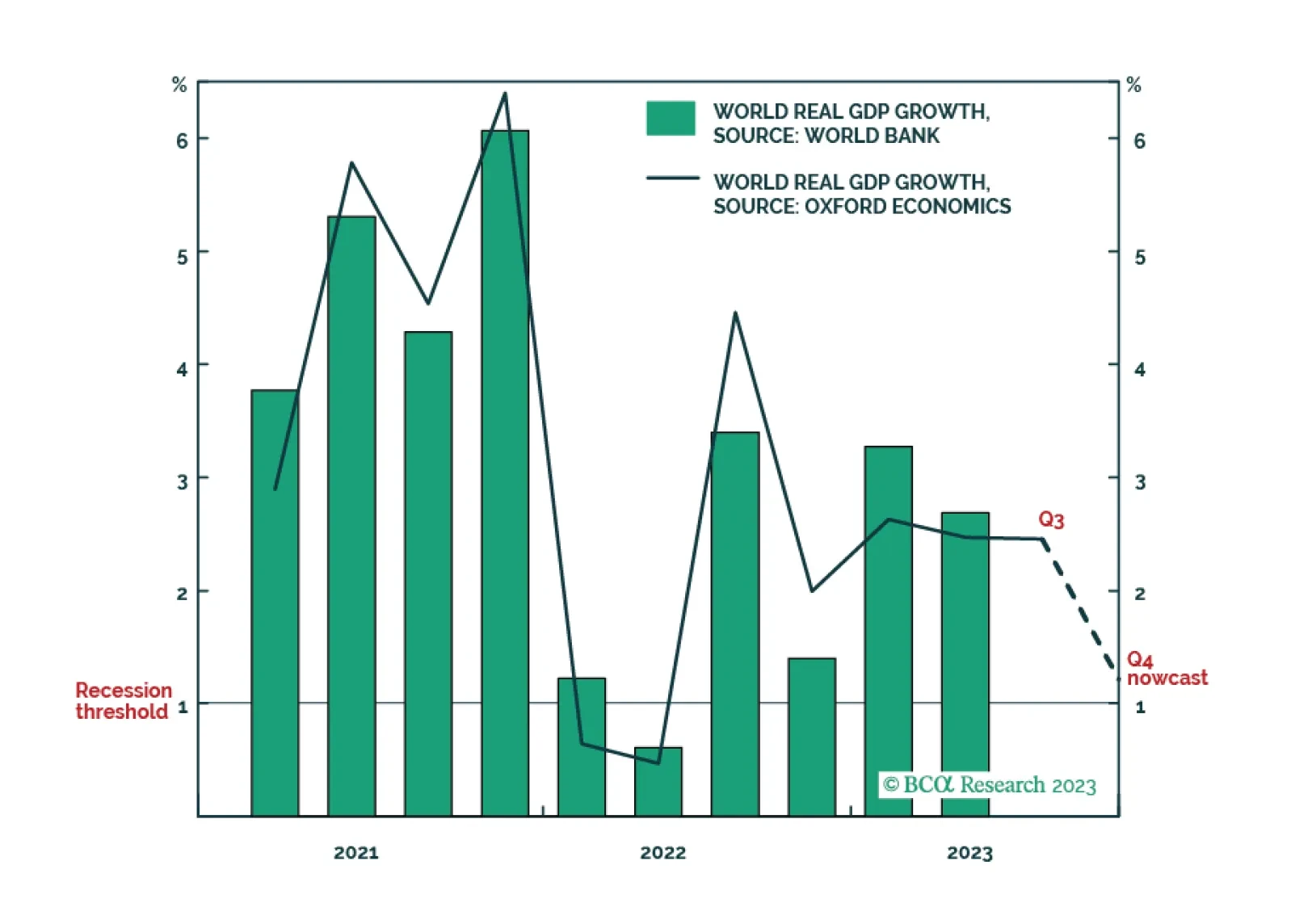

The latest ‘nowcast’ for world economic growth in the fourth quarter has plunged to just 1.2 percent, marking the cusp of another world recession. One important implication is that expectations for oil demand growth and industrial…

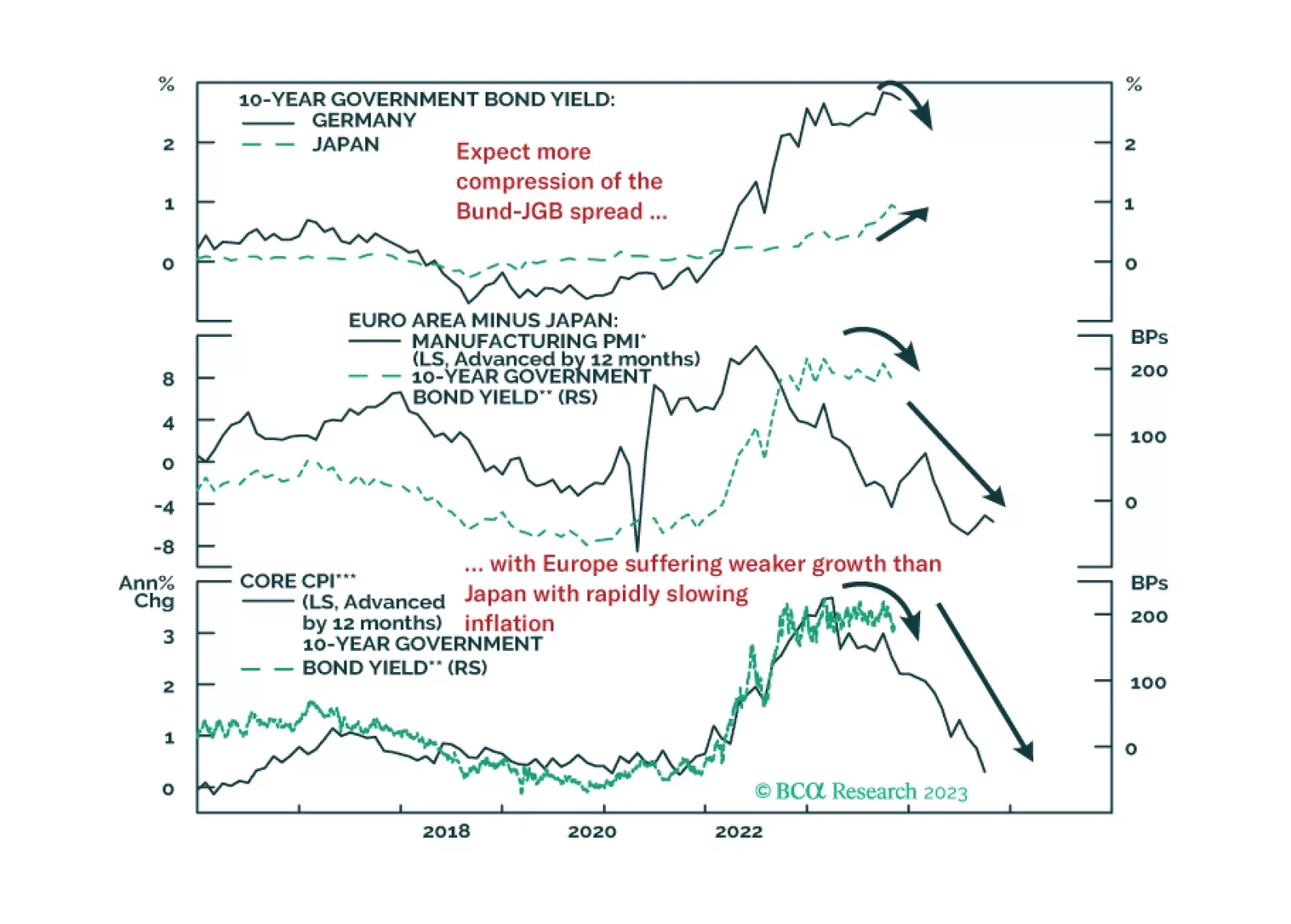

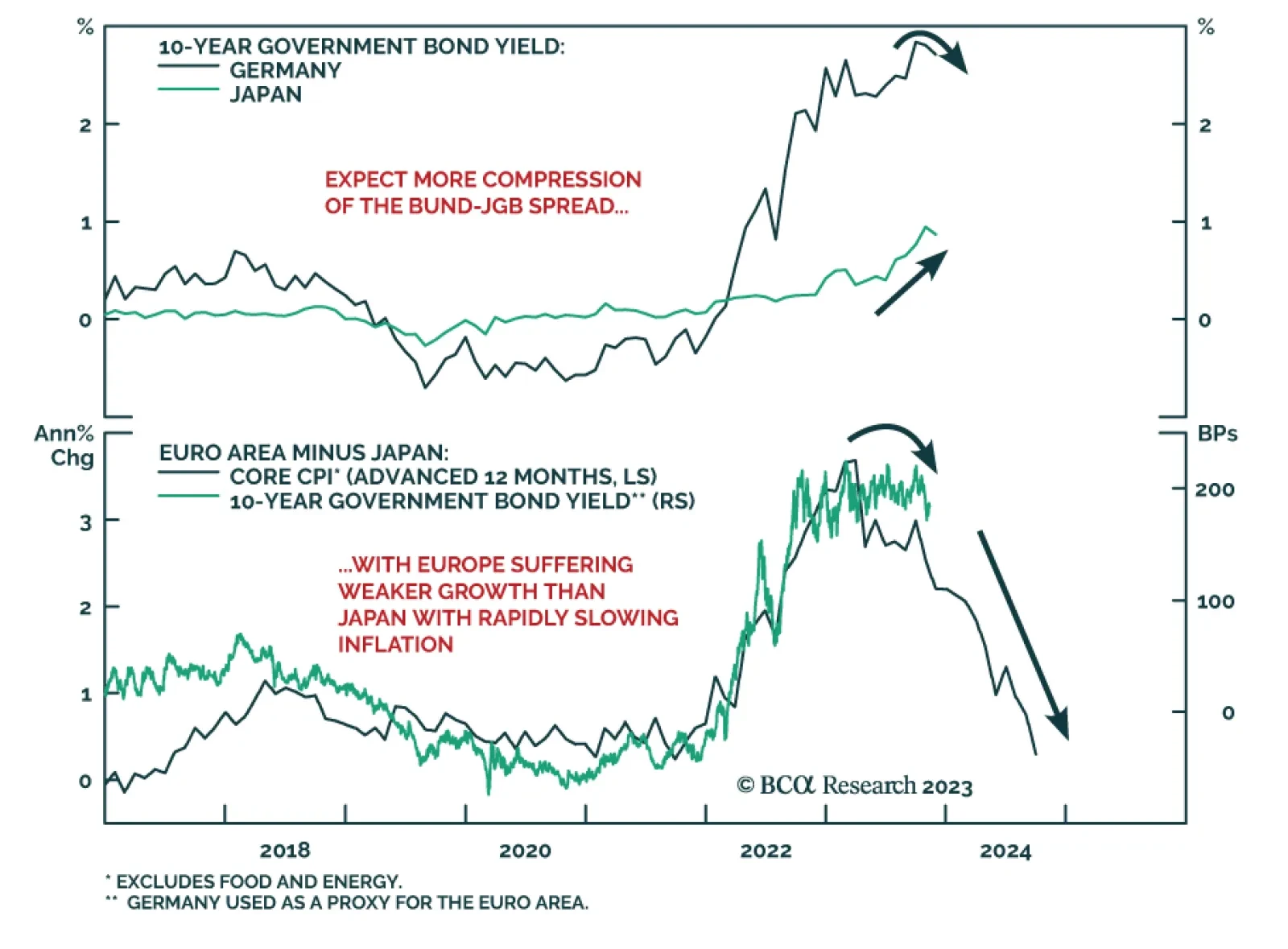

BCA Research’s Global Fixed Income Strategy service remains long 10-year German bunds vs short 10-year Japanese government bonds (JGBs) as a tactical trade. This trade mirrors the team's two highest conviction…

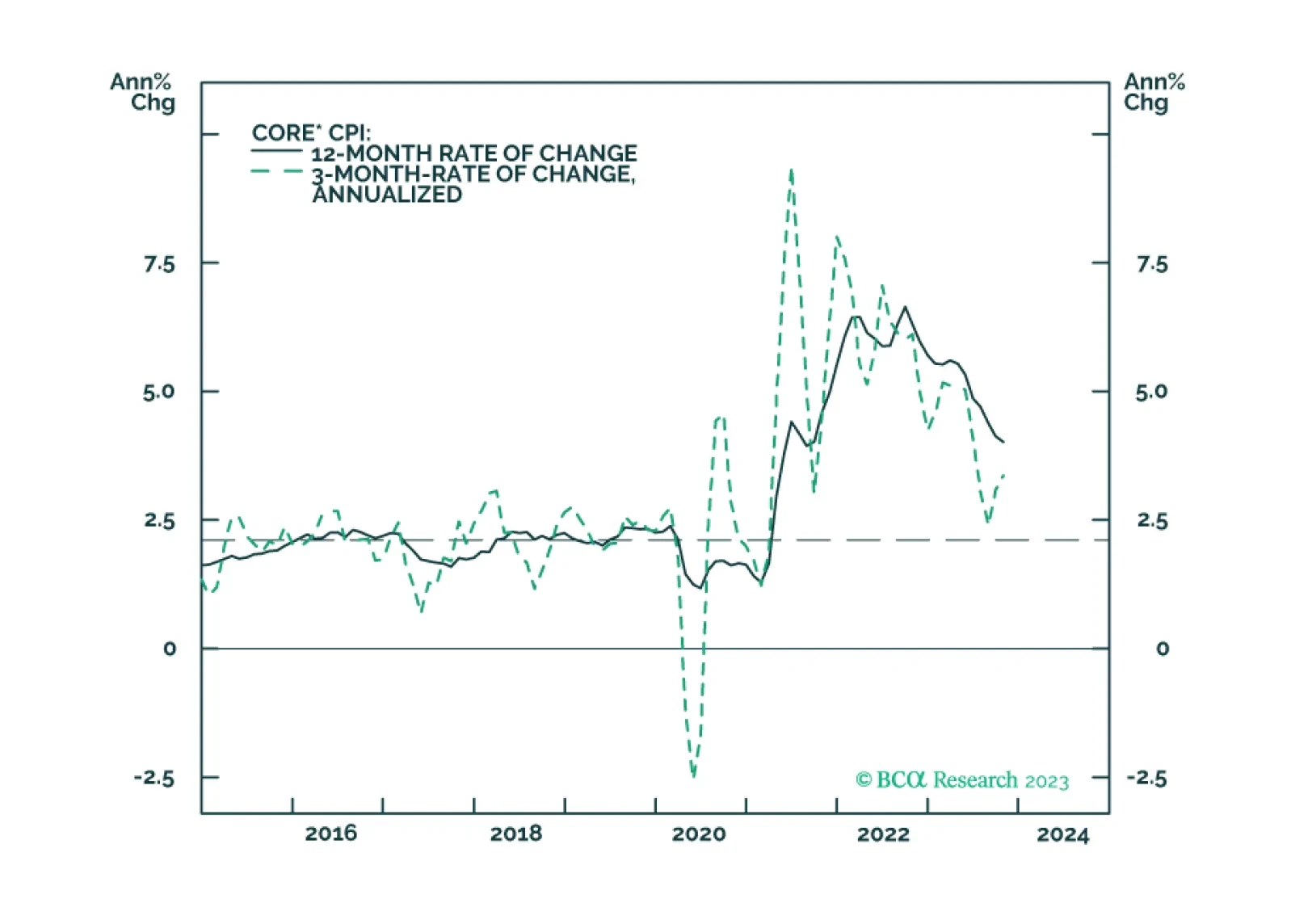

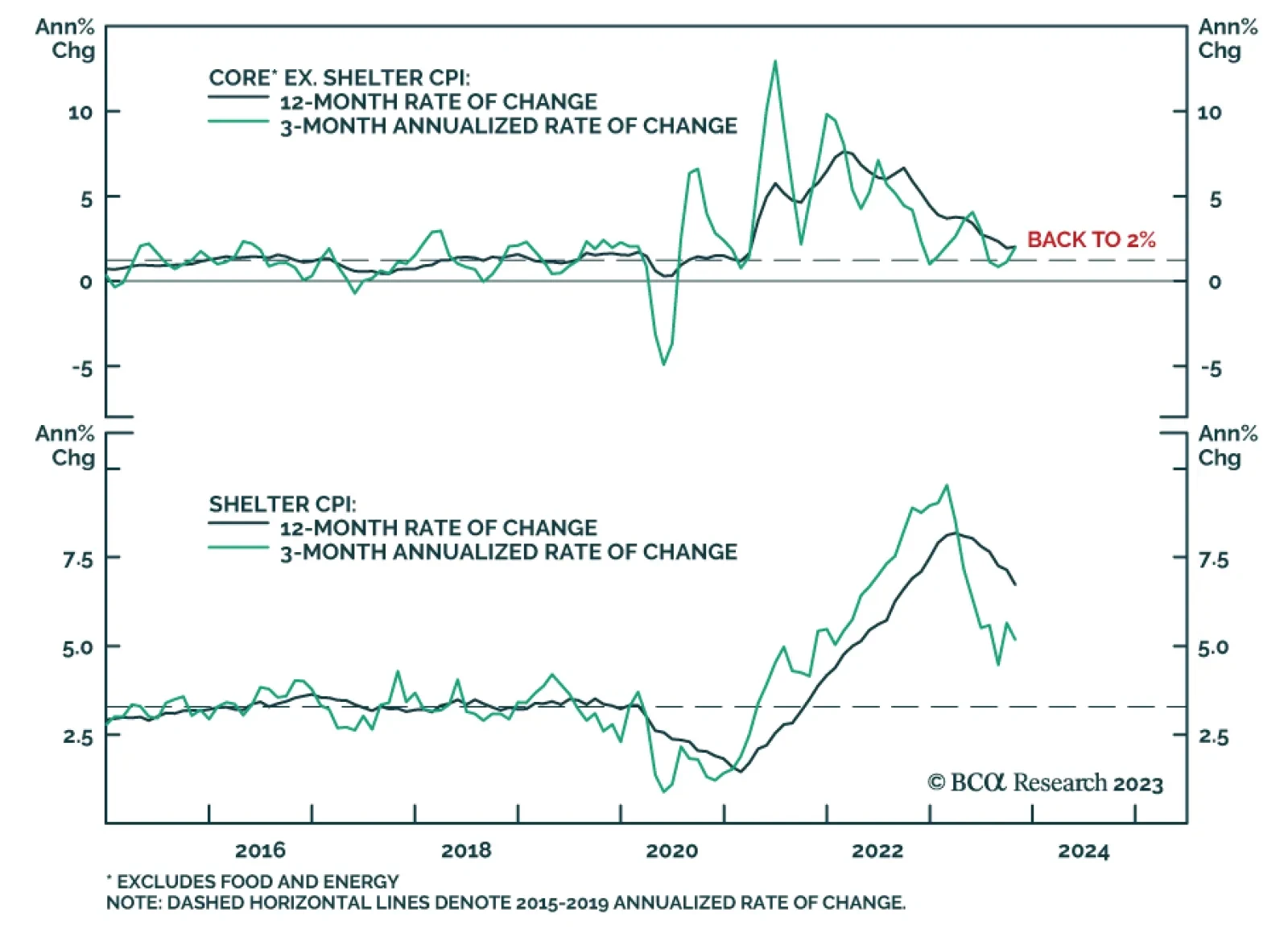

US Treasury yields fell sharply following yesterday’s soft October CPI report, and investors have now officially priced out all remaining rate hikes from the yield curve. In fact, the fed funds futures curve is priced for a…

Our thoughts on this morning’s CPI print and the bond market’s reaction.

In this Insight, we review the performance and rationale for our current set of tactical fixed income trade recommendations. Our highest conviction positions also happen to be our most successful trades: positioning for a narrowing…

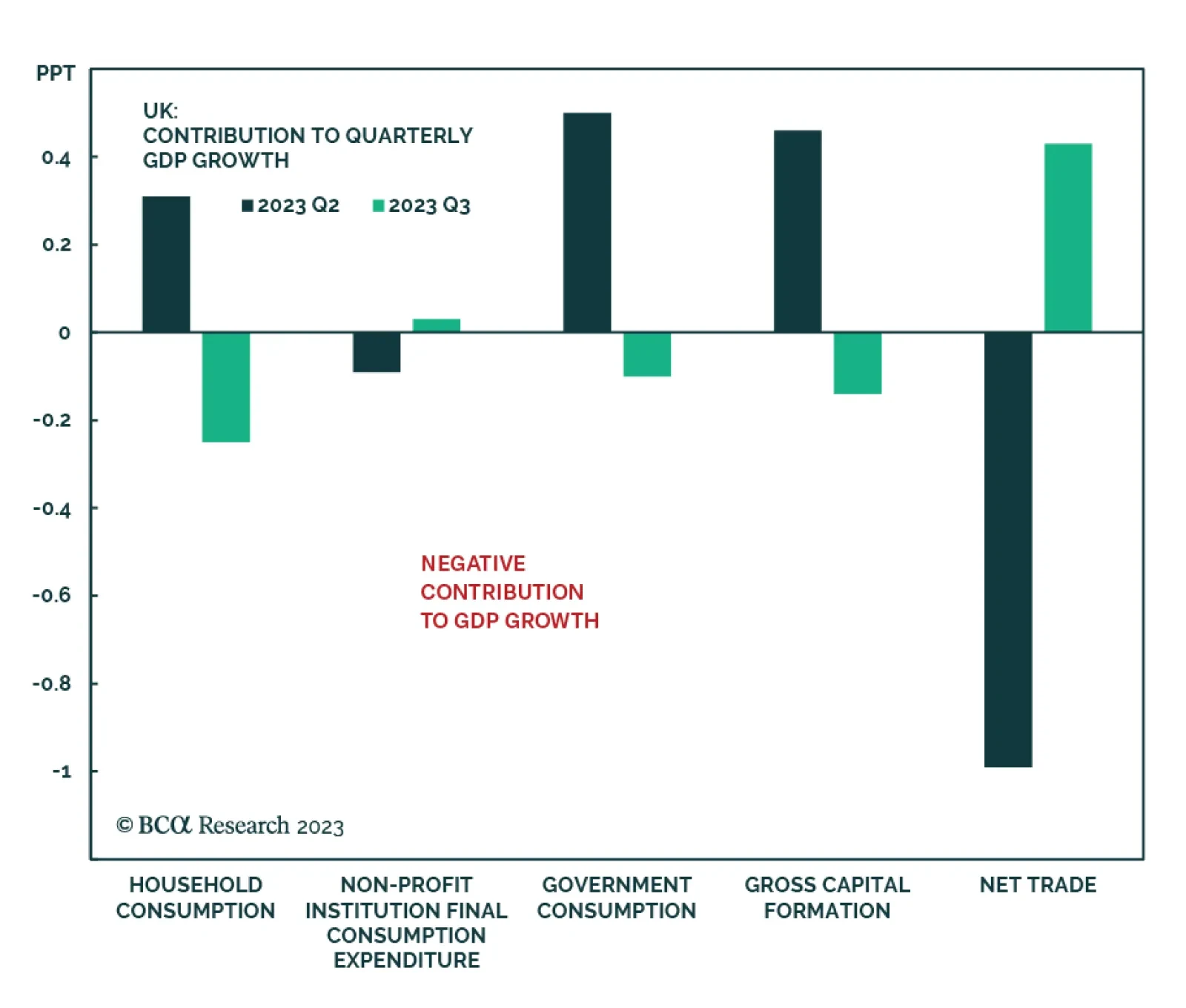

The UK economy stagnated in Q3 – a deterioration from the minor 0.2% q/q expansion in the prior quarter. Although the Q3 figure is slightly better than anticipations of a 0.1% q/q contraction, the details of the report are…

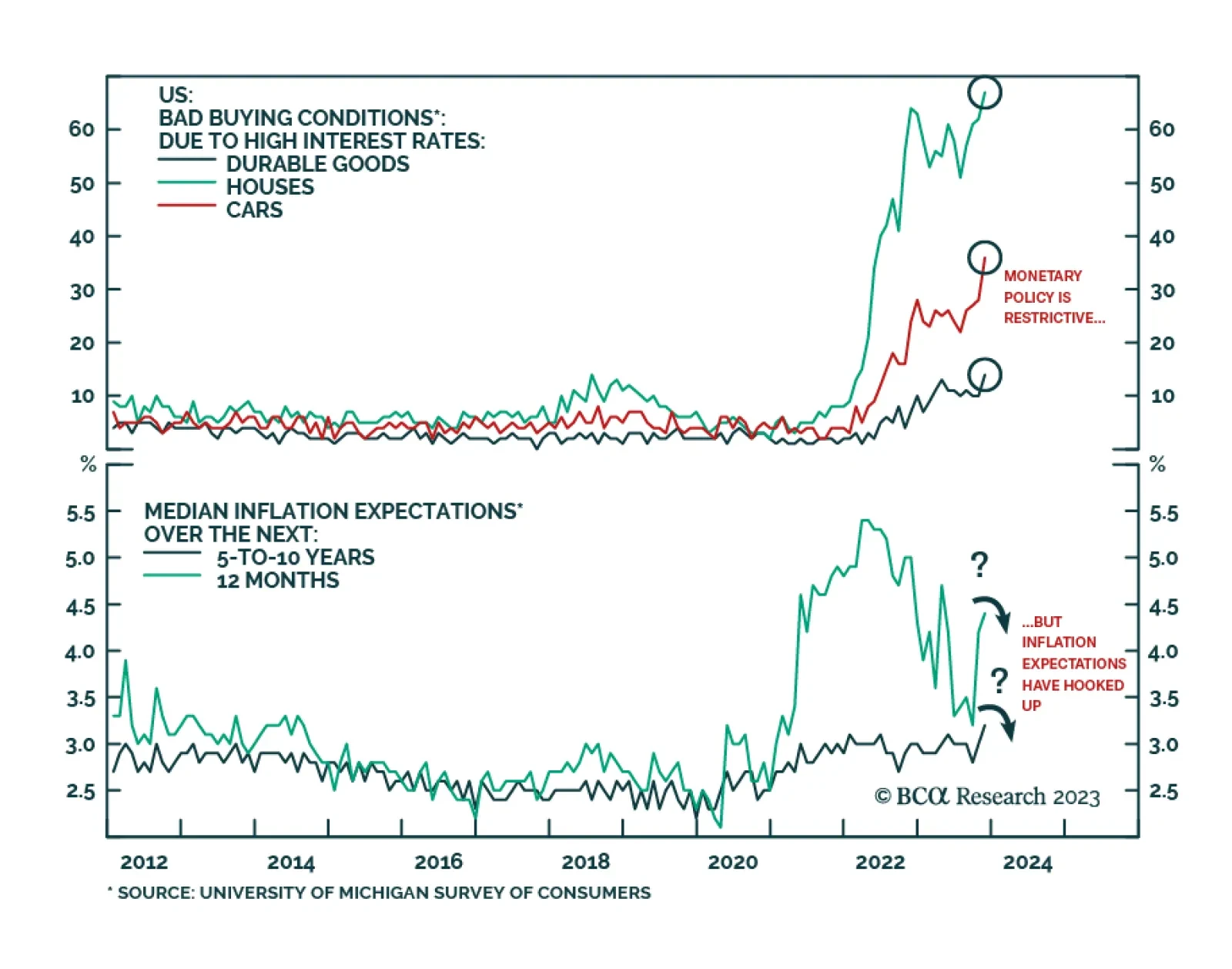

The preliminary release for the University of Michigan’s Consumer Survey sent a pessimistic signal about consumer sentiment on Friday. The headline index fell from 63.8 to 60.4 in November, below expectations of a marginal…

In this report, we go around the globe and survey the near-term outlook for G10 currencies. Our longer-term view on the dollar has been clear, we are sellers. In this report, we review if a tactical sell is also warranted given…

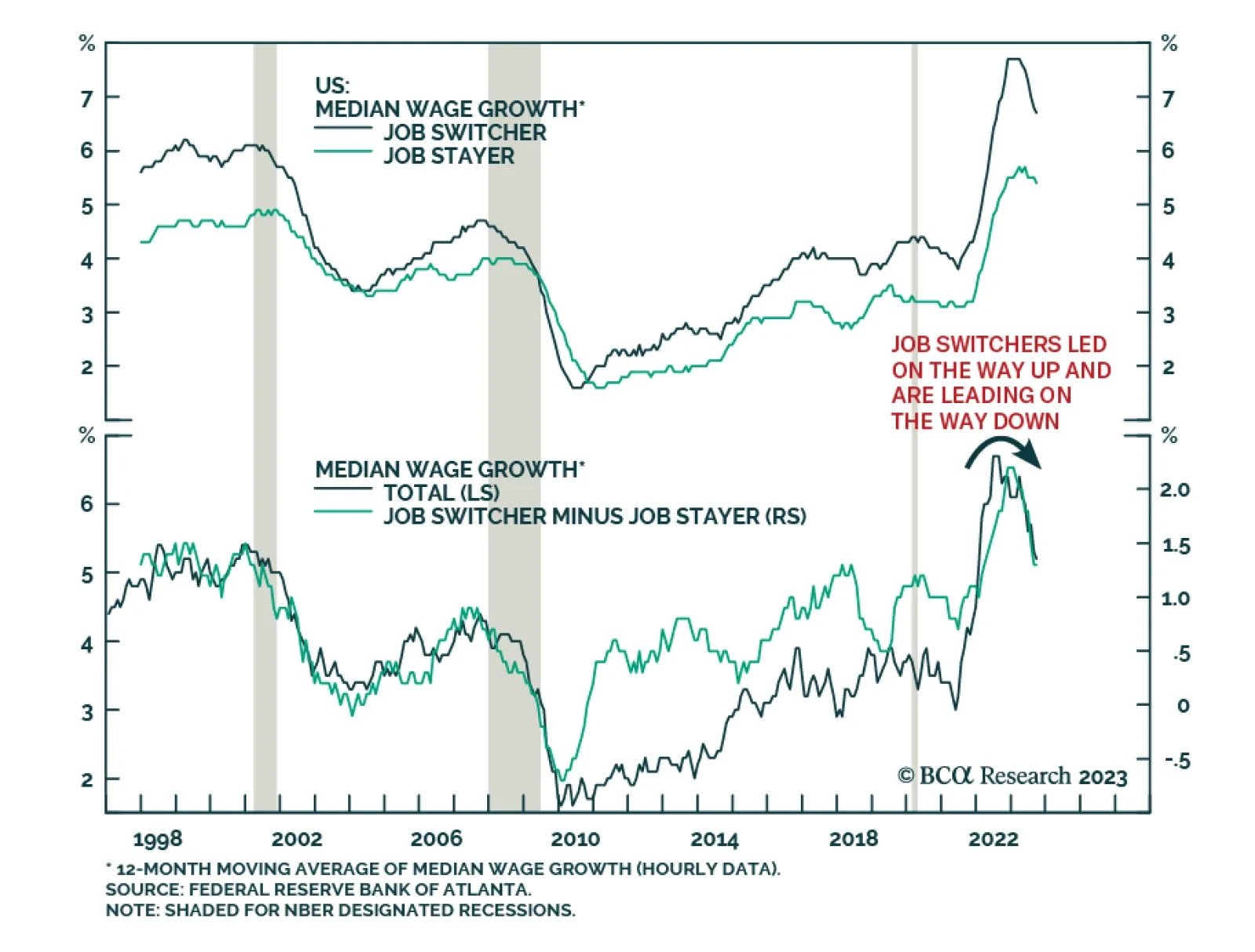

After surging in H2 2021/H1 2022, the Atlanta Fed's Wage Growth Tracker has been on a general downtrend for over a year. The latest reading of 5.2% in October – albeit unchanged from September – is considerably…

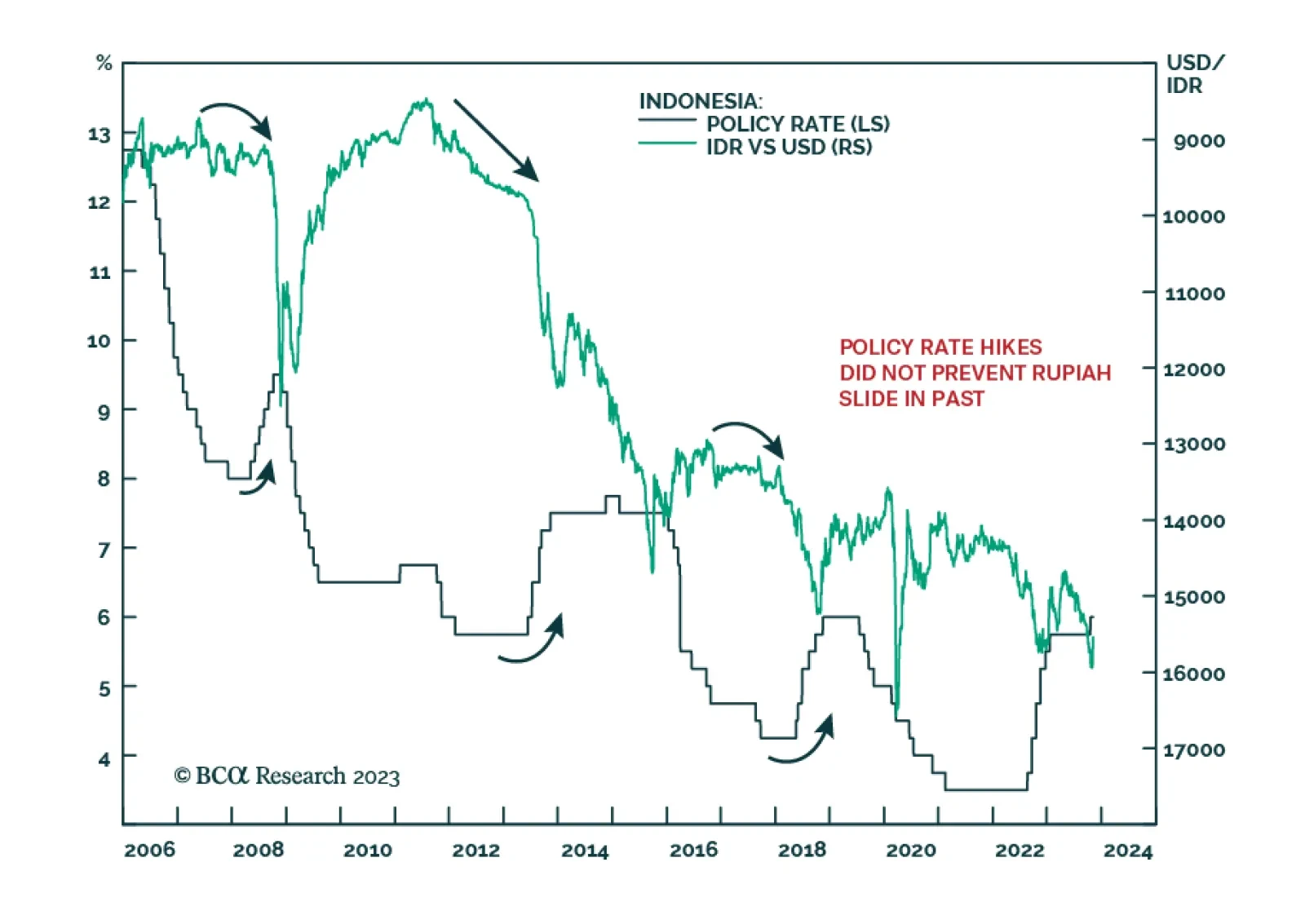

According to BCA Research’s Emerging Markets Strategy service, Indonesia's “window of opportunity” to transition to a lower real interest rate regime – without jeopardizing the currency stability…