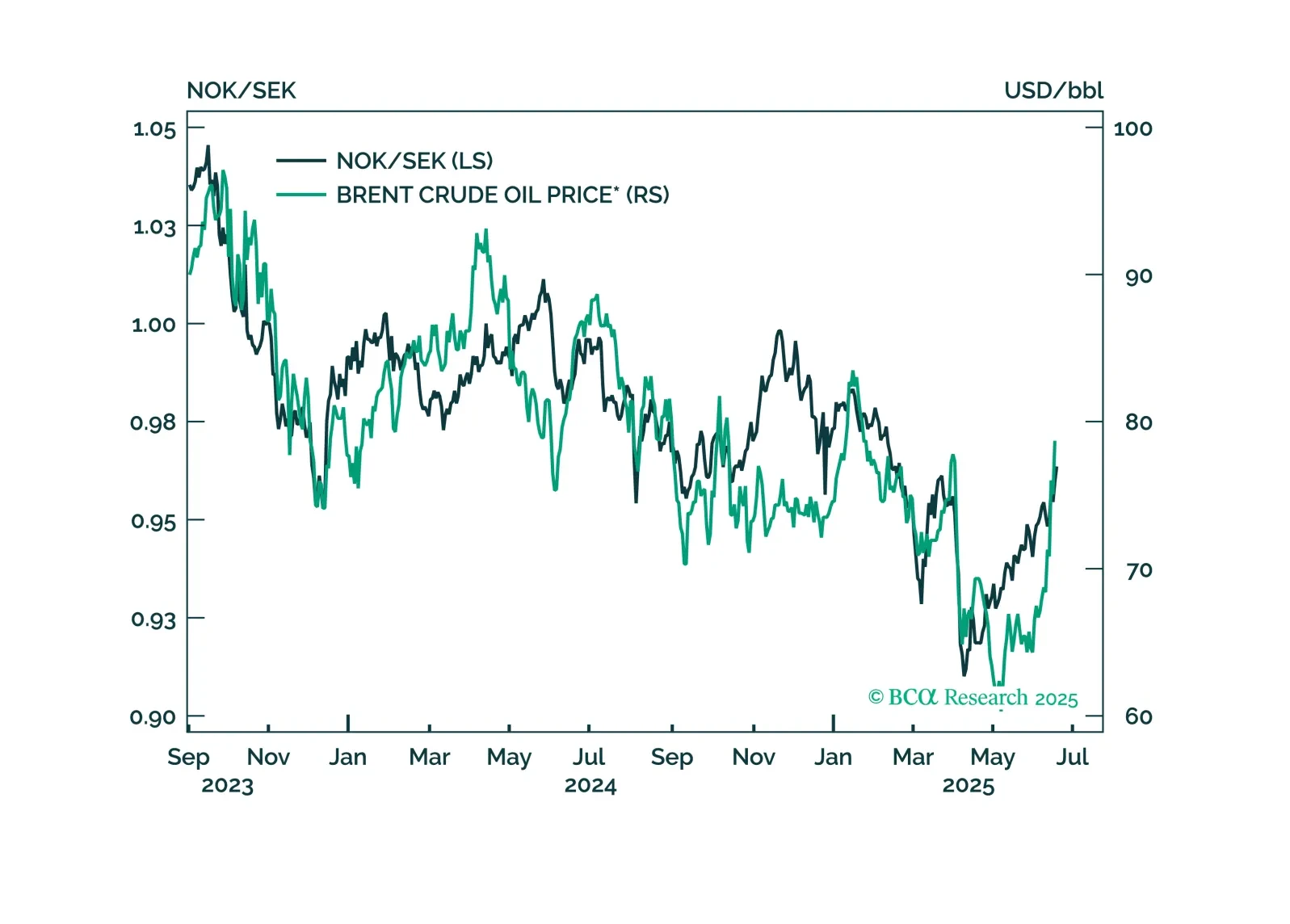

In this Insight, we look at the best trade idea from the recent rate cut by the Riksbank.

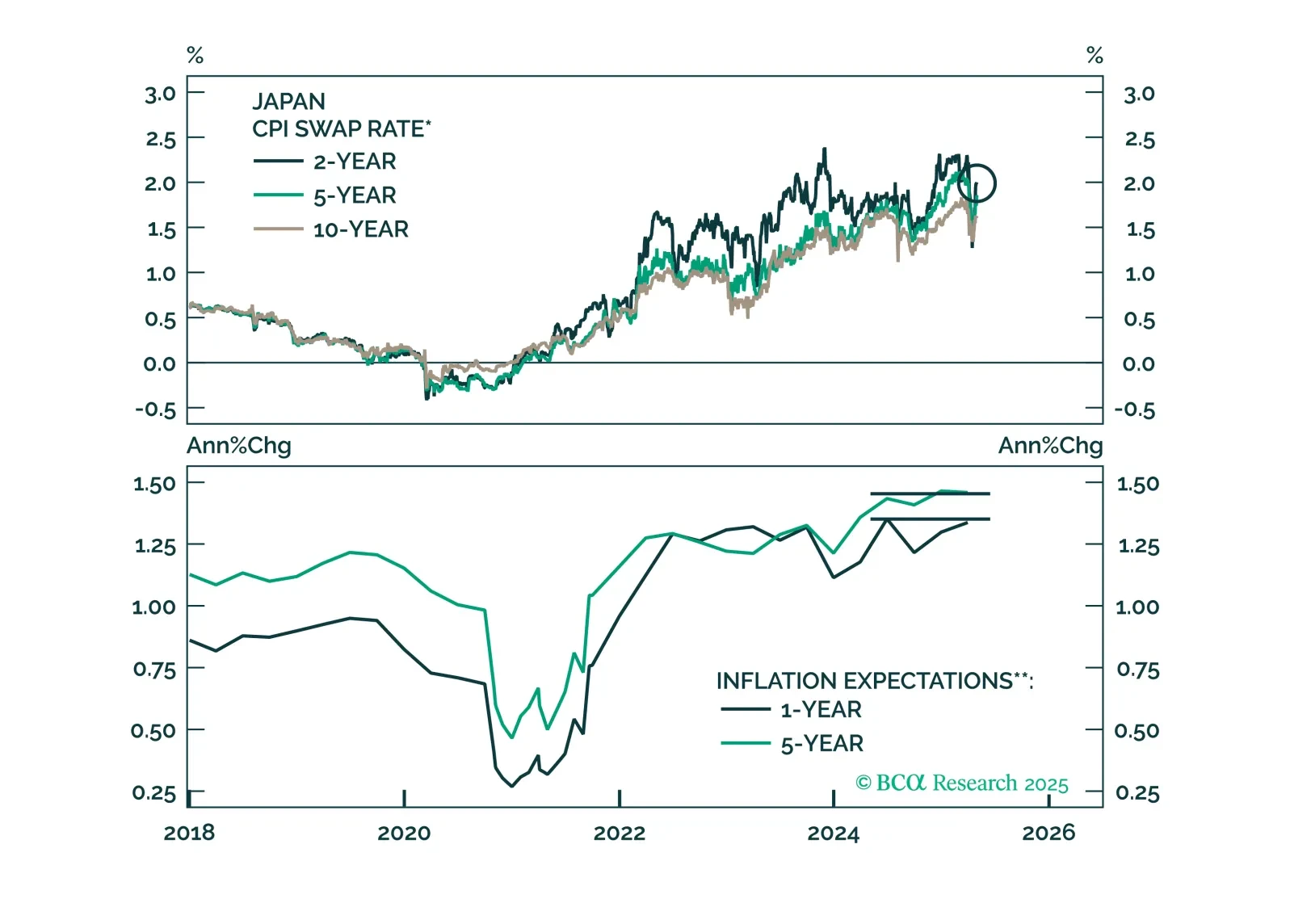

In this note, we reaffirm our underweight position in JGBs and long yen positions given the BoJ’s meeting overnight.

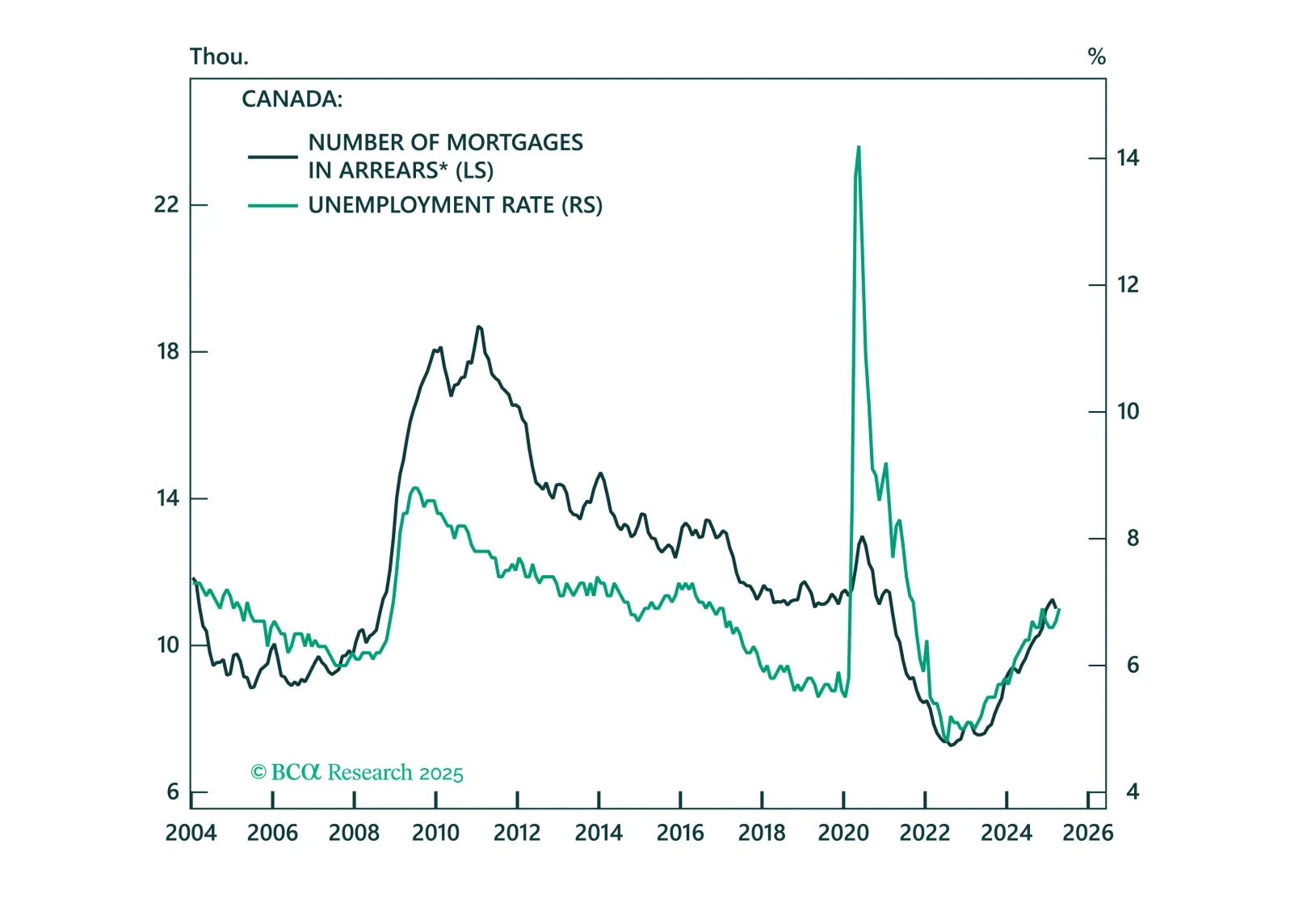

The Bank of Canada may be on hold for now, but deflationary risks are rising fast. Find out why rate cuts may come sooner than markets expect.

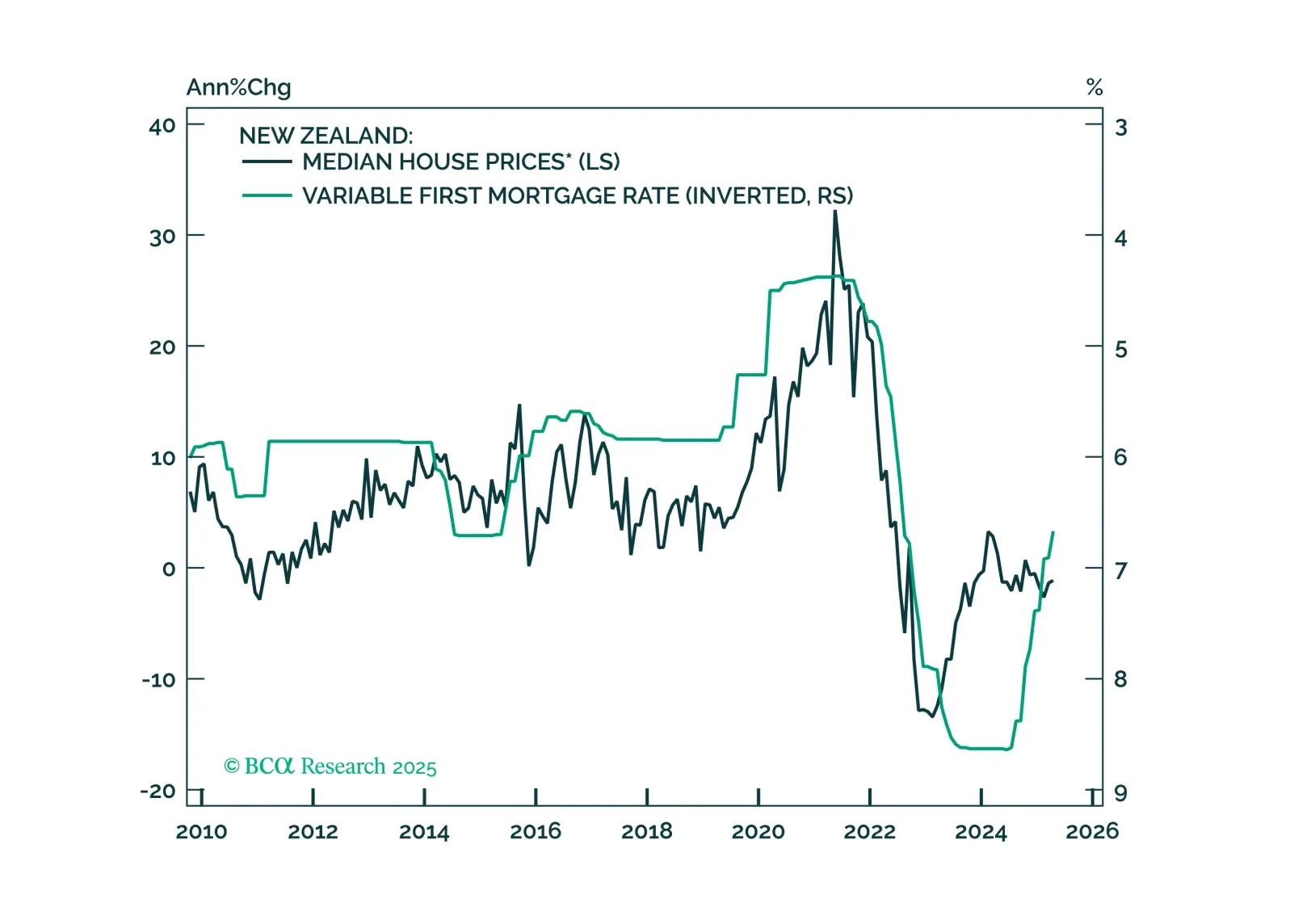

This Insight looks at the implications of the RBNZ’s rate cut on New Zealand assets.

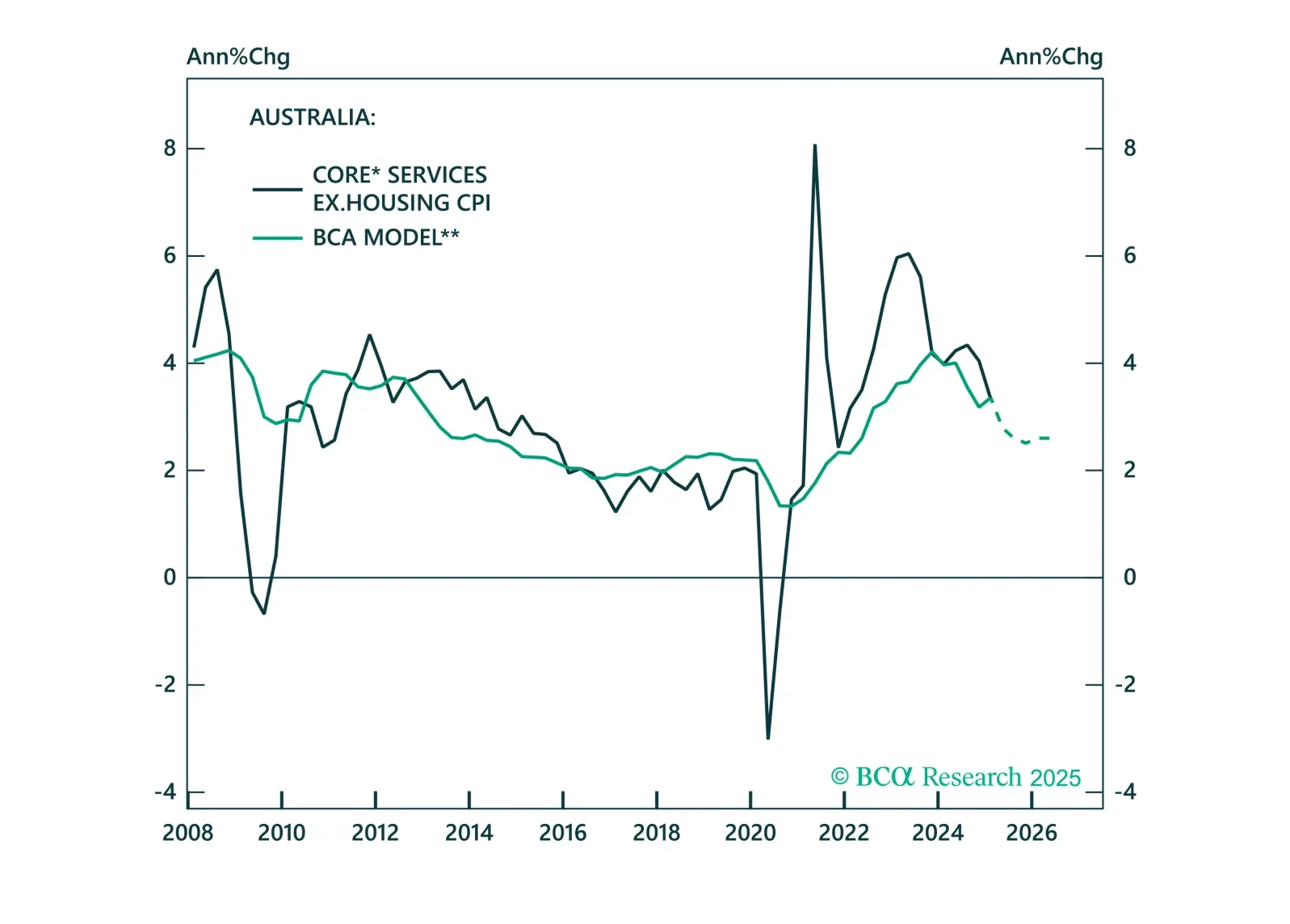

The RBA just turned dovish, but the macro data do not justify many more cuts. We unpack why Australia’s strong labor market and sticky inflation limit the scope for further easing.

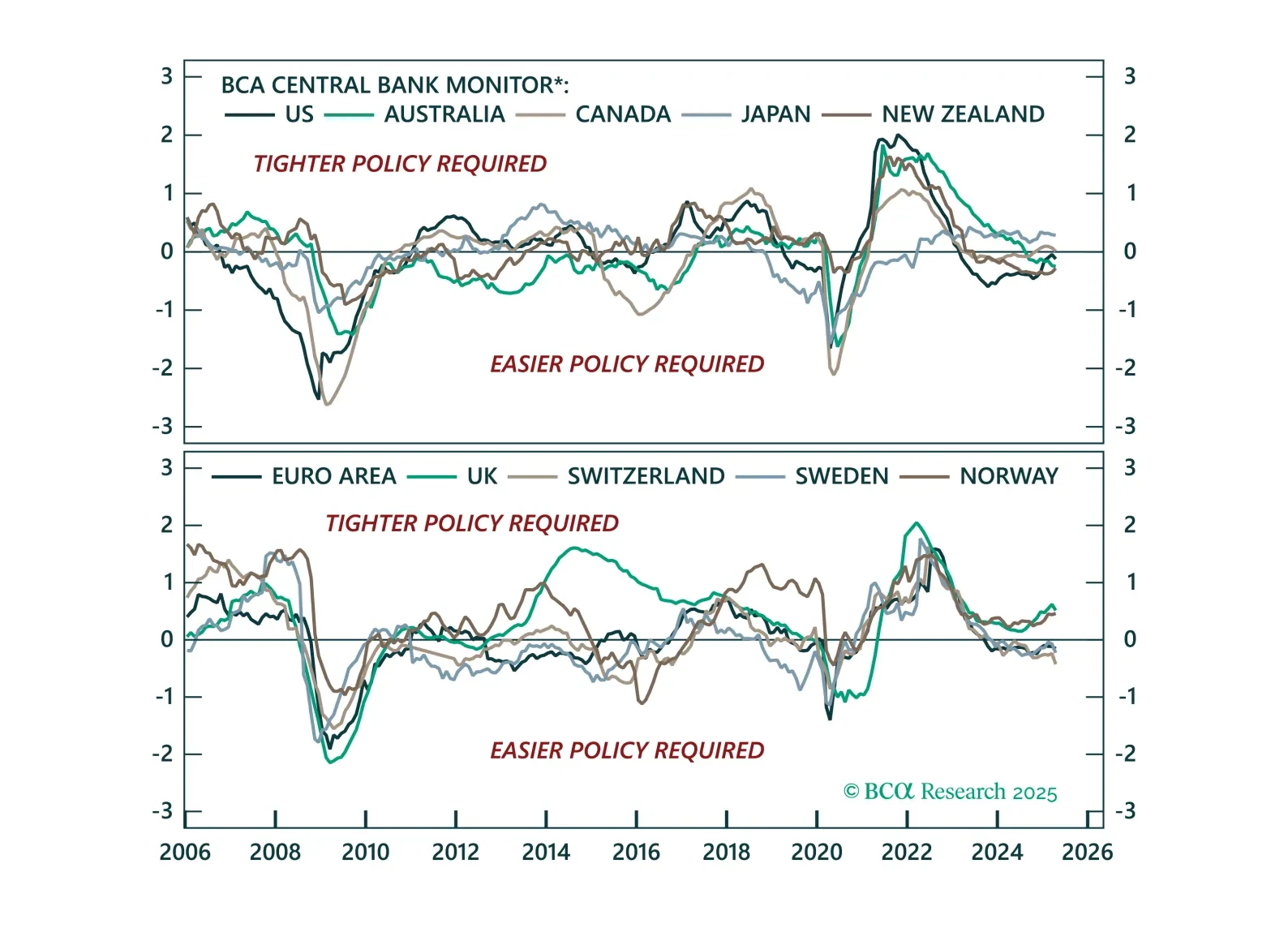

The easing bias remains, but not all central banks are equal. This Central Bank Monitor update reveals who is ready to cut more and who is still pretending not to.

This week’s report looks at Japan, with the recent BoJ meeting. While a trade war has injected uncertainty into the Japanese economy, our conviction remains high that JGBs will underperform other government bond markets, and the yen…

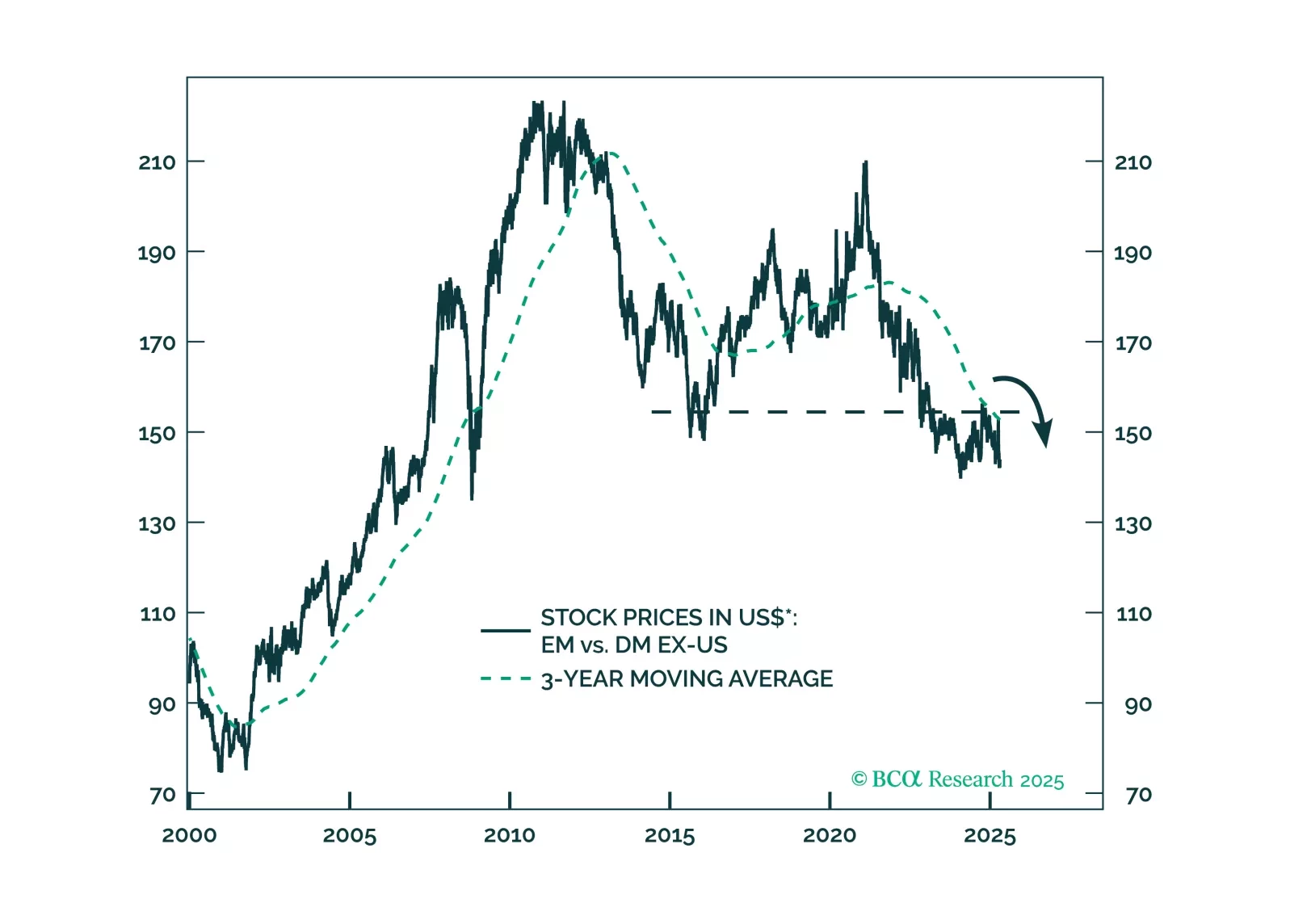

Bessenomics has failed so far. The key pillars of Bessent’s policy mix – achieving lower interest rates and robust economic growth – have been severely jeopardized. The US dollar has depreciated for different reasons than Bessent had…

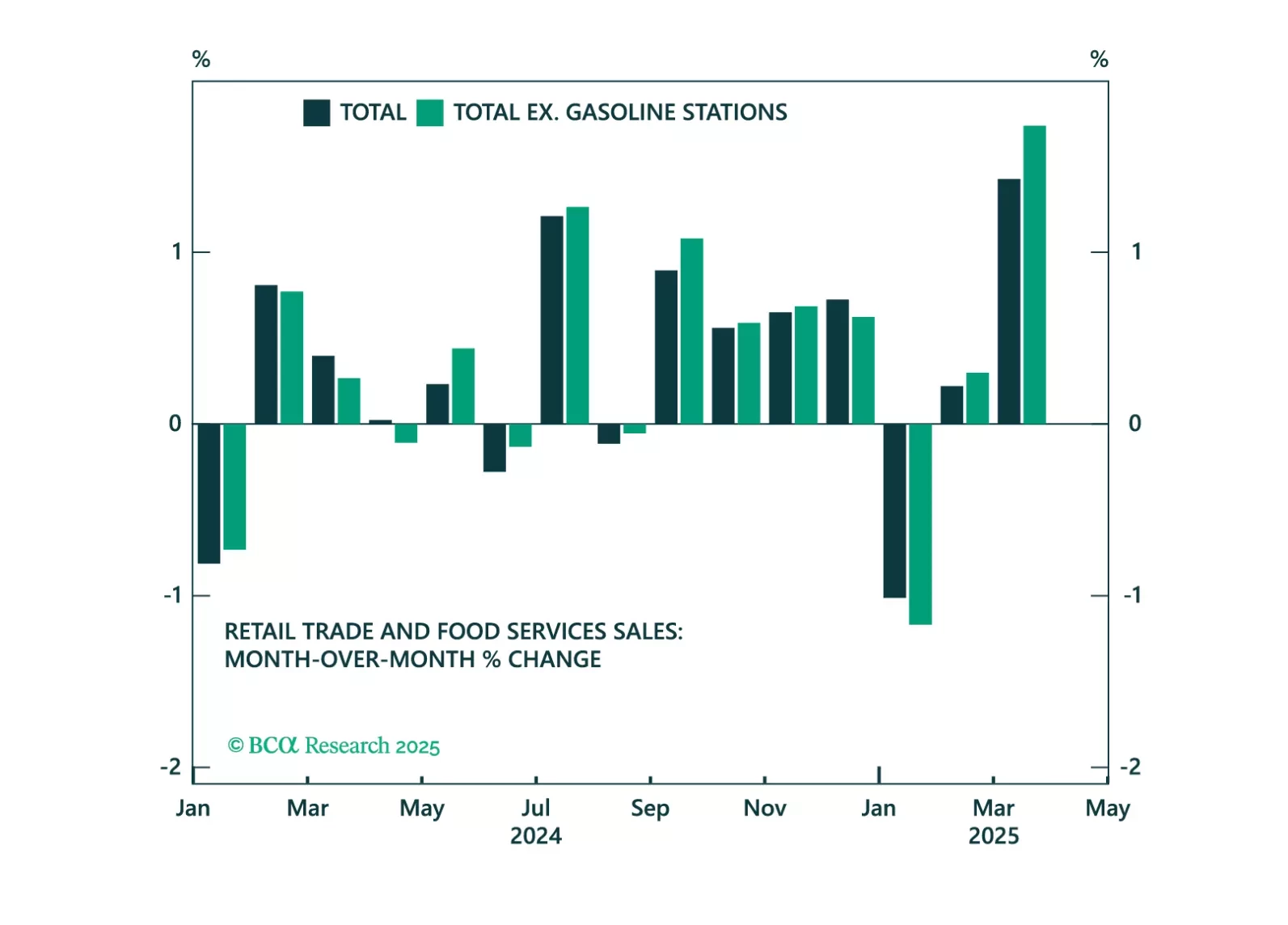

Fed Chair Jay Powell’s remarks yesterday were in-line with our base case expectation that the Fed will not cut rates proactively in the face of rising tariff-driven inflation.

Today, we publish our Quarterly Model Bond Portfolio report. We discuss how the trade war has further increased the global recession risk, but US Treasuries could underperform their global peers in the near term. We cover the fixed…