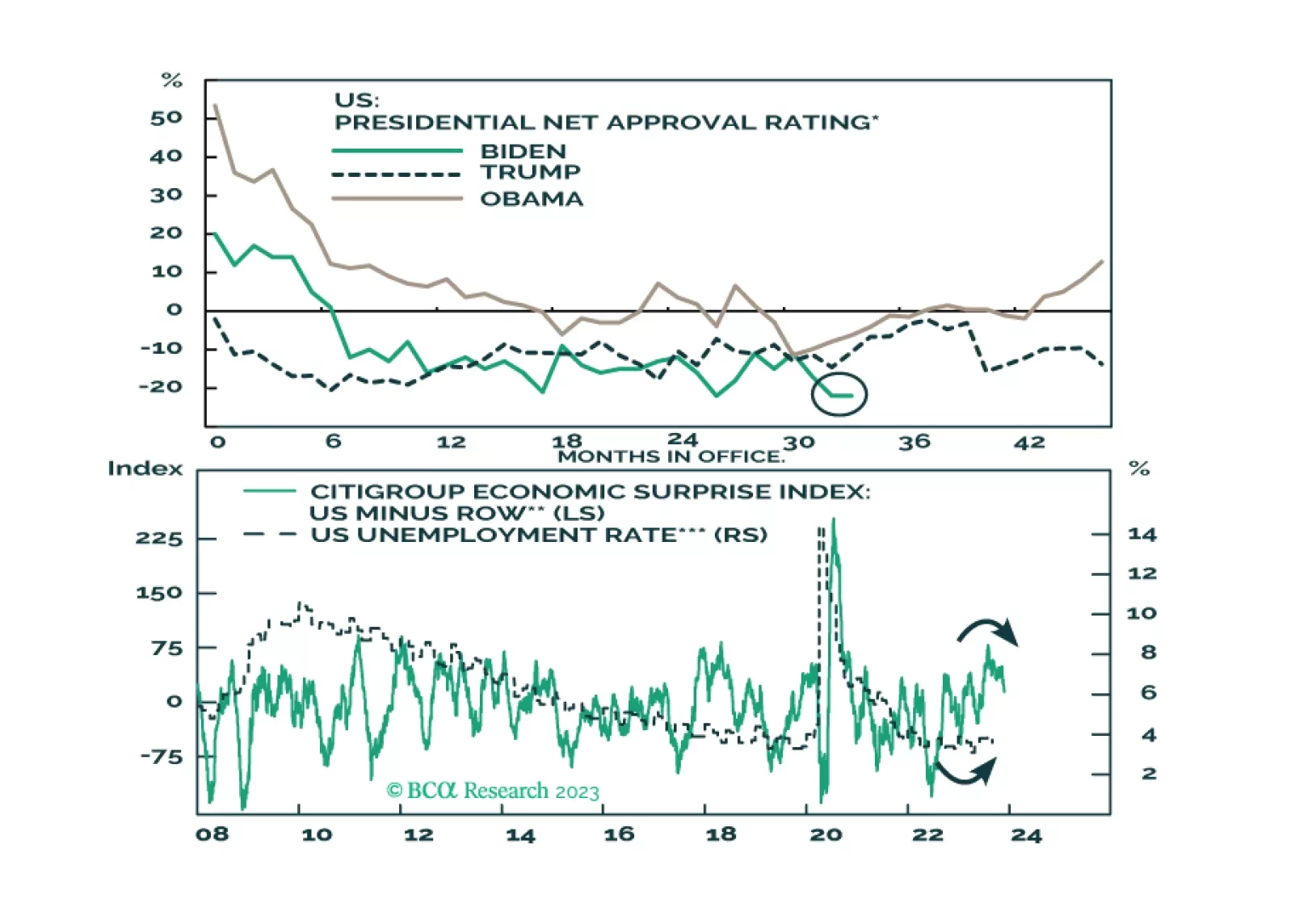

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…

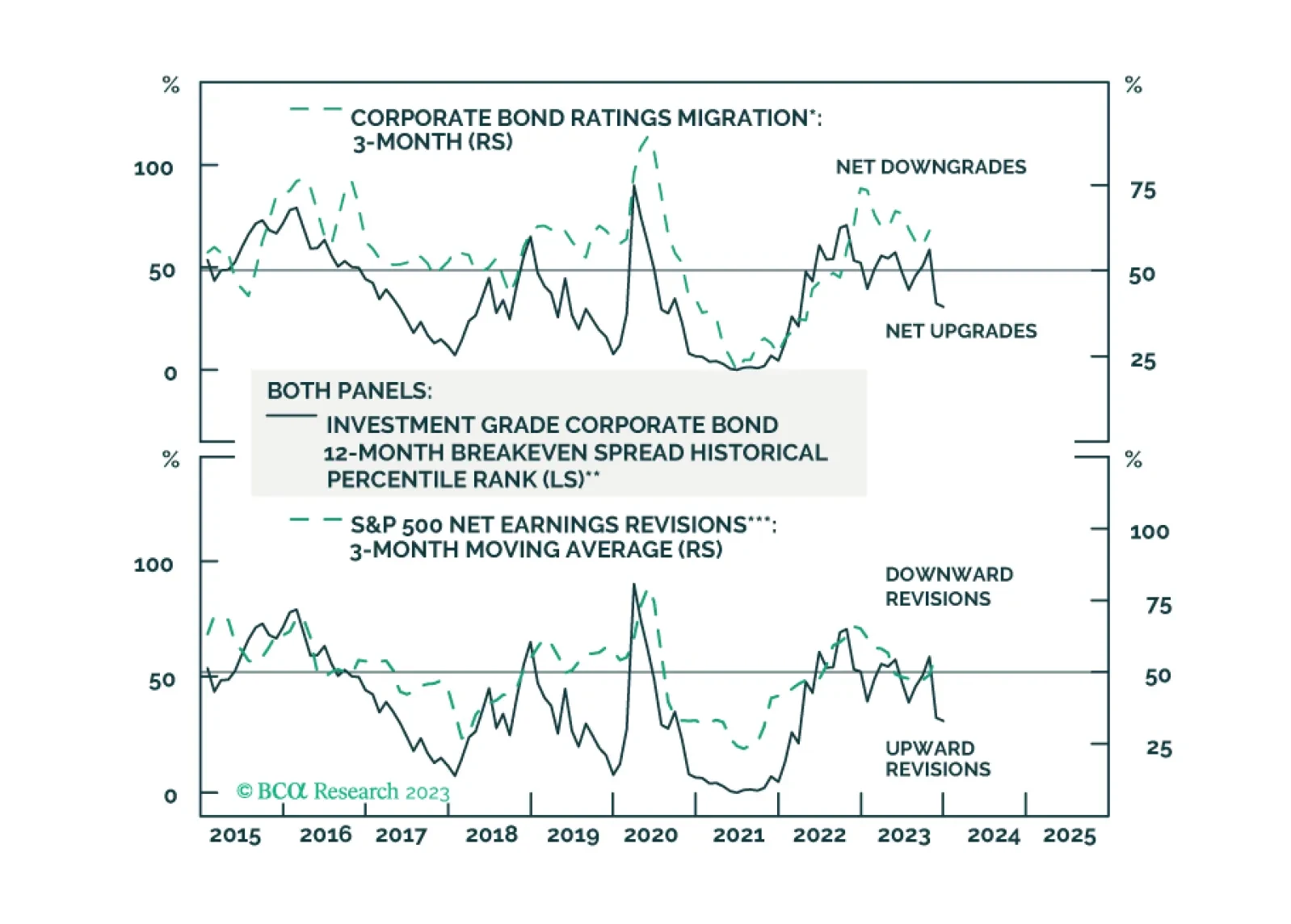

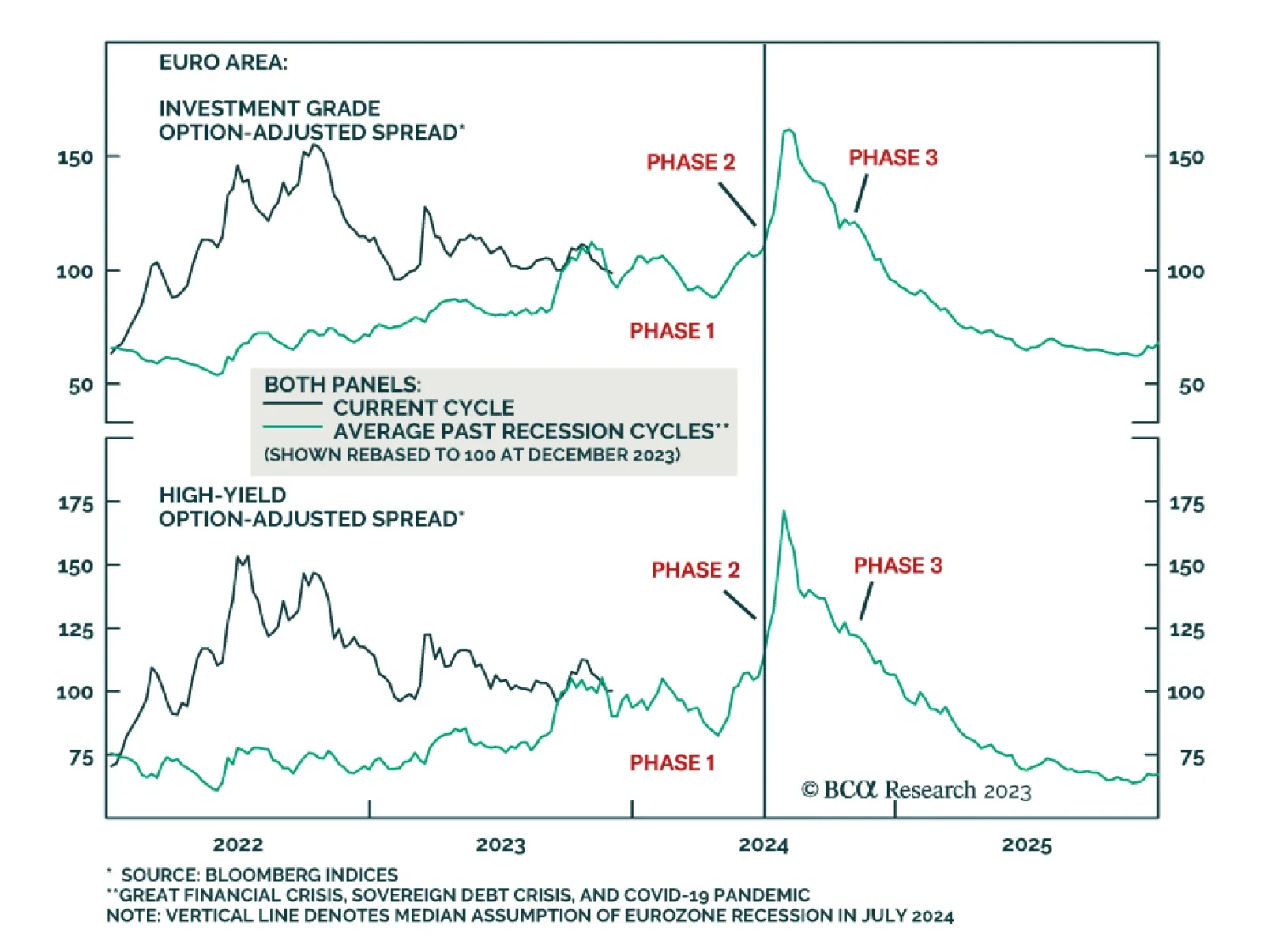

According to BCA Research’s European Investment Strategy service, European corporate spreads will widen over the coming six months before an attractive buying opportunity emerges in the second half of 2024. 2024 will…

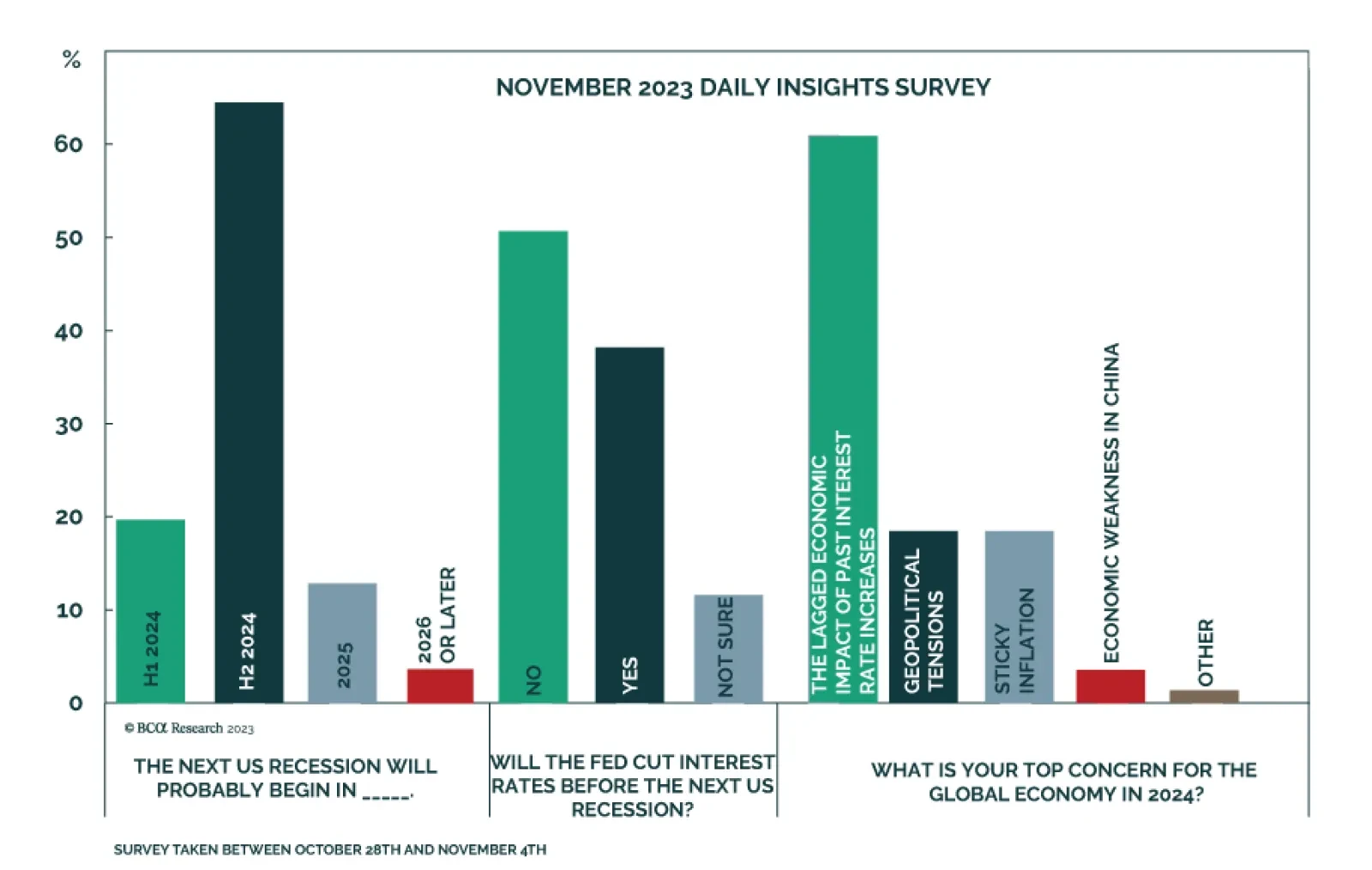

In the monthly Daily Insights Survey we conducted over the past week, we asked about our readers’ outlook for the timing of the next US recession, the Fed, and concerns for the global economy in 2024. On the US economic…

Our Portfolio Allocation Summary for December 2023.

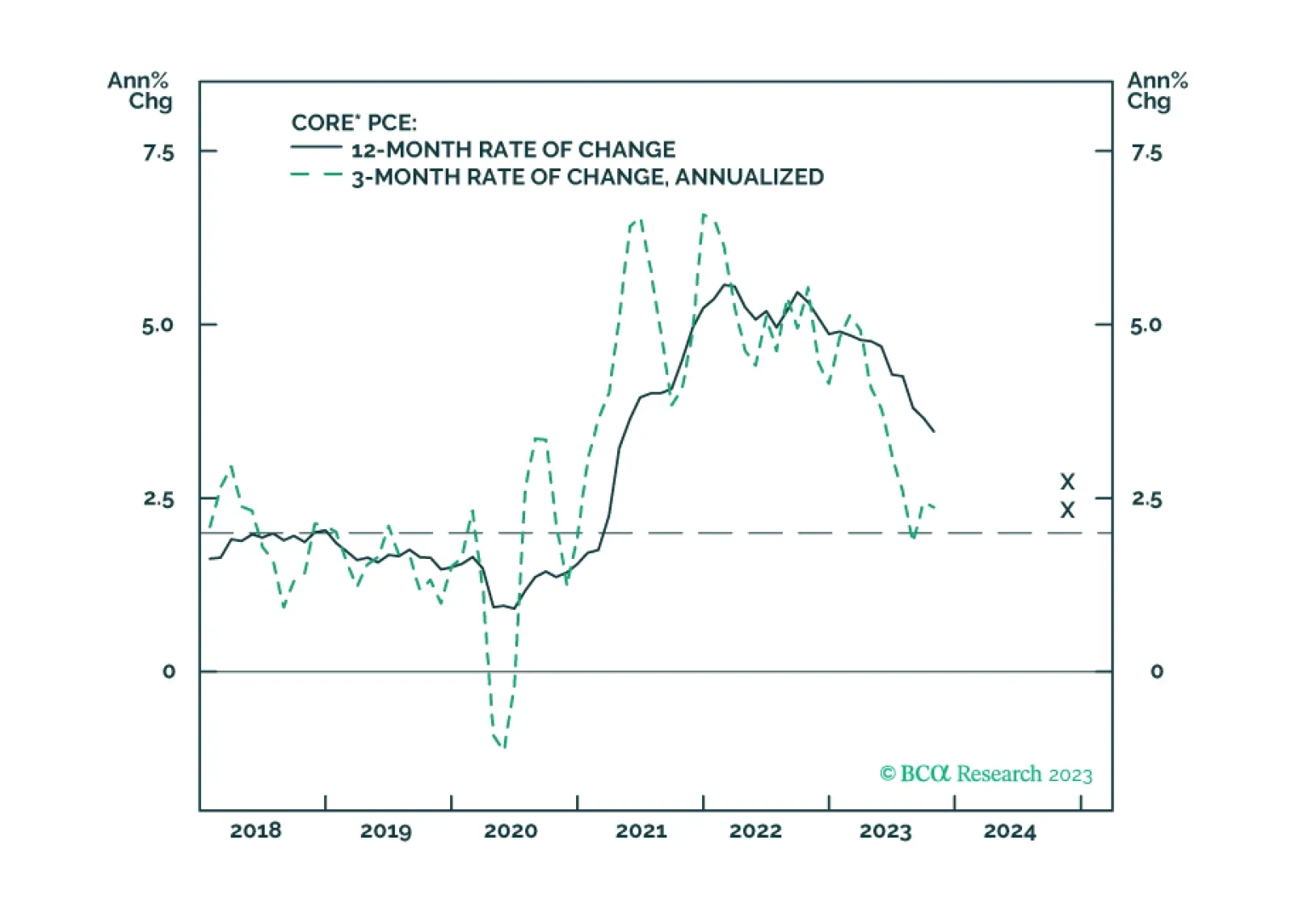

Treasury yields will sketch out a range between now and Q1 2024, with the upside determined by inflation and the downside determined by labor markets.

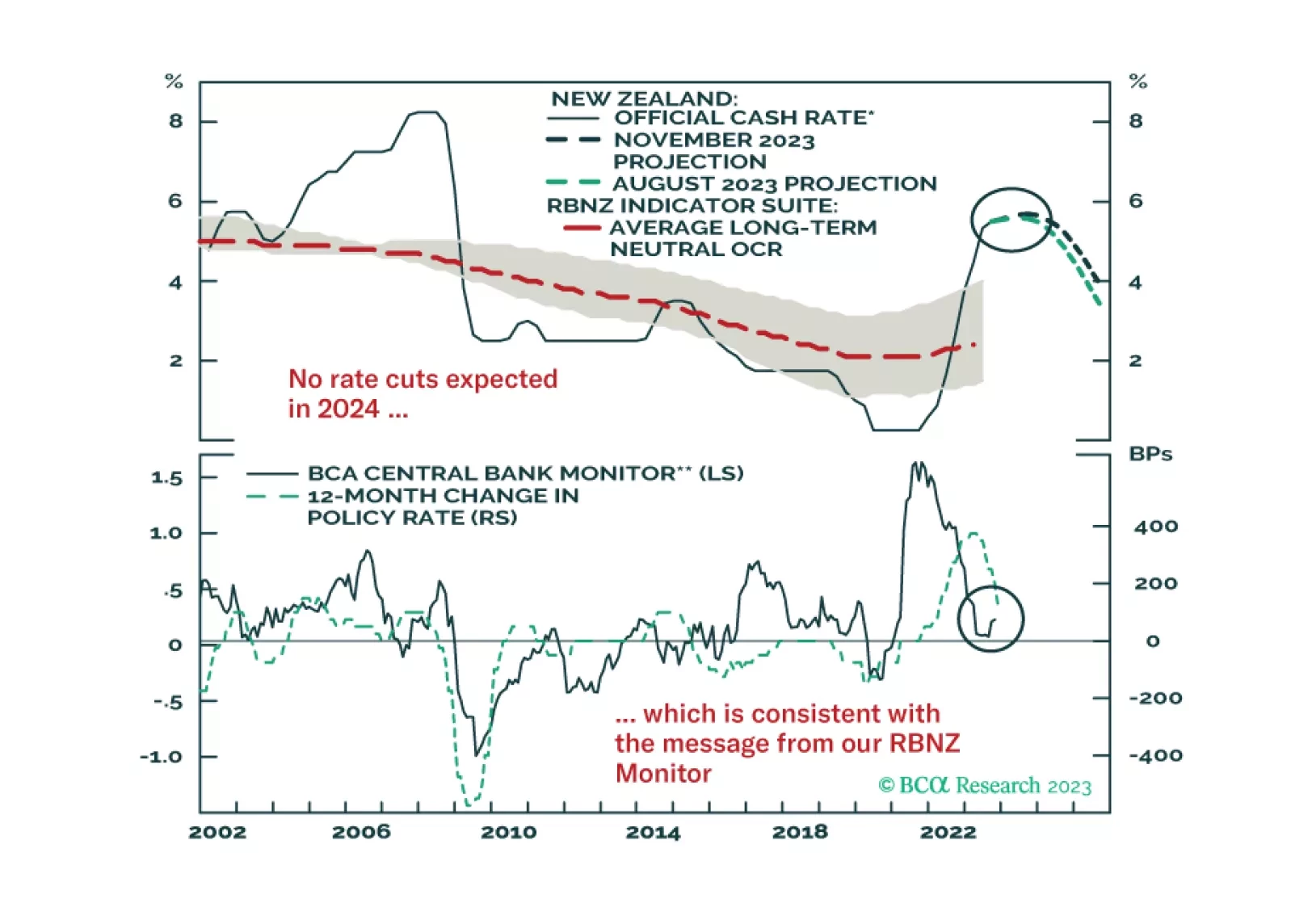

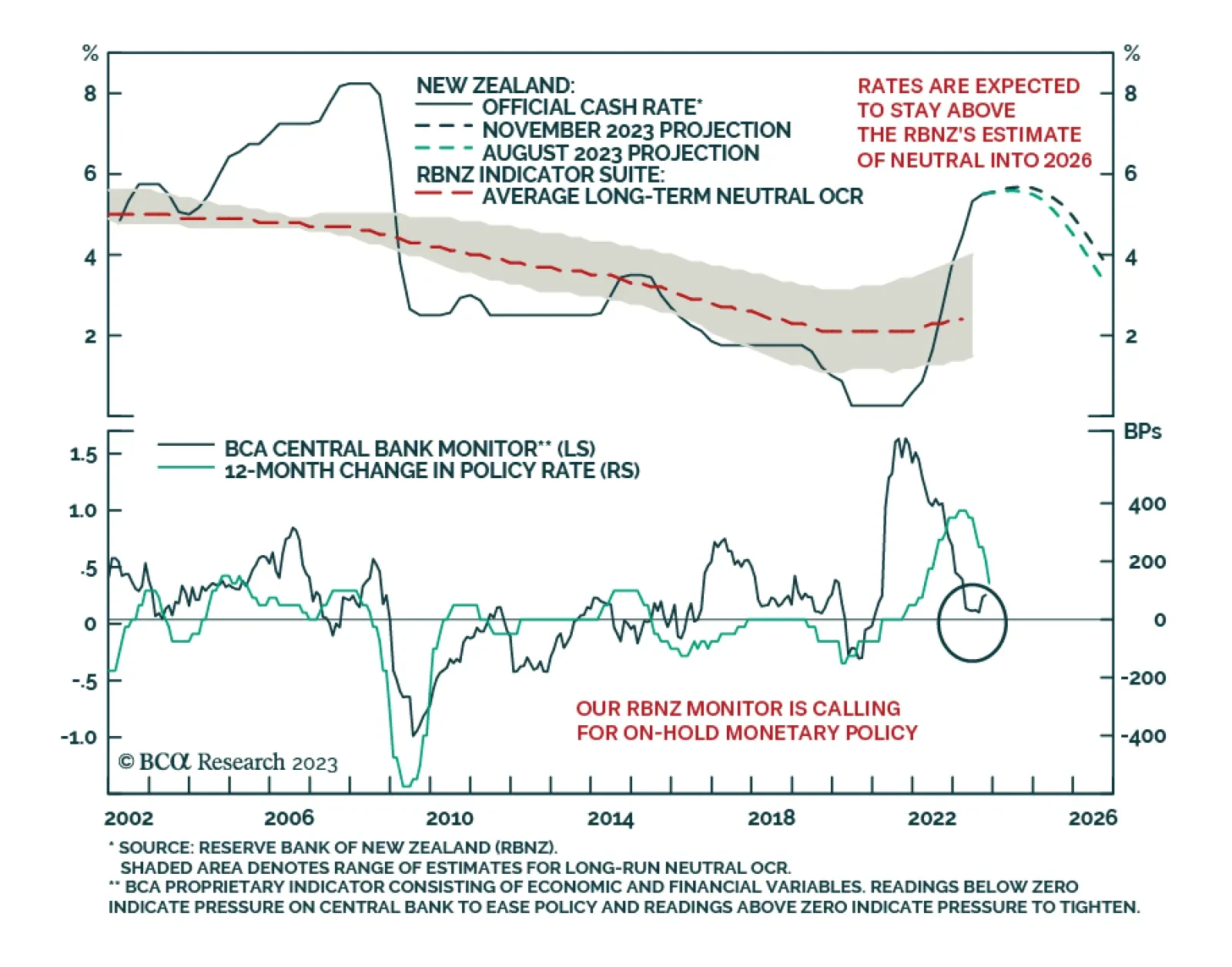

In this Insight, we discuss the outlook for monetary policy in New Zealand after this week’s RBNZ policy meeting, and introduce related fixed income and currency trade ideas.

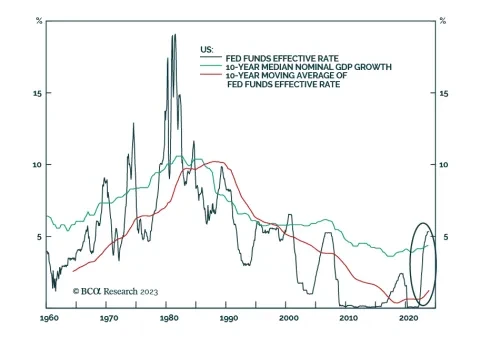

According to BCA Research’s Bank Credit Analyst service, events that have occurred since the onset of the pandemic have highlighted that the easy money era that prevailed from 2009-2021 is very likely over. The Fed will…

The Reserve Bank of New Zealand (RBNZ) held its key interest rate steady at 5.5% at the November policy meeting yesterday. That decision was as expected, but the messaging surrounding the announcement was surprisingly…

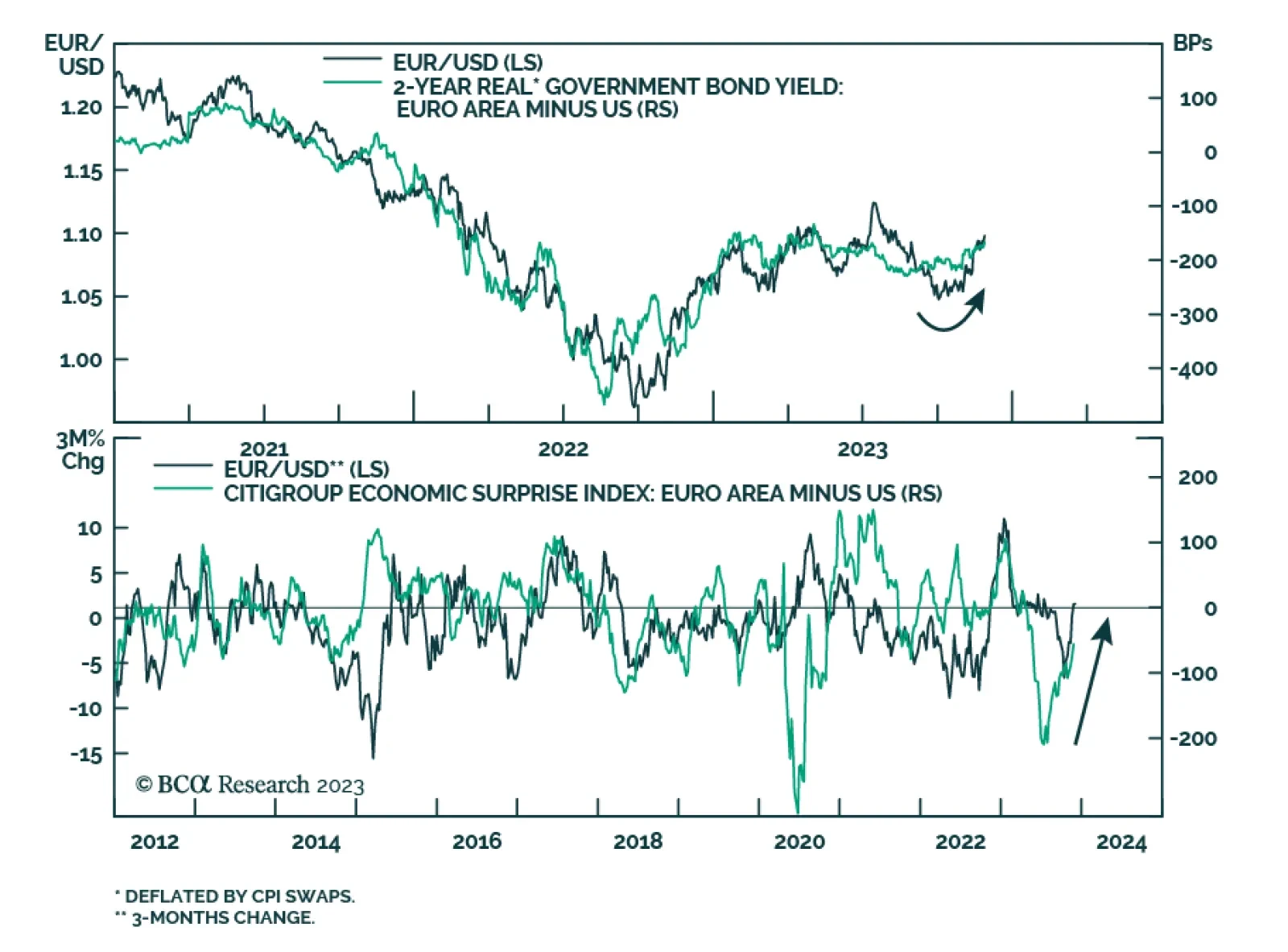

Recent Euro Area economic data have been sending a less pessimistic signal. Wednesday’s releases are in line with this trend. The European Commission’s confidence indicator shows a mild improvement in economic…

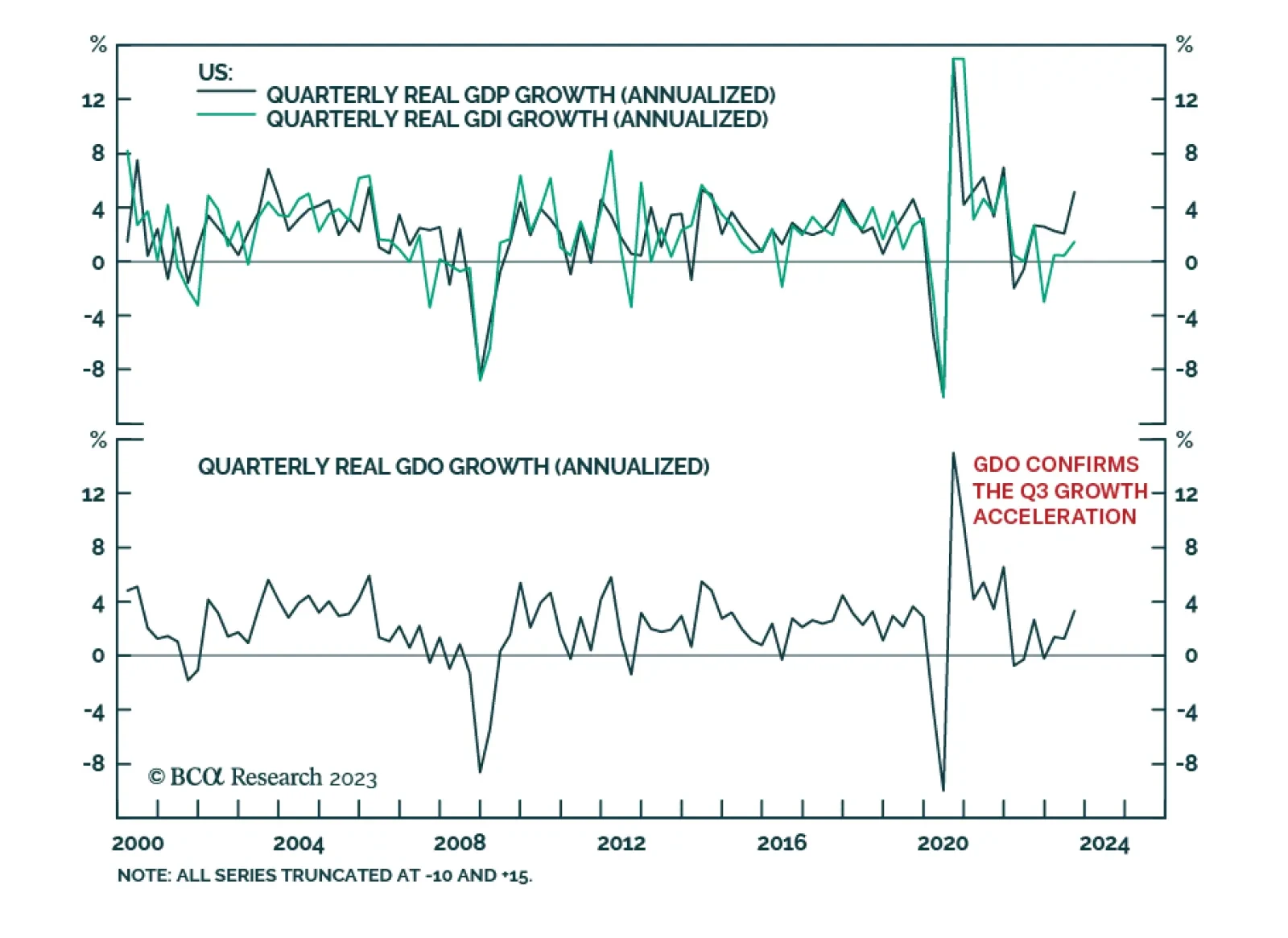

Q3 US real GDP was revised higher in the second estimate that was released on Wednesday. The 5.2% q/q annualized increase beat expectations of a more muted upwards revision to 5.0% q/q from the advance estimate of 4.9% q/q. In…