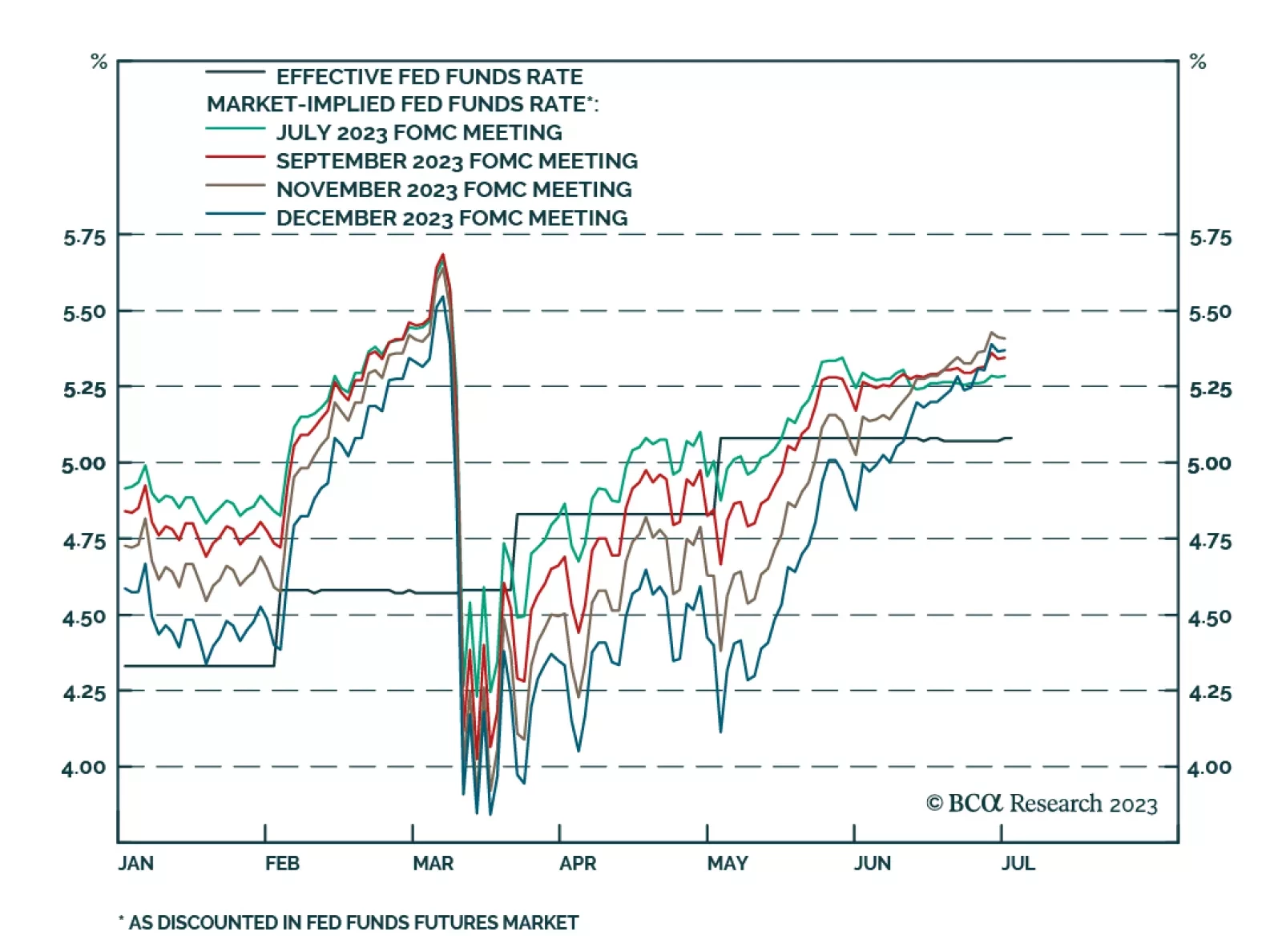

The minutes from the June FOMC meeting didn’t reveal anything that wasn’t already known. They did explicitly say that “some” participants would have preferred a 25 basis point rate hike instead of a pause…

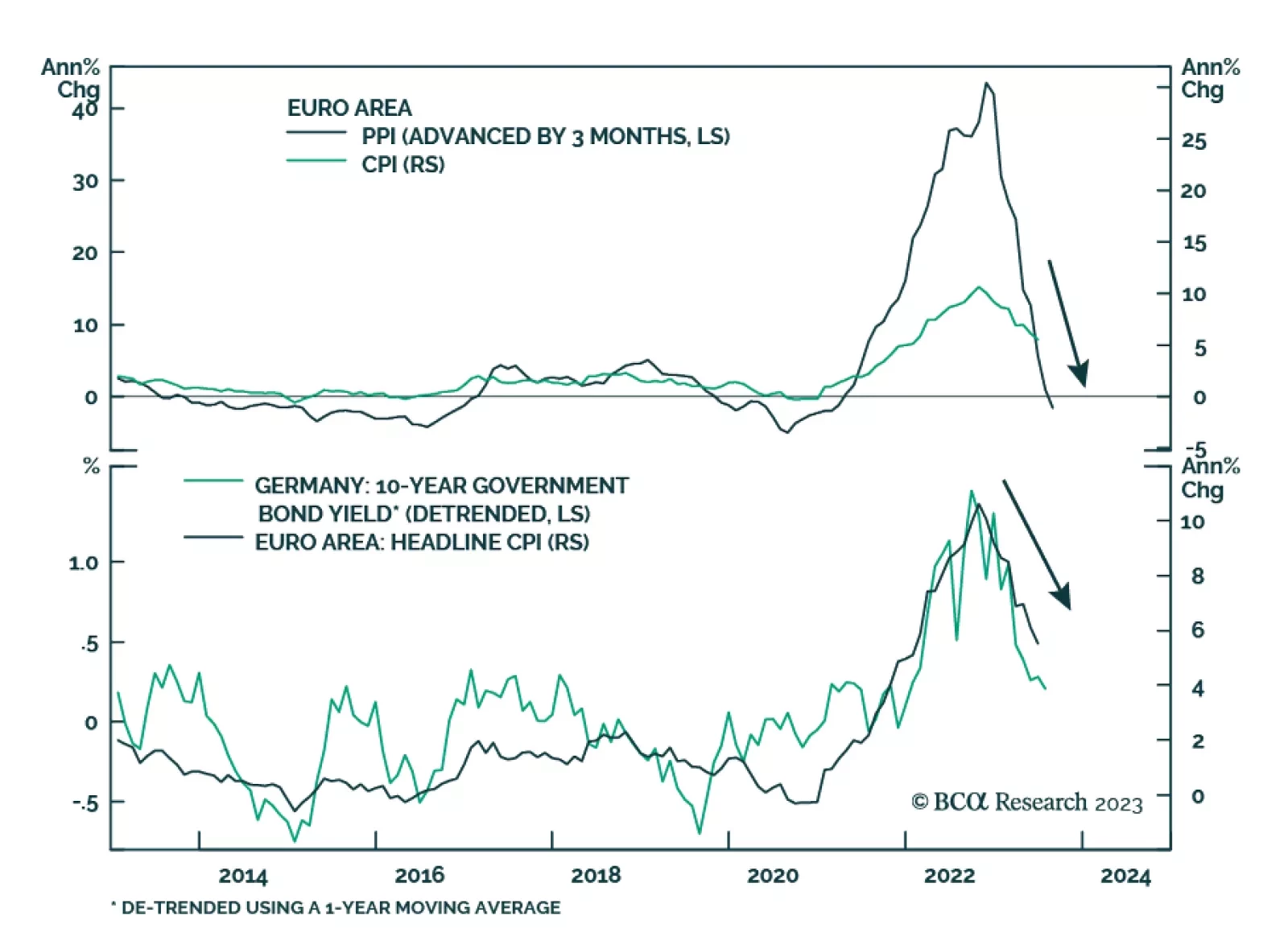

Eurozone producer prices fell by more than anticipated in May. The -1.5% y/y decrease – which marked the first annual drop since December 2020 – was more pronounced than expectations of a -1.3% y/y decline and…

The world economy is likely already in recession, defined as world growth dipping to sub-2 percent. So far, the world recession has been China-led, but in the coming months it will change to being developed economy-led. Hence, while…

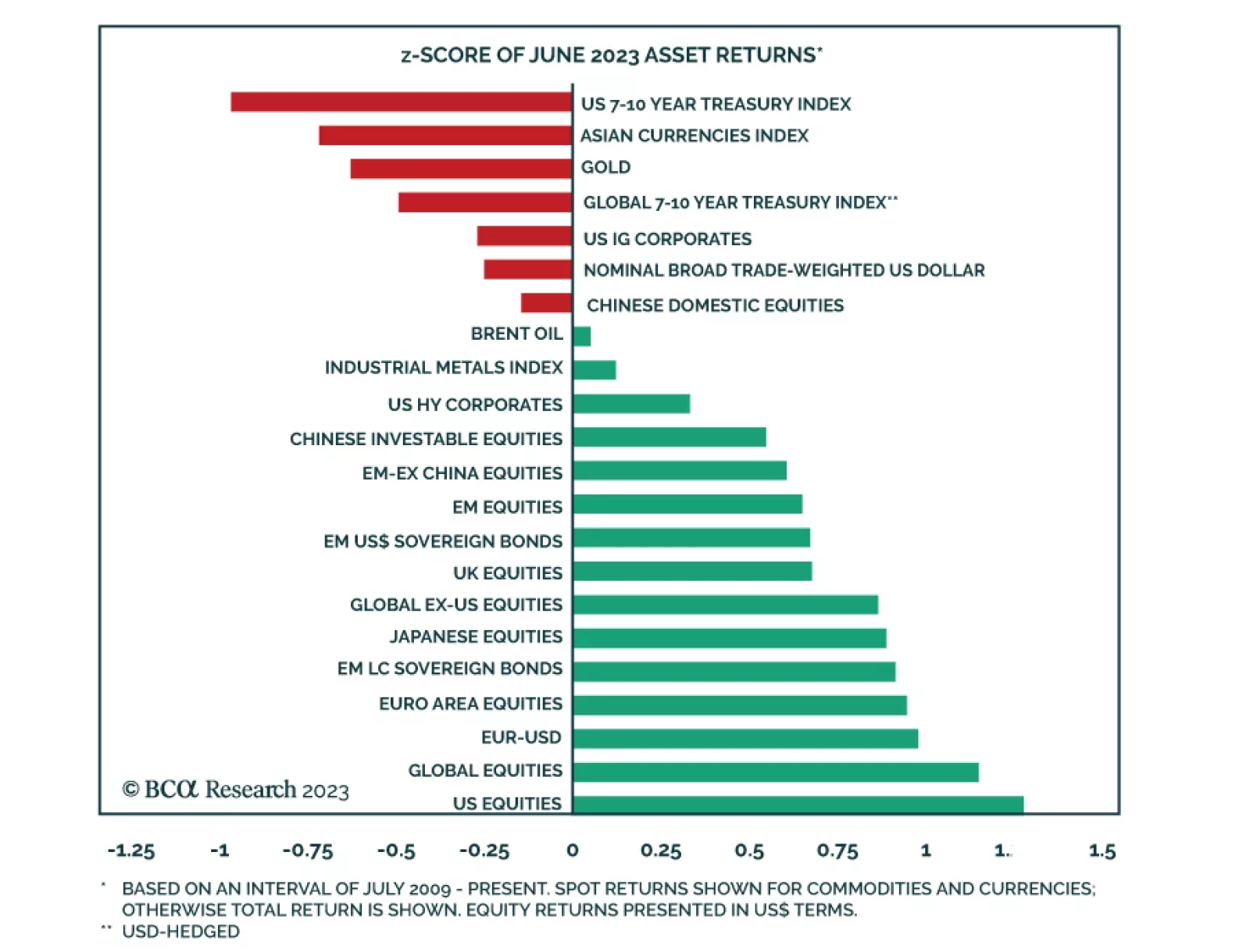

The performance of financial markets continued to improve in June, with most of the major financial assets we track generating positive abnormal returns. The US equity rally – which had been narrowly concentrated among…

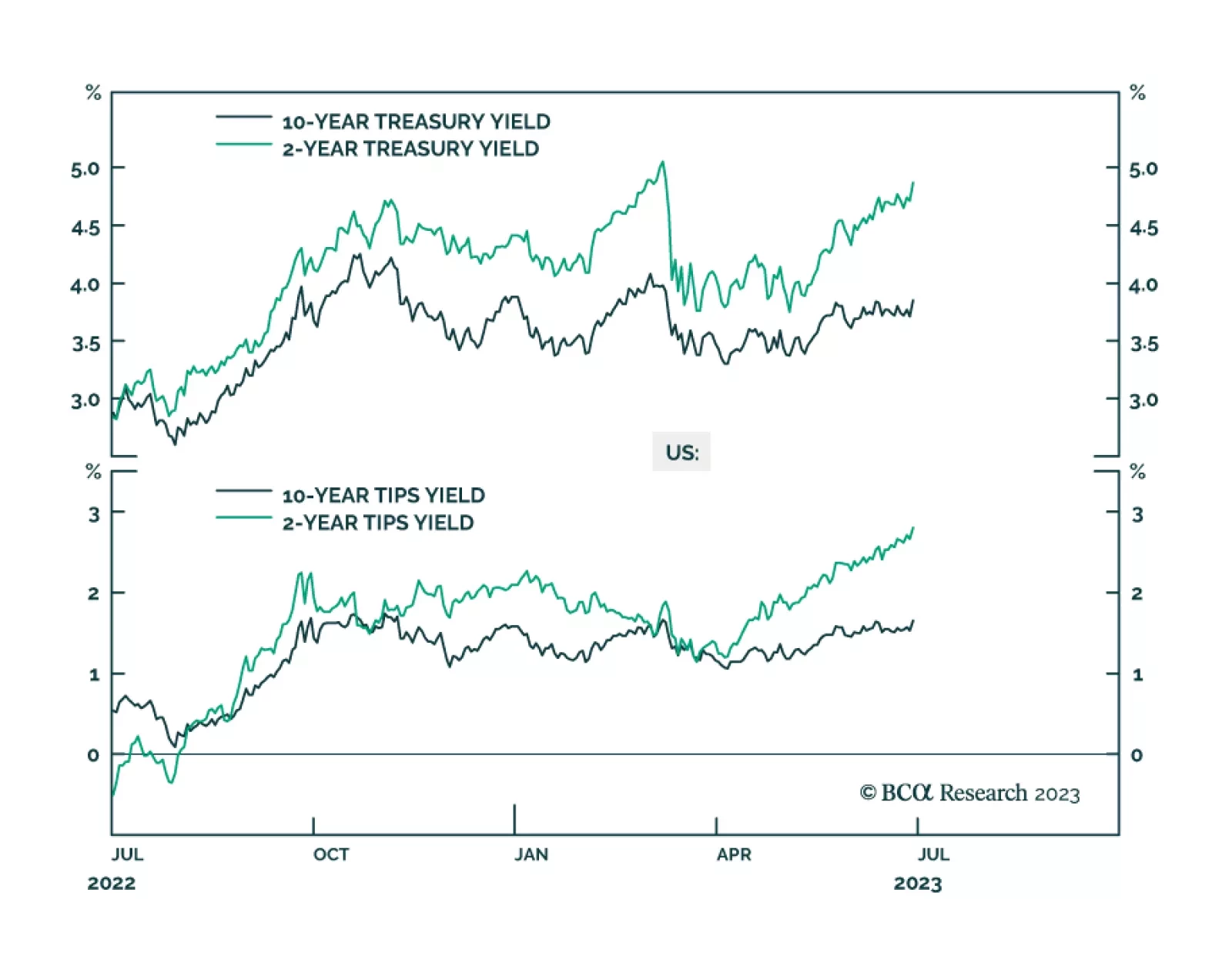

Our US Bond Strategy service responds to recent data releases which showed that real economic growth and the labor market are surprisingly resilient, while inflation pressures continued to decline. The 10-year Treasury yield…

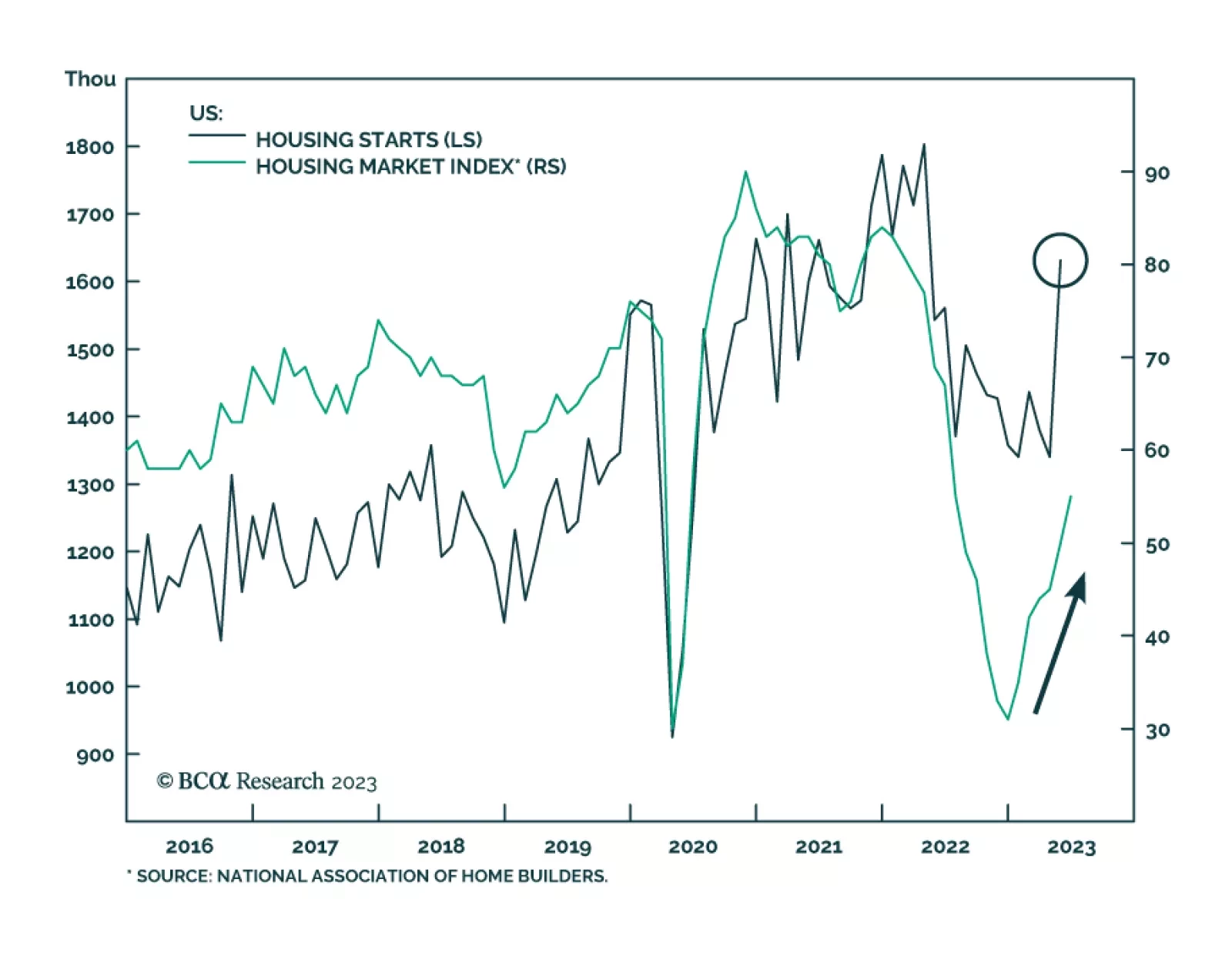

In their just-published update of US housing market conditions, our colleagues at the BCA Bank Credit Analyst focus on whether May’s strong showing in new home starts and sales in May – up 21% and 12%,…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

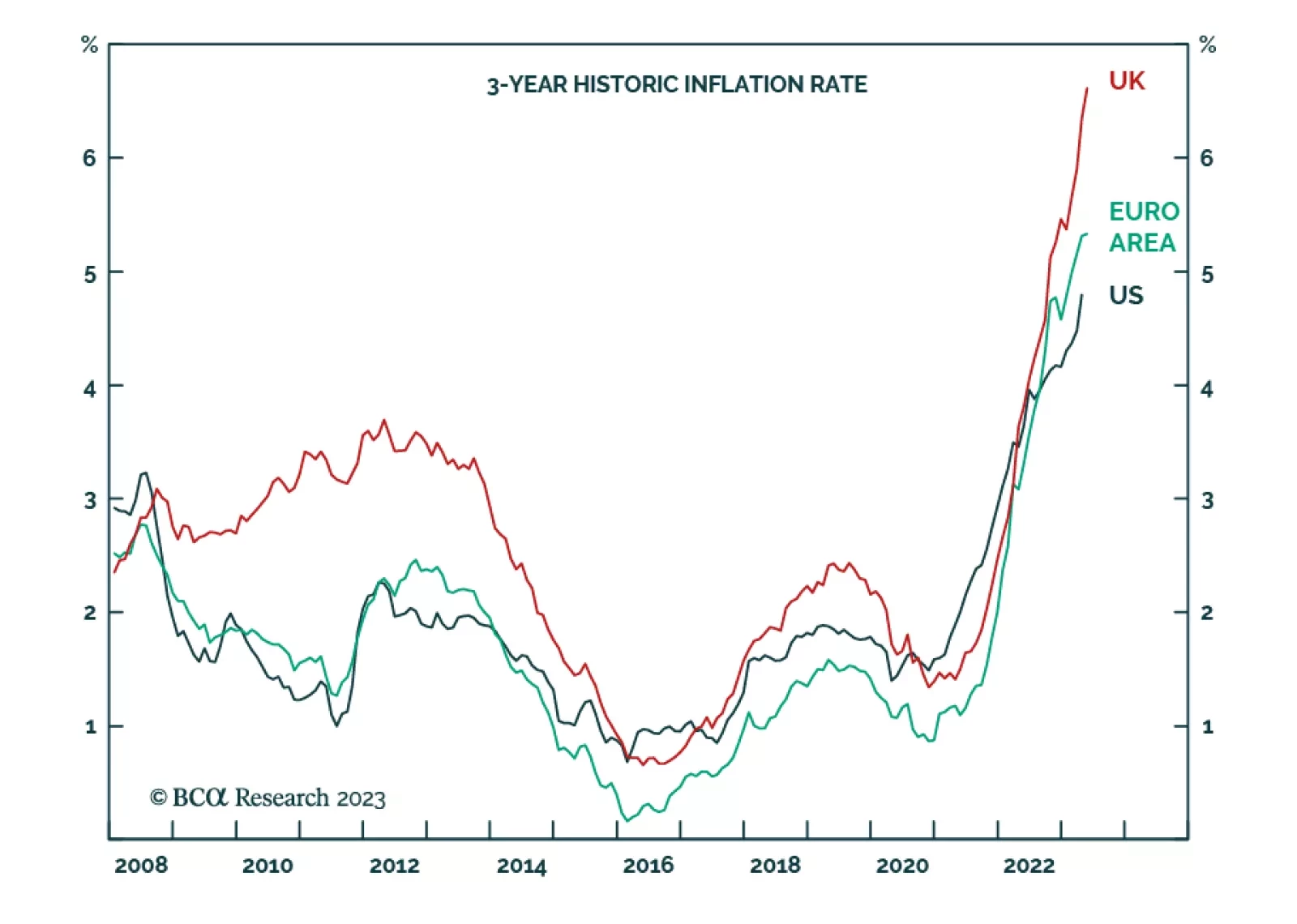

Our Counterpoint service argues that it is not enough that inflation stabilizes at 3 percent for inflation expectations to be anchored and central banks must make inflation undershoot 2 percent for some time to prevent a repeat…

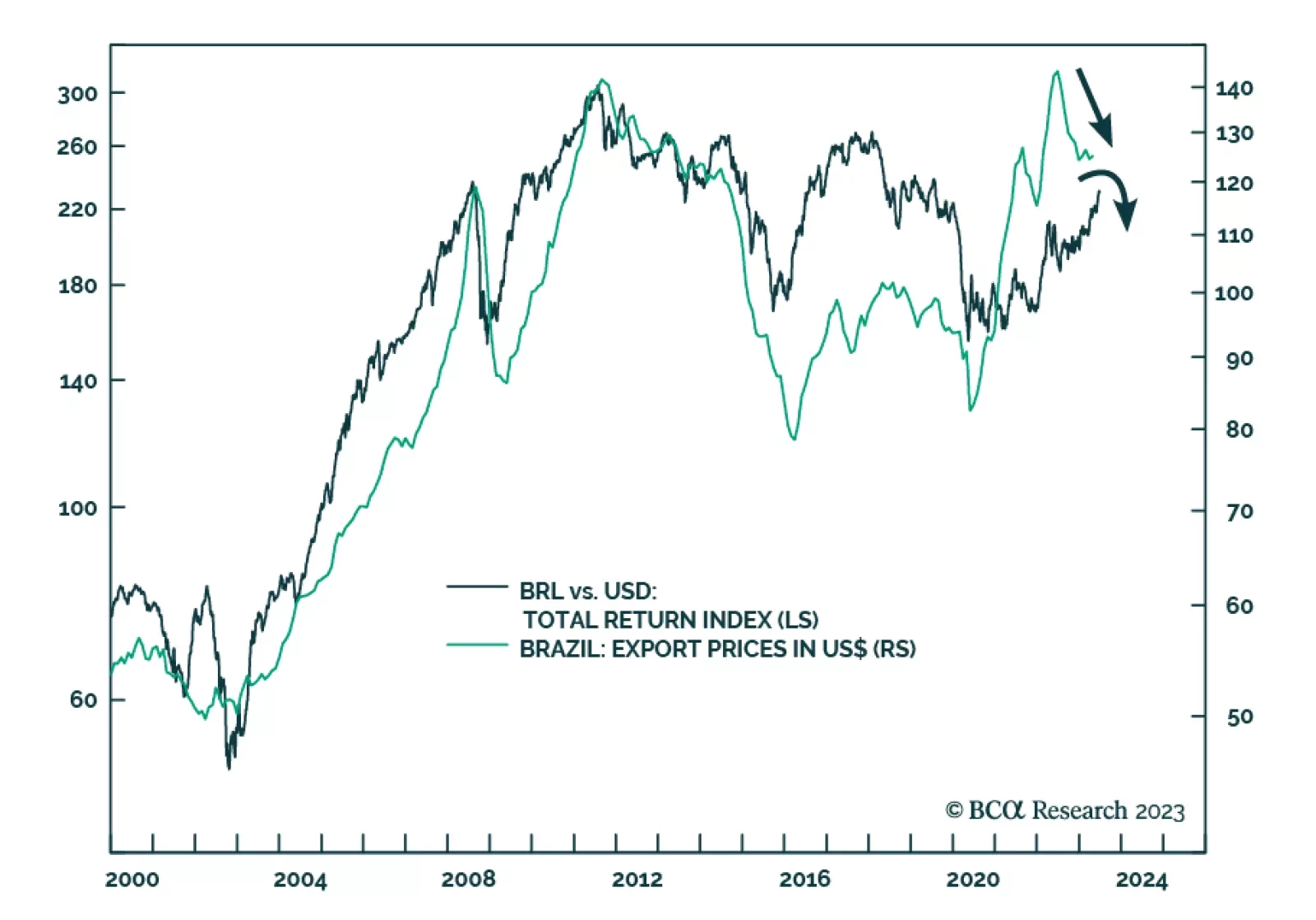

Since the Brazilian Central Bank (BCB) released its latest monetary policy minutes on June 27th, the Brazilian real has depreciated for three days in a row. Will the BRL resume its strengthening trajectory, or is the currency set…