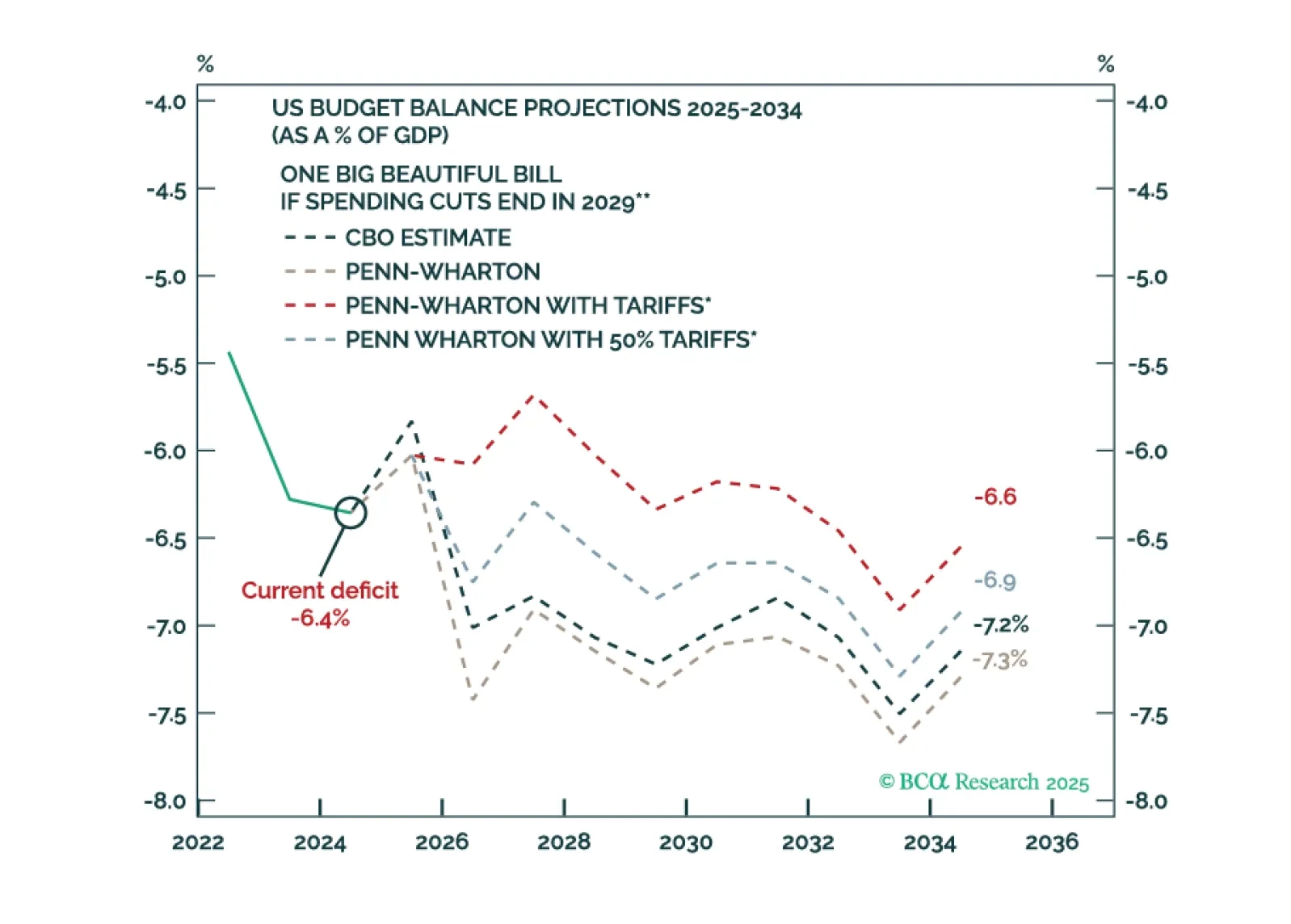

Bond market volatility will spike again in the near term. The Fed is committed to an easing cycle yet the Trump administration’s signature fiscal policy action will stimulate the economy. Tariffs are supposed to keep the budget…

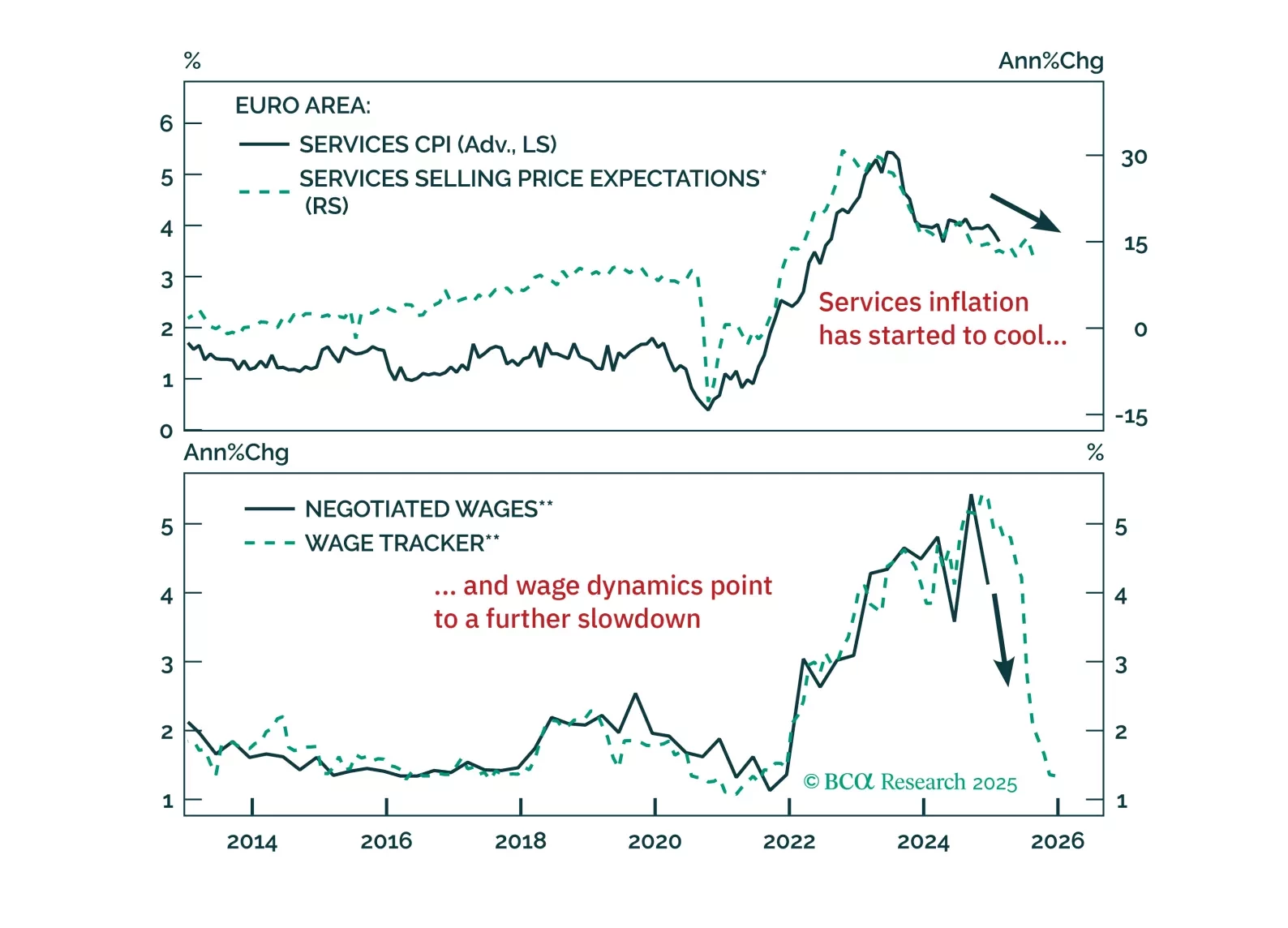

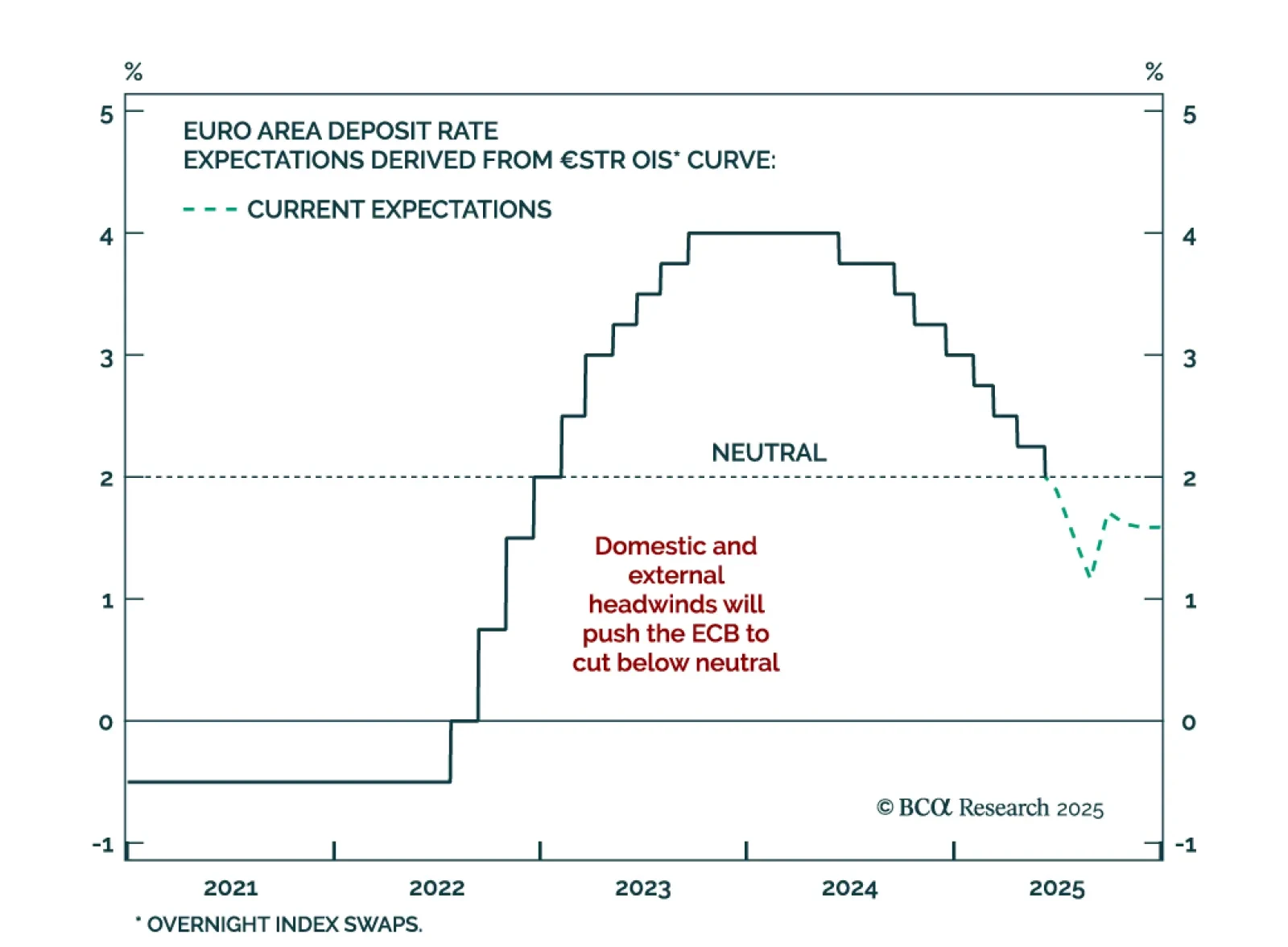

The ECB’s expected rate cut to 2% marks a slower easing phase, capping Bund yields. The shift to a quarterly pace of cuts, barring surprises, confirms a more gradual approach despite ongoing disinflation and weak growth. Staff…

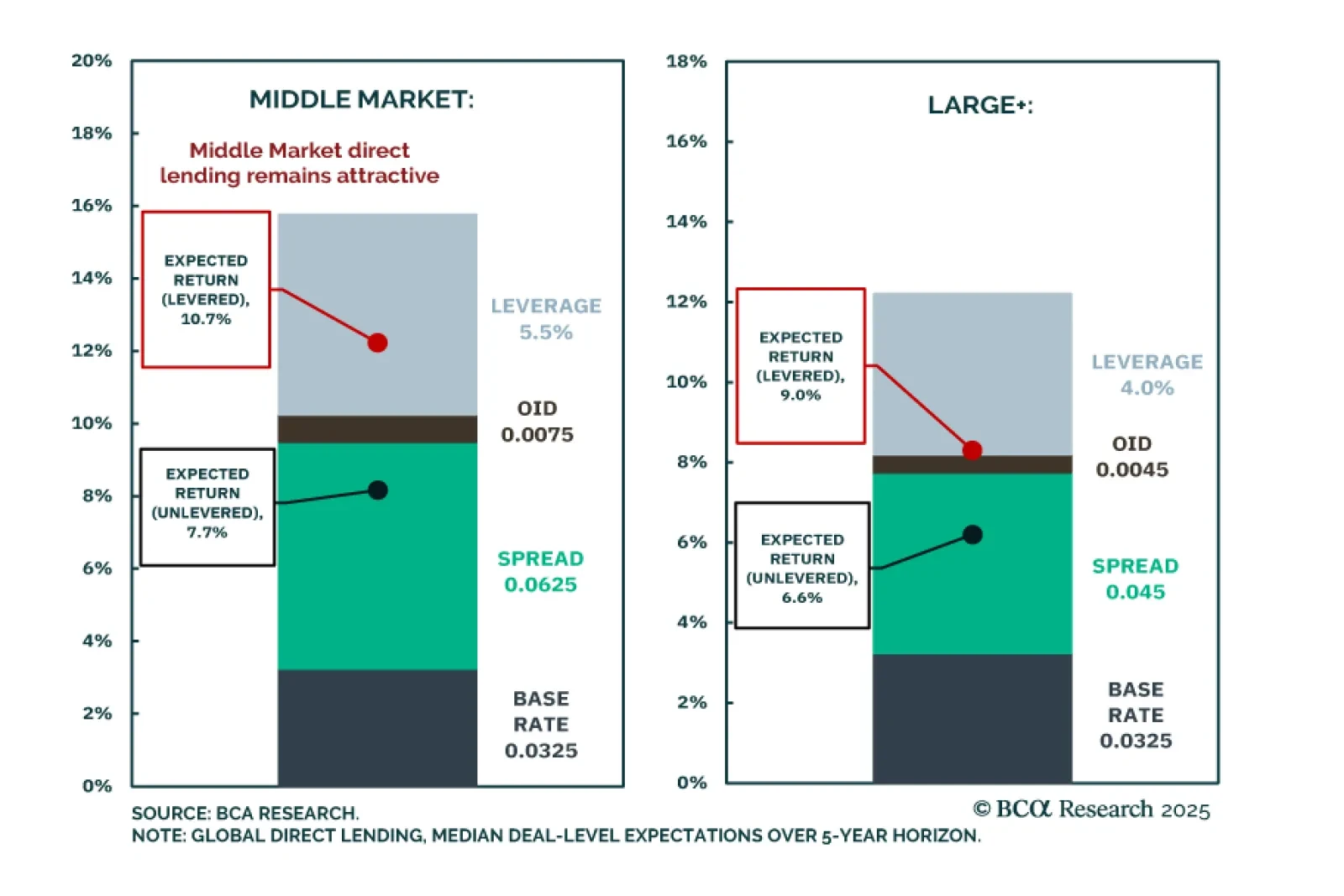

Our PMA strategists published Part 2 of their Capital Market Assumptions update, focusing on Direct Lending. They project gross annualized returns of 7.7% unlevered and 10.7% levered for Global Middle Market Direct Lending, and 6.5%…

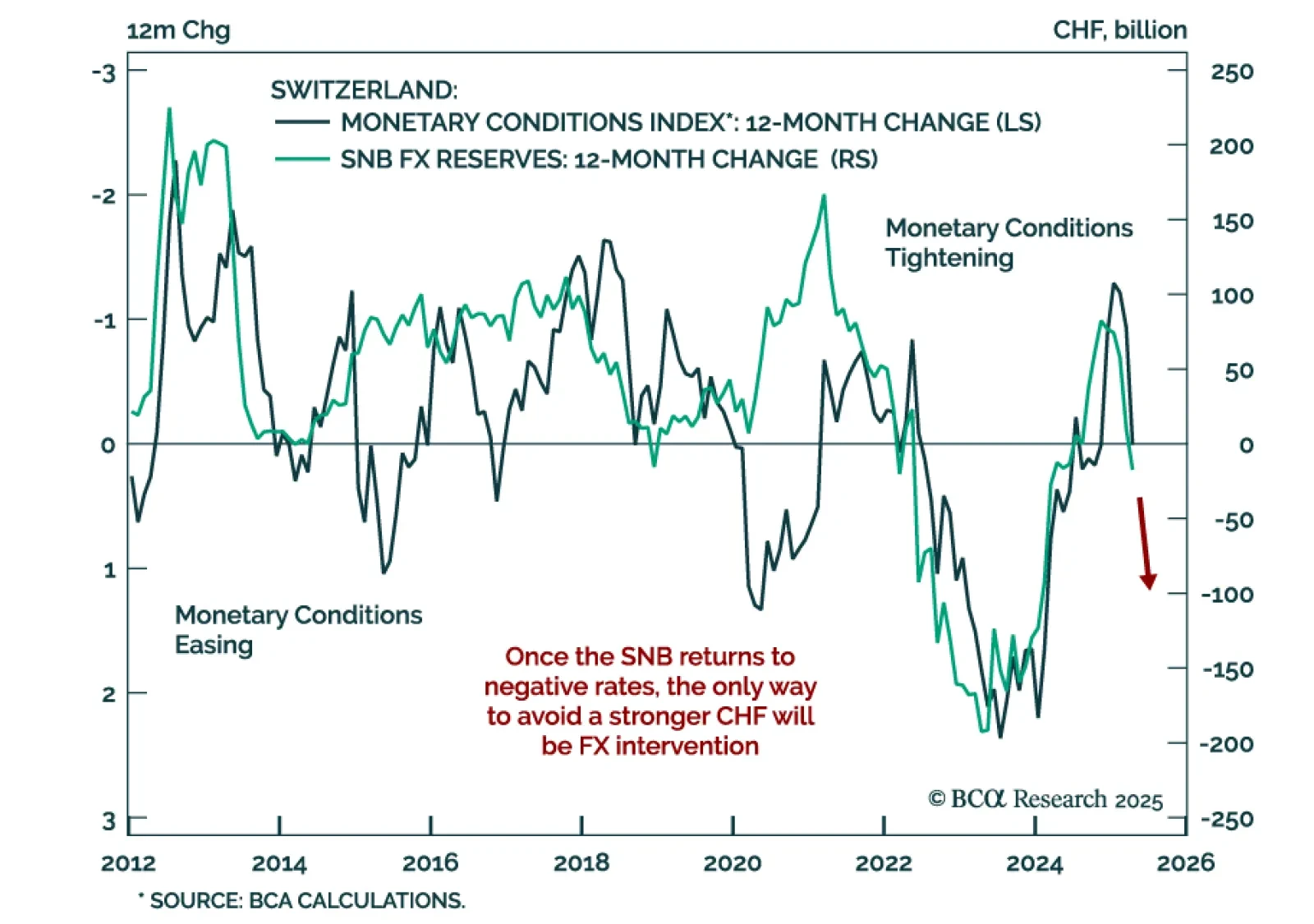

Swiss National Bank will have to resort to negative interest rates and FX intervention before year-end. Swiss inflation fell to 0% year-over-year in April, or the lower end of the SNB’s 0%-2% target range, and the continued…

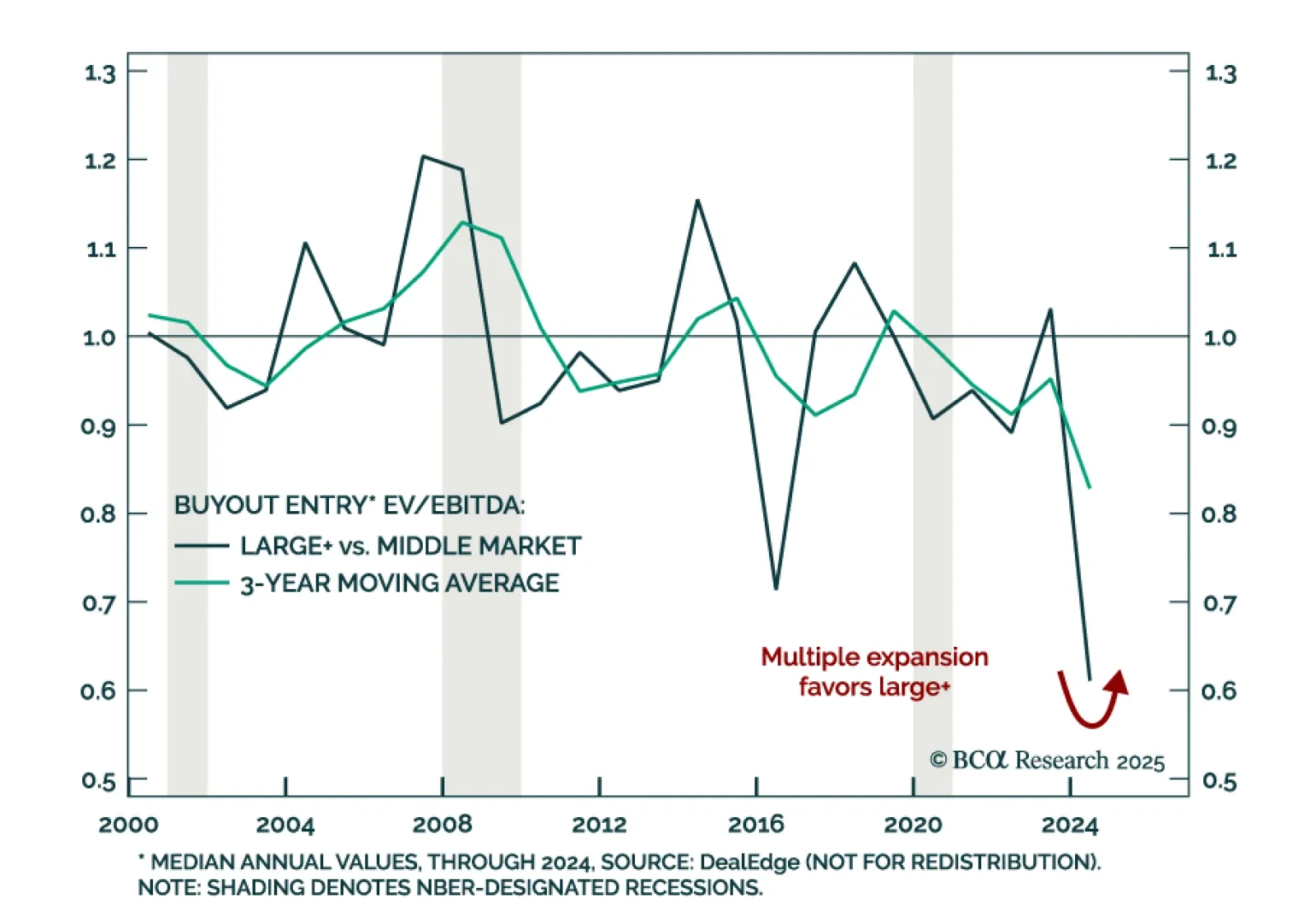

Our Private Markets & Alternatives team’s latest update to return expectations for Global Buyout yields a modest increase in projected returns, including the expectation of a greater multiple expansion tailwind in the Large…

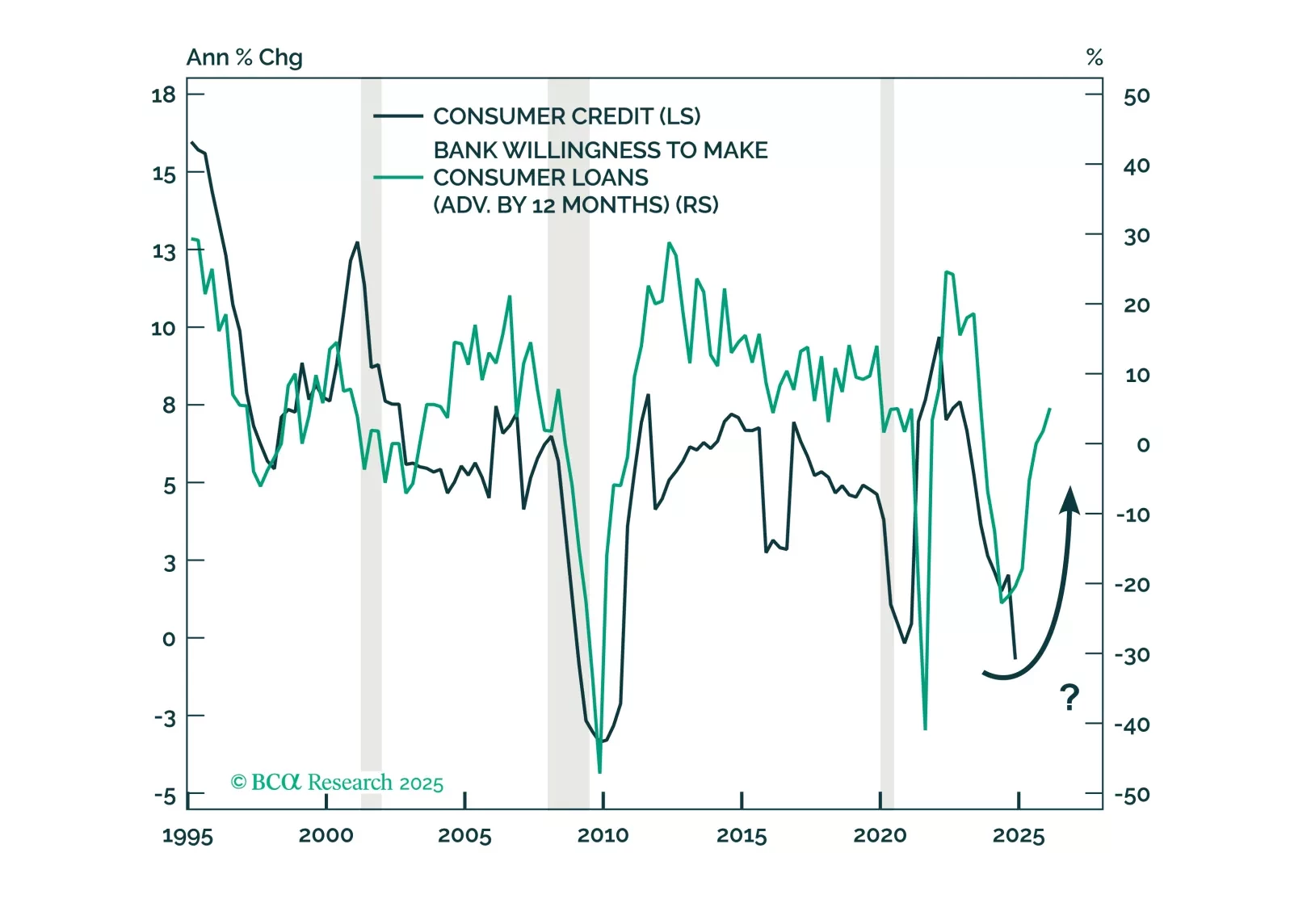

Households’ healthy balance sheets do not square with the rise in credit cards and auto loans delinquencies. The tailwinds that have supported higher-income cohorts’ spending have faded, presaging broad-based deterioration in credit…

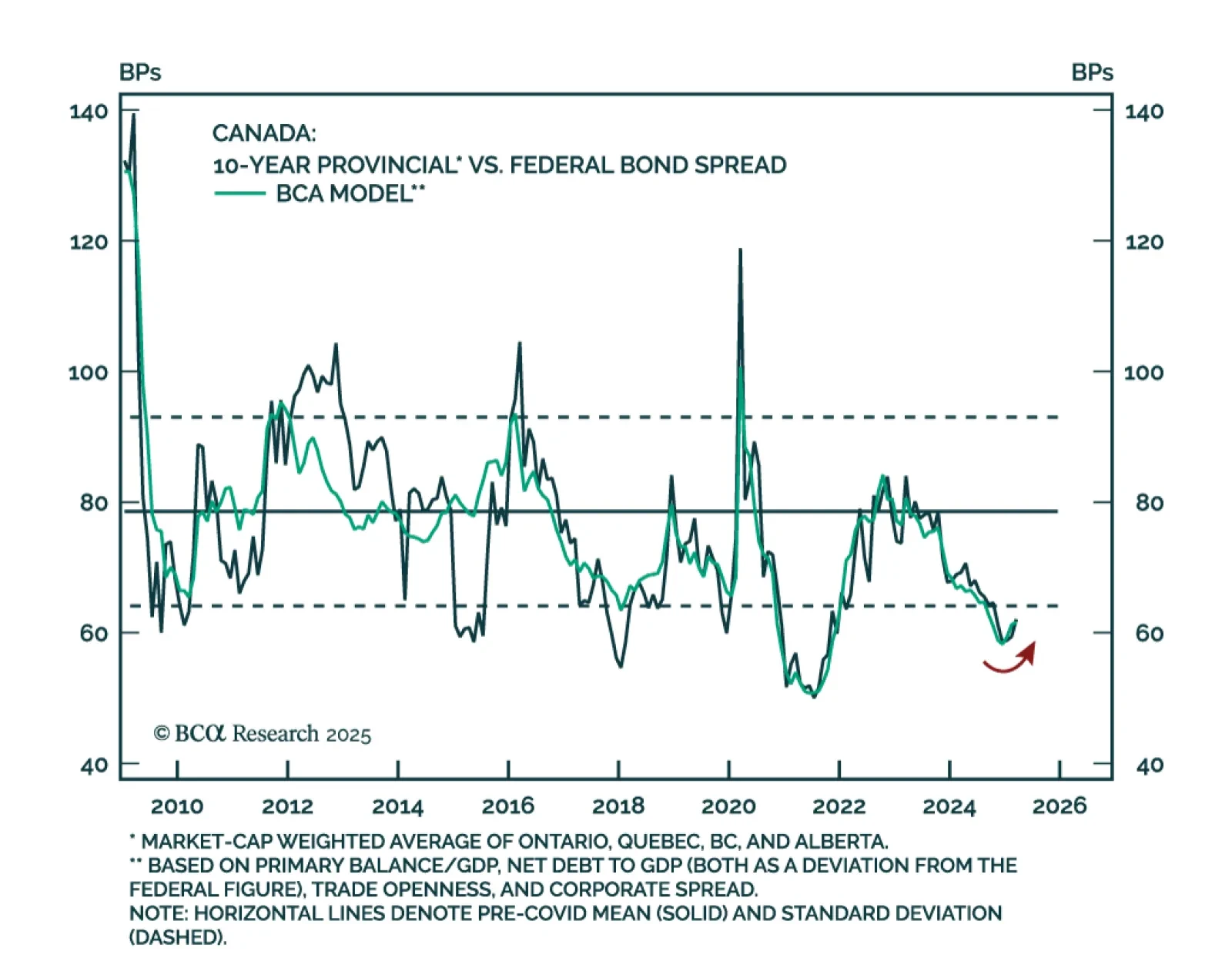

Our Global Fixed Income team wrote a primer on the Canadian provincial bond market, an overlooked yet substantial market. Canadian provincial bonds are a major segment of the country's fixed income market, with spreads primarily…

The ECB cut rates as expected, but rising yields and a stronger euro are tightening financial conditions just as fiscal policy shifts the macro landscape. With more rate cuts ahead and market positioning stretched, we outline the key…