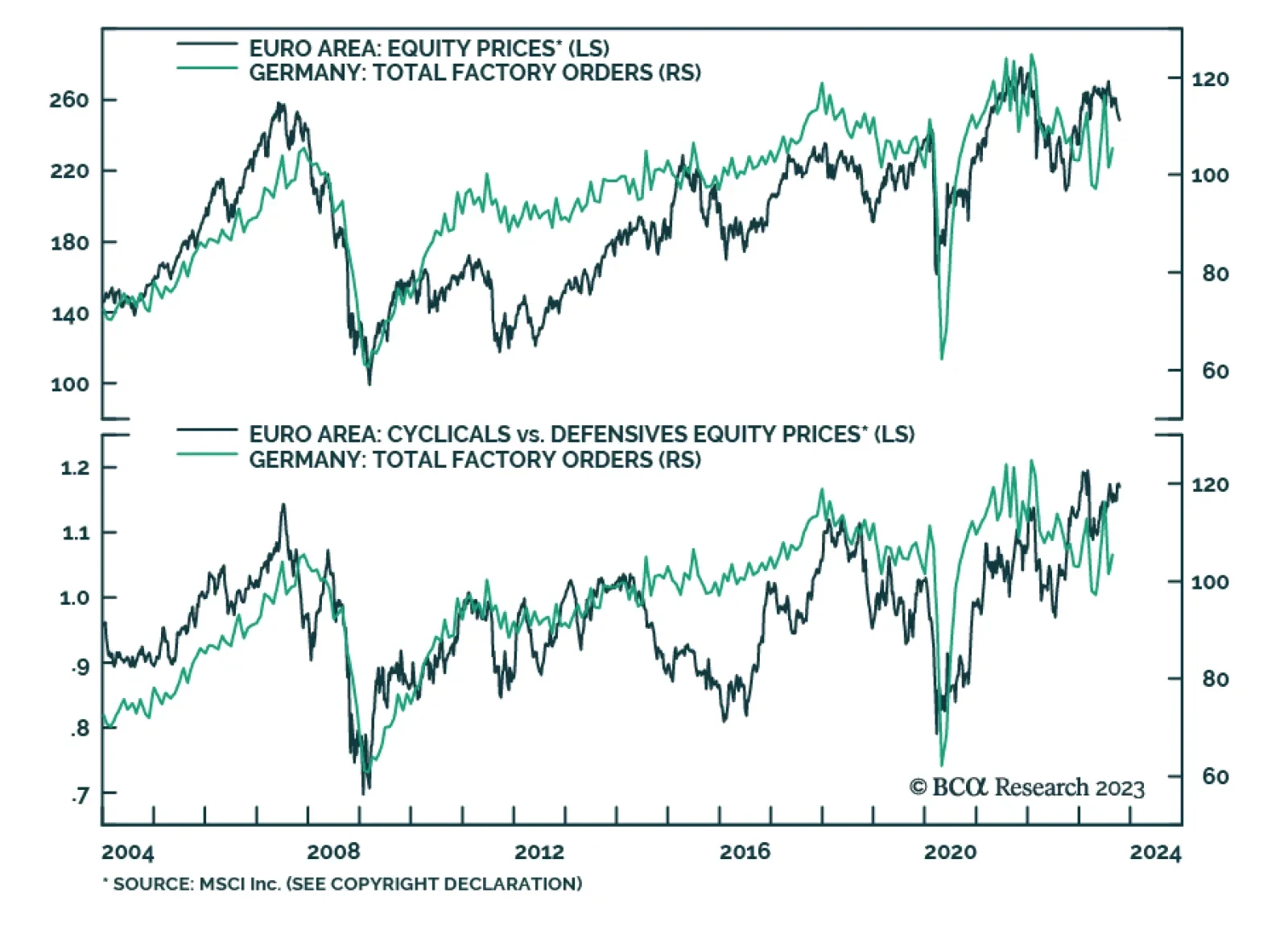

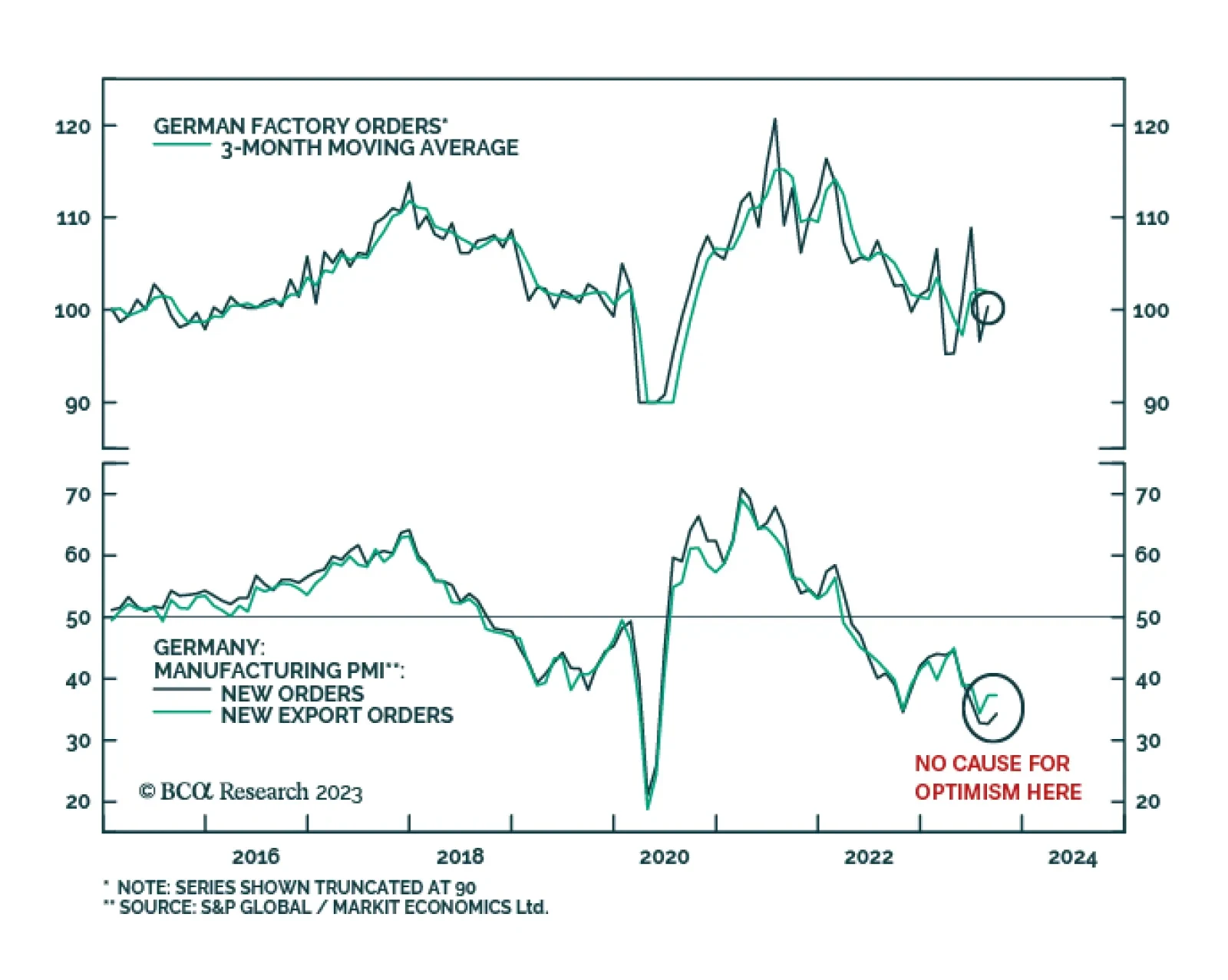

As we highlighted in a recent Insight, the stronger-than-anticipated improvement in German factory orders should be viewed with some degree of caution. Germany is the European economy most exposed to the global manufacturing…

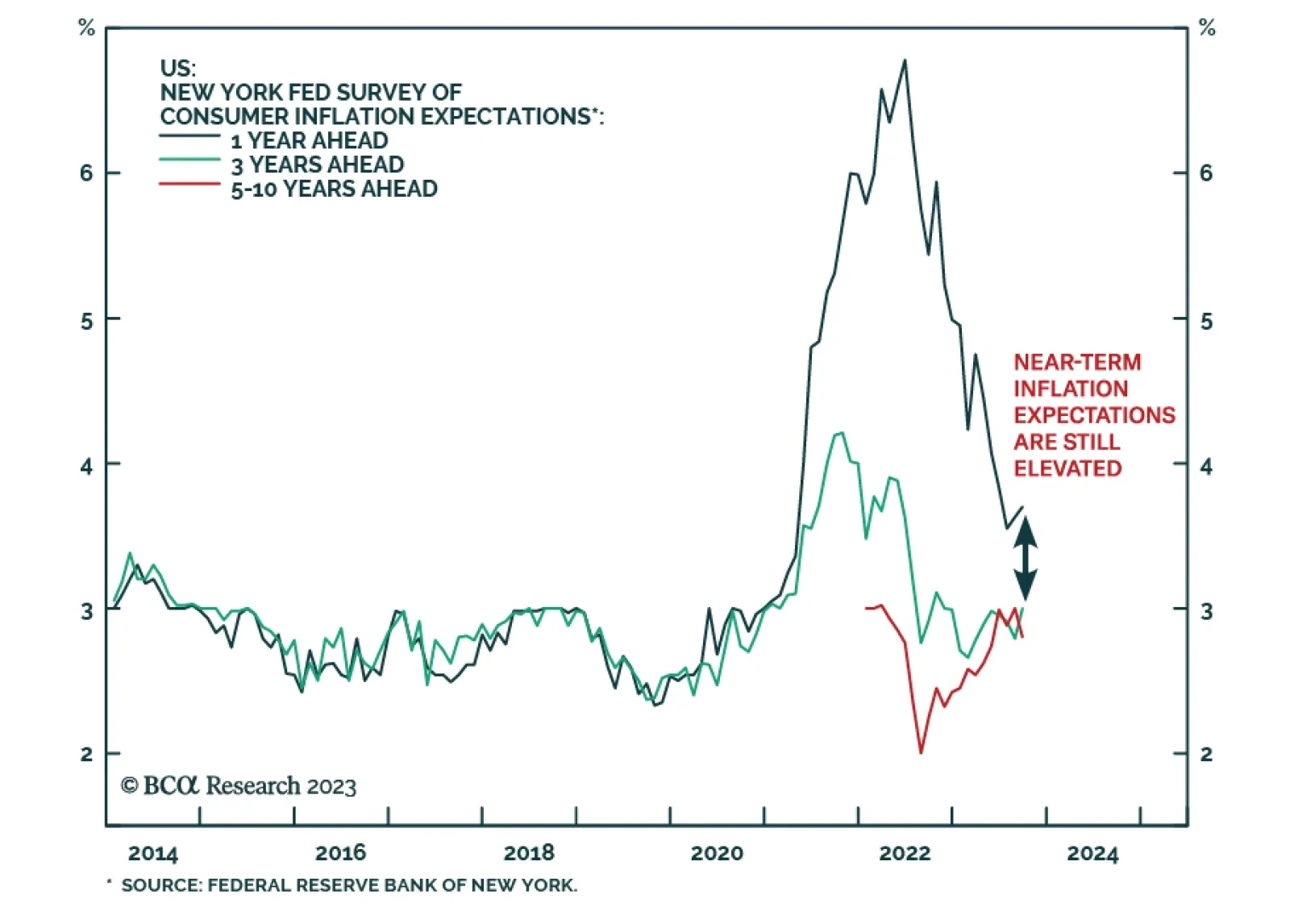

Results of the New York Fed’s survey show American consumers’ near-term inflation outlook ticked up in September. Respondents’ one-year ahead inflation expectations rose from 3.6% to 3.7%, and the three-year…

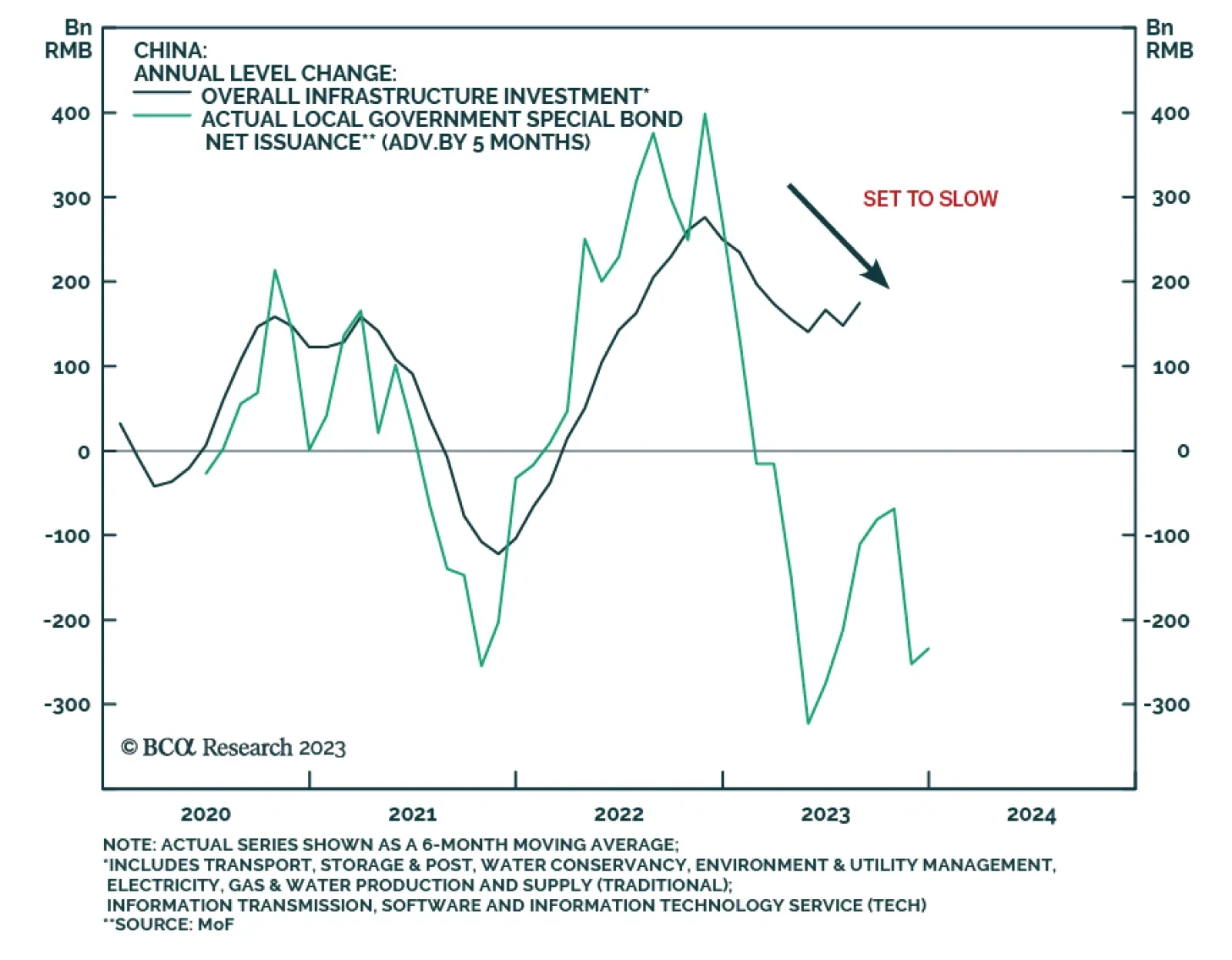

Dovish comments by several Fed officials contributed to a Treasury rally and improvement in sentiment towards risk assets on Tuesday. Globally, rumors that Beijing is planning to unleash more stimulus supported Chinese financial…

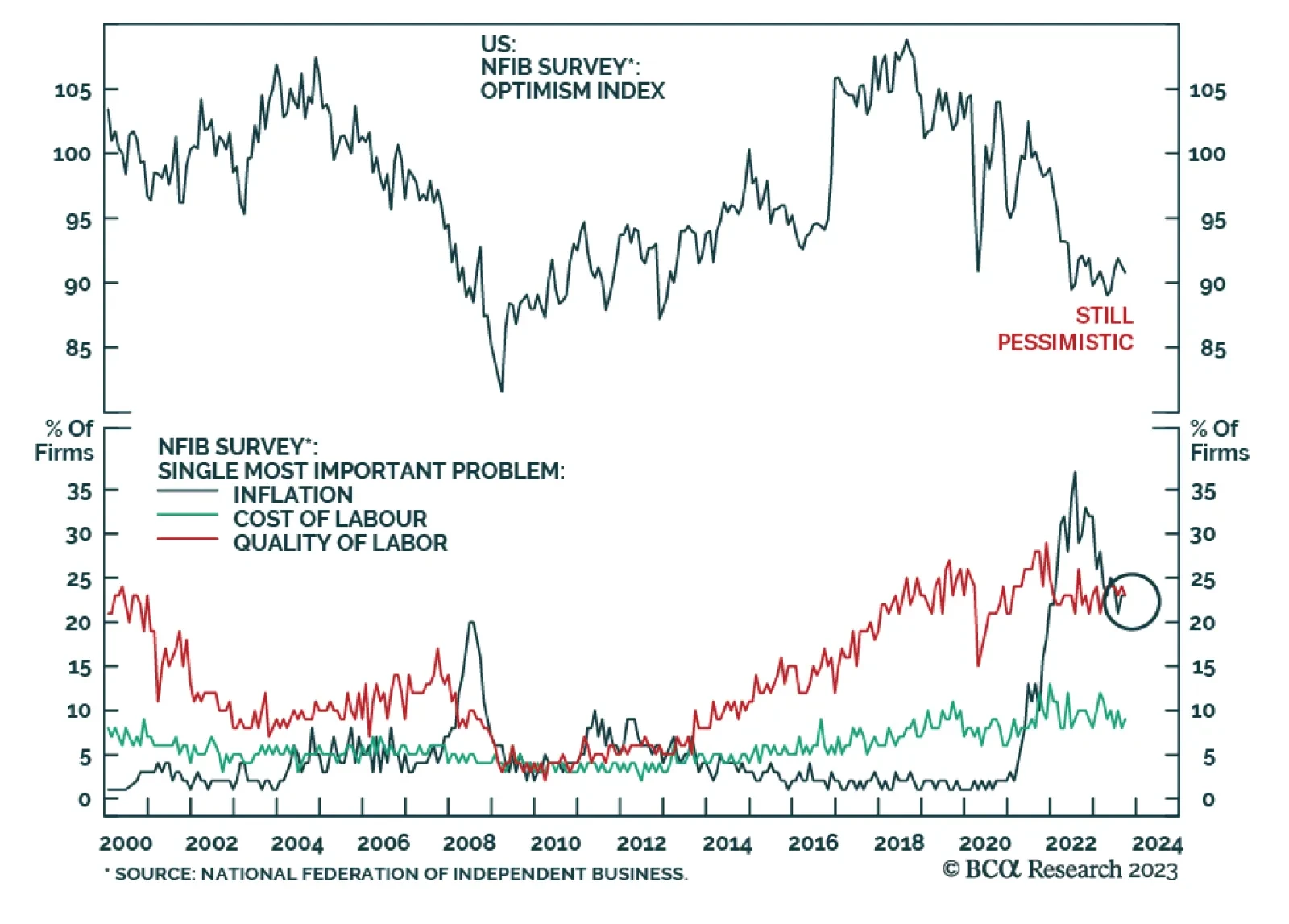

US small business optimism deteriorated for the second consecutive month in September. The NFIB index weakened by 0.5 points to 90.8, slightly below expectations of a more muted decline to 91.0. The latest move brings the index…

The market has been held hostage by surging rates. Zombie companies are “alive” and are multiplying – they are highly sensitive to surging borrowing costs. Underweight Utilities to reduce portfolio duration. Maintain neutral…

August brought some respite for German factories struggling with poor demand this year. After falling by 11.3% m/m in the prior month, German factory orders rebounded by 3.9% m/m in August – beating expectations of a 1.5% m…

An update to our US bond strategy following this morning’s employment report.

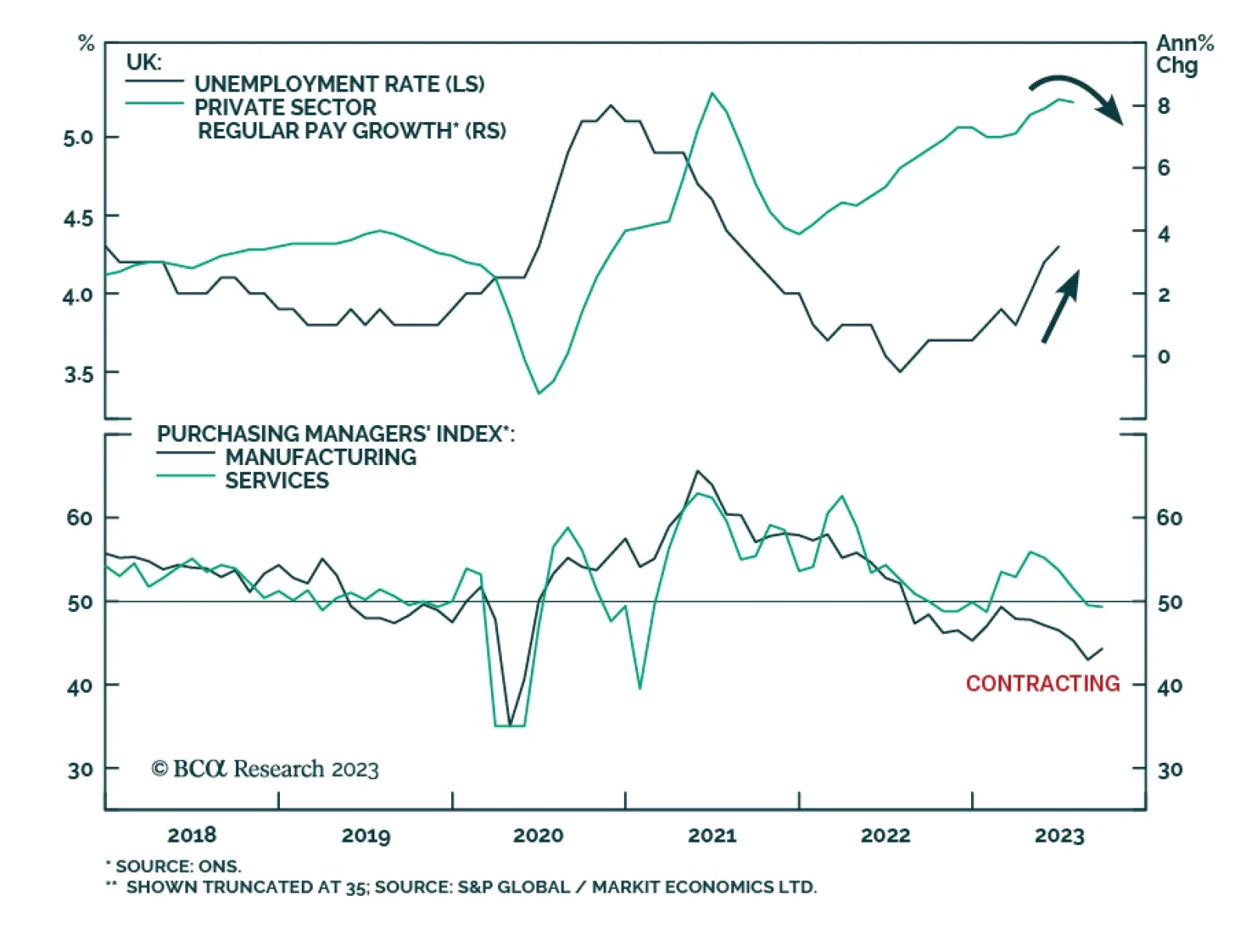

The results of the Bank of England’s latest monthly Decision Maker Panel survey reduces pressure on policymakers to tighten further. Business expectations regarding output price inflation over the coming year fell from 5…

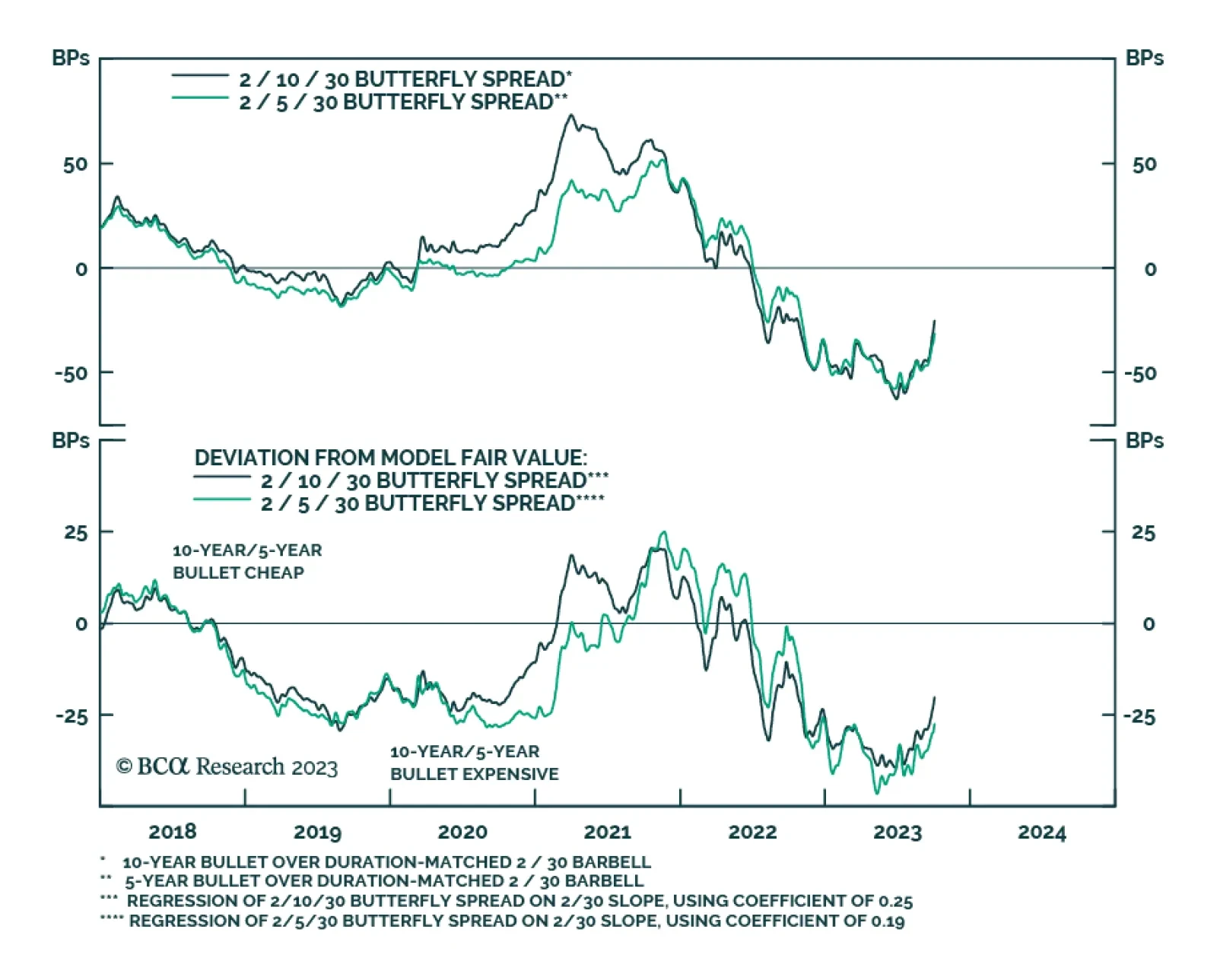

BCA Research’s US Bond Strategy service recommends a barbelled allocation across the Treasury curve. The Treasury curve bear-steepened in September. The 2-year/10-year Treasury slope steepened 32 bps on the month and…

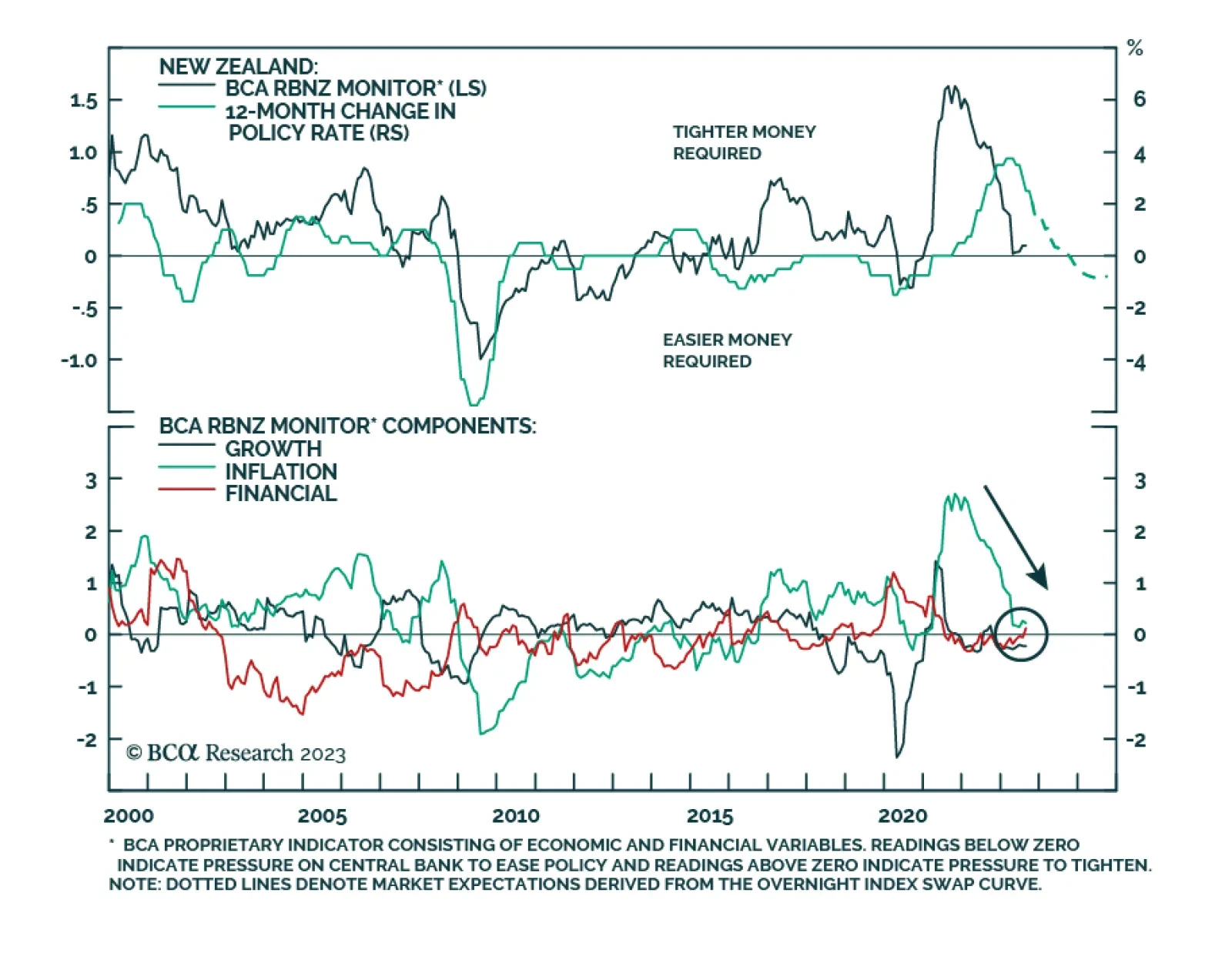

As expected, the Reserve Bank of New Zealand held the official cash rate at 5.5% on Wednesday, keeping policy unchanged for the third consecutive meeting. The press release underscored that while monetary policy is weighing on…