There is a connection between the bond market meltdown and Republican Party’s meltdown. Investors should expect more short-term financial market volatility as a result of the triple whammy of high bond yields, high oil prices, and a…

We unveil the ‘Joshi rule’ real-time recession indicator as a much better version of the Federal Reserve’s own ‘Sahm rule’. And we identify what would trigger these recession indicators in this week’s and future US jobs reports. Plus…

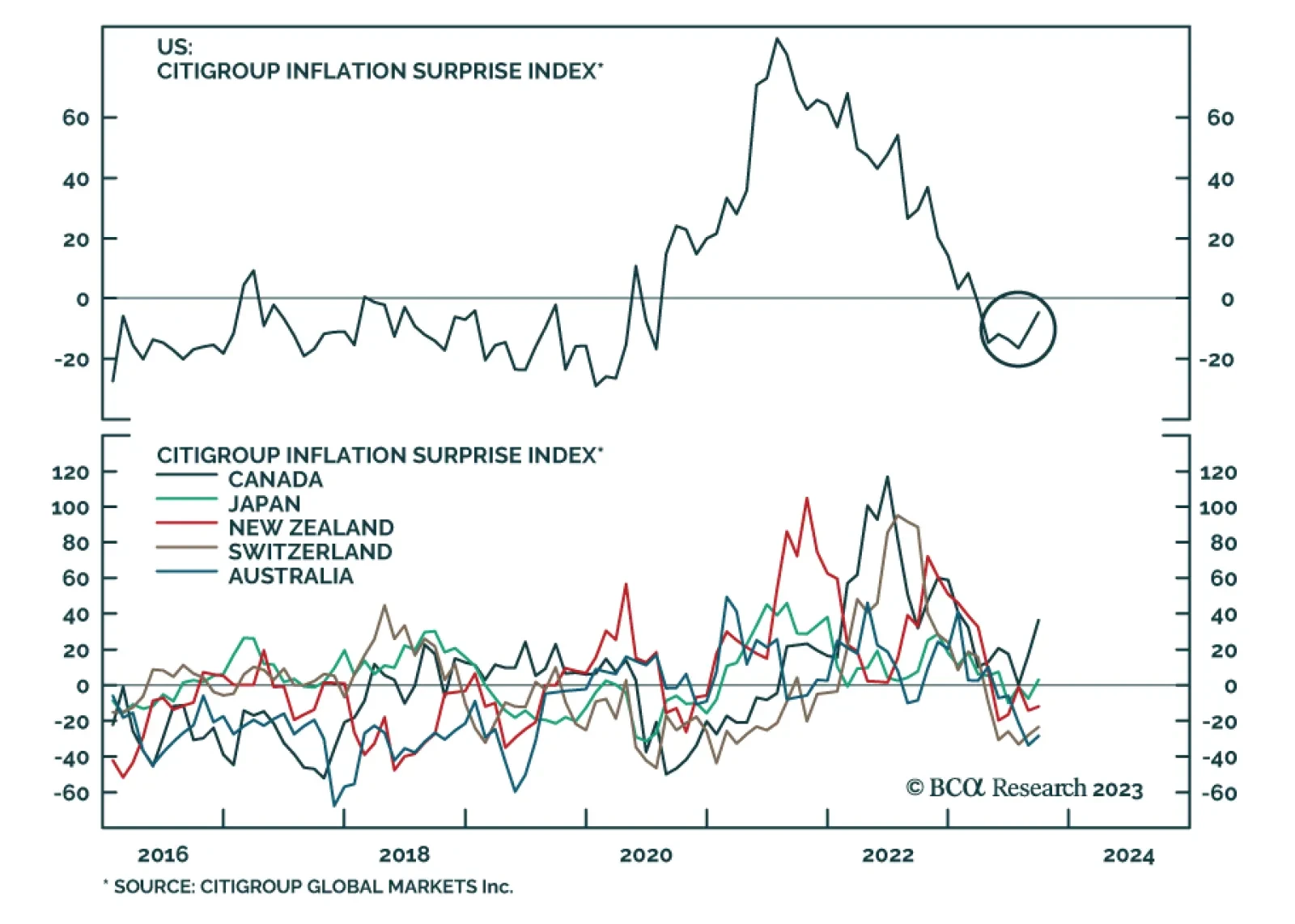

The Citi US Inflation Surprise Index has risen over the past two months after having bottomed at a three-year low in July. The good news is that the level of the index remains negative after having first fallen below zero in…

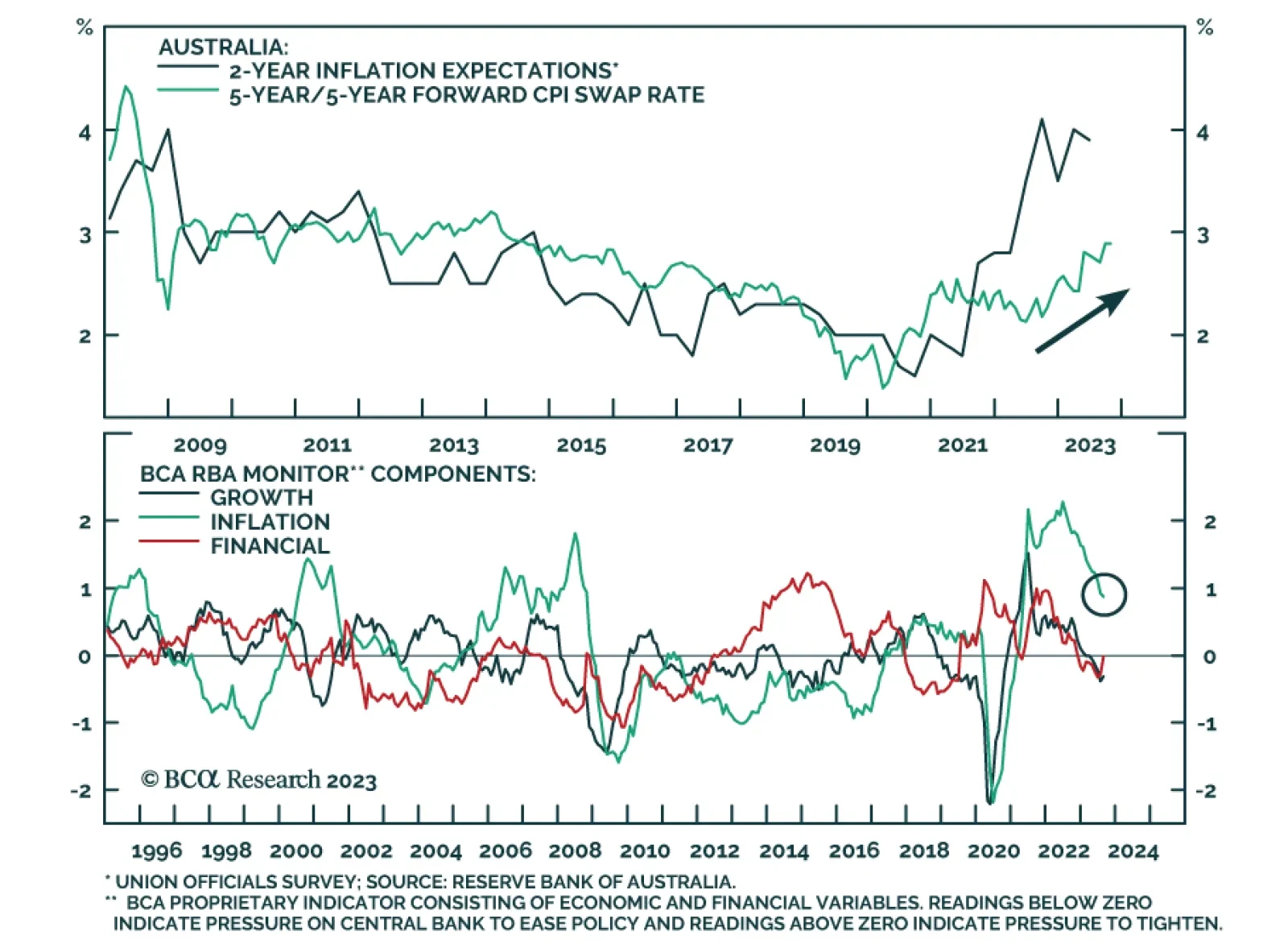

The Australian dollar was among the worst performing major currencies on Tuesday after the Reserve Bank of Australia held the cash rate at 4.1% for the fourth consecutive month. In her post meeting statement, newly appointed…

We present our Portfolio Allocation Summary for October 2023.

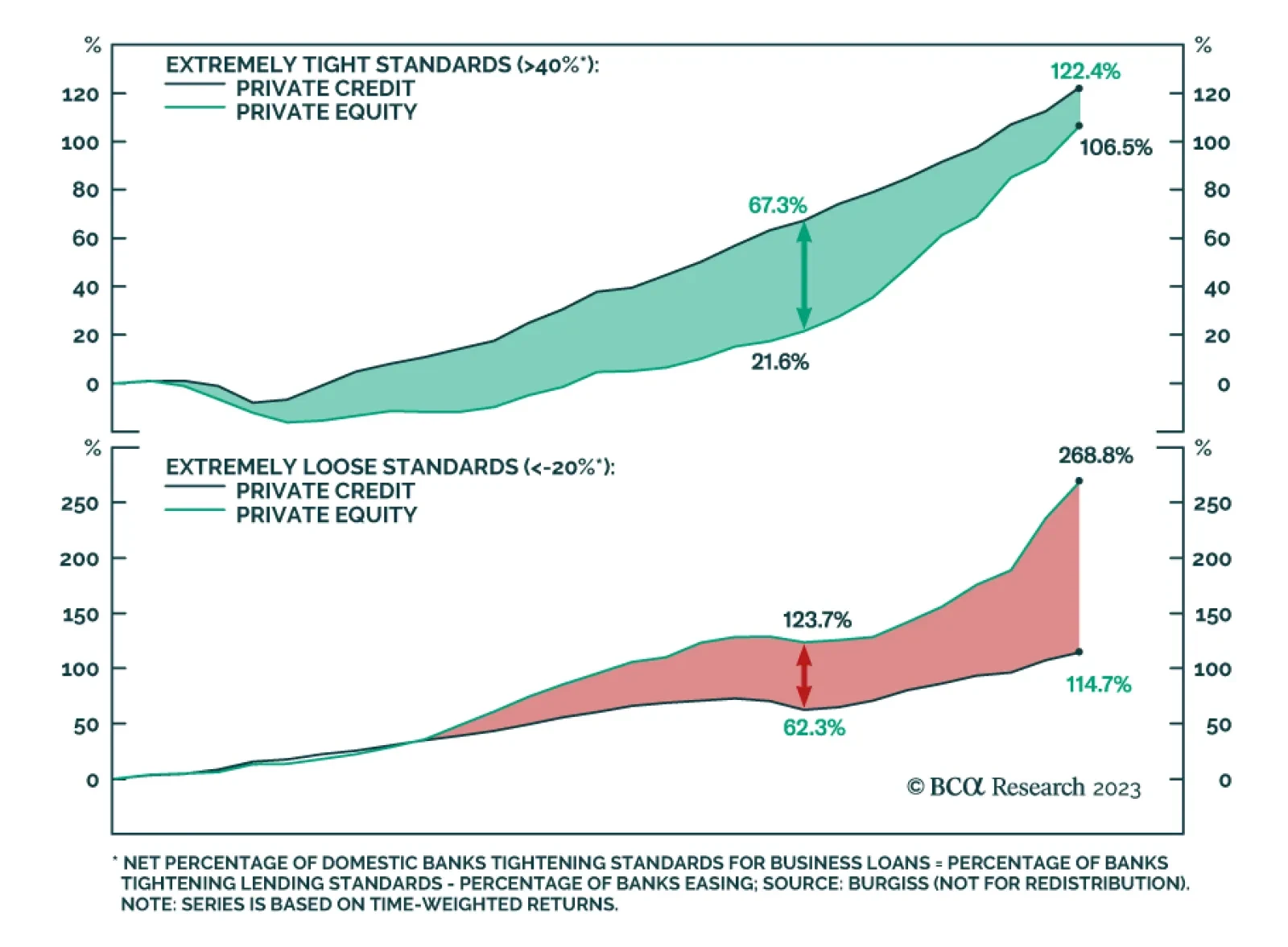

Within alternatives, BCA Research’s Global Asset Allocation service favors Private Credit since yields are in double-digits and lenders are in a strong negotiating position. Private Credit (Overweight): …

In the monthly Daily Insights Survey we conducted over the past week, we asked about our readers’ outlook for oil prices, Fed policy, and the global economy. On the outlook for crude oil, a larger share of respondents…

Downside risks to equities are building. Rates, the dollar, and energy prices will remain elevated into yearend. This trifecta makes a soft landing less likely than before and hurts corporate profits and multiples. However, high cash…

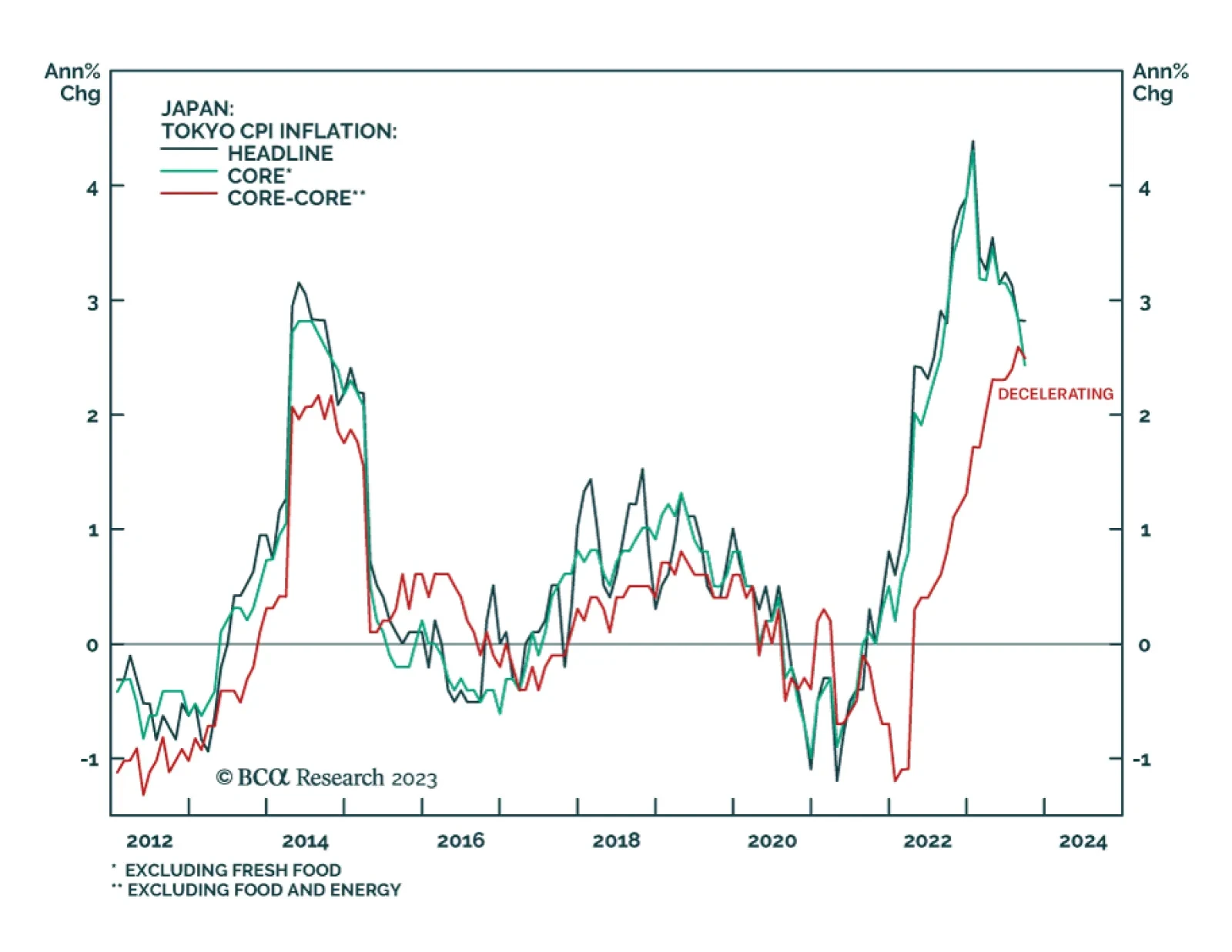

The BoJ remains an outlier among global DM central banks. While many of its peers are now debating whether to end their rate tightening cycles, the Japanese central bank has not even started raising interest rates yet.…