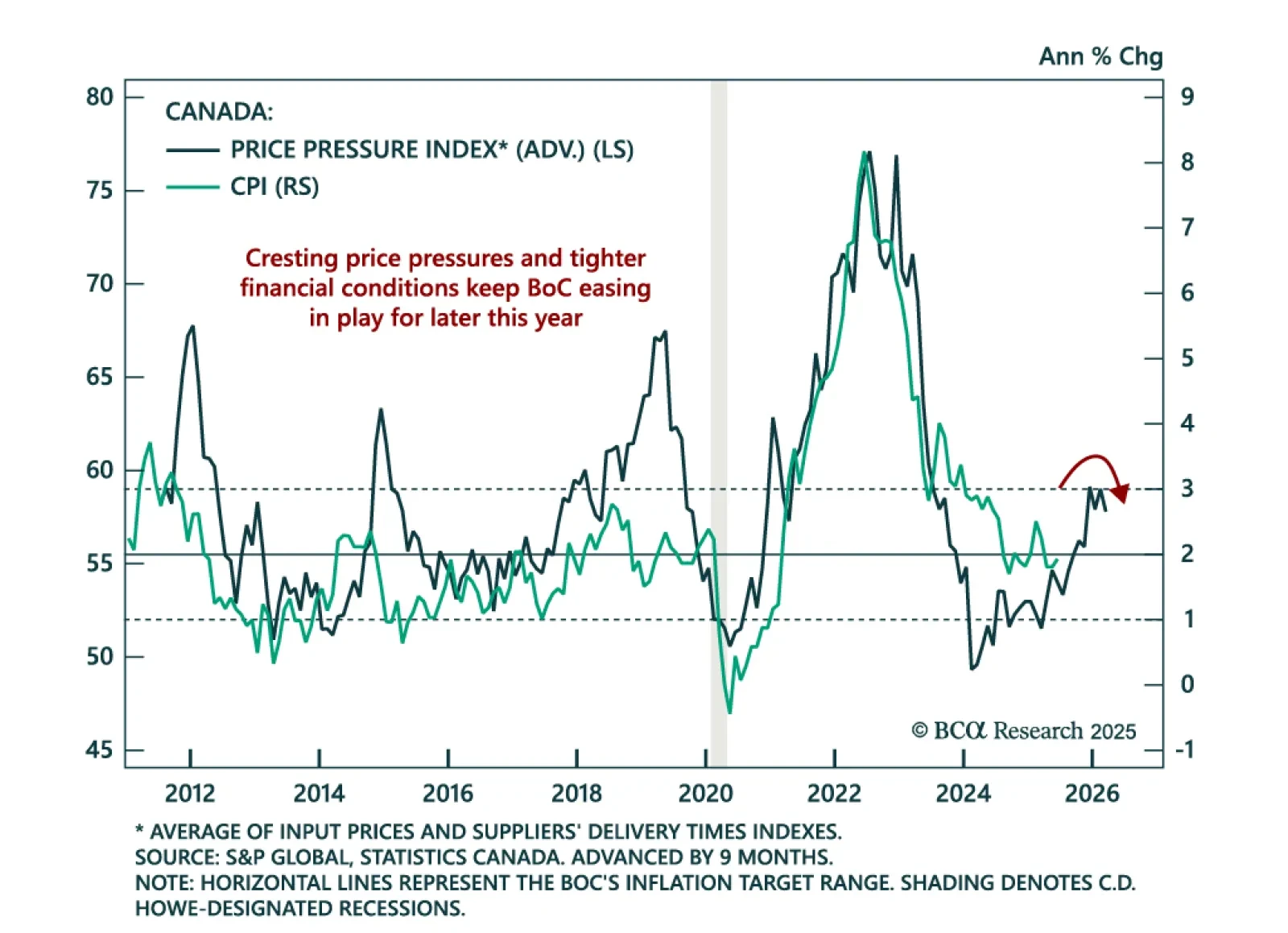

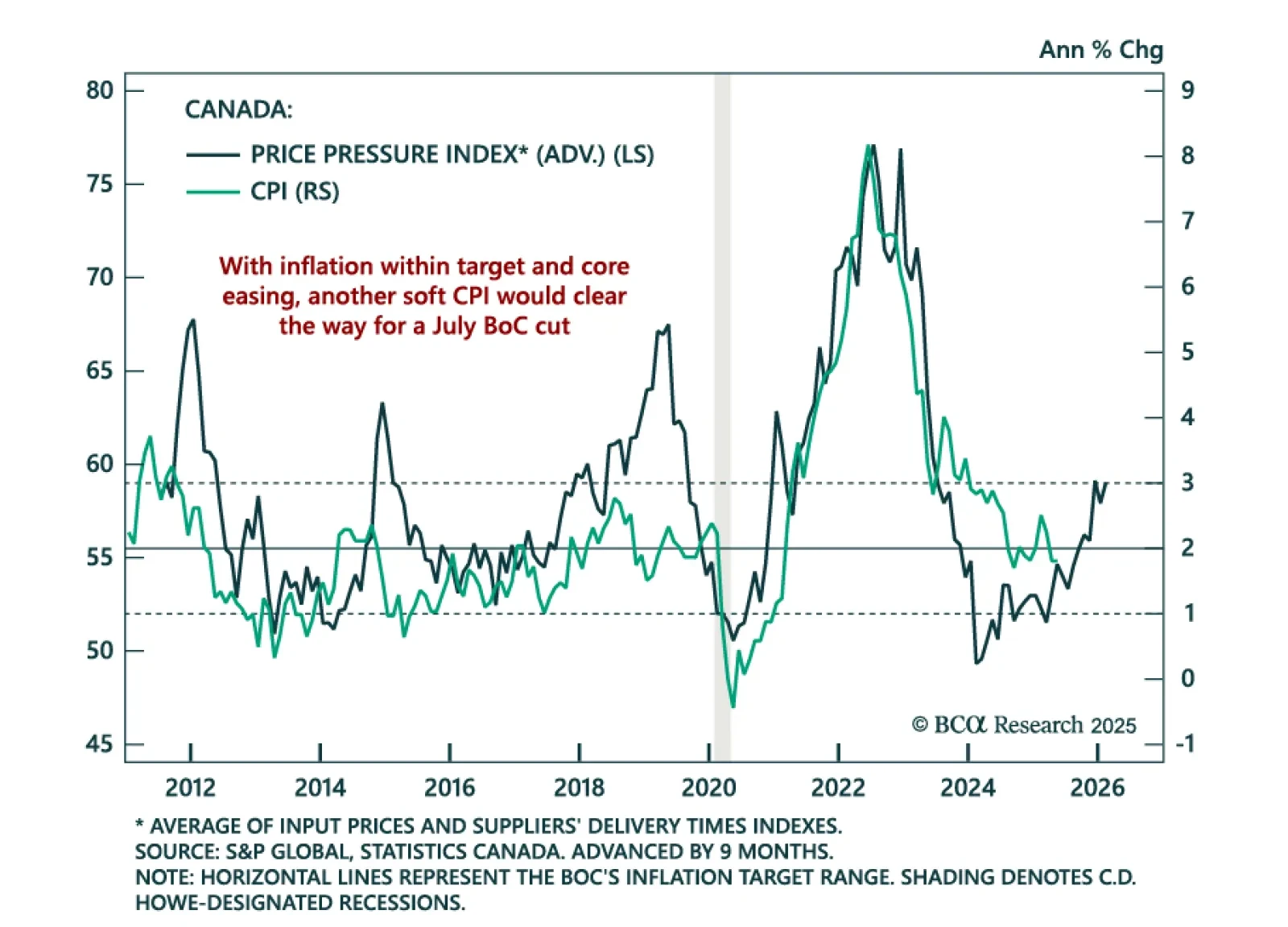

Canada’s inflation re-acceleration makes a BoC July cut unlikely, but softening growth and tight financial conditions keep easing on the table. June headline inflation rose to 1.9% y/y from 1.7%, roughly in line with expectations.…

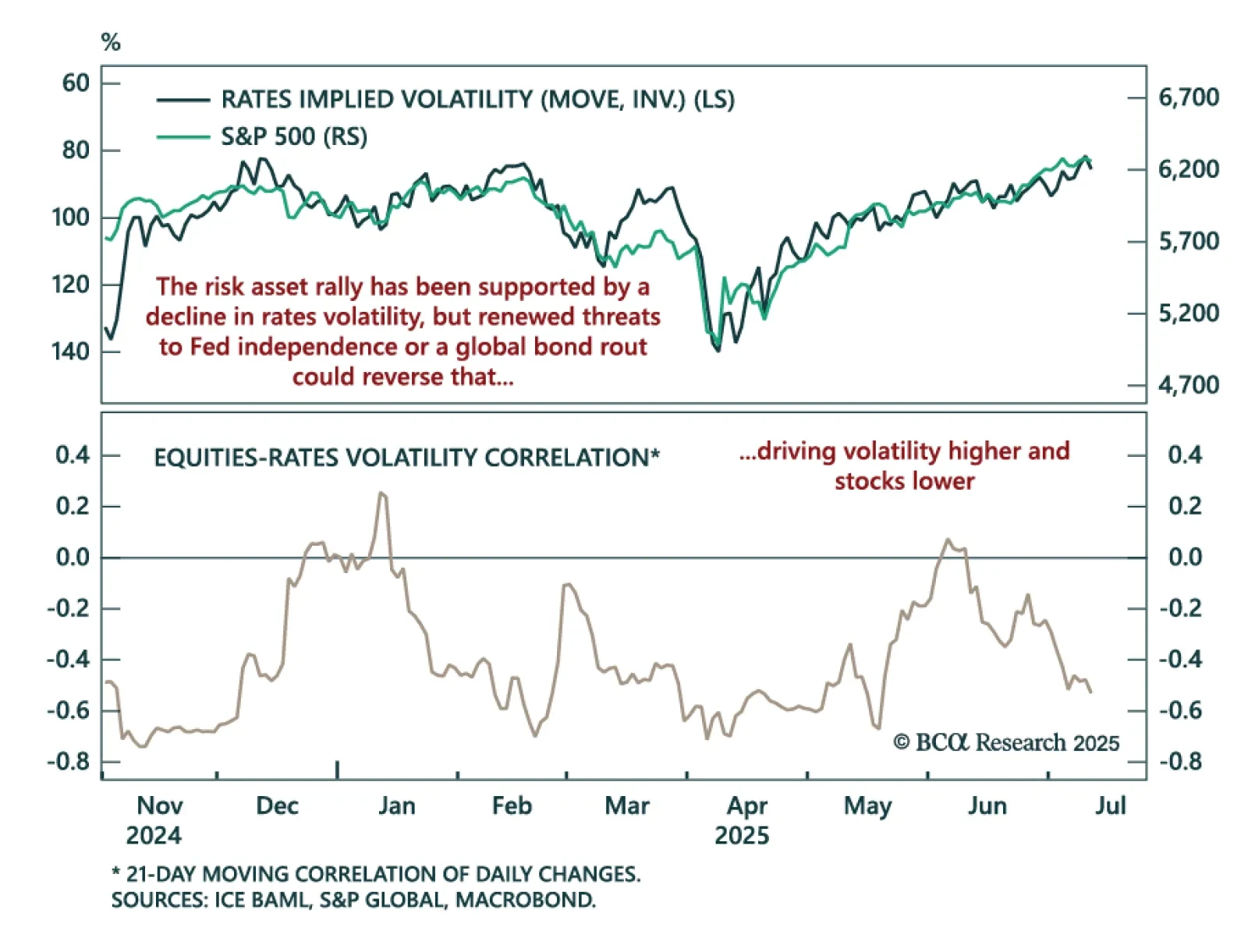

Equities have retraced sharply from Liberation Day lows, but renewed policy risk and mispriced volatility keep us tactically cautious. The Trump administration softened its trade stance as equities neared bear market territory in…

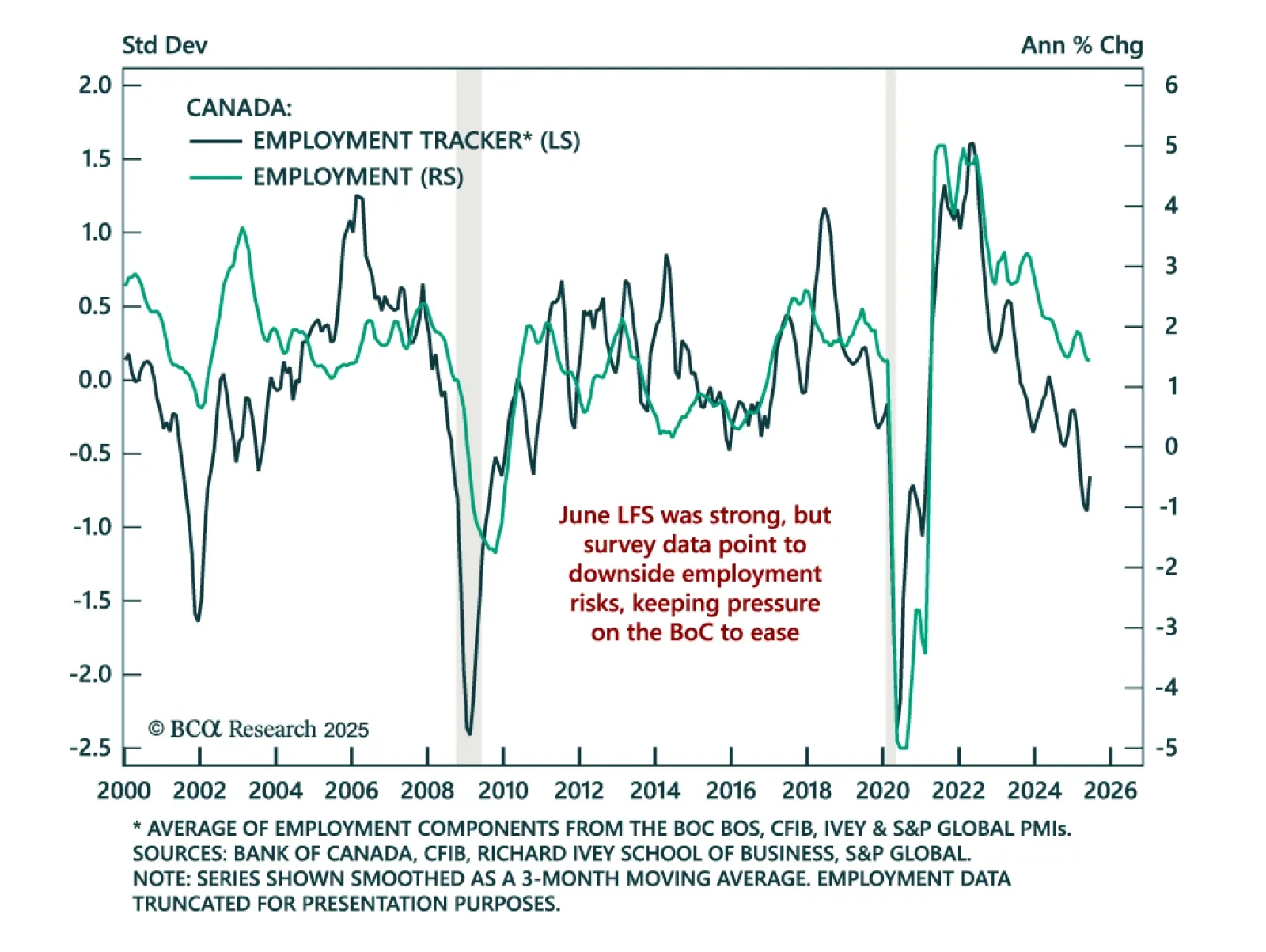

June’s strong Canadian jobs data does not argue against further easing and a CGBs overweight. Employment rose by 83.1k versus expectations for no growth, the first increase since January. The unemployment rate fell to 6.9% from 7.0…

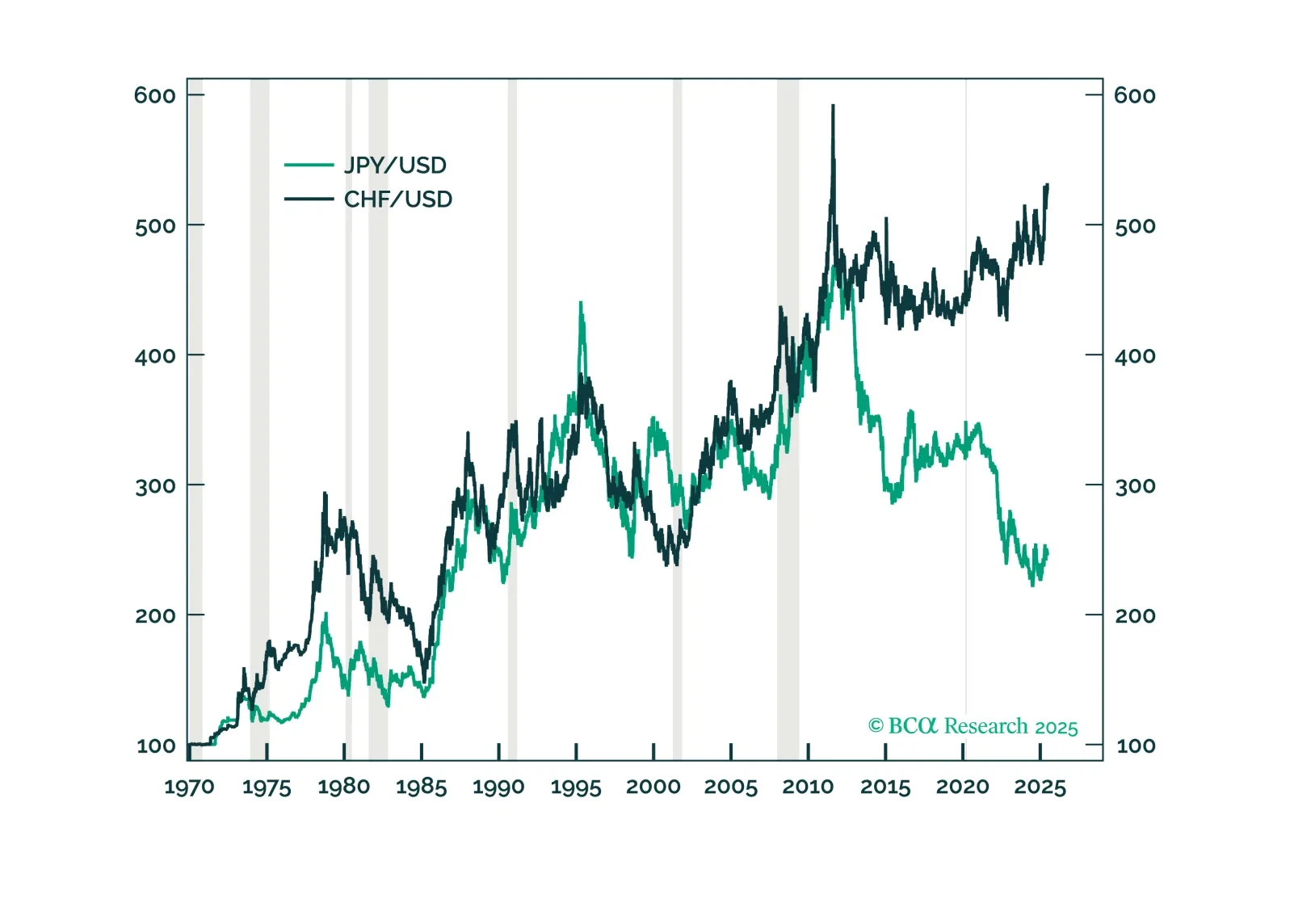

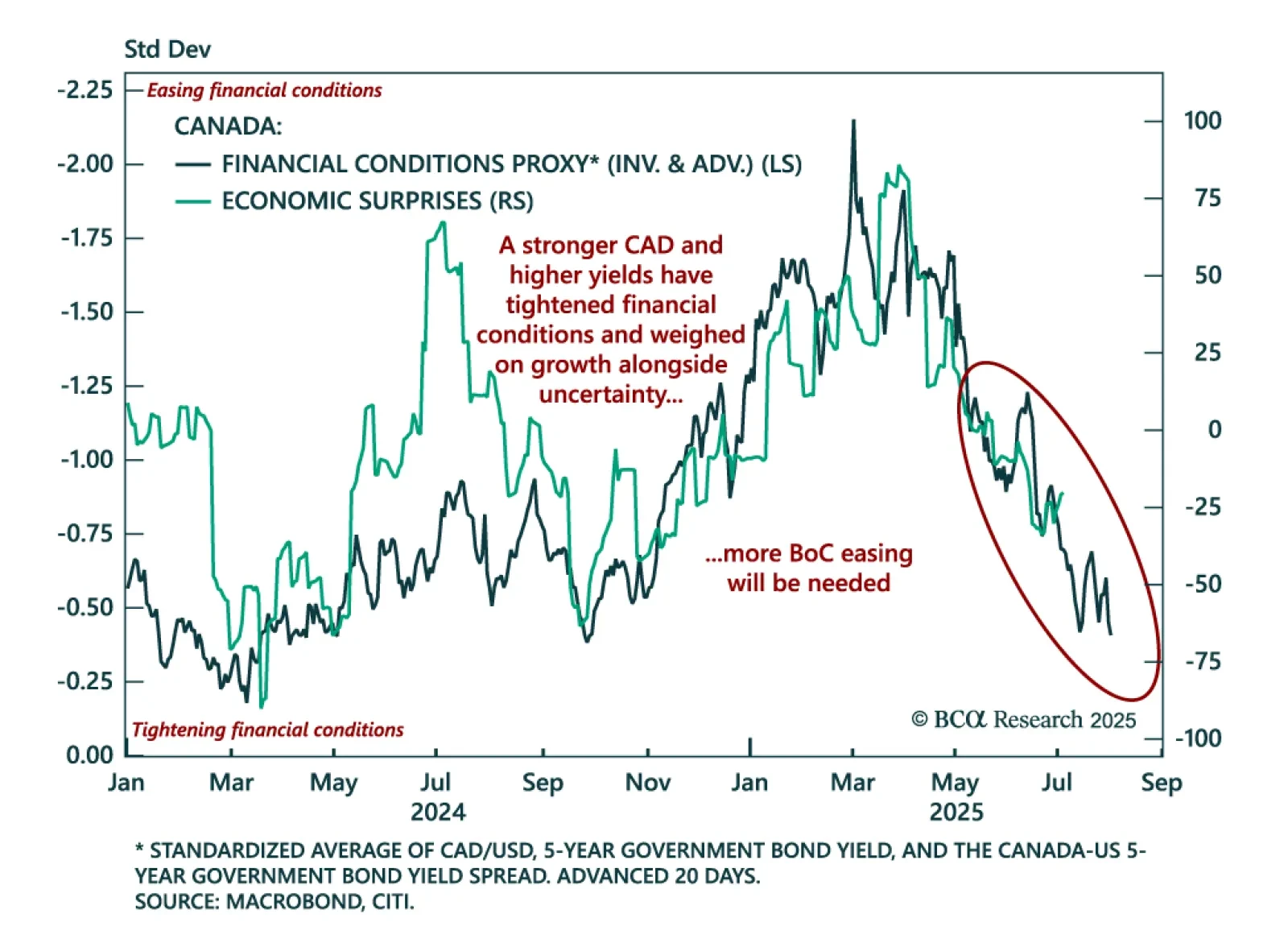

Canada’s stronger currency and tightening financial conditions point to further BoC easing and support long Canadian bond positions. The CAD has appreciated this year alongside the global push to diversify away from USD assets, which…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

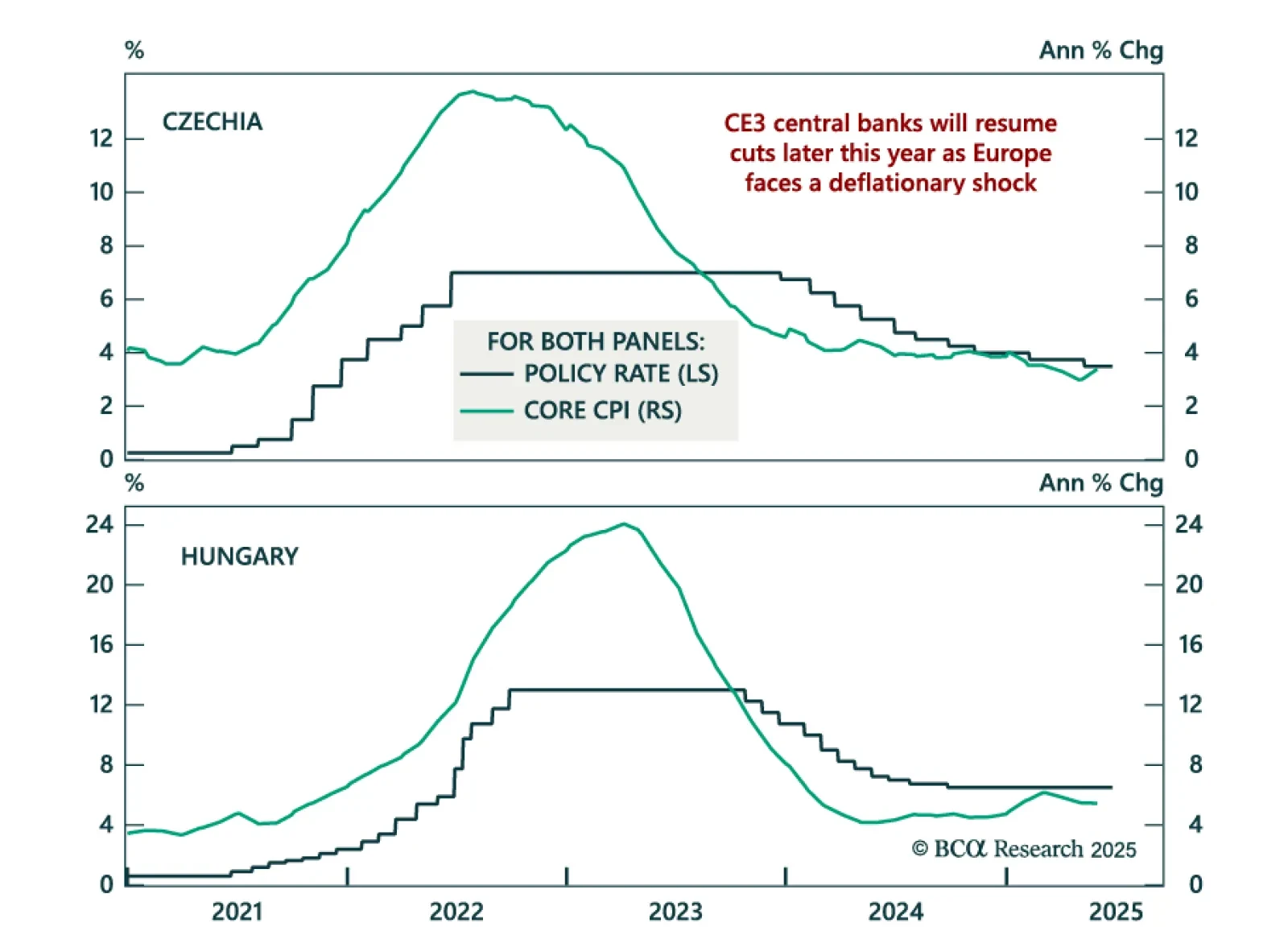

Deflationary pressures and weak core Europe growth support CE3 bond longs as rate cuts loom. The Czech and Hungarian central banks held rates steady at 3.5% and 6.5% this week, following Poland’s earlier decision to keep rates…

Contained Canadian inflation and soft macro conditions support our overweight on Canadian government bonds. May CPI was in line with expectations, with headline inflation holding at 1.7% y/y and core measures slowing to 3.0%, the…

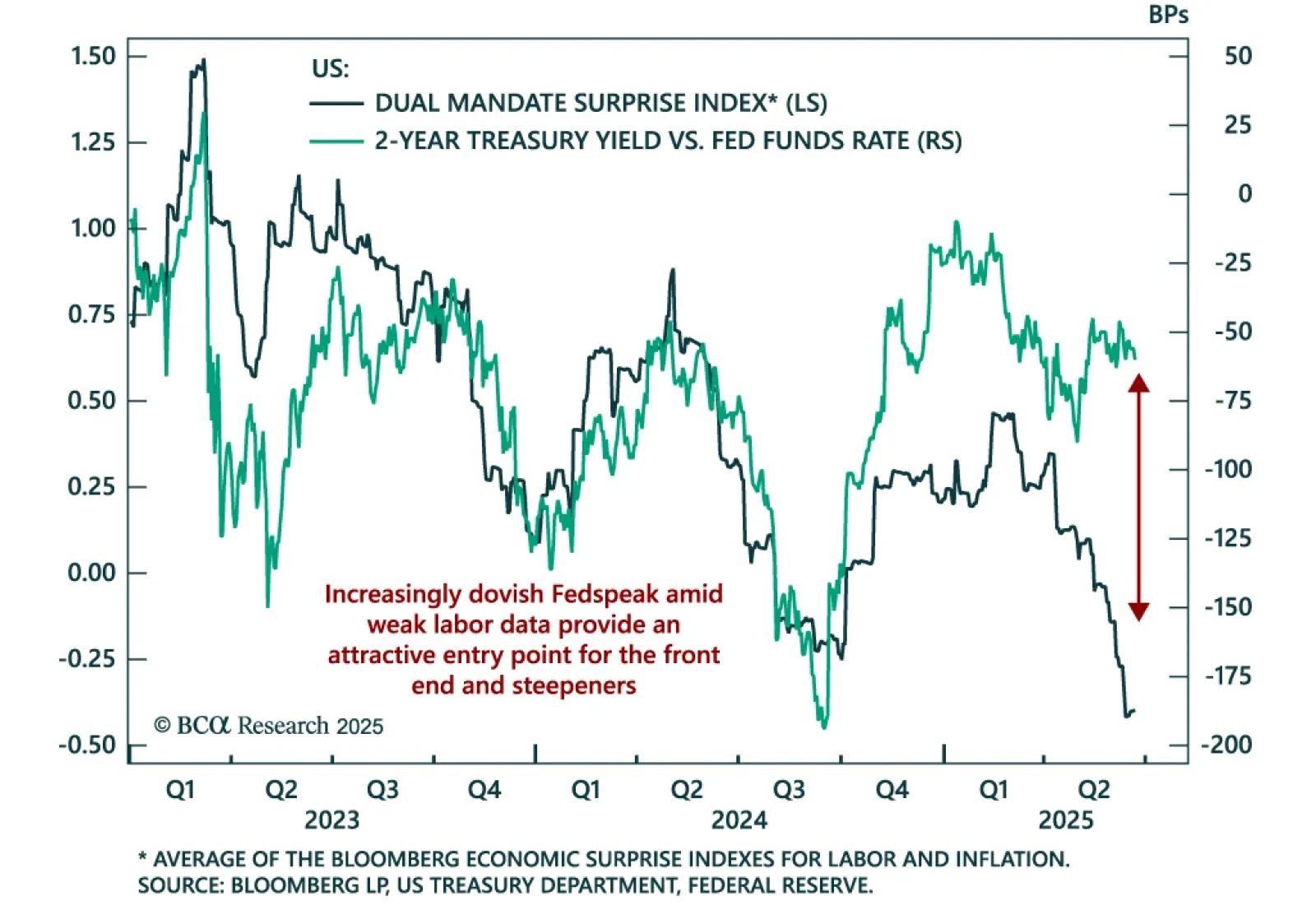

Dovish signals from Fed Governors Waller and Bowman increase the likelihood of a rate cut as early as July, supporting long front-end positions and steepeners. Last week’s FOMC meeting revealed a split between hawkish participants…

In this Insight, we highlight our strong conviction trades based on the central bank meetings held by the Bank of England, the Norges Bank, the Swiss National Bank and the Riksbank.