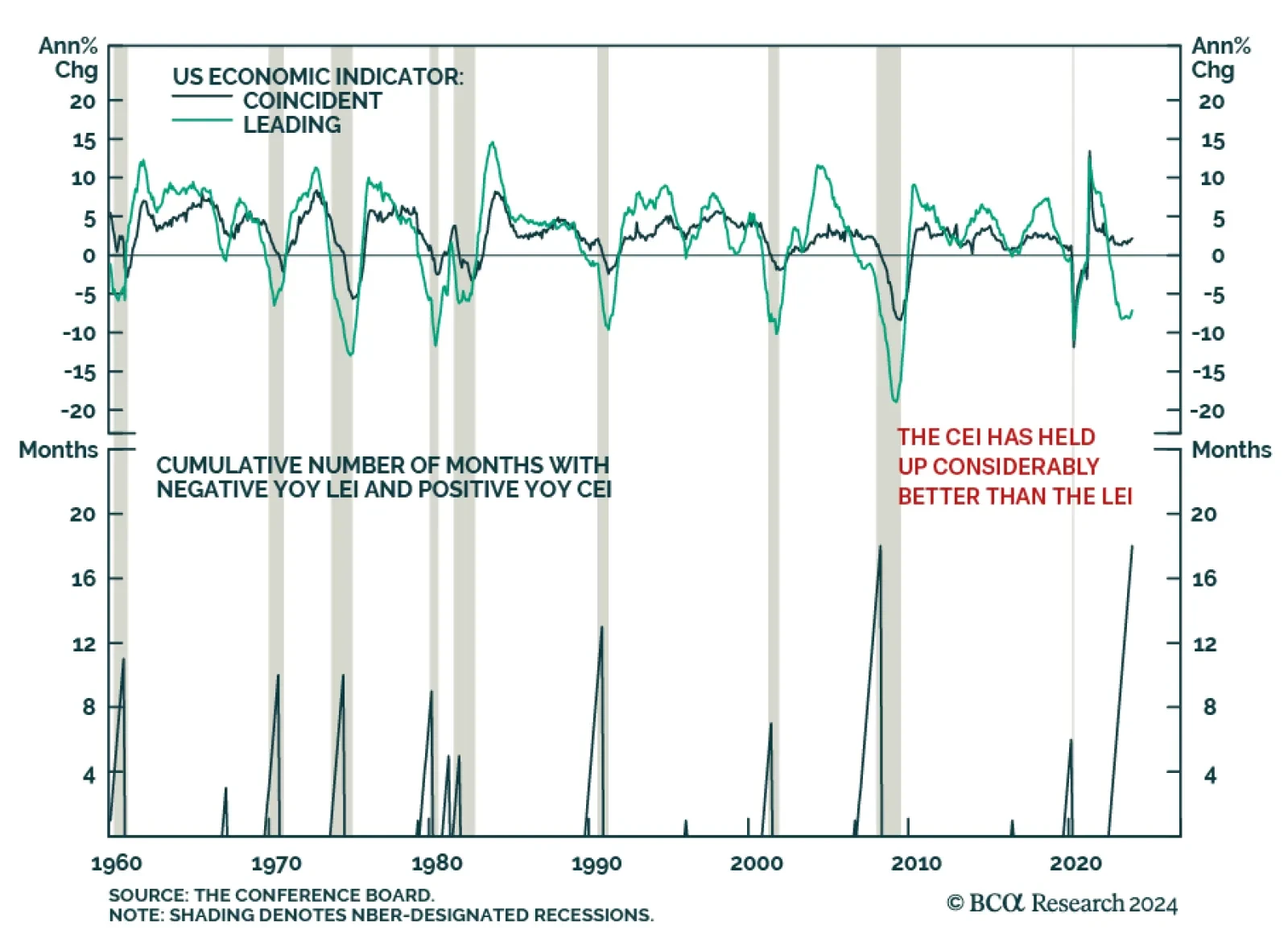

The US Conference Board’s Leading Economic Indicator (LEI) sent a mixed signal on Monday. On the one hand, the LEI posted its 22nd consecutive month-over-month decline in December – a negative sign for the…

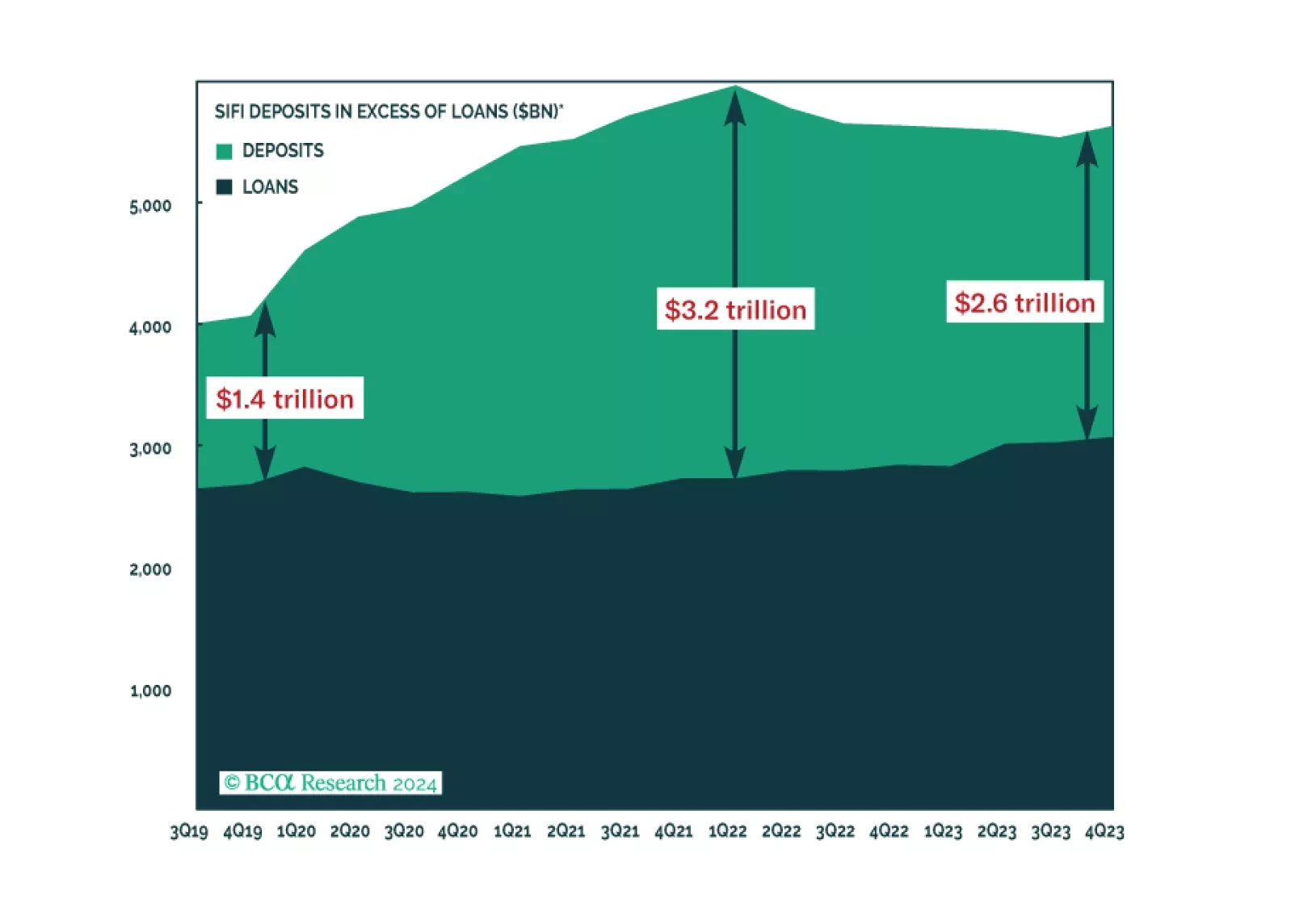

The SIFI banks expressed confidence in their credit outlook for 2024 and expect that credit losses will crest soon, given the reserves they’ve already set aside. Their implicit embrace of the soft-landing narrative suggests to us…

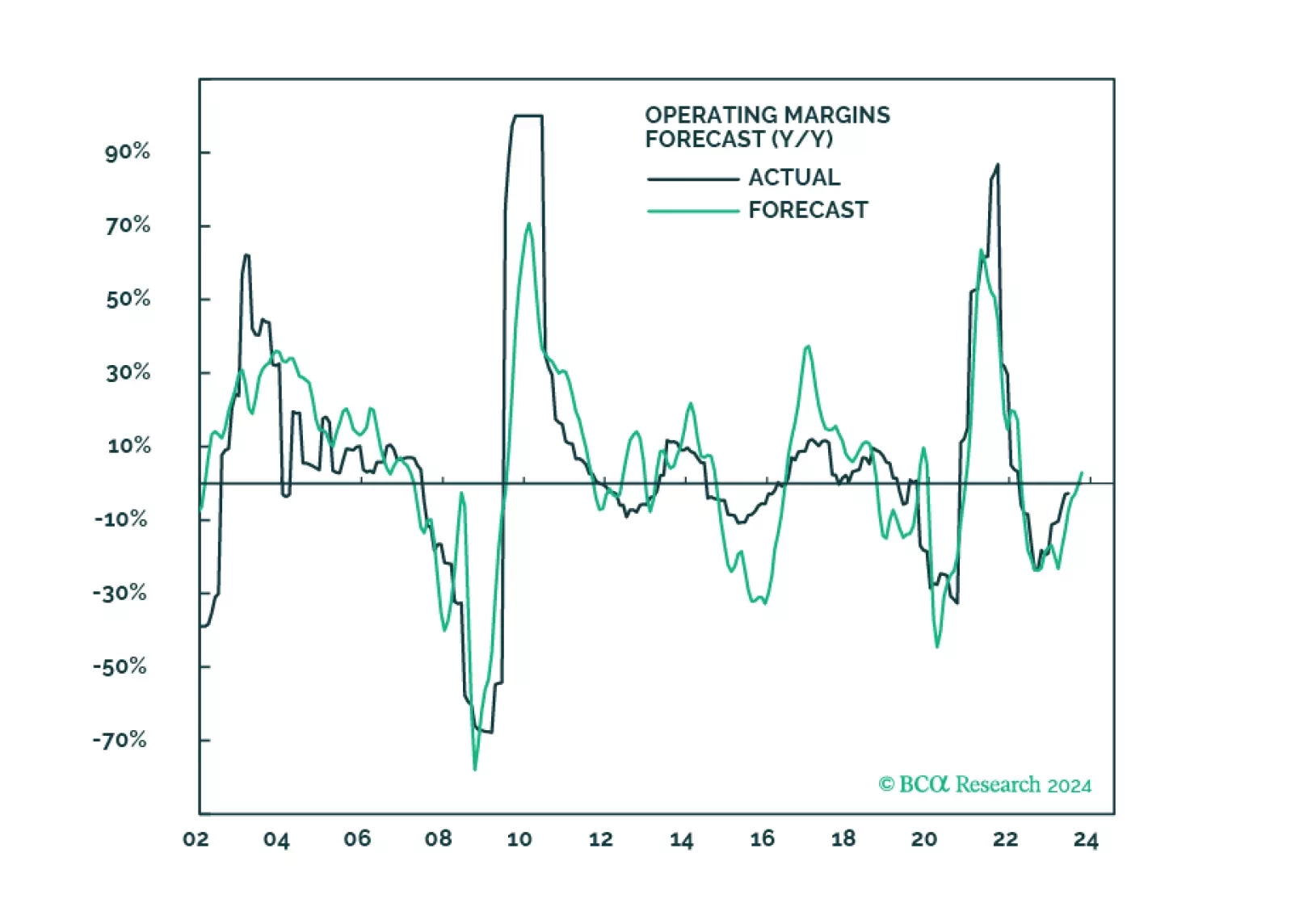

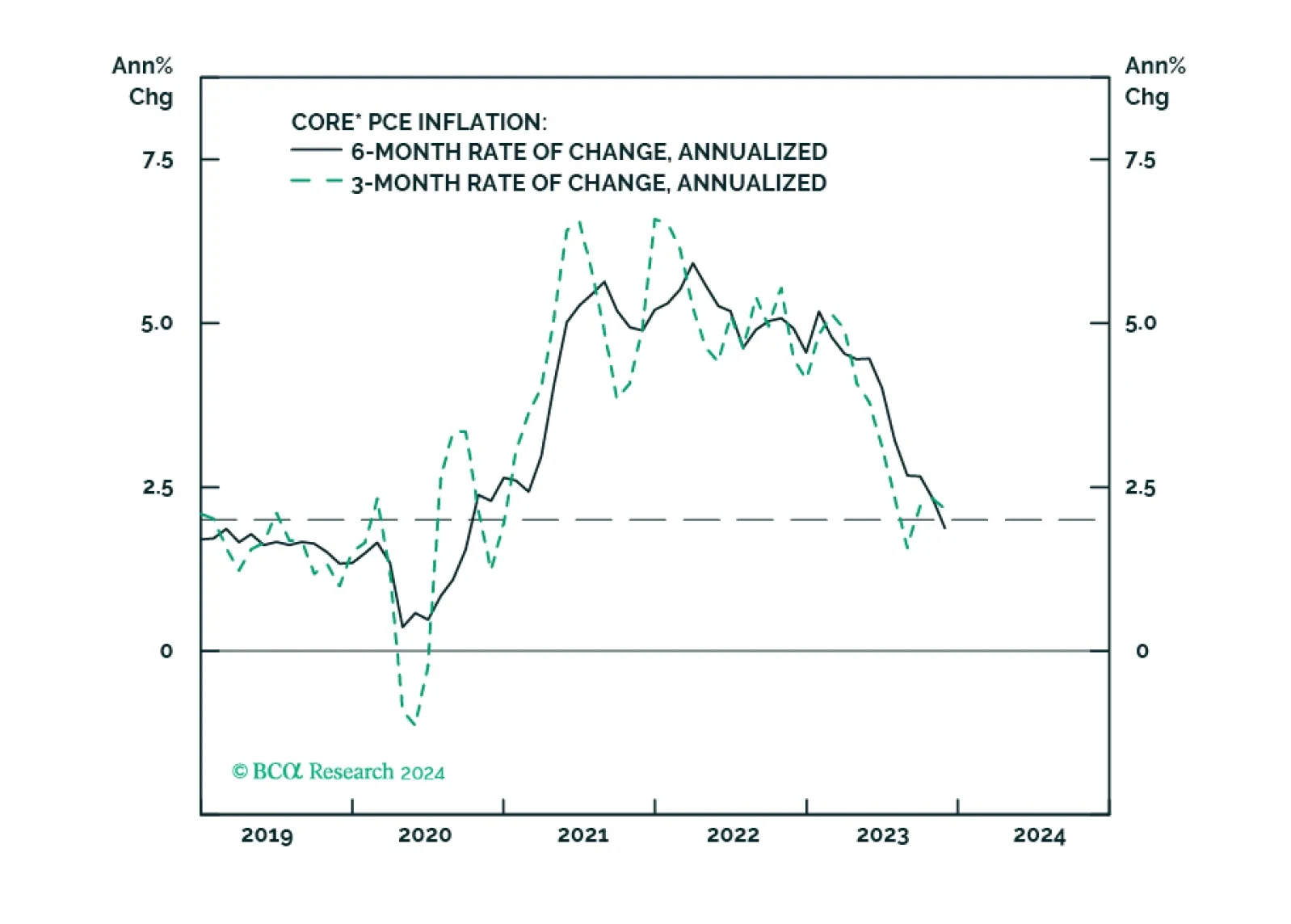

Disinflation coupled with sticky wage growth is likely to result in either a second wave of inflation or layoffs and a recession. In the meantime, market expectations for sales, growth, and margins are overly optimistic and are…

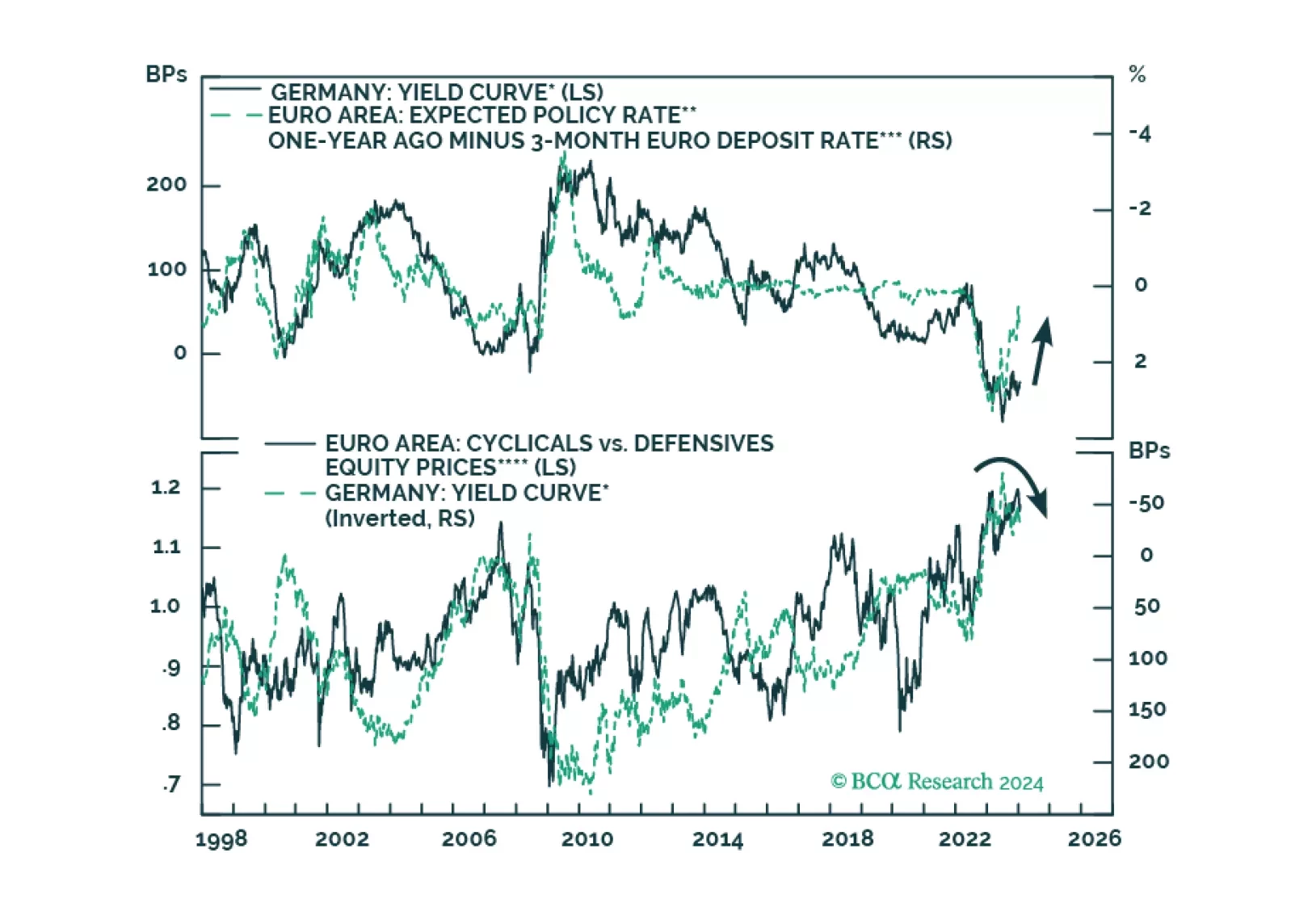

The ECB will begin cutting rates in June, what does this start date imply for the yield curve and European cyclicals?

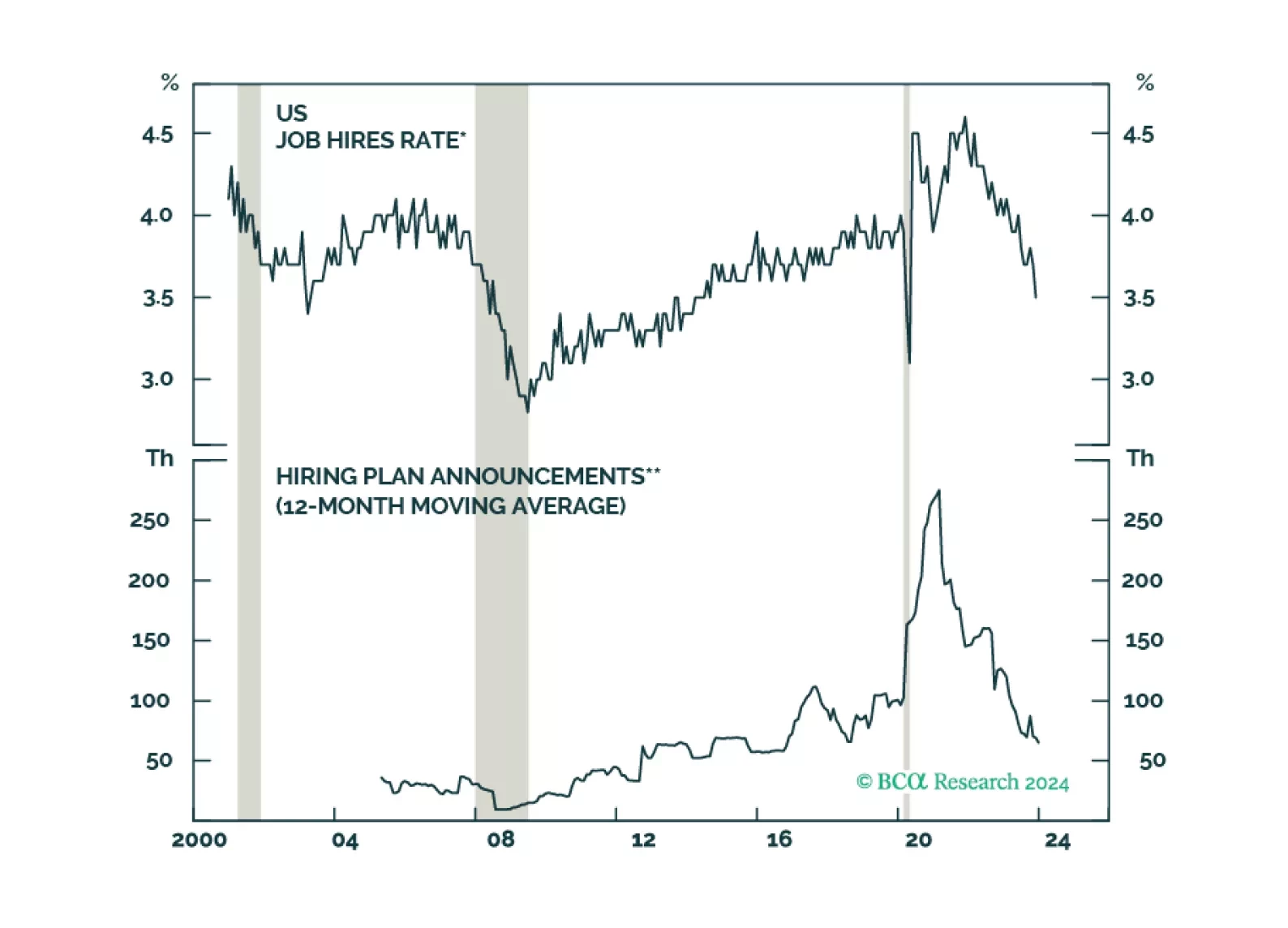

Investors have taken comfort in the fact that unemployment has remained low in the major economies. But underneath the surface, there are clear signs that labor demand is weakening. The clock keeps ticking towards our H2 2024…

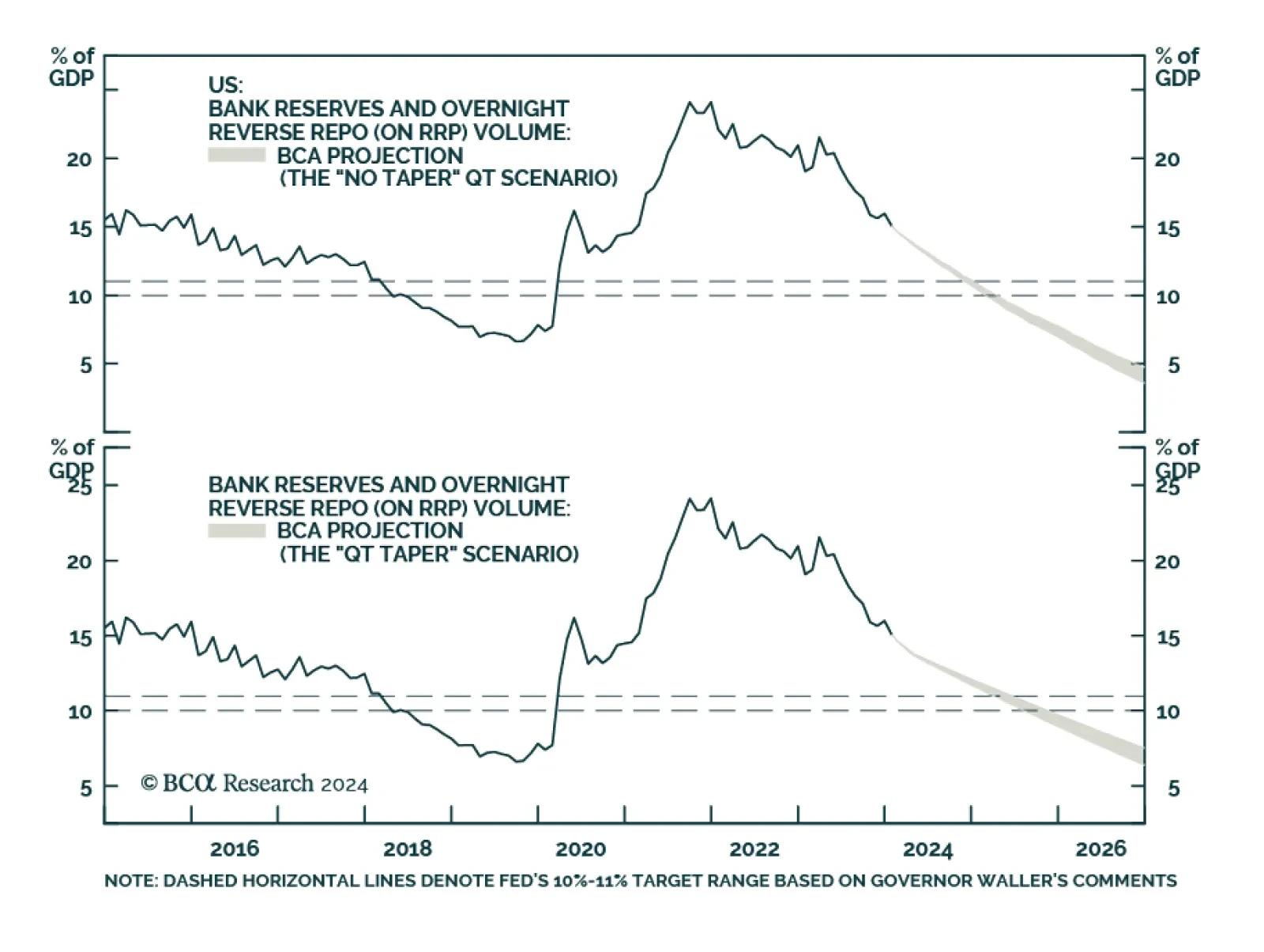

BCA Research’s US Bond Strategy service expects the Fed to slow the pace of QT starting at the May FOMC meeting, the same time that it starts cutting rates. QT will likely end altogether later in 2024 if the economy enters…

The Central Bank of Brazil (BCB) has cut the Selic rate by 50 basis points in each of the past four meetings and has alluded to maintaining this size of cuts for the coming meetings. Governor Roberto Campos Neto stated last month…

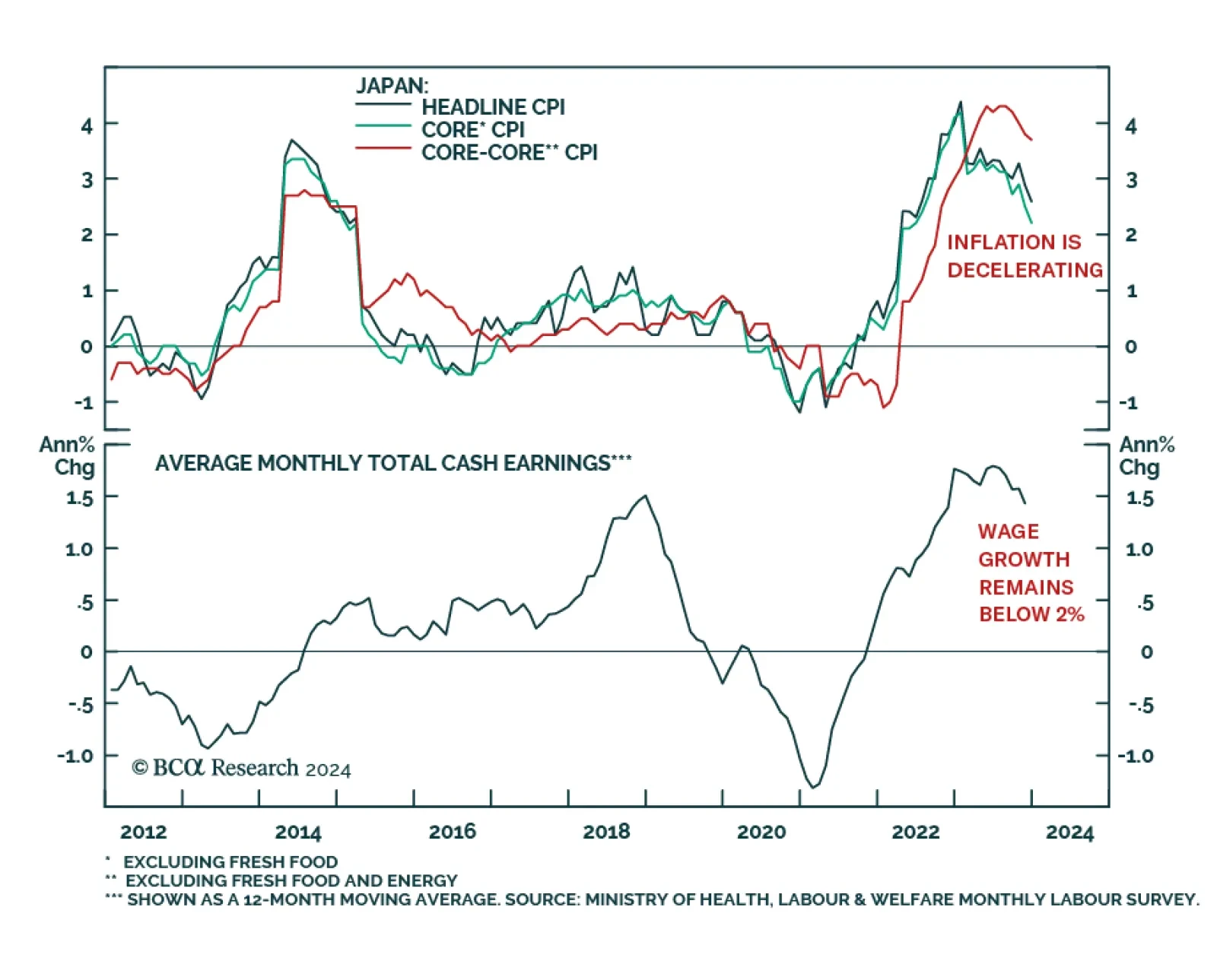

Inflation cooled for the second consecutive month in Japan with annual headline CPI inflation falling from 2.8% y/y to 2.6% y/y in December. Underlying inflation gauges also cooled, with the December prints of core and “…

An update to our outlooks for the Fed’s interest rate and balance sheet policies following this week’s remarks from Fed Governor Waller.

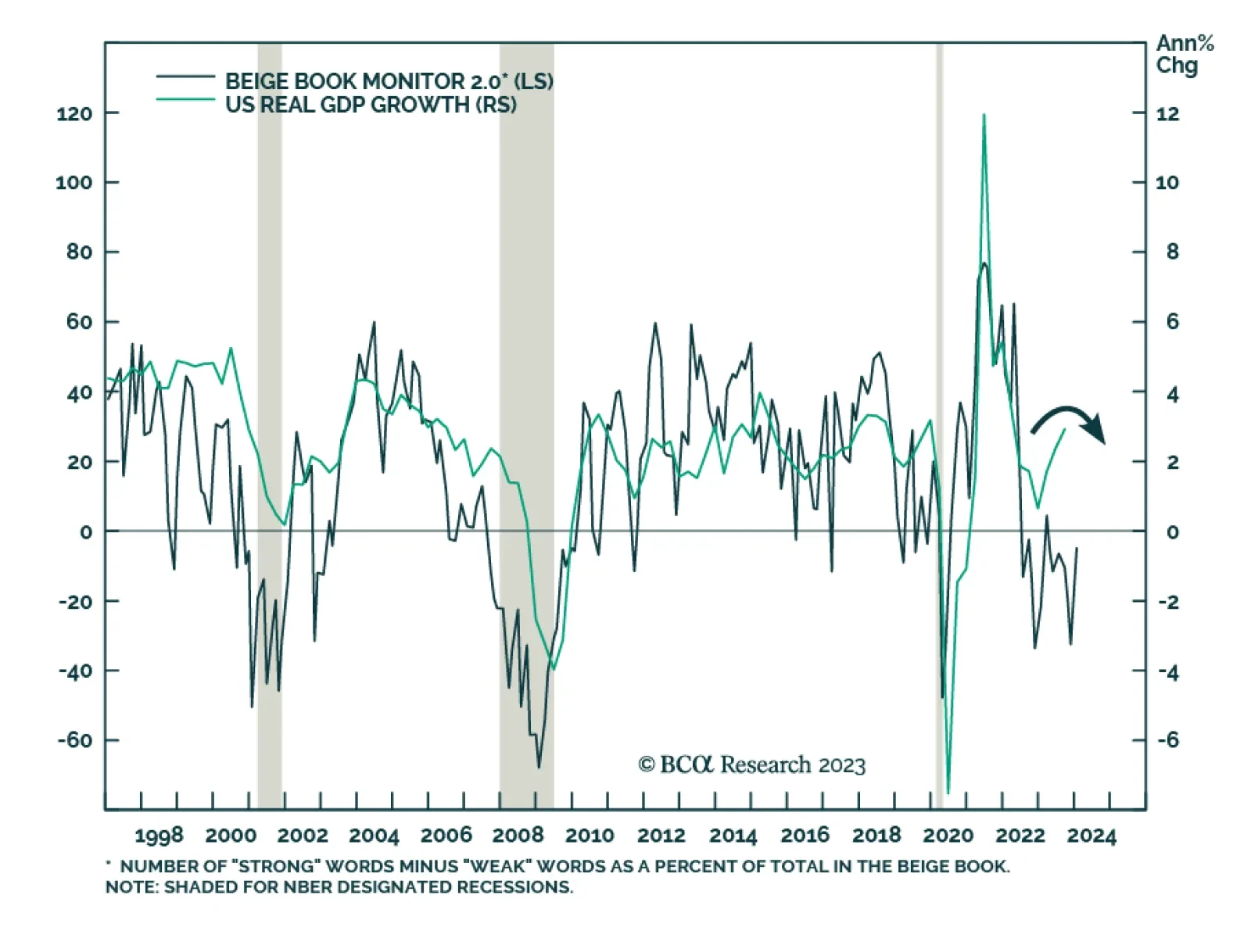

The Fed’s latest Beige Book delivered a lukewarm message on the US economy. Growth, employment, and prices were all relatively stable since the previous release in late-November. Eight districts reported little or no change…