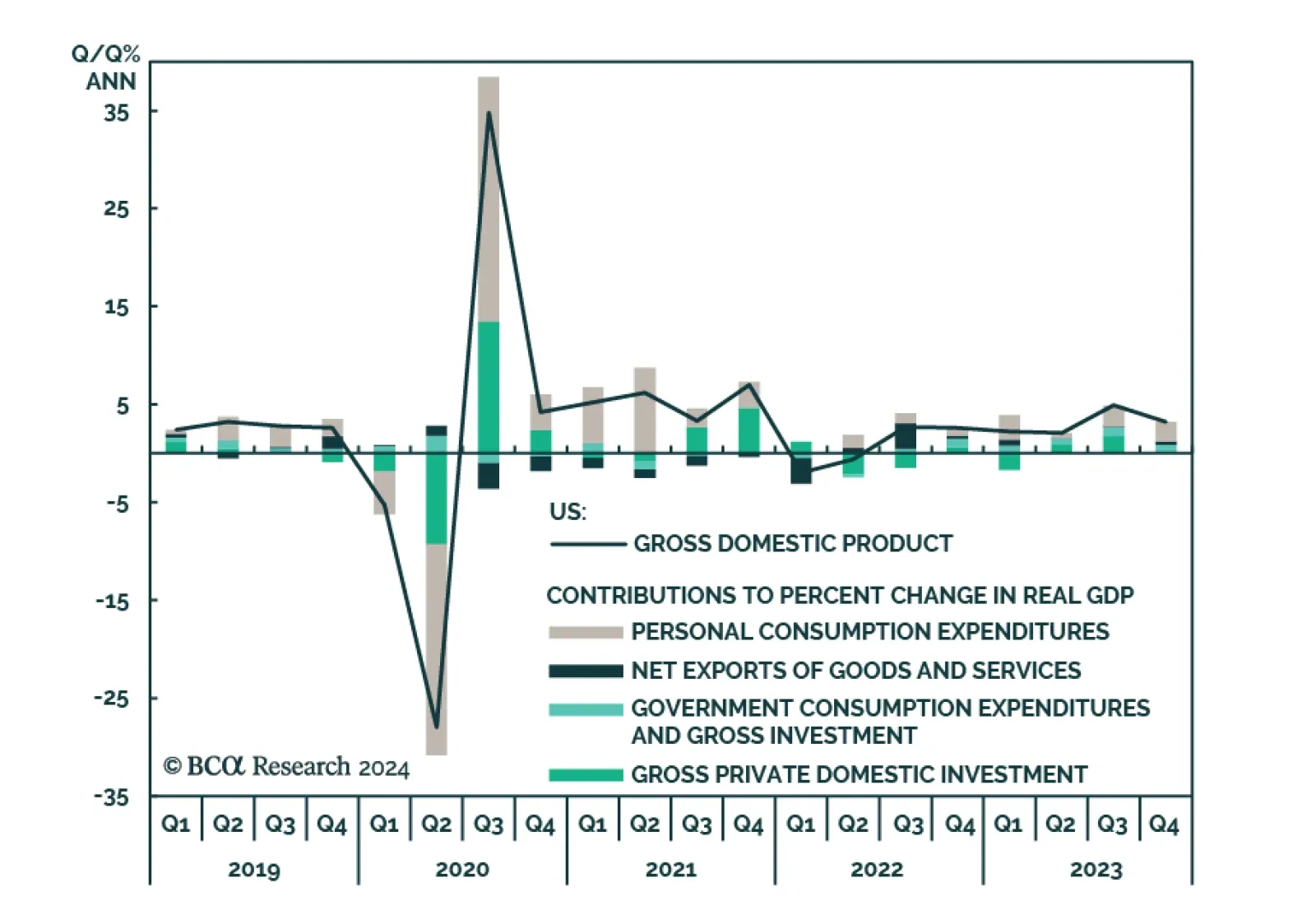

US GDP growth for Q4 was revised lower from 3.3% to 3.2% annualized, driven by a downward revision to private inventory investments (now detracting 0.27 points from a previous 0.07 contribution to GDP). However, consumer spending…

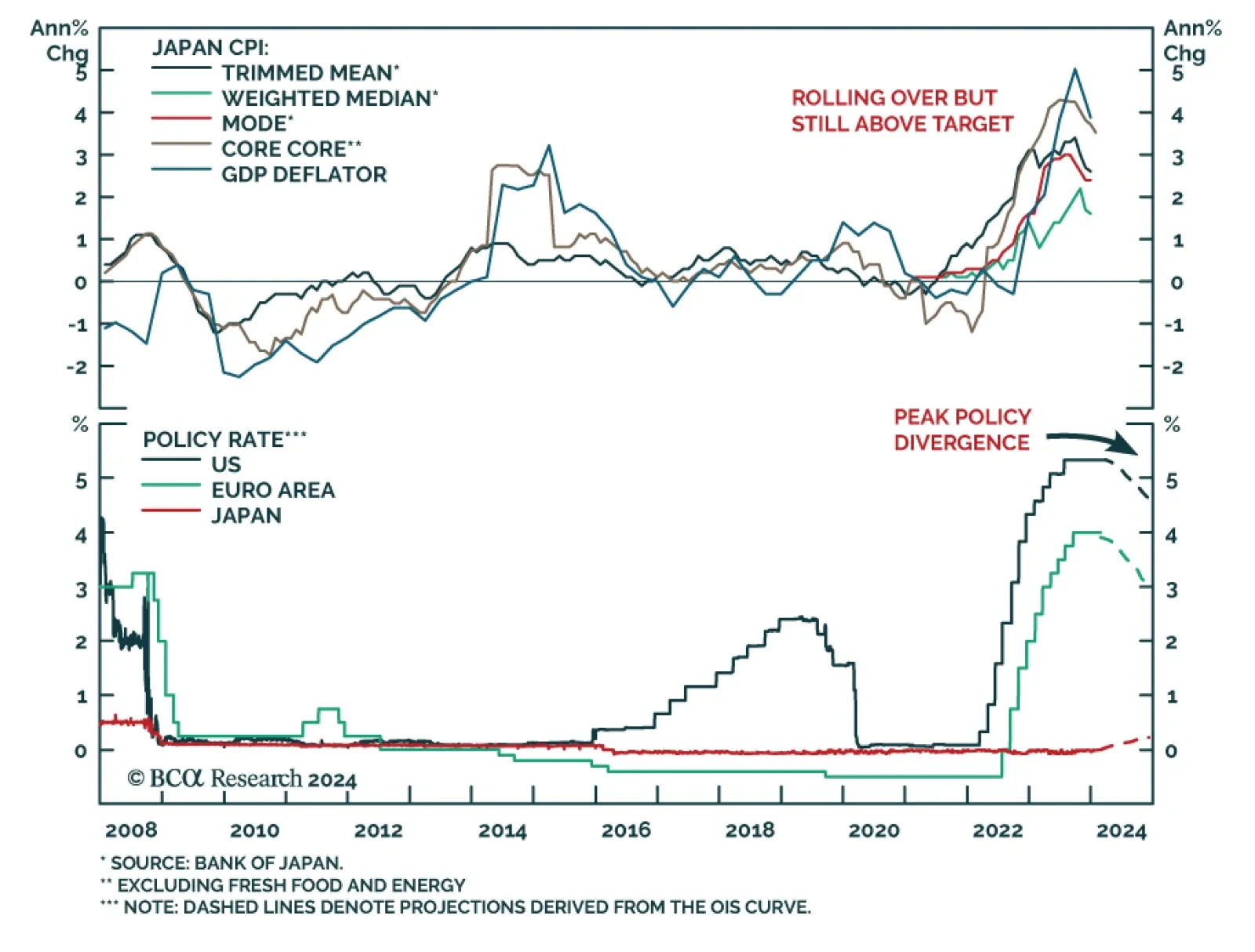

Japan’s CPI inflation dropped from 2.6% to 2.2% y/y in January. However, the sharp slowdown comes on the back of falling energy prices. Meanwhile, the BoJ’s core-core measure of underlying inflation (CPI excluding…

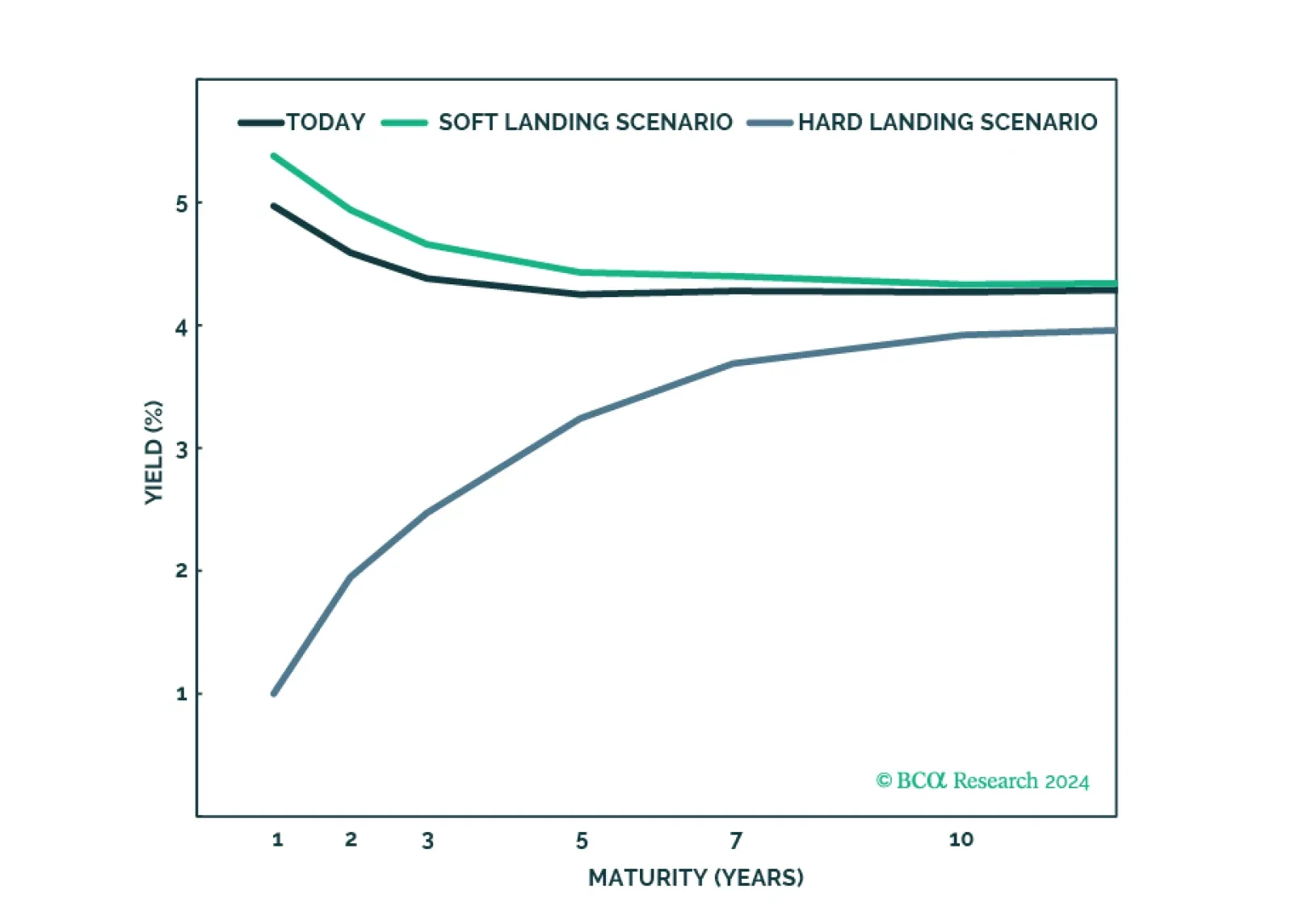

The first in a series of Strategy Insights where we present a checklist for extending duration in each major government bond market. This first entry focuses on the US.

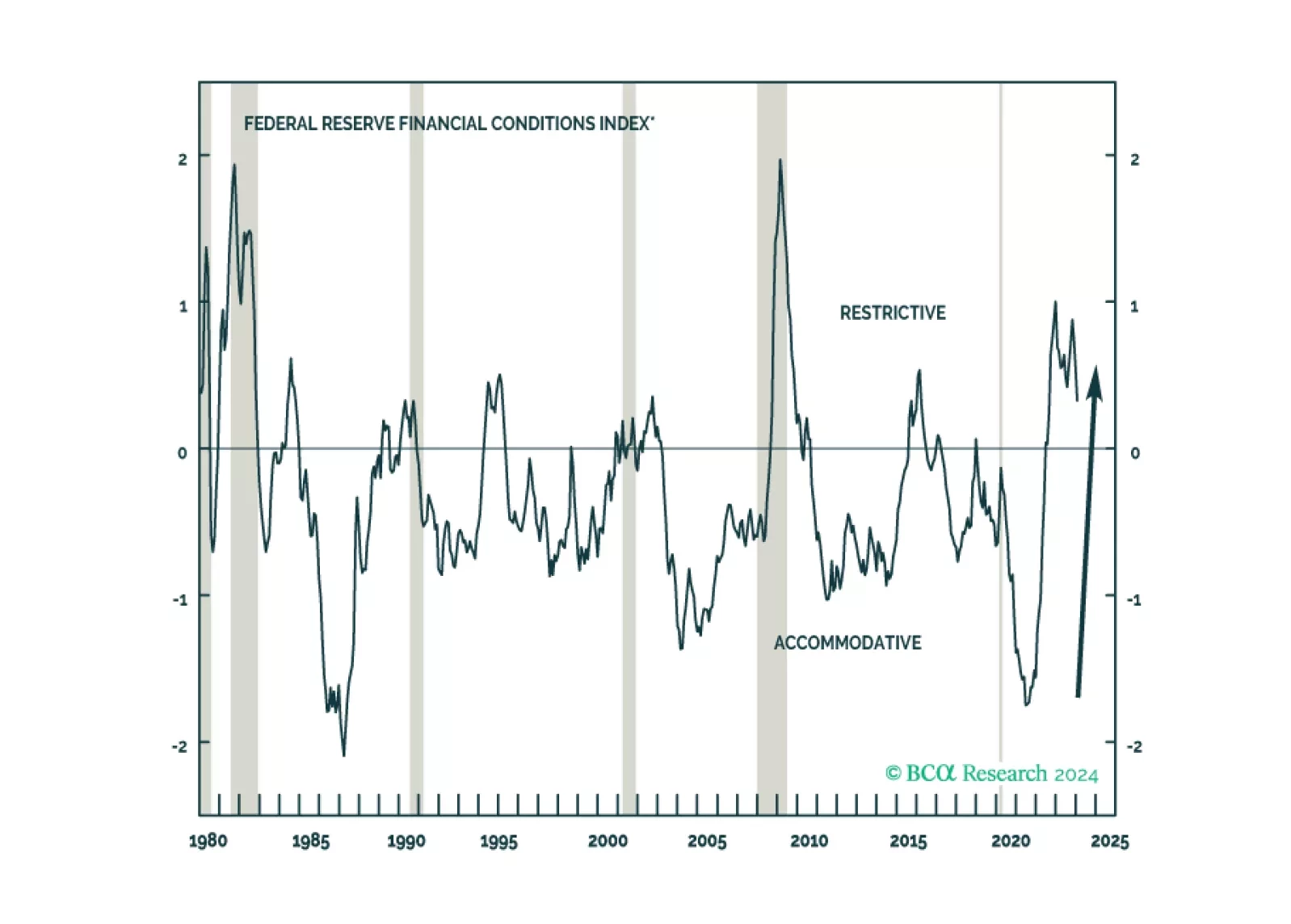

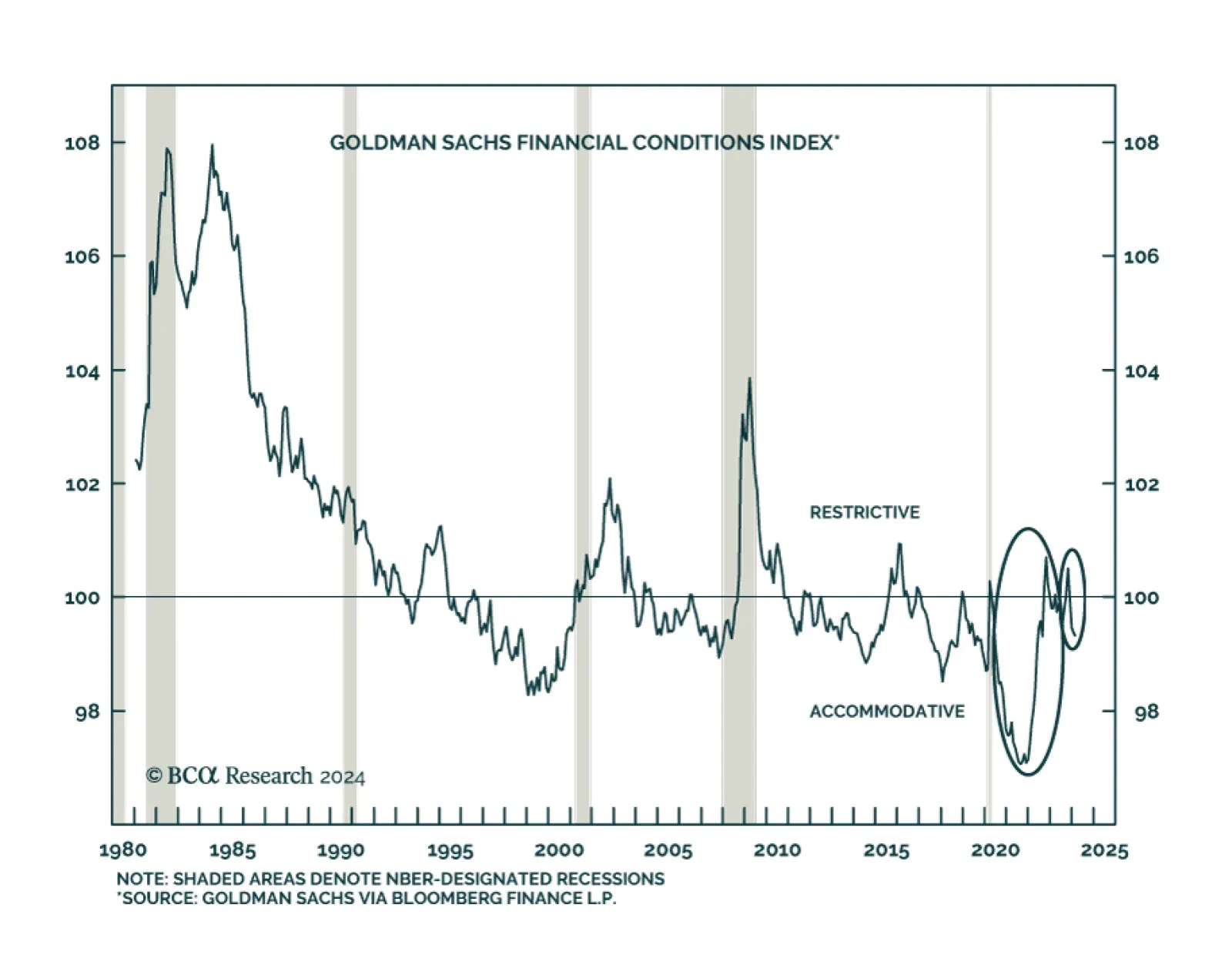

According to BCA Research’s US Investment Strategy service, investors should take care not to read too much into the recent easing in financial conditions. According to Goldman Sachs’ Financial Conditions Index (…

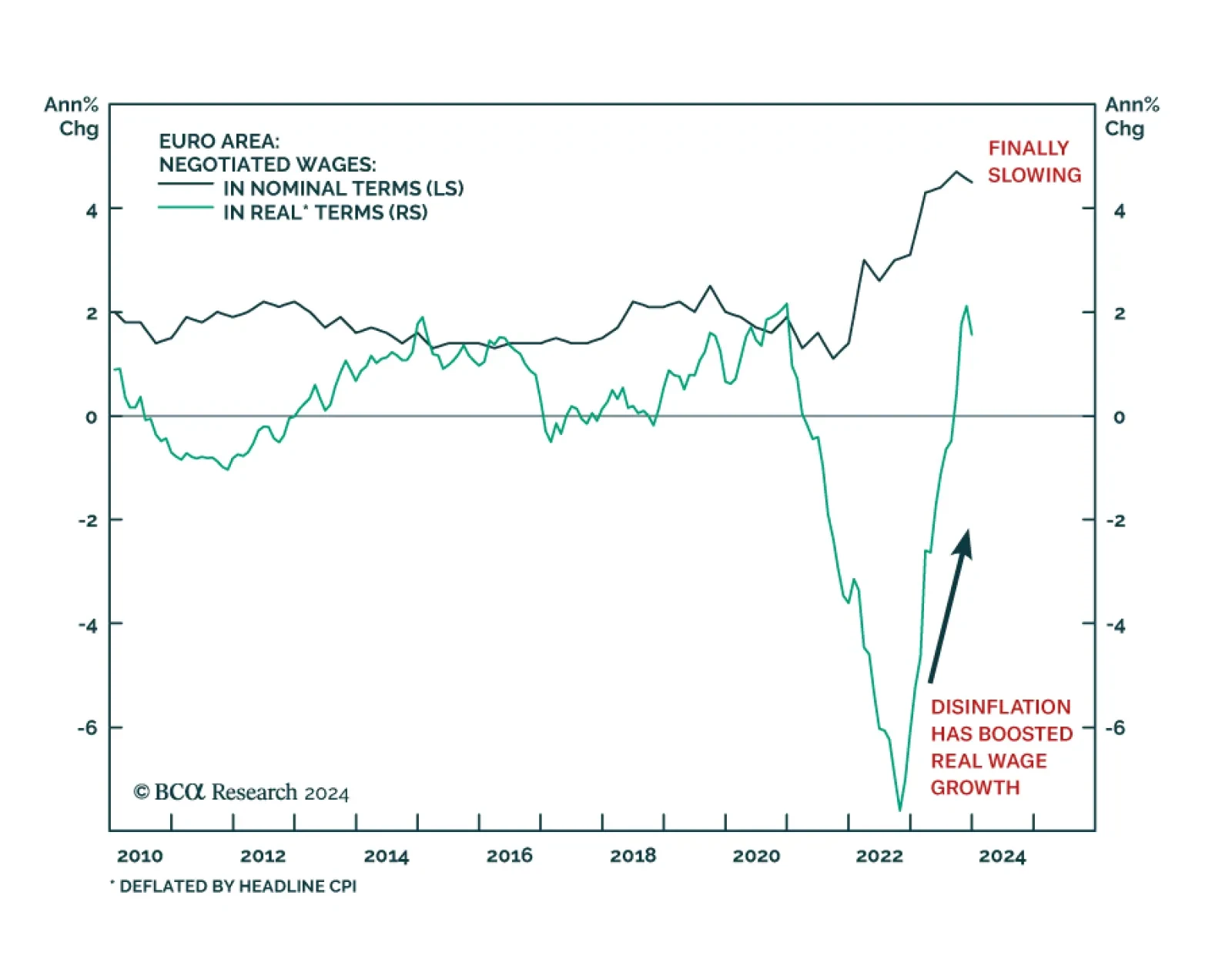

The messaging from the minutes of the ECB’s January meeting was similar to the Fed. Although Governing Council members noted that “for the first time in many meetings, the risks to reaching the inflation target were…

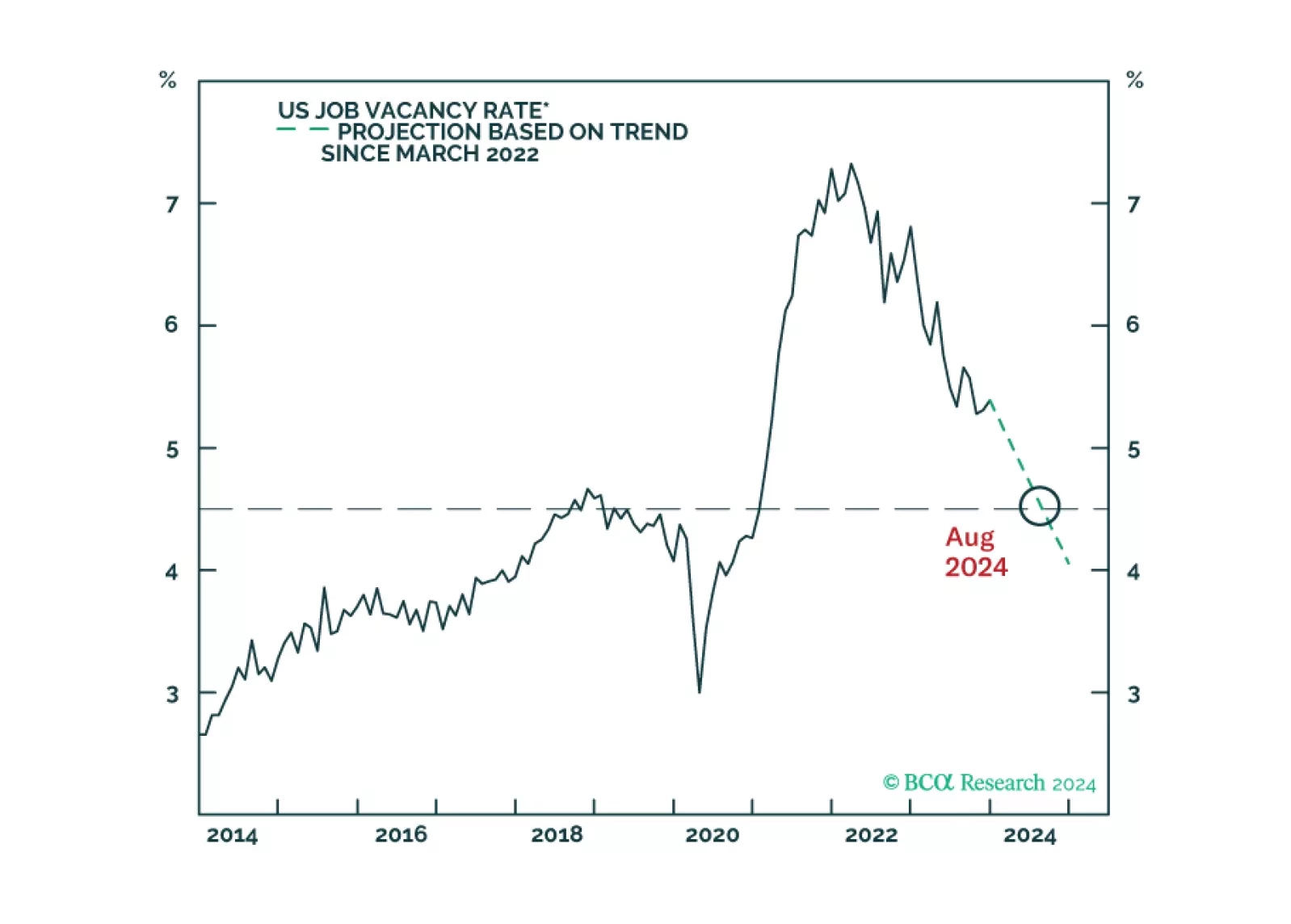

Clients have been pushing back on our recession call on the grounds that it is incompatible with the economy’s second-half acceleration and the more recent easing in financial conditions. We examine both of those points in the course…

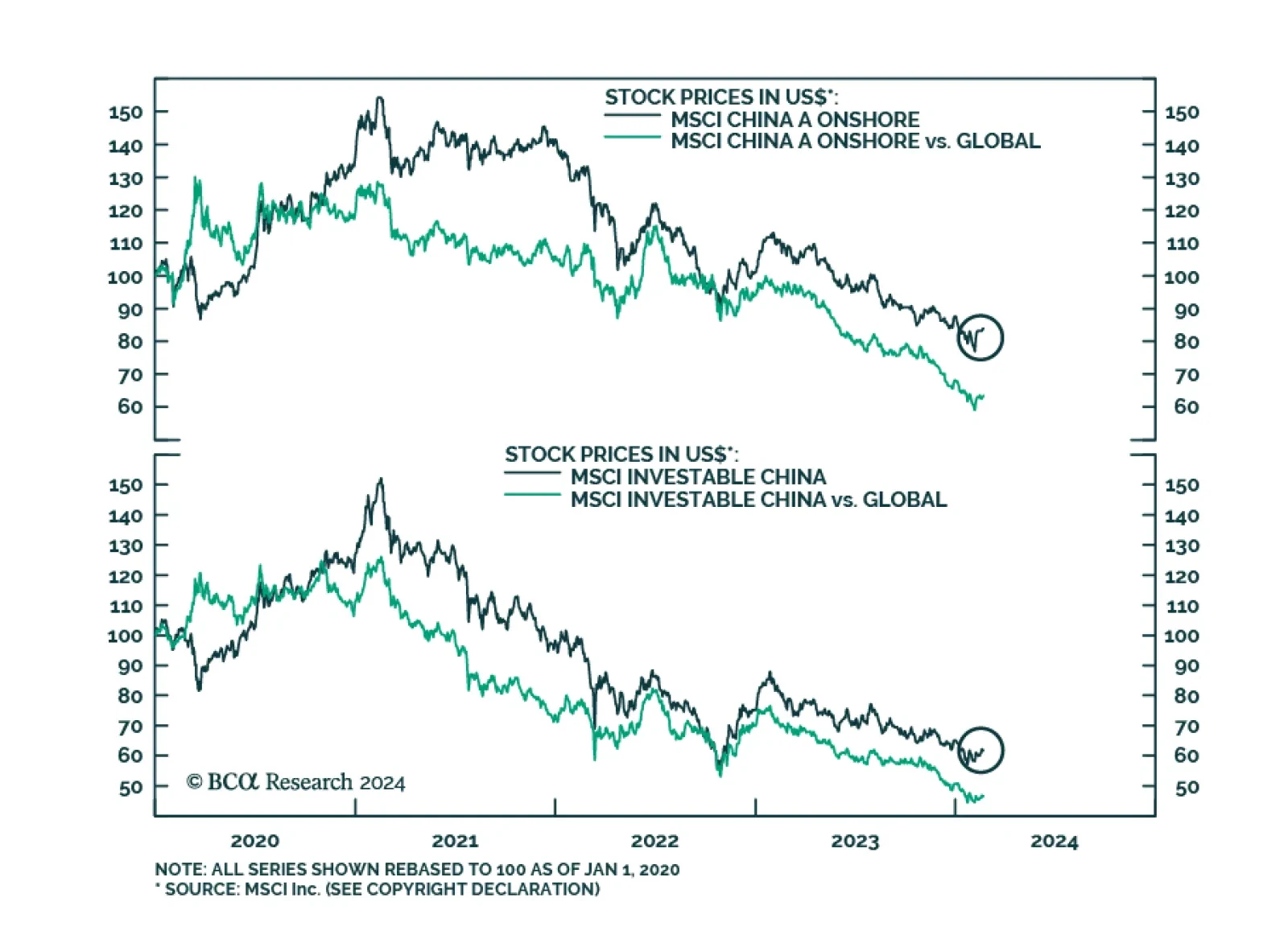

Chinese equities are extending their gains following the end of the Lunar New Year holiday. Onshore stocks have gained 9.0% since February 5, outperforming the global benchmark by 7.5 percentage points over this period. Similarly…

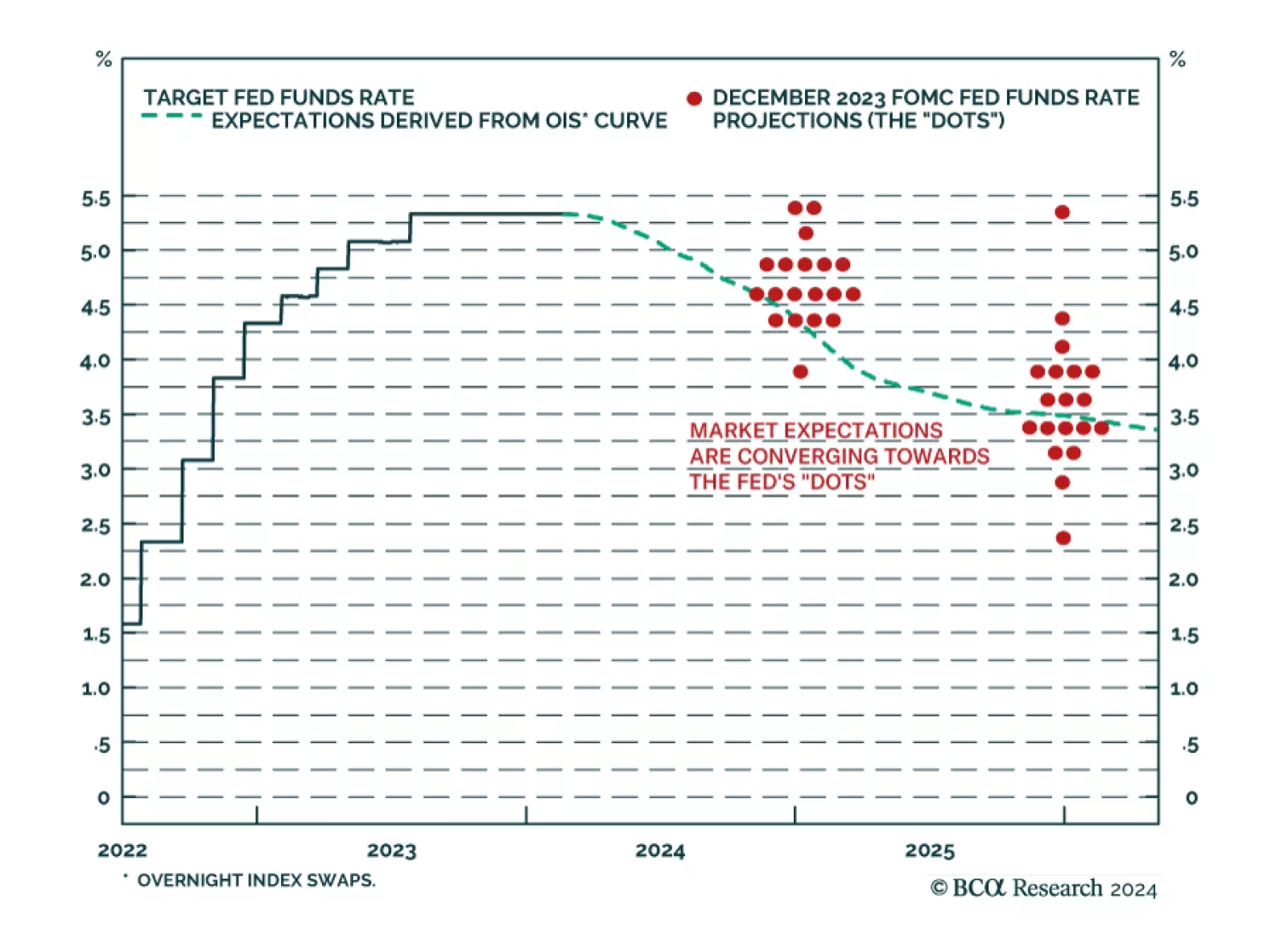

The minutes of the January FOMC meeting underscore that policymakers are adopting a cautious approach in timing the pivot to policy easing. Although Fed officials acknowledged that inflation and employment risks are “…

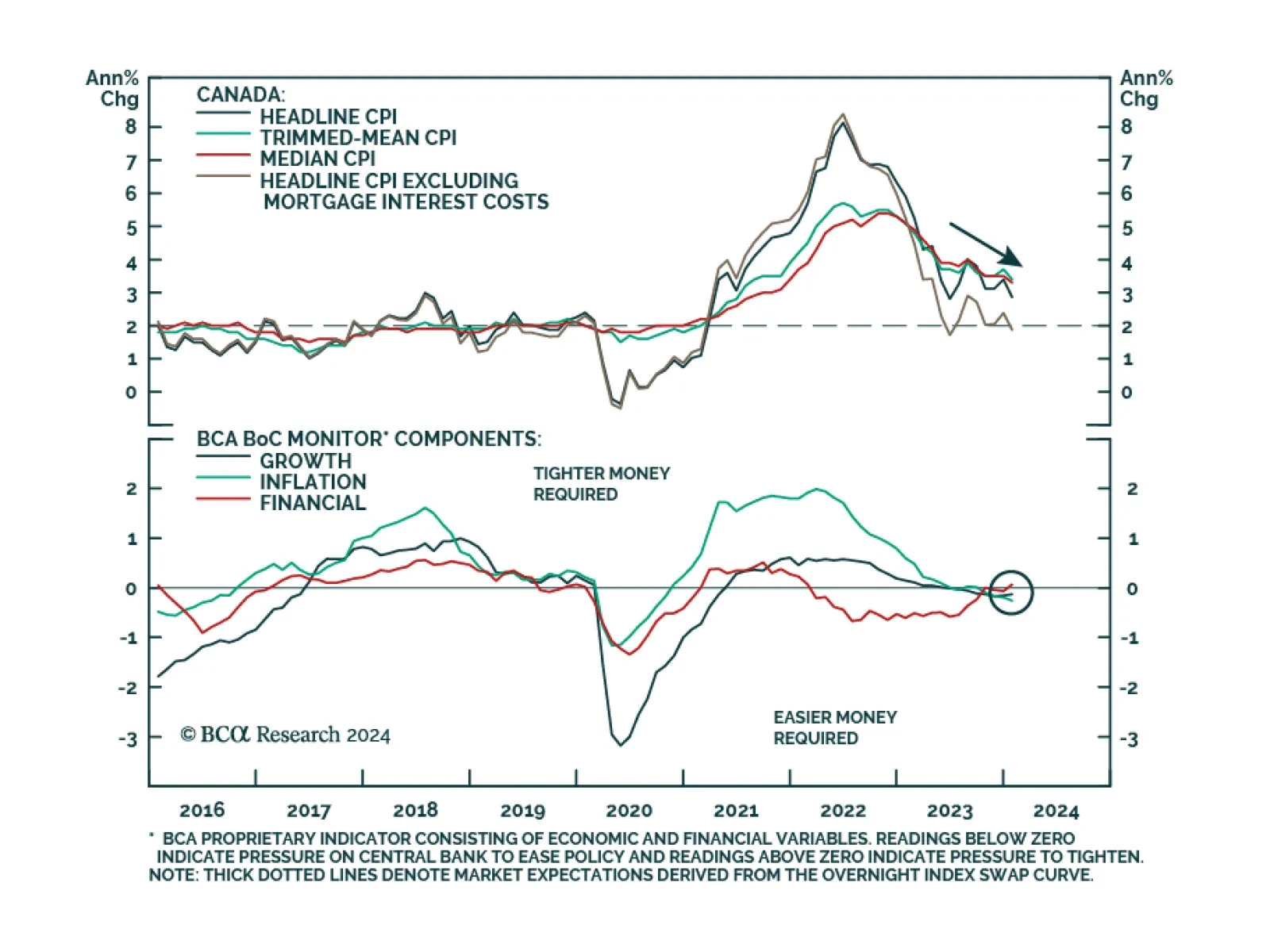

Canada’s January CPI release shows price pressures cooling last month. Headline CPI eased to 2.9%y/y from 3.4%y/y in December, below expectations of 3.3%y/y. Furthermore, month-over-month inflation fell for the first time…

We rank the US spread sectors in terms of risk versus reward.