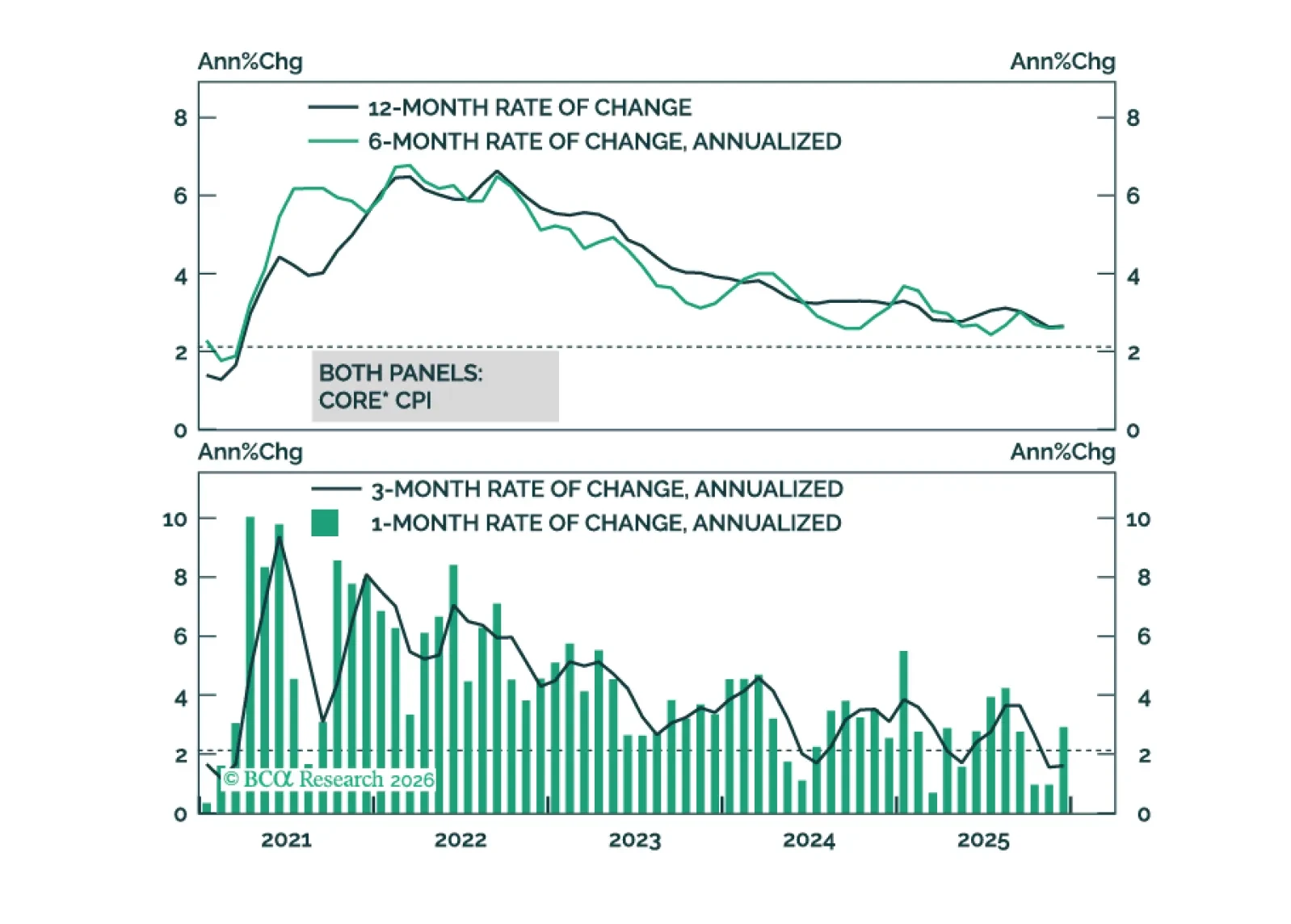

This morning’s CPI report signals that the worst of the tariff impact on inflation may already be in the rearview mirror.

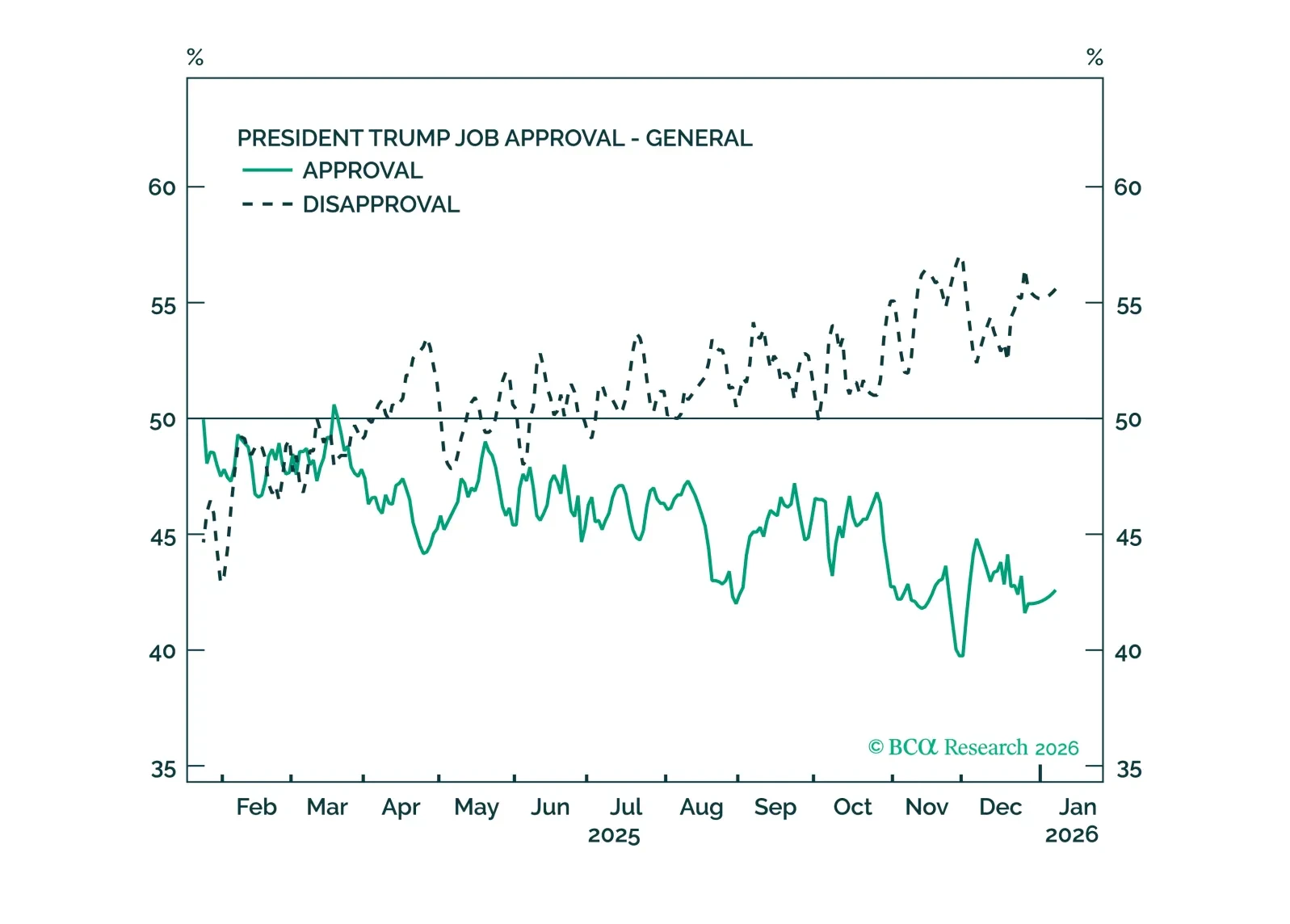

Congress will ultimately limit Trump from acting on his worst impulses, but his efforts to bypass those limits will cause market volatility.

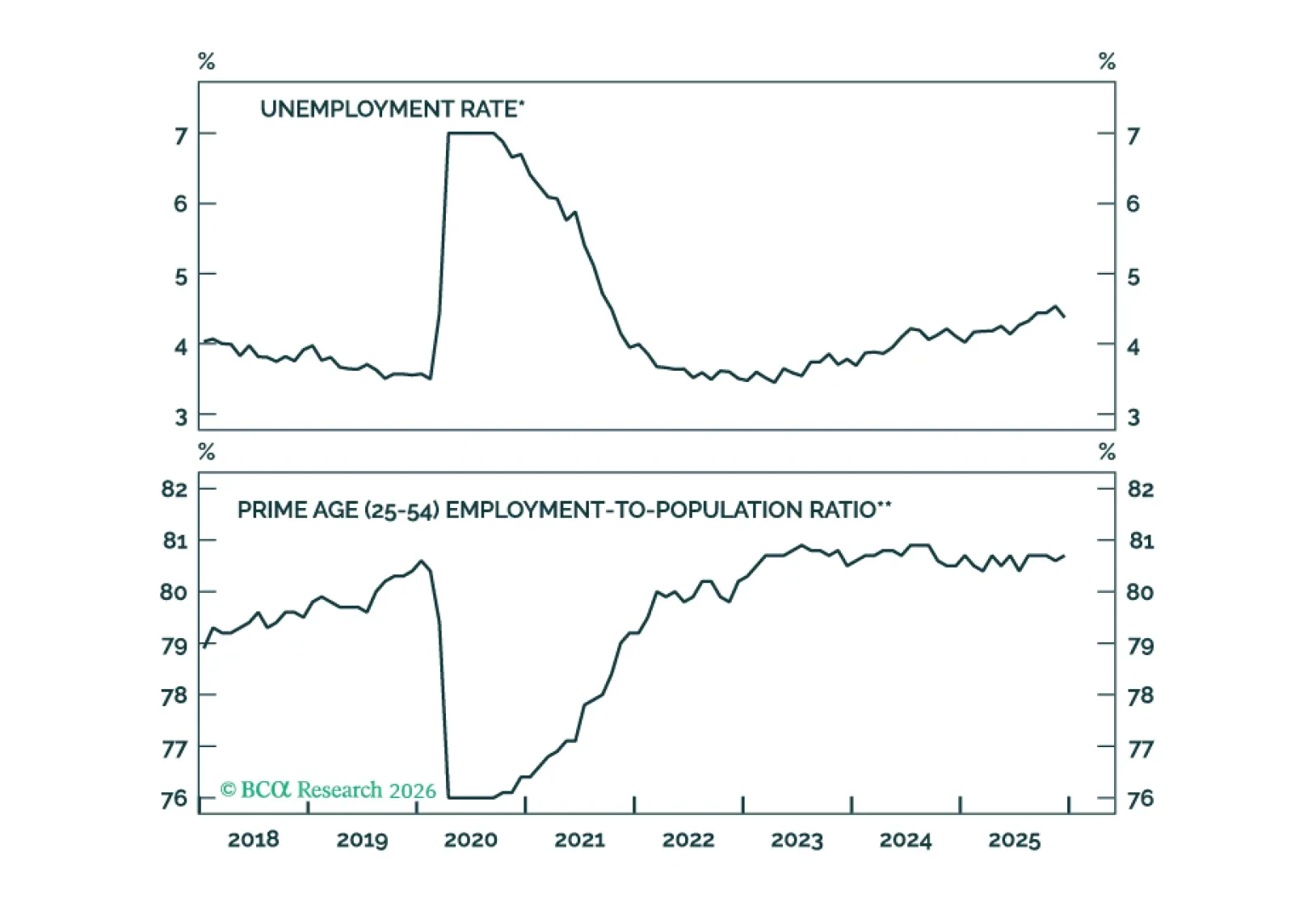

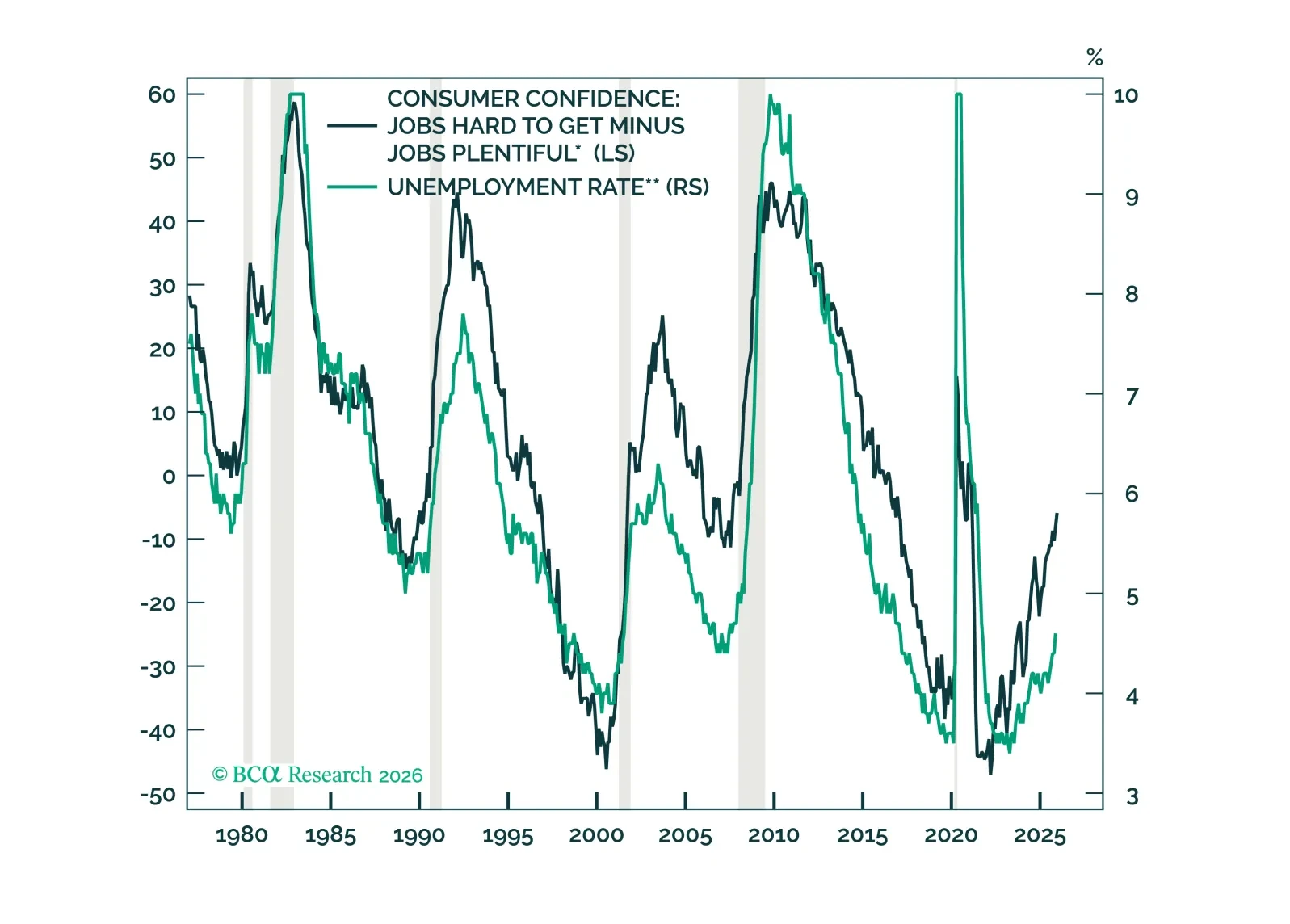

Measures of labor market utilization improved in December, ruling out a January cut and significantly reducing the odds of a March cut.

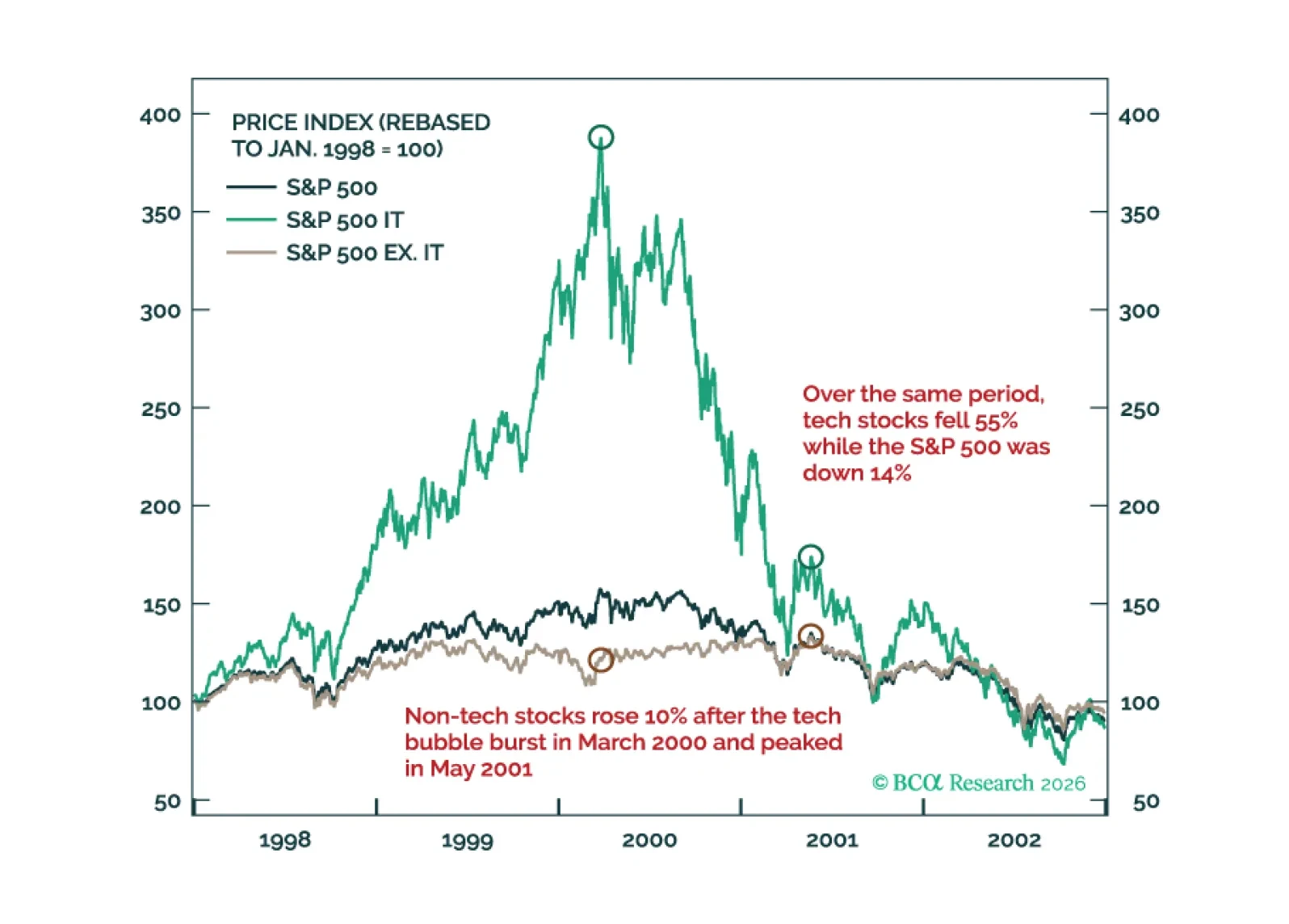

Much like the 2000 episode, we expect this year to unfold in two stages: A “Great Rotation” from tech stocks to non-tech names in the first half of 2026 followed by a broad-based selloff in stocks in the second half on the back of a…

We have been surprised that consumption has held up well despite anemic payrolls growth. This brief considers ways that consumption might continue to beat our base-case expectations.

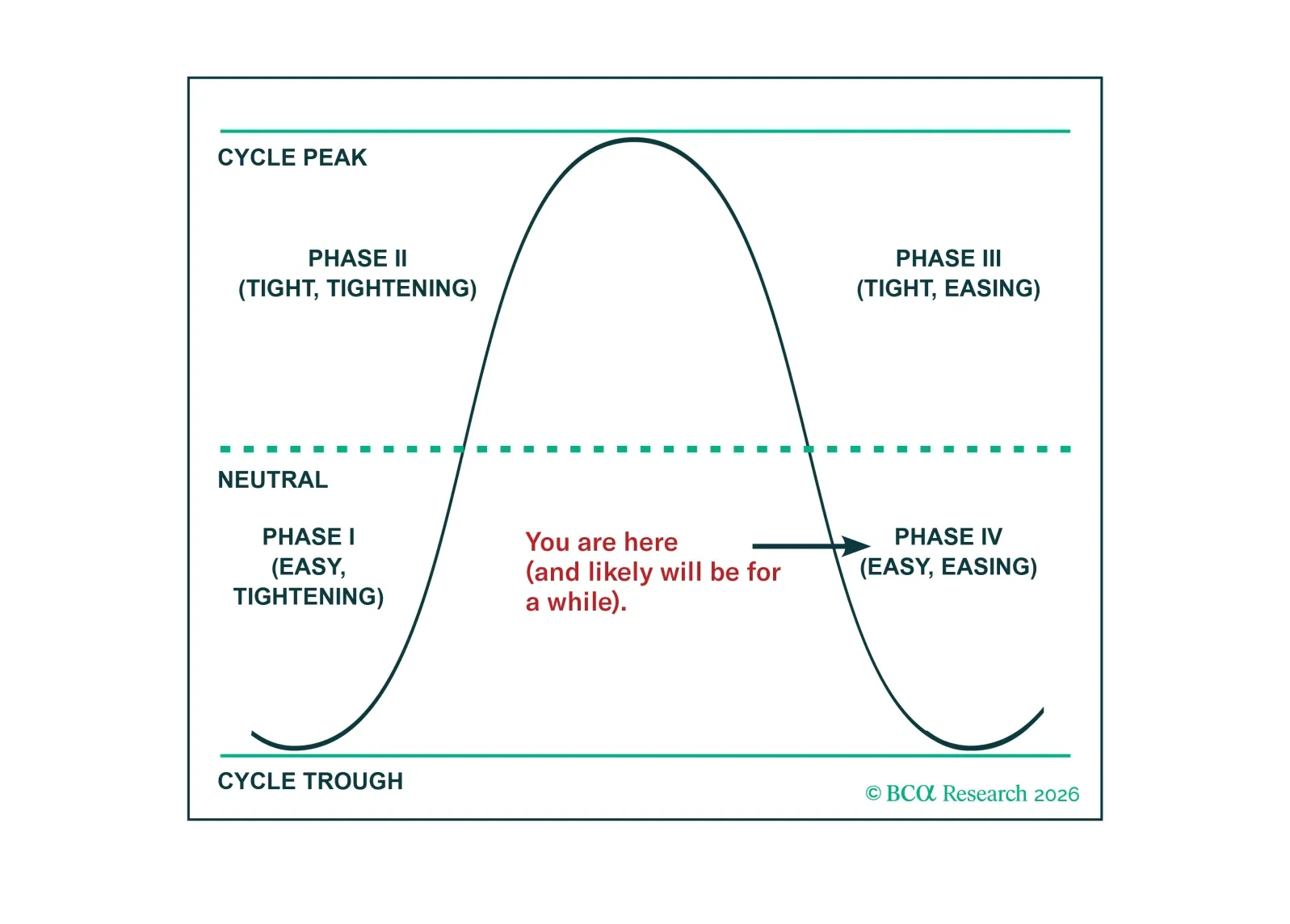

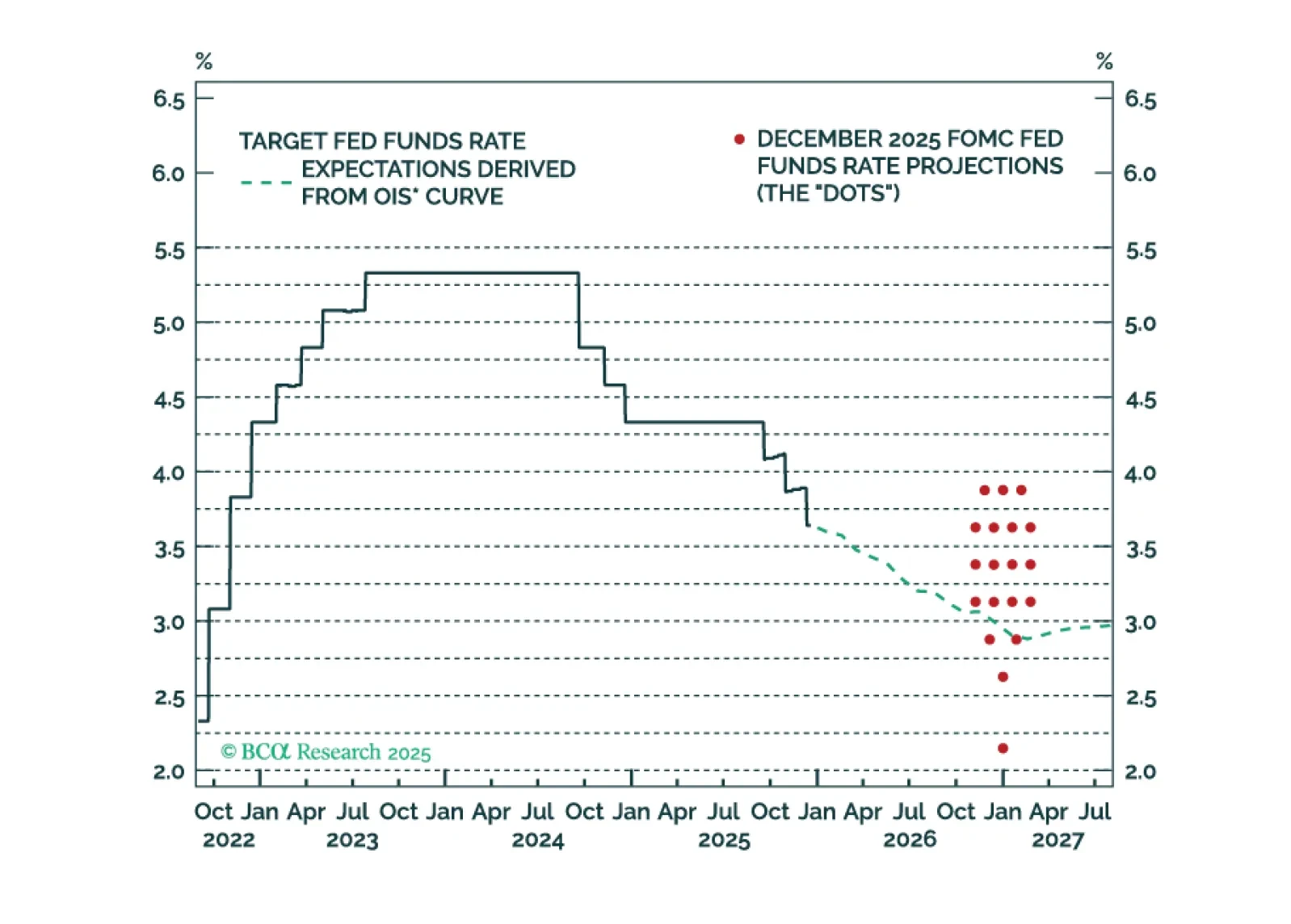

The Fed is on hold for now, but its 2026 economic projections are far too optimistic. The Fed will ease more next year than it currently anticipates.