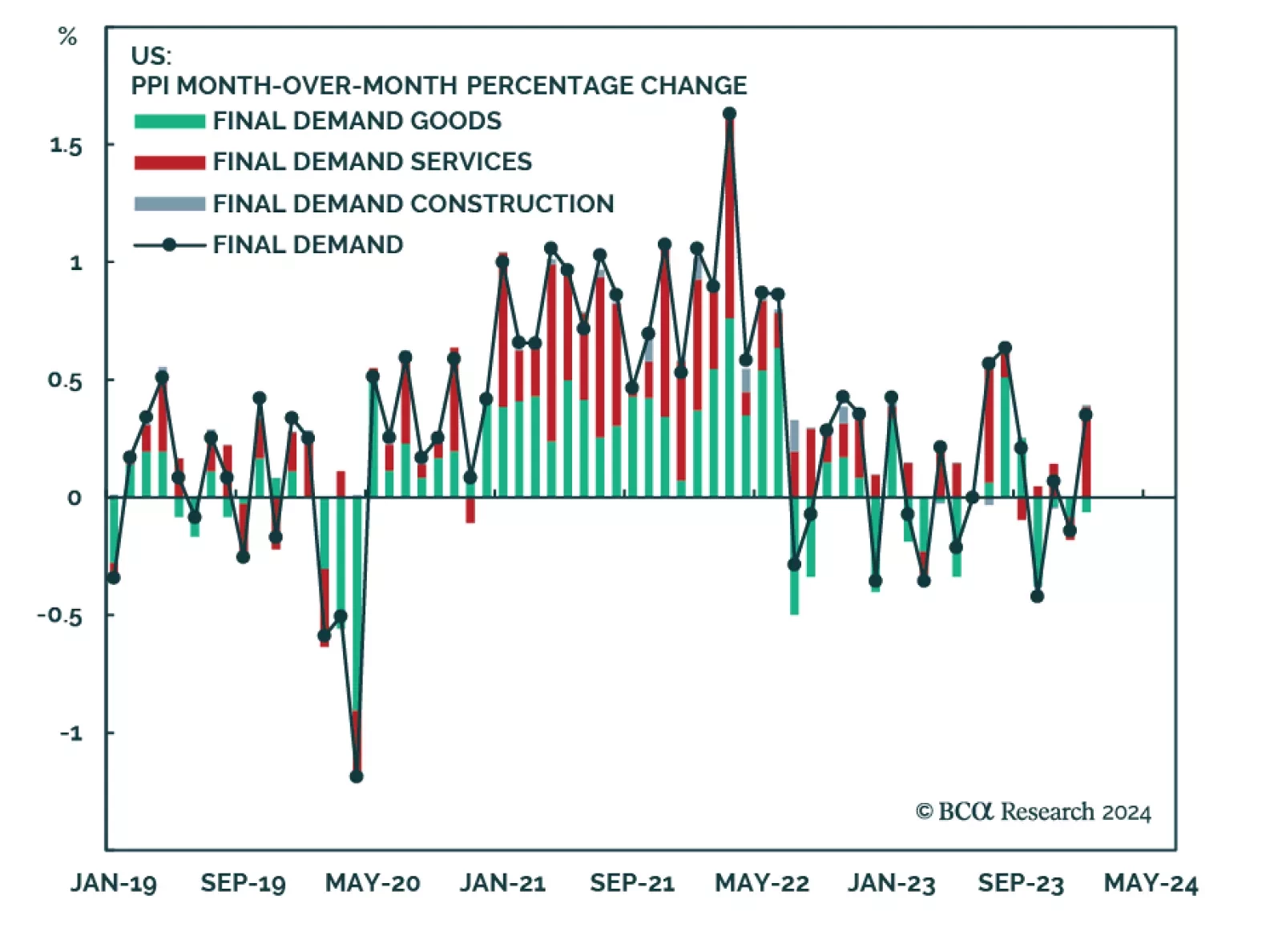

The hotter-than-anticipated US PPI report for January prompted a selloff in Treasuries on Friday. The monthly and annual changes in both the headline as well as the core measures of final demand PPI came in above expectations.…

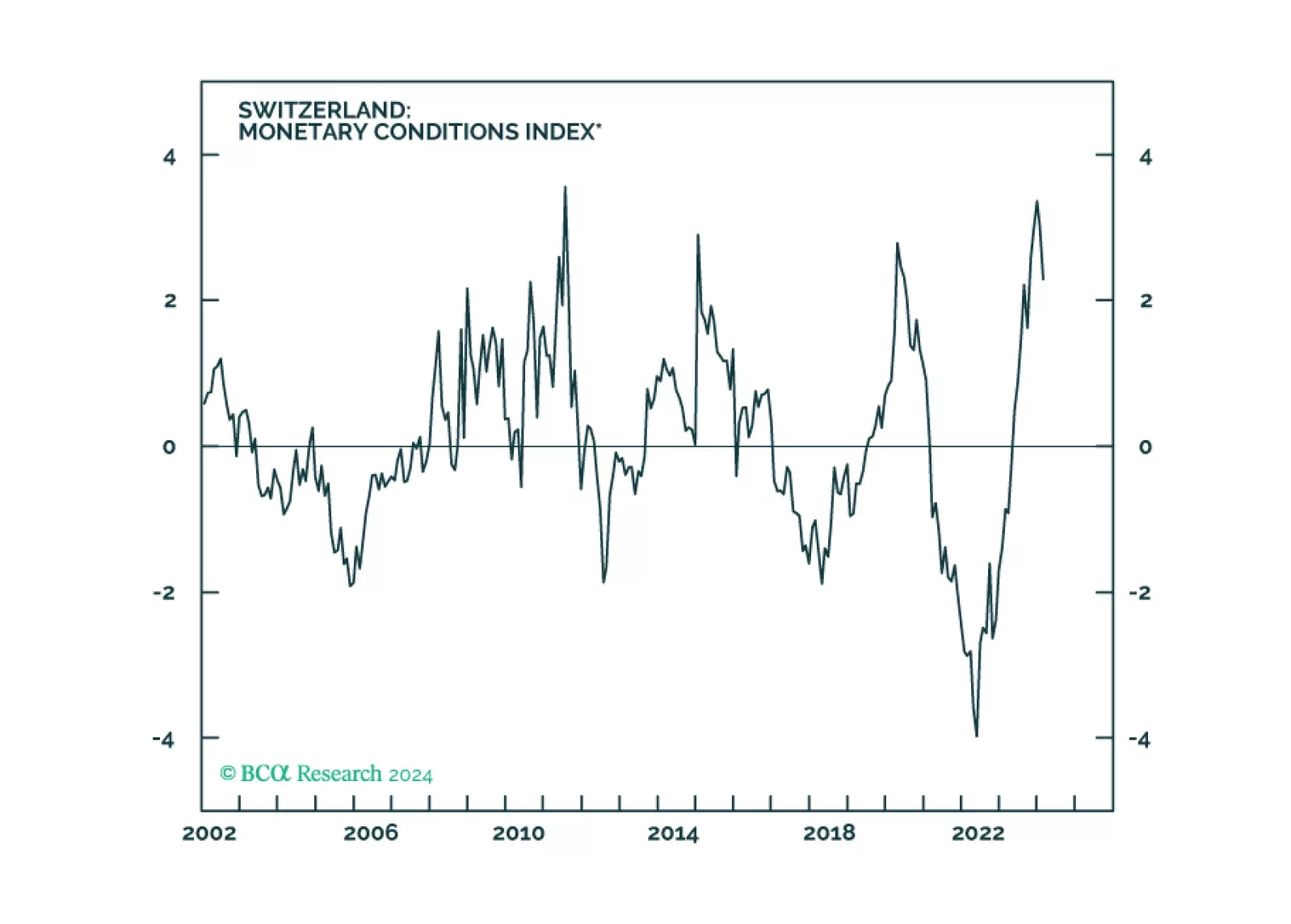

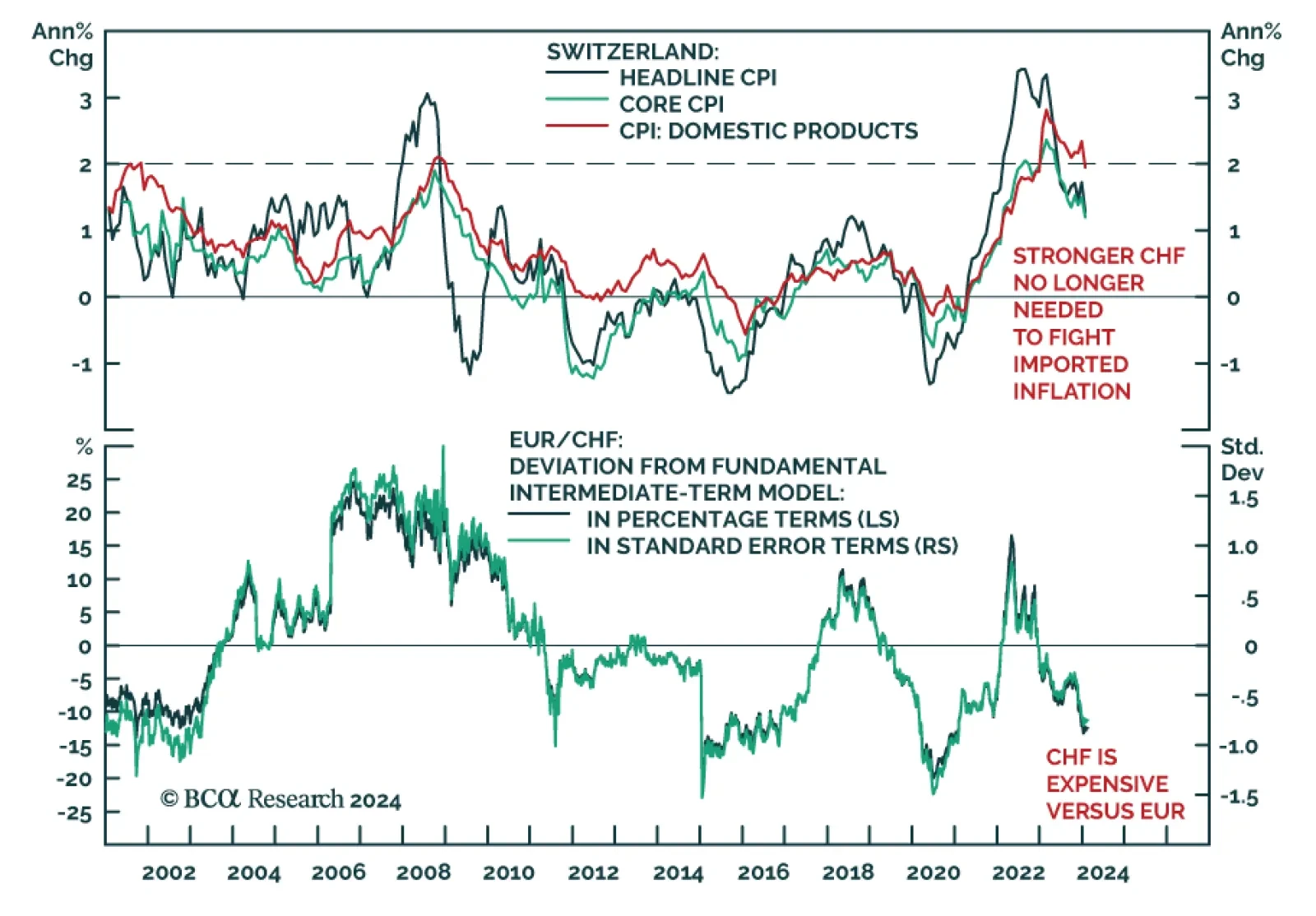

In this Insight, we speculate on the outlook for the CHF.

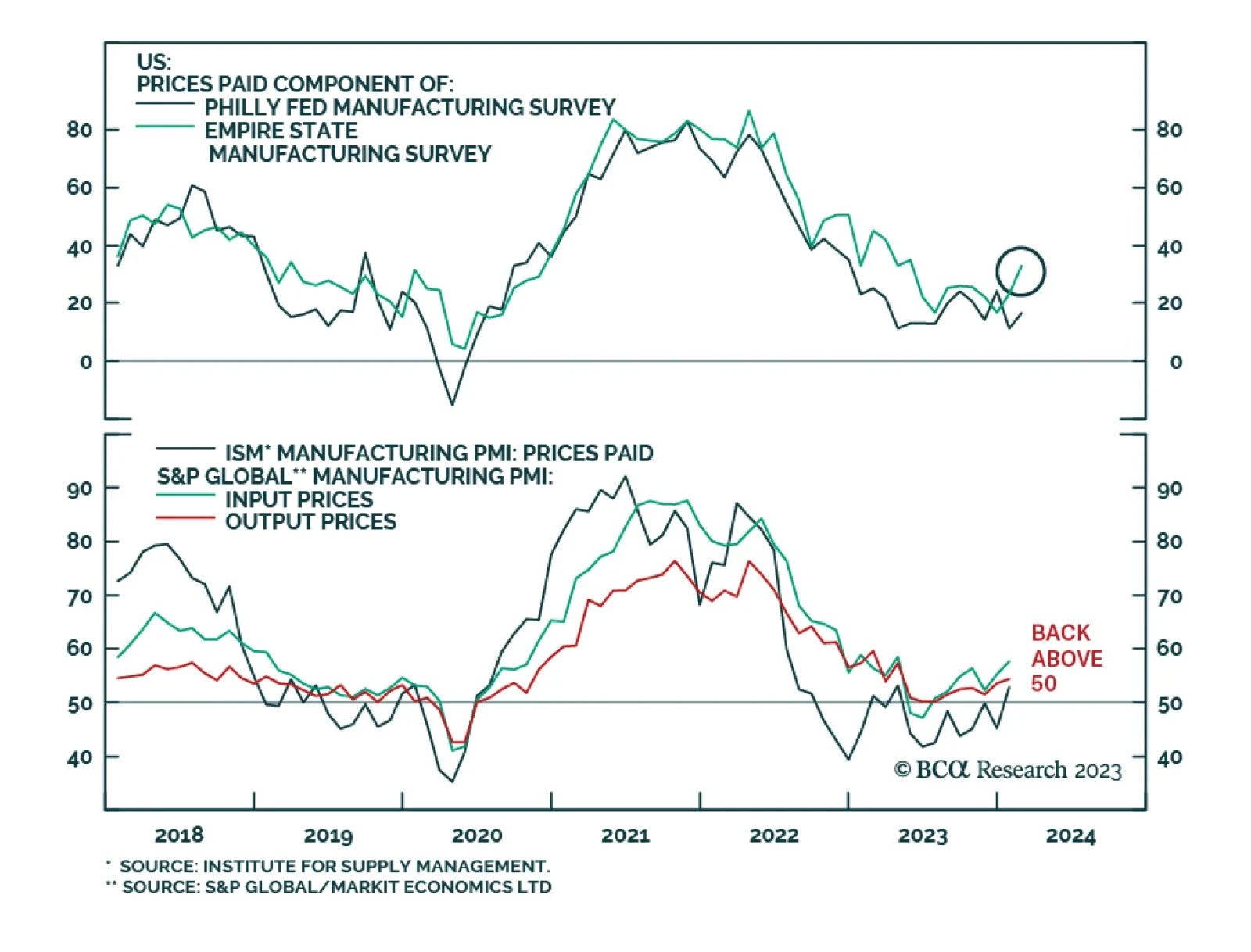

The first two regional fed manufacturing surveys for February delivered strong upside surprises. The New York Fed’s Empire Index surged from -43.7 to -2.4, unwinding its January slump. Similarly, the Philly Fed current…

Prices of agricultural commodities have come under intensified downward pressure this year. Corn, soybean, and wheat prices have fallen by 8.6%, 8.3%, and 4.9% respectively so far this year. Multiple factors are behind the…

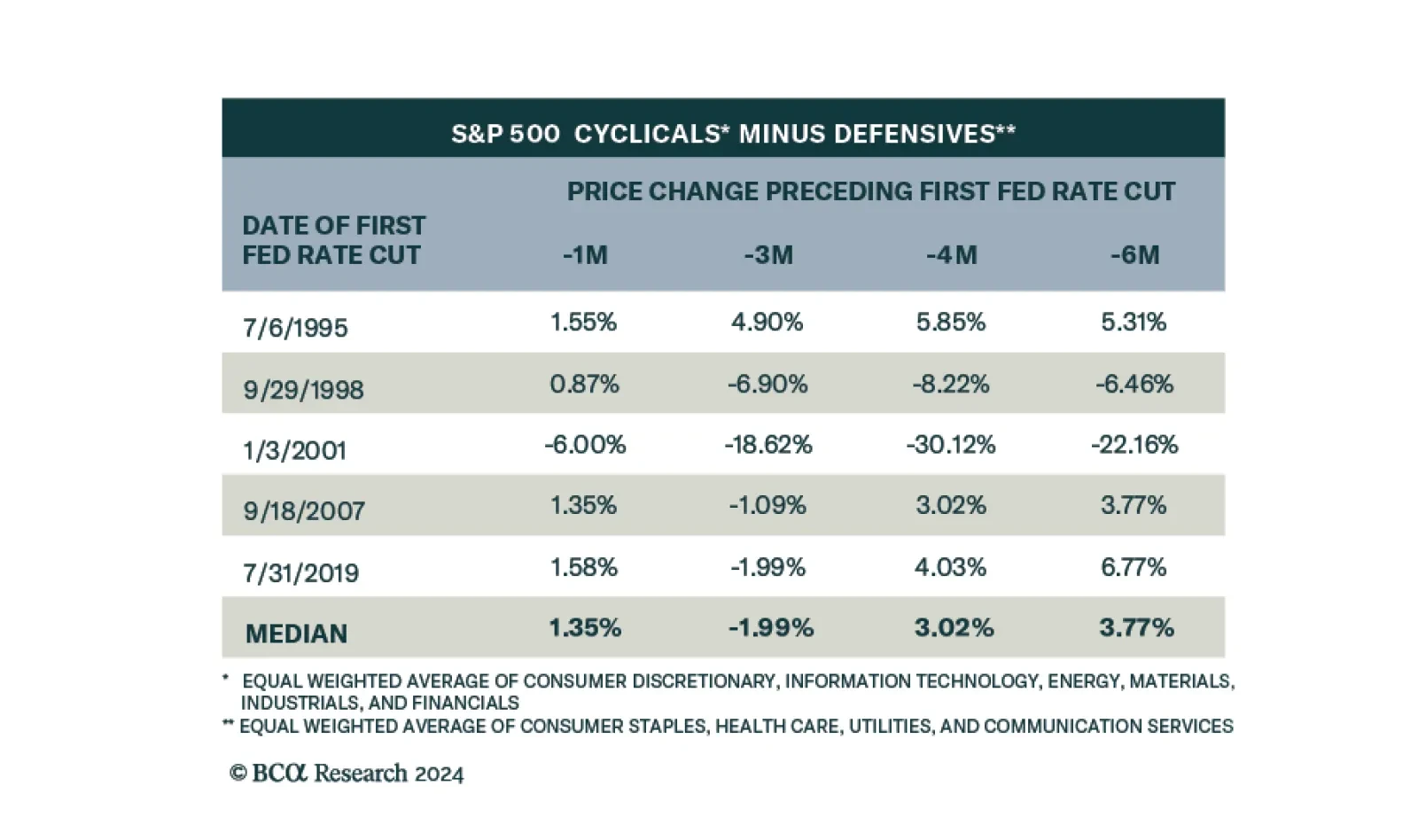

In a recent Insight we looked at the performance of equities following the start of monetary easing cycles. Specifically, we looked at the historical performance of US cyclical sectors versus defensive sectors at various points…

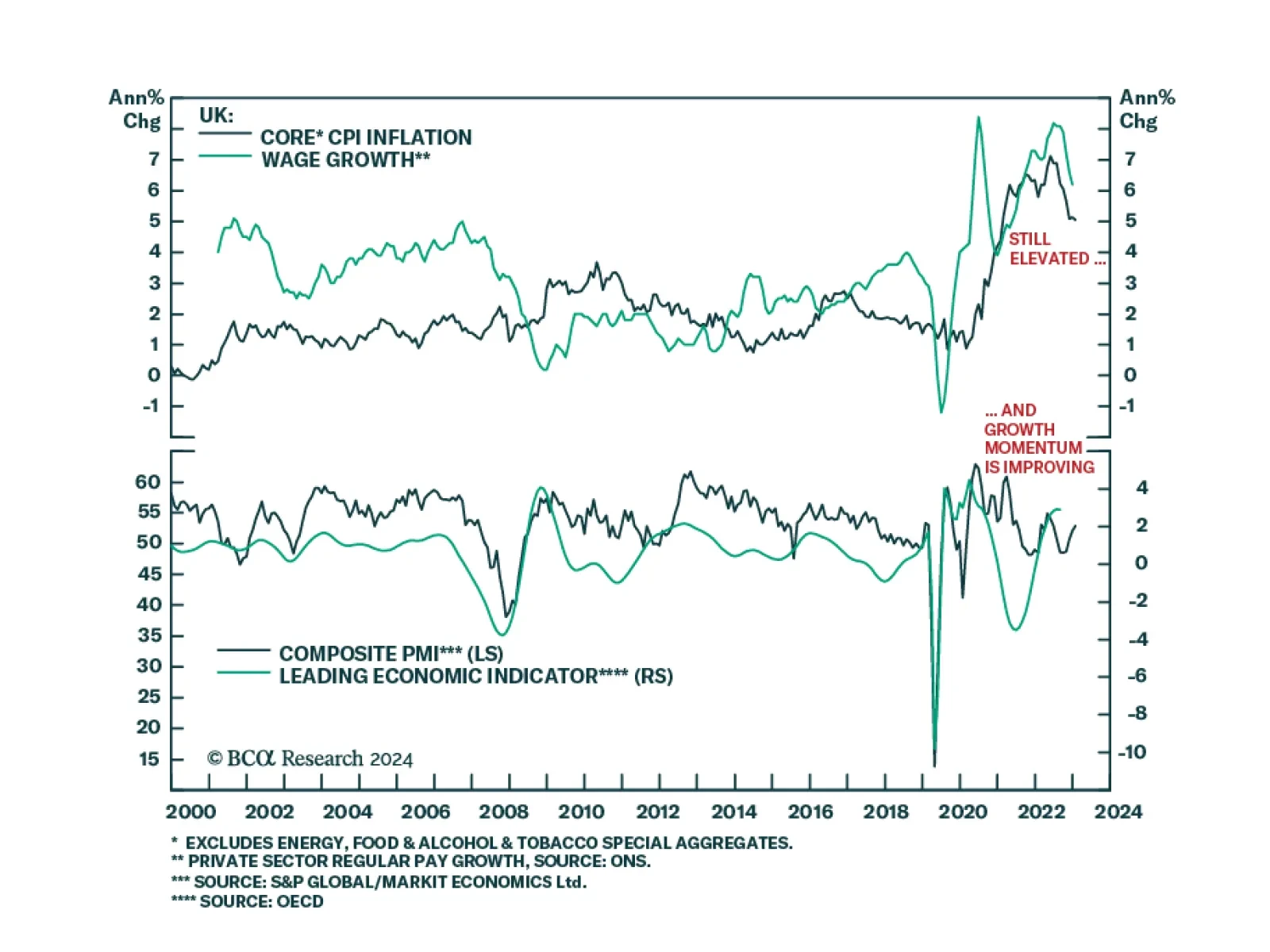

The UK inflation release for January came in slightly softer than anticipated. Both headline and core CPI were unchanged on year-over-year basis at 4.0% and 5.1%, respectively – below expectations of slight accelerations.…

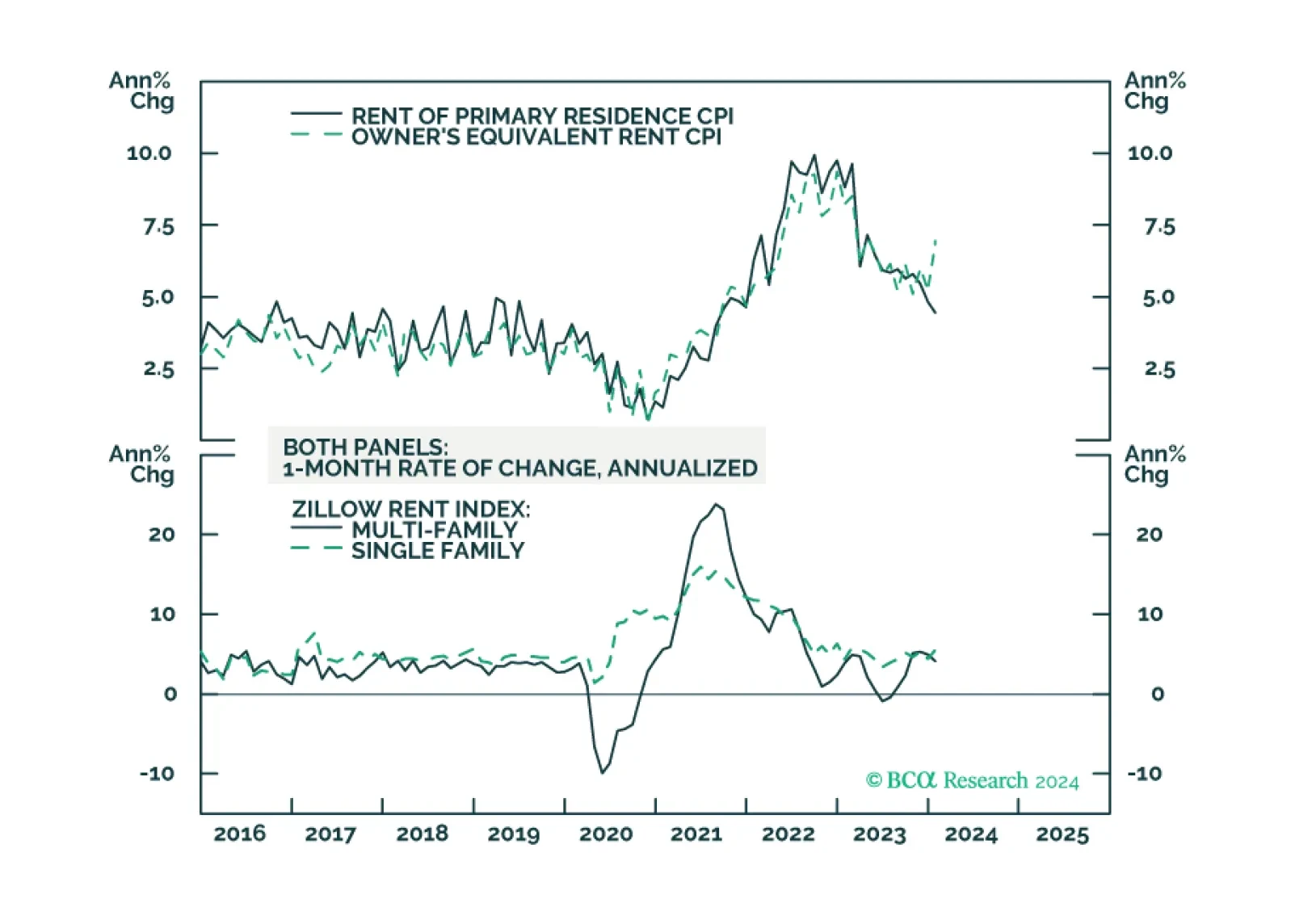

Comments on yesterday’s CPI report and yield moves.

The Swiss franc is among the worst performing major currencies so far this year. This marks a reversal following its stellar performance last year. The Swiss National Bank’s (SNB) support for the domestic currency…

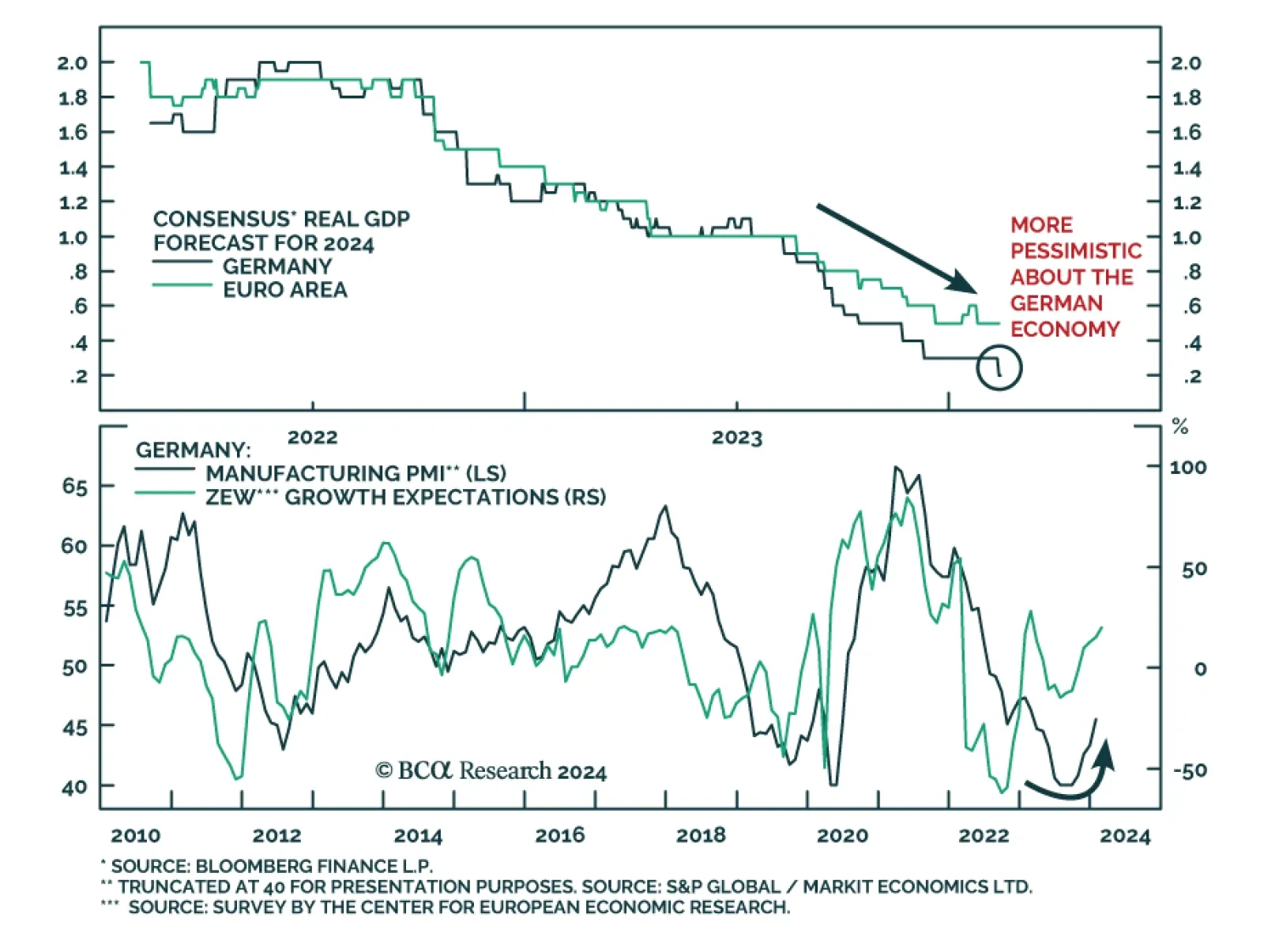

The German economy was a laggard at the end of last year, posting a 0.3% q/q real GDP contraction in Q4 2023 while the broader Eurozone economy stagnated. Importantly, while economists have been revising up their 2024 forecasts…

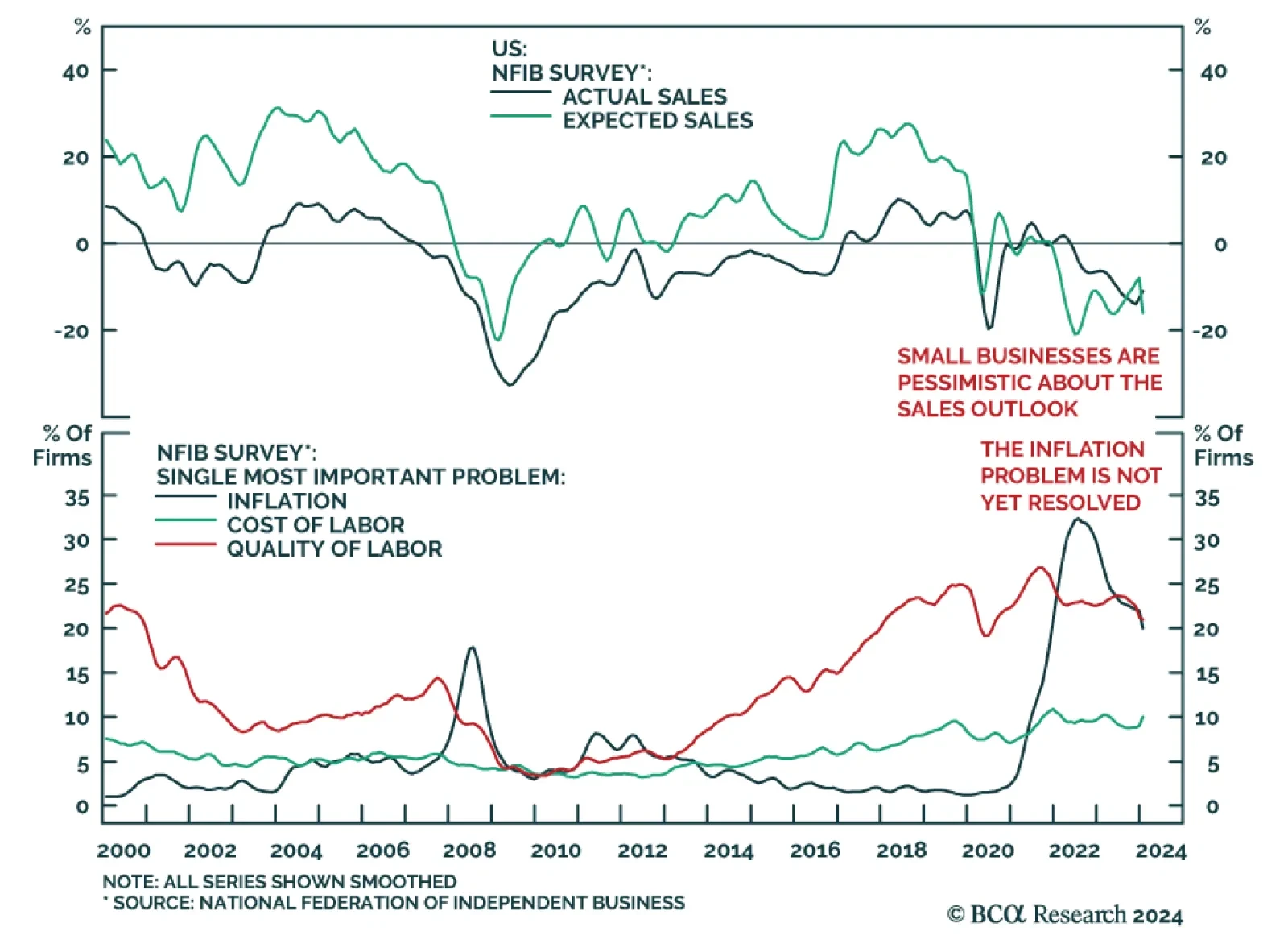

We highlighted in a recent Insight that positive economic surprises are prompting economists to revise up their US economic growth expectations. The Goldilocks narrative is supporting the rally in risk assets. However, results of…