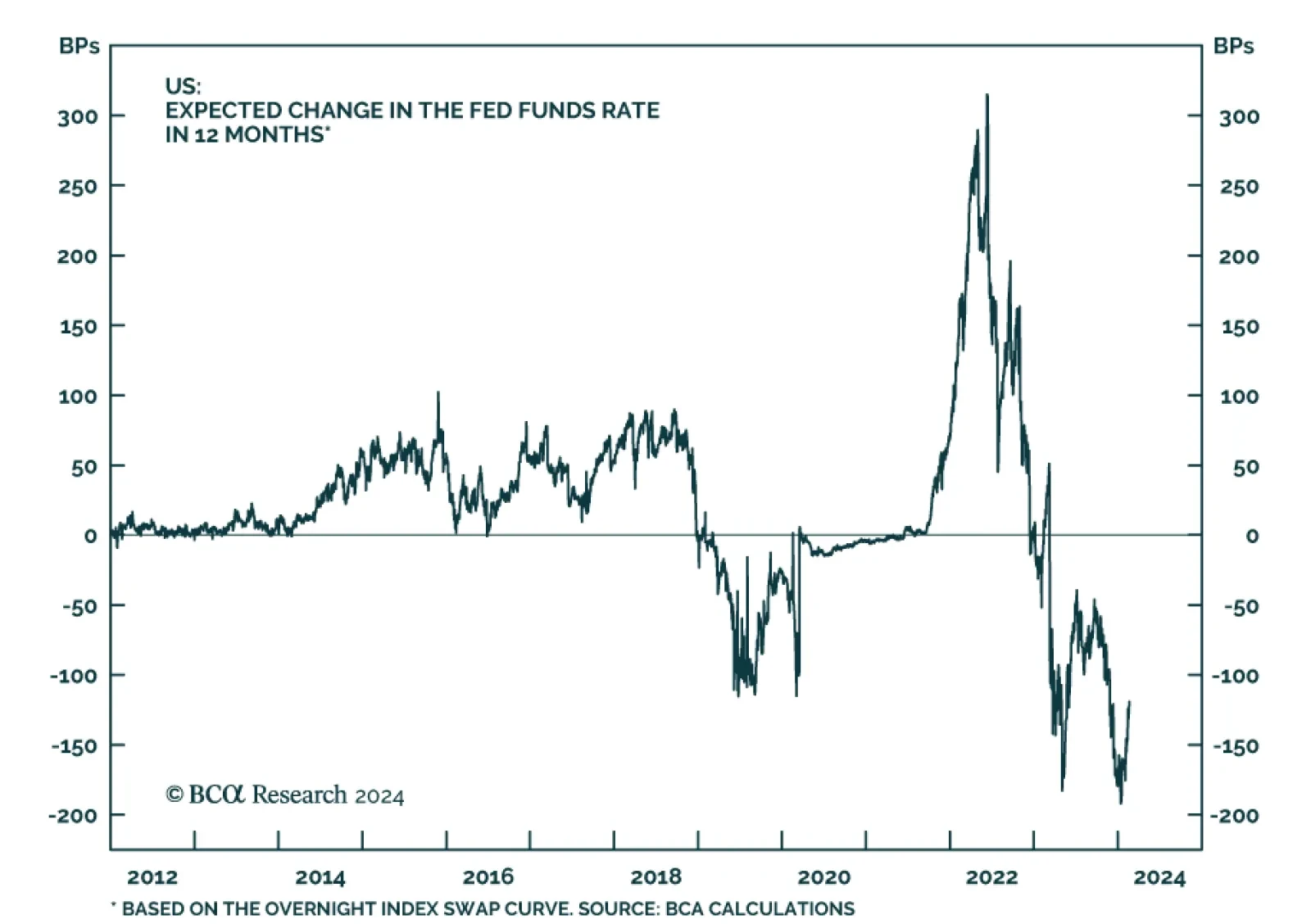

US Treasuries have been selling off over the past two months as investors downgrade the odds of an imminent start to the Fed’s easing cycle. Naturally, a question facing investors is whether current levels constitute a good…

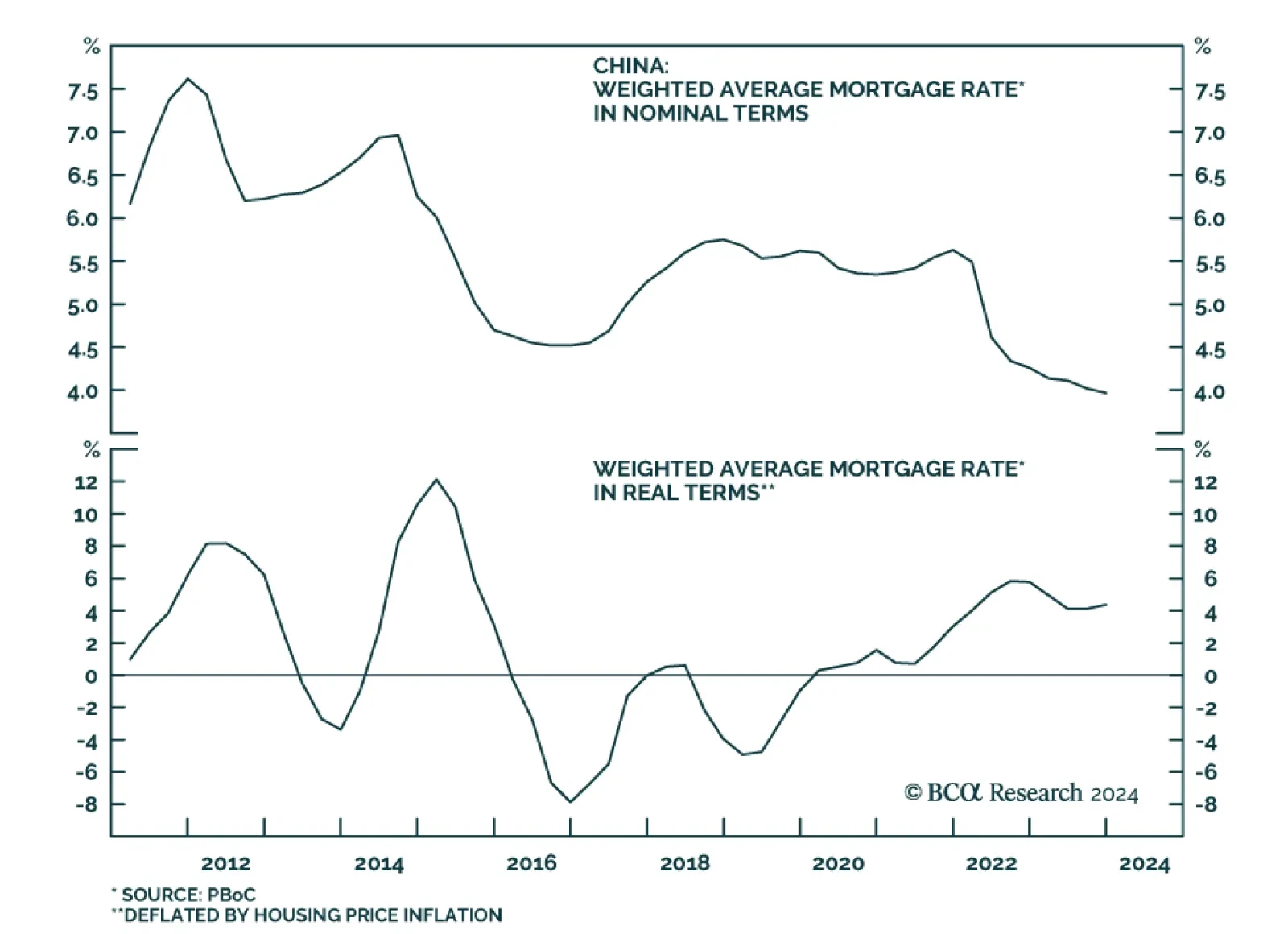

Chinese policymakers surprised on Tuesday with greater-than-anticipated easing for the troubled property market. Although the 1-year loan prime rate (LPR) – the benchmark for most household and corporate loans – was…

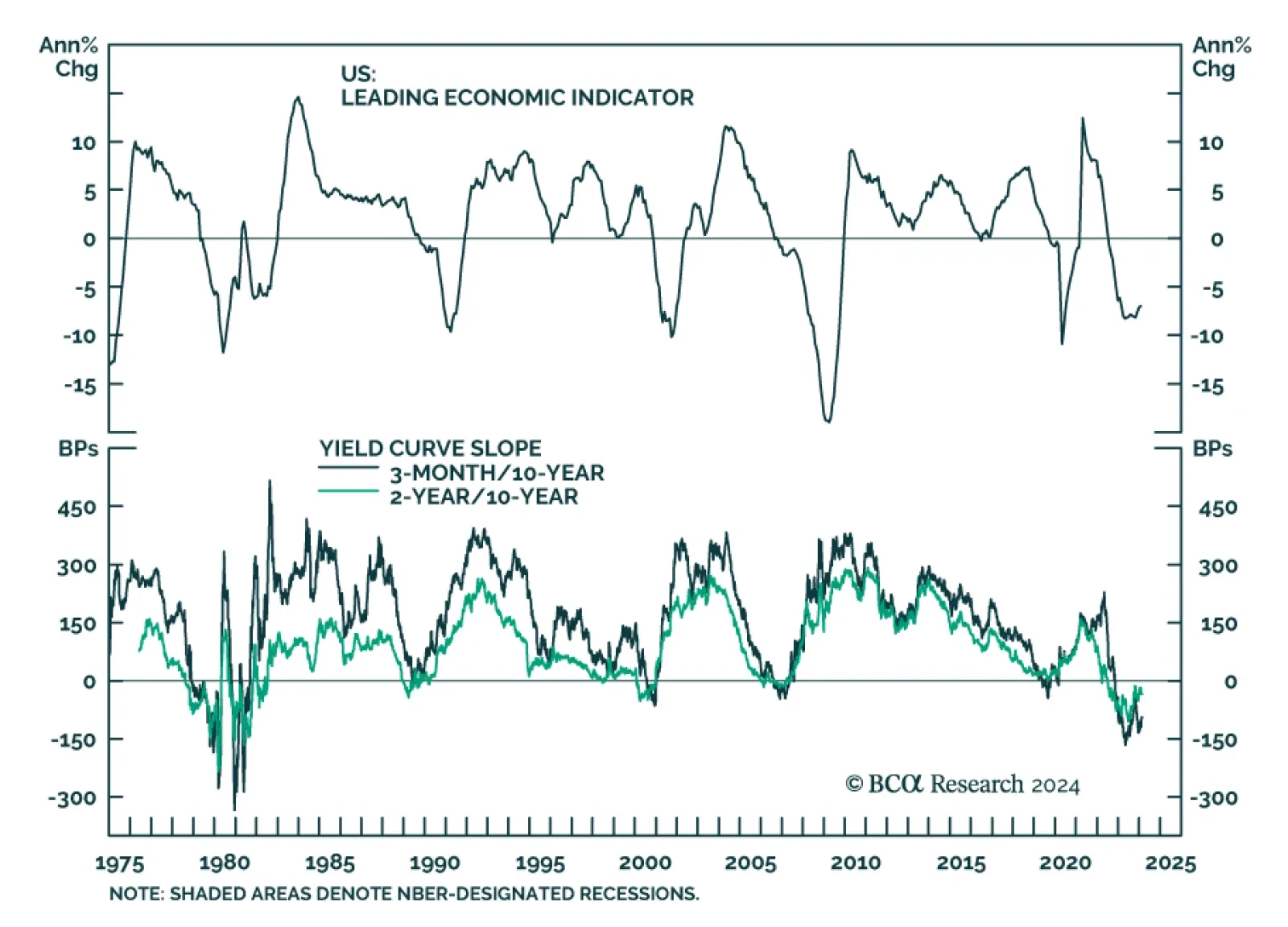

The US Conference Board’s Leading Economic Index (LEI) fell by 0.4% m/m in January, following a 0.1% m/m drop in December – disappointing expectations of a milder decline. This marks the 23rd consecutive monthly…

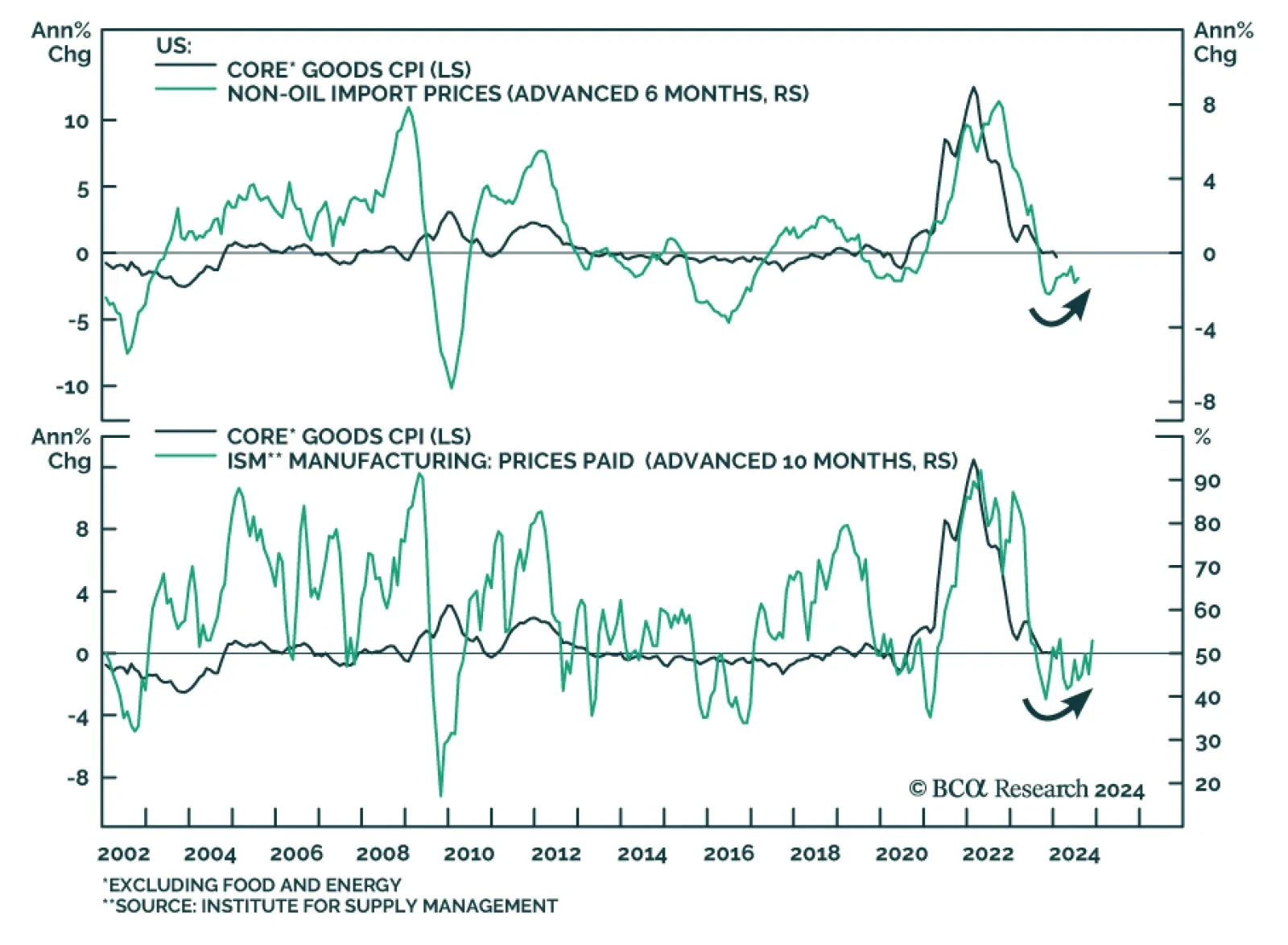

Much of the focus of investors concerned about lingering price pressures has been on services prices. There is good reason for that. Even though core CPI inflation remains relatively elevated at 3.9% y/y in January, core goods…

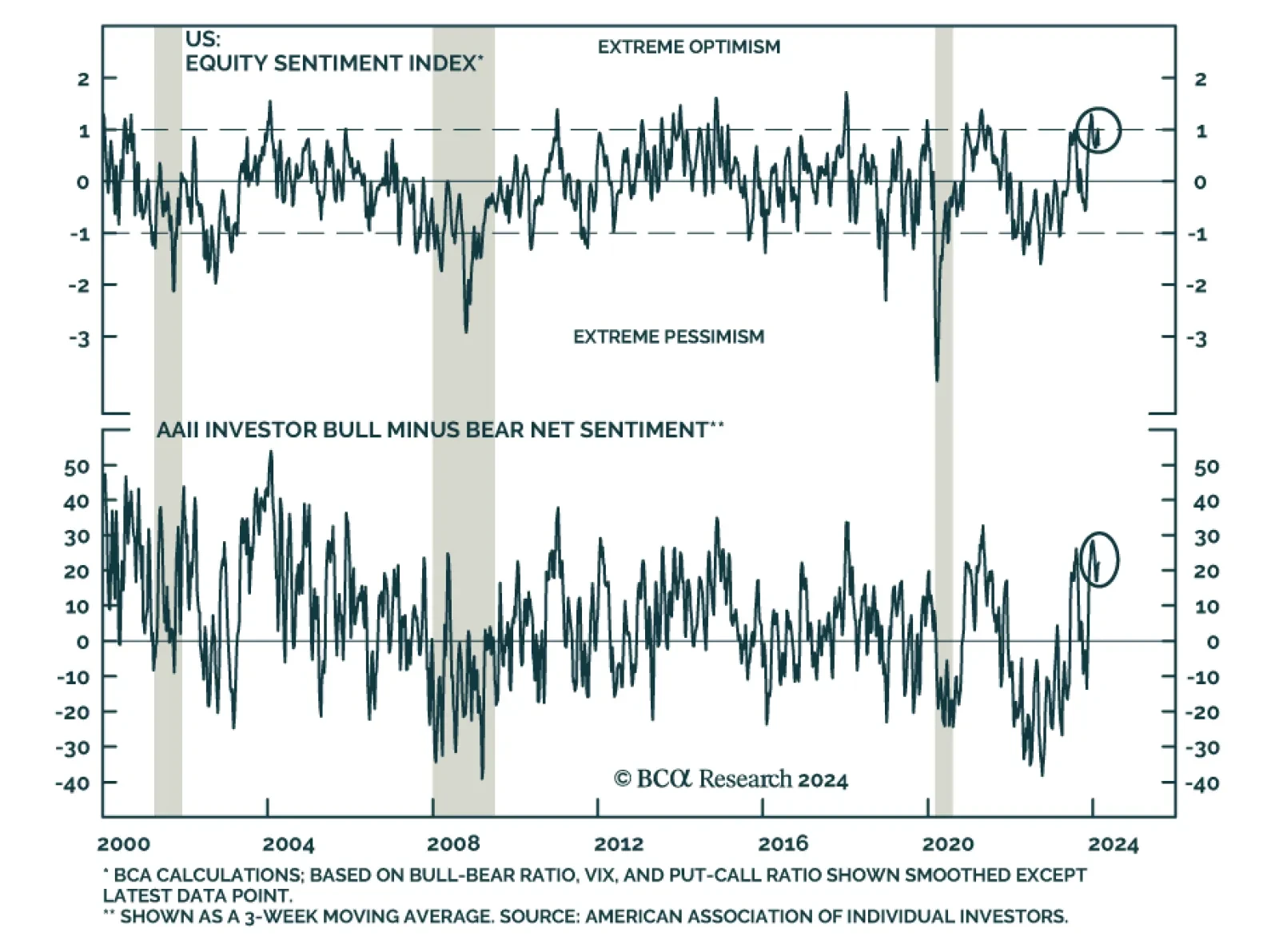

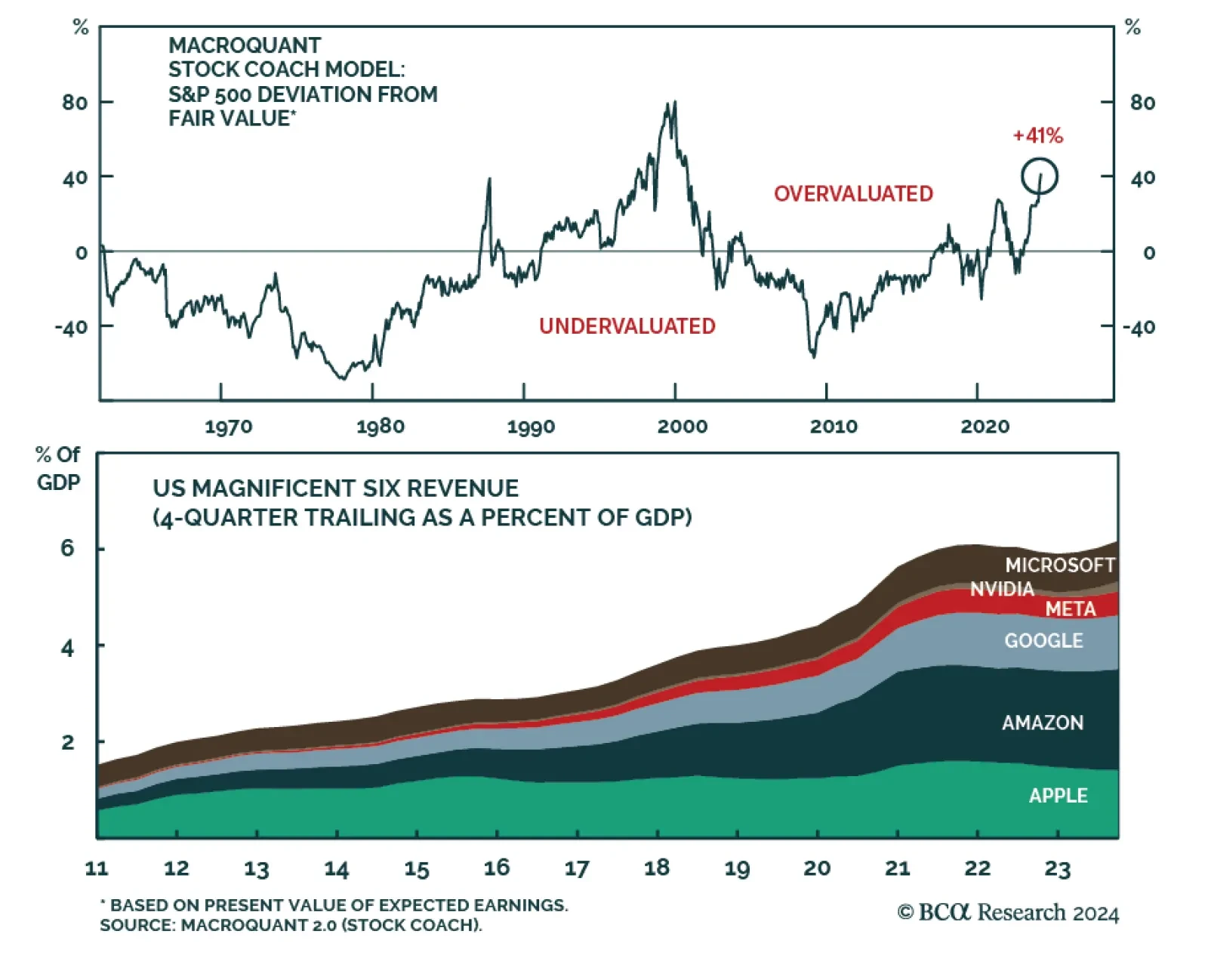

The S&P 500 forged a new all-time high last Thursday and ended the week with a 4.9% year-to-date gain, extending the rally that started in late-October. Interestingly, the recent increase comes even though investors have…

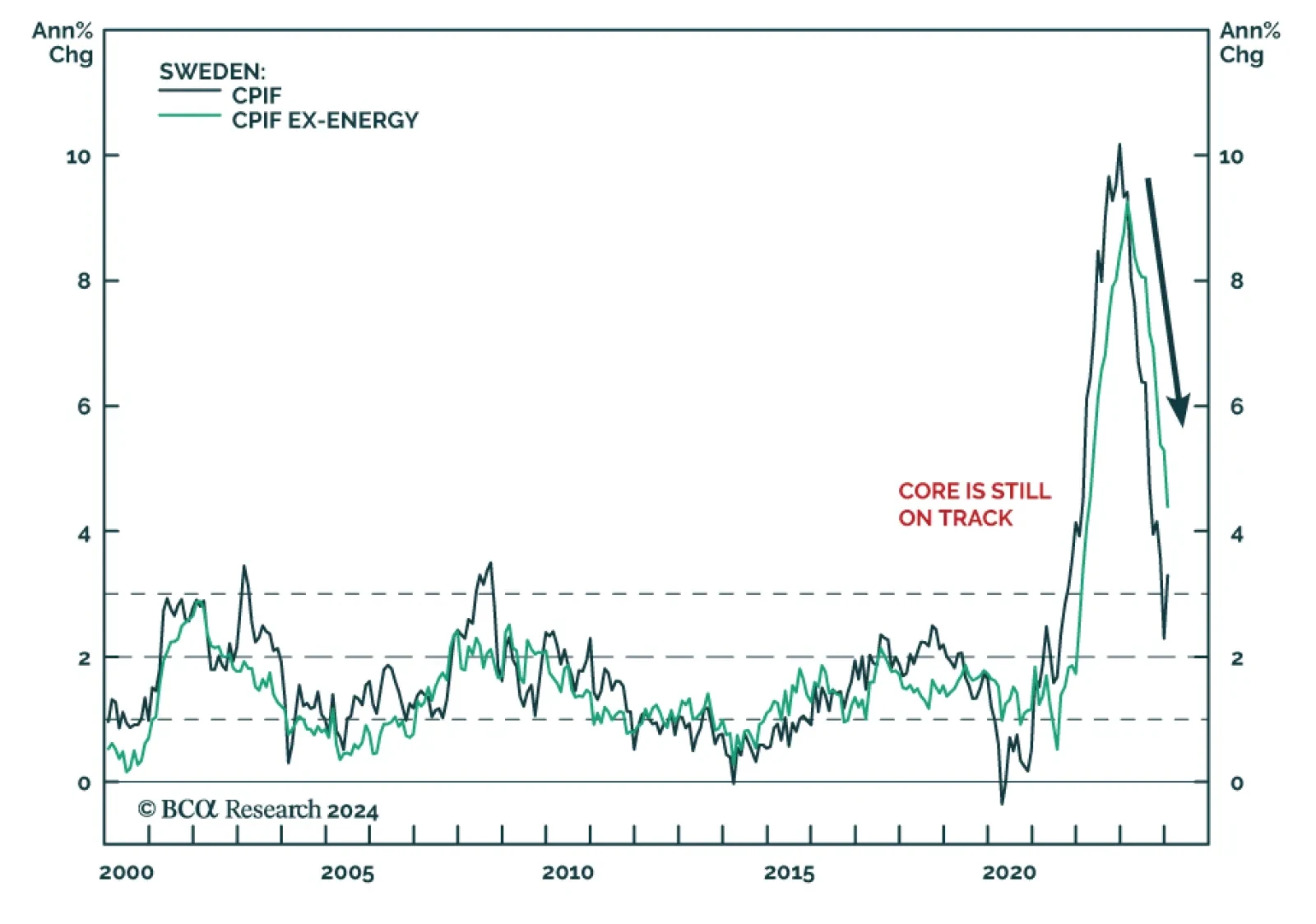

The stronger-than-anticipated acceleration in Sweden’s headline CPI inflation is unlikely to derail the Riksbank’s plan to pivot to policy easing this year. In particular, base effects from lower energy prices a year…

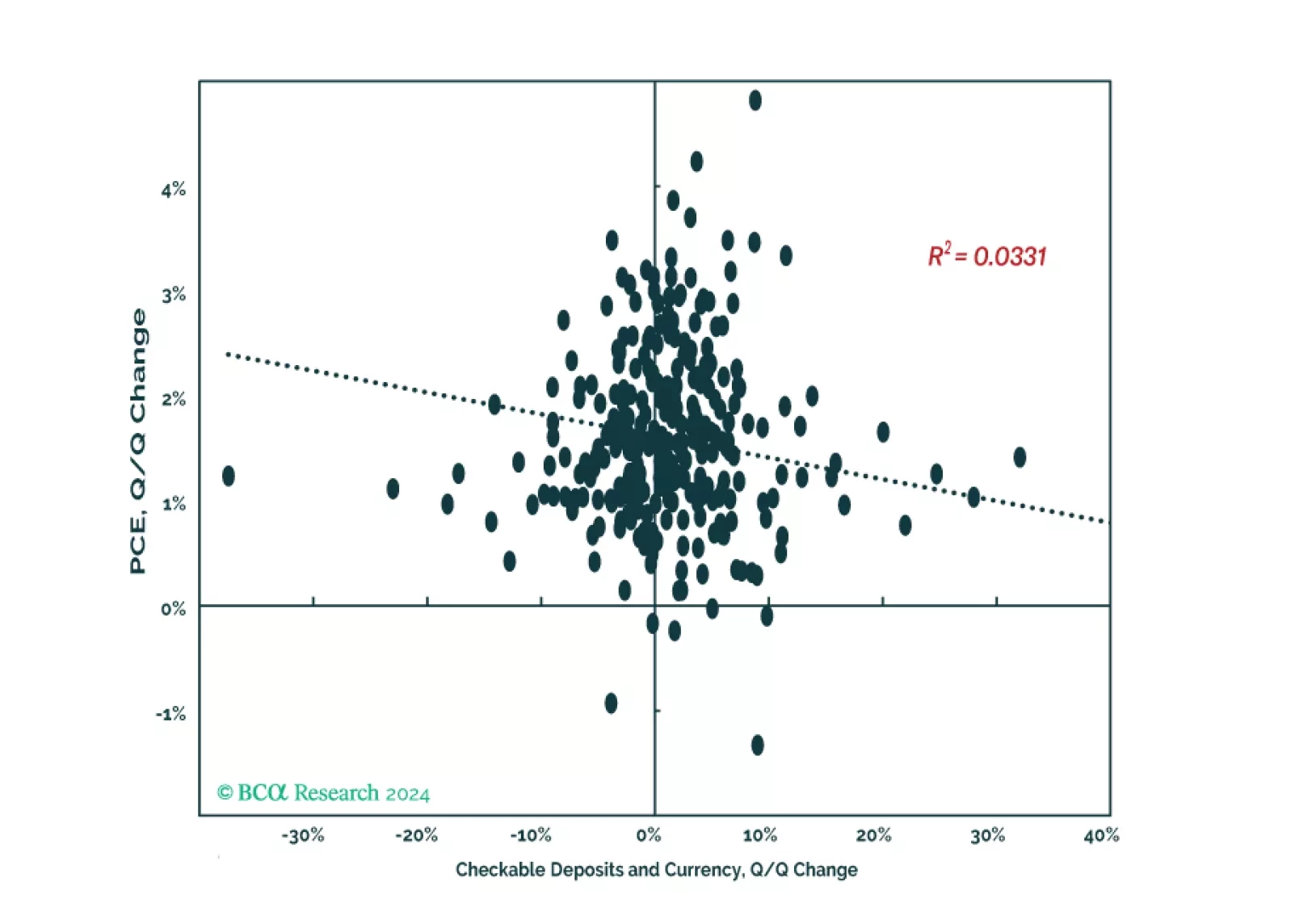

Households have ramped up their cash holdings since the end of 2019, but the absence of an empirical link between cash and consumption leads us to believe that we’ve modestly overestimated the risk of consumer-driven overheating.

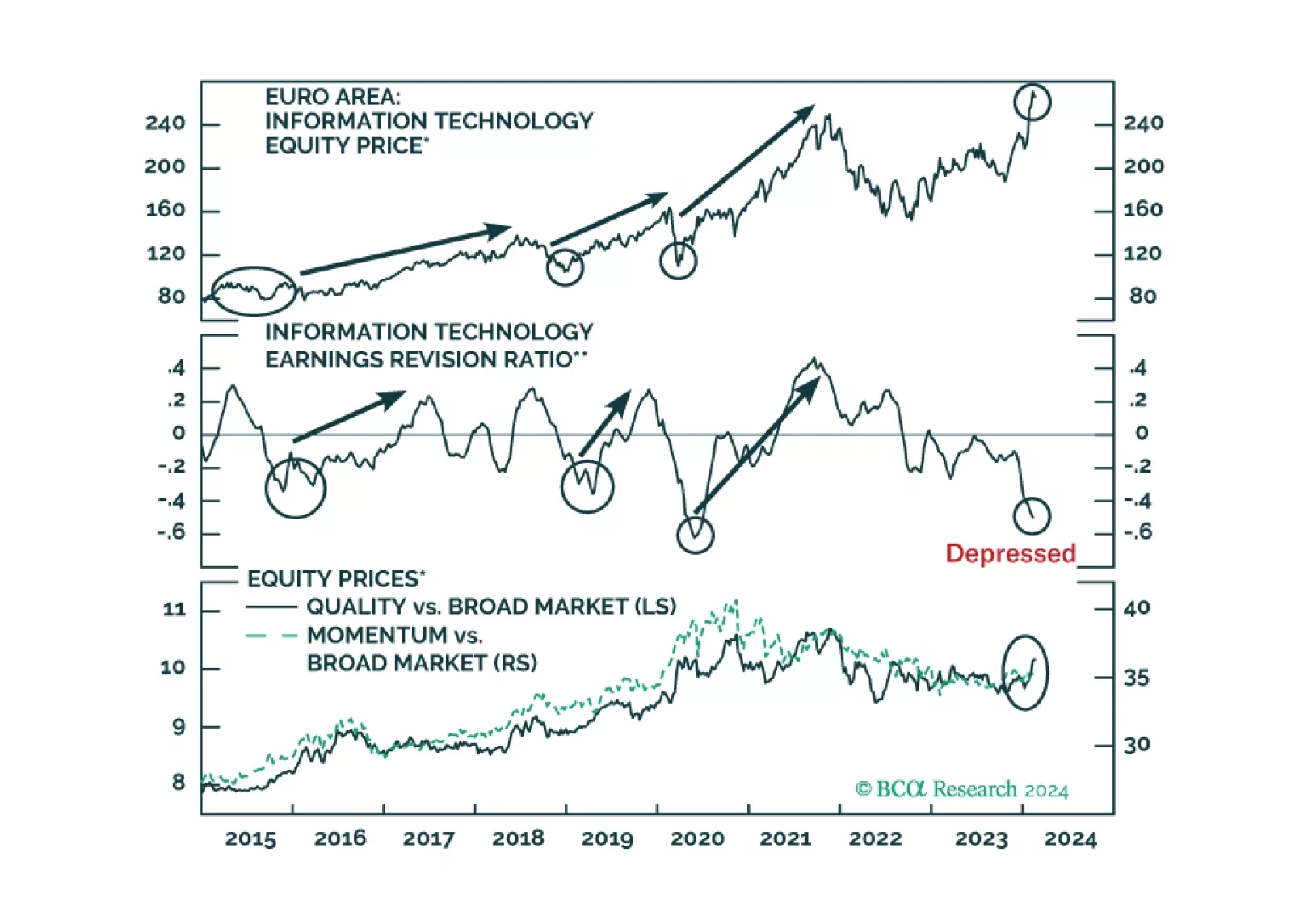

Signs that we are entering the last phase of a bubble are building up. Can European equities benefit from a new tech mania?

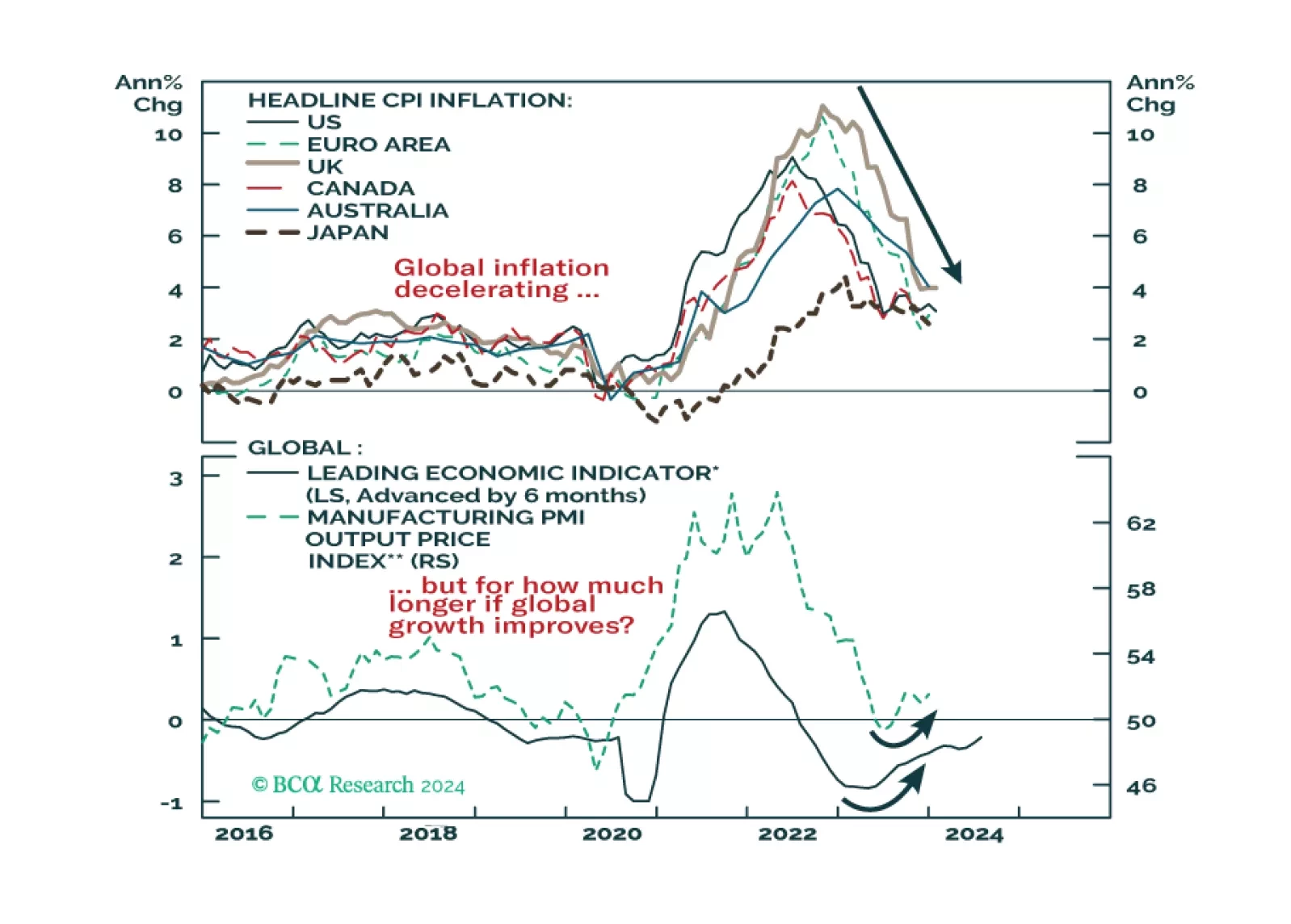

Could a second wave of global inflation be underway? The latest inflation prints in the US and UK showed upside surprises, while there is evidence of increased price pressures in global manufacturing. Combined with the improvements…

According to BCA Research’s Global Investment Strategy service, although the next recession is likely to be mild-to-moderate, the ensuing financial avalanche will be more severe. Valuations are highly stretched and hopes…