According to BCA Research’s Commodity & Energy Strategy service, current monetary policy settings at the Fed and ECB risk pushing commodity and energy prices lower. Lower prices and higher rates will suppress capex and…

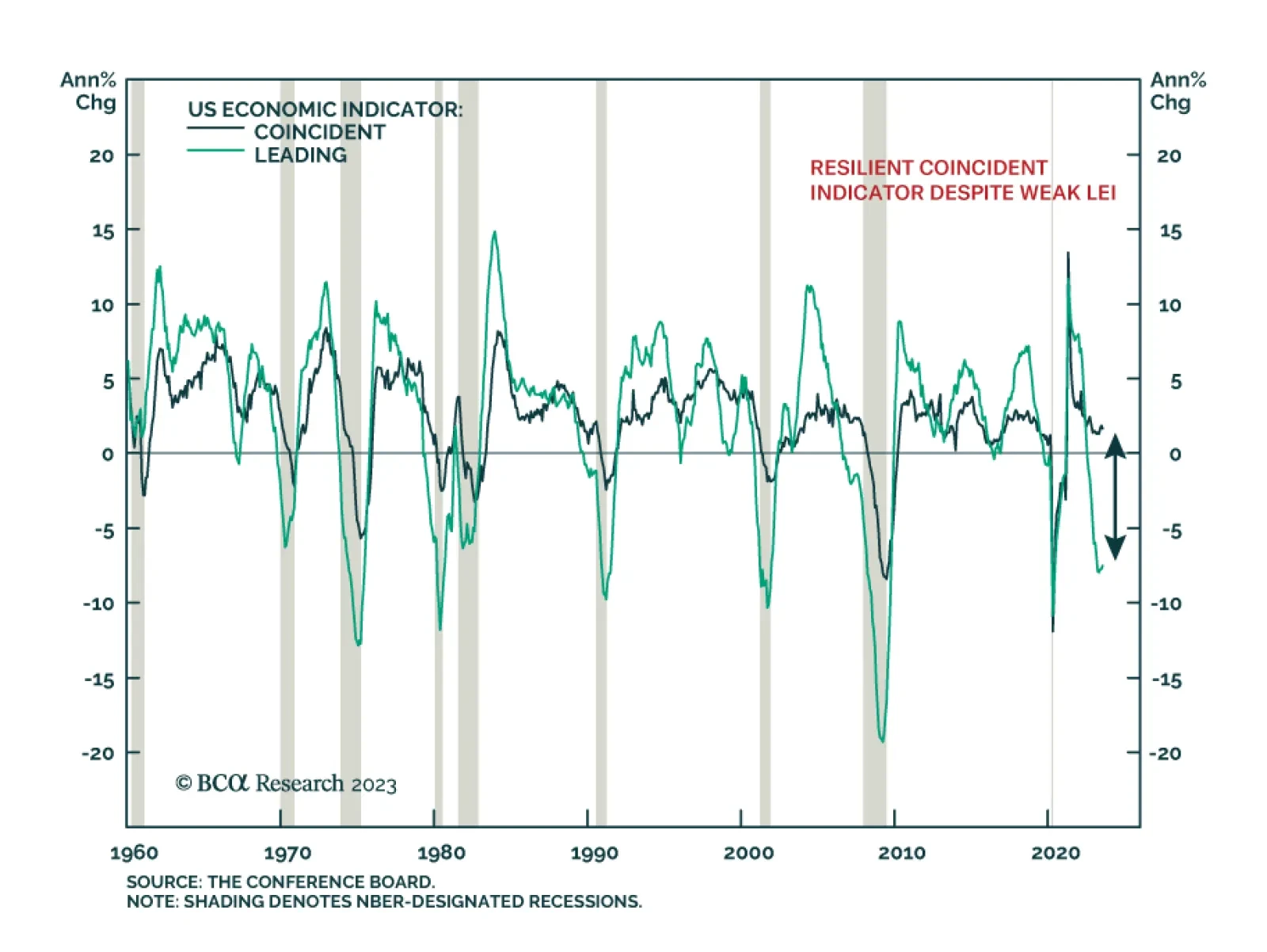

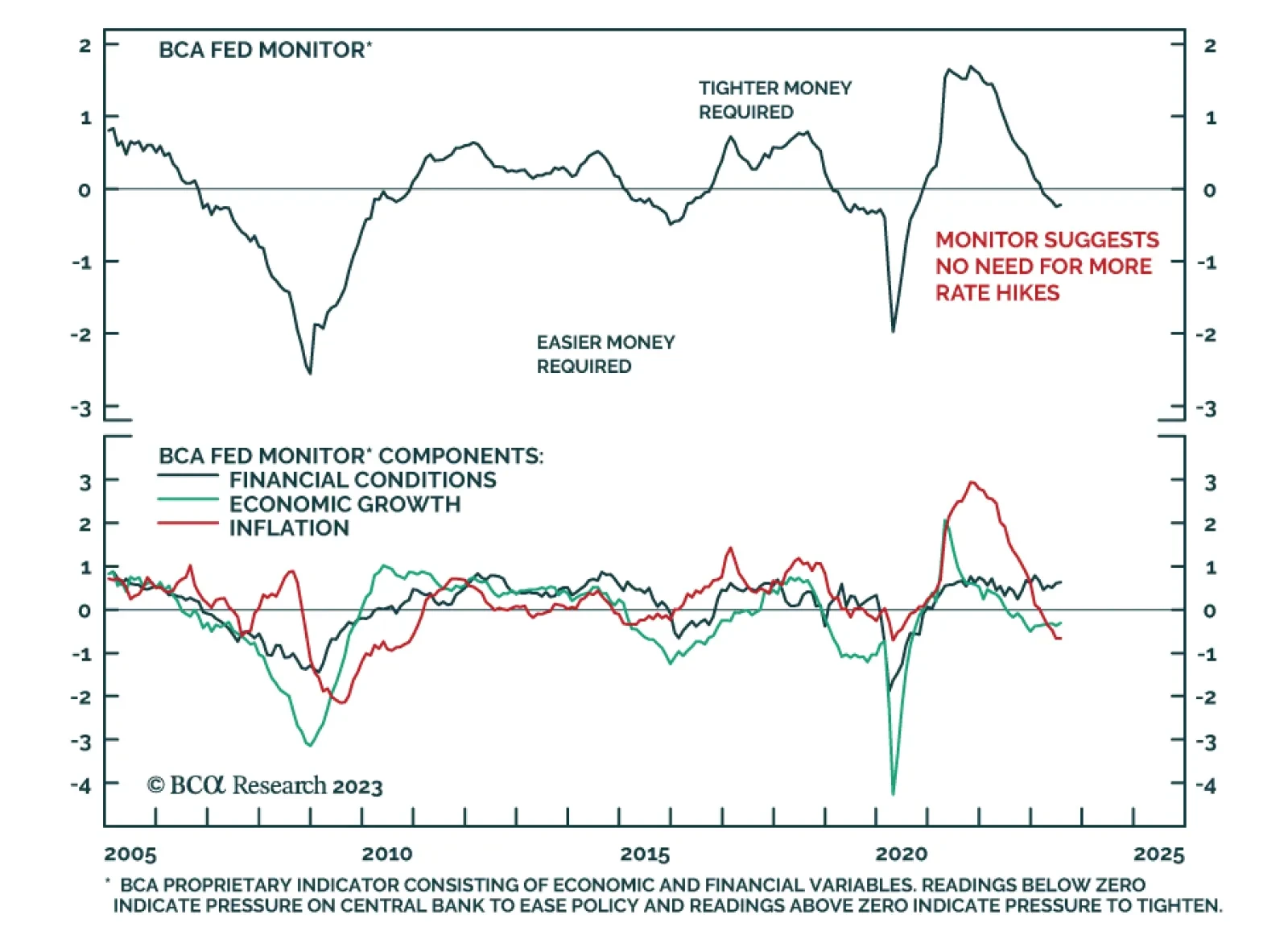

In Section I, we respond to the ongoing challenge to our view that the US economy is on a recessionary path. The available evidence overwhelmingly supports the notion that US monetary policy is tight, which argues against the “no…

Consensus expectations for the US economy were bleak at the start of the year. In hindsight, this pessimism was excessive: real GDP expanded in the first two quarters of the year (see Country Focus). Similarly, the US Conference…

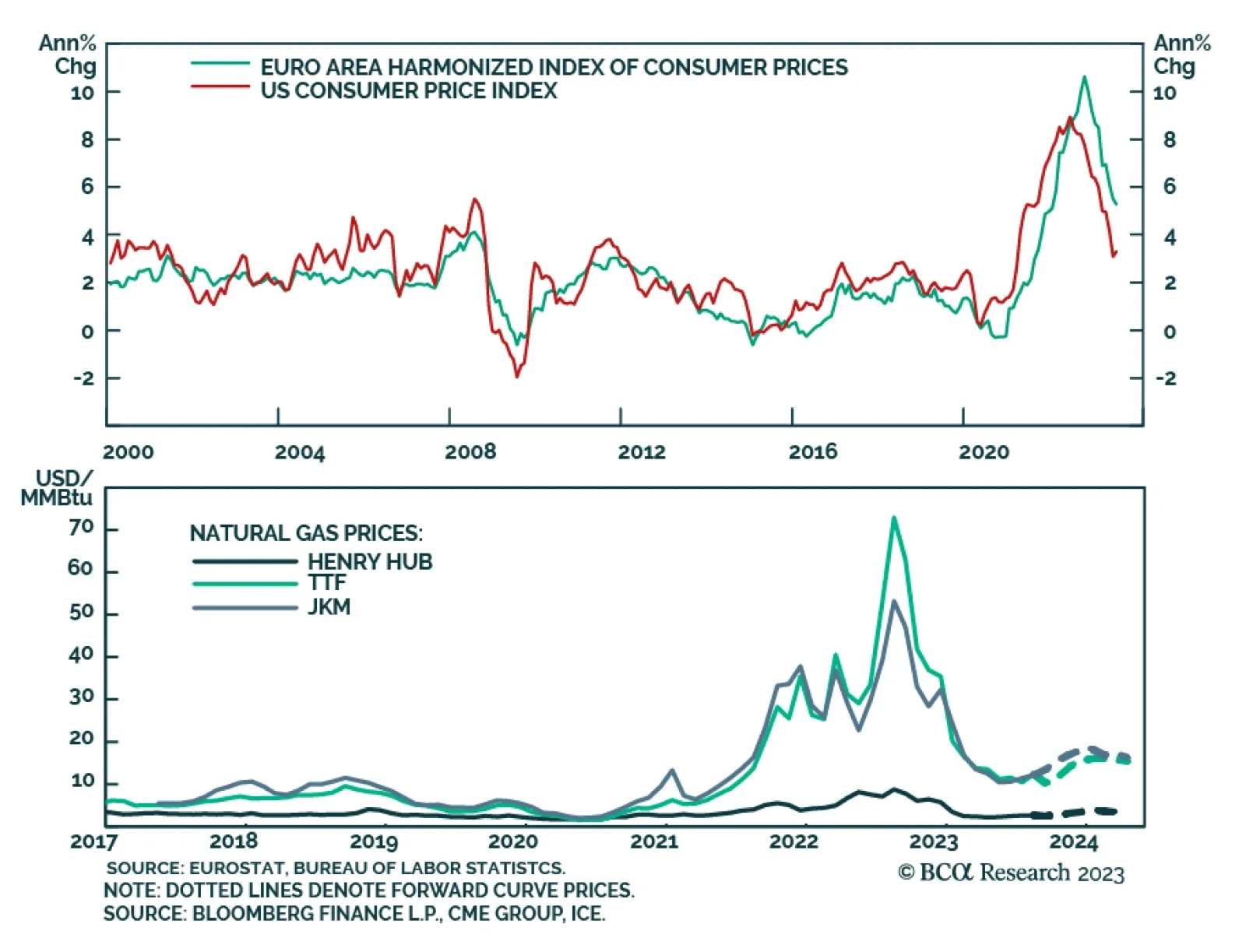

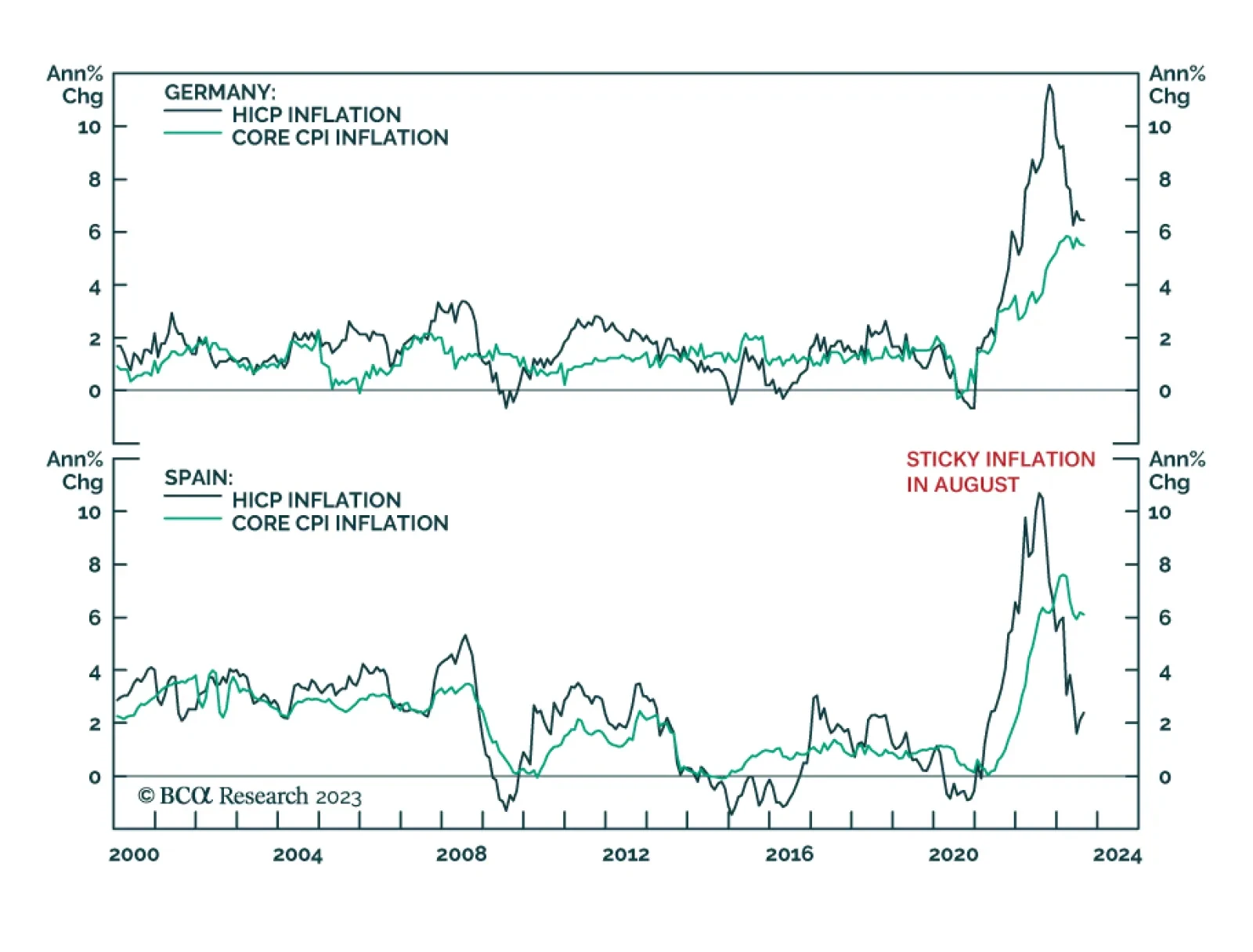

Euro Area inflation data surprised to the upside on Wednesday. According to preliminary data, although Germany’s harmonized headline CPI inflation rate fell from 6.5% y/y to 6.4% y/y in August, it nevertheless came in…

We comment on Jay Powell’s Jackson Hole speech and recommend shifting to a barbelled allocation along the Treasury curve.

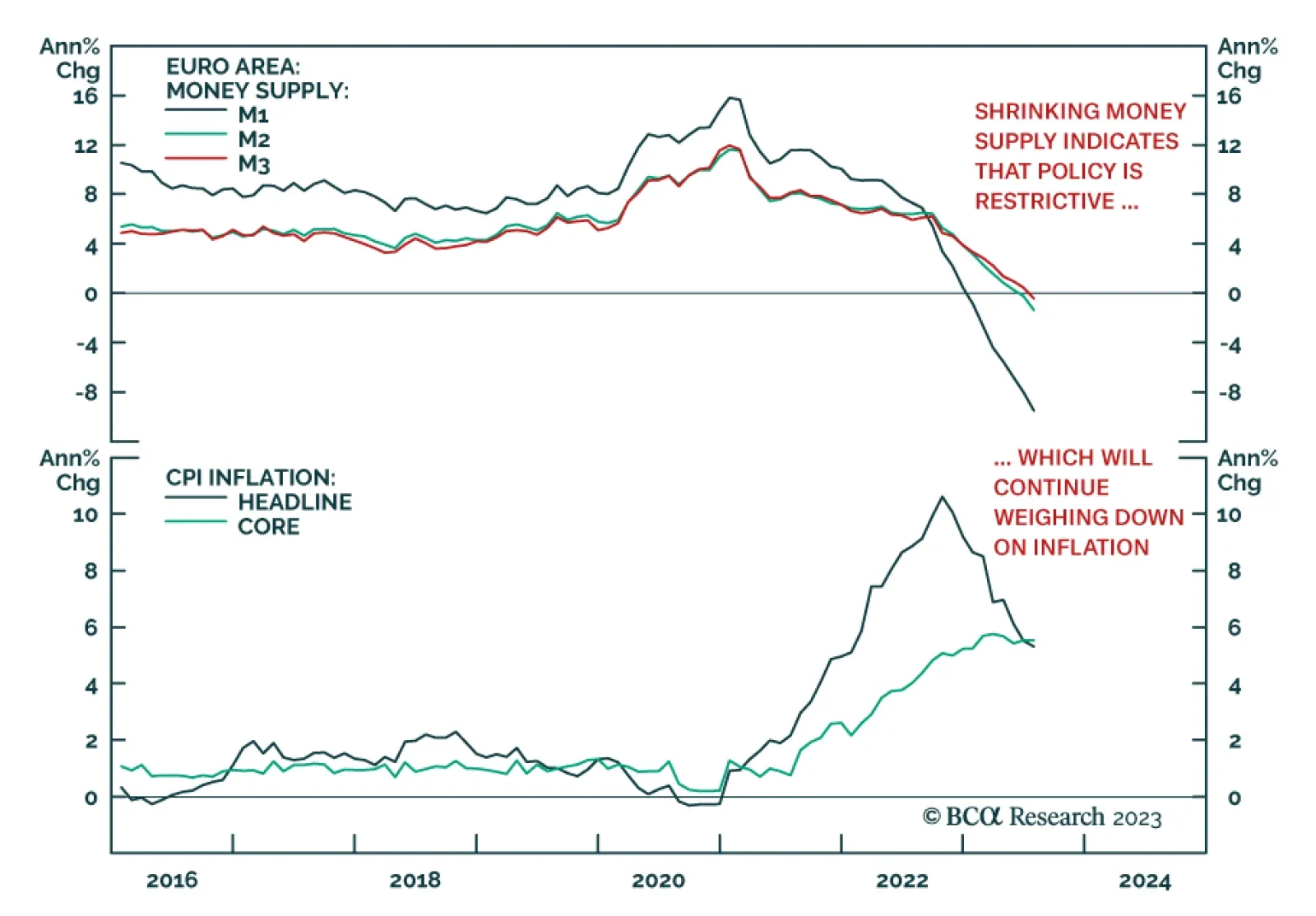

Eurozone money supply data reflect the impact of the ECB’s aggressive tightening campaign on the region’s economy. Data released on Monday showed the July M3 measure of broad money (the sum of M2, repurchase…

Today’s Strategy Report chartbook presents the data underpinning our view that both inflation and growth are slowing, likely pointing to a recession beginning sometime in the first half of next year. We are tactically equal weight…

The Treasury market’s reaction to Fed Chair Jermone Powell’s Jackson Hole speech was relatively tame on Friday. Although there was some volatility during the speech, the 10-year yield ended the day broadly unchanged.…

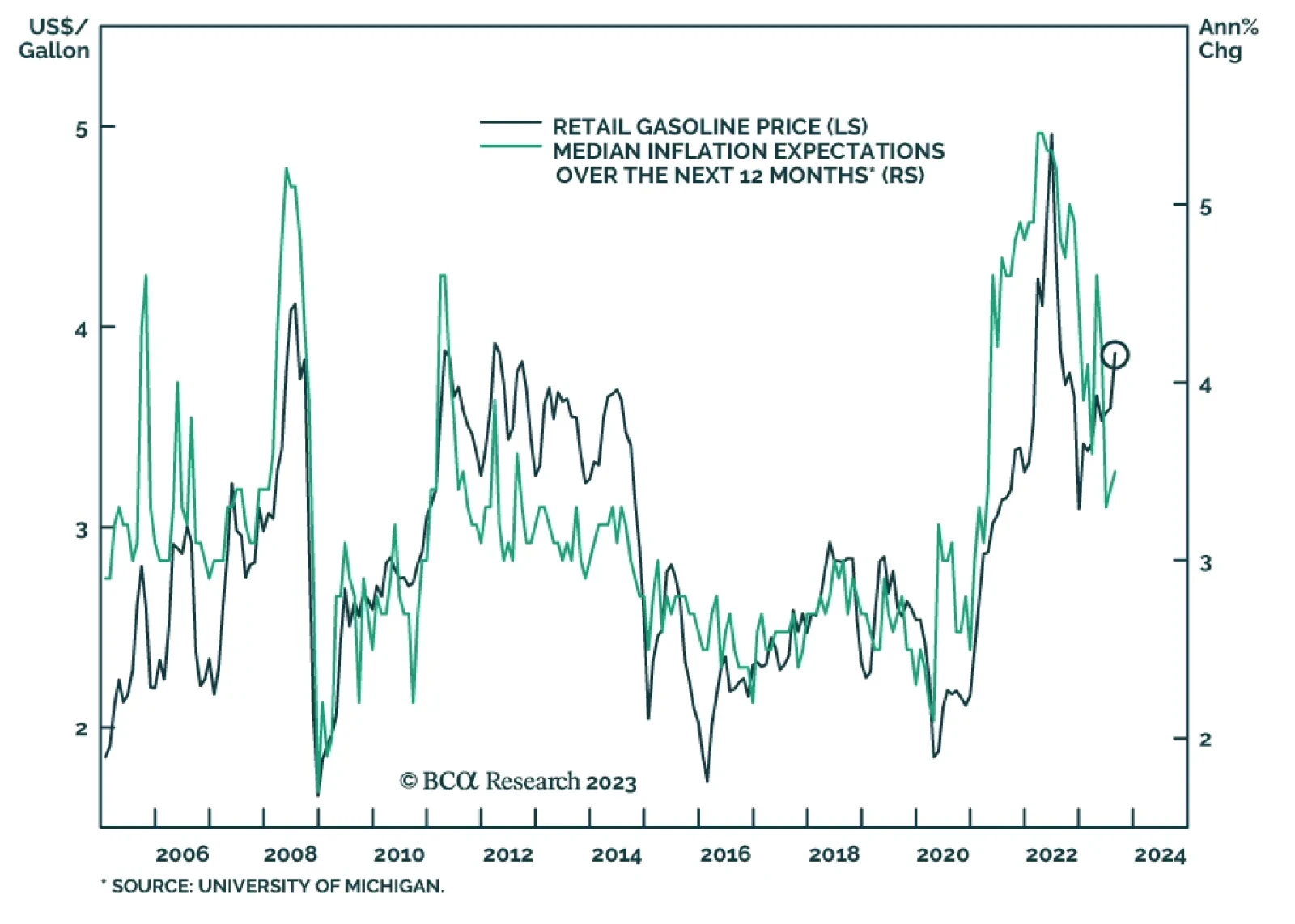

The final release of the University of Michigan’s gauge of US consumer inflation expectations unexpectedly rose in August. It shows 1-year ahead inflation expectations increased by a tenth of a percentage point to 3.5% (an…