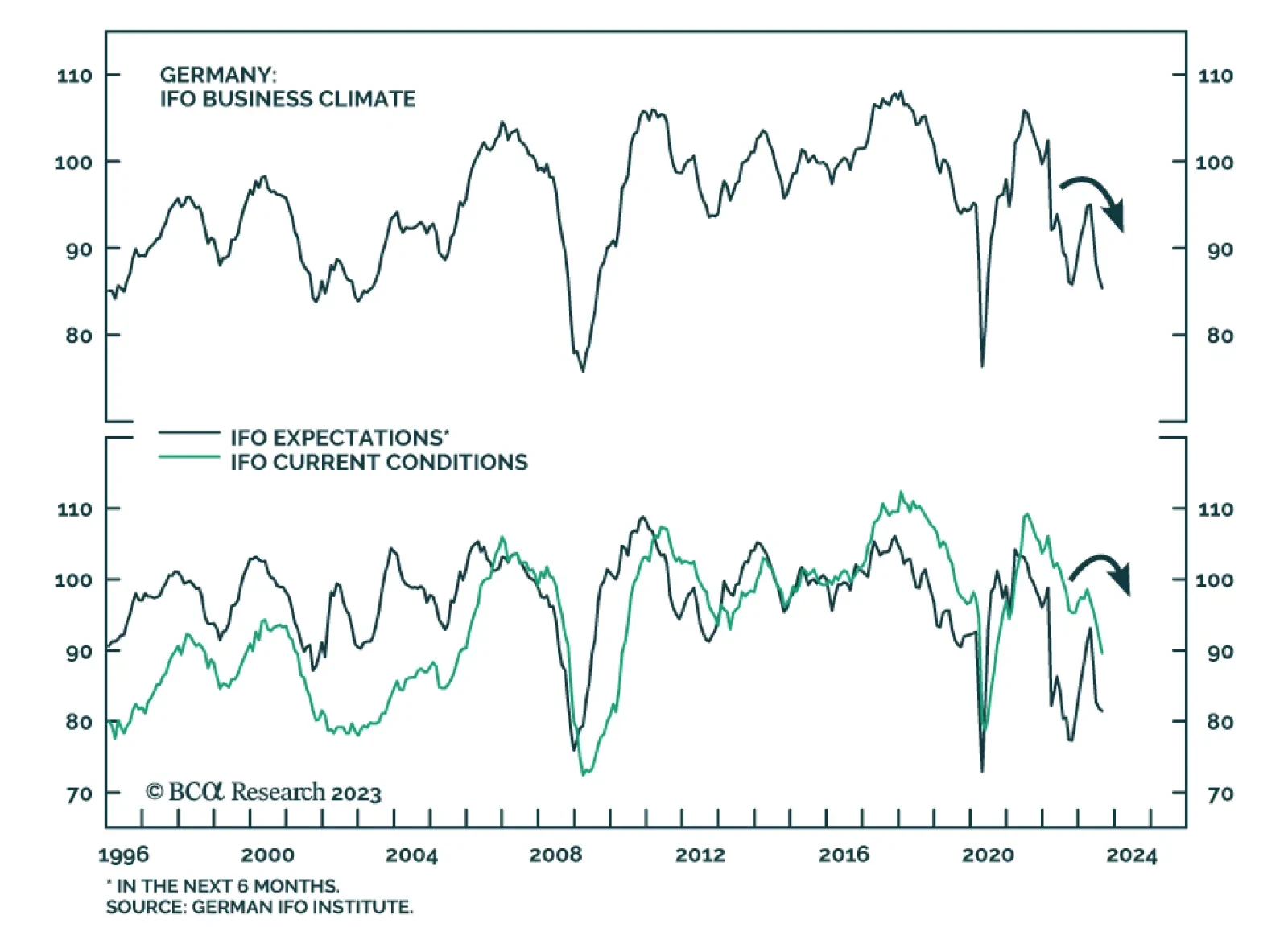

Germany’s IFO survey sent a downbeat message on Friday. The headline Business Climate Index fell by 1.7 points to 85.7, below expectations of 86.8 and near the 85.2 level at which it bottomed in October. A 2.4-point…

In this report, we review our FX trade recommendations with suggestions on how to position for the next few months.

In this report, we assess the best opportunities in inflation-linked bonds in the major developed economies, based on trends in growth, inflation and the stance of monetary policies in each country. We conclude that the environment…

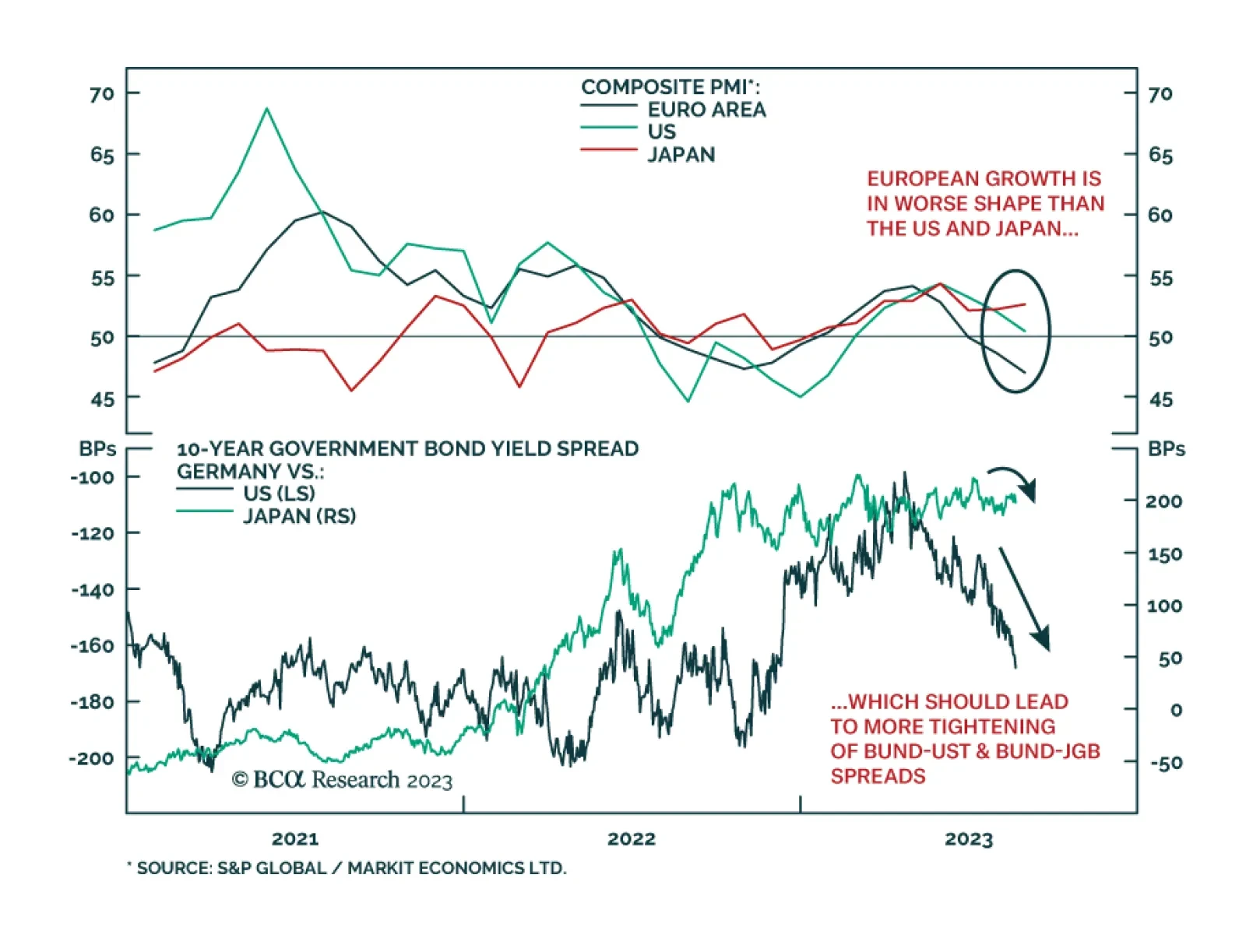

The flash August S&P Global PMI data released on Wednesday painted a picture of softer global growth, while also hinting that Europe is on the cusp of recession. The composite PMI for the euro area fell by 1.6 versus the…

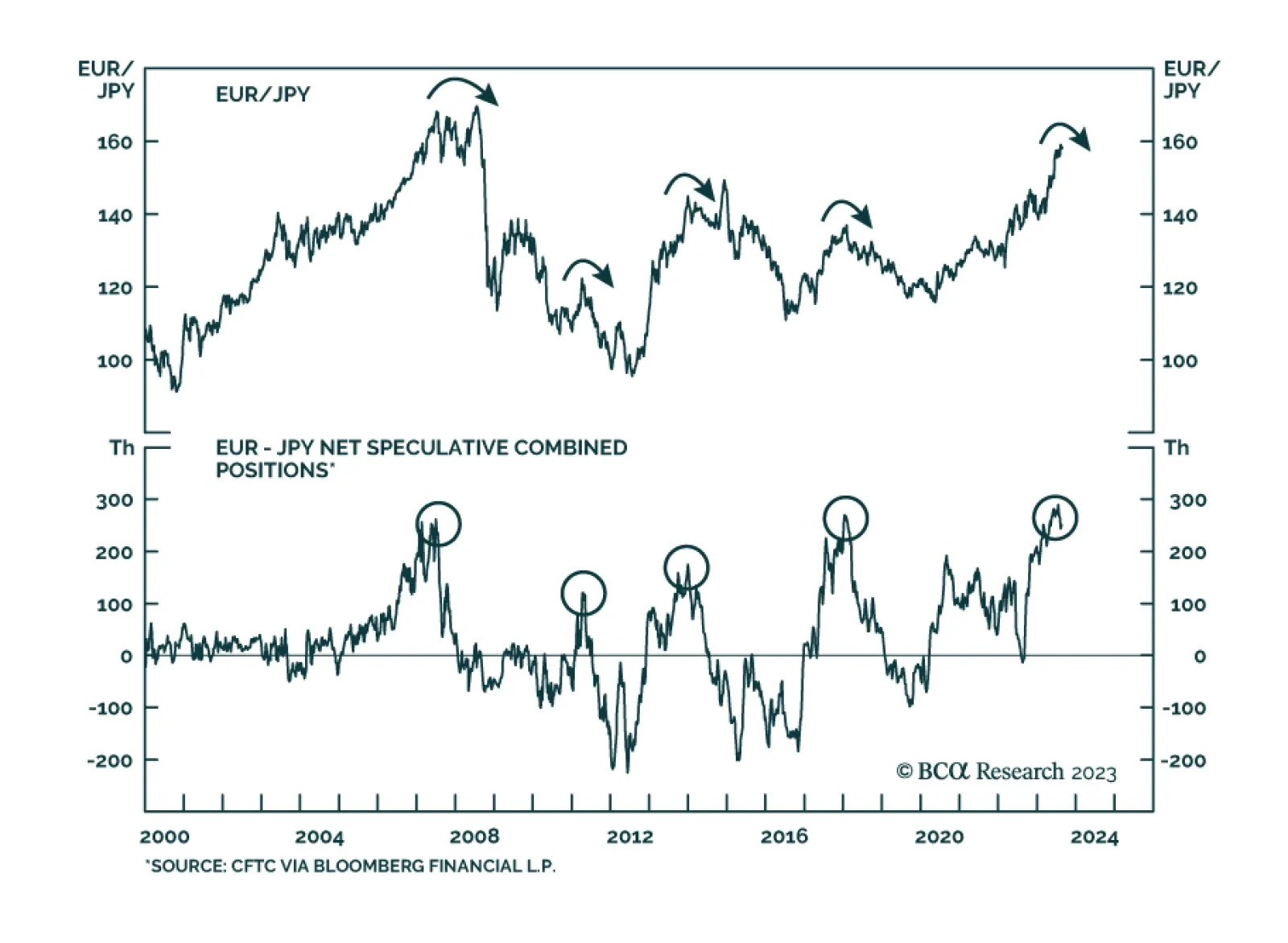

Earlier this week, EUR/JPY closed at a fresh 15-year high, bringing its year-to-date gain to 14%, before losing some ground over the subsequent two days. To the extent that the recent increase in global bond yields continues to…

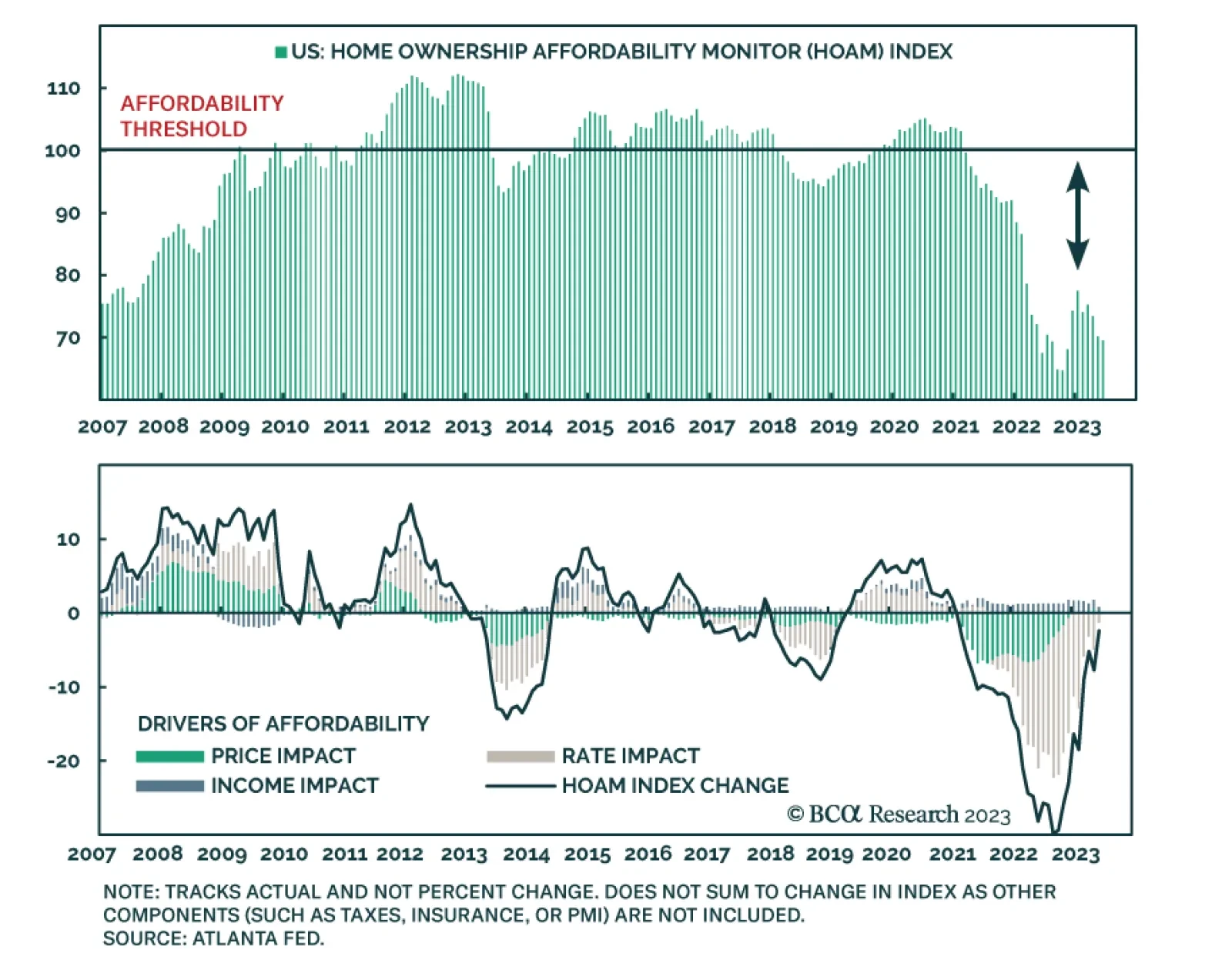

The latest update of the Atlanta Fed’s Home Ownership Affordability Monitor (HOAM) – which gauges a median-income households’ ability to absorb annual costs related to owning a median-priced home – is now…

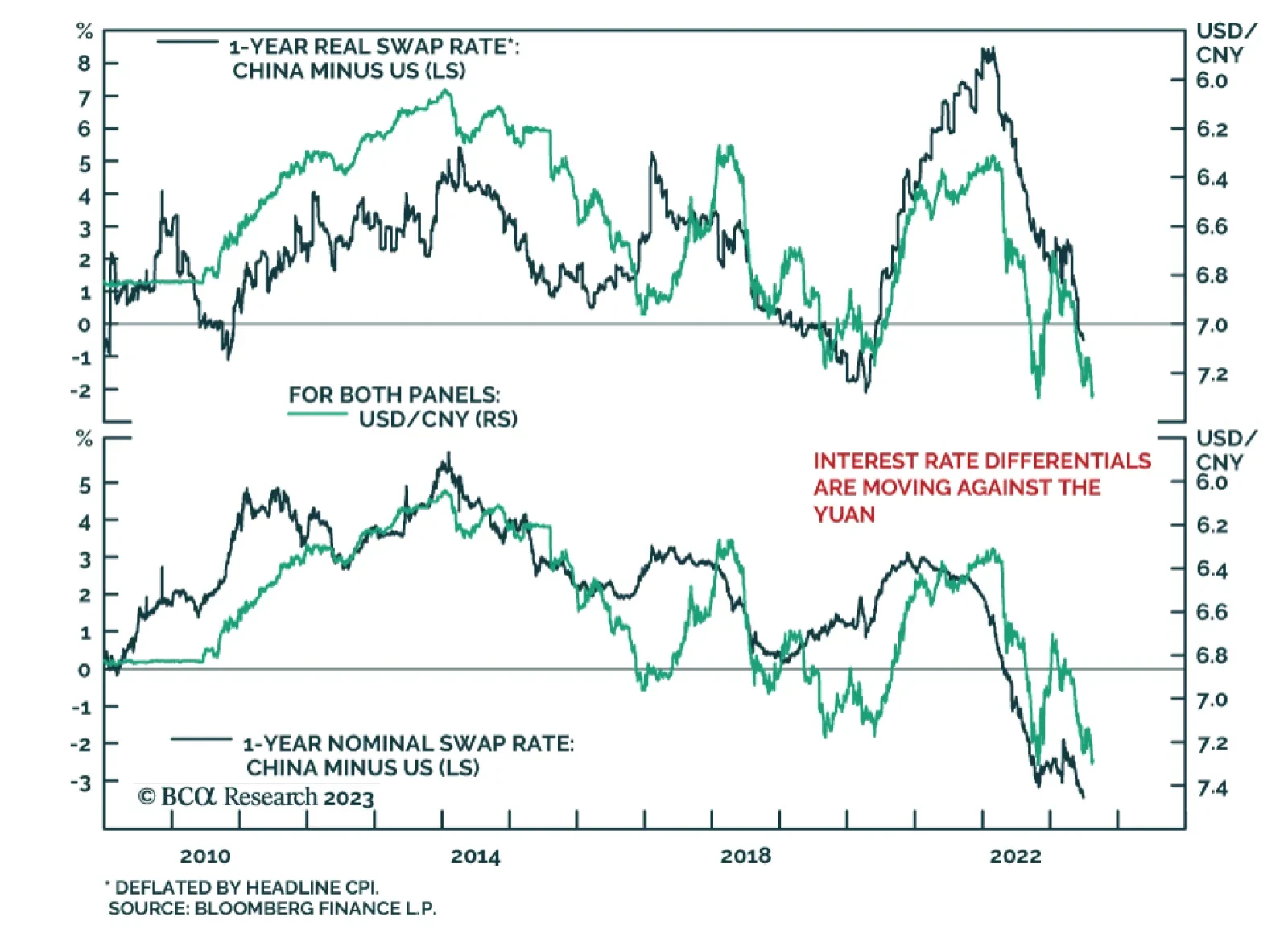

Chinese authorities have recently ratcheted up support for the currency. The PBoC continues to set its daily yuan fixing at a stronger-than-expected rate, with the yuan midpoint (a reference for trading that caps the range…

Investors should prepare for an equity market pullback this fall, prefer Treasuries over stocks, and US defensives over cyclicals. A pullback could also morph into another bear market given that monetary policy is tight, policy…

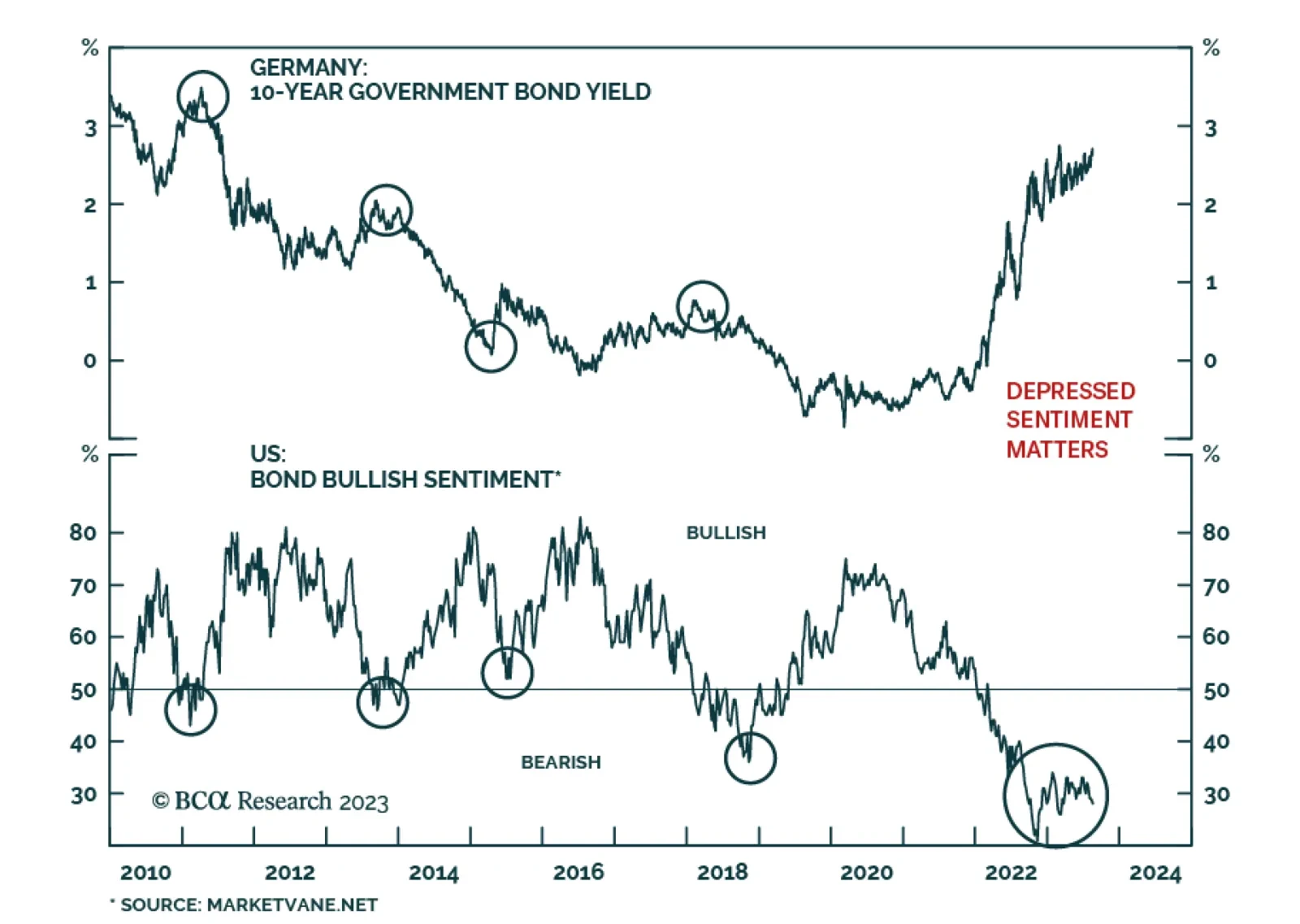

According to BCA Research’s European Investment Strategy service, German yields are unlikely to experience a decisive break out that would carry them to 3%. Five economic forces suggest that German yields are unlikely to…