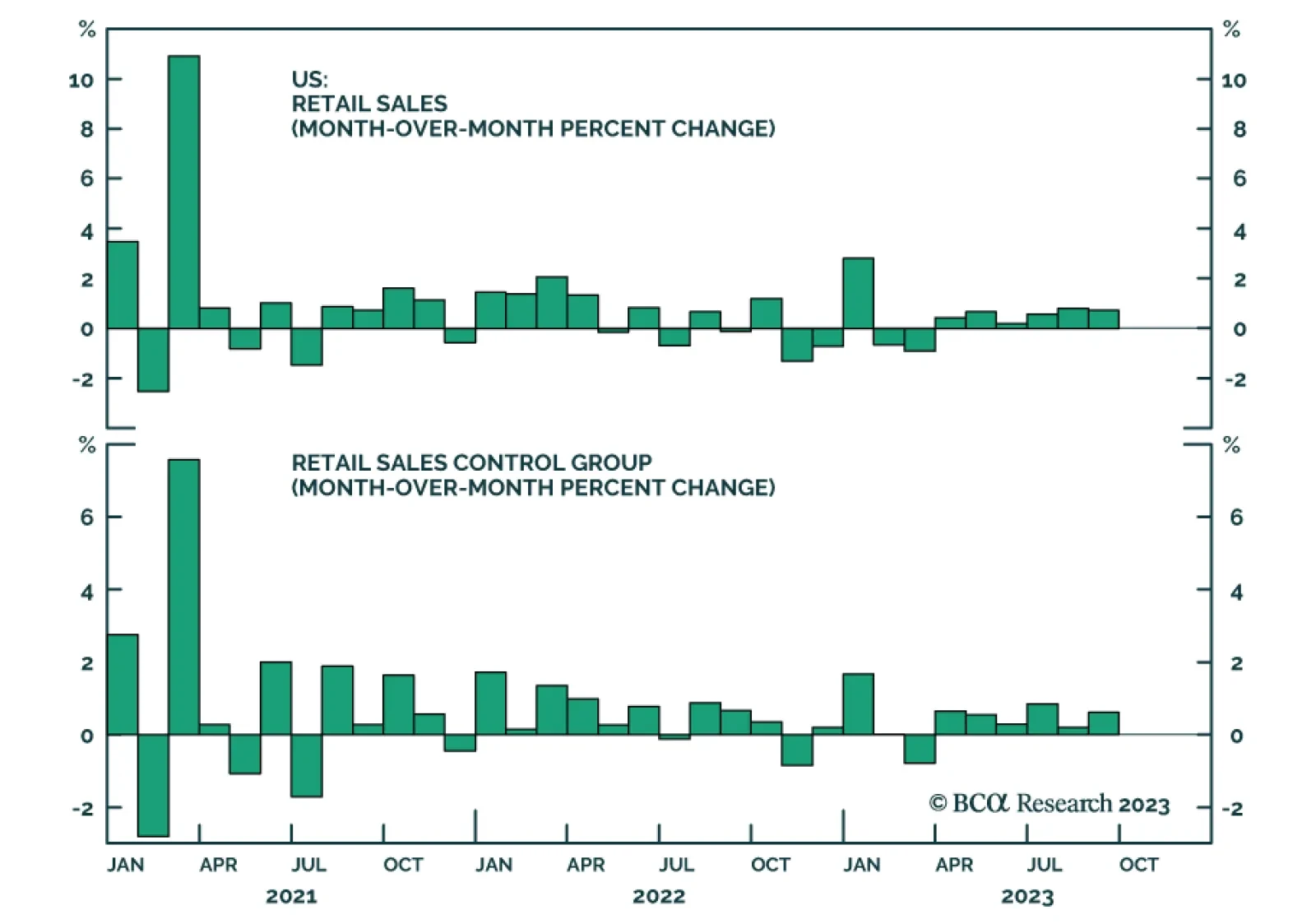

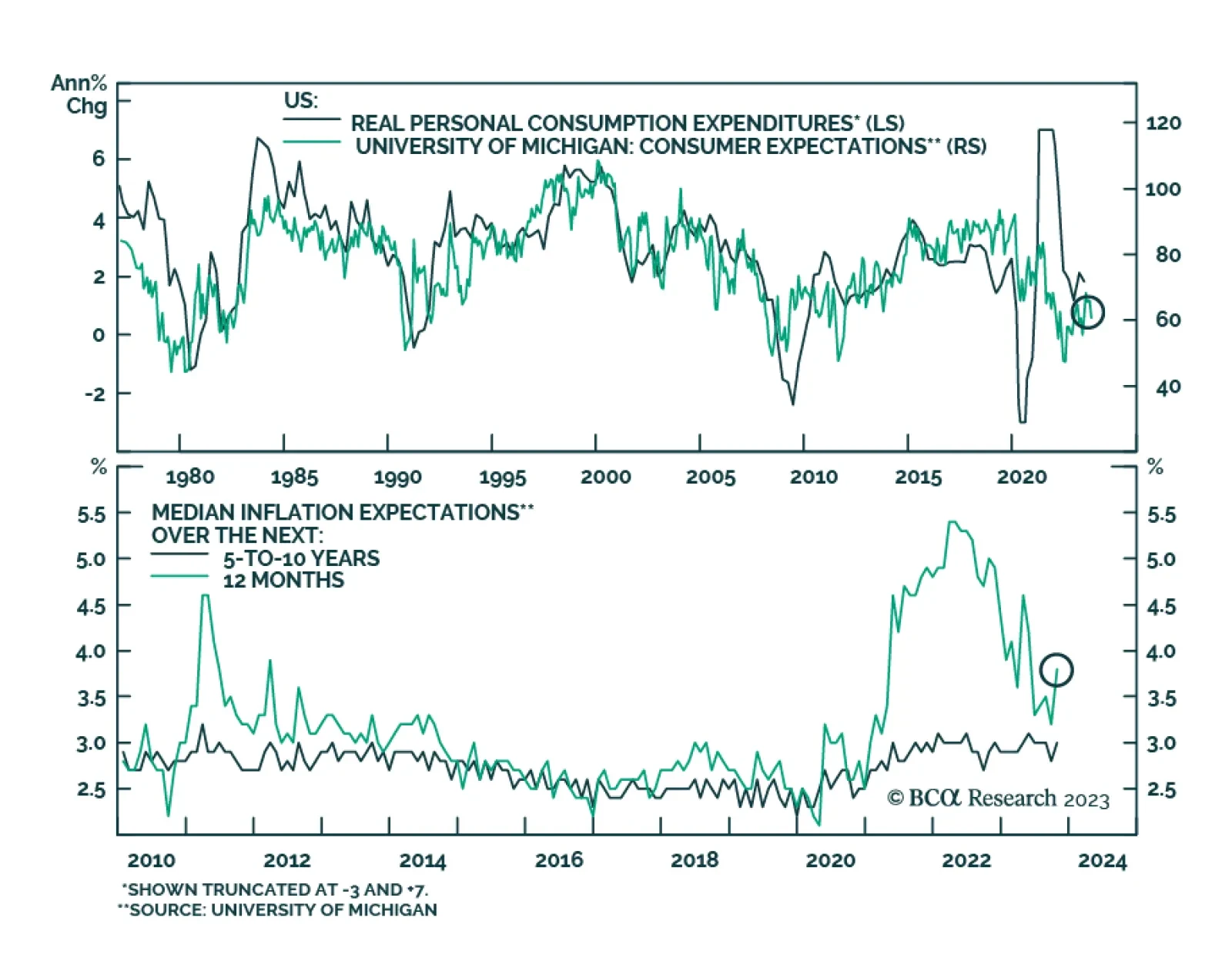

The US retail sales report delivered a sanguine update on US consumption. Overall spending increased by 0.7% m/m in September – above expectations of a 0.3% m/m rise and following an upwardly revised 0.8% m/m in August. The…

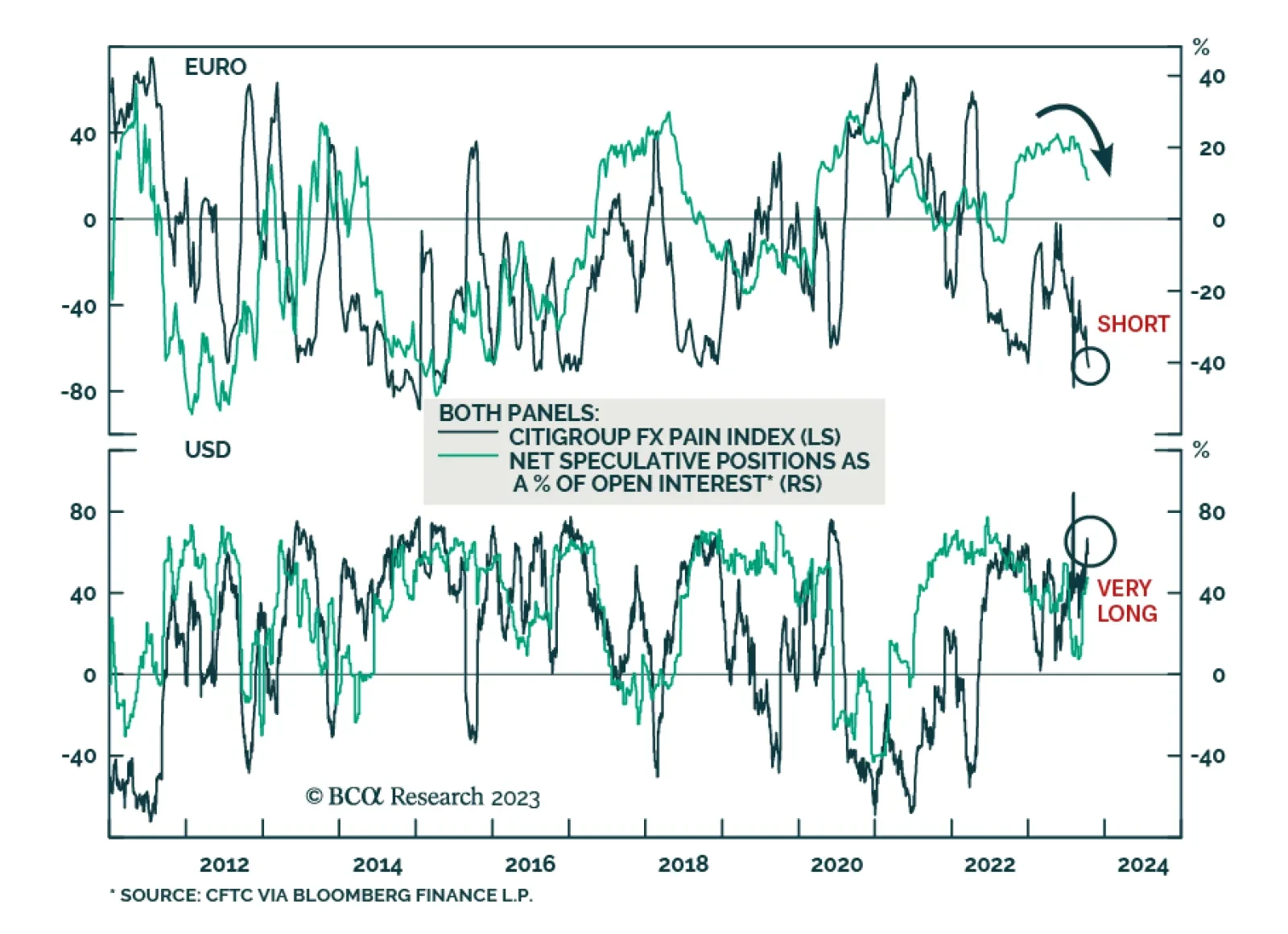

According to BCA Research’s European Investment Strategy service, the euro's correction is now advanced. During the first week of the month, EUR/USD briefly dipped below 1.045. Previously, the team argued it would…

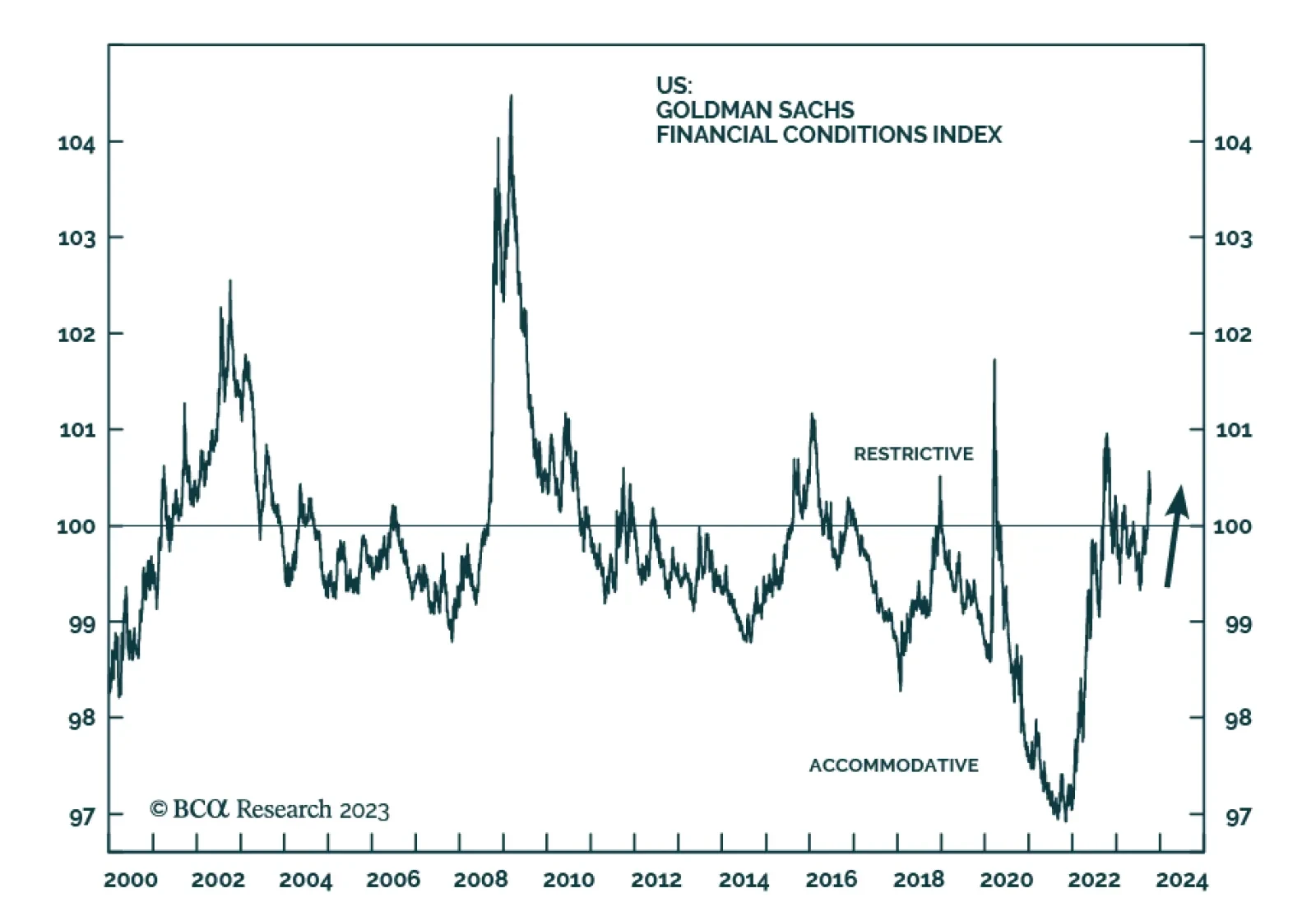

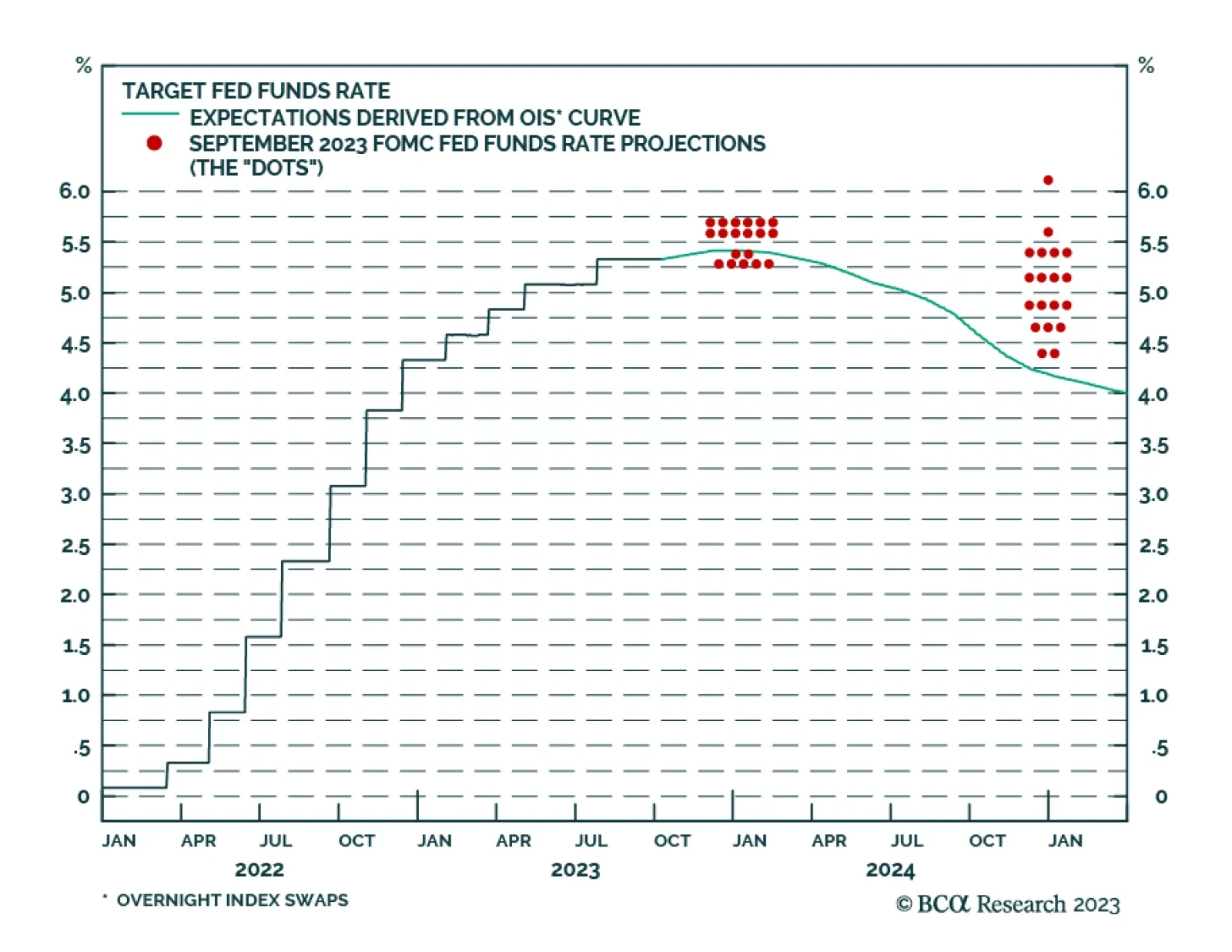

US financial conditions have tightened meaningfully in Q3. While the Goldman Sachs index remains below where it was a year ago, it crossed above the 100 line in late September into restrictive levels after spending most of the…

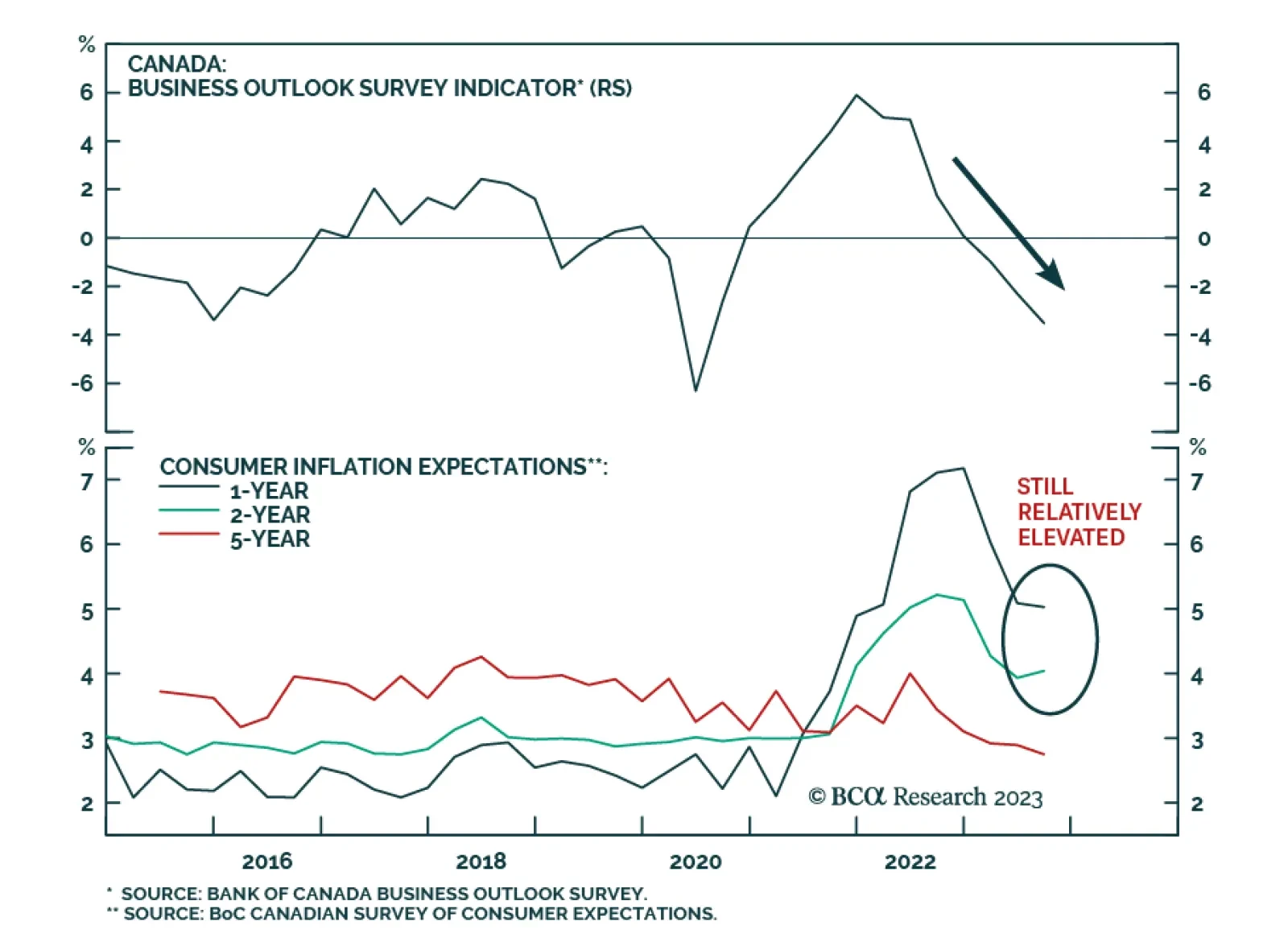

Results of the Banks of Canada’s Q3 business and consumer surveys reveal that the aggressive tightening cycle is dampening economic agents’ sentiment. Putting aside the sharp decline at the onset of the pandemic in Q2…

The preliminary release of the University of Michigan’s Consumer Sentiment survey delivered a negative surprise on Friday. A bigger-than-anticipated drop pushed the headline sentiment index down to a five-month low of 63.…

This week's Insight gauges the potential of a dollar breakout or breakdown and suggests a few trade ideas.

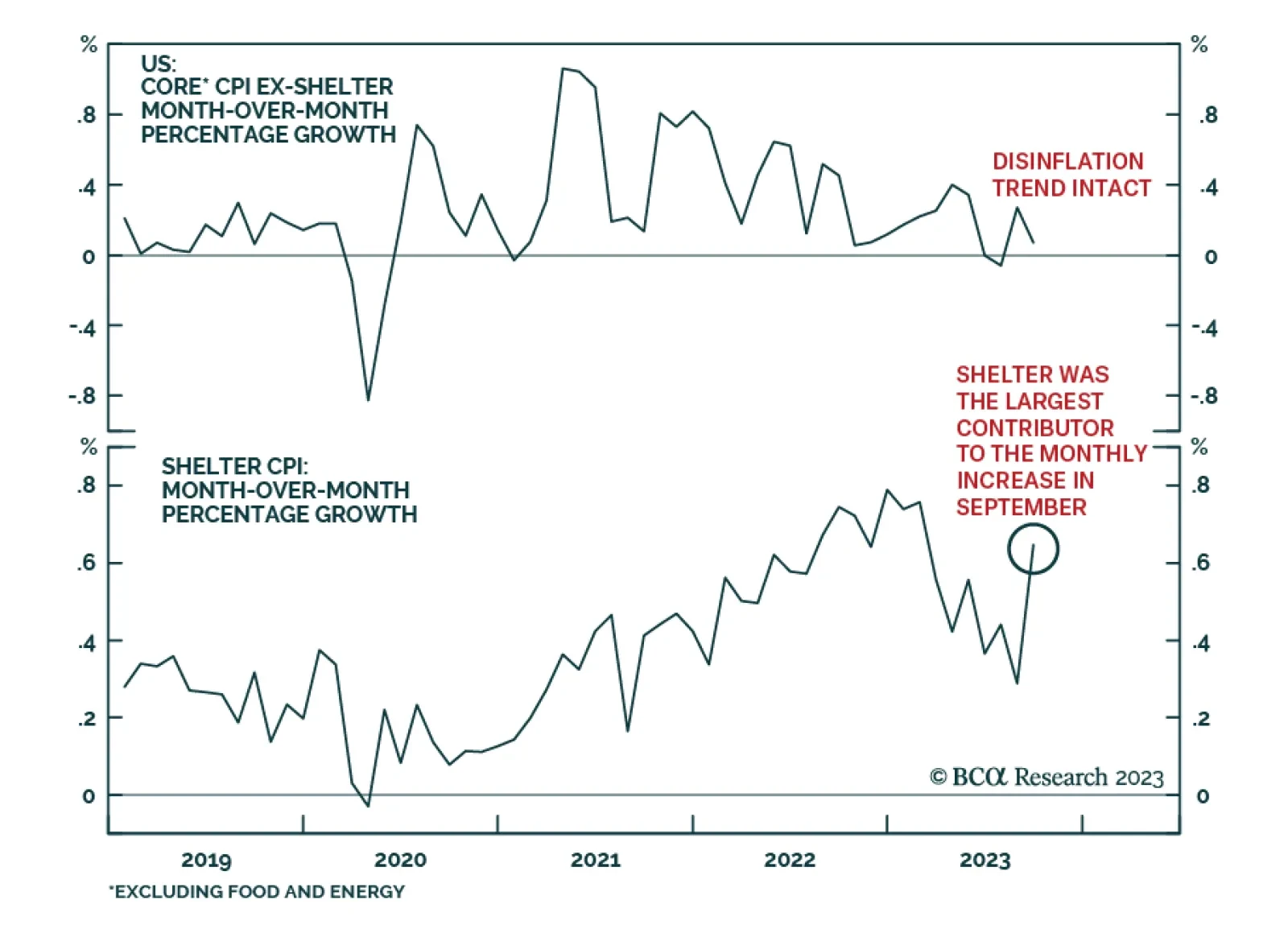

The US CPI report shows inflation was higher than anticipated in September. Although the headline index decelerated from 0.6% m/m to 0.4% m/m, it is above expectations of 0.3% m/m. The annual rate of change remains at 3.7% y/y…

US monetary policy is restrictive, as evidenced by a falling jobs-workers gap. The reason that unemployment has not risen is because labor demand still exceeds supply. That will change in the second half of 2024 when the US economy…

Comments on recent Fedspeak, bond market moves and this morning’s CPI report.

The minutes of the September FOMC meeting confirmed that the Fed intends to maintain restrictive monetary policy for longer. Although inflation has been moderating, participants continue to view it as unacceptably high and…