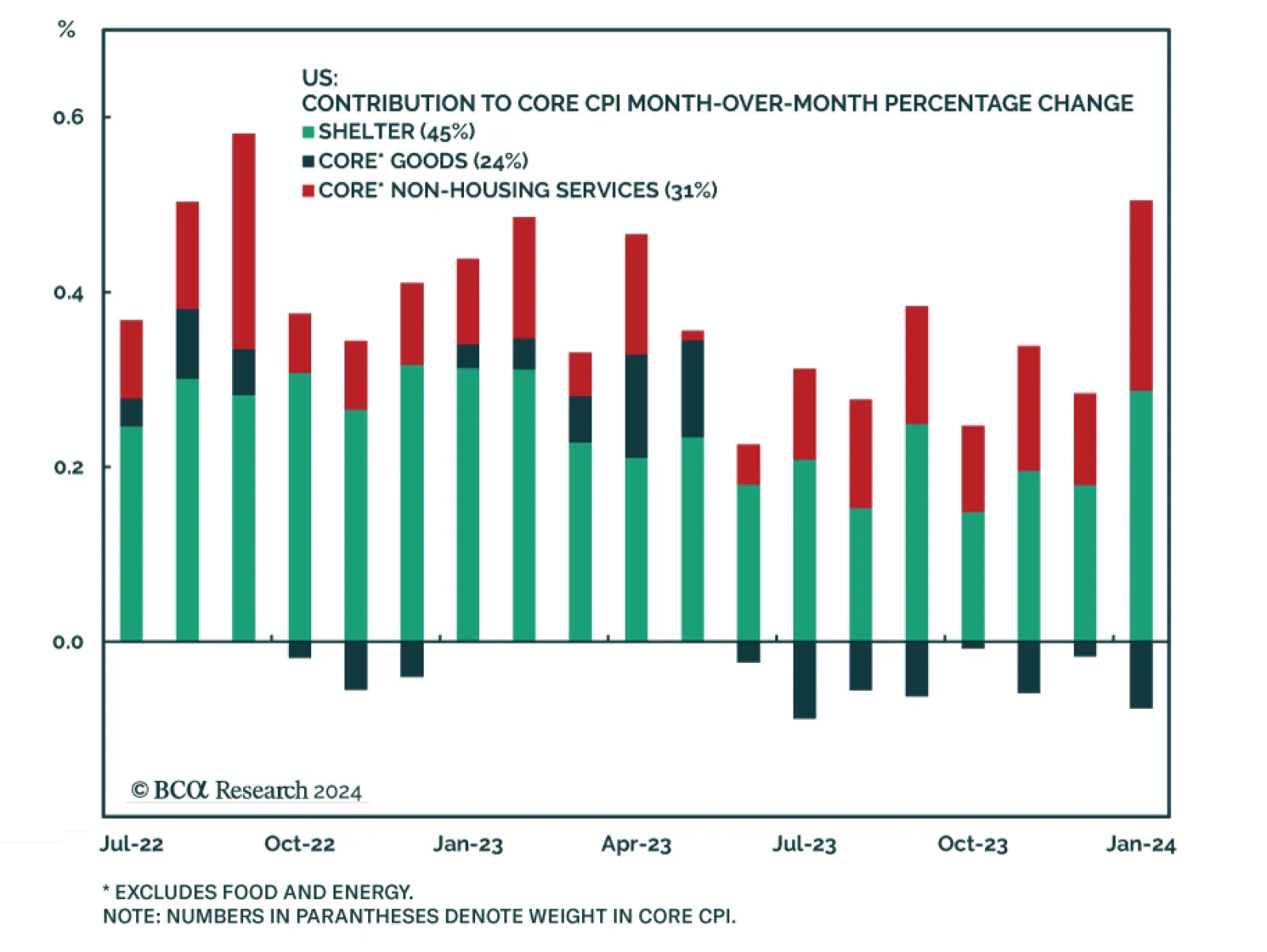

The US CPI report for January showed inflation did not cool as much as anticipated. Headline inflation accelerated from 0.23% to 0.31% on a month-over-month basis, higher than anticipations of 0.2% m/m. It fell from 3.4% to 3.1%…

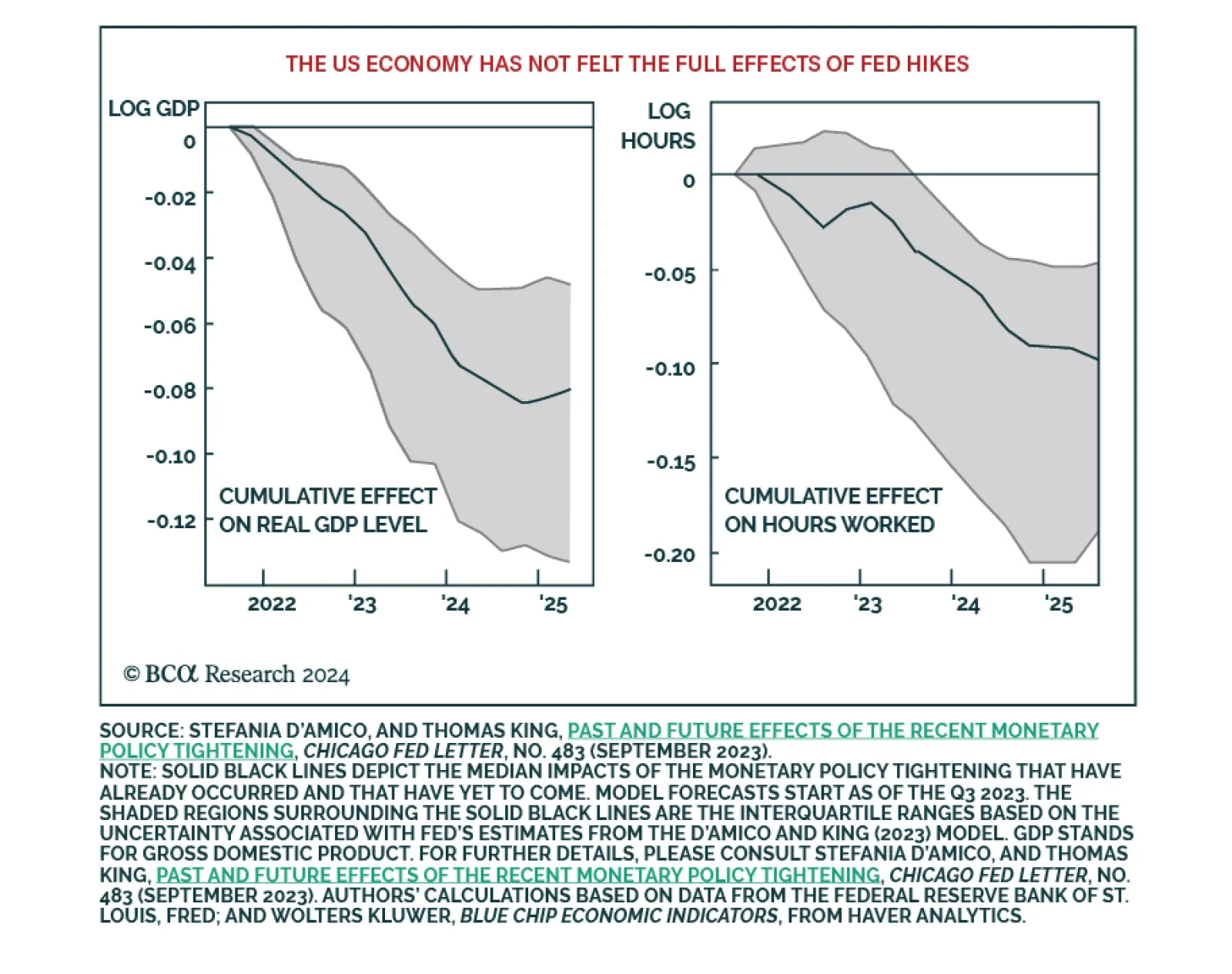

BCA Research’s Global Investment Strategy service’s revised forecast is centered on a recession starting in late 2024 or early 2025. The strong pace of US growth has continued into early 2024. Preliminary estimates…

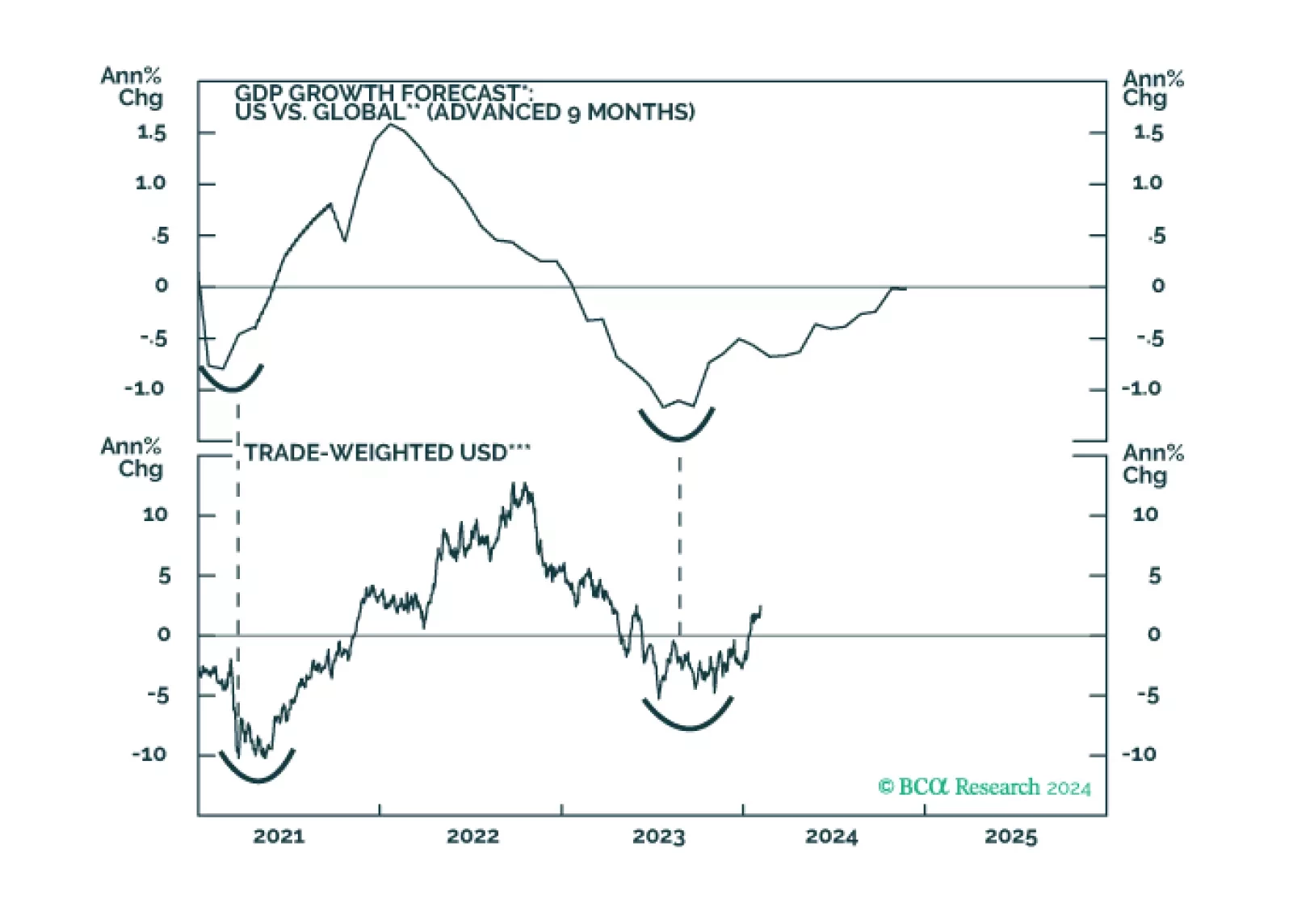

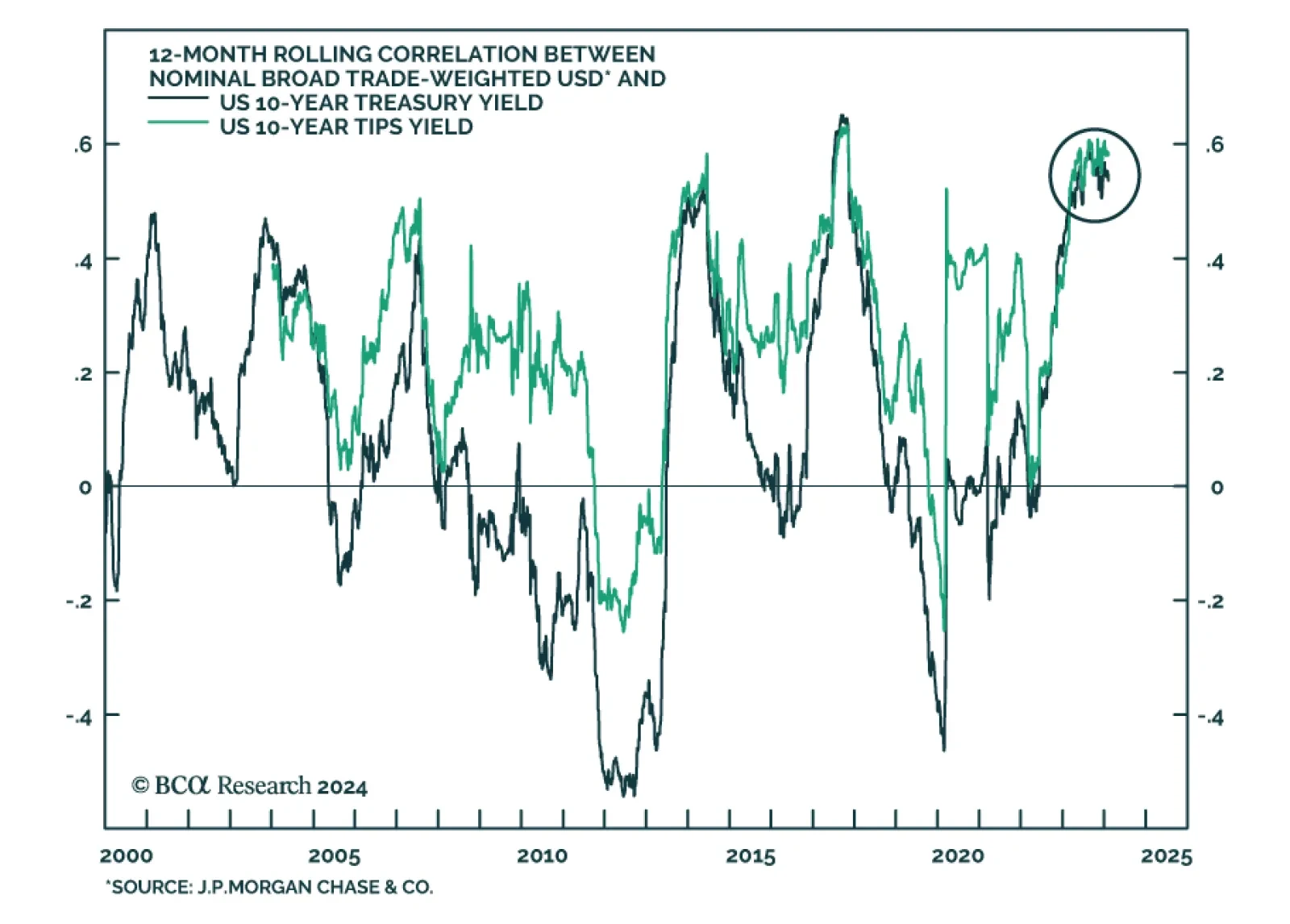

Our Emerging Markets team believes that the risk-reward profile of the US dollar remains very attractive. First, if US growth stays robust, US interest rate expectations will rise because rate cuts priced in will not be…

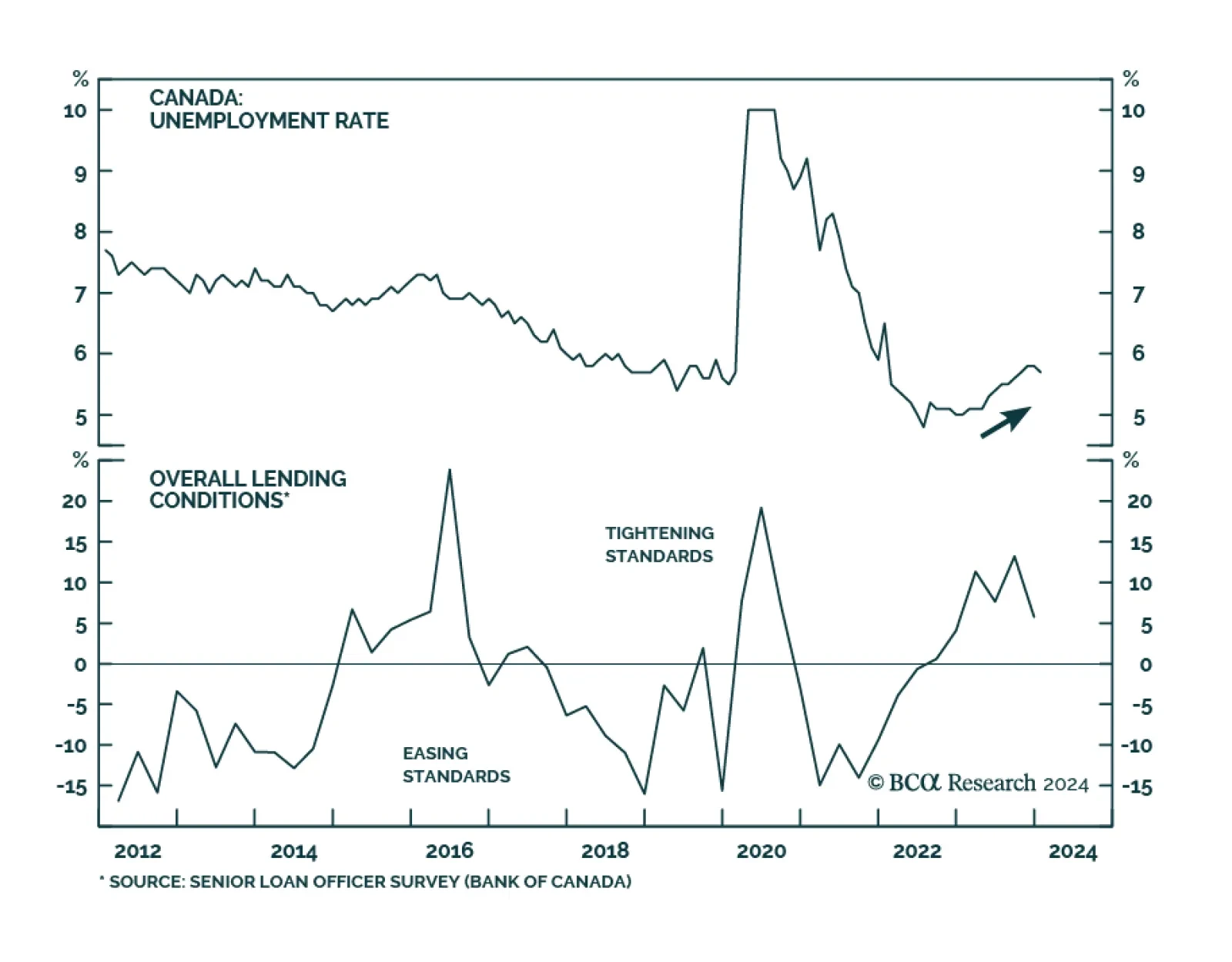

The latest Canadian data suggest that although demand is cooling down, the Canadian economy is not in freefall. The unemployment rate fell for the first time since December 2022, declining by 0.1 percentage points to 5.7%,…

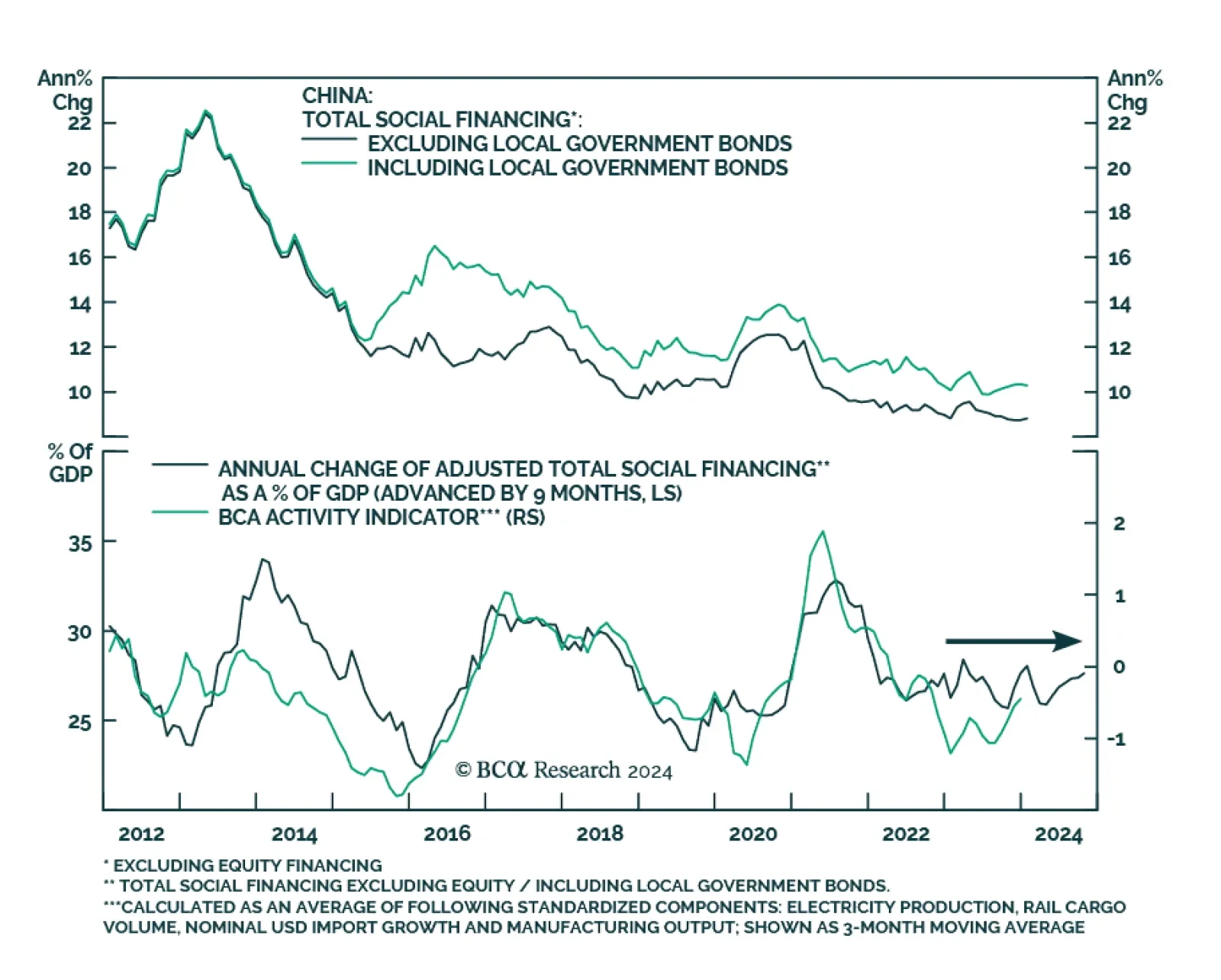

China’s credit data update for January delivered a mixed signal on Friday. The CNY 6.50 trillion increase in aggregate financing beat expectations of CNY 5.60 trillion and marked a significant acceleration from CNY 1.94…

This week’s report explores factors behind the recent rise in the dollar, and whether this could continue in the next month.

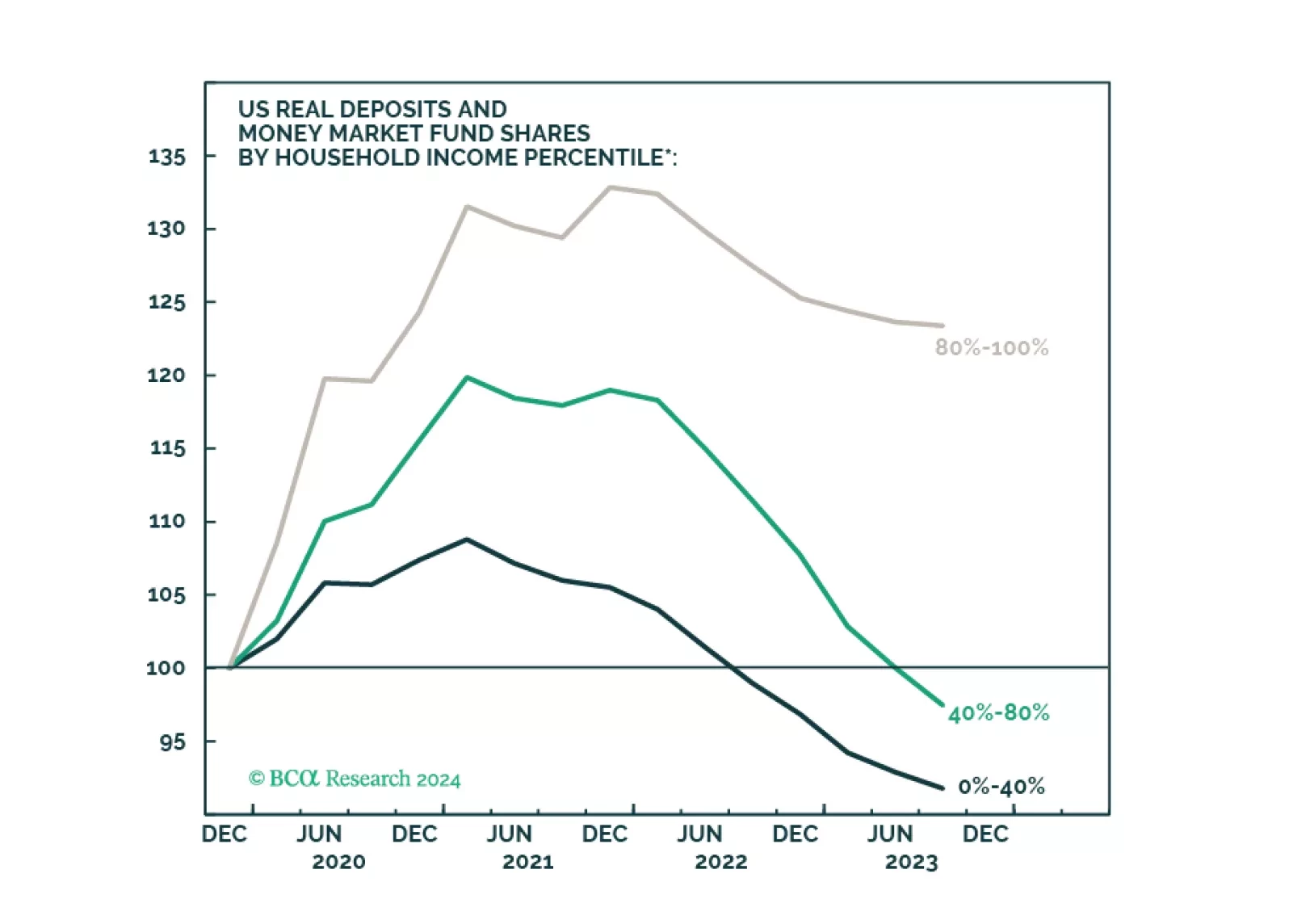

Easier financial conditions, rising home prices, rebounding consumer sentiment, and a stabilization in manufacturing activity all augur well for near-term US growth prospects. An unsustainably low savings rate is a key risk to the US…

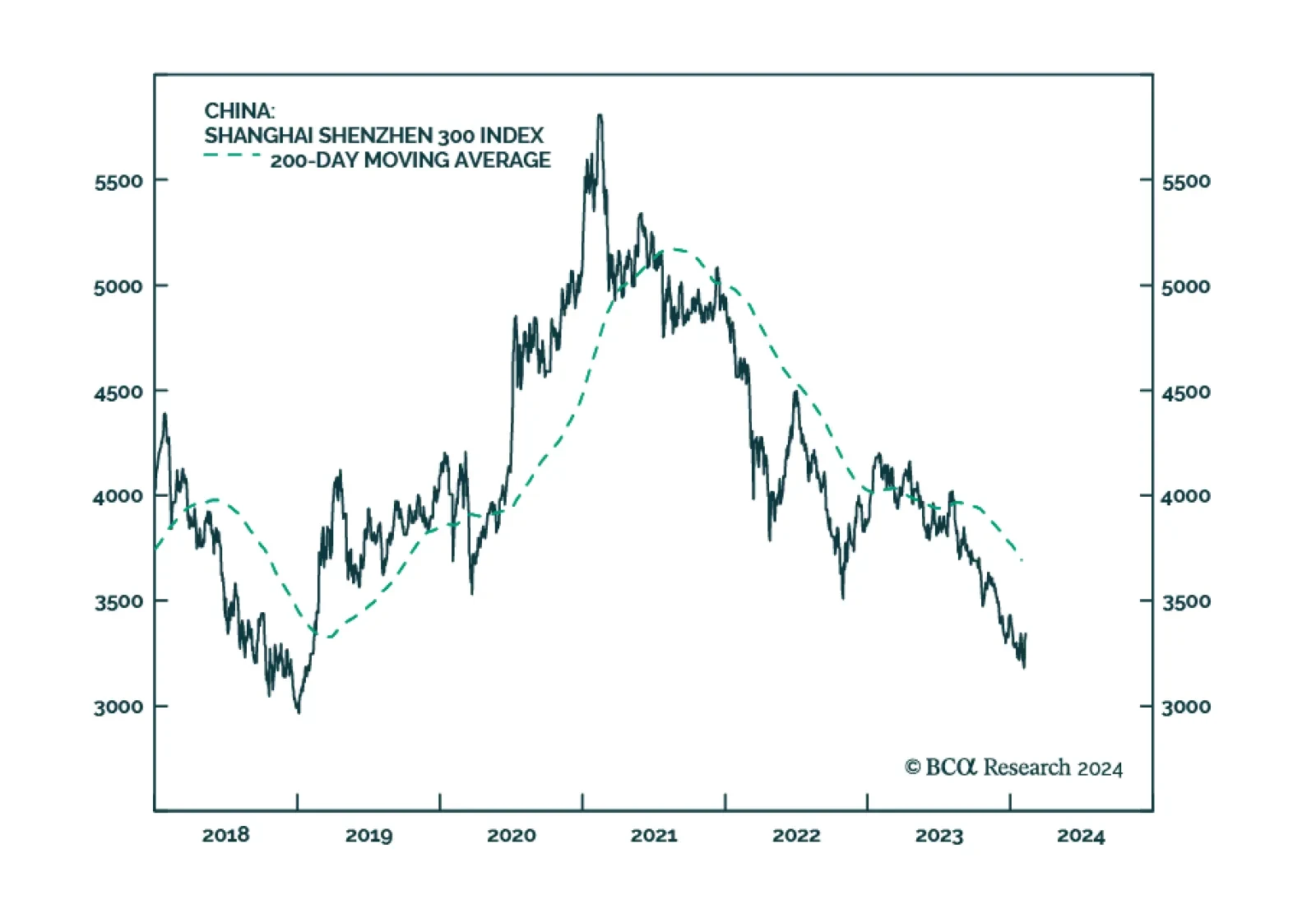

Chinese domestic stocks have fared quite poorly over the past year. Since late-January 2023, the Shanghai Shenzhen 300 index fell roughly 24% to last week’s low, driven by ongoing weakness in China’s economy and a…

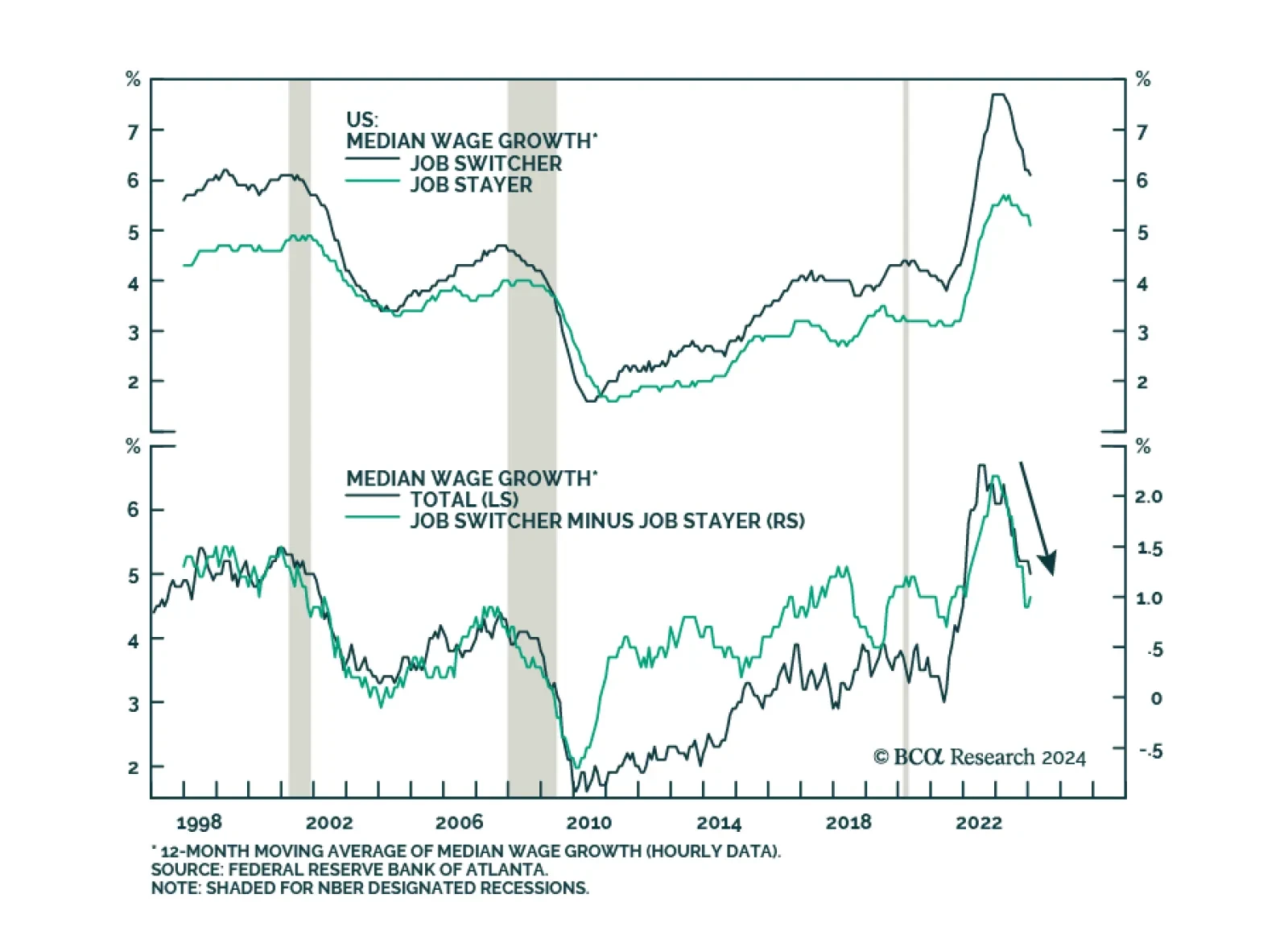

After having surged in the second half of 2021 and early 2022, the Atlanta Fed’s Wage Growth Tracker peaked in mid-2022 and has since been on a general downtrend. The latest reading of 5.0% in January is a continuation of…