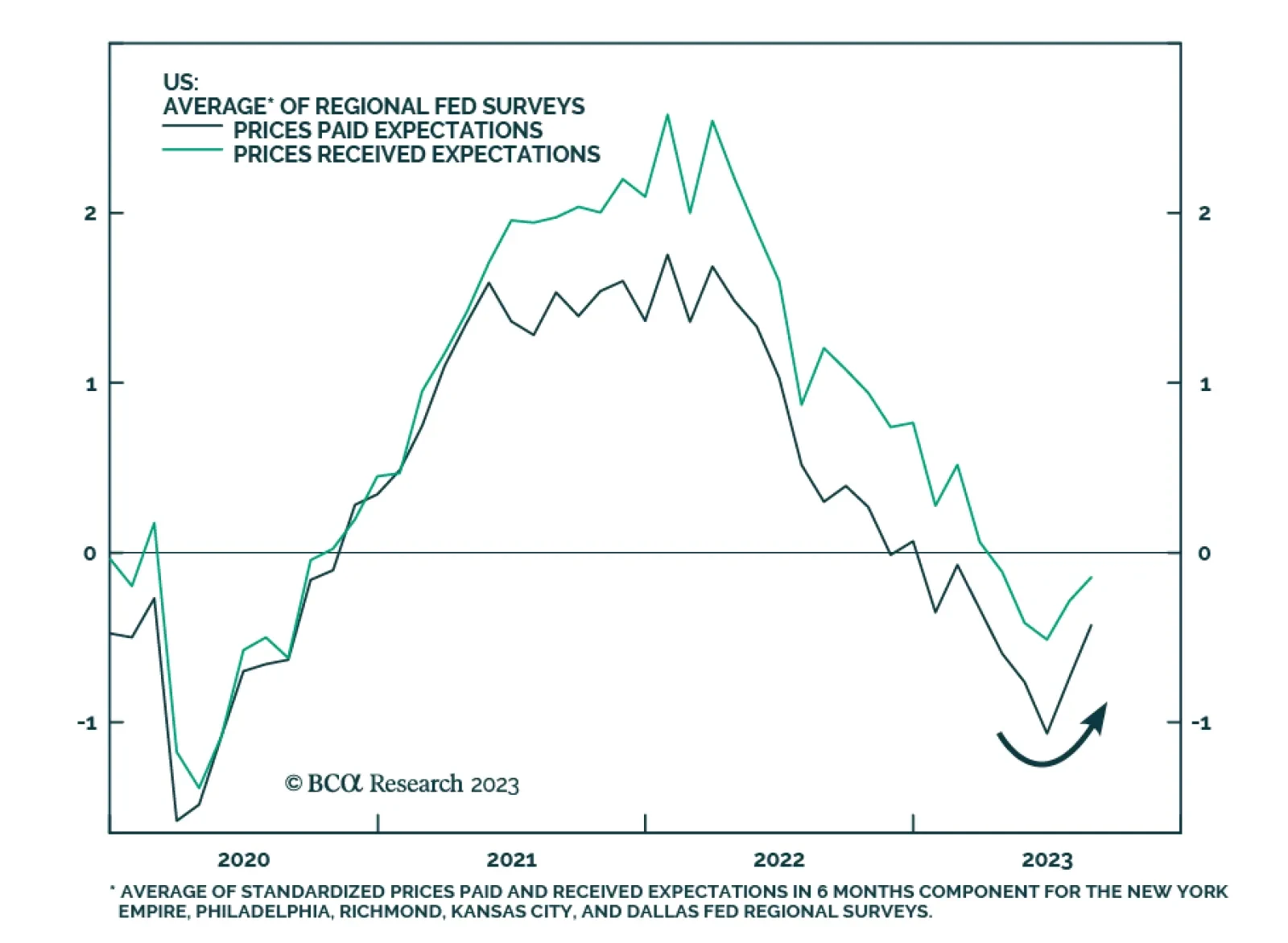

In an Insight last month, we noted that the Global Investment Strategy service increased its subjective odds for the resurgence of US inflation later this year or early next year from 20% to 30%. Here are some of the data points…

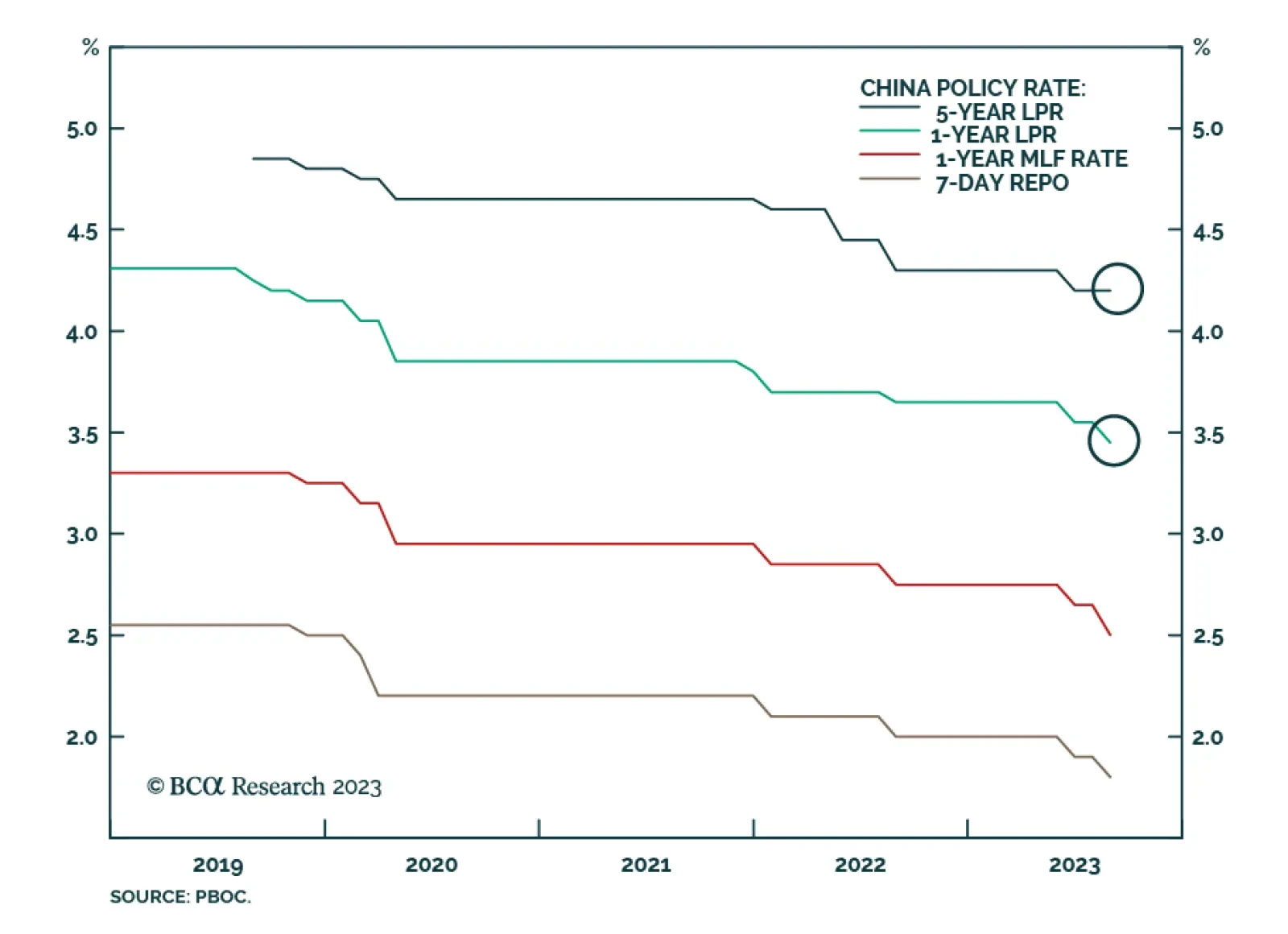

Chinese banks surprised markets with a more modest-than-anticipated rate cut on Monday. The one-year loan prime rate (LPR) was reduced by 10 basis points to 3.45% – slightly above expectations of a bigger cut to 3.40%.…

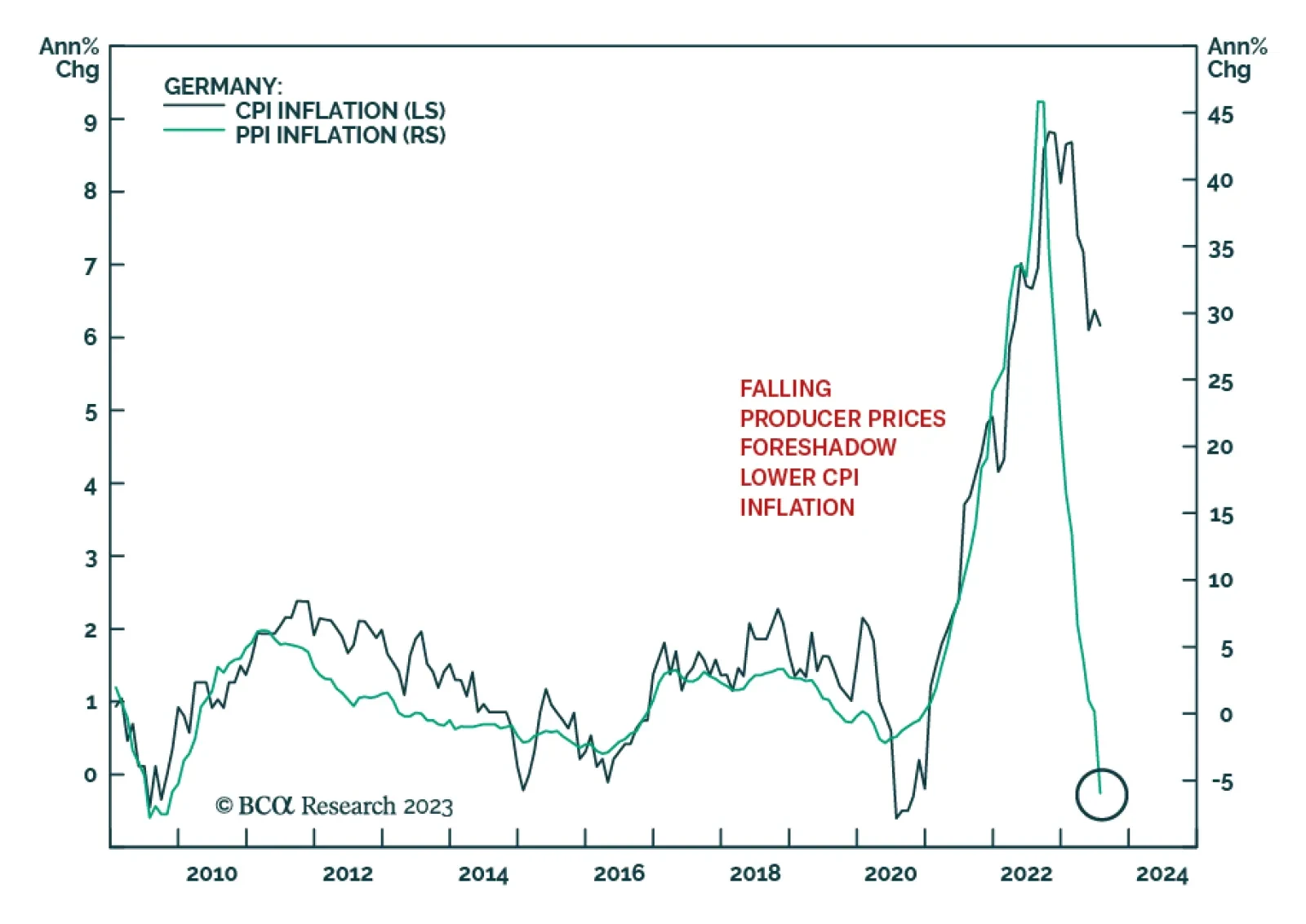

German producer prices indicate that inflationary pressures continue to moderate. The producer price index’s 6.0% y/y drop in July is more pronounced than the anticipated 5.1% y/y decline and marks the first annual decrease…

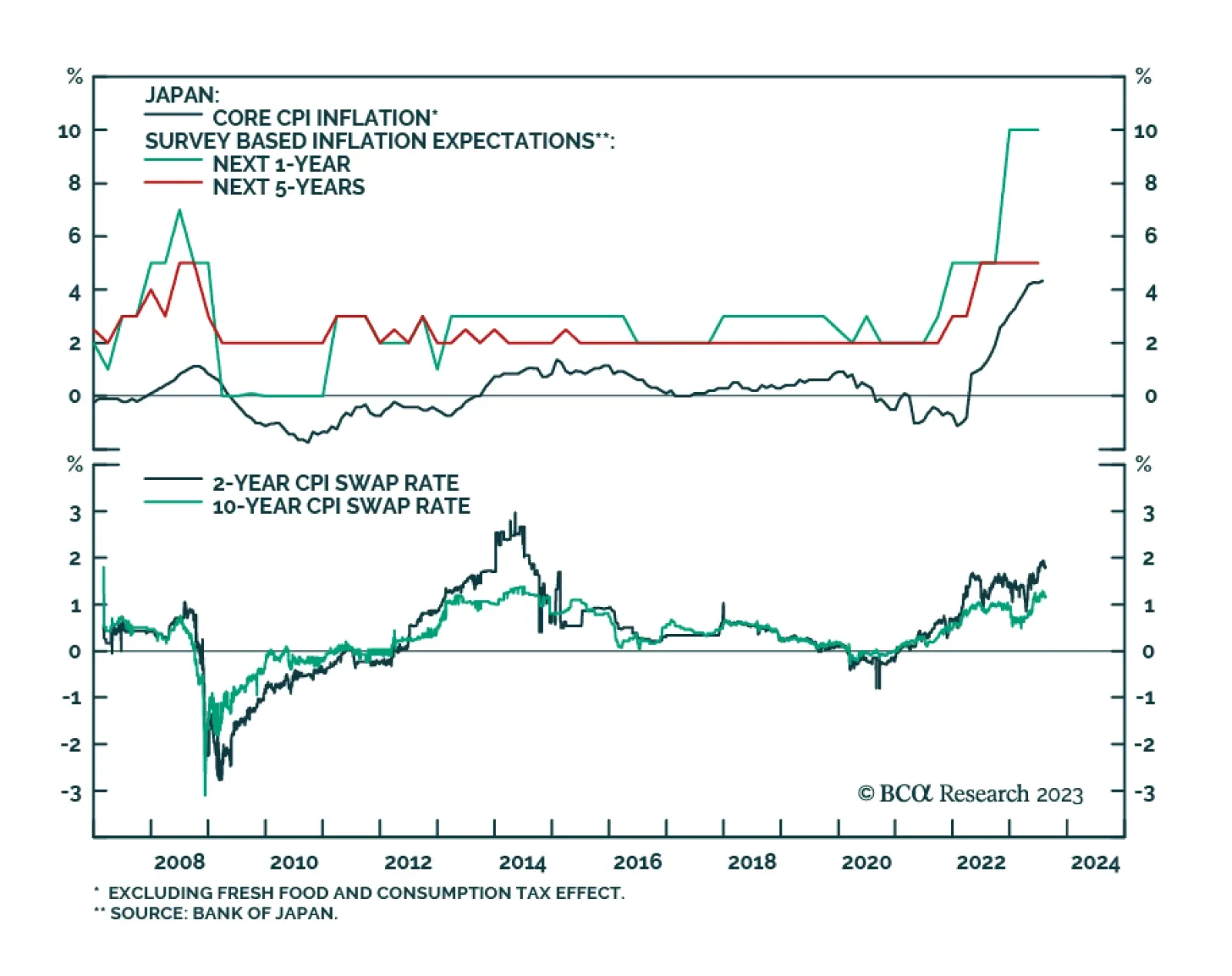

According to BCA Research’s Foreign Exchange Strategy and Global Investment Strategy services, most indications of Japanese inflation are pointing to upside surprises. This will boost interest-rate differentials in…

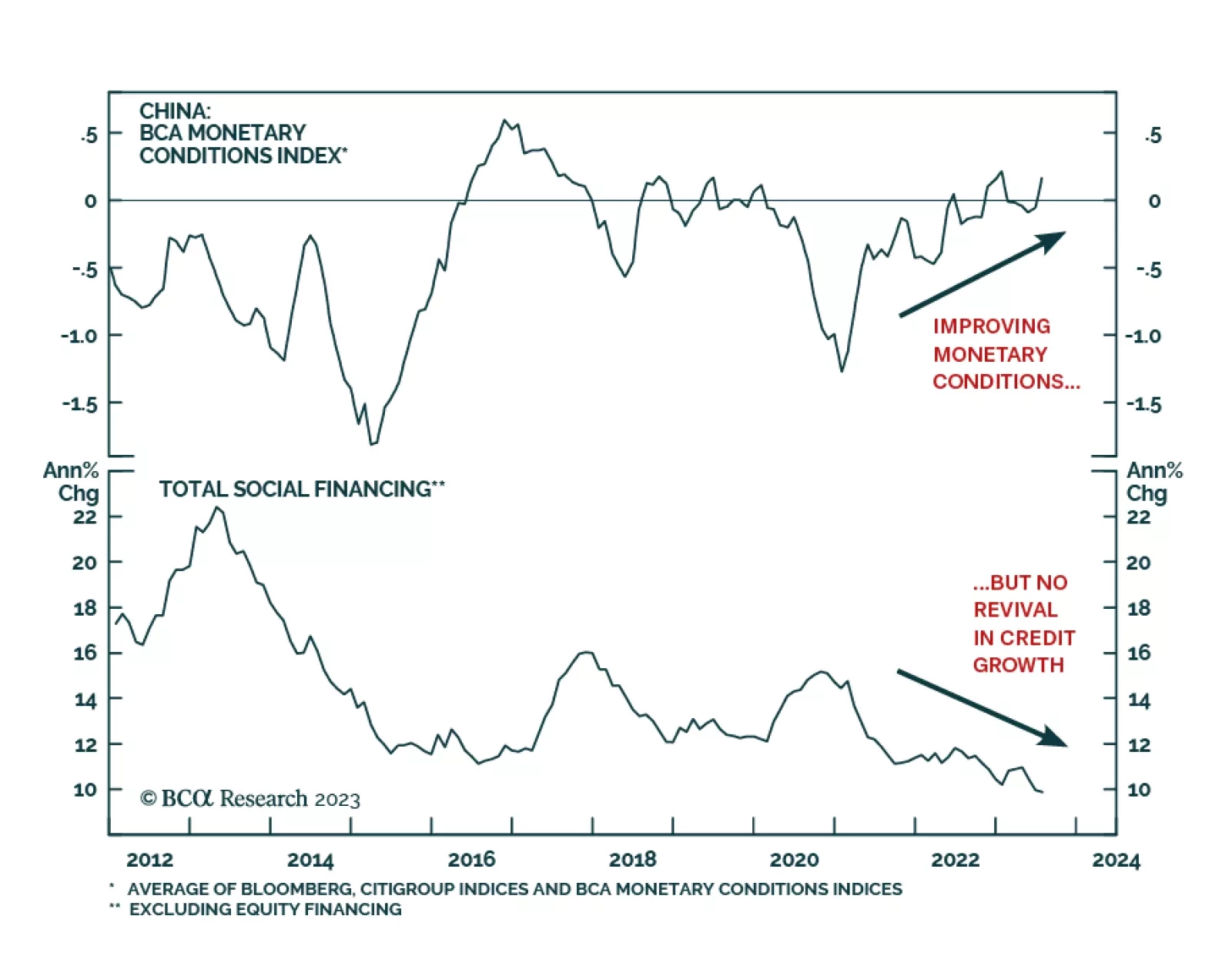

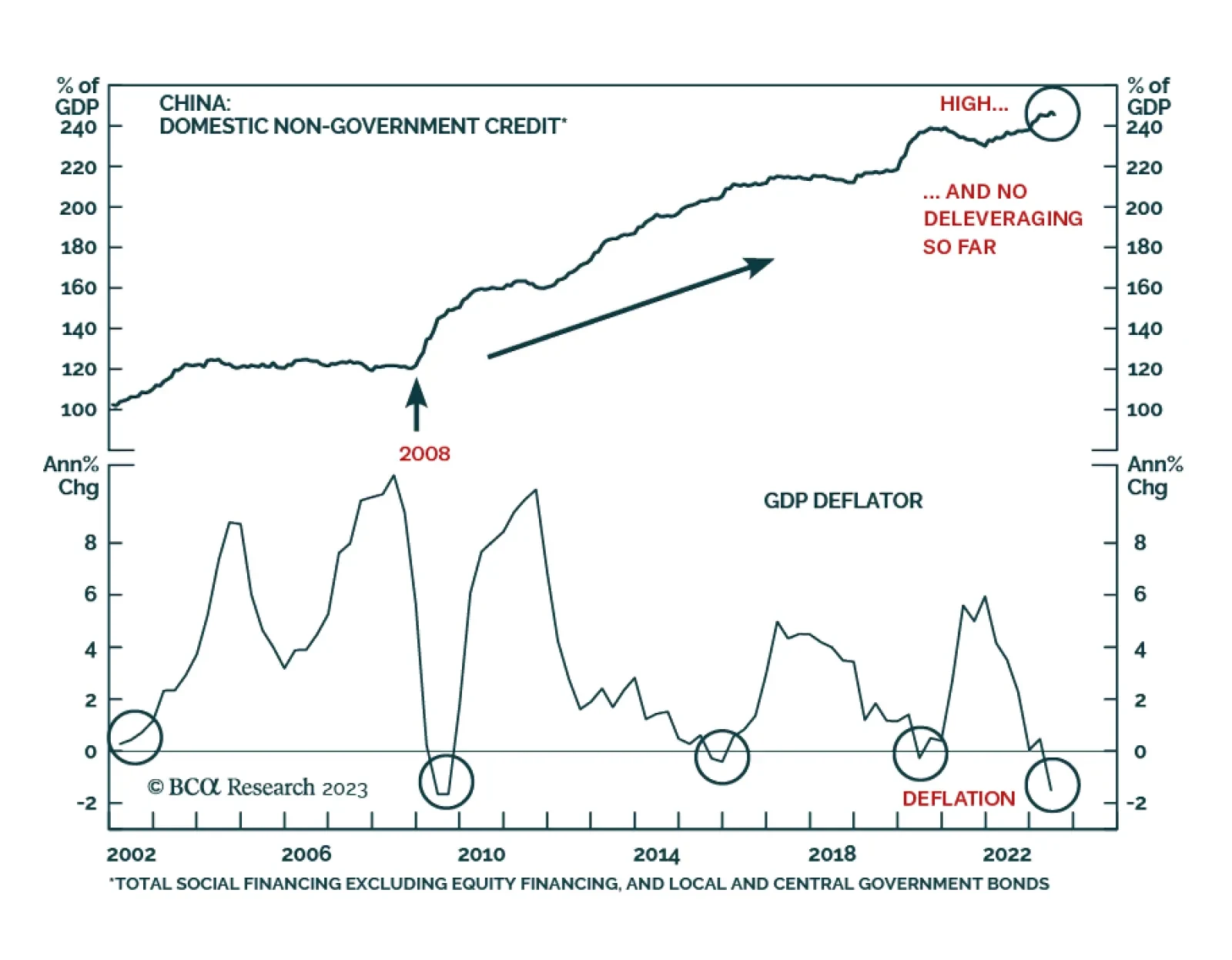

Despite the underwhelming economic recovery, Chinese authorities remain reluctant to open wide stimulus taps as much as they have in past economic downturns. This is corroborated by the PBoC’s marginal interest rate cut…

Before doctors prescribe treatments to a patient, they first make a diagnosis. The success of the treatment is contingent upon the accuracy of the diagnosis. The same is true for a country’s economy. Many commentators…

While the bearish bond trade currently has a lot of momentum, we continue to think that Treasury yields are close to a cyclical peak and will be lower on a 6-12 month horizon.

In this special report, we discuss whether the economic conditions necessary for a stronger yen (and higher JGB yields) will materialize over the next 12-to-18 months.

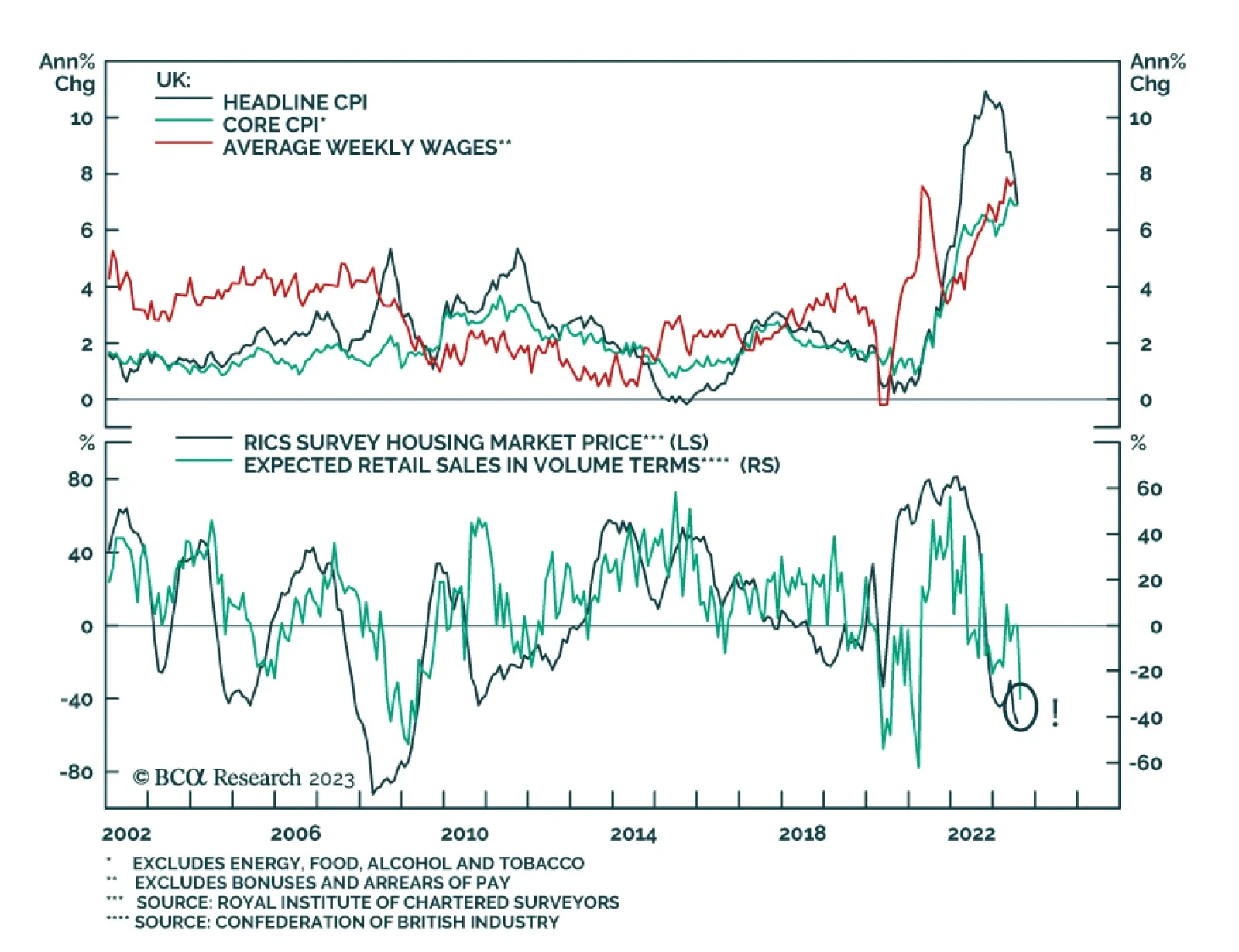

Despite a decline from 7.9% to 6.8% in July, the UK’s headline CPI surprised to the upside. The slowdown in headline CPI mostly reflects the deceleration in the annual inflation for housing, water, electricity, gas and…