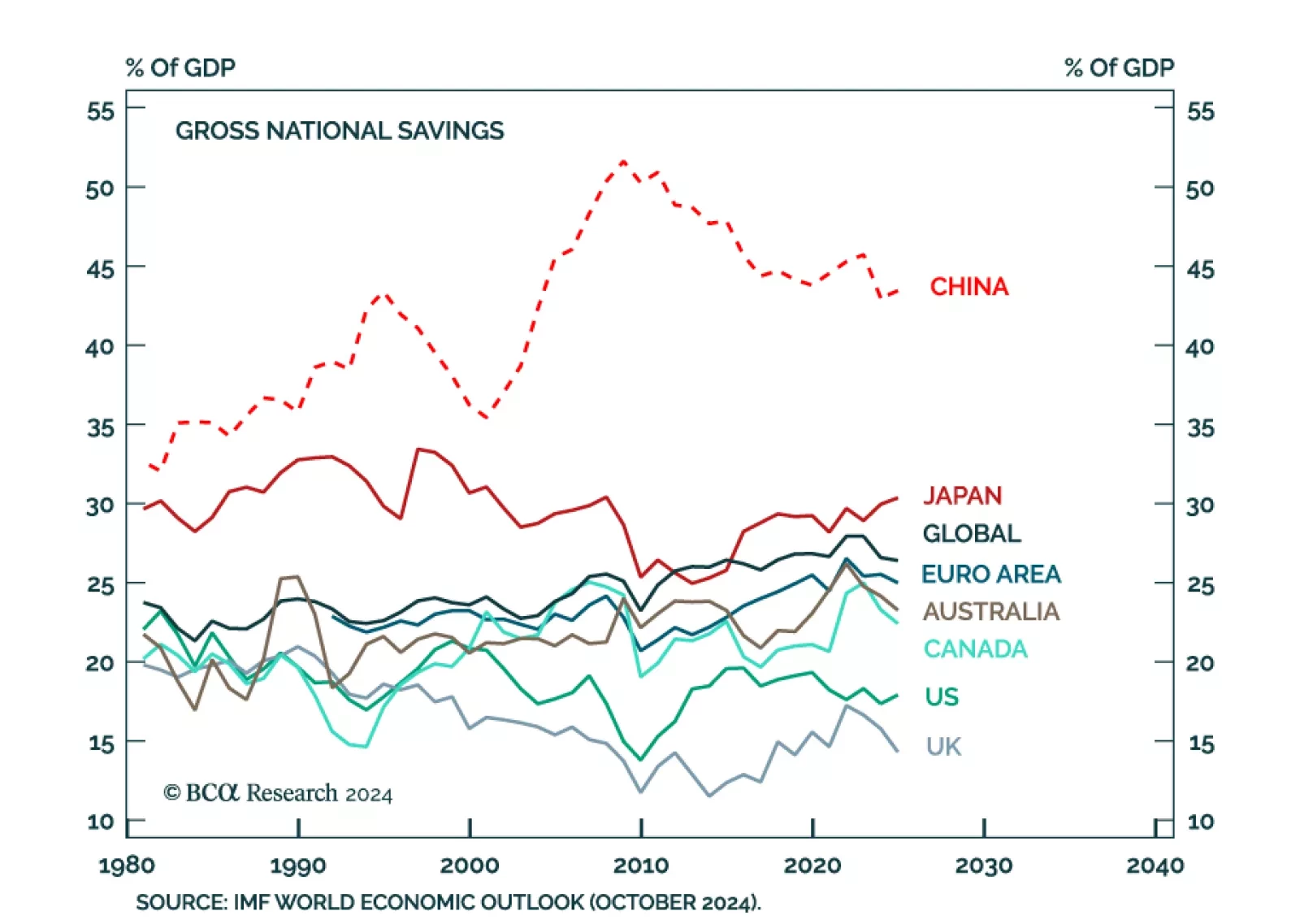

Savings must either flow into domestic investment, or abroad. Saving too much, with nowhere to funnel it, is breaking China’s economic model according to our Global Investment Strategy colleagues. As China's share of…

The US dollar had a strong October thus far, breaching its 20-,50- and 200-day moving averages with a 4% increase and only three trading days in the red. The DXY now sits above where it was before the August selloff in risk…

This Insight looks at the likely direction of bond yields and the dollar, from the lens of money velocity.