A soft landing can be achieved but not maintained. We are cutting our tactical recommendation on stocks from overweight to neutral and scaling back our long-duration stance.

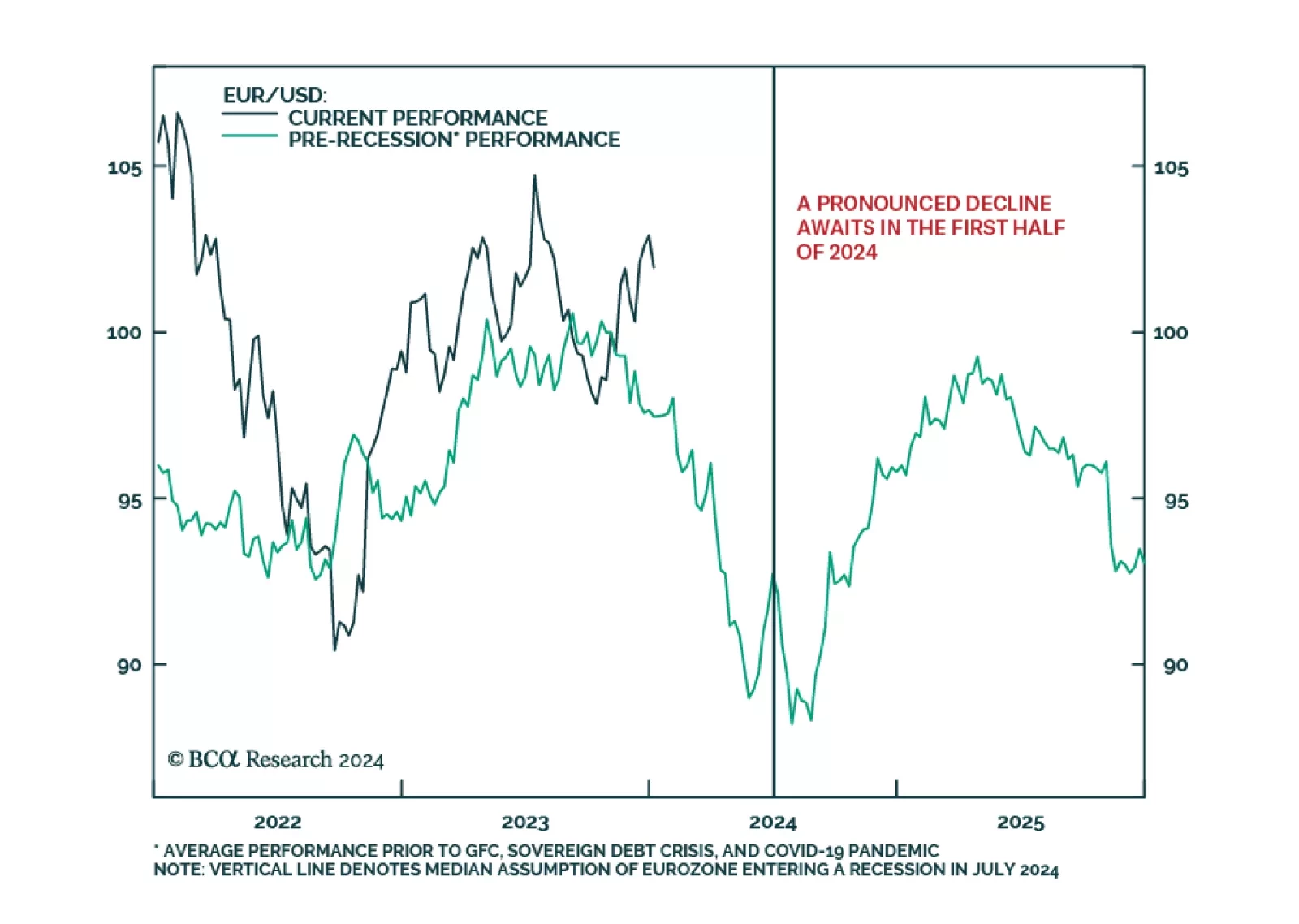

According to BCA Research’s European Investment Strategy service, the euro has ample attractive features that justify a positive long-term outlook. However, its pro-cyclicality and the dollar’s negative…

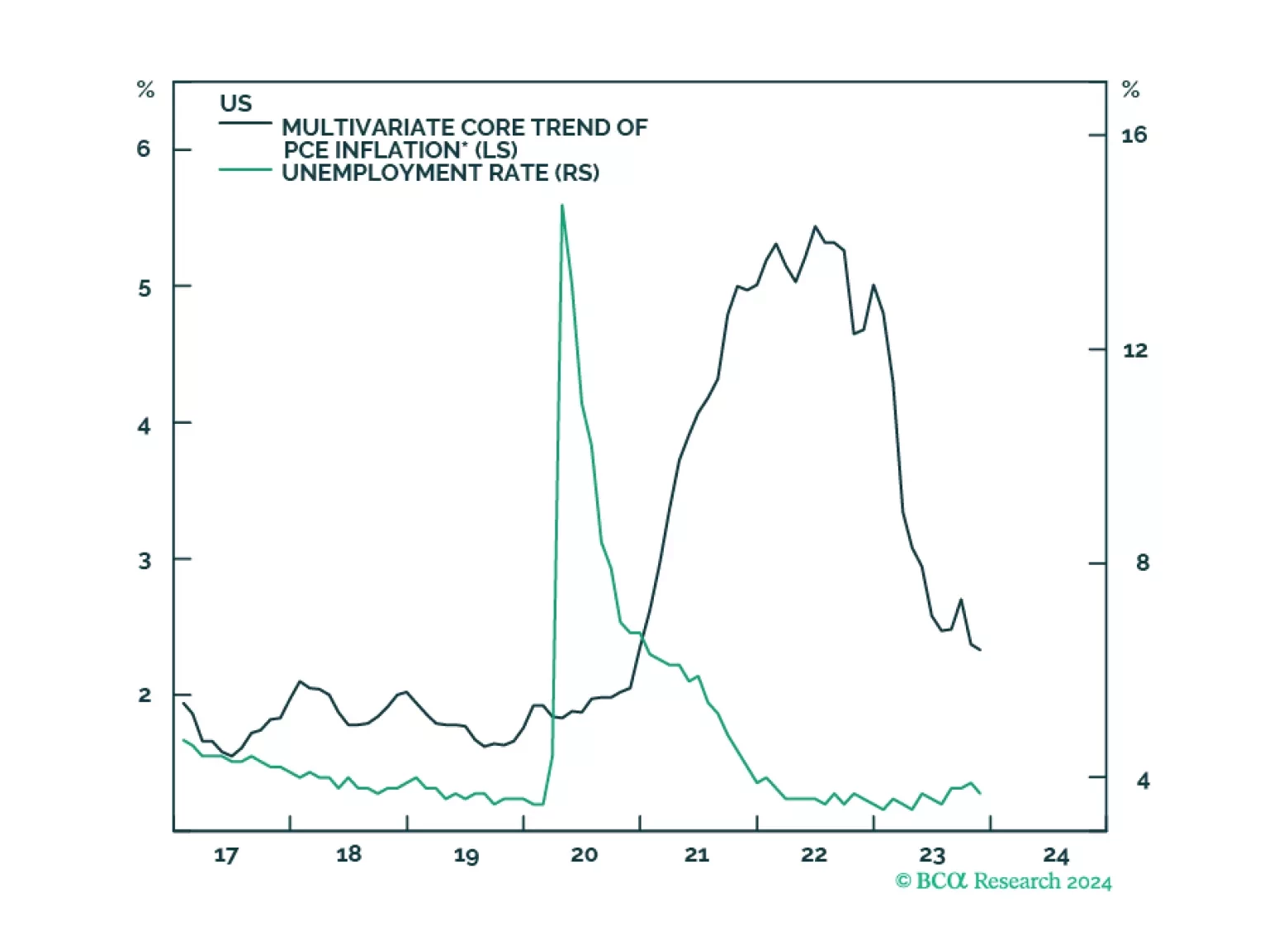

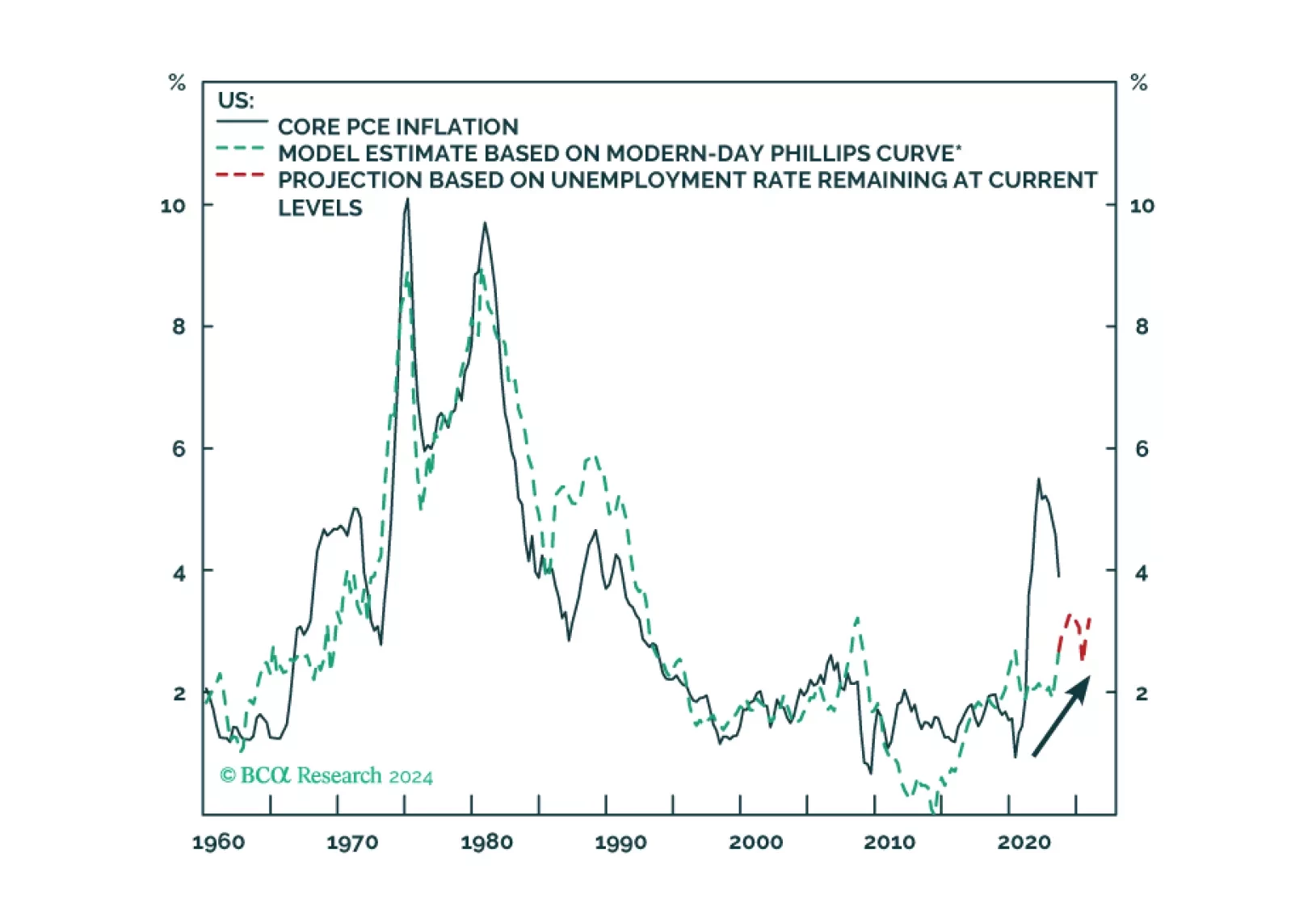

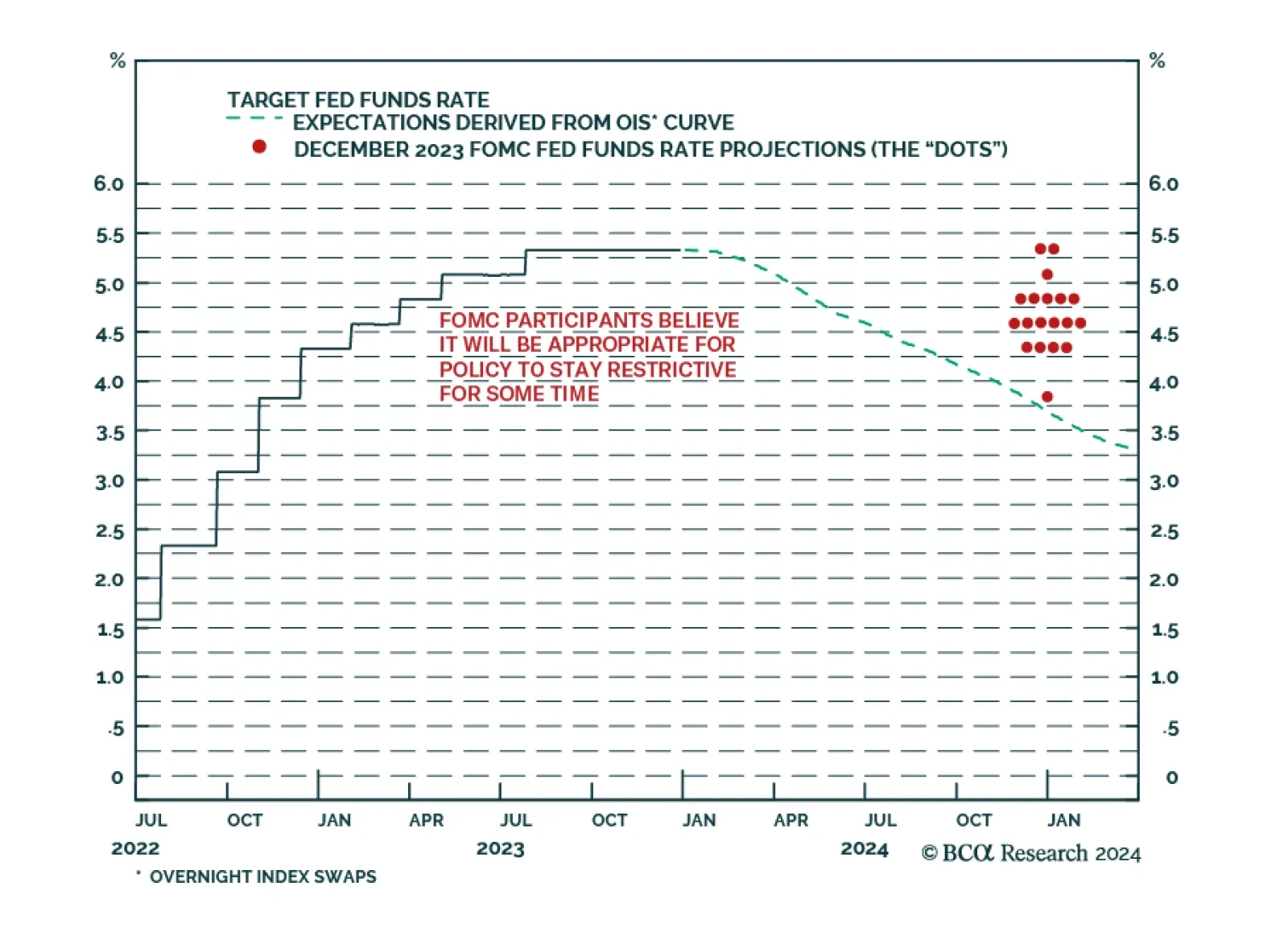

Minutes from the Fed’s December 12-13 FOMC meeting suggest that policymakers are more confident that inflation is on track to return to target. While they continued to note that inflation remains elevated and that they are…

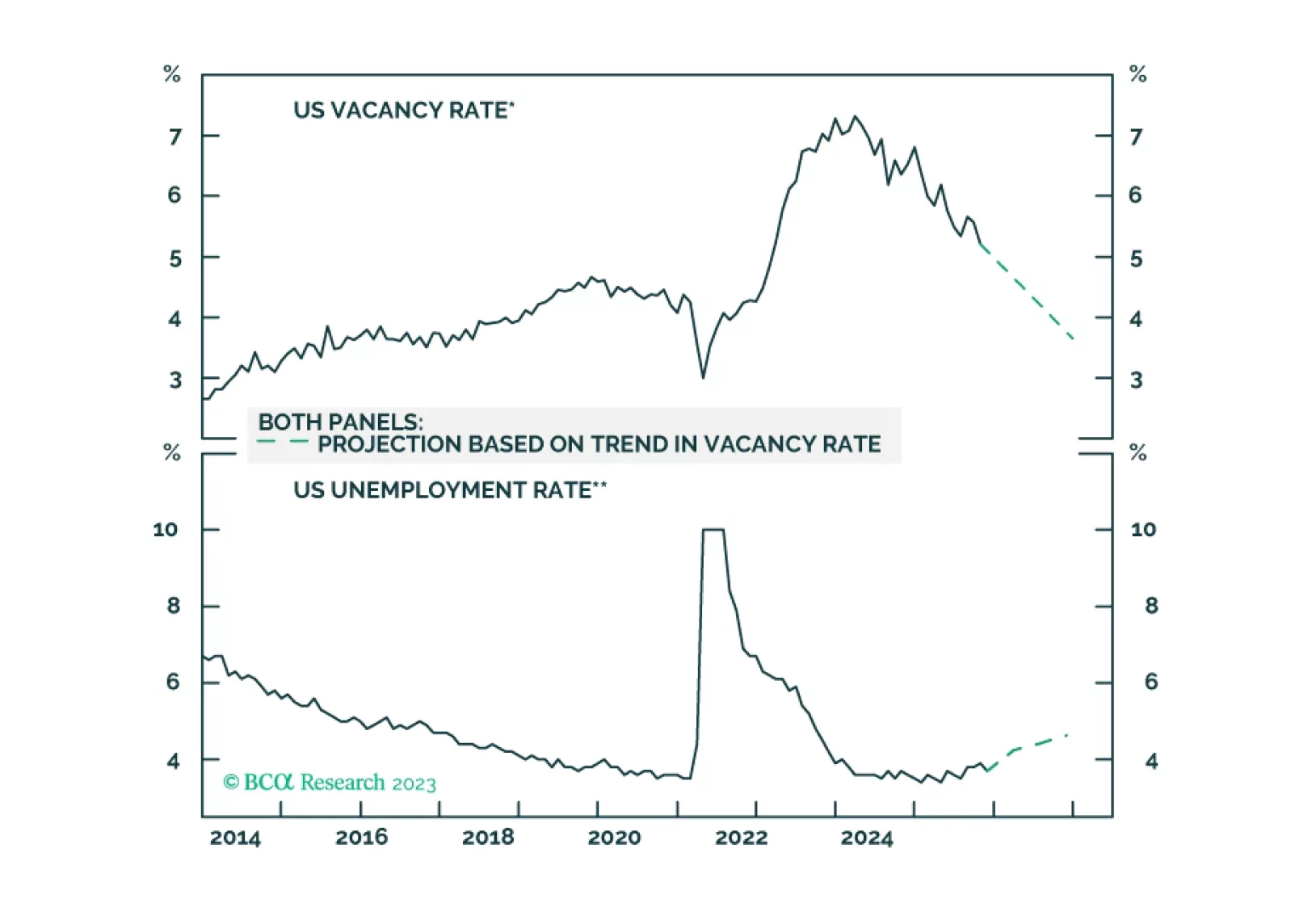

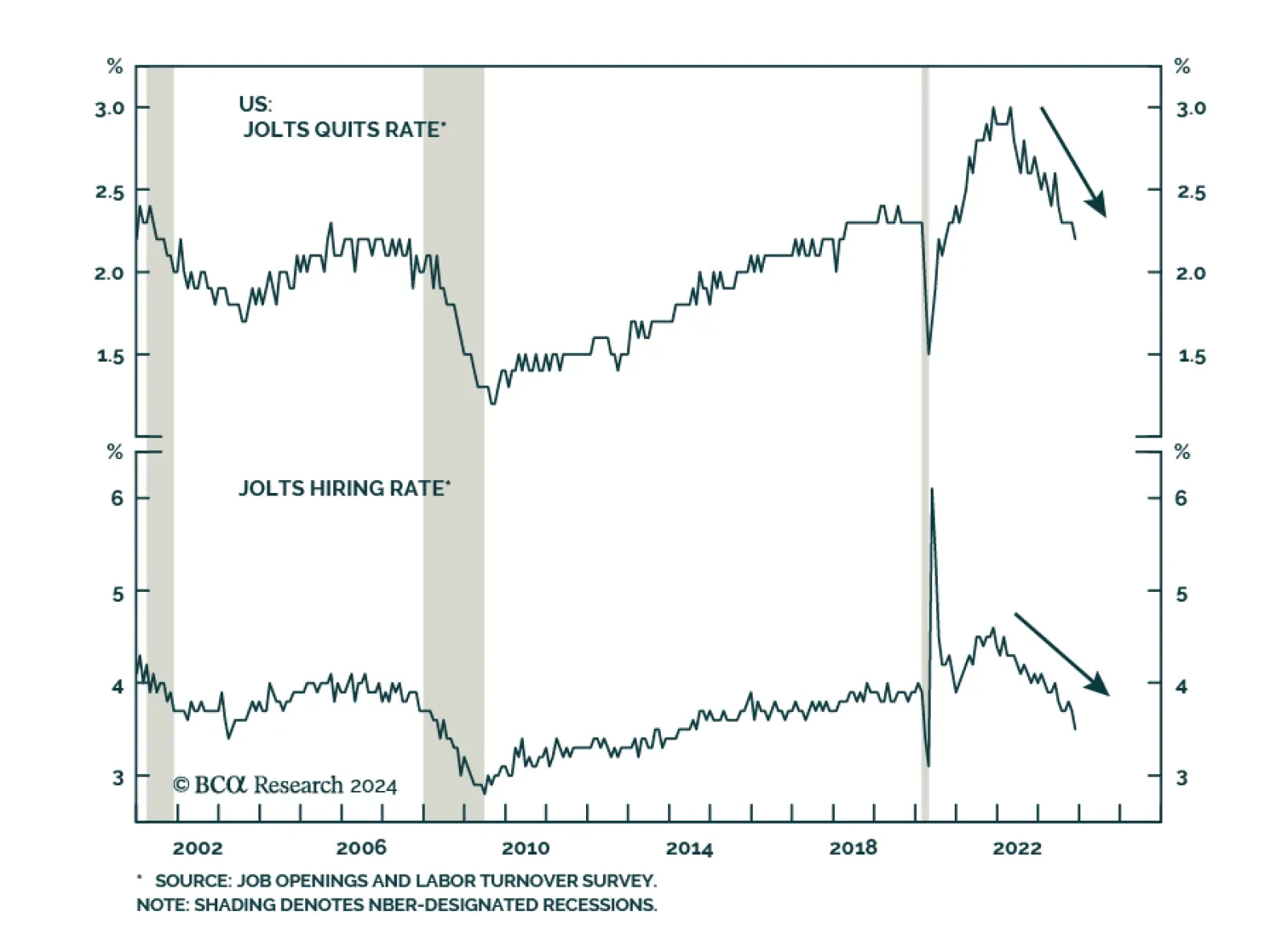

Results of the November JOLTS survey indicate that the US labor market is softening. The number of job openings slowed from 8.85 million to 8.79 million – the lowest since March 2021 and slightly below expectations of 8.…

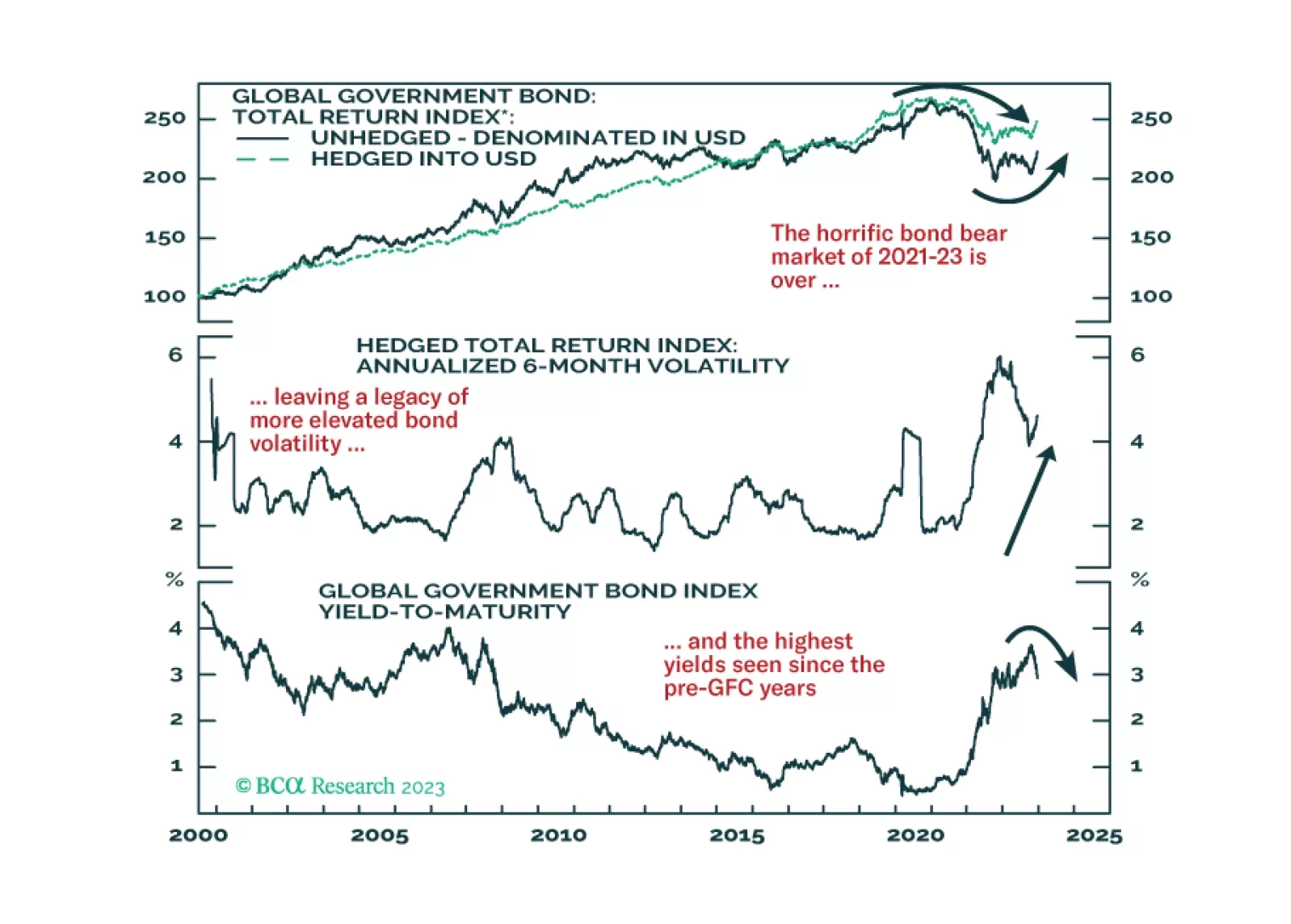

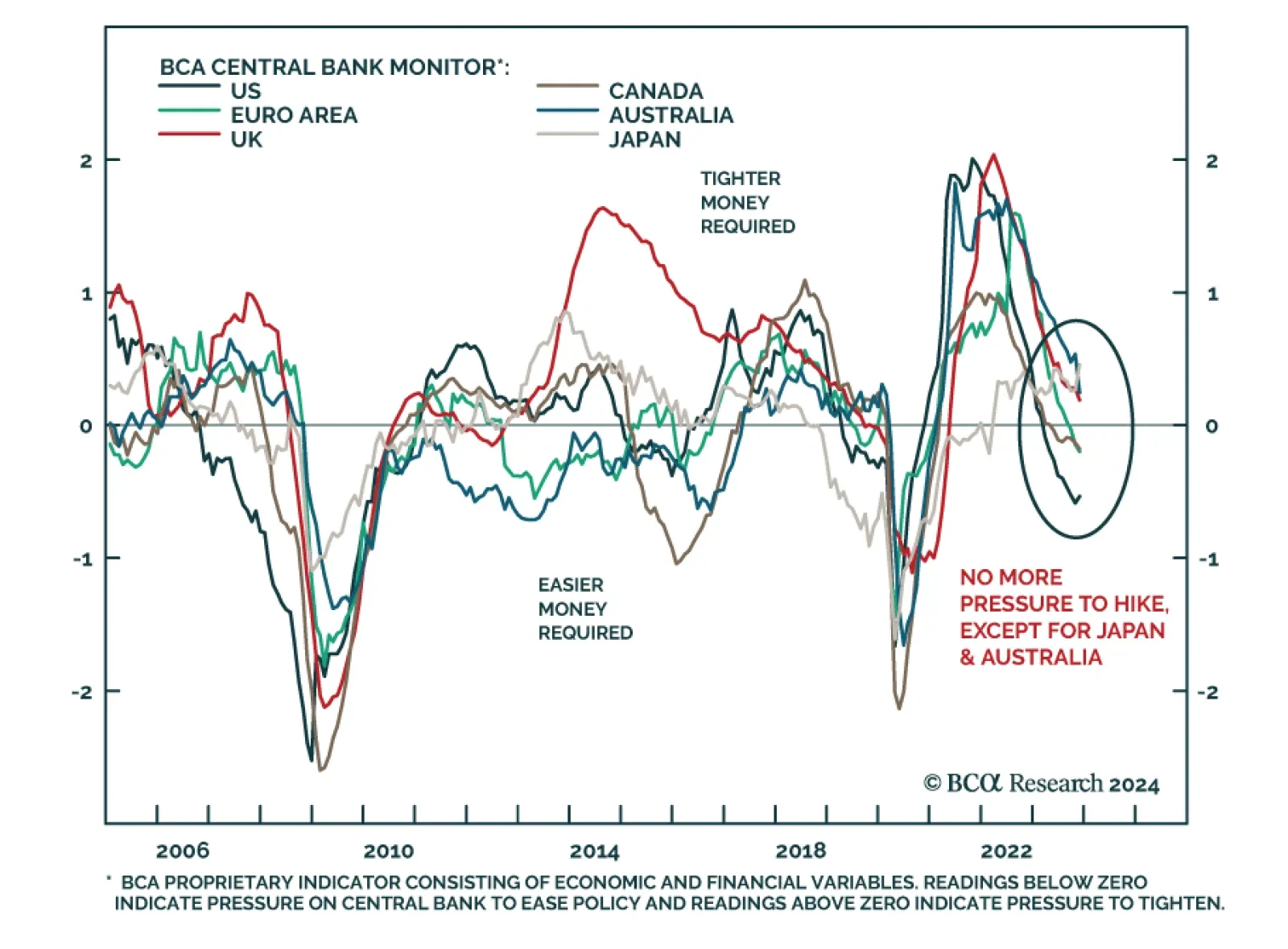

According to BCA Research’s Global Fixed Income Strategy service, the timing and pace of rate cuts in 2024 will differ across countries, representing a big sea change from the highly correlated rate hiking cycles of the…

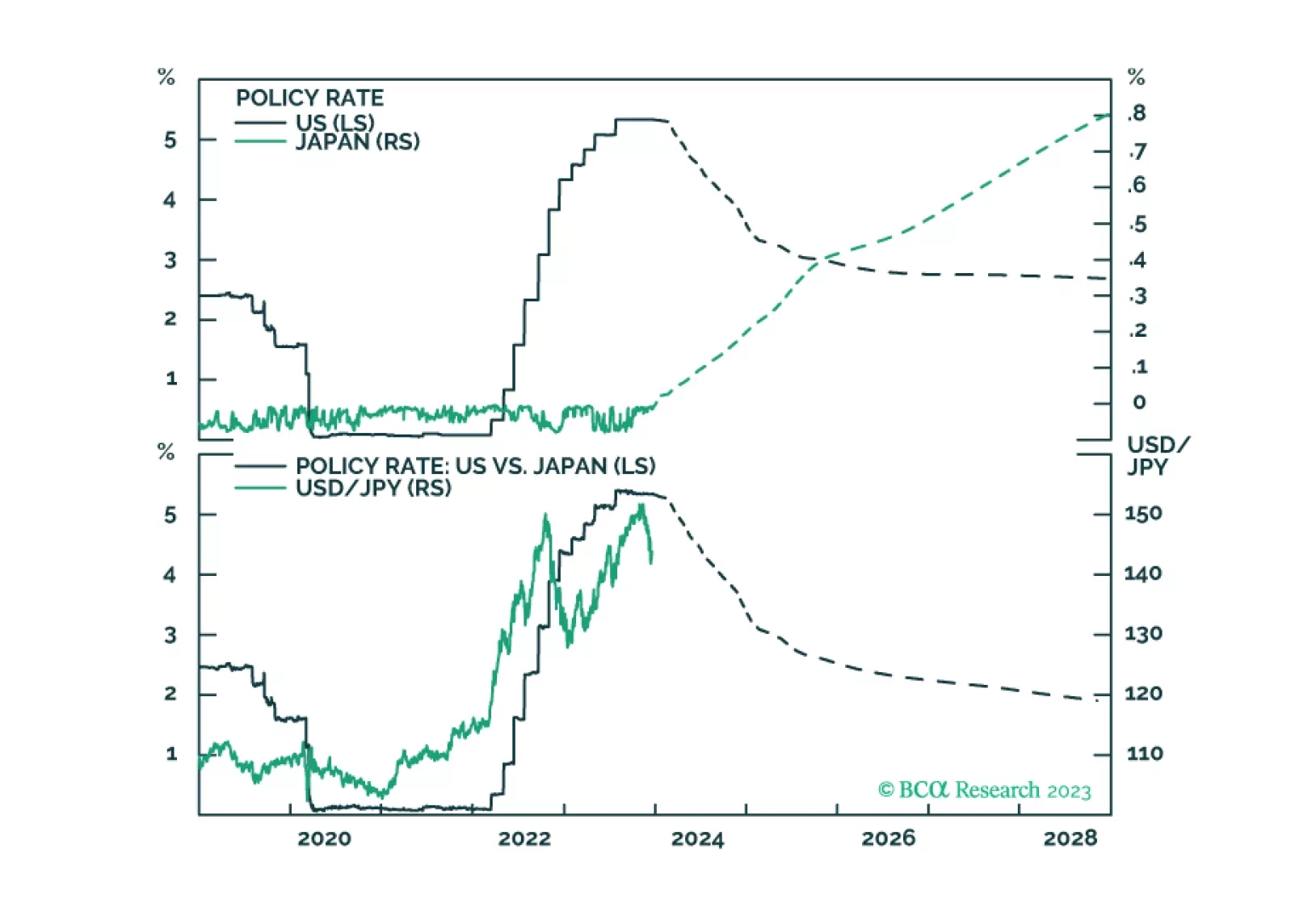

A post-mortem of our trades for the year, and also comments on future yen and sterling moves from the recent BoJ meeting, and the UK inflation report.

In Section I, we discuss the implications and potential risks of the Fed’s recent pivot. The near-term implications of the Fed's dovish pivot are likely to continue to be bullish for risky asset prices, and a new high in global stock…

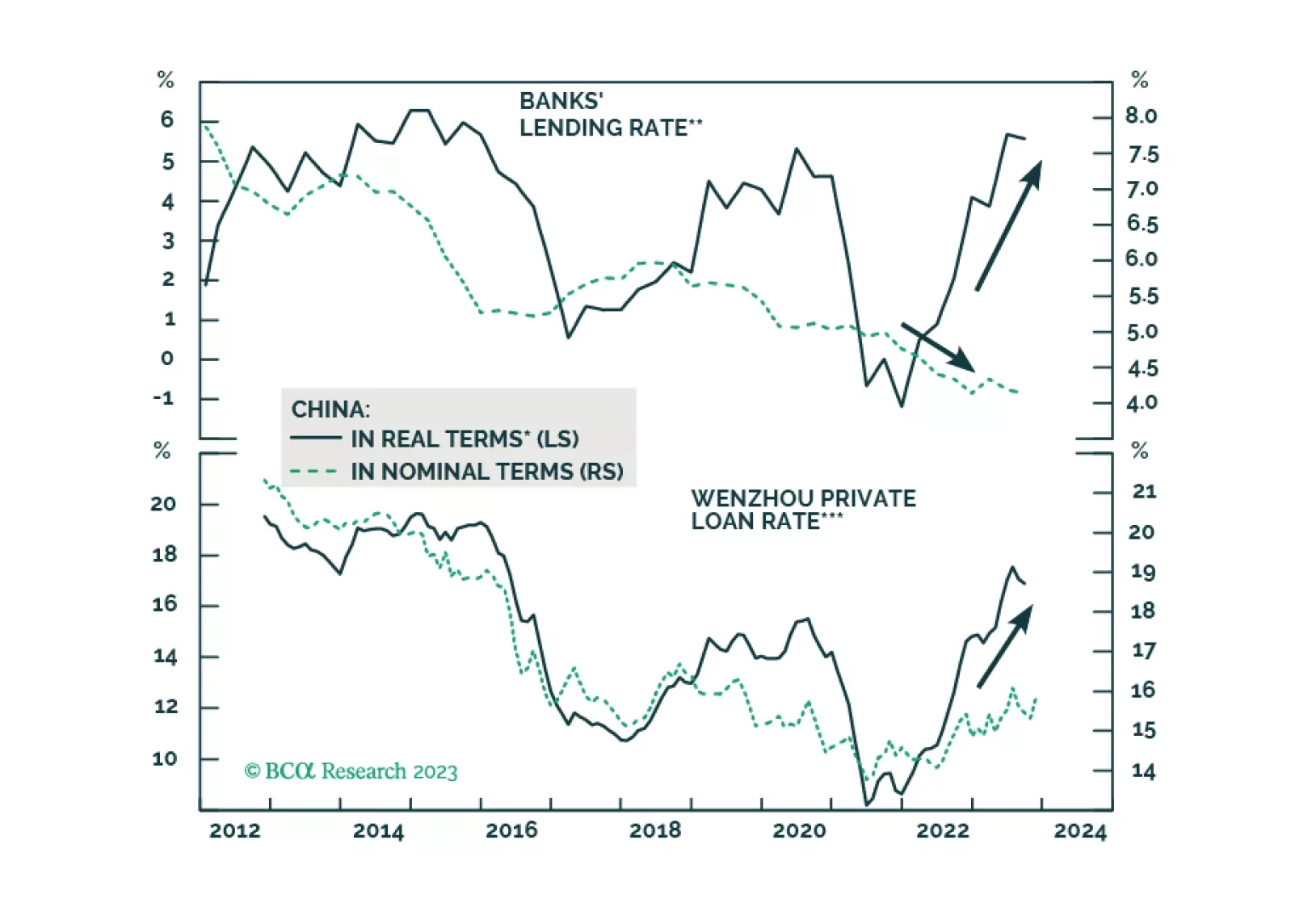

The statement from last week’s Central Economic Work Conference indicates that Chinese authorities are still not considering large-scale stimulus in 2024. Odds are that a full-fledged business cycle recovery in 2024 is unlikely.…