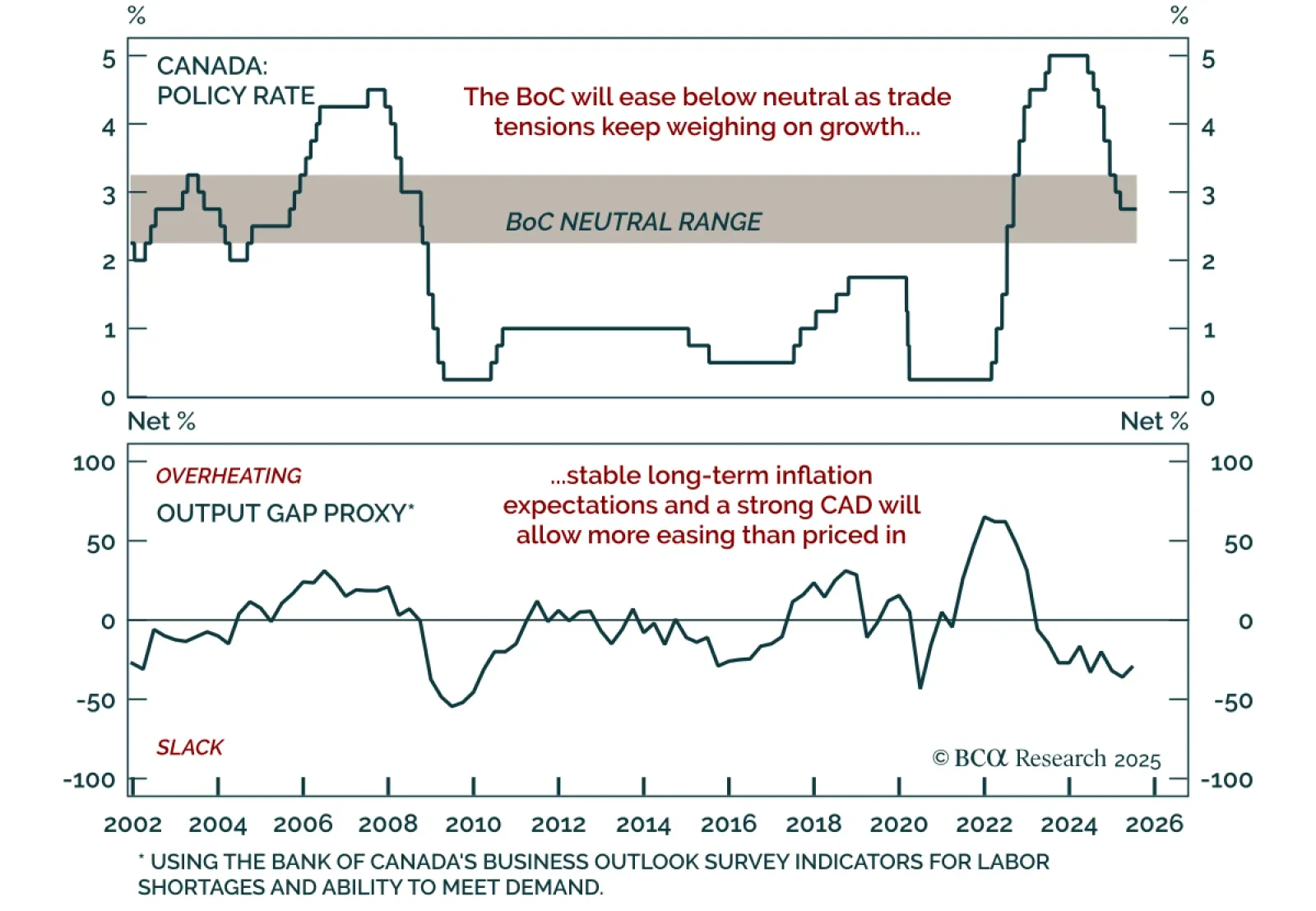

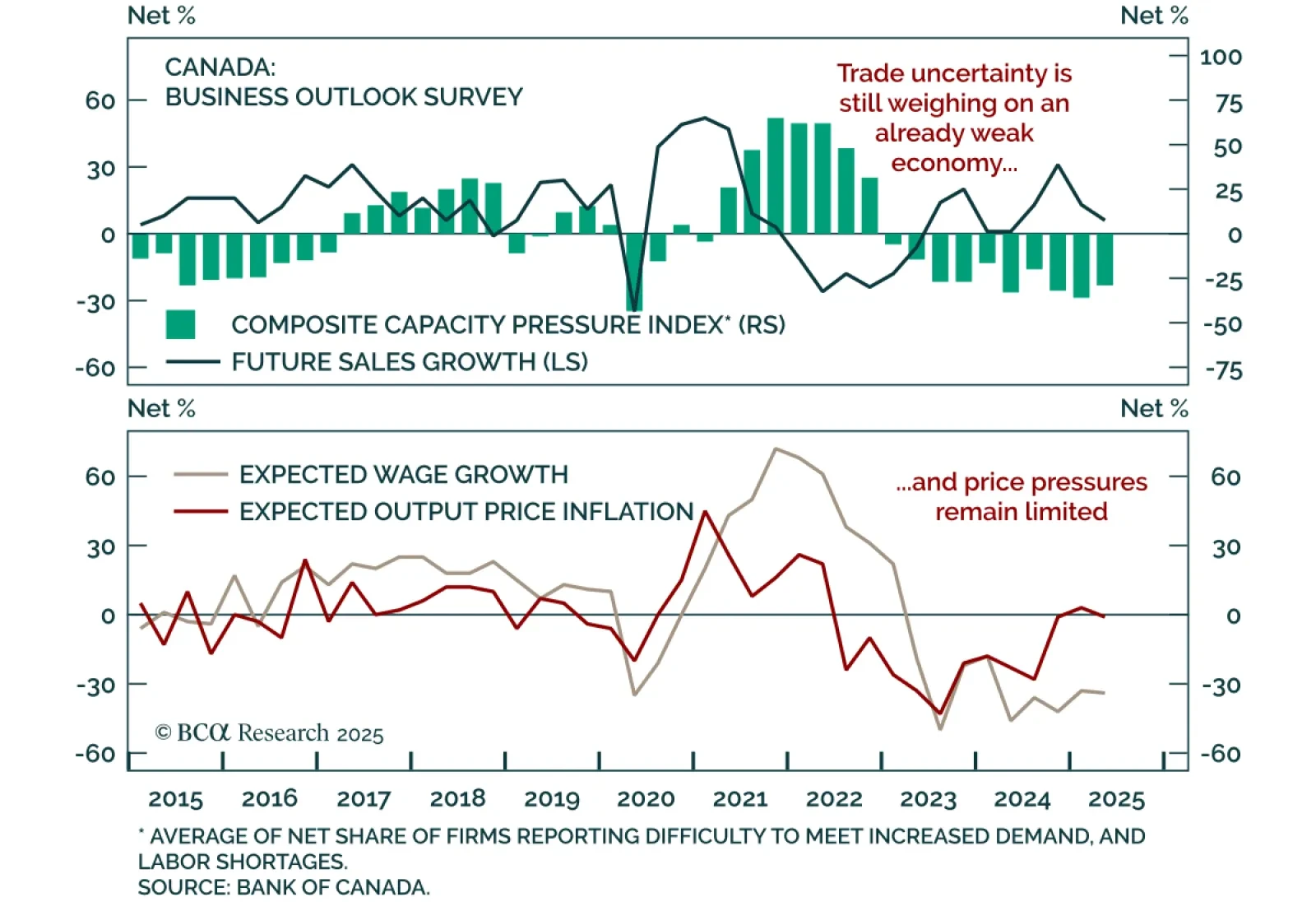

The BoC held rates at 2.75% for a third consecutive meeting, but a weak growth outlook and contained inflation reinforce our overweight in Canadian bonds. With policy within the 2.25%–3.25% neutral range, the BoC remains…

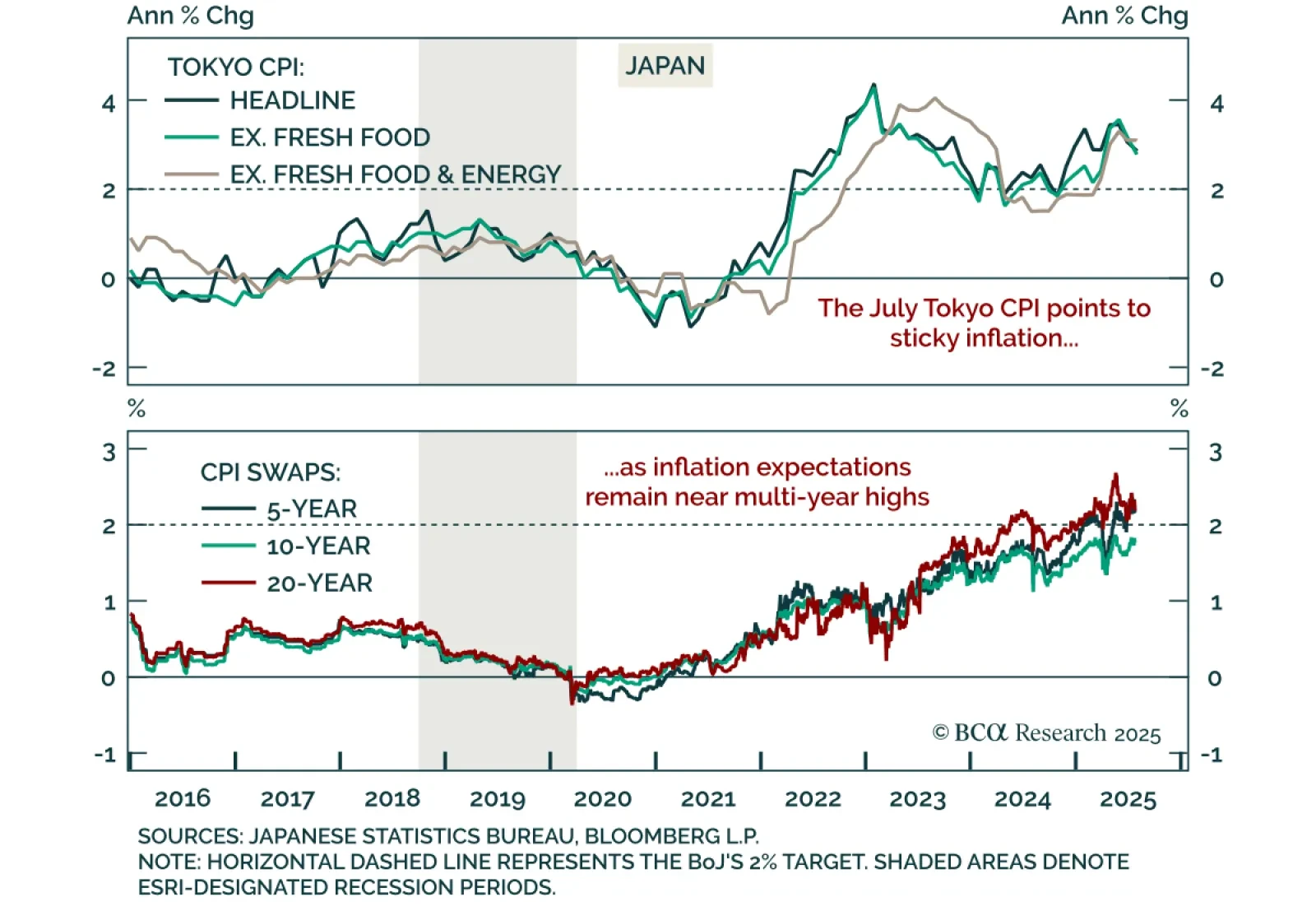

Tokyo CPI data confirms persistent inflation pressures in Japan, keeping the BoJ on a hawkish footing and reinforcing our underweight in JGBs and bullish stance on the yen. July Tokyo CPI came in broadly in line, falling to 2.9% y/y…

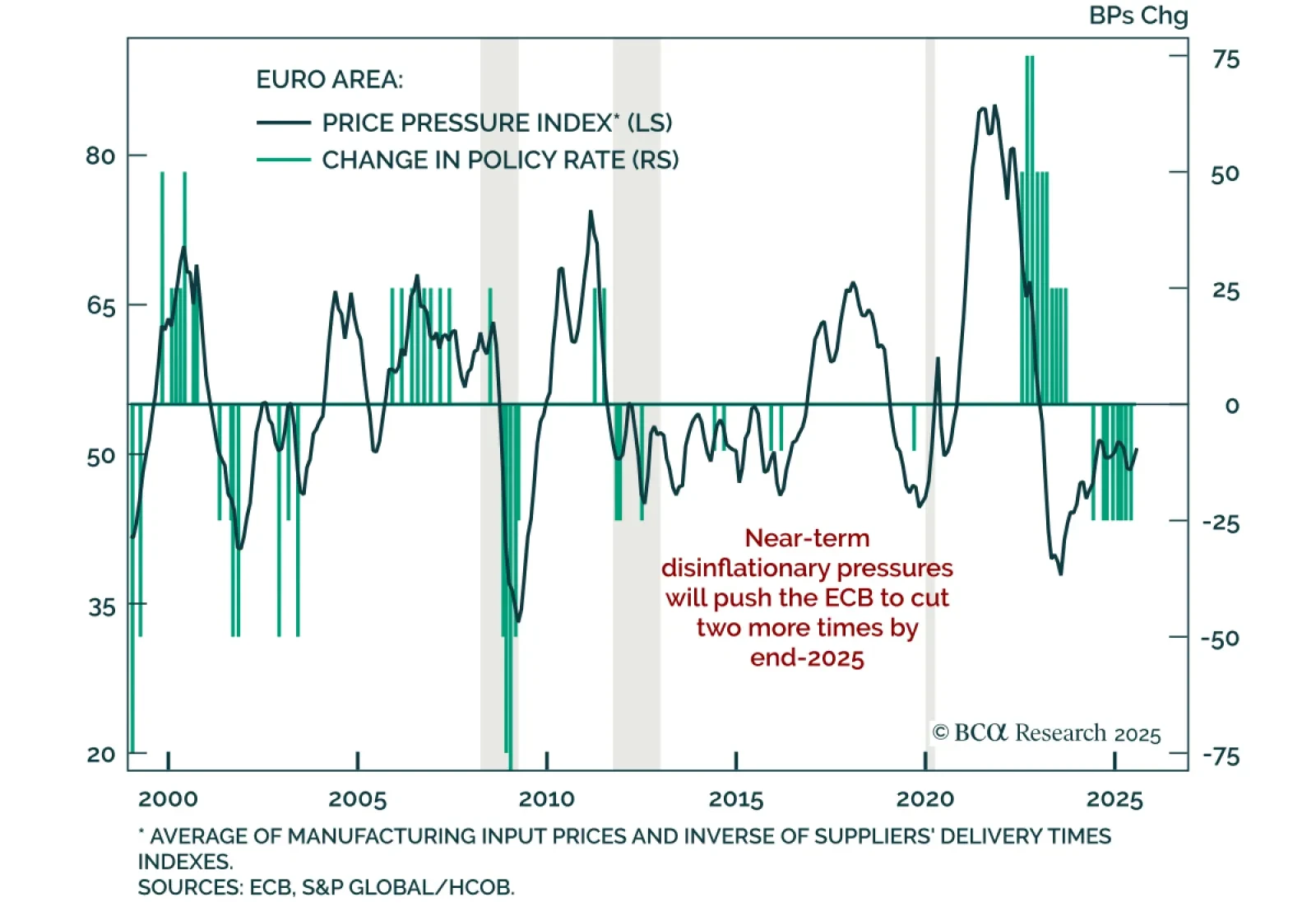

The ECB held rates steady for the first time in eight meetings, signaling a slower pace of easing while downside risks and entrenched disinflation support positioning for further cuts. The deposit facility rate remains at 2.0%,…

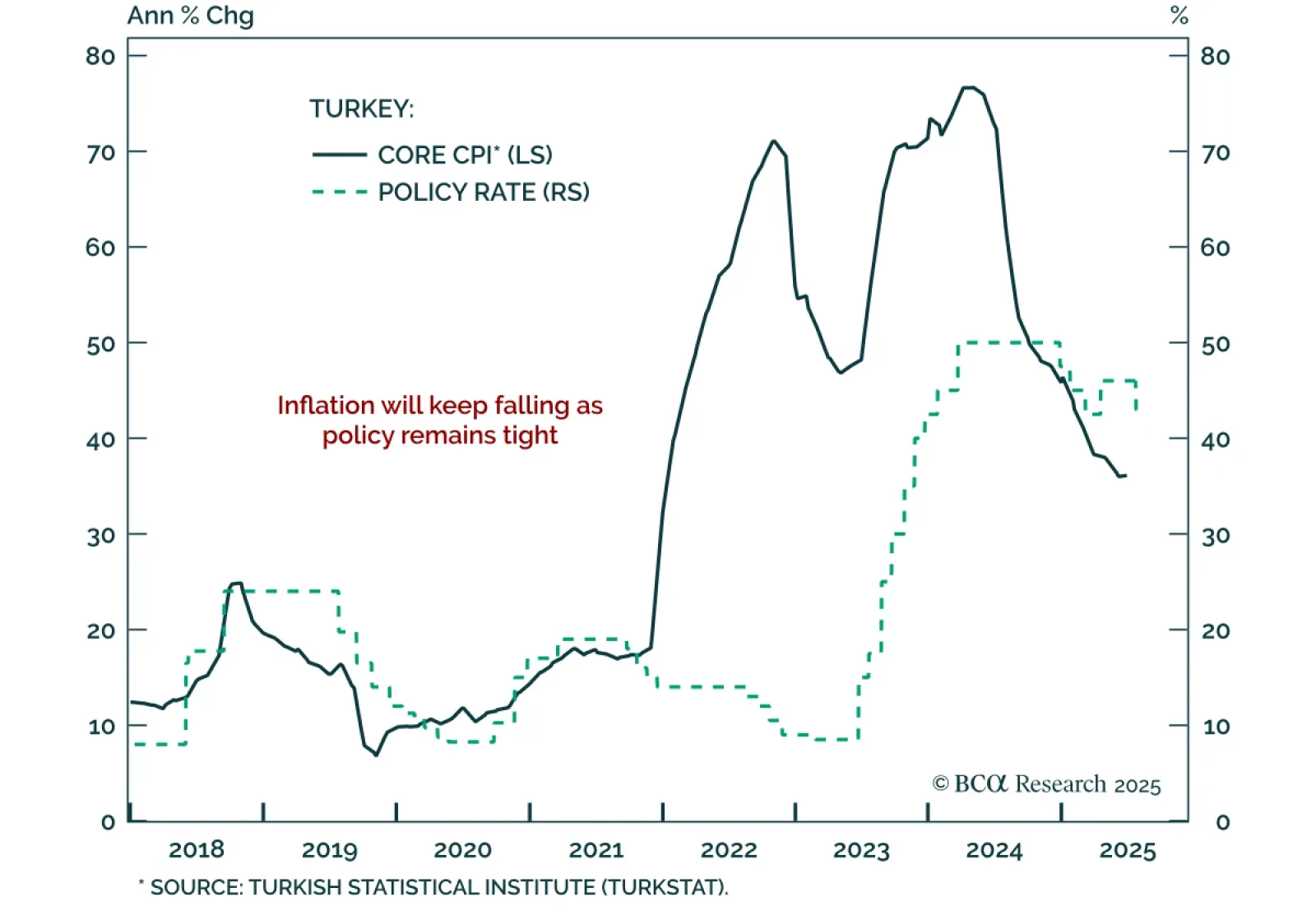

Our Emerging Markets strategists upgraded Turkey across assets, citing falling inflation, tight policy, and limited external imbalances. The Central Bank of Turkey cut its benchmark 1-week repo rate by 300 bps to 43%, citing…

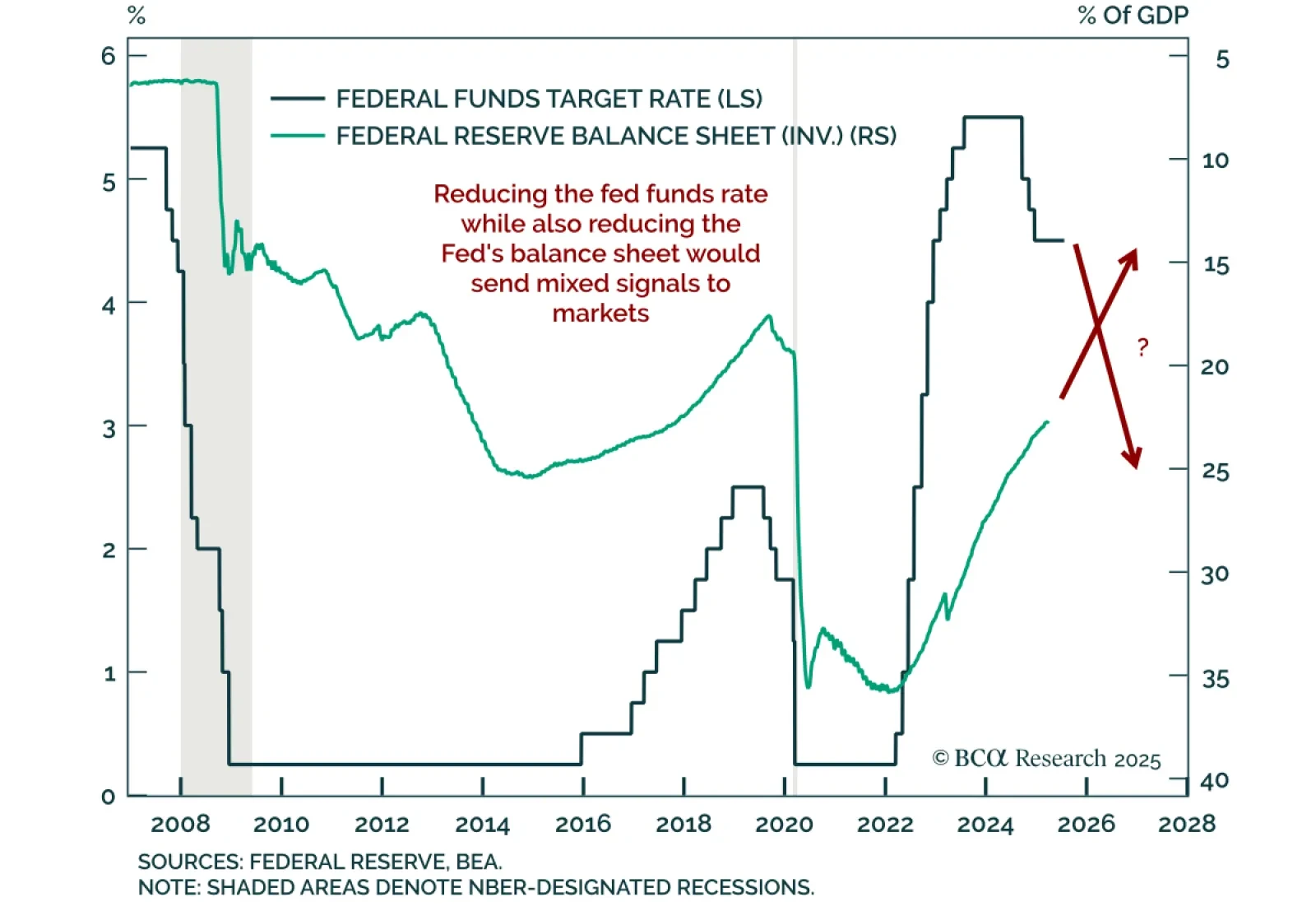

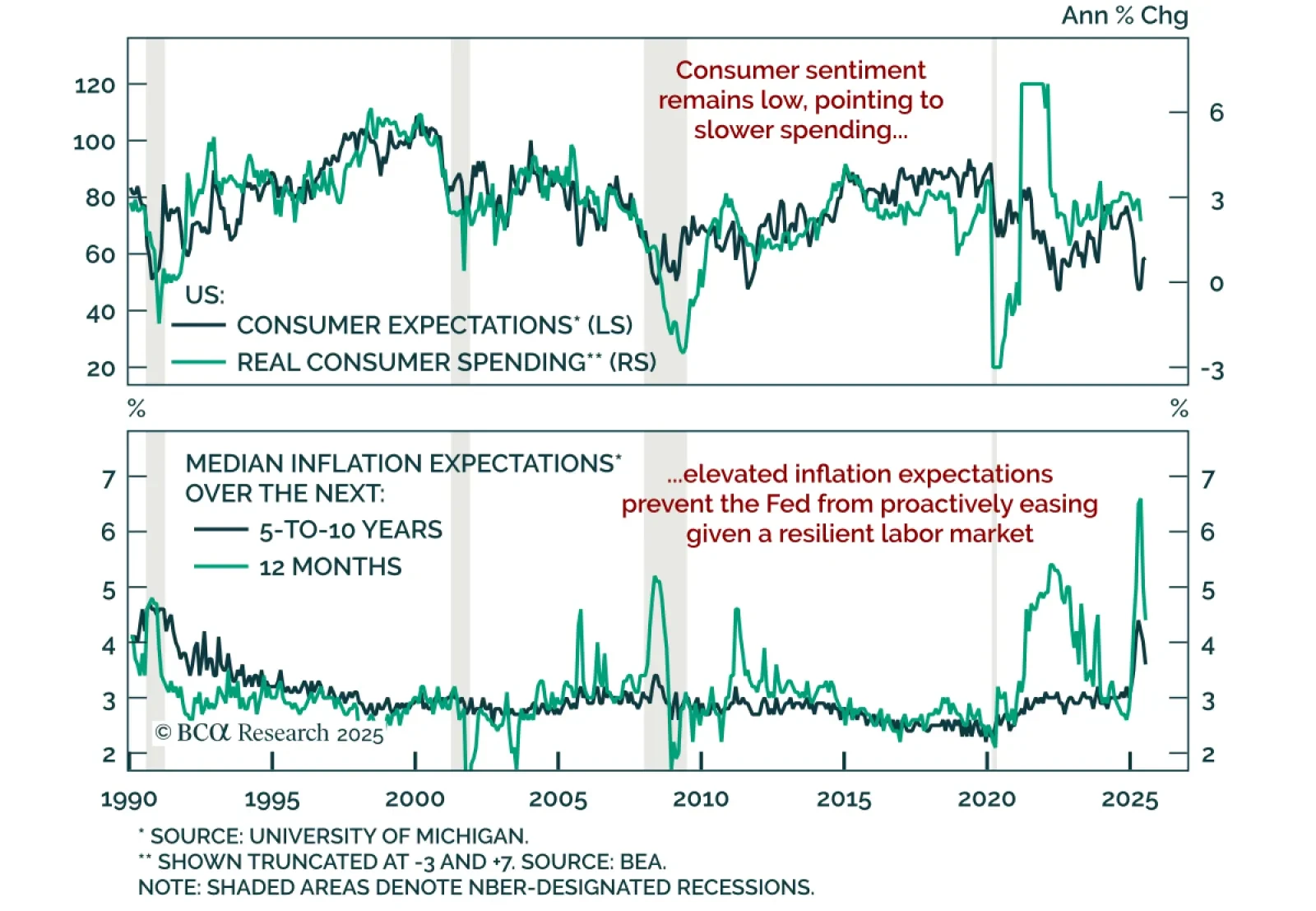

Recent criticism of the Fed centers on post-GFC policy, but proposed solutions would risk policy incoherence and higher long-end yields. Criticism covers the Fed’s reliance on balance sheet policies aimed at easing financial…

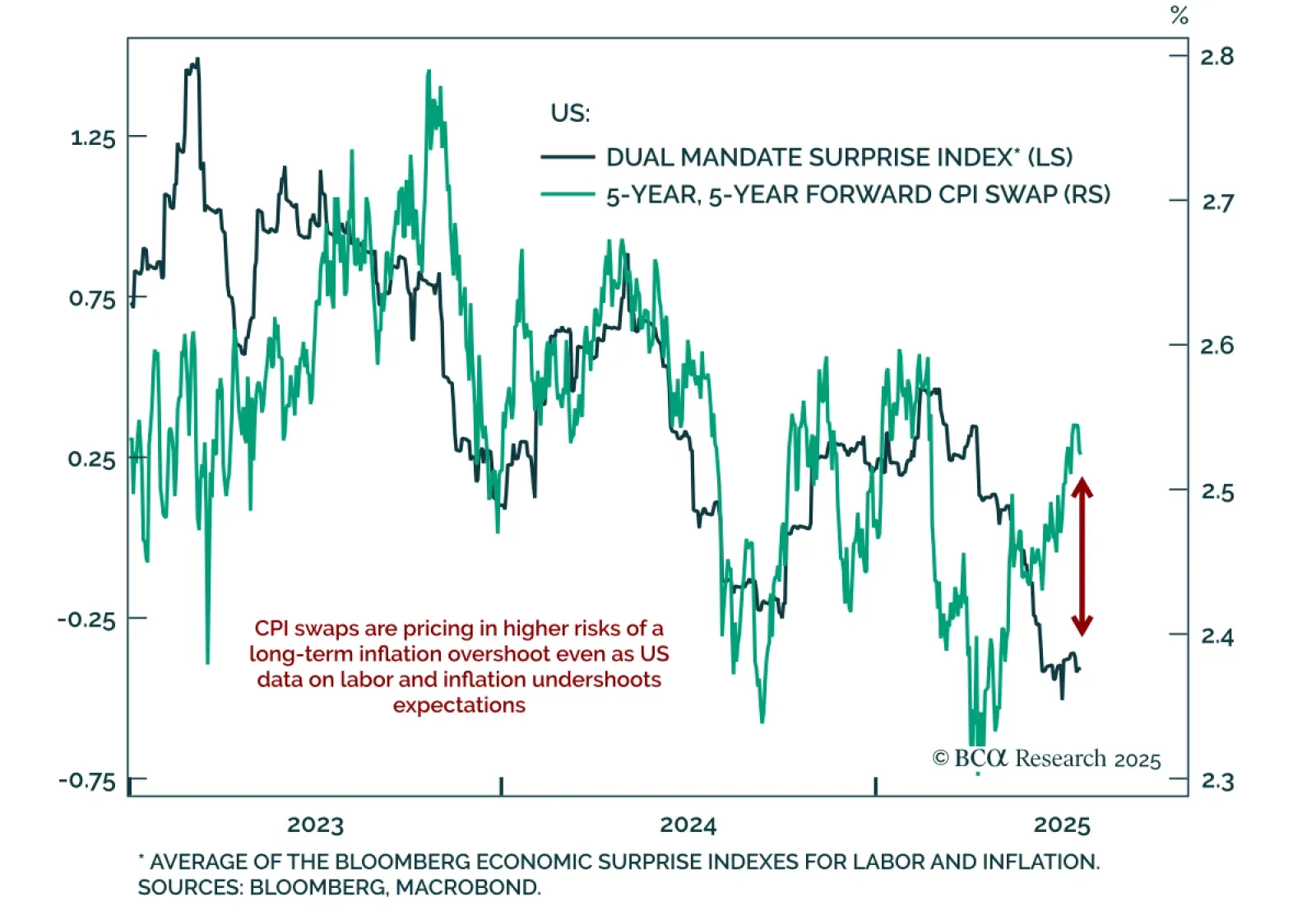

Rising political pressure on the Fed risks undermining policy credibility, risking a de-anchoring of long-term inflation expectations. The Trump administration keeps escalating attacks on Fed Chair Powell. While the Fed…

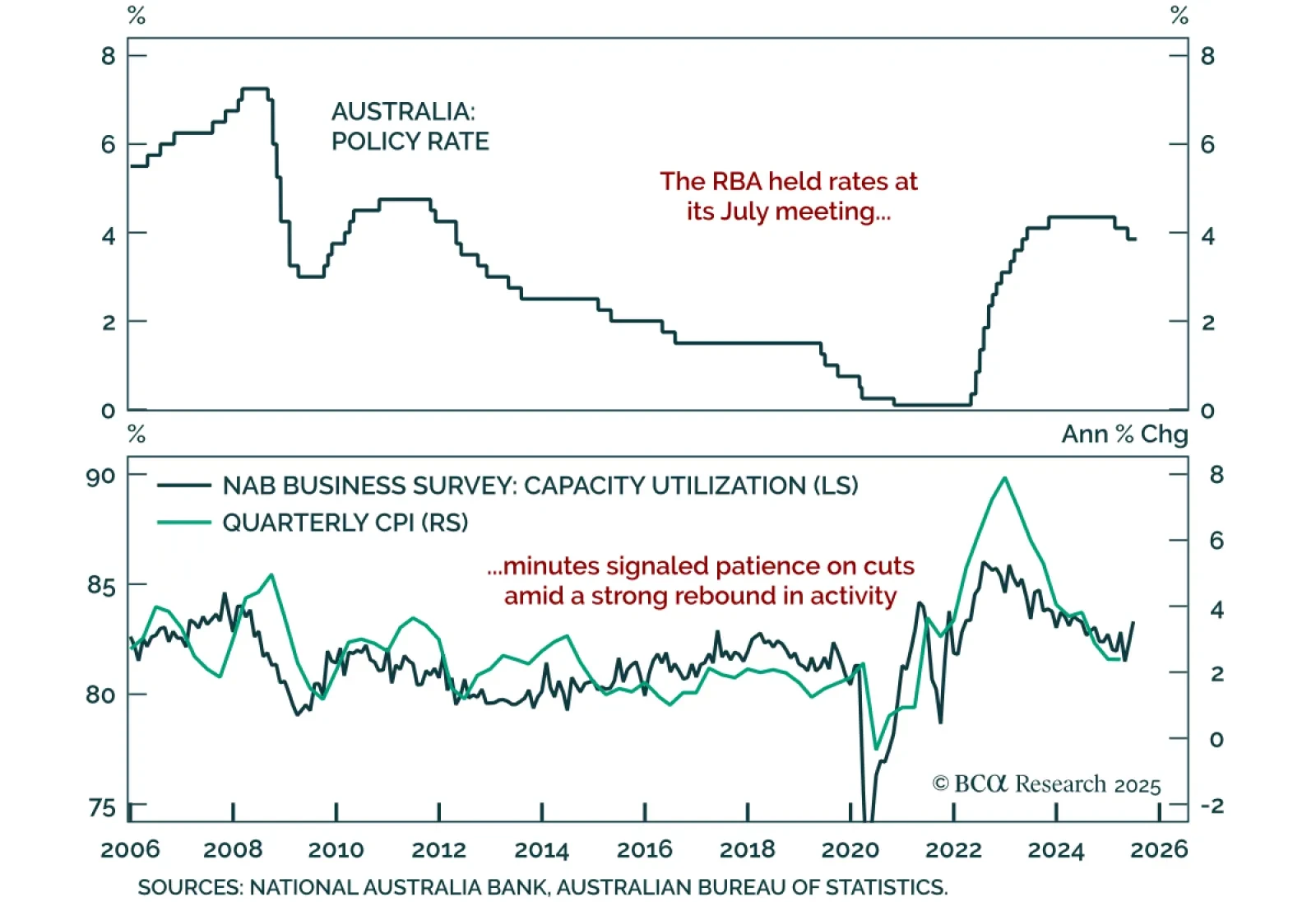

RBA minutes confirmed a cautious approach to easing, reinforcing our underweight in ACGBs and long AUD/NZD stance. The decision to hold at 3.85% surprised markets expecting a 25 bps cut. Governor Bullock had framed the decision…

The Q2 Business Outlook Survey showed weaker sentiment and subdued hiring and investment intentions, reinforcing the case for deeper BoC rate cuts and our overweight in Canadian bonds. The BOS indicator ticked down to -2.4 from -2.1…

Consumer sentiment improved modestly in July, but remains at levels that still point to subdued spending, reinforcing our defensive stance. The preliminary University of Michigan index rose to 61.8 from 60.7 in June. Expectations…