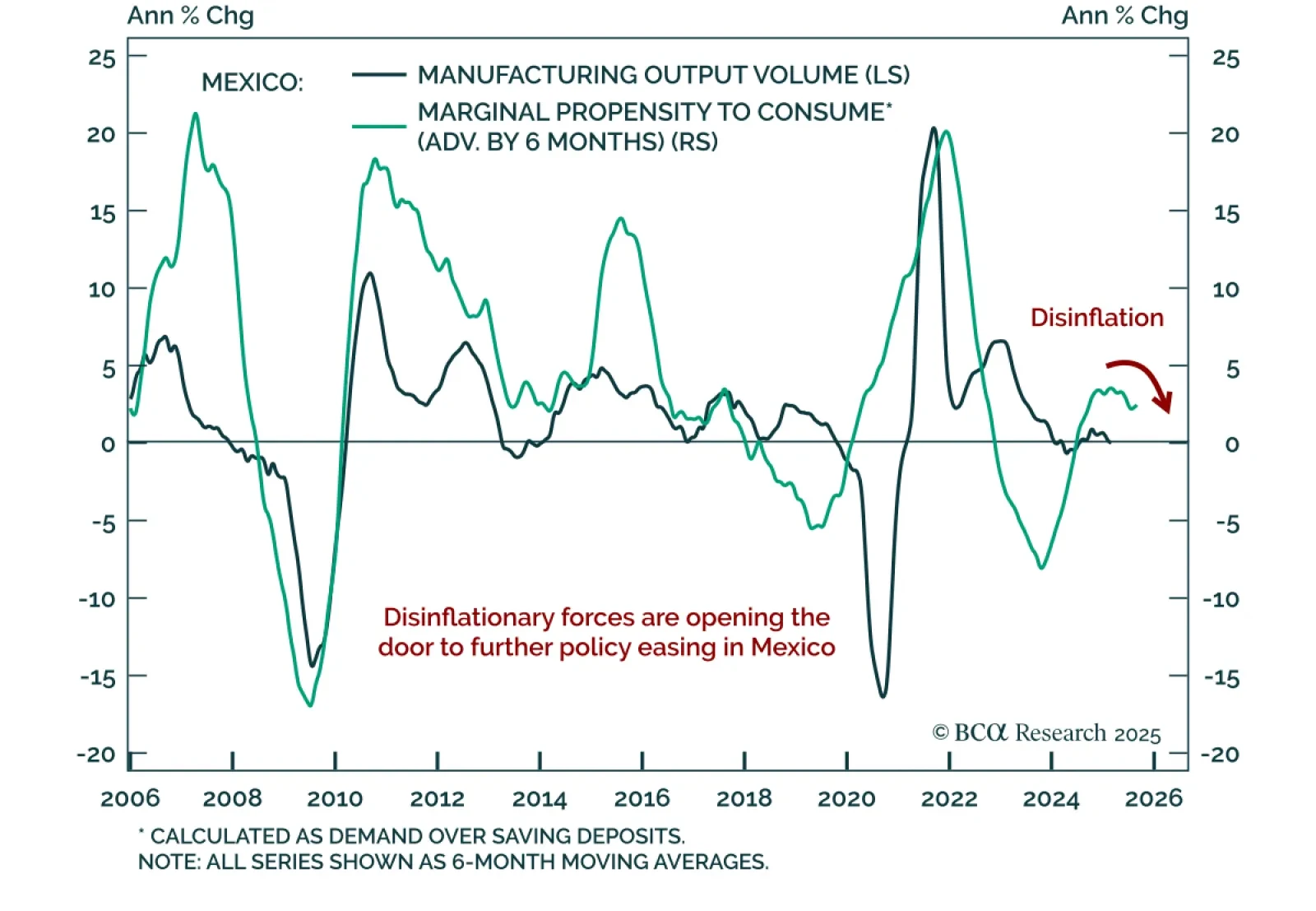

Banxico’s latest rate cut reinforces our bullish view on Mexican domestic bonds. Mexico’s central bank eased policy by another 25 basis points to 7.75%. Investors should bet on further easing. Inflation will continue…

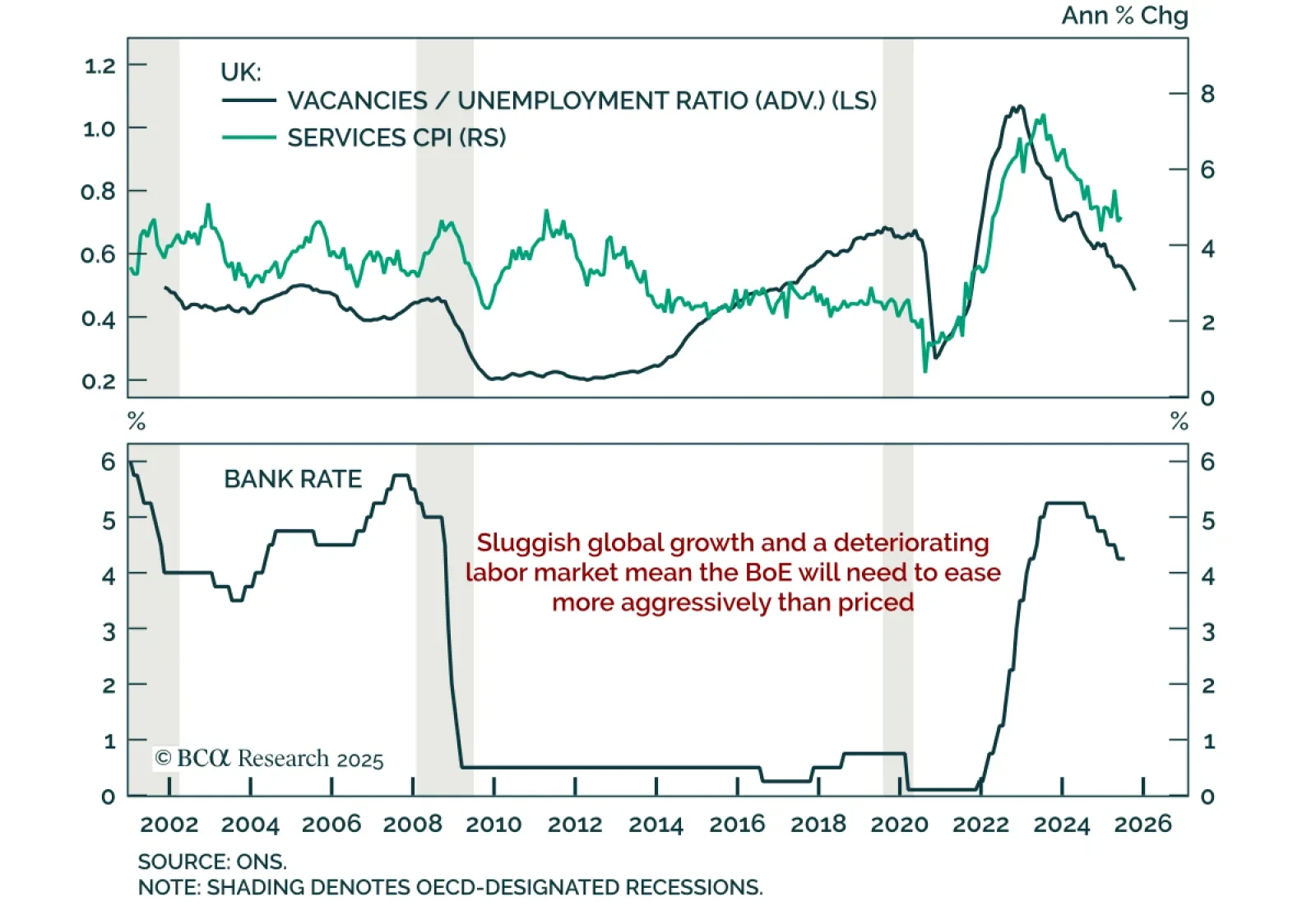

The BoE delivered a narrow rate cut to 4%, but a divided vote and fading growth momentum suggest markets are underpricing further easing. Stay overweight UK Gilts. The 5-4 split reflected concerns among dissenters about a…

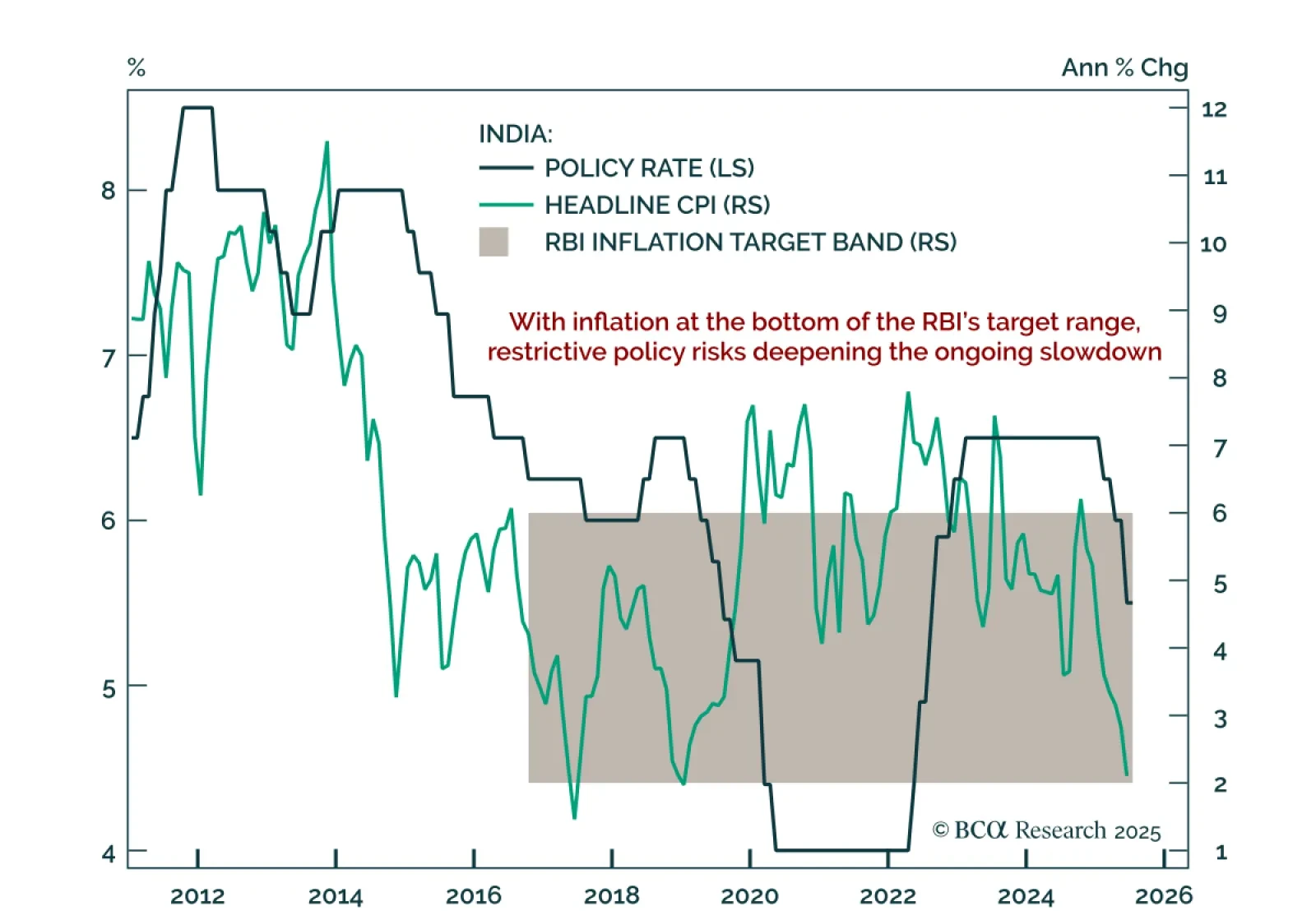

India’s central bank held rates at 5.5%, but restrictive policy, weak credit impulse, and rising external risks support further easing and a long bond position. Real lending rates remain near decade highs, and the negative…

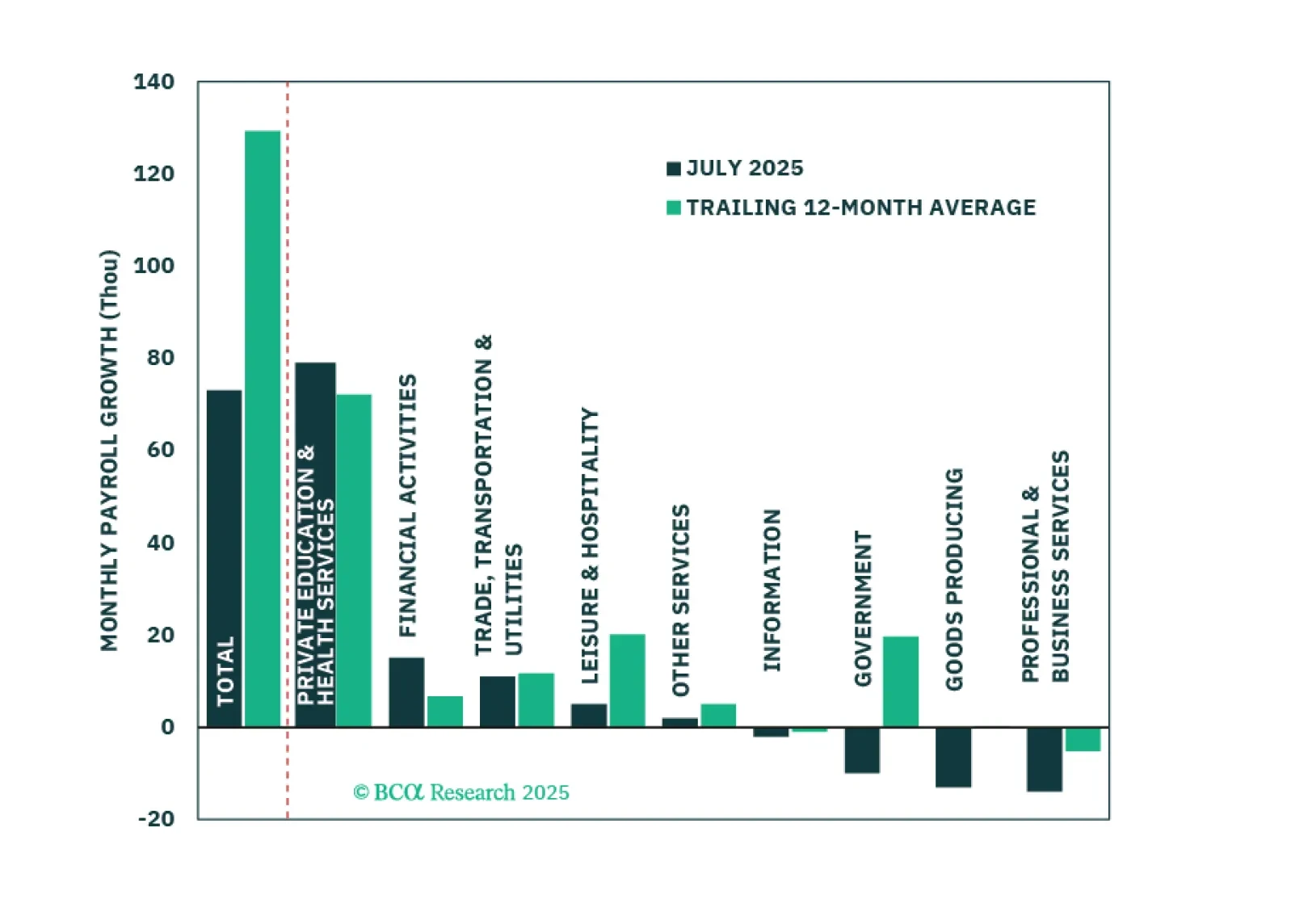

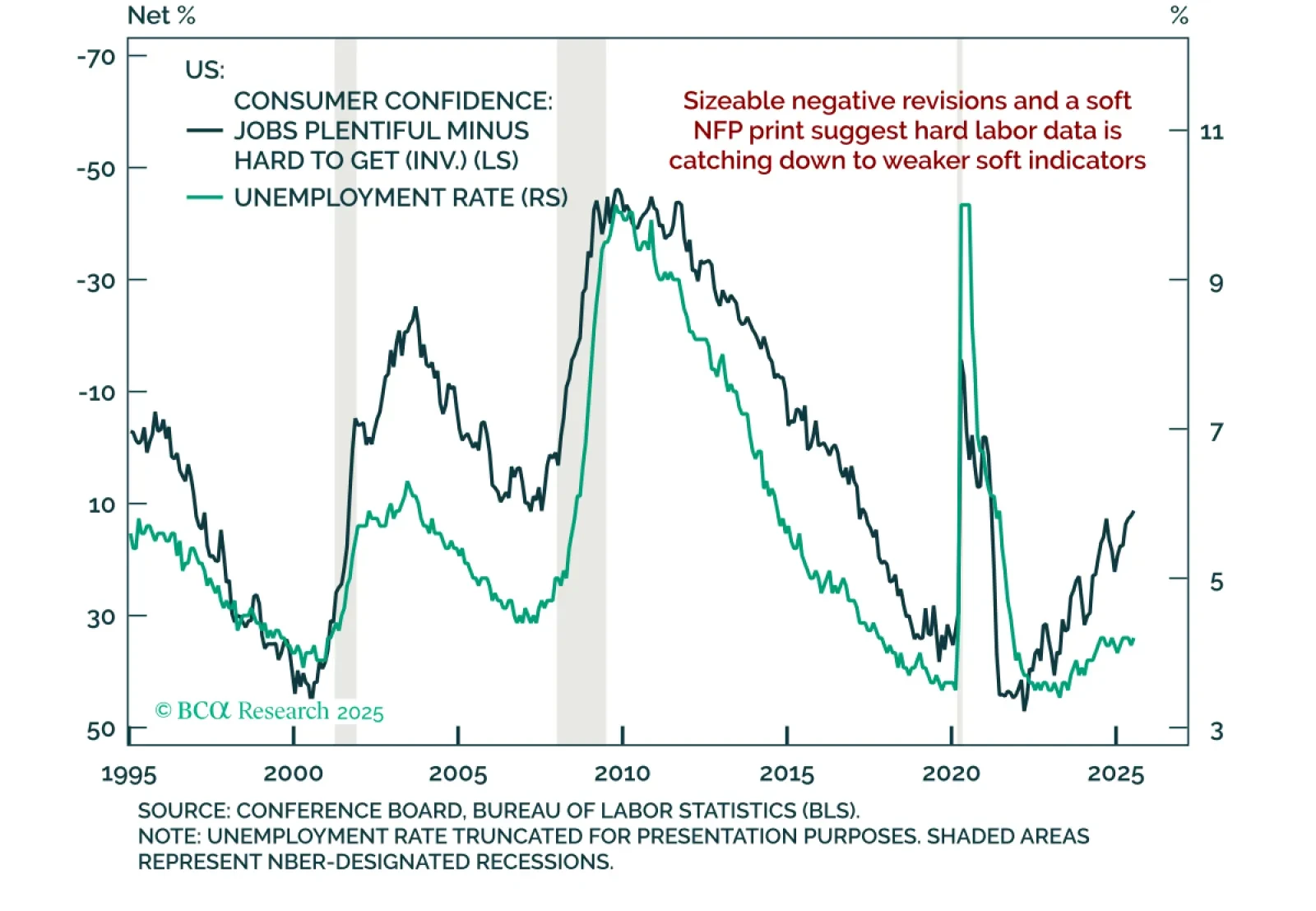

The July employment report revealed large downward revisions and slowing payroll growth, reinforcing our defensive stance. Nonfarm payrolls rose just 73k, and prior months were revised down by 258k, bringing the 3-month average to…

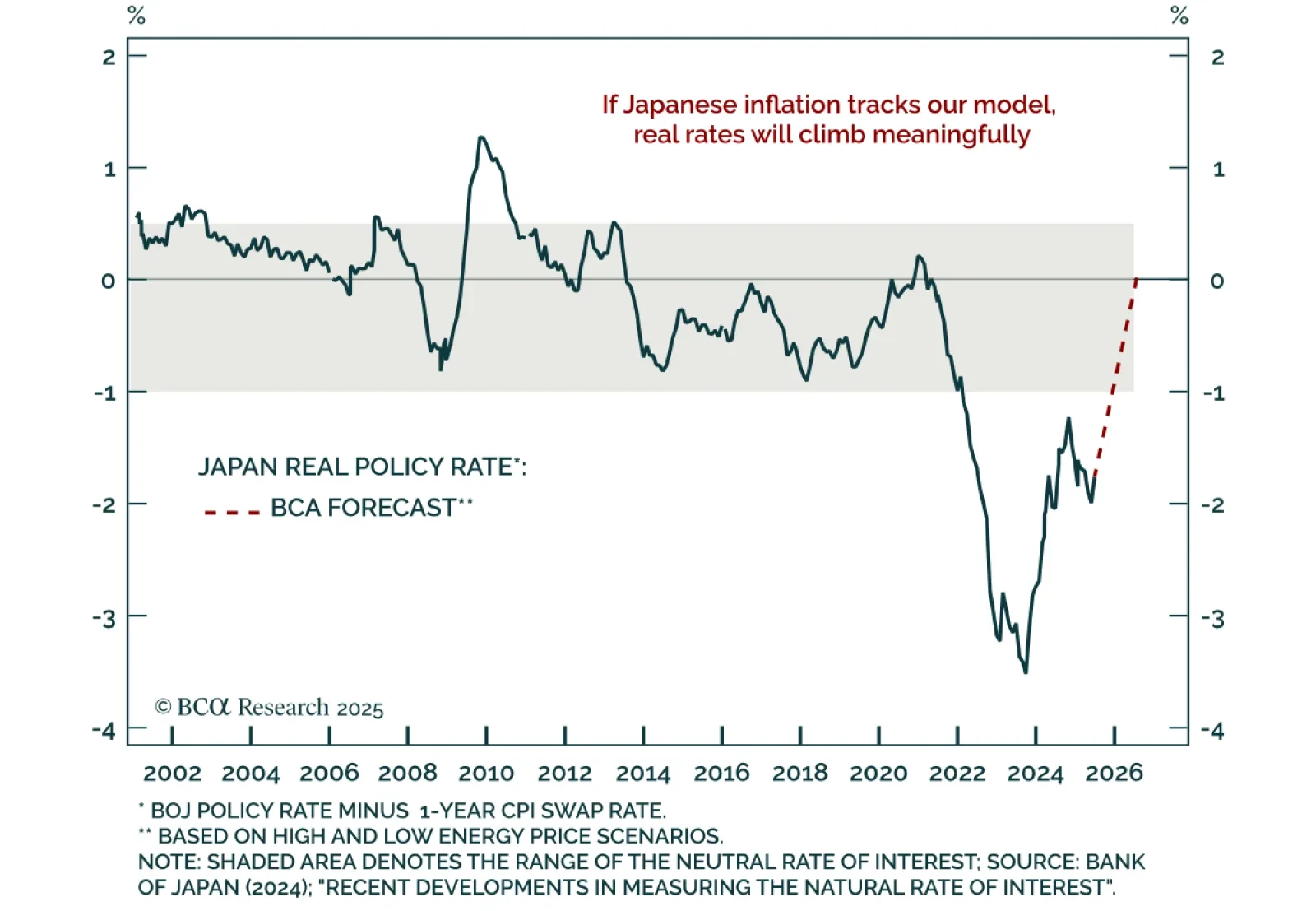

Our DM ex. US strategists see the yen entering a multi-year rally and recommend shorting EUR/JPY now while preparing to short USD/JPY as Fed cuts approach. The yen remains deeply undervalued across PPP, unit labor cost, and real…

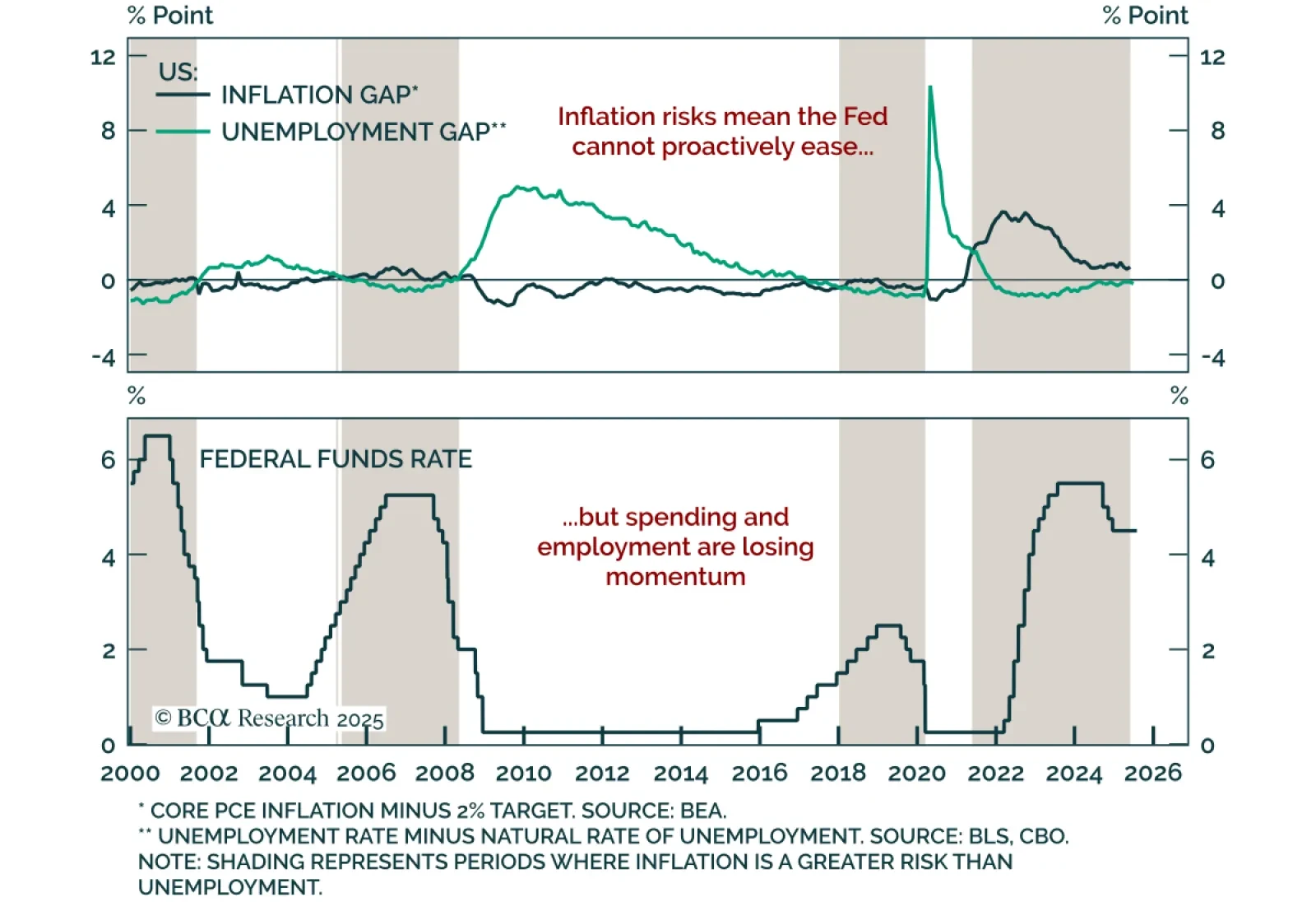

Economic activity and hiring cooled significantly in the first half of the year. The most important question for investors is whether this signals an imminent increase in labor market slack.

The SARB cut rates by 25 bps to 7.00%; our EM strategists expect further easing and recommends short ZAR exposure. Real interest rates remain elevated, and high borrowing costs are intensifying debt sustainability concerns, with…

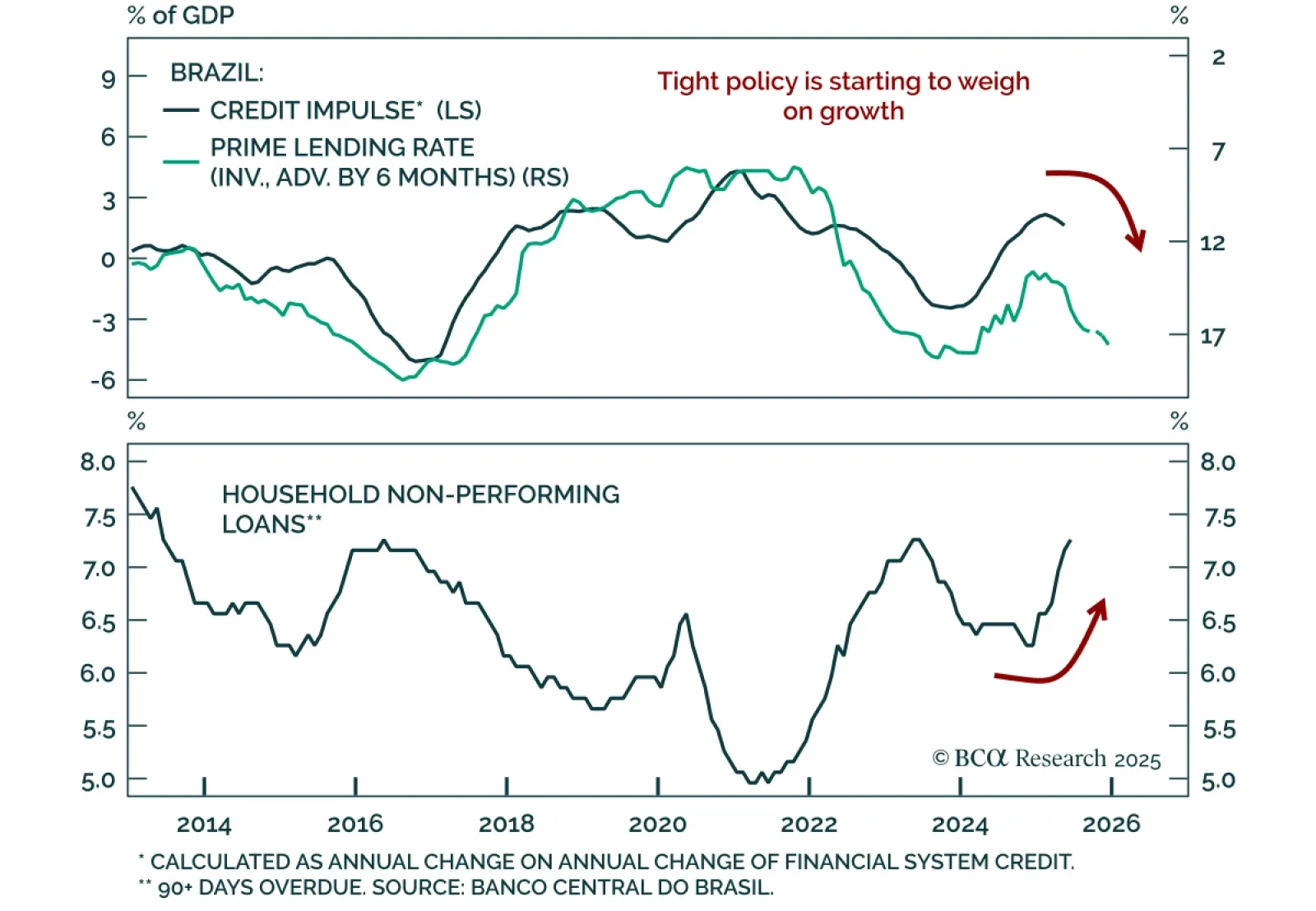

The Central Bank of Brazil (BCB) held rates at 15%, guaranteeing a sharp growth slowdown and reinforcing our underweight stance on Brazilian equities versus EM. All Copom board members voted to maintain an ultra-hawkish policy…

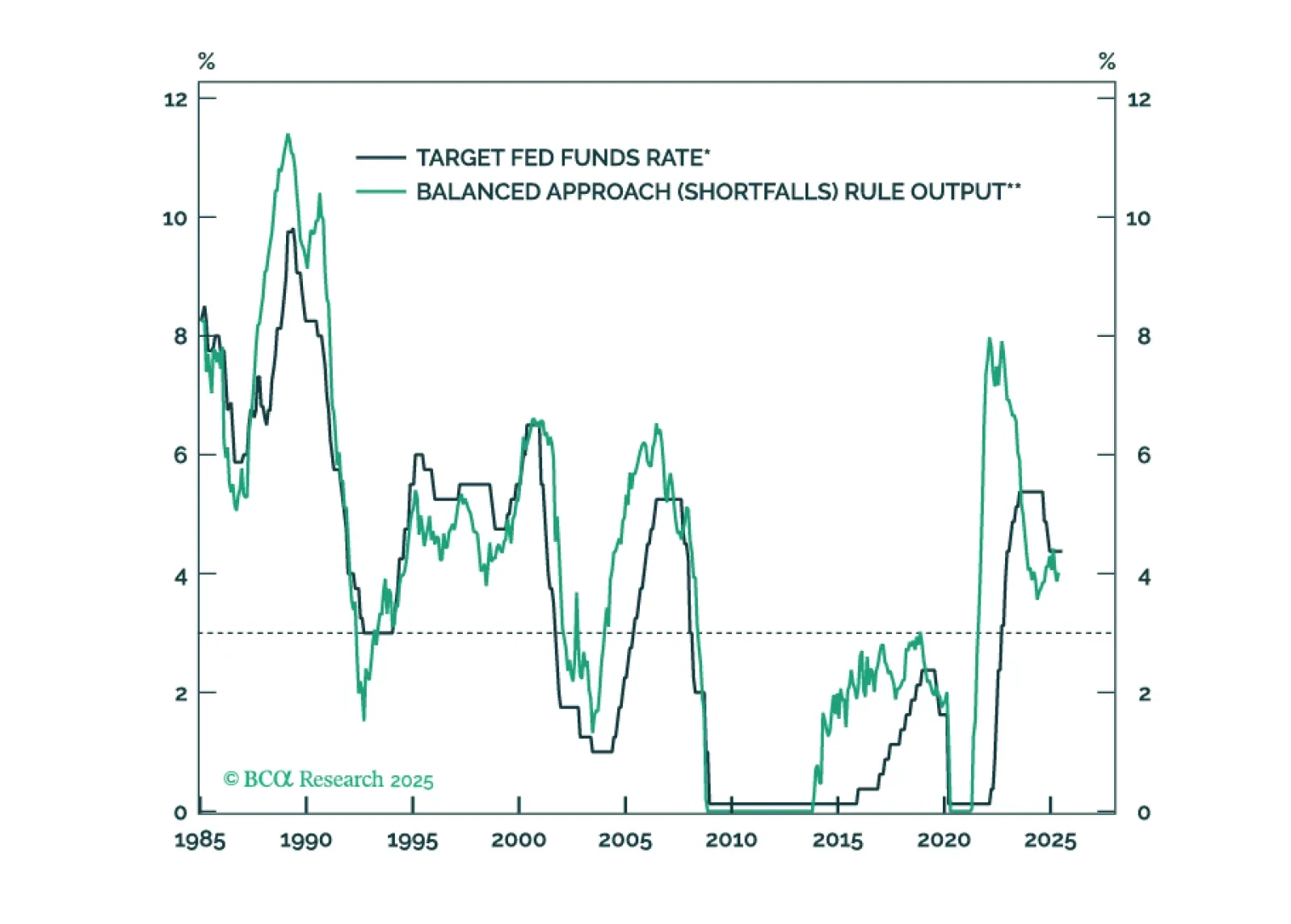

The Fed will keep rates on hold until the unemployment rate forces its hand.

The Fed held rates steady for a fifth straight meeting, with a divided FOMC and resilient growth keeping policy on hold, supporting our long-duration stance. The target range remains at 4.25%–4.50%, with the statement reflecting only…