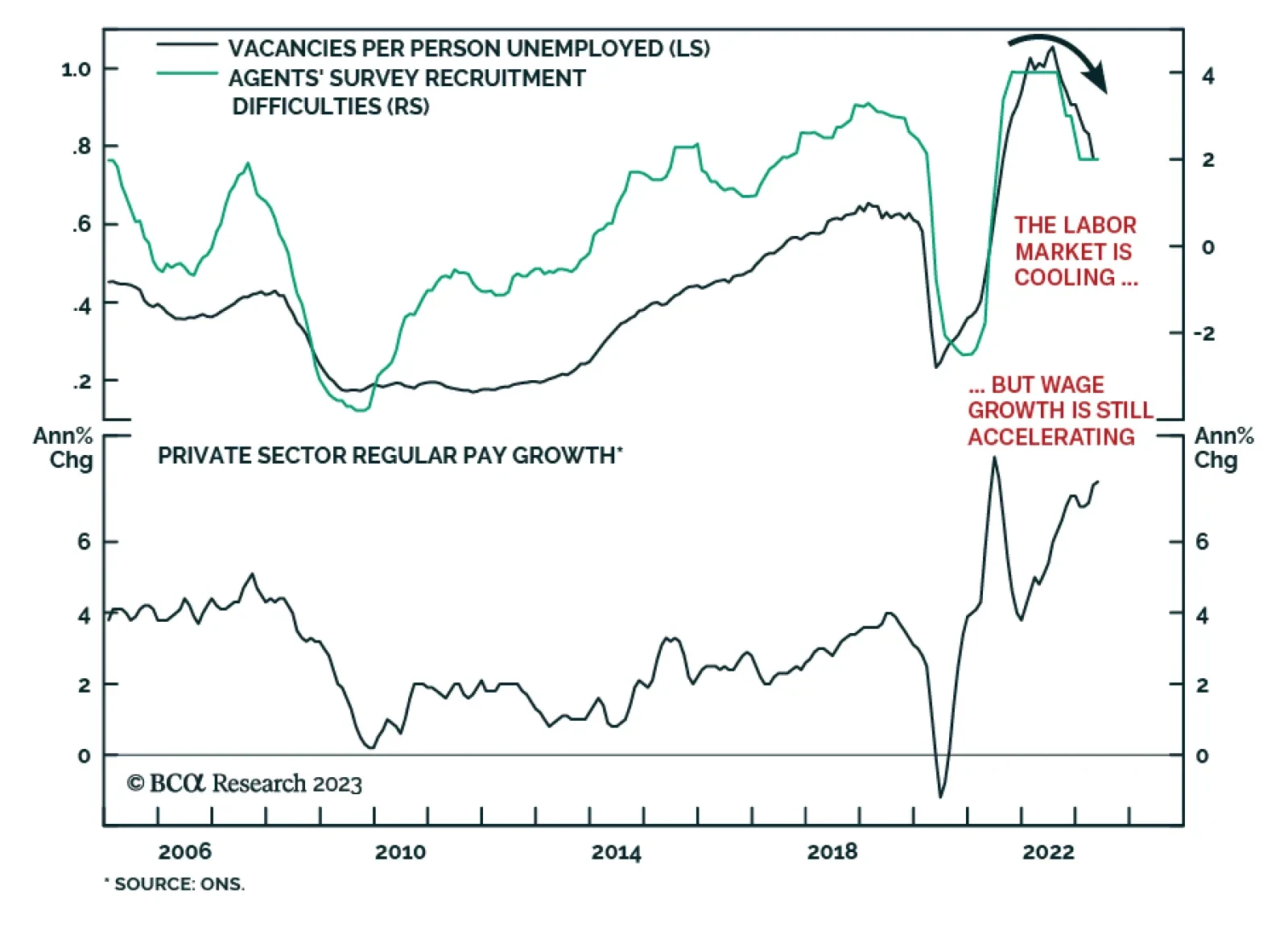

As expected, the Bank of England delivered another 25 basis point rate increase at its Thursday meeting, lifting the policy rate to 5.25%. Going forward, Bailey – not unlike his counterparts at the Fed and ECB –…

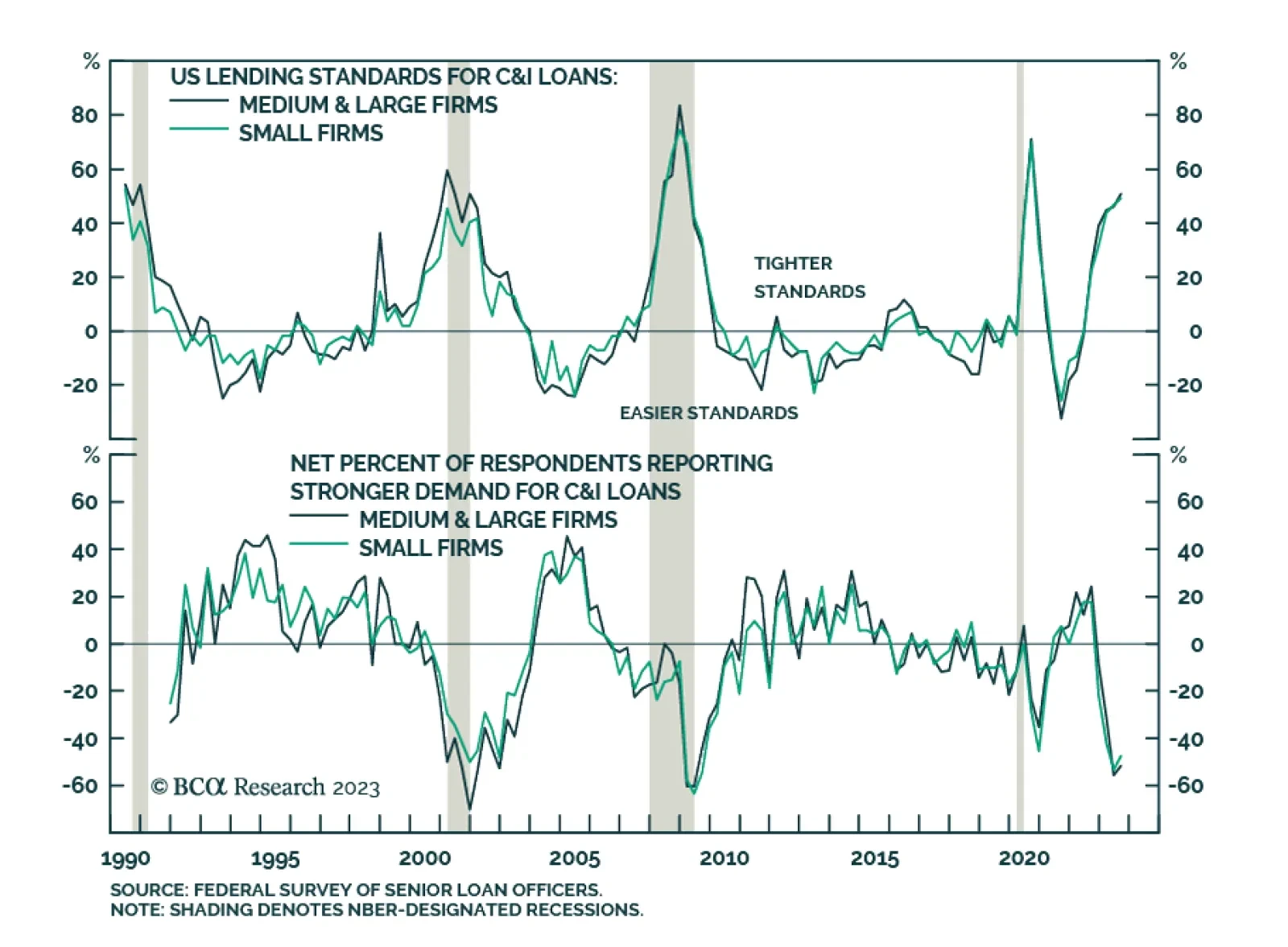

The US Federal Reserve Senior Loan Officer Opinion Survey (SLOOS) reveals that US banks continue to tighten lending standards for commercial and industrial (C&I), commercial real estate (CRE), residential real estate (RRE),…

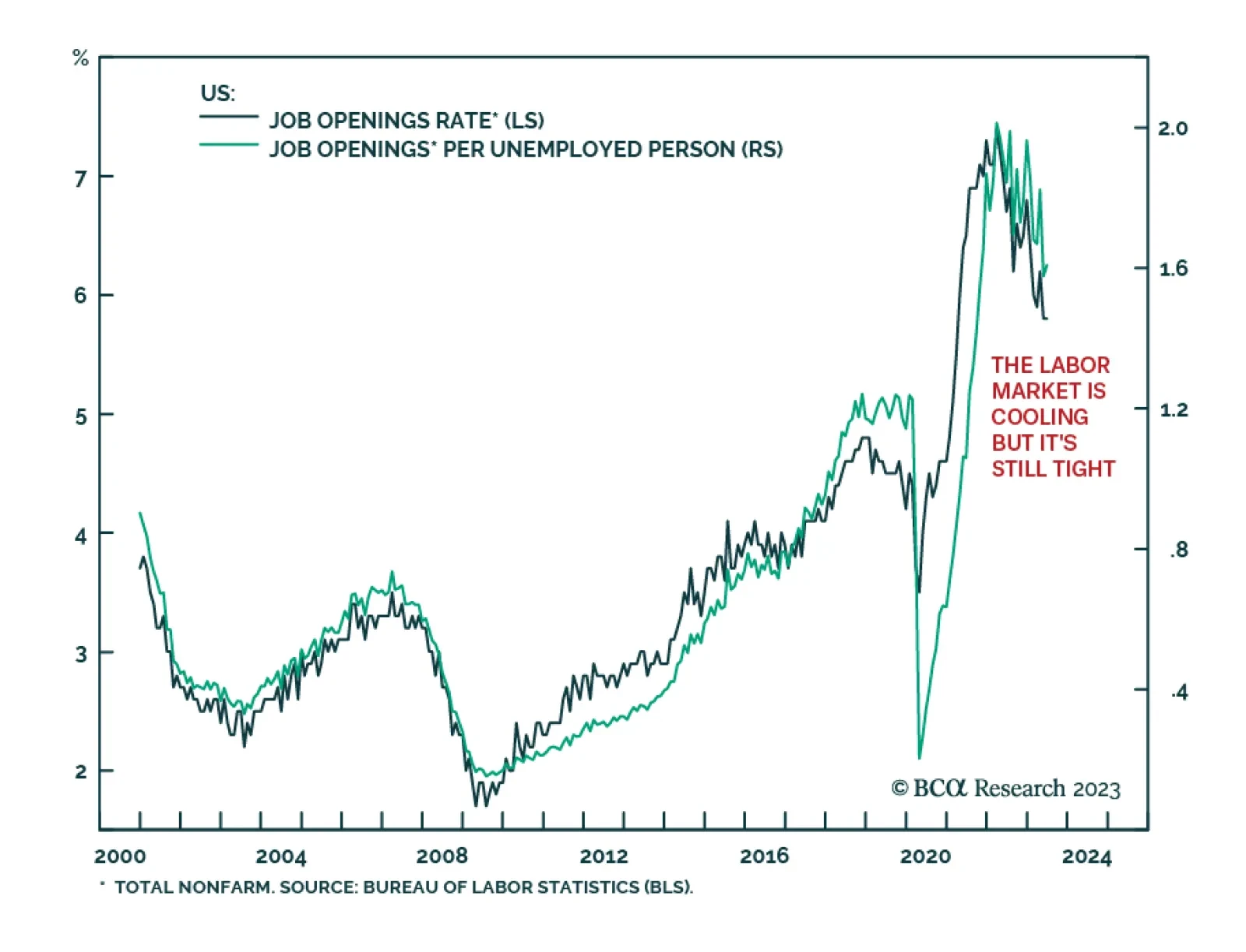

The ADP Jobs Report delivered a better-than-anticipated signal about the US labor market on Wednesday. The 324 thousand increase in private employment in July beat expectations of a 190 thousand rise and marks the second highest…

Collapsed complexity, plus the unwinding of favourable base effects and favourable seasonal adjustments to the inflation and jobs numbers, all pose a danger to the Goldilocks market.

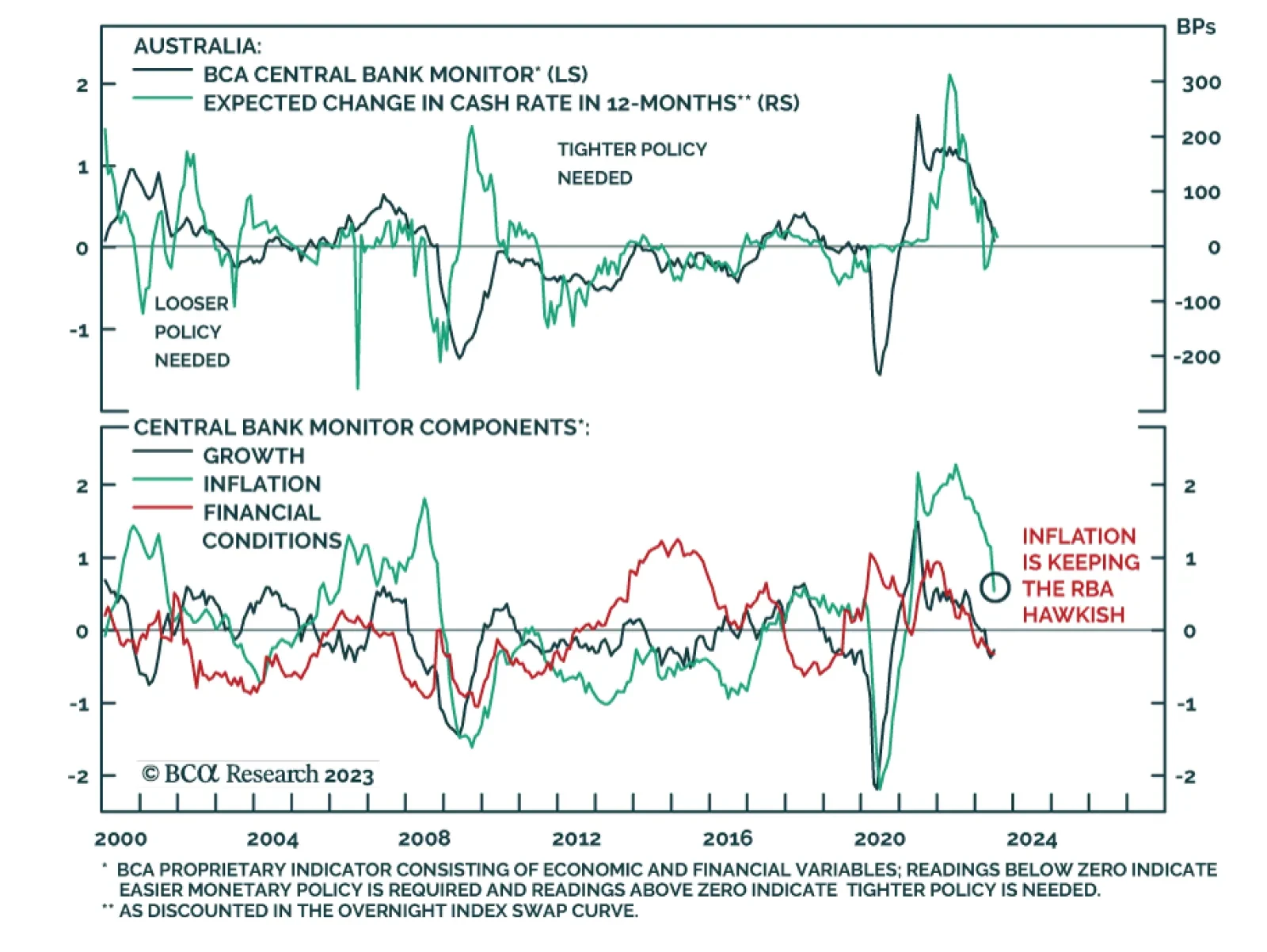

The Reserve Bank of Australia kept interest rates on hold at 4.1% on Tuesday, surprising expectations of a 25bps increase. Governor Philip Lowe’s statement underscores that the decision “will provide further time…

History suggests that a “soft landing” is highly unlikely after such an aggressive Fed tightening cycle. The rally could continue for a little longer but, on the 12-month horizon, market risks are very skewed to the downside.

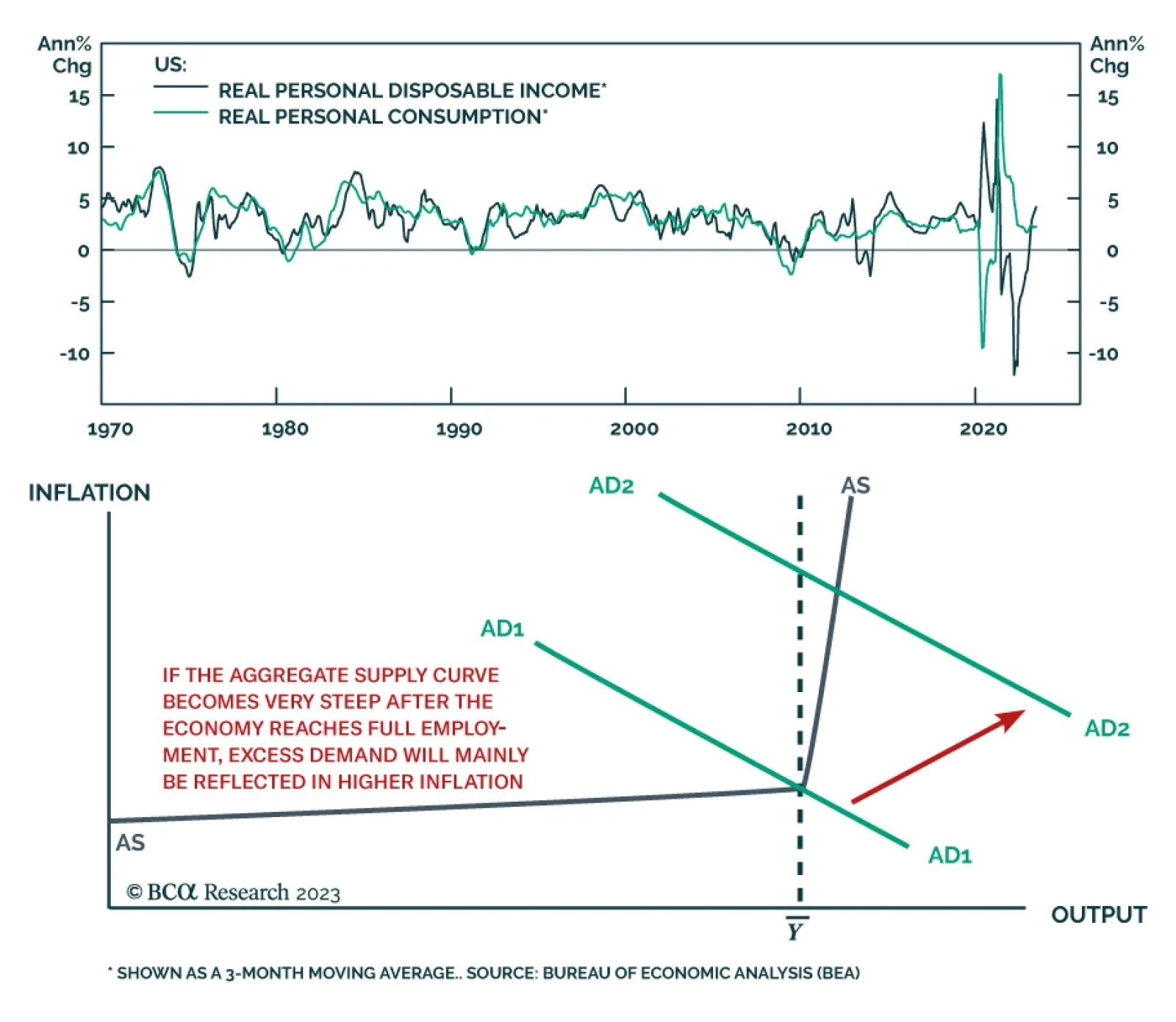

According to BCA Research’s Global Investment Strategy service, it is too early to conclude that the Fed can stop raising rates. Consumption and real income growth are highly correlated. If inflation continues to fall,…

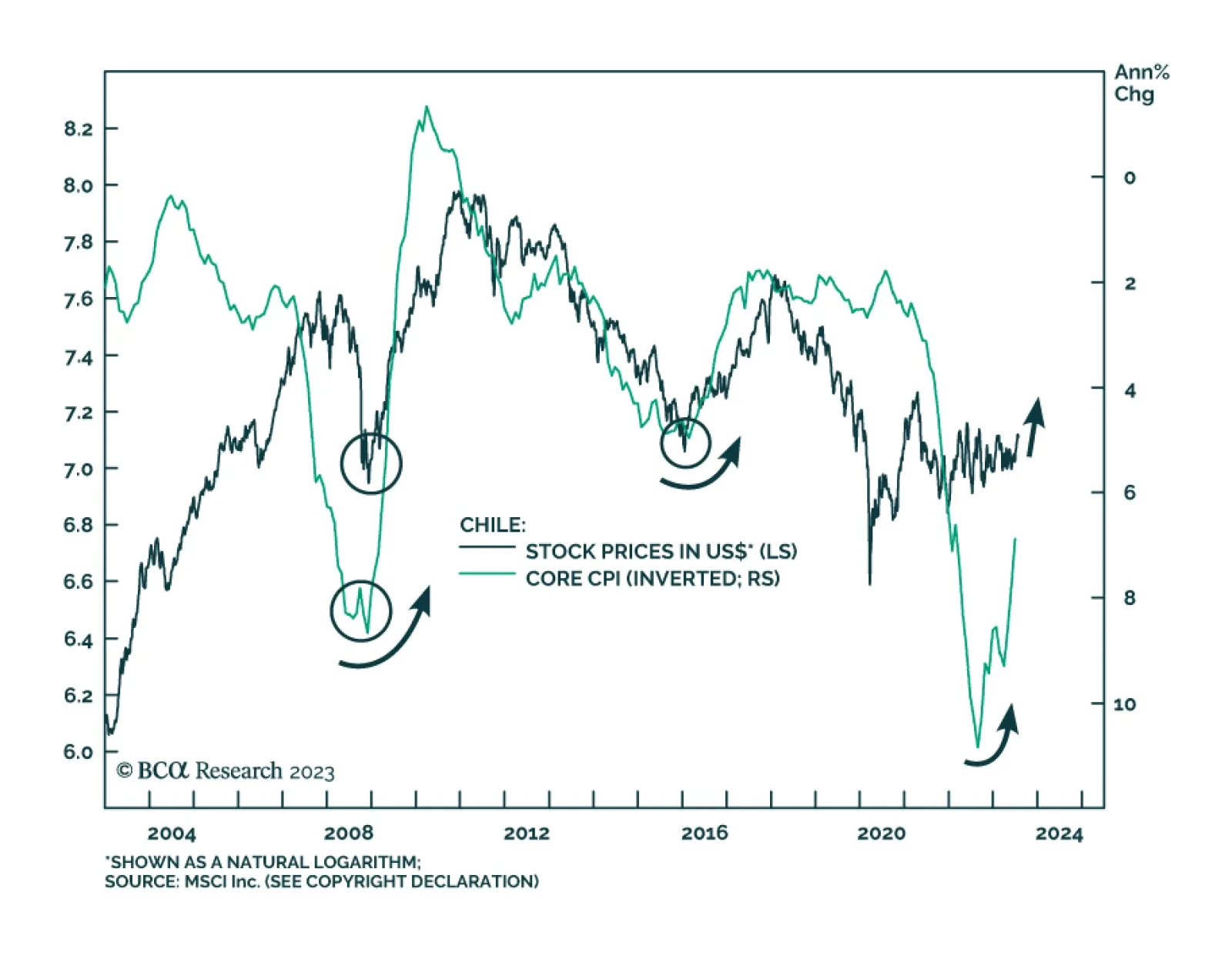

Last Friday, the Central Bank of Chile became the first major Latin American monetary authority to cut rates, thereby beginning the EM monetary easing cycle. In its latest meeting, board members decided to reduce the policy…