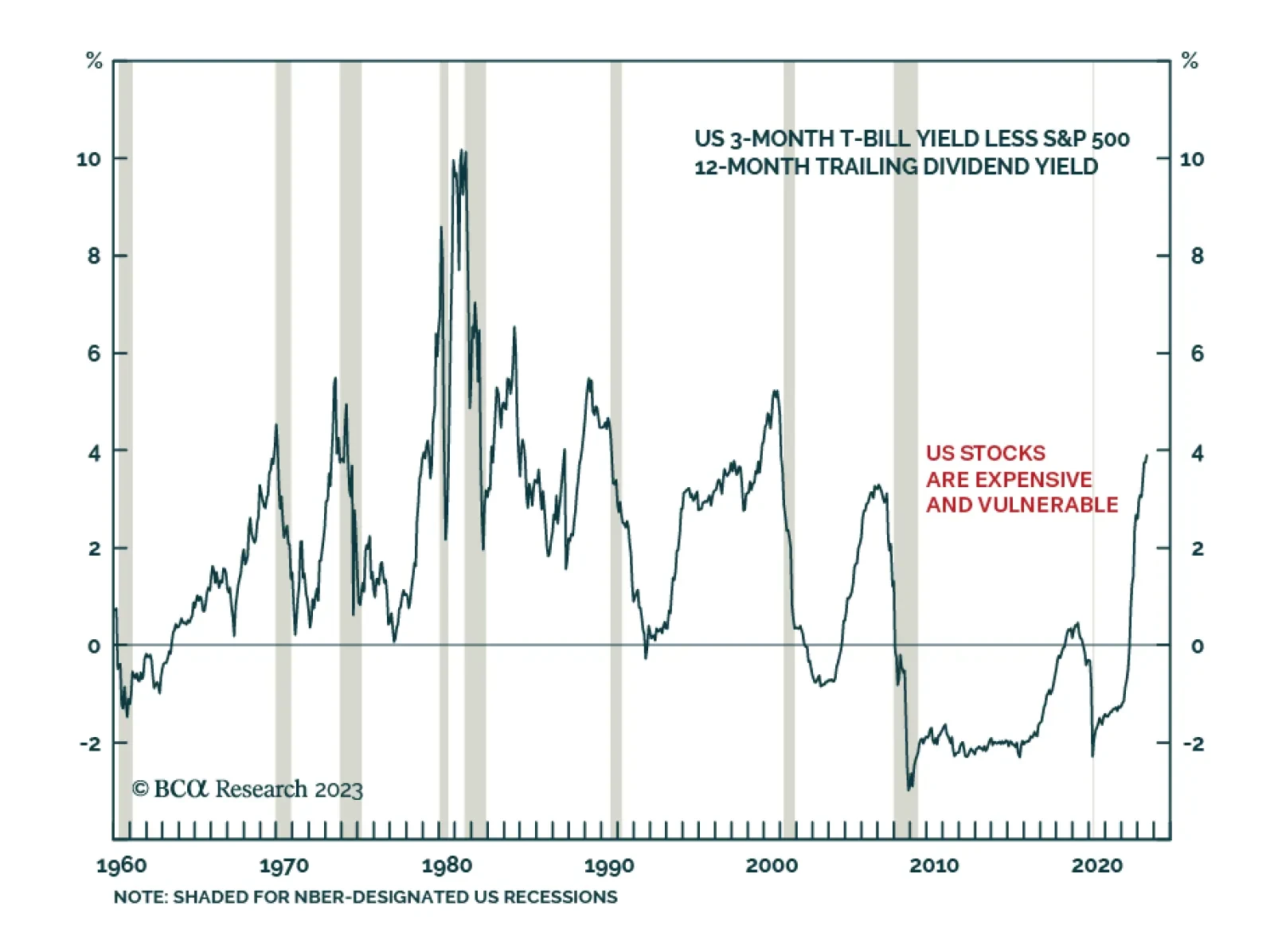

During the last economic expansion, a structurally overweight allocation to stocks was at least partially warranted by the idea that “There Is No Alternative” – or “T.I.N.A.” During the last…

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

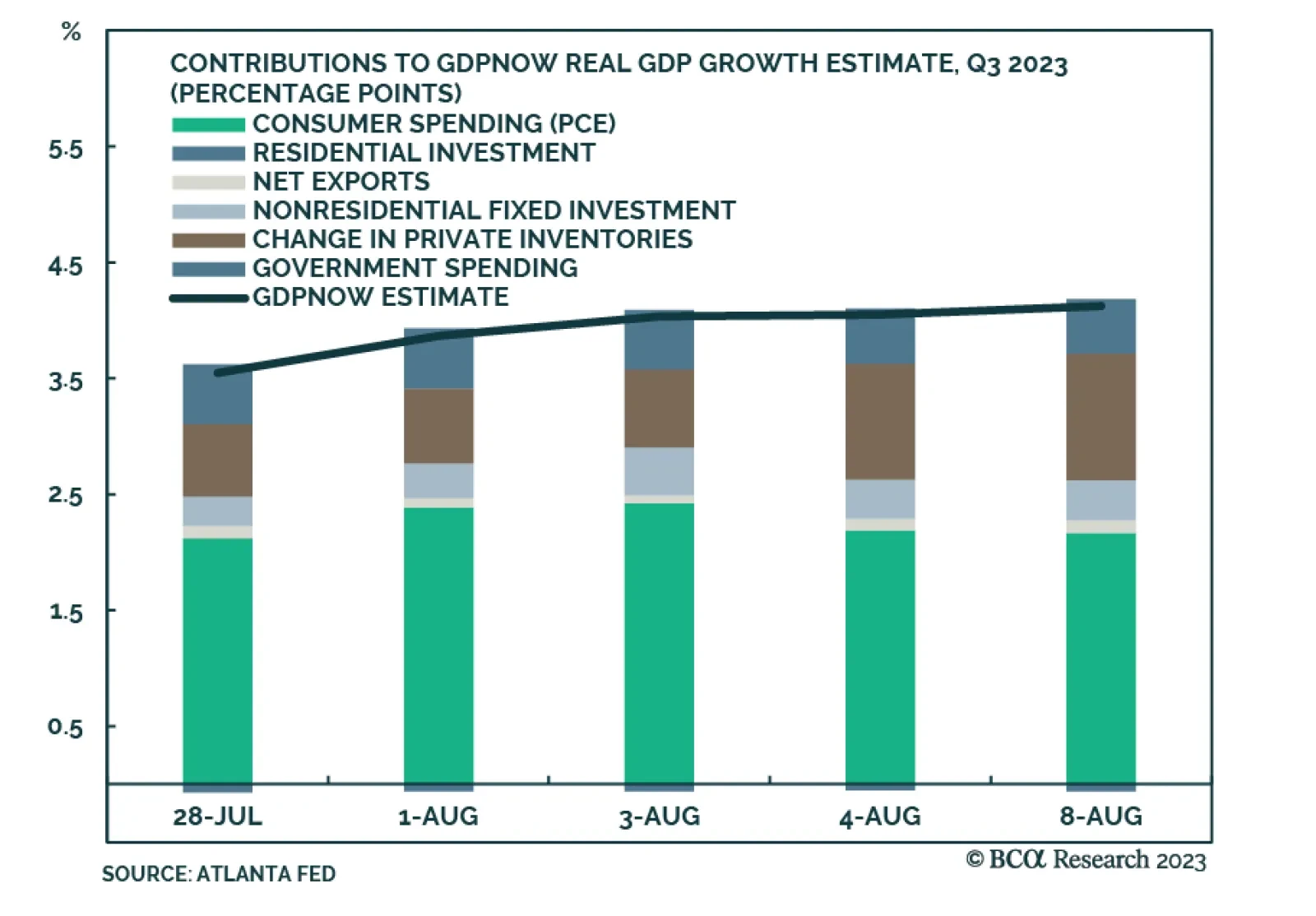

Over the past two months, risk sentiment has improved amid receding fears of an imminent US recession. Economic data have been generating strong upside surprises and the US equity rally has broadened with cyclicals outperforming…

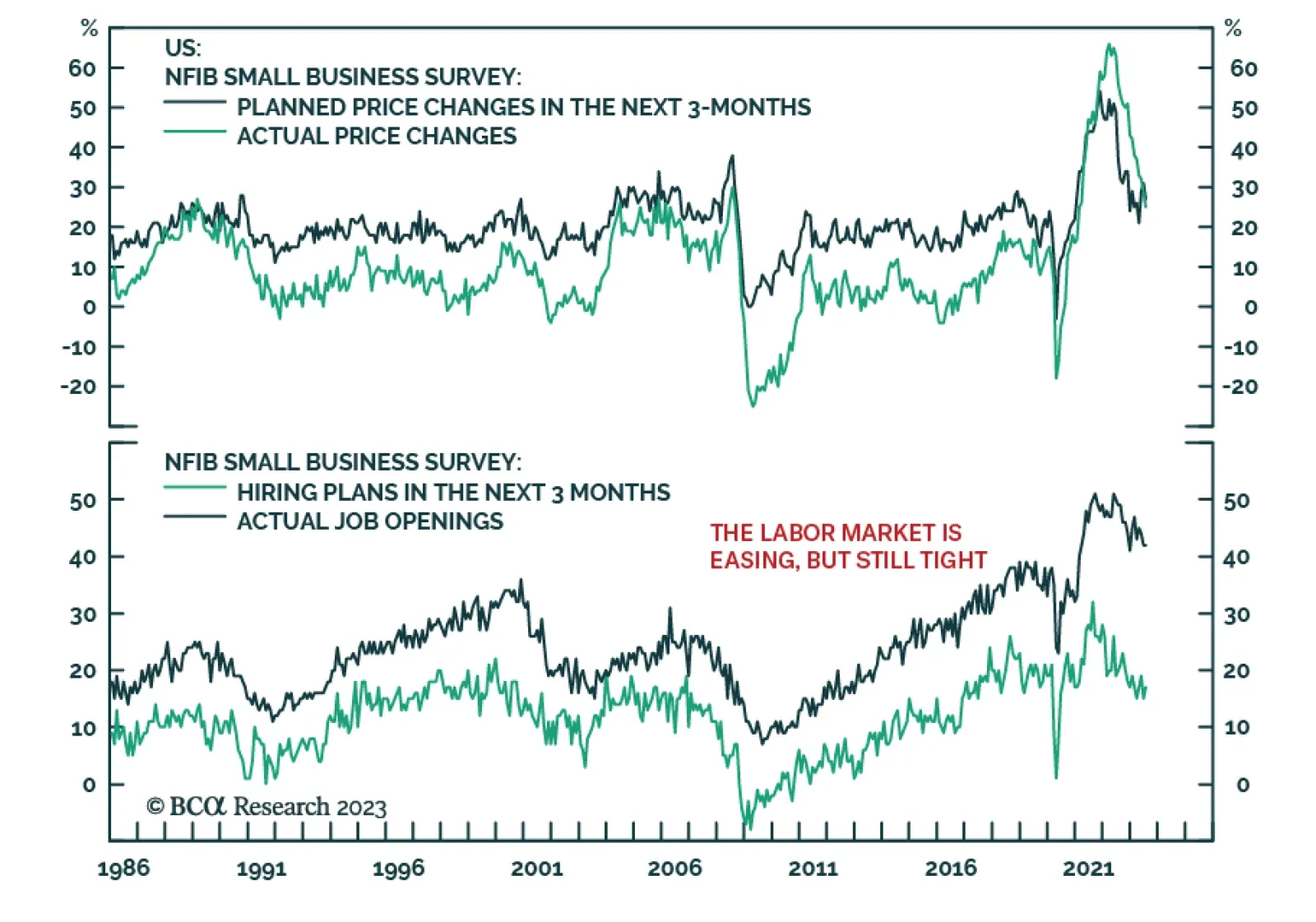

The US NFIB’s Small Business Optimism Index increased by 0.9 points to an eight-month high of 91.9, beating expectations of a more muted 0.3-point increase. Although the level remains depressed below the 49-year average of…

Time is running out on the Bank of England’s tightening cycle. UK economic growth is flirting with recession, unemployment is rising, house prices are contracting and inflation is decelerating. Markets are overestimating the eventual…

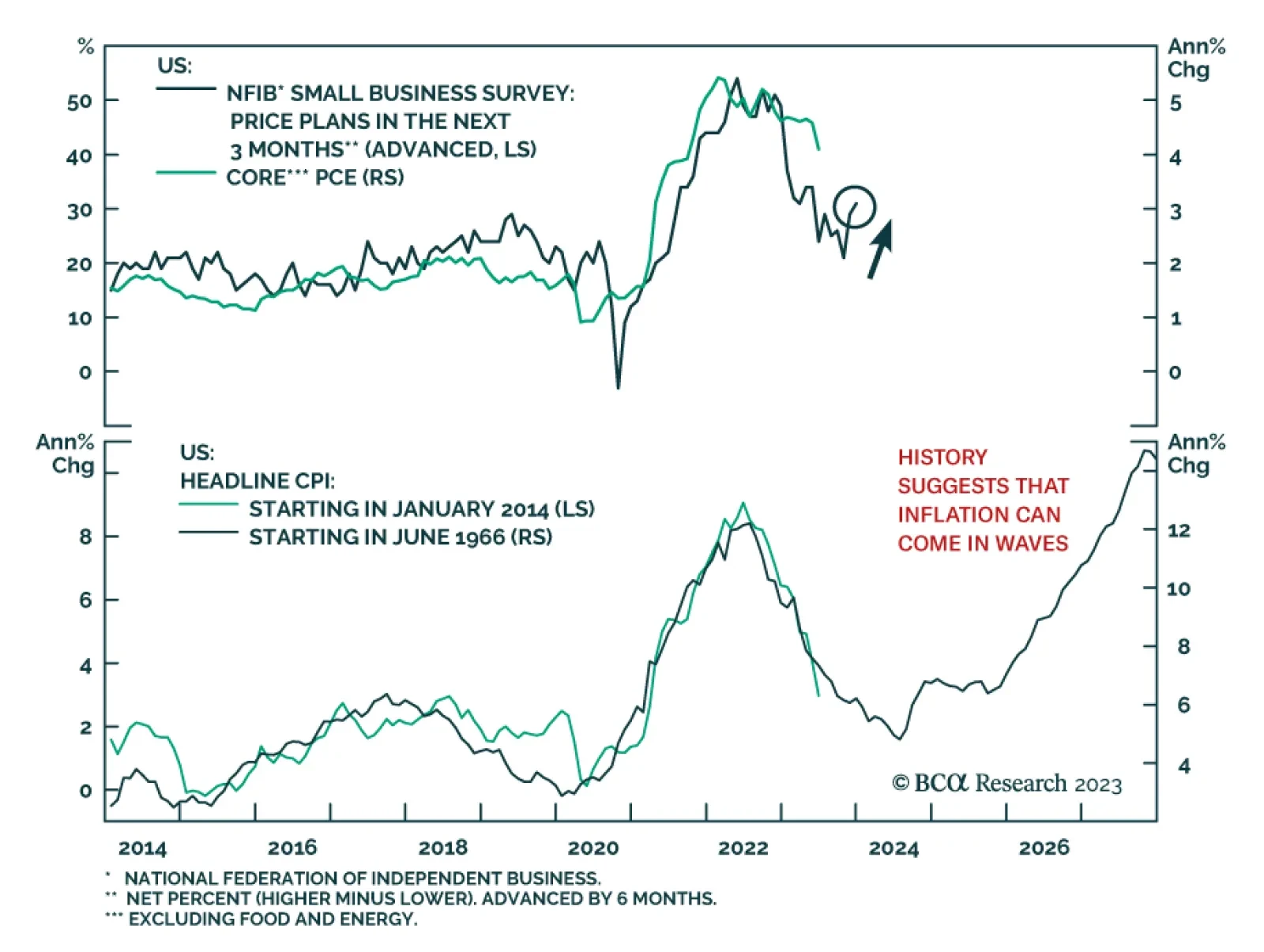

Core inflation in the US should drift lower in the coming months. However, it is too early to conclude that the US is completely out of the woods when it comes to inflation. Given that the US job market remains tight, and the…

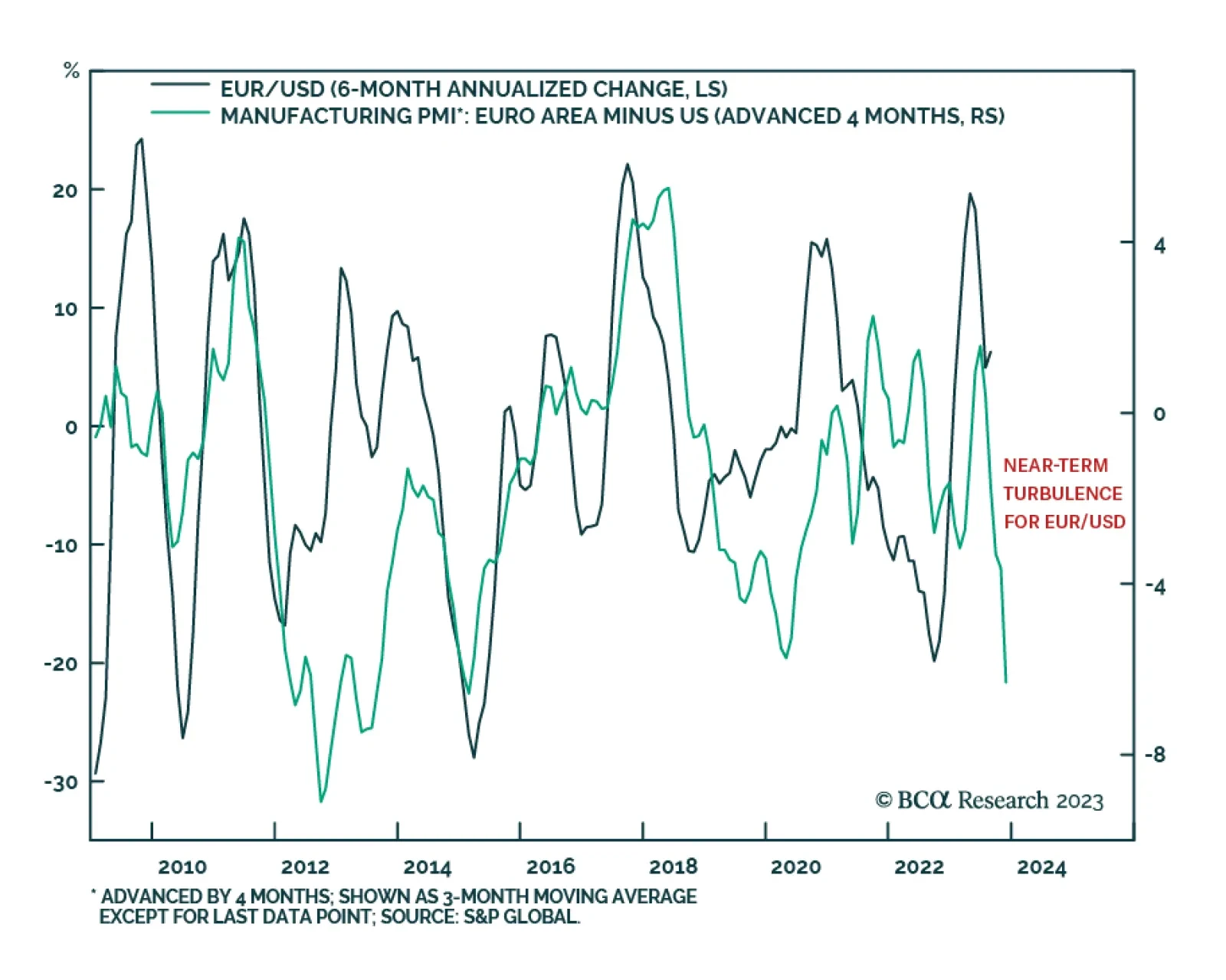

Ever since the bottom below 0.96, the euro has staged a powerful rally. At 1.1, the euro is up 14.6% from its lows. The key question going forward is if investors should chase the rally, or fade strength in the common currency…

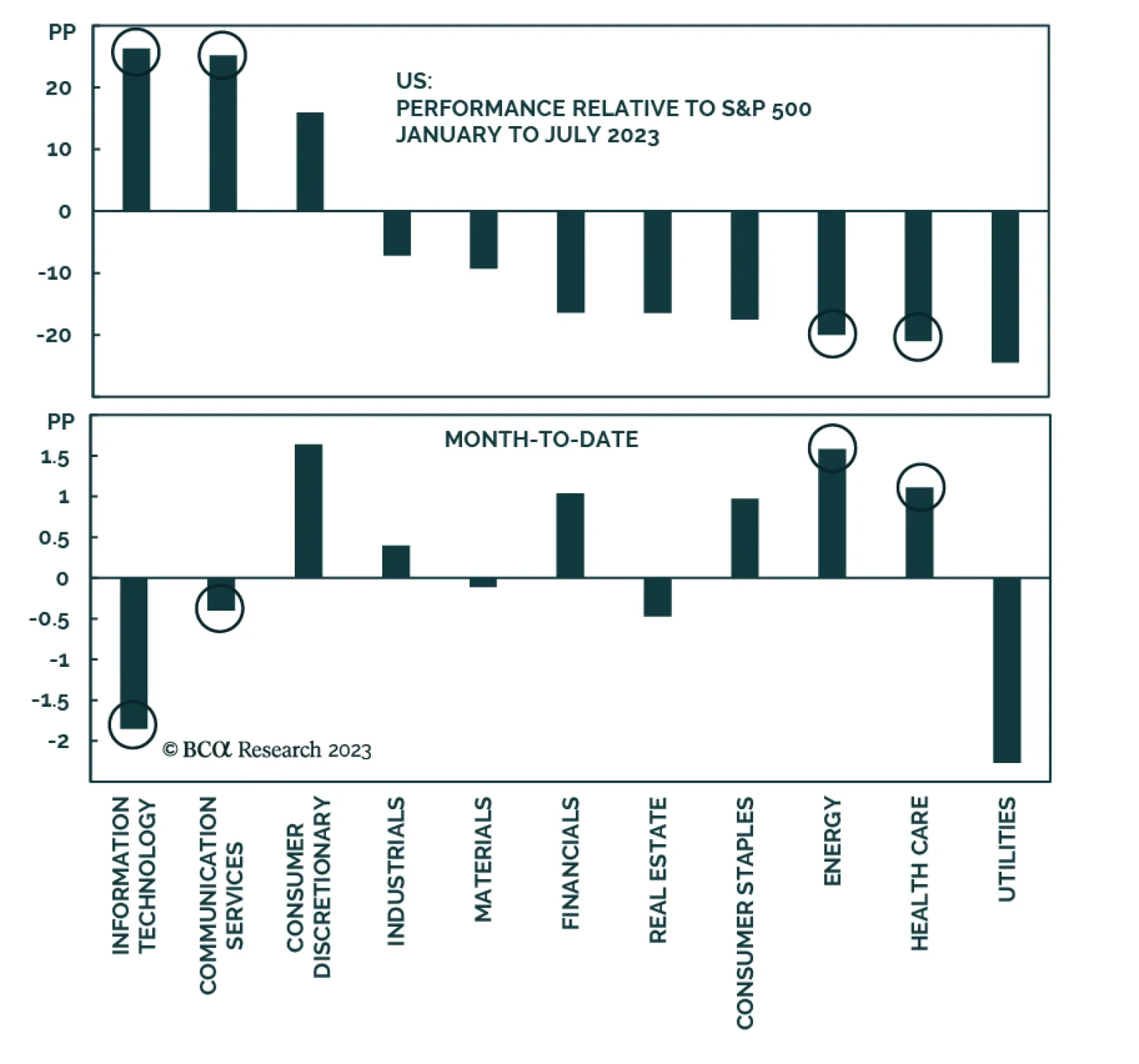

The S&P 500 has had a rough start to August. The index’s selloff since the end of July has pushed it down by 2.4%. Notably, the weakness is broad-based with all S&P 500 sectors in the red over this period. This…

Some thoughts on this week’s bear-steepening of the Treasury curve and this morning’s employment report.

In this insight, we assess the prospect of the Swiss franc over the next six months.