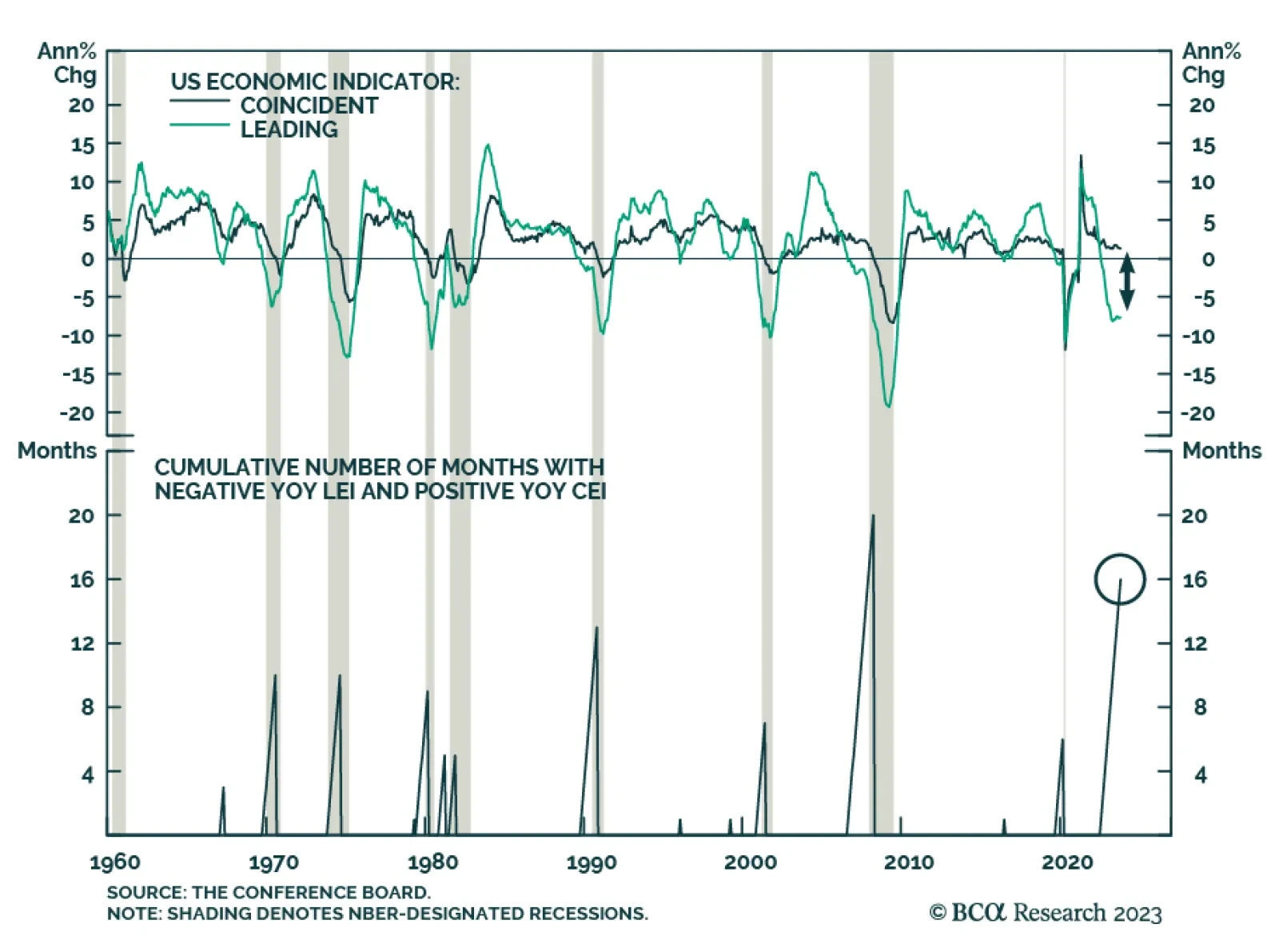

The US Conference Board's Leading Economic Indicator (LEI) continues to send a poor signal about the economic outlook. The monthly pace of contraction quickened to -0.8% m/m in October from -0.7% m/m in September. In terms…

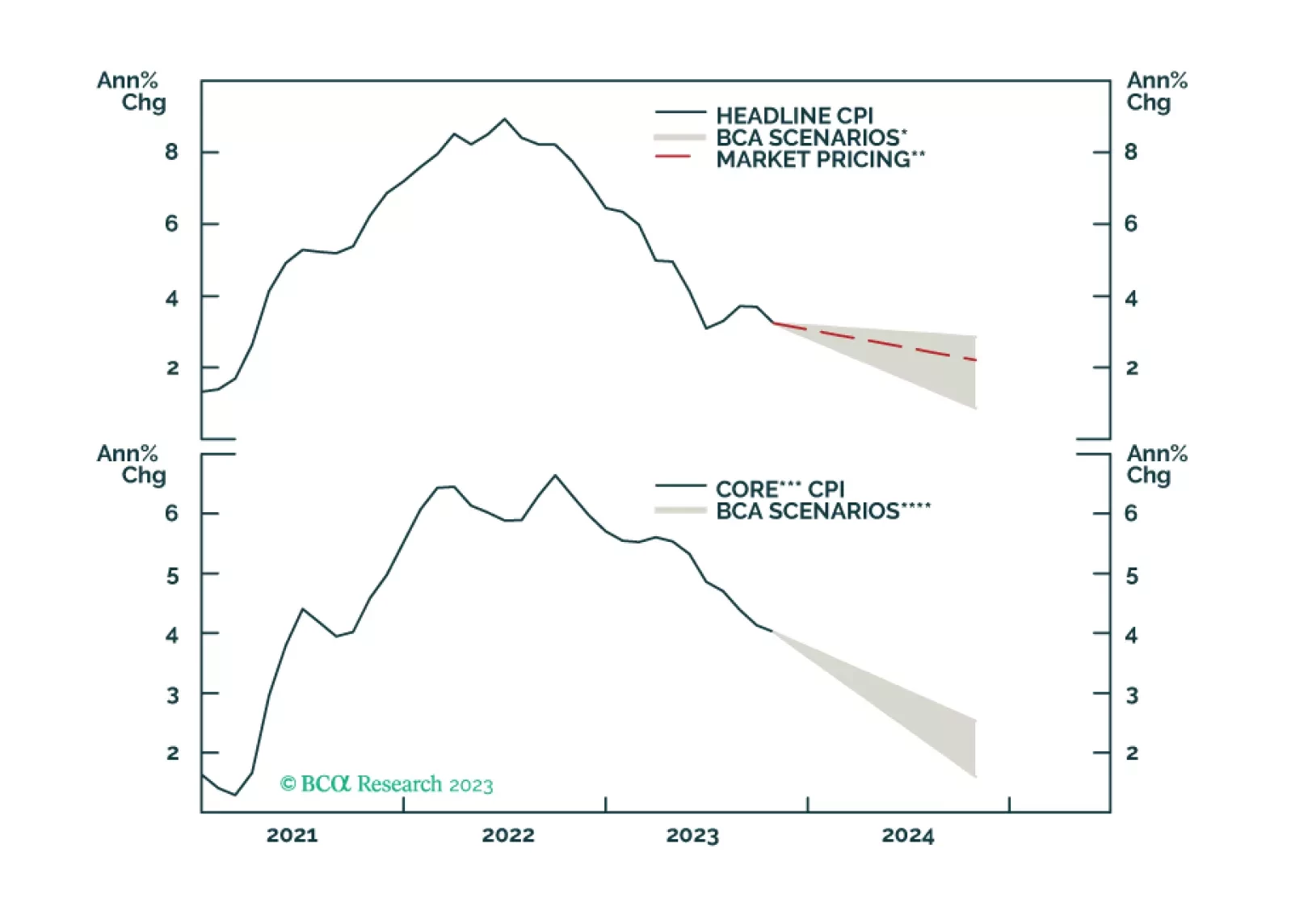

BCA Research's US Bond Strategy service continues to recommend a neutral allocation to TIPS for now, but with a bias to turn underweight. The team calculates a forecasted range for headline CPI inflation of 0.9% to 2.9%…

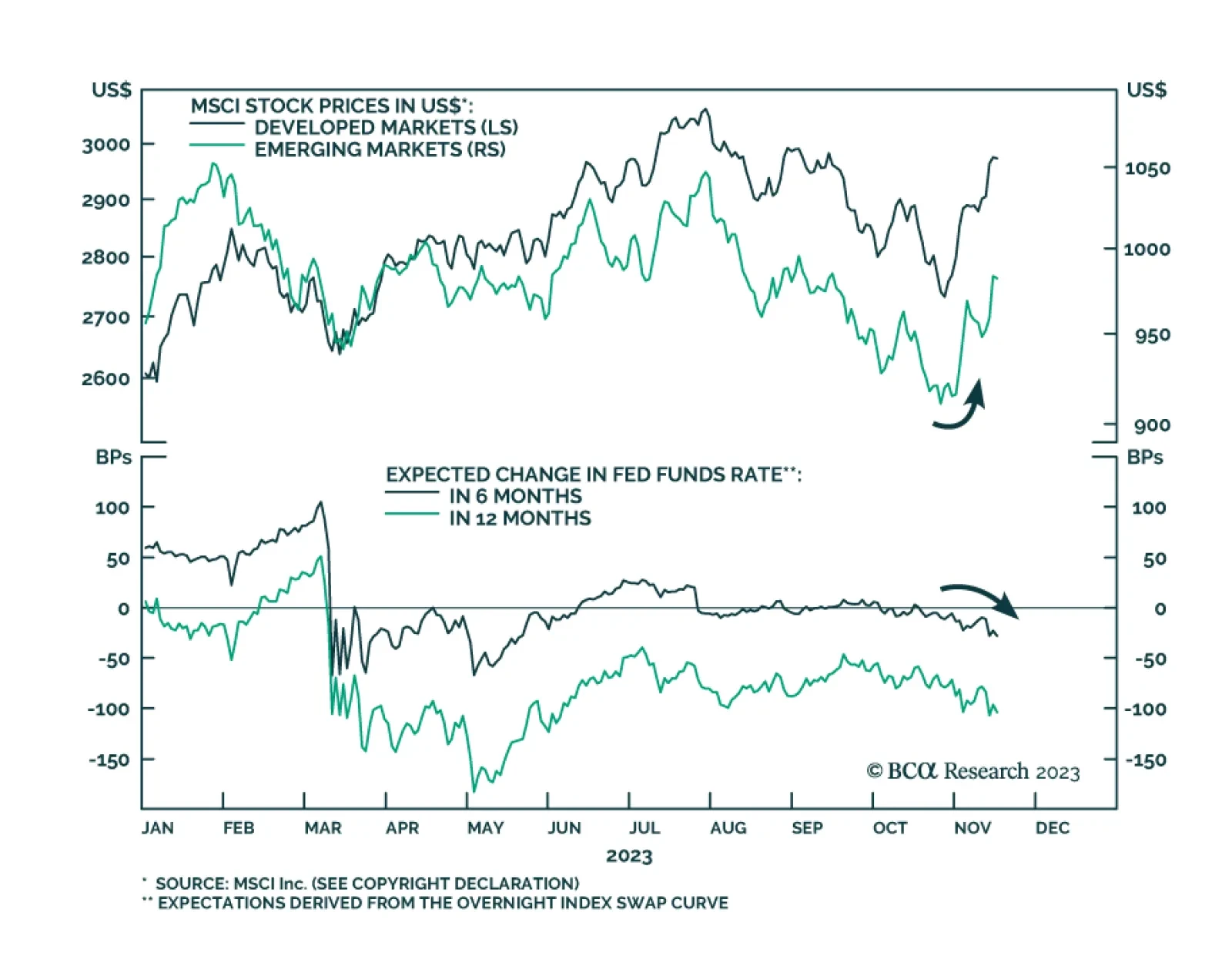

Global market sentiment has improved notably since late-October. In the equity space, DM and EM stocks have gained 8.5% and 7.8% respectively since October 26. Regarding currencies, the counter-cyclical DXY index has lost 2.2% so…

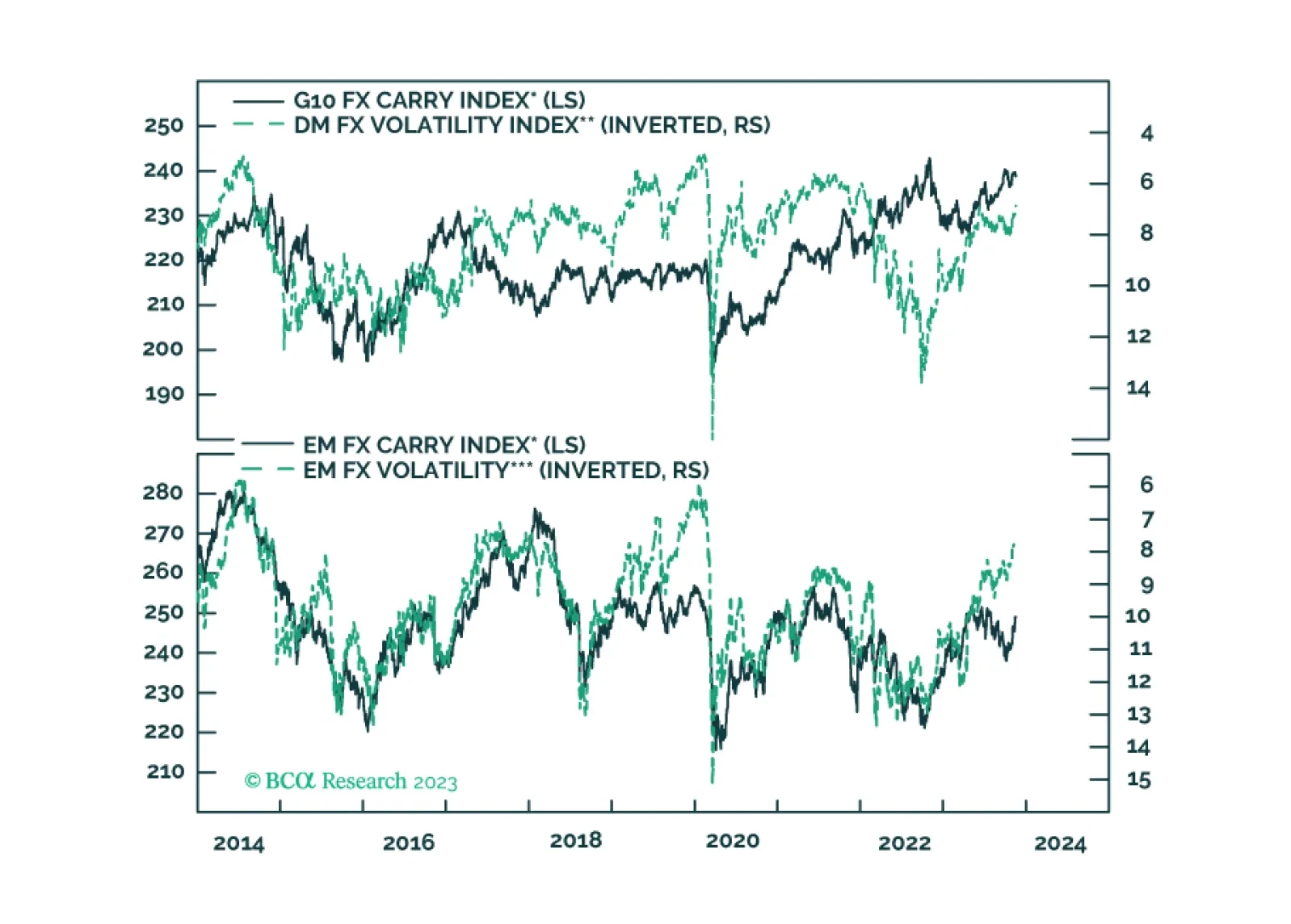

In this report, we evaluate the risk to carry trades in the coming months.

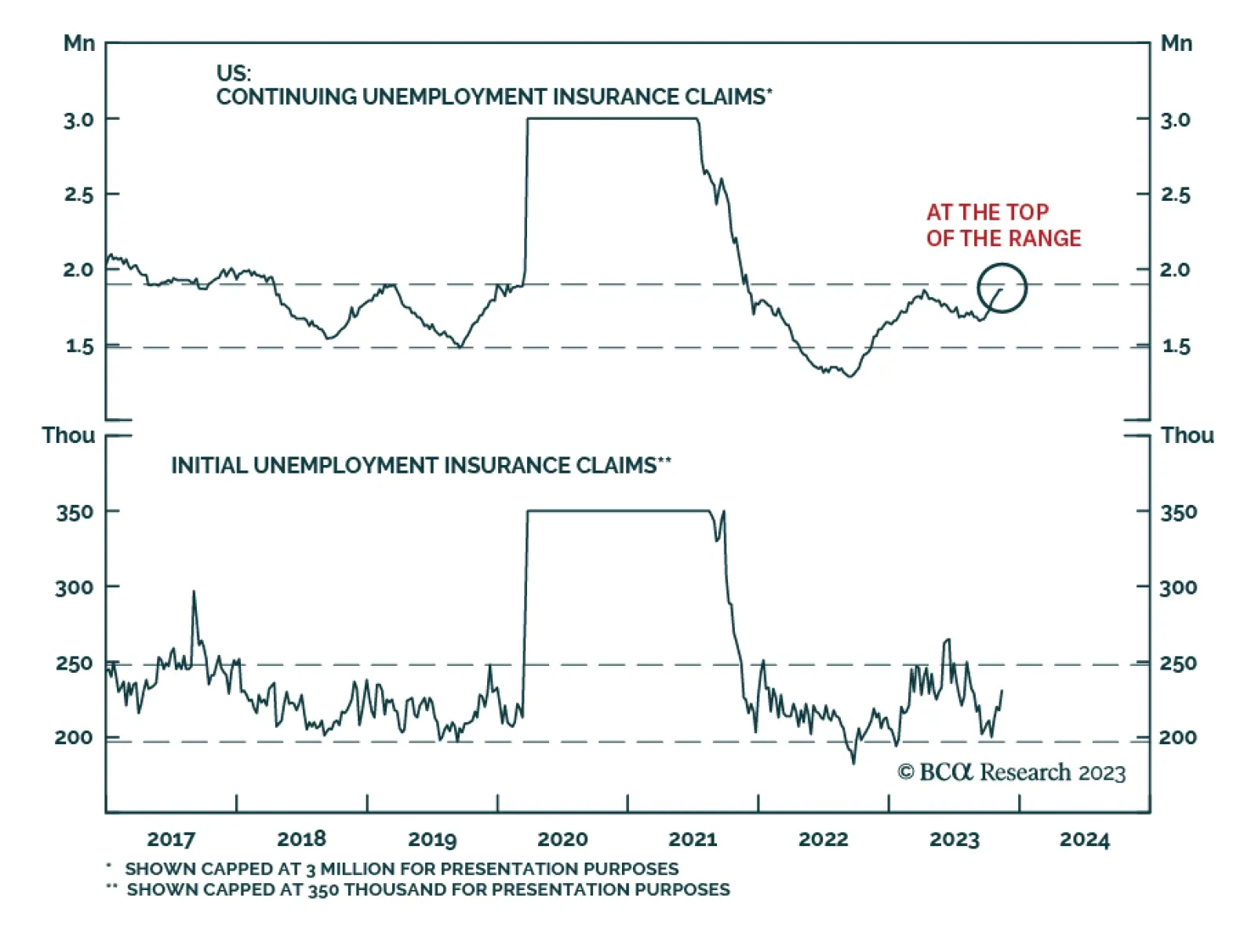

US jobless claims have been trending higher in recent weeks, confirming that labor market conditions are deteriorating. Initial claims came in slightly above consensus estimates on Thursday, increasing by 231 thousand versus…

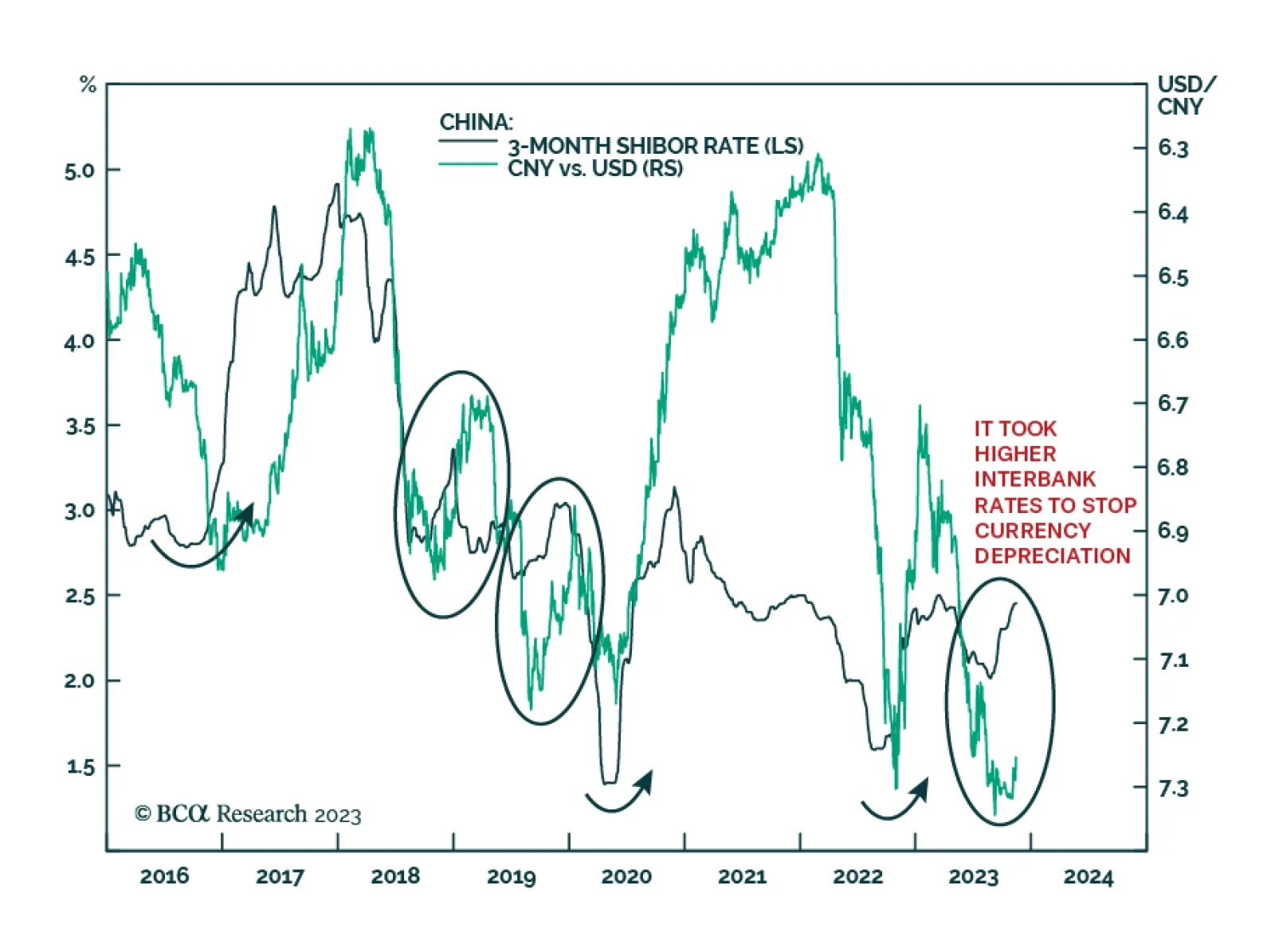

According to BCA Research’s China Investment Strategy service, Chinese policymakers are facing the Impossible Trinity. When faced with rapid currency depreciation in August-September, the PBoC deliberately tightened…

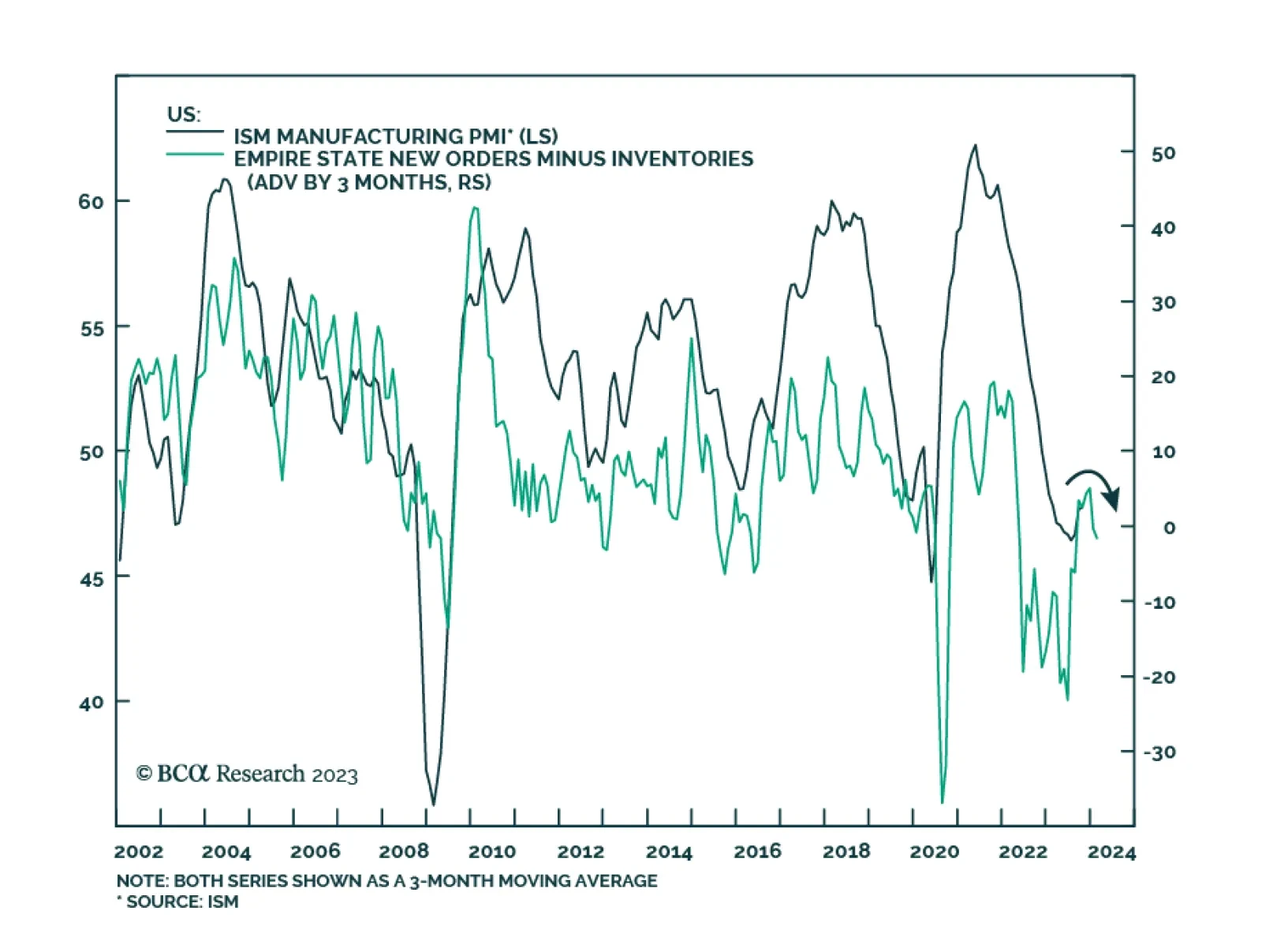

The New York Fed's Empire Manufacturing Index unexpectedly returned to positive territory in November, climbing 14 points to its highest level since April. The headline index suggests that manufacturing activity is…

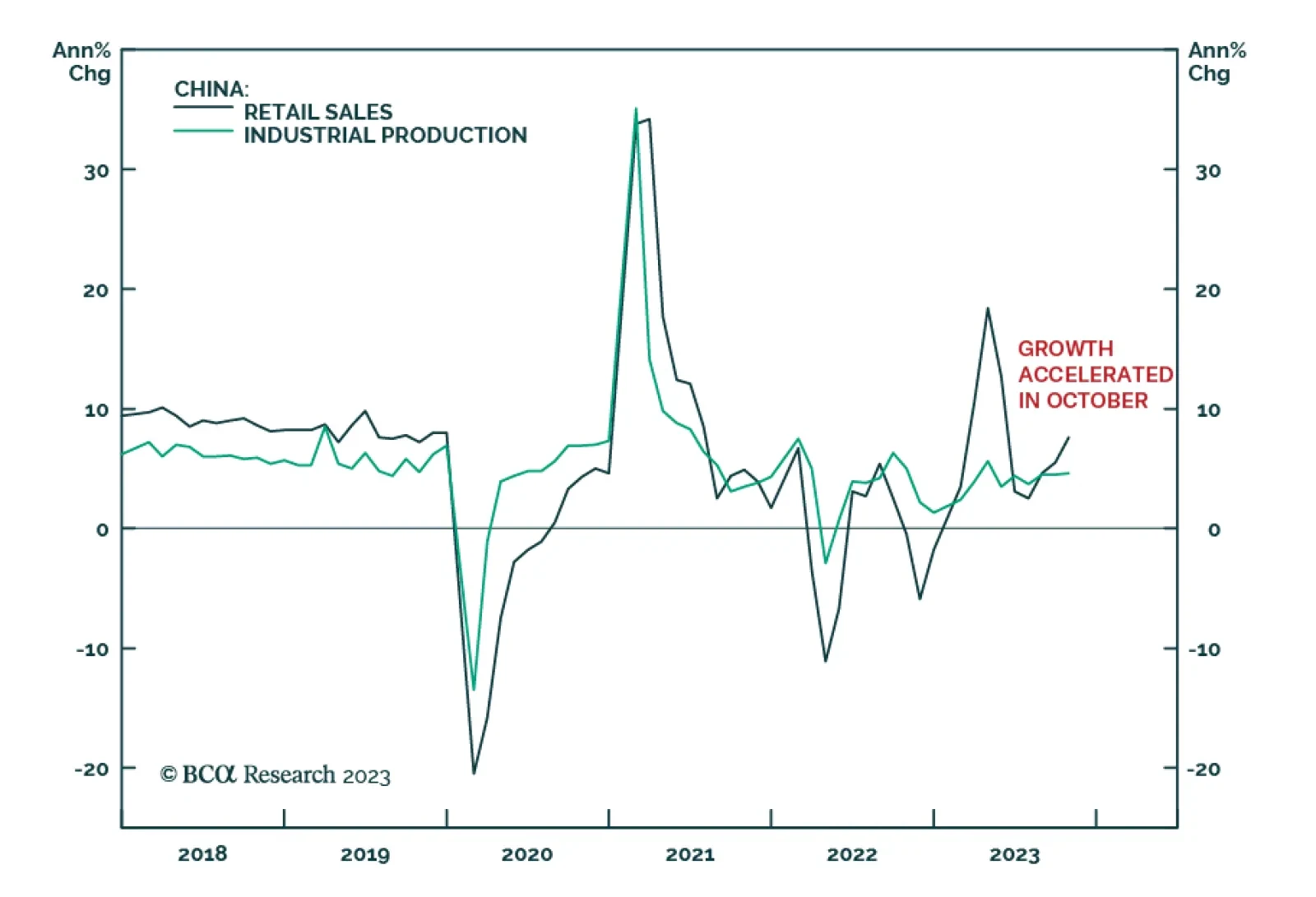

On the surface, the acceleration in Chinese retail sales and industrial production growth in October suggests that the economy is holding up. Retail sales expanded by 7.6% y/y last month – beating expectations of 7.0% y/y…

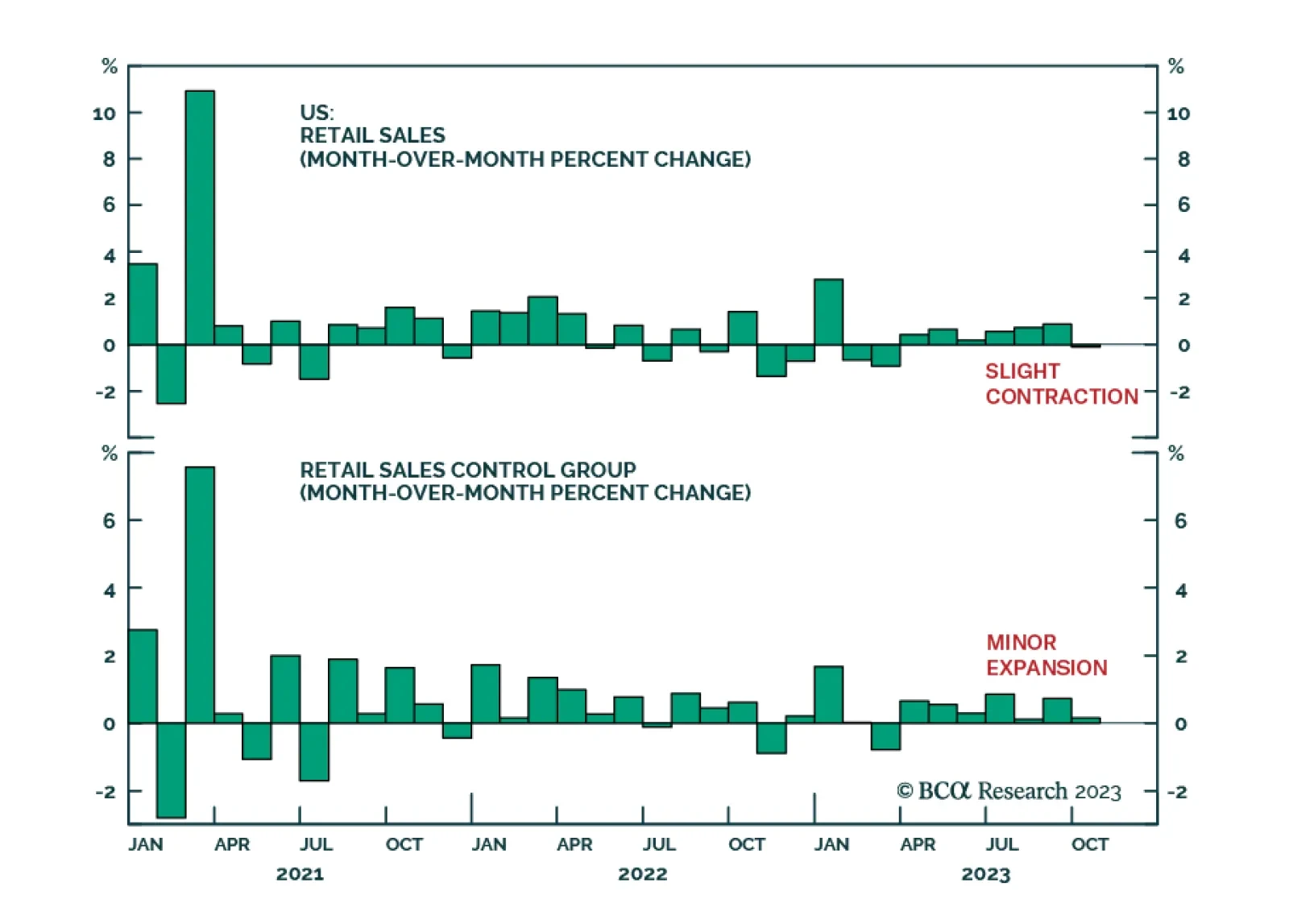

The US retail sales release delivered a mixed signal about US consumption. Although the headline figure contracted by 0.1% m/m in October, it was better than expectations of a 0.3% m/m decline. Moreover, the September increase…