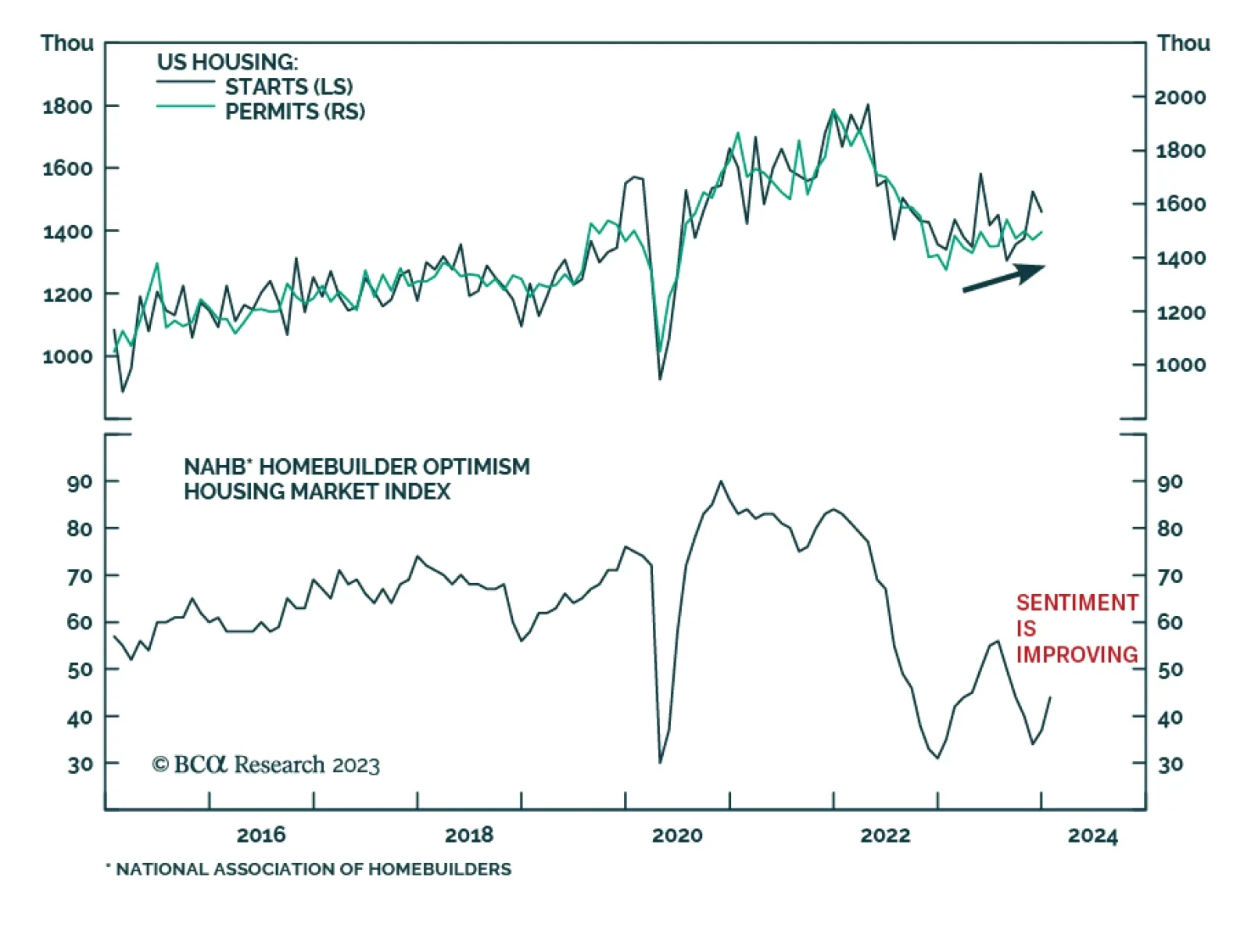

Recent data suggest that the US housing market is resilient. In particular, a strong rebound in homebuilder sentiment is sending a positive signal. The NAHB Housing Market Index jumped from 37 to 44 in January – handily…

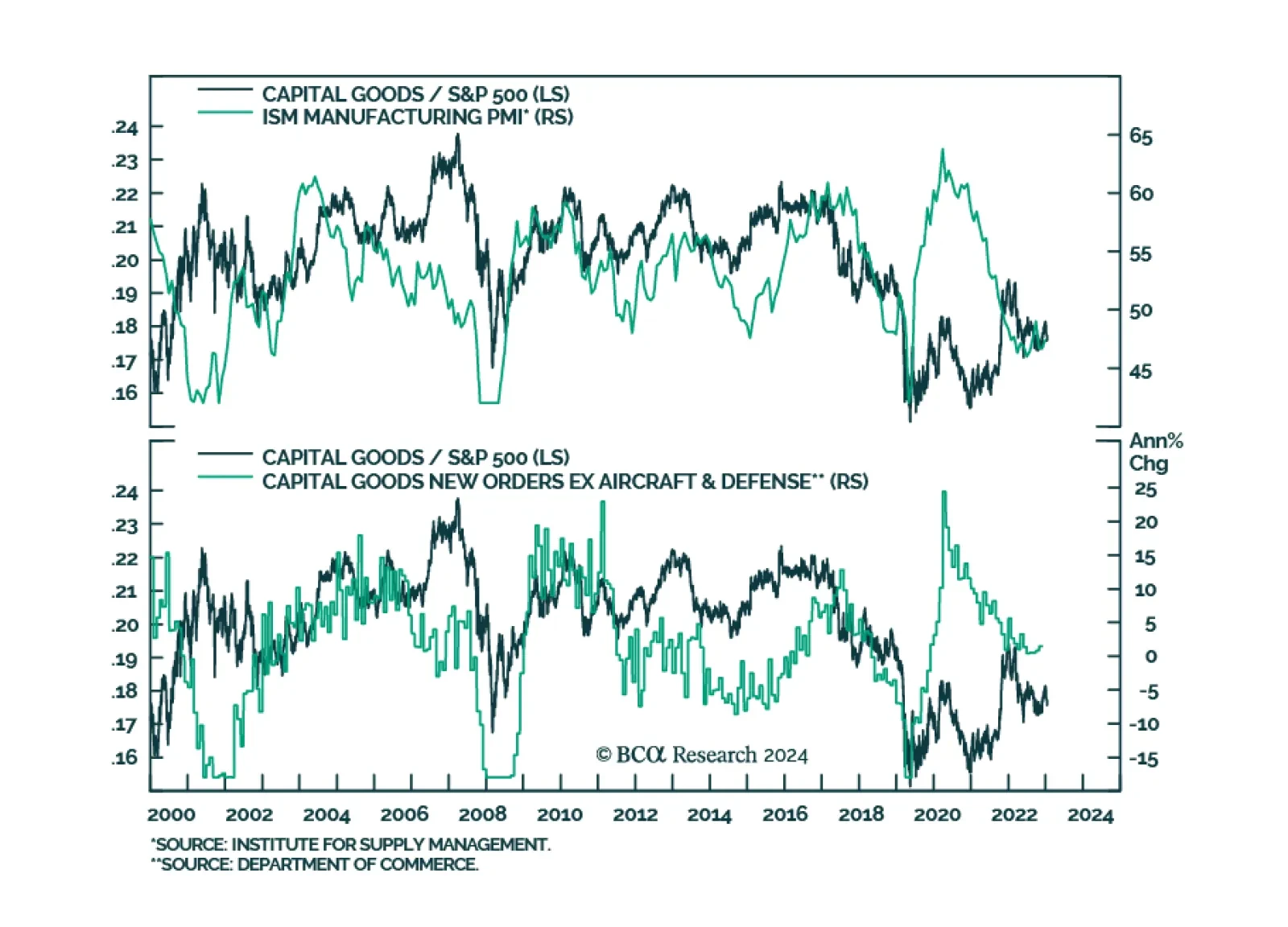

The performance of the Industrials sector tends to lag the business cycle, as companies invest in capex on the heels of economic expansion. But demand is not entirely cyclical, as the need to replace obsolete or aging equipment…

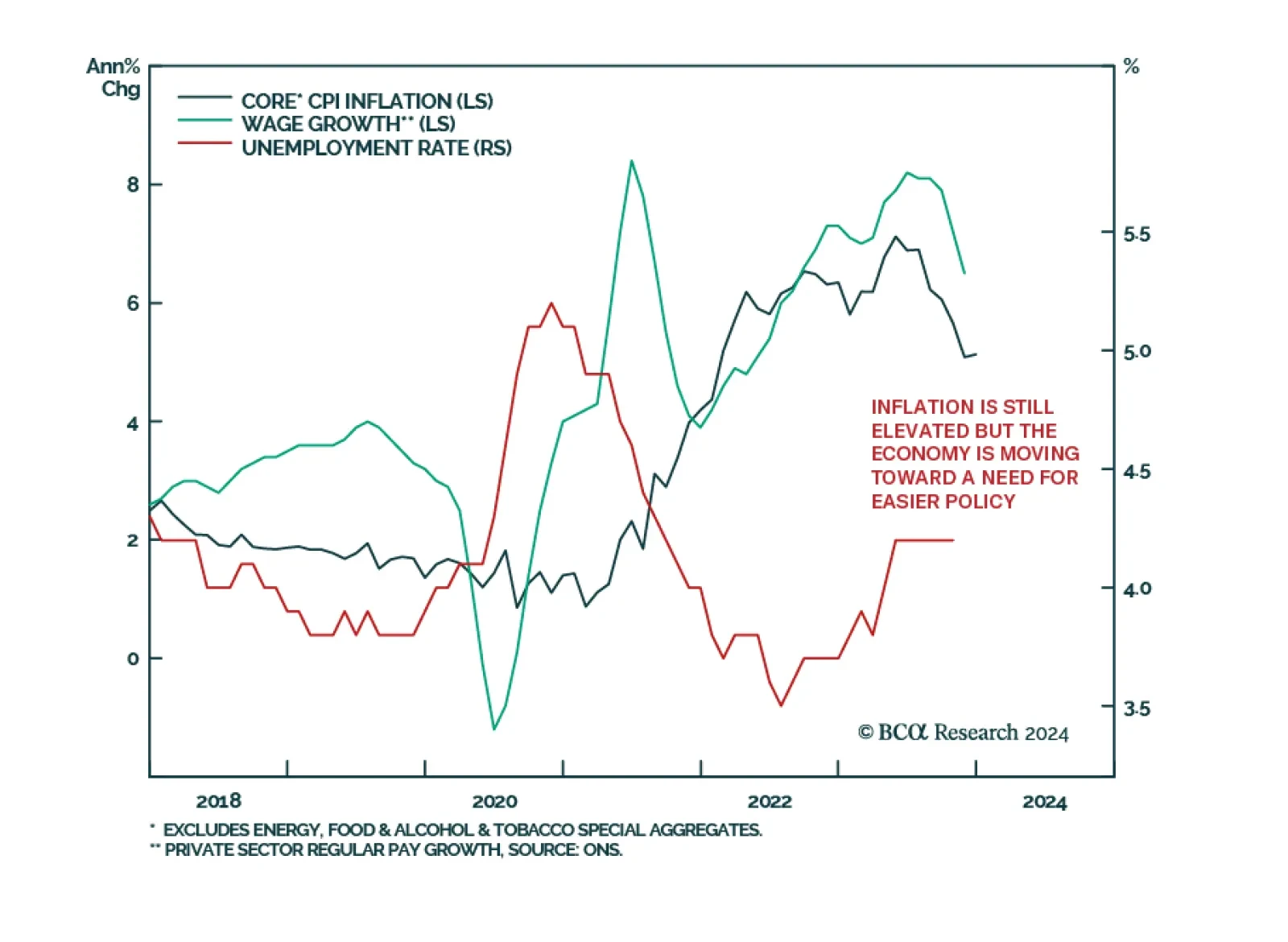

The British pound was the best performing G10 currency on Wednesday as UK gilts sold off meaningfully with the 10-year yield ending the day nearly 19 basis points higher. An unexpected acceleration in CPI inflation in December…

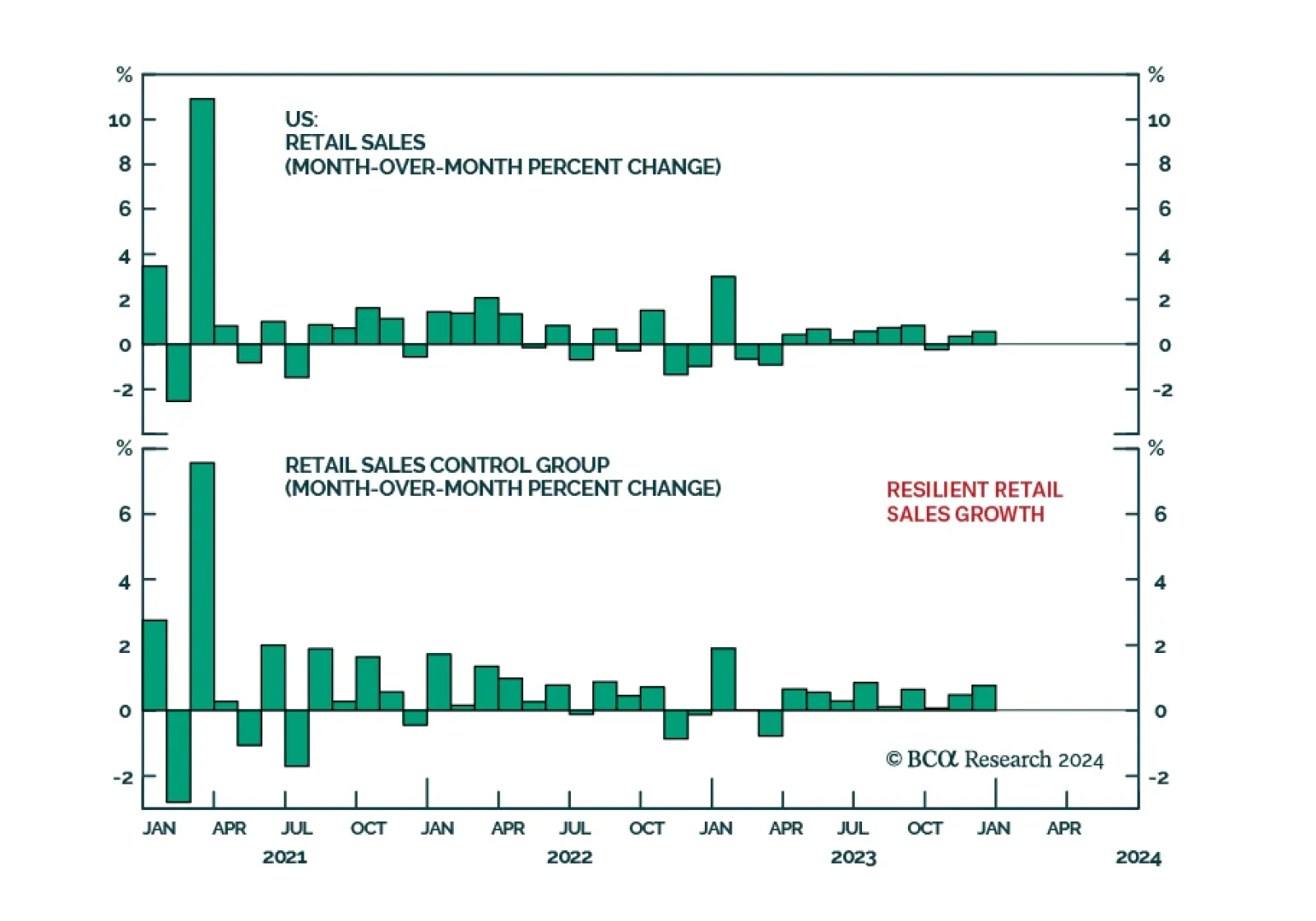

The US retail sales release delivered a positive signal about the US economy in December. The 0.6% m/m increase in overall retail sales beat expectations of a more muted acceleration from 0.3% m/m to 0.4% m/m. Importantly, the…

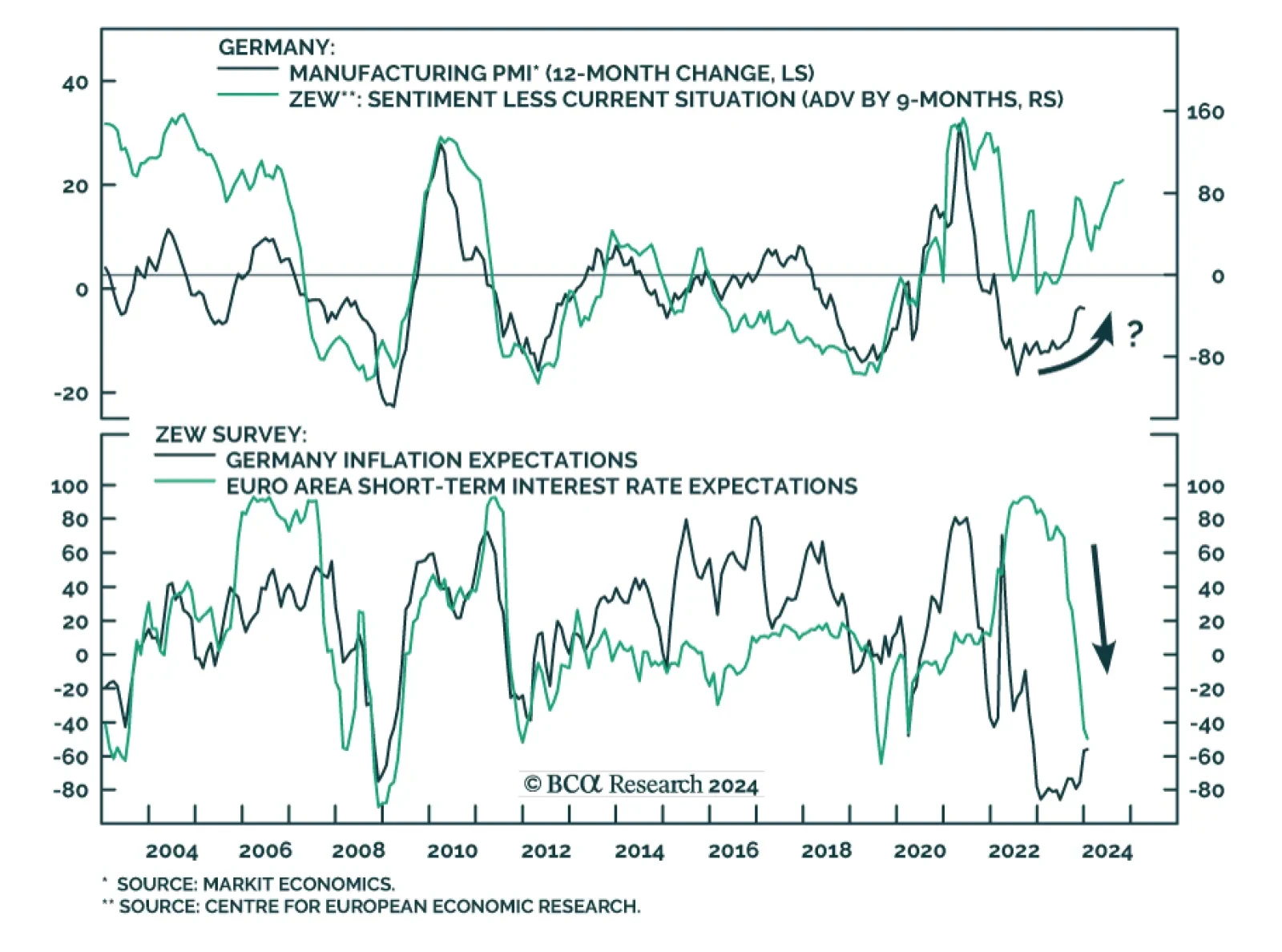

Results of the ZEW survey sent a slightly positive signal on German investor sentiment. The economic expectations indicator rose to an 11-month high in January – beating consensus estimates of a decline. This increased…

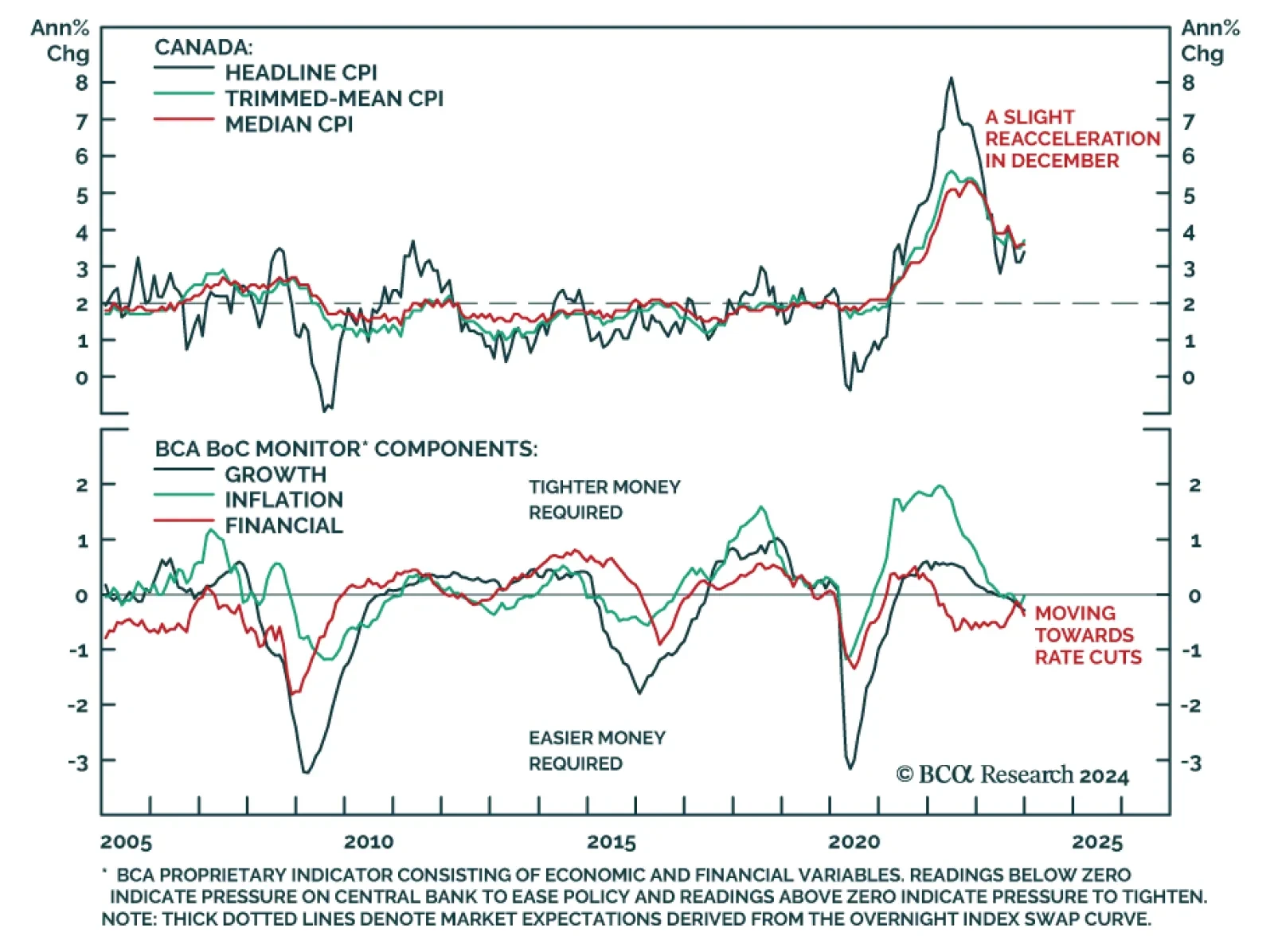

Canadian government bond yields jumped on Tuesday, with the 10-year yield rising by nearly 14 basis points. While most other major DM government bonds also sold off, the move in Canadian yields was relatively more pronounced.…

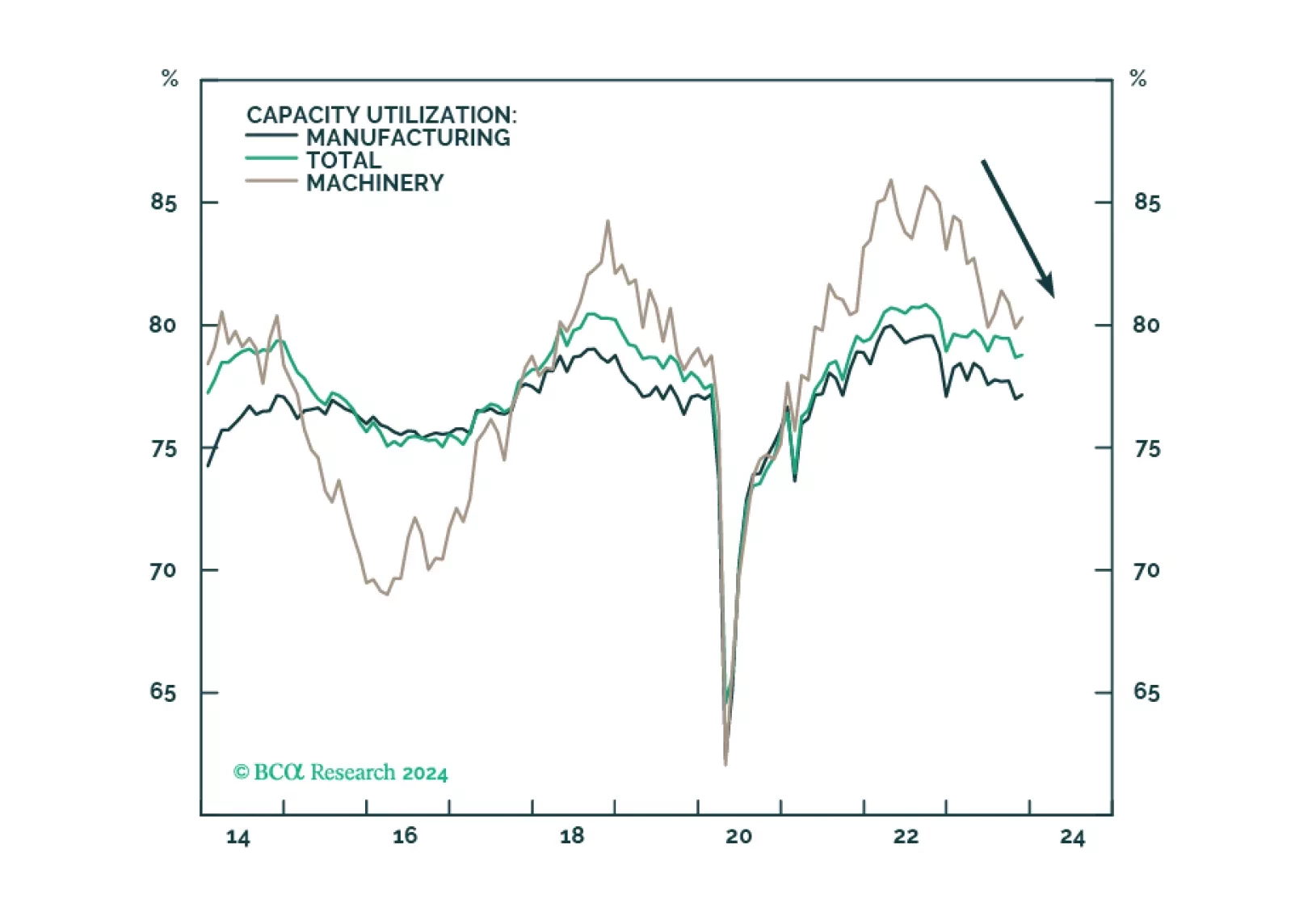

The US manufacturing renaissance, spurred on by reshoring, automation, and government spending, is running its course but progress has slowed on the back of tight monetary conditions and the manufacturing recession. The deceleration…

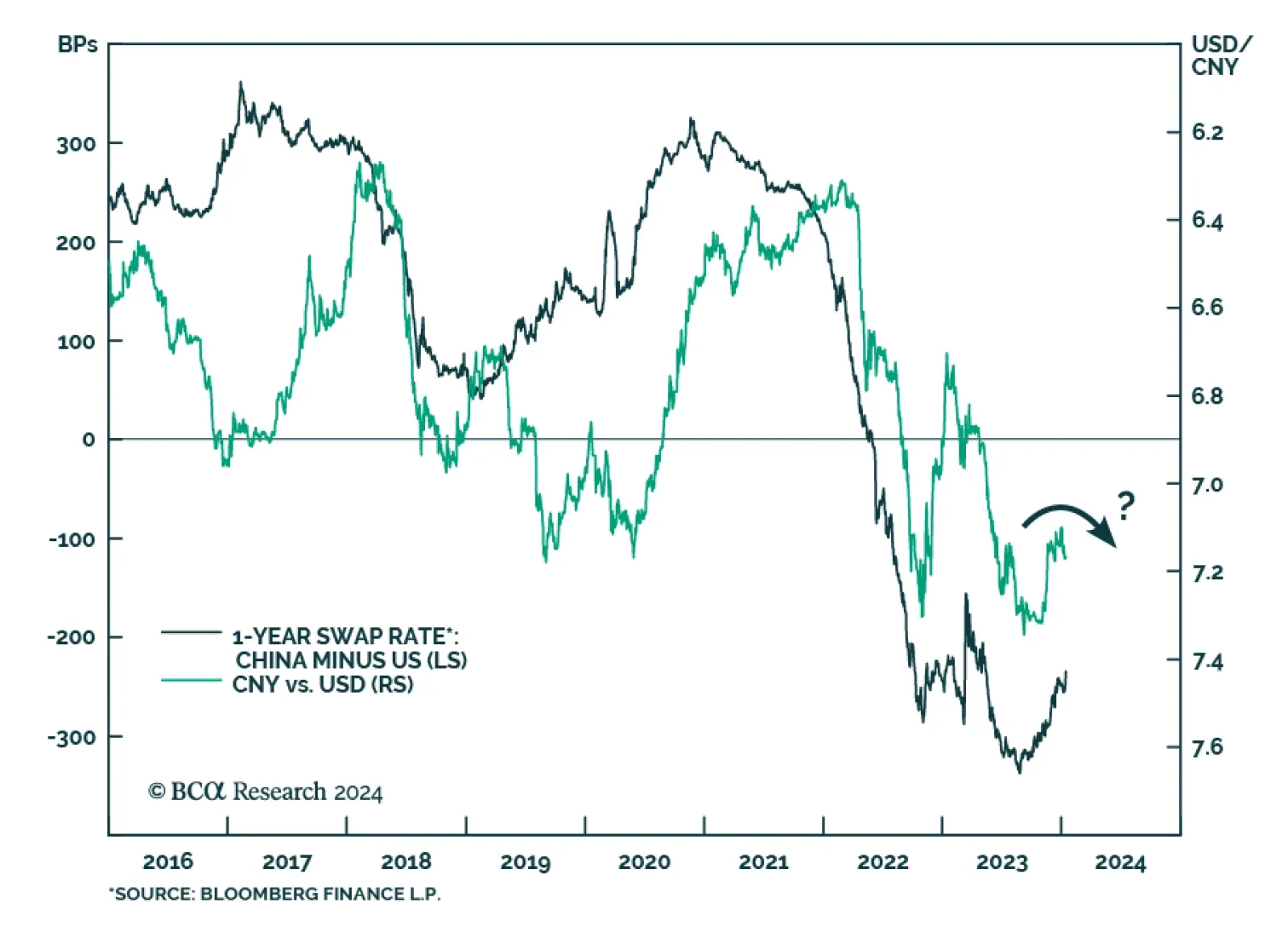

China’s central bank unexpectedly held the medium-term policy rate unchanged at 2.5% on Monday, surprising expectations of a 10 basis point cut. Given that deflationary forces dominate China’s economy, the decision to…

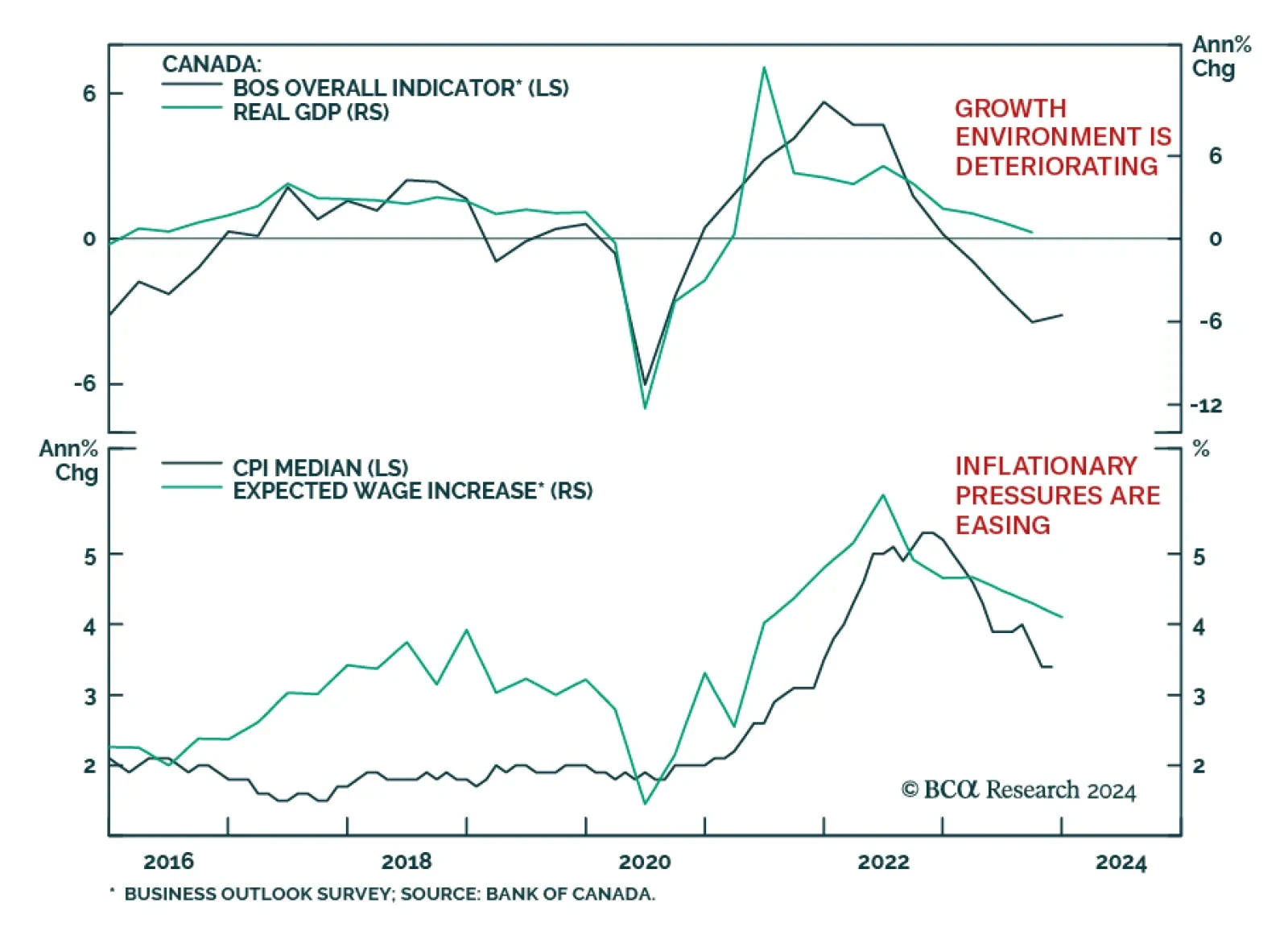

Canada’s Business Outlook Survey (BOS) indicator increased slightly in Q4, suggesting that sentiment stabilized at the end of 2023. In particular, easing inflationary pressures amid weaker demand and greater competition…

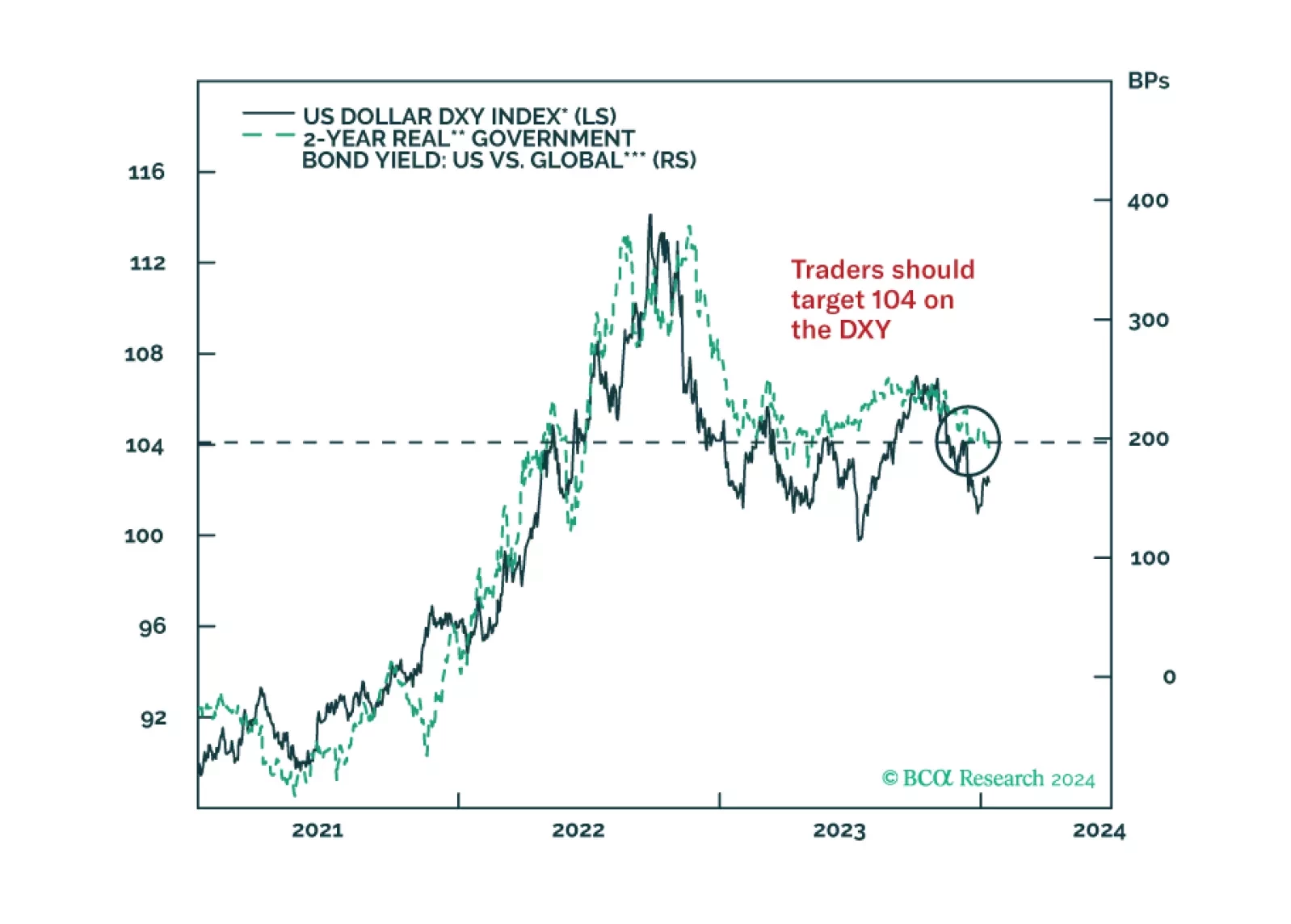

In light of the hotter-than-expected US CPI report, we look at what interest rate currency investors should focus on. Our conclusion largely keeps our existing trades in place, as published in our outlook, a few weeks ago.