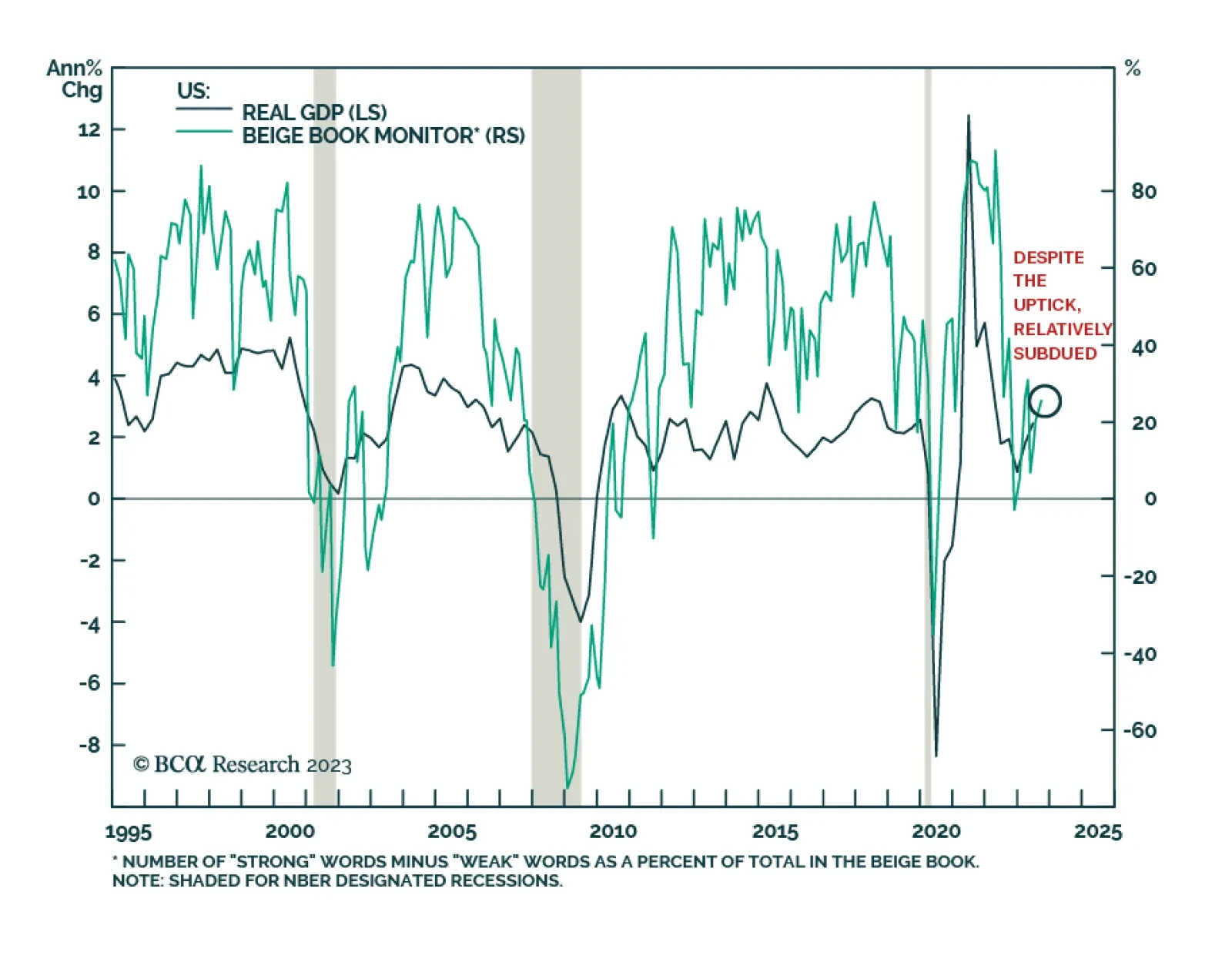

Overall, the Fed’s latest Beige Book provided a pessimistic assessment of the US economy. Although the report characterized tourism spending as “stronger than expected,” it also noted that pent-up demand for…

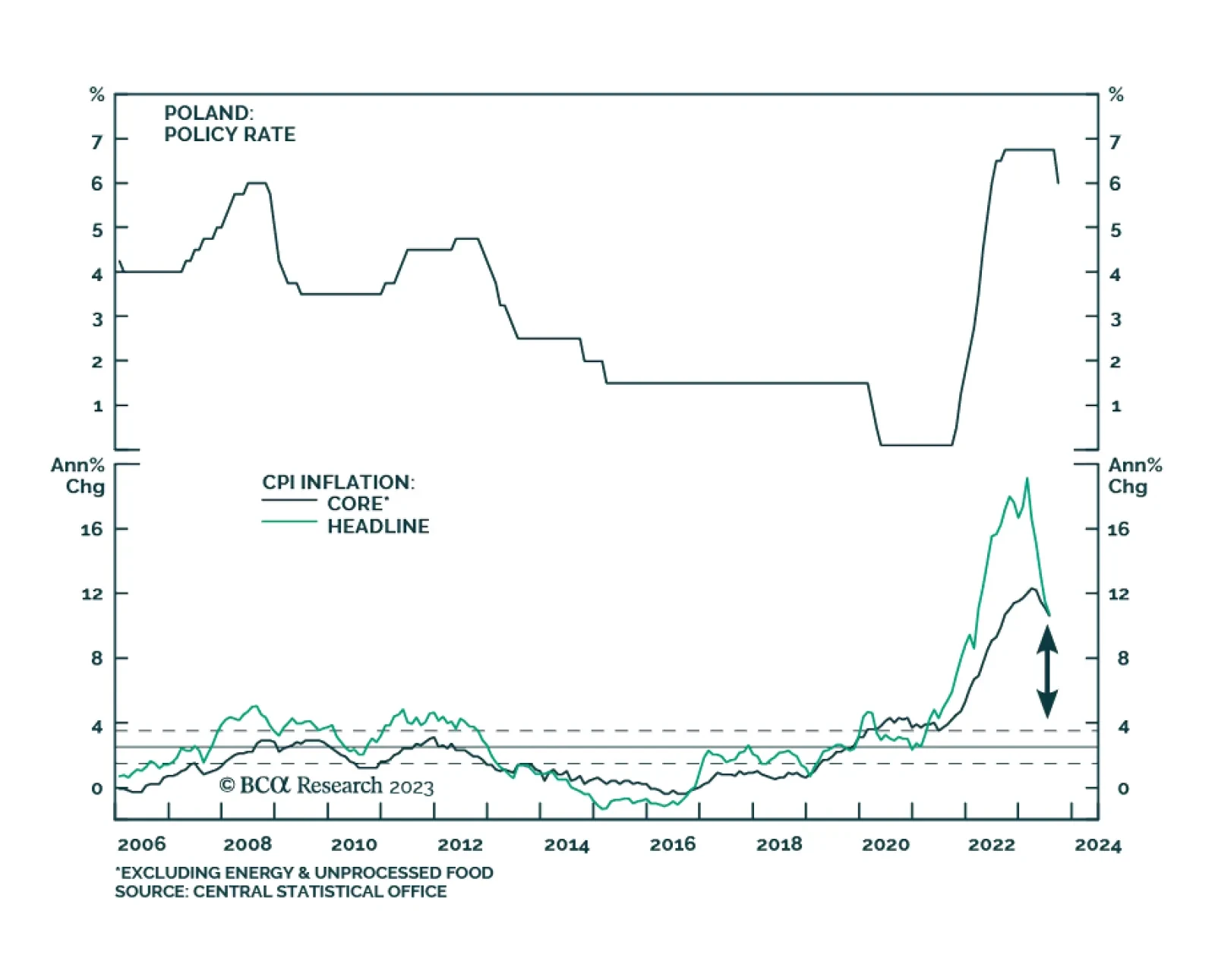

The Polish central bank delivered a larger-than-anticipated 75 basis point rate cut on Wednesday – slashing the policy rate to 6%, versus expectations of 6.5%. The aggressive move marks the first rate cut following a 11-…

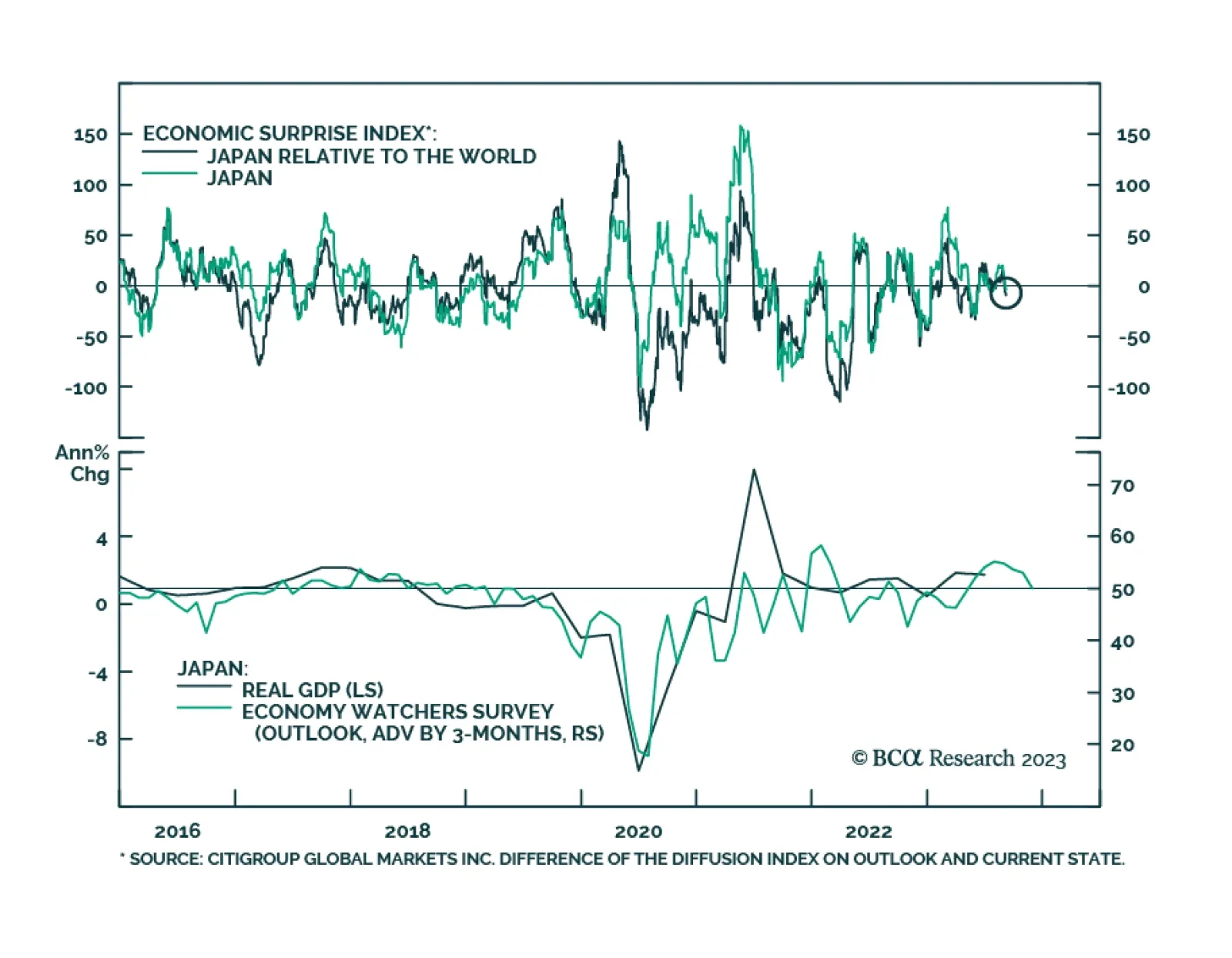

Japanese economic data delivered a negative surprise on Friday. Q2 GDP growth was revised down from 1.5% q/q to 1.2% q/q, below expectations of 1.4% q/q. The downwards revision reflects a 1% q/q decline in business spending (…

Our Portfolio Allocation Summary for September 2023.

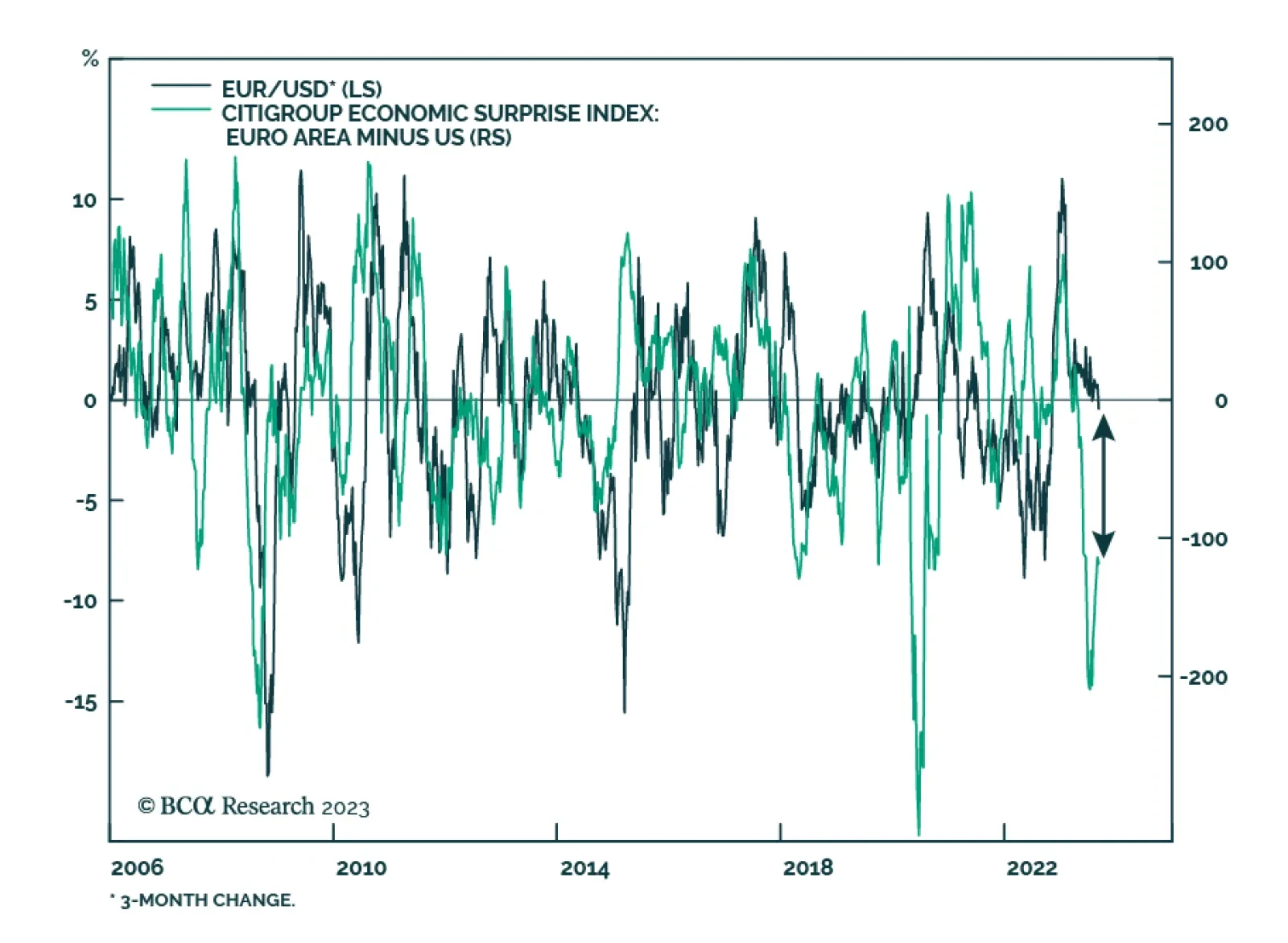

Recent Eurozone economic data indicate that restrictive monetary policy and the global manufacturing downturn are weighing down on the region’s economy. In particular, new orders at German factories plunged by 11.7% m/m…

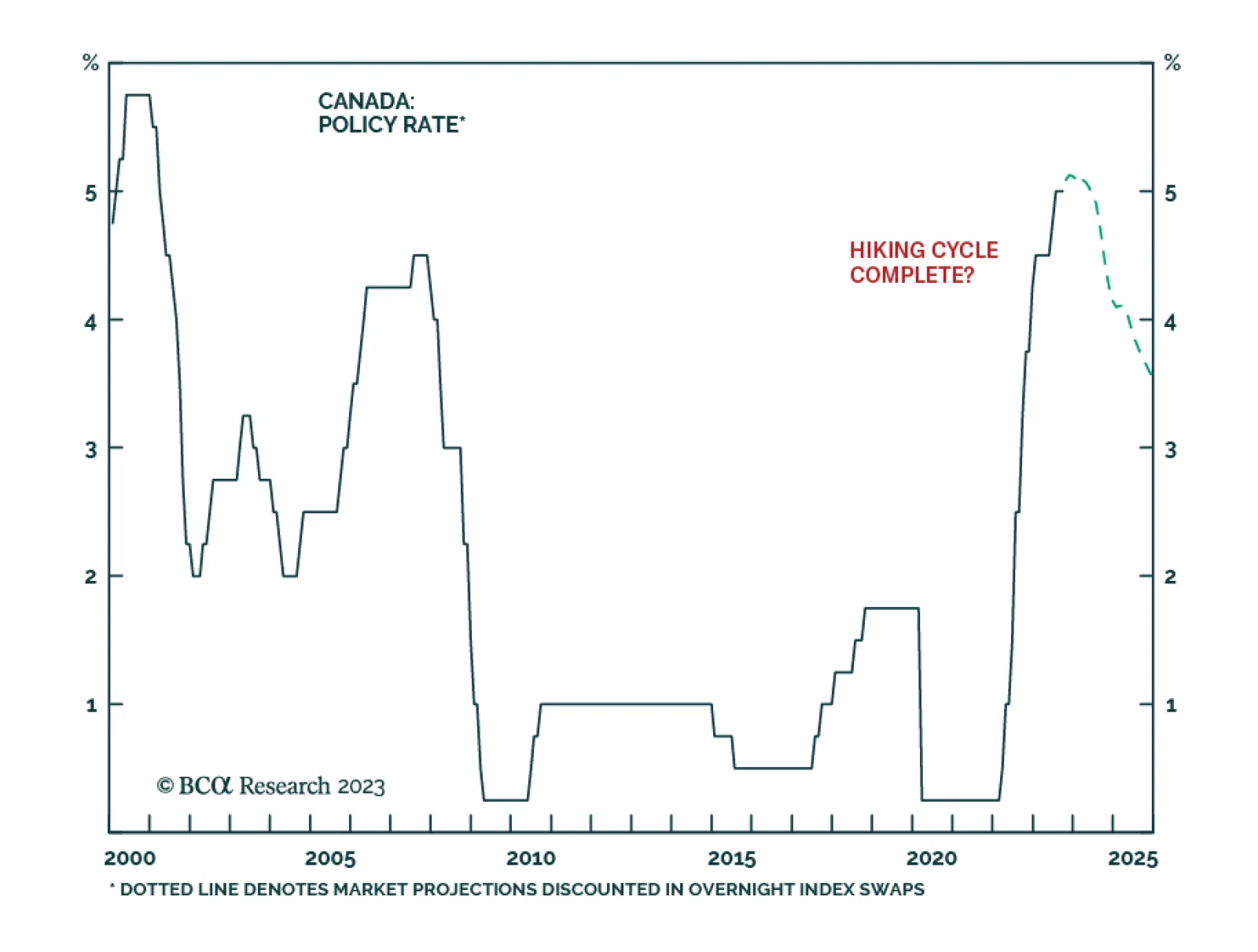

As expected, the Bank of Canada kept its policy rate unchanged at 5% on Wednesday. In particular, the central bank highlighted that domestic economic growth deteriorated. Indeed, last week’s GDP release showed the…

The broader rally that started in June is premised on a Goldilocks narrative that will prove to be a fairy tale. Either by stubborn inflation. Or, by higher unemployment that shows that the war on inflation is far from costless. Or,…

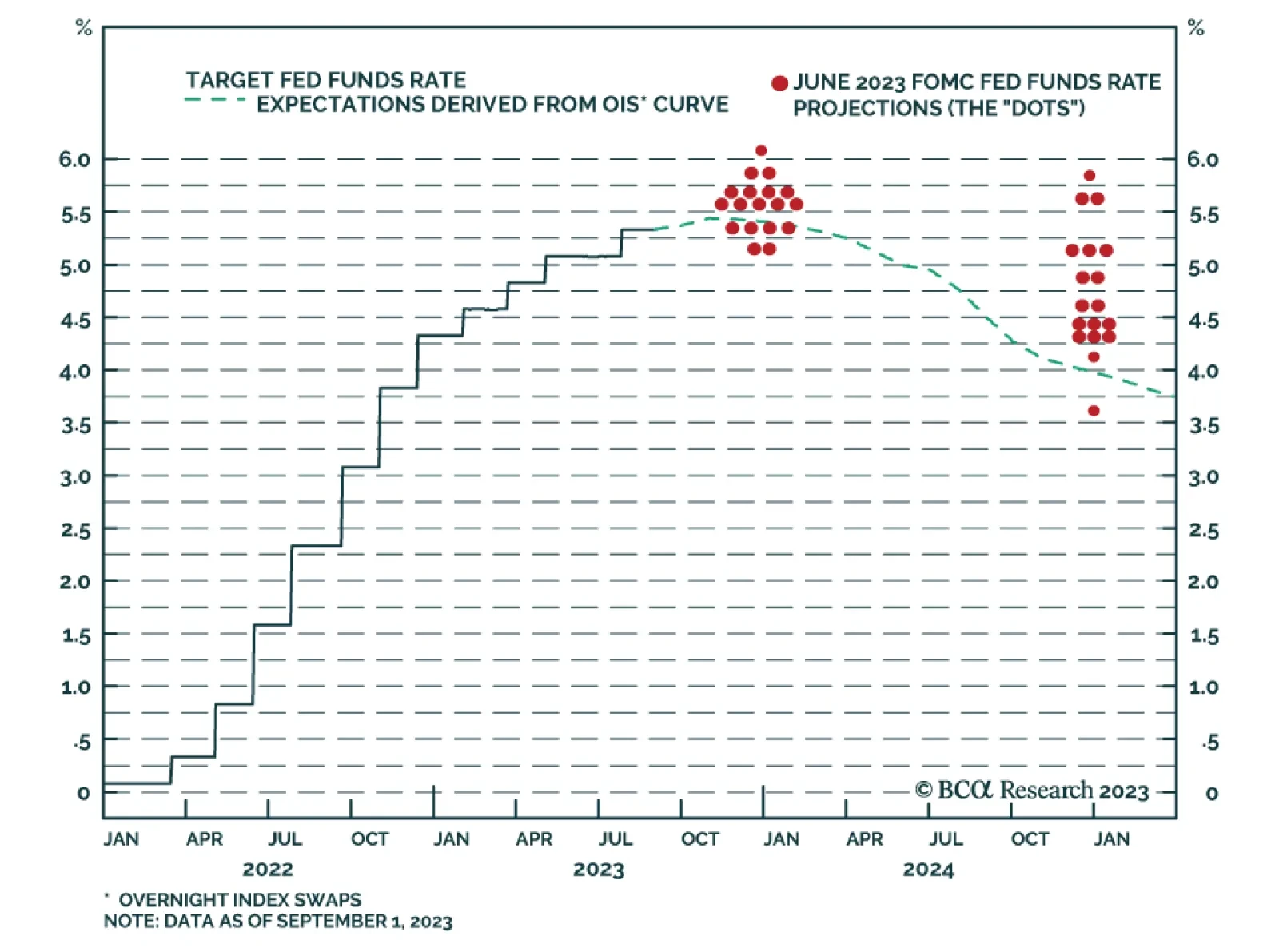

In a Tuesday morning television interview, Fed Governor Christopher Waller signaled that the Fed will not lift rates when it meets later this month. Specifically, Waller echoed language used by Chair Powell at the Jackson Hole…

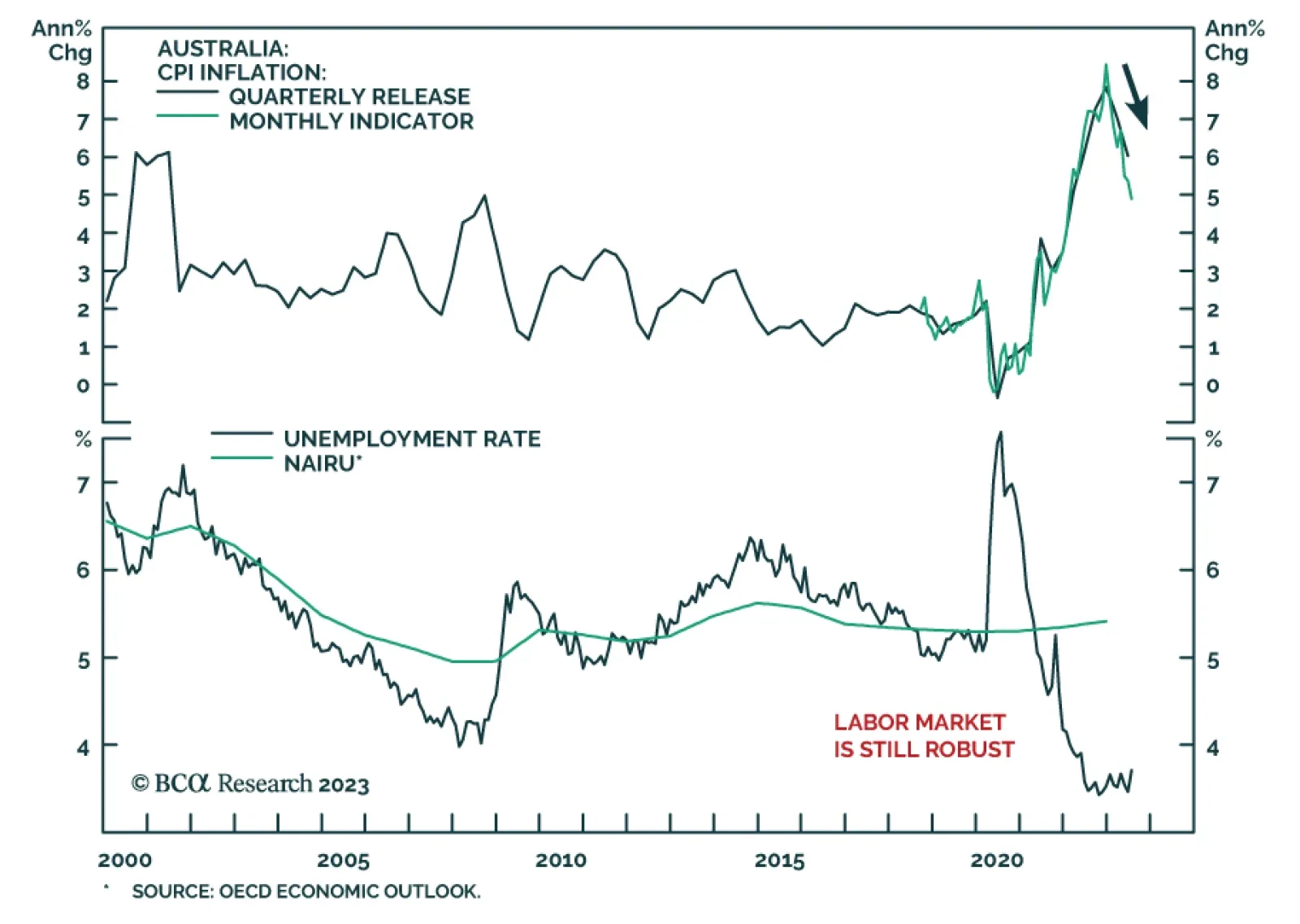

The AUD was the worst performing currency on Tuesday after the Reserve Bank of Australia kept its cash rate target unchanged at 4.1% for the third consecutive month. In particular, outgoing Governor Philip Lowe underscored that…

US bond investment takeaways from this week’s PCE and employment releases.