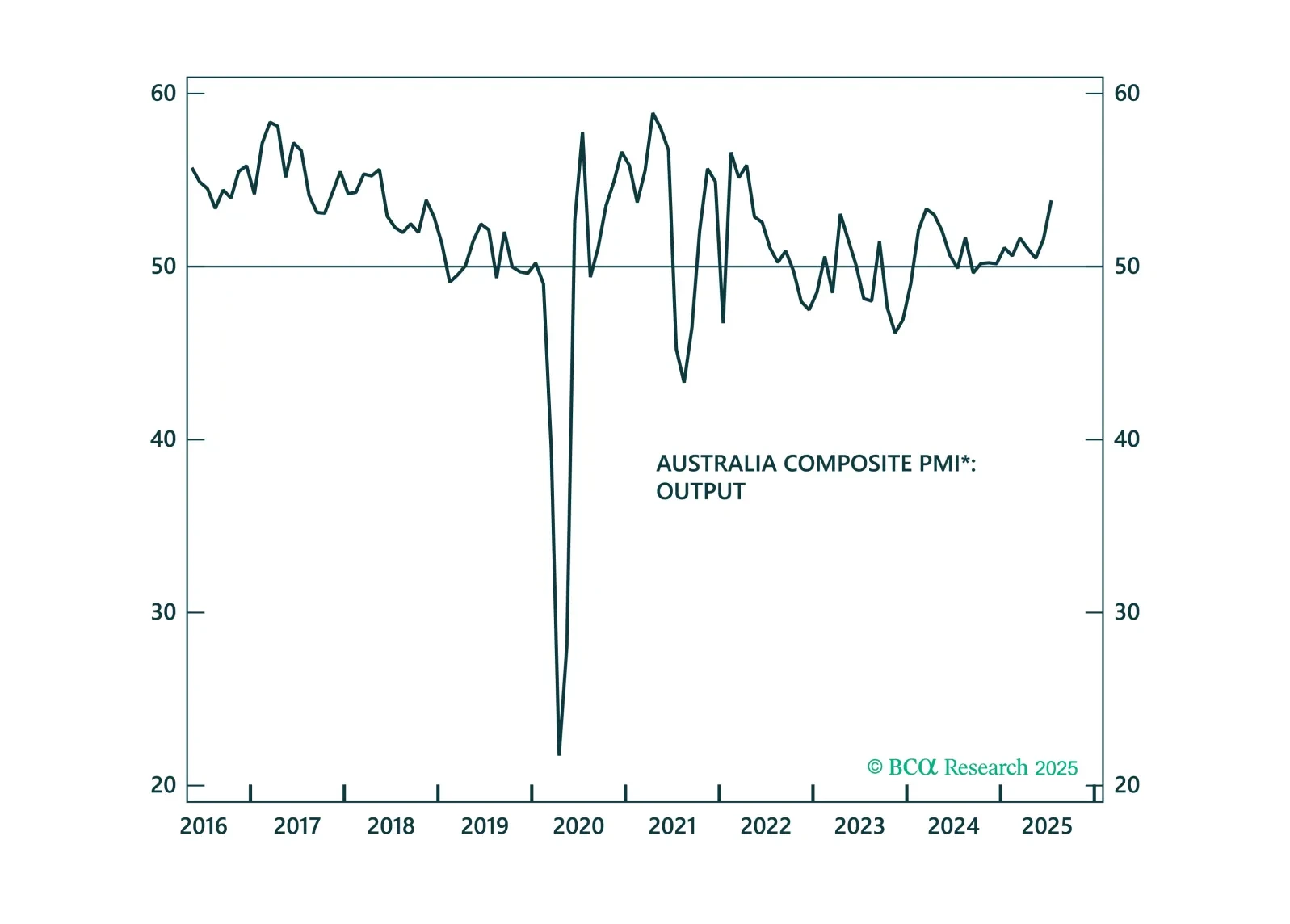

In a widely anticipated move, the RBA resumed cutting rates. However, with housing, consumption, and PMIs improving, we see little scope for the RBA to ease beyond market expectations.

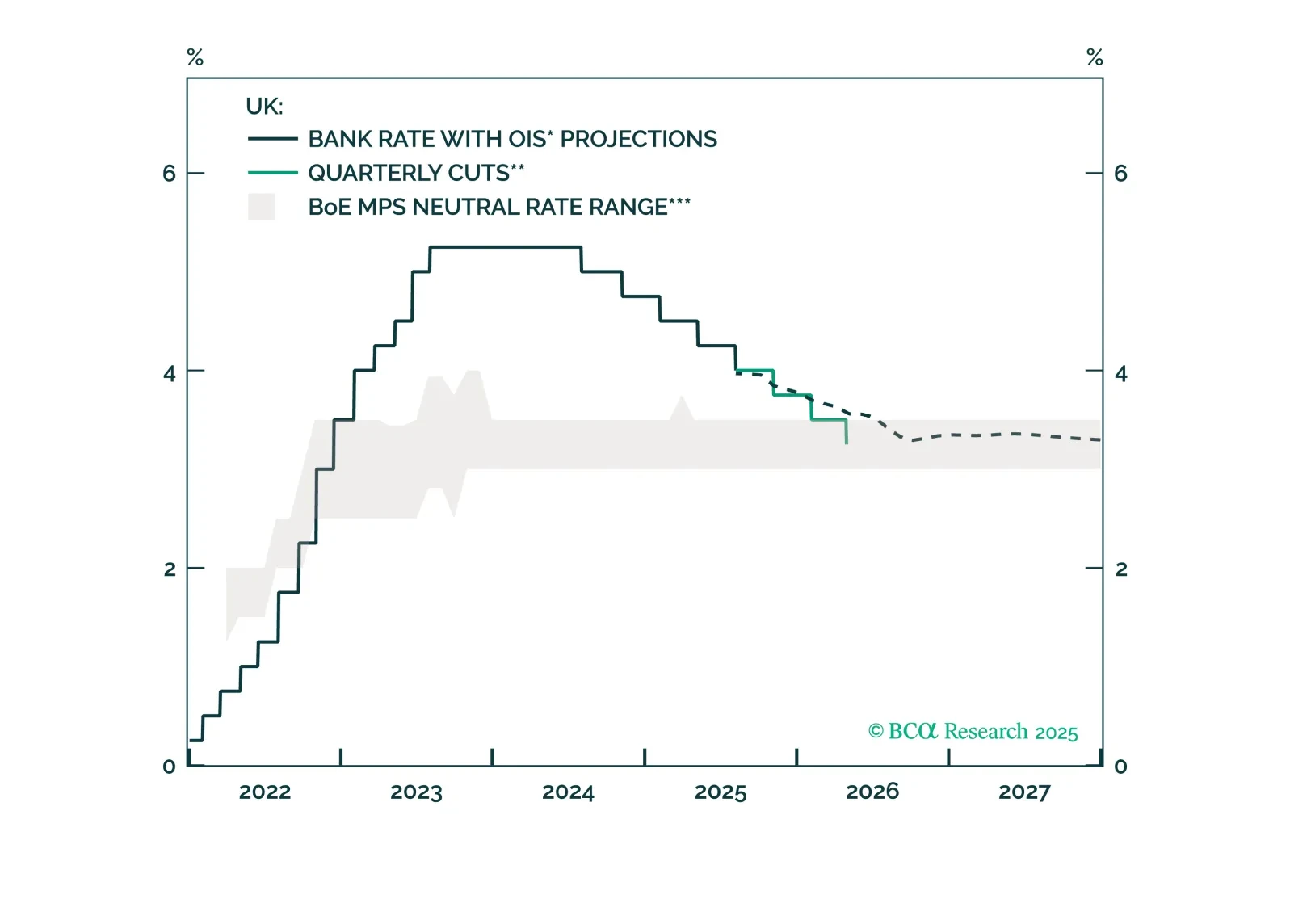

The BoE is easing, but risks falling behind. Labor and growth cracks are starting to emerge, and the Bank may soon be forced to move more decisively. This report outlines why gilts remain a buy and sterling’s path is diverging vs.…

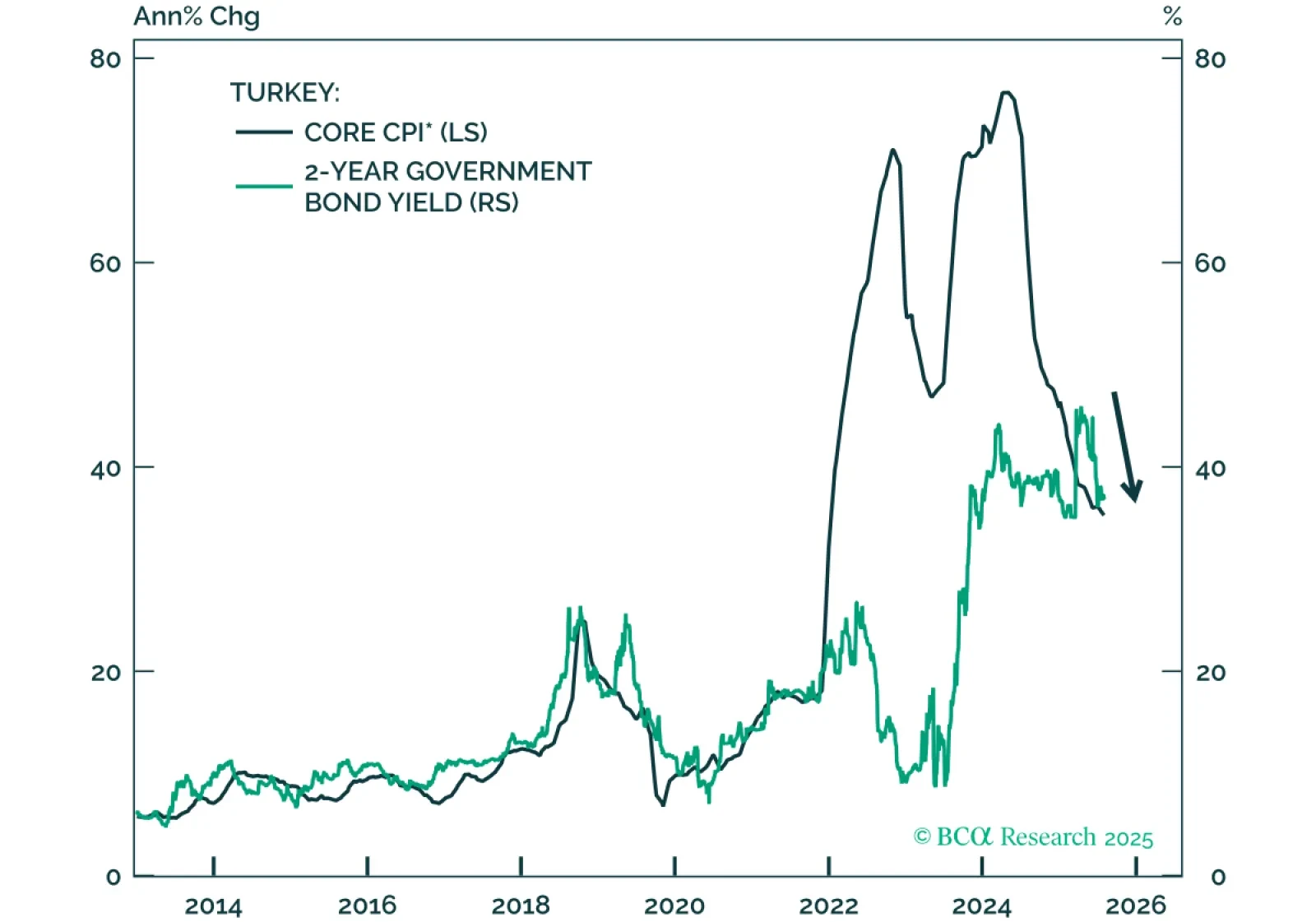

Turkey’s financial policymakers have pursued a disciplined and restrictive policy mix so far, delivering high real interest rates and curbing fiscal expansion even as the economy slows. This commitment to inflation control has paved the…

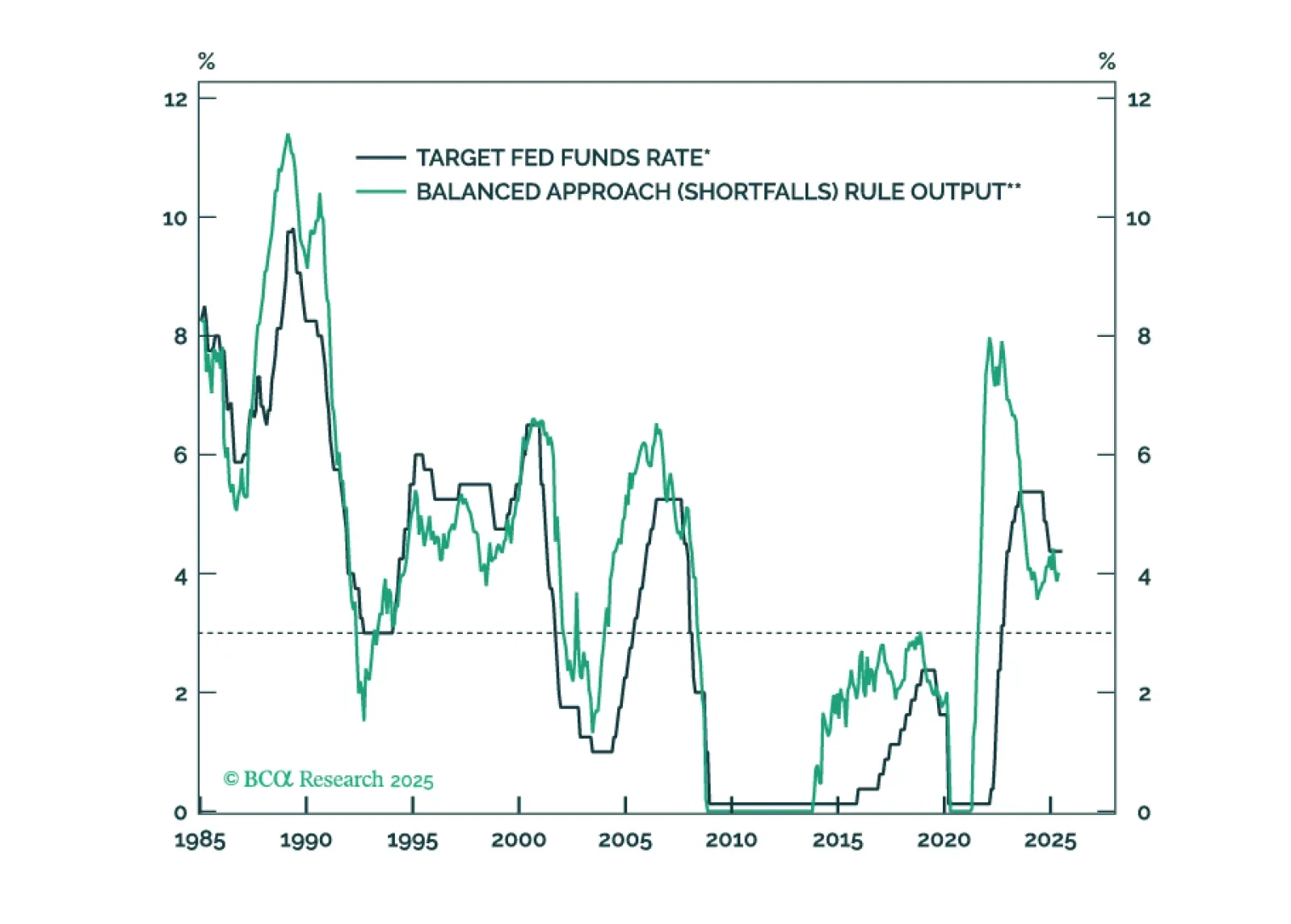

The Fed will keep rates on hold until the unemployment rate forces its hand.

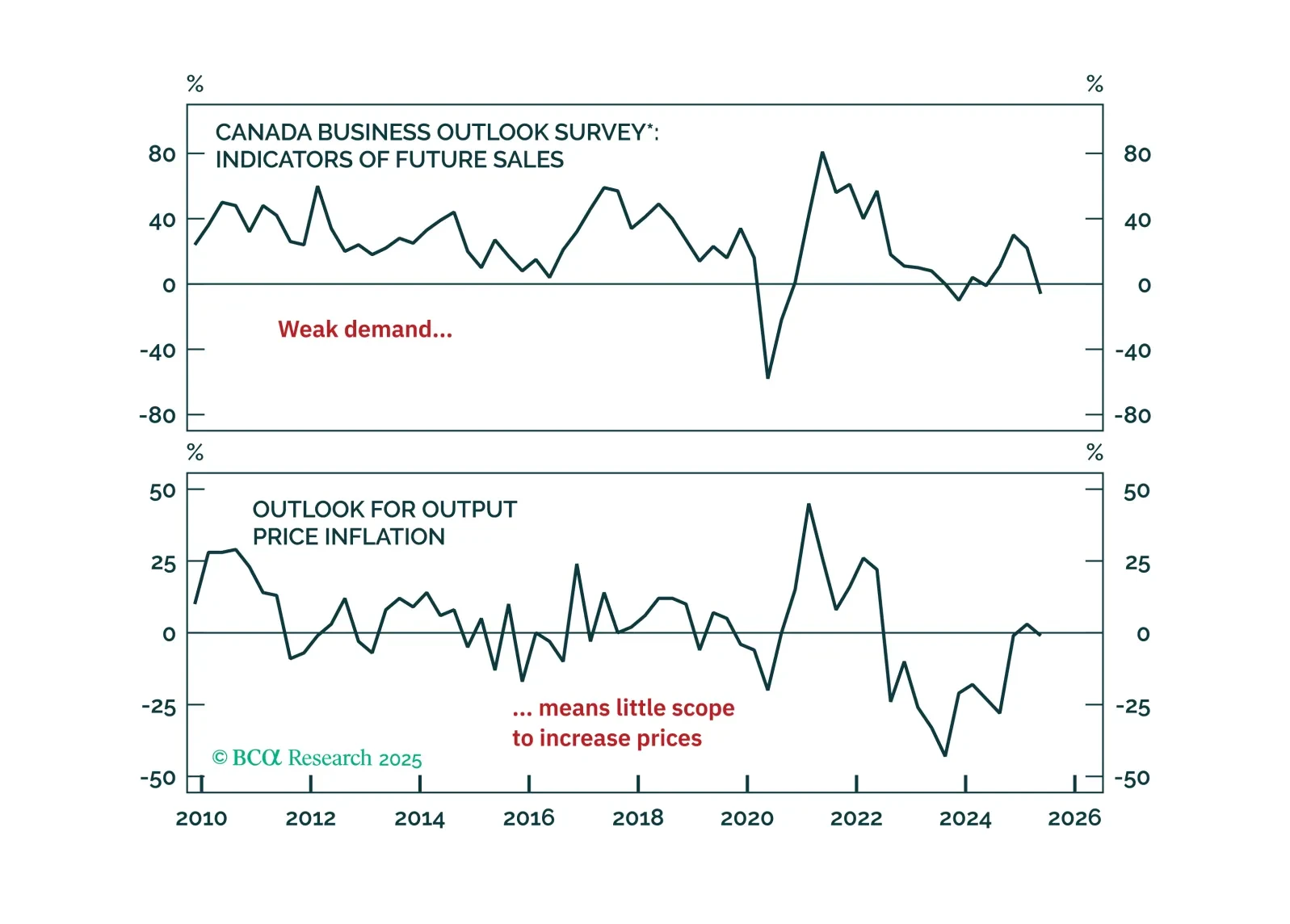

The Bank of Canada continues to hold its policy rate amid trade uncertainty and shows little concern about the potential economic damage from tariffs. We judge the risks differently and view a bet on more rate cuts this year as…

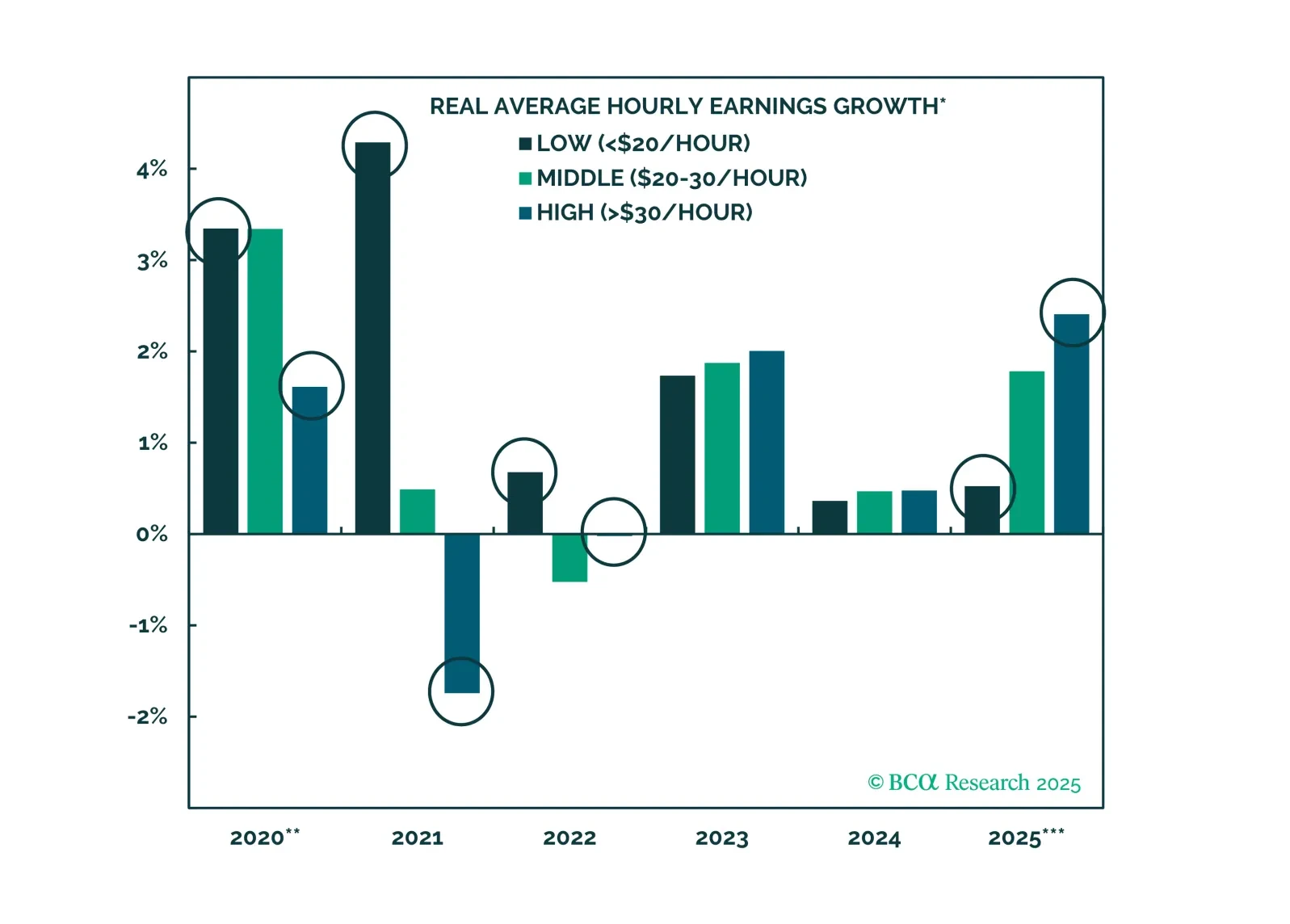

We still believe a recession looms, but it has yet to rear its ugly head. We continue to recommend investors position defensively, but we will change tack if clear signs of a recession don’t emerge soon.

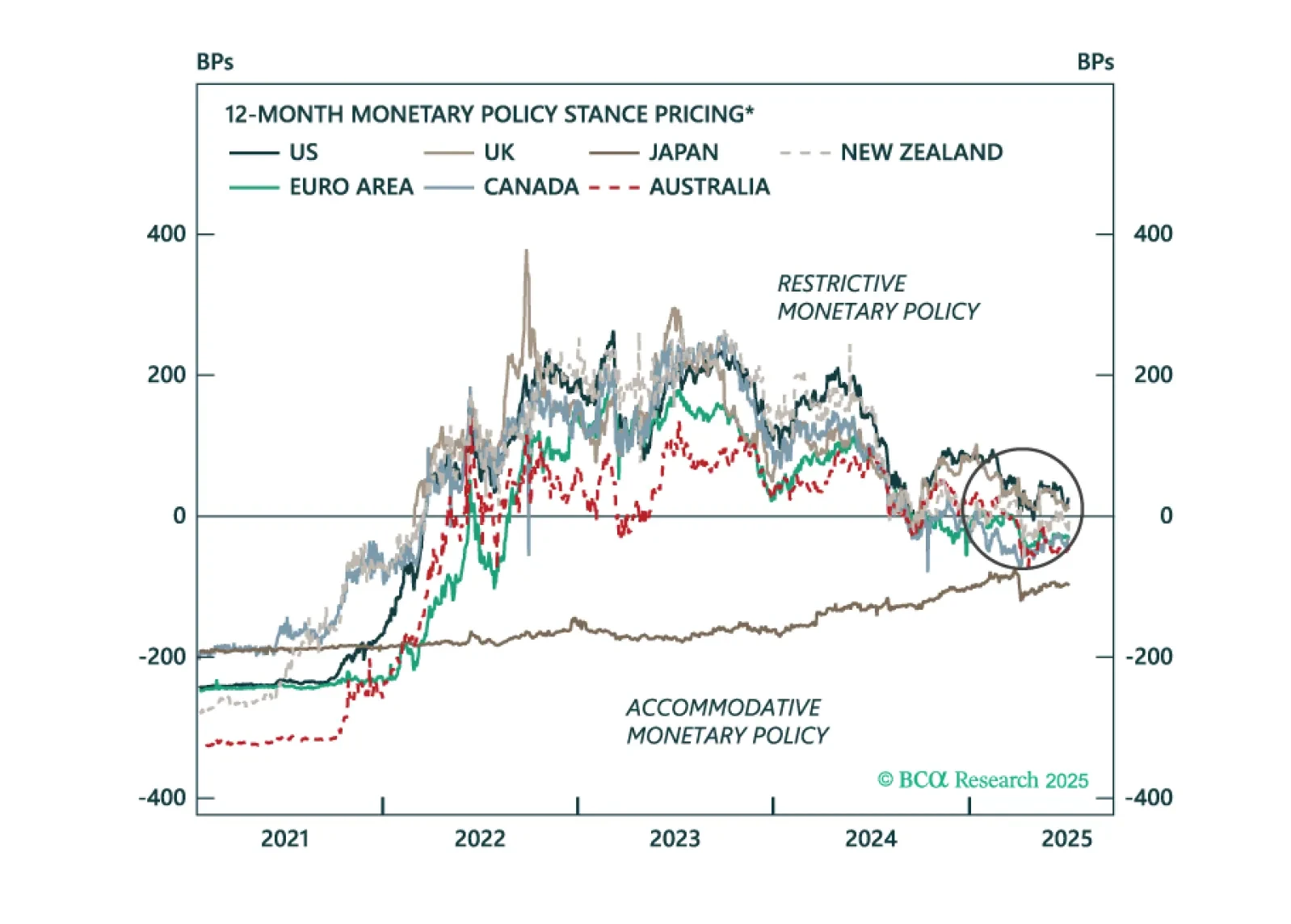

Markets are pricing a return to a neutral policy stance for the major central banks within the next 12 months. However, recession risks still loom amid slowing growth. We unpack where recession risks are underappreciated and what it…

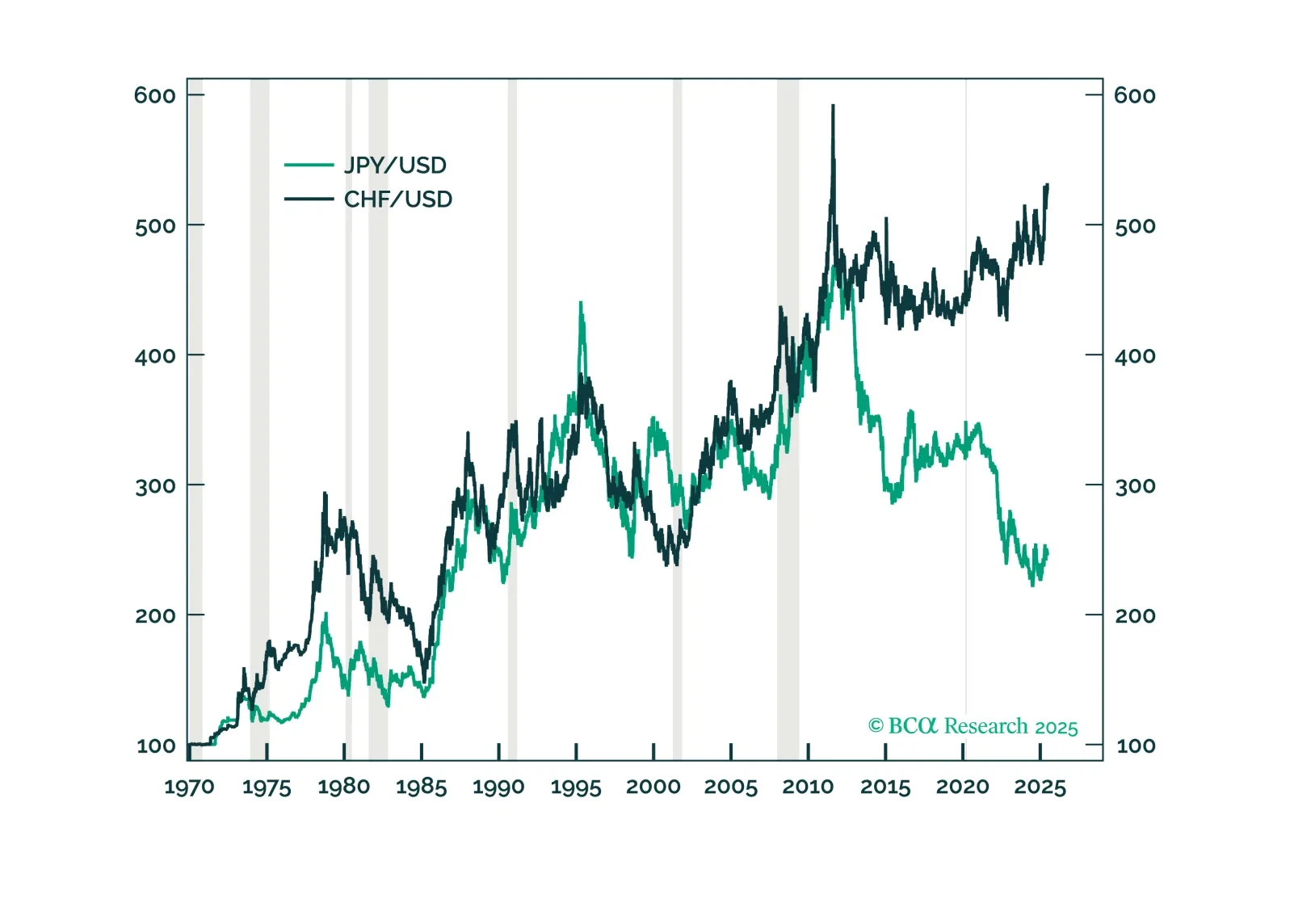

In this Insight, we highlight our strong conviction trades based on the central bank meetings held by the Bank of England, the Norges Bank, the Swiss National Bank and the Riksbank.

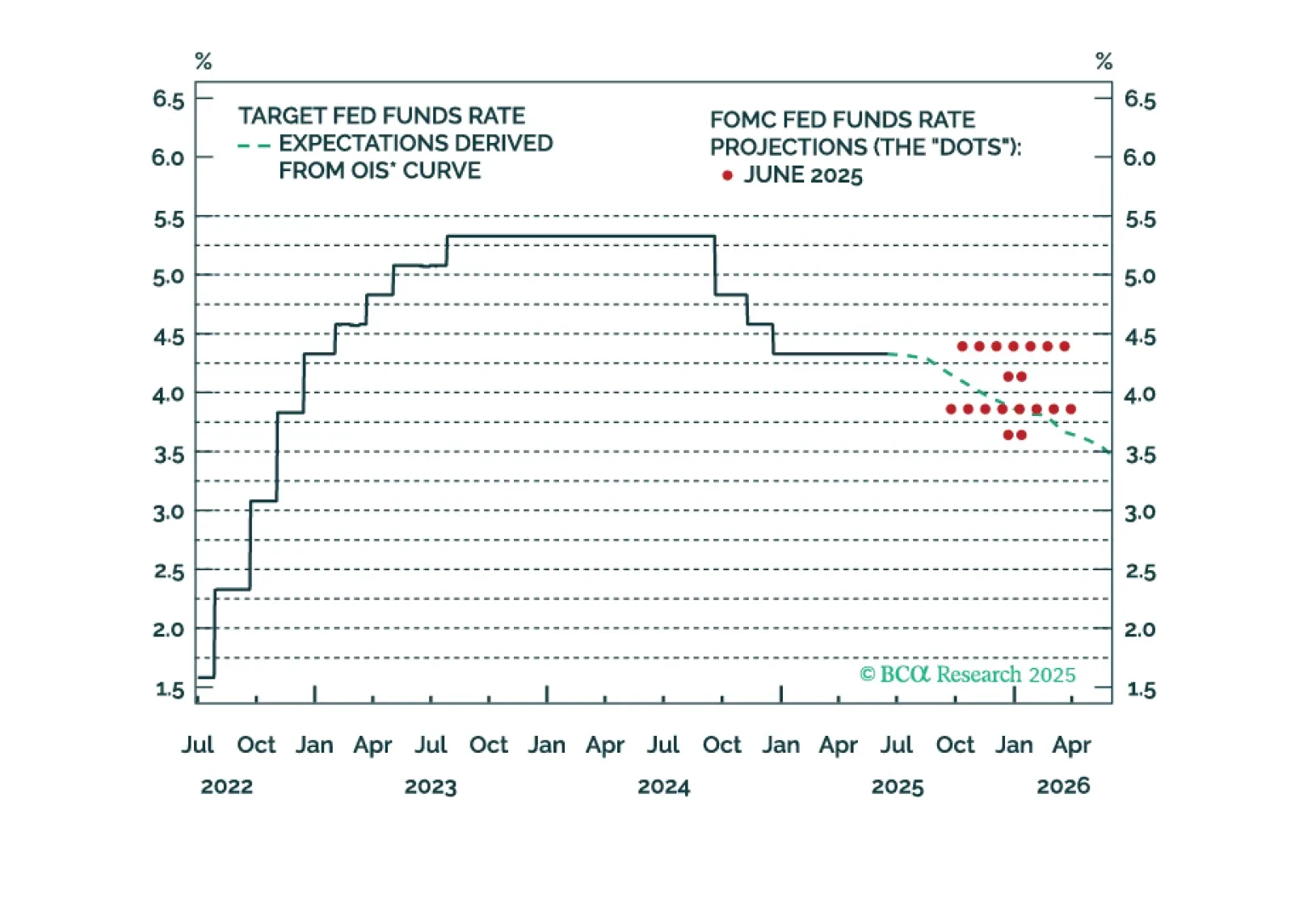

The Fed’s 2025 interest rate projections reveal two camps within the committee. One group looking for no rate cuts this year and another looking for 50-bps of easing. We think the second group’s forecast will turn out to be more…