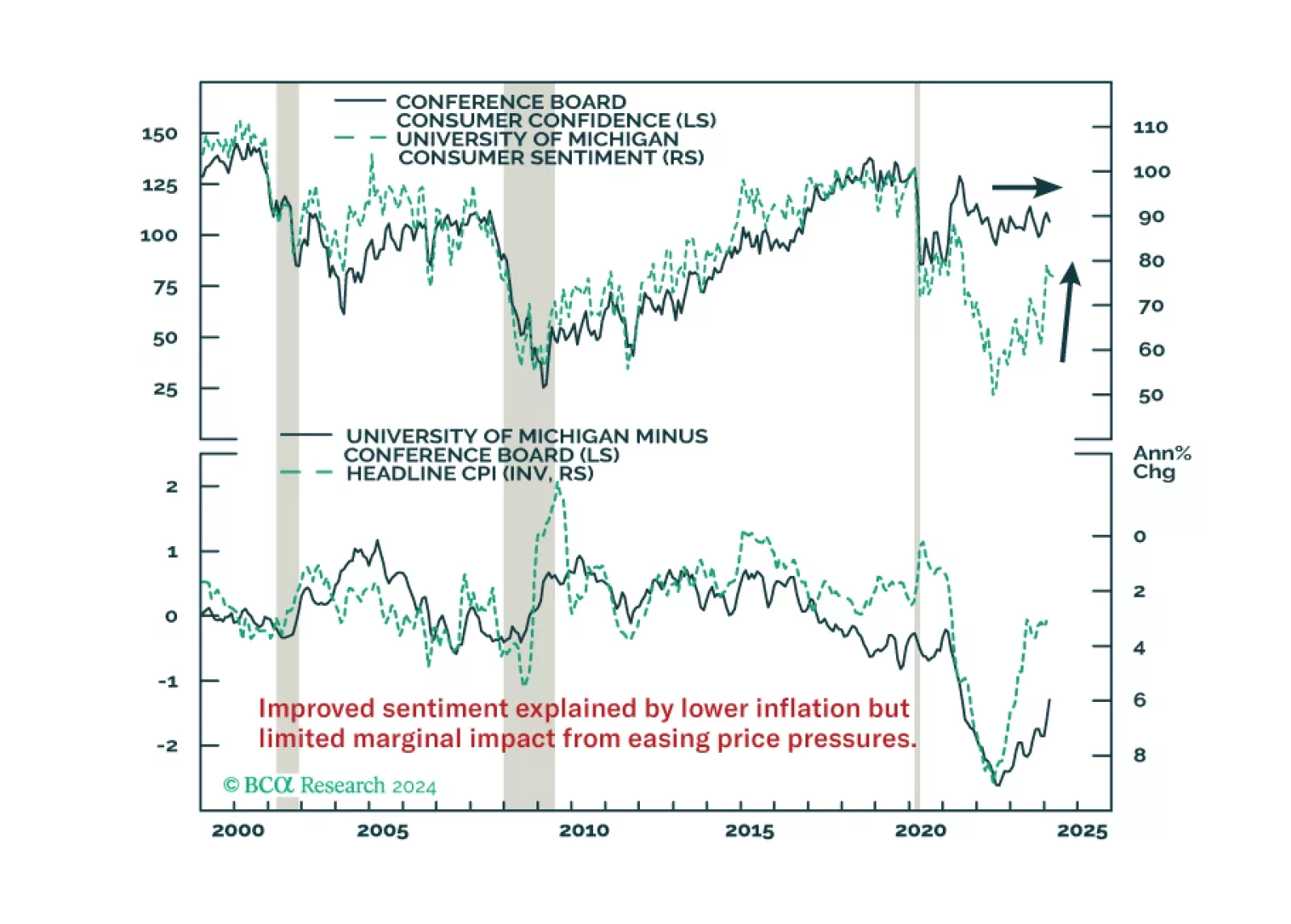

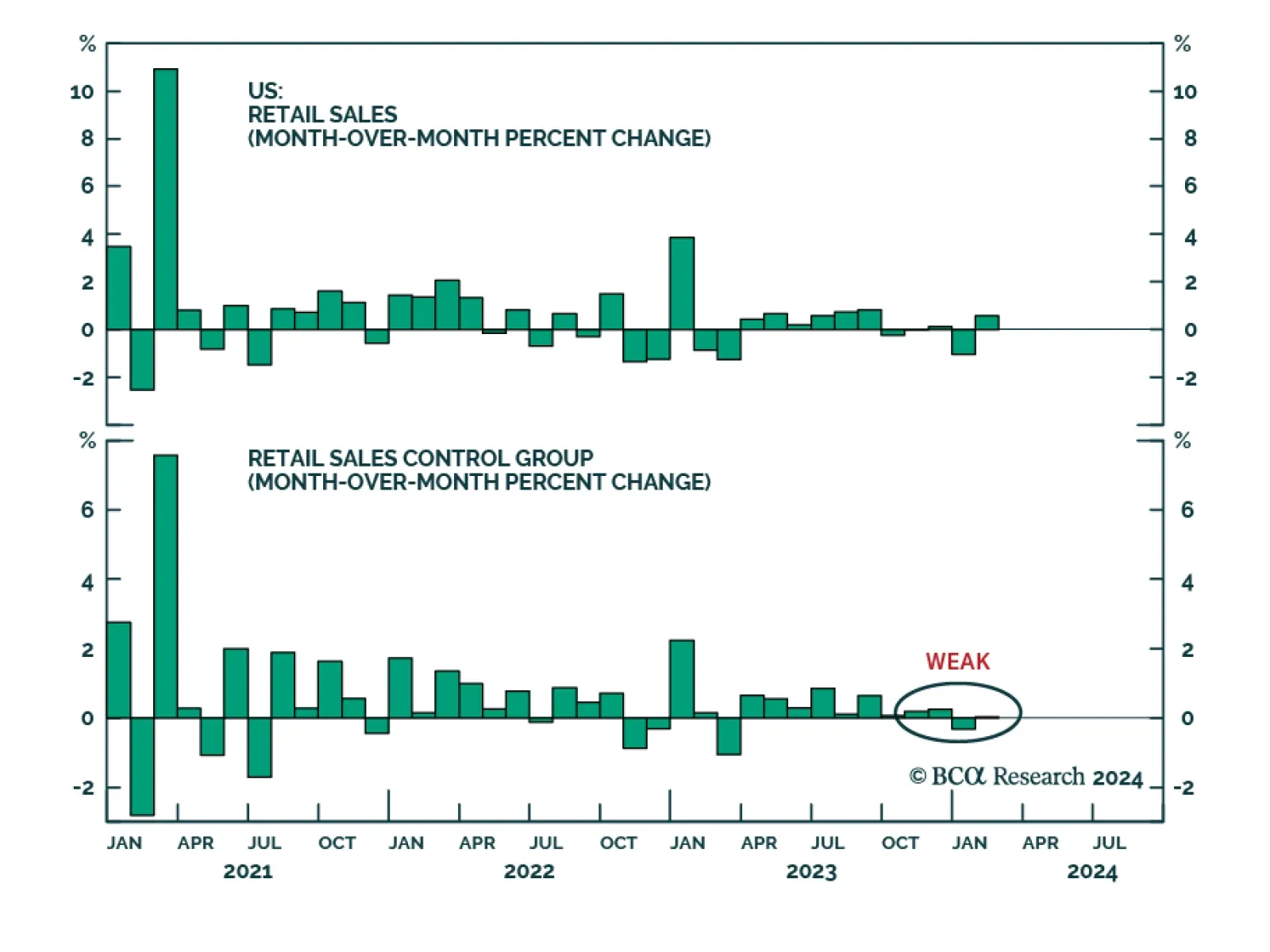

Improved consumer morale will not compensate for the fading tailwinds to consumption. Neither will the wealth effects from higher stocks and home prices.

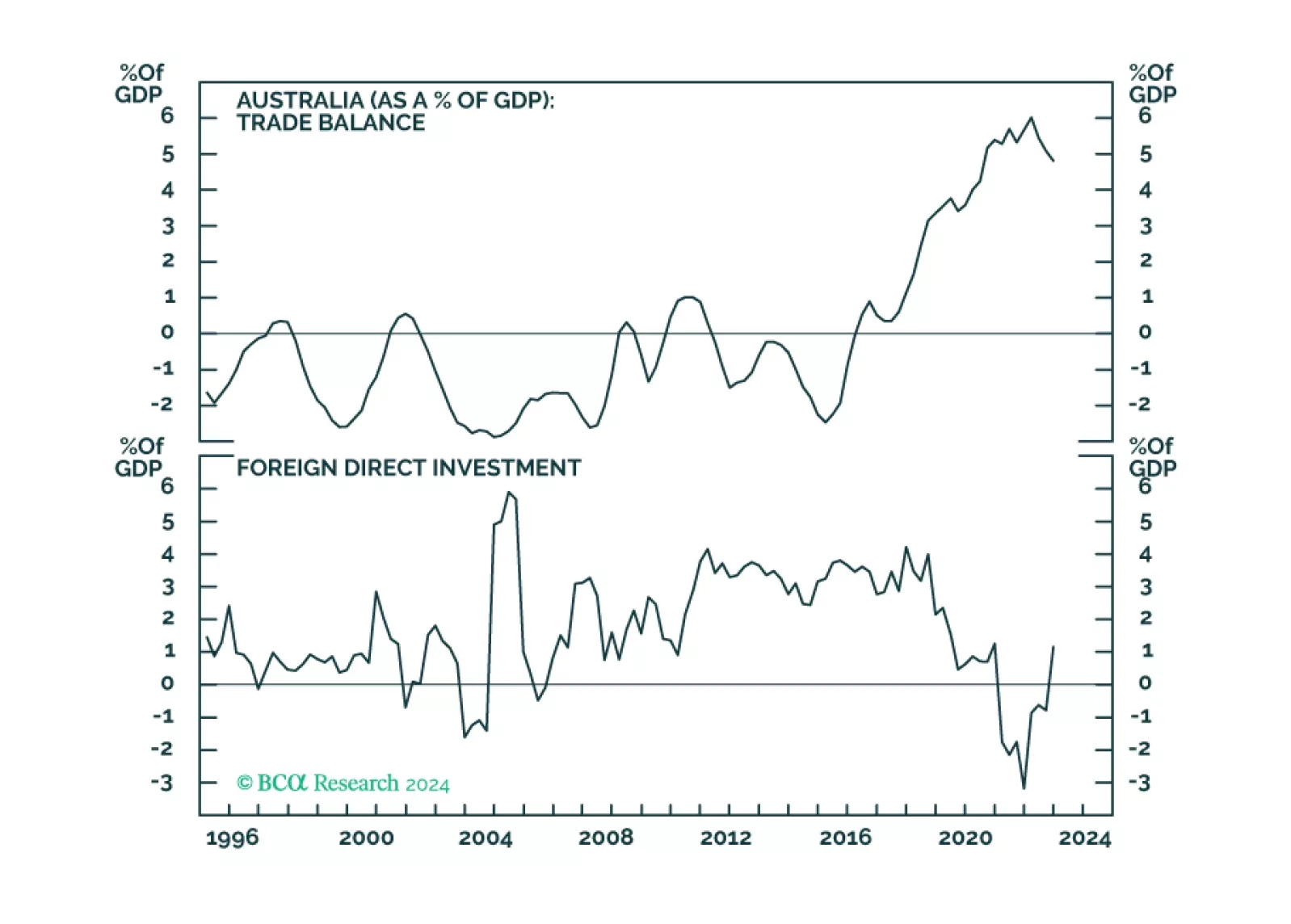

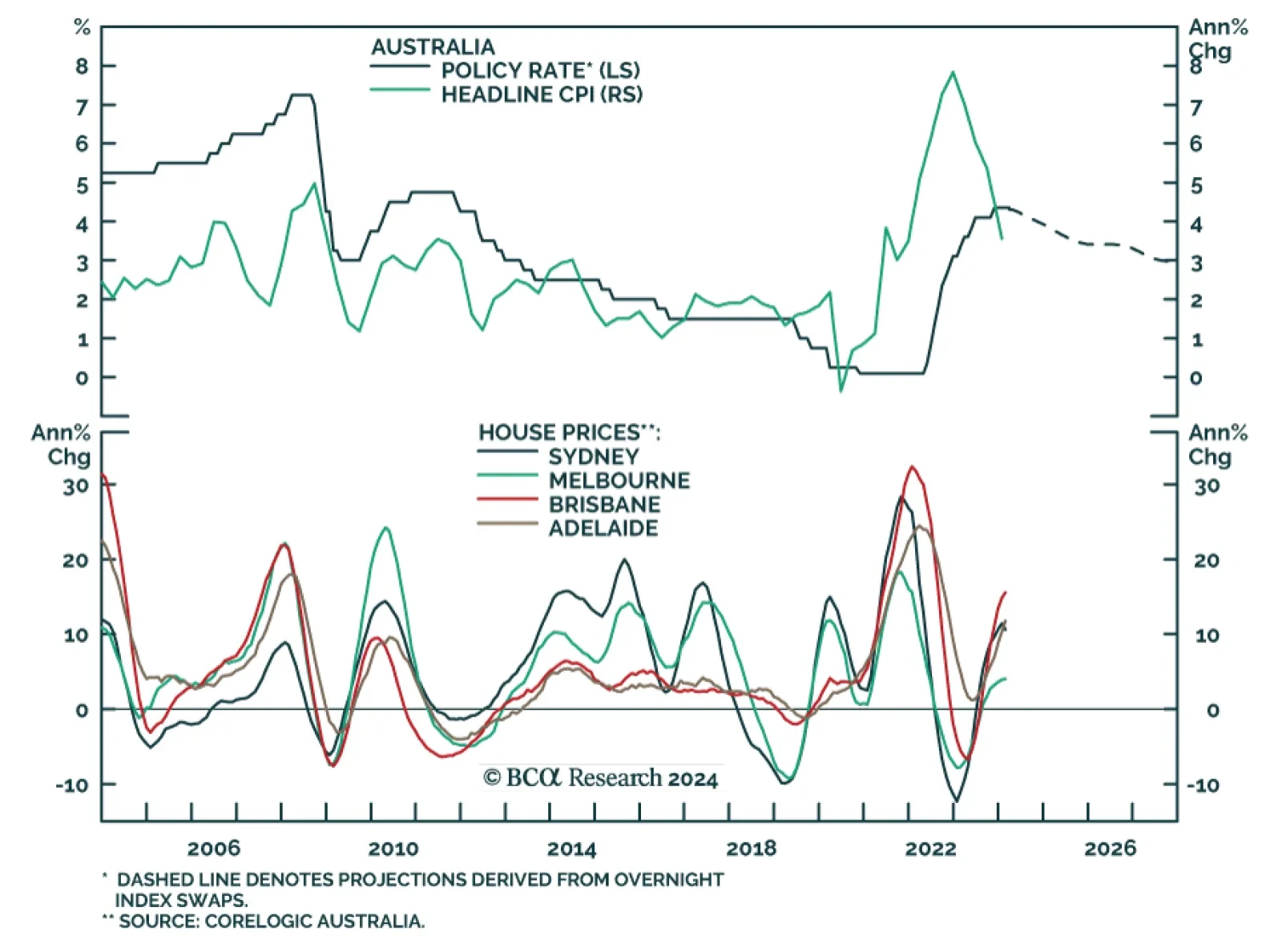

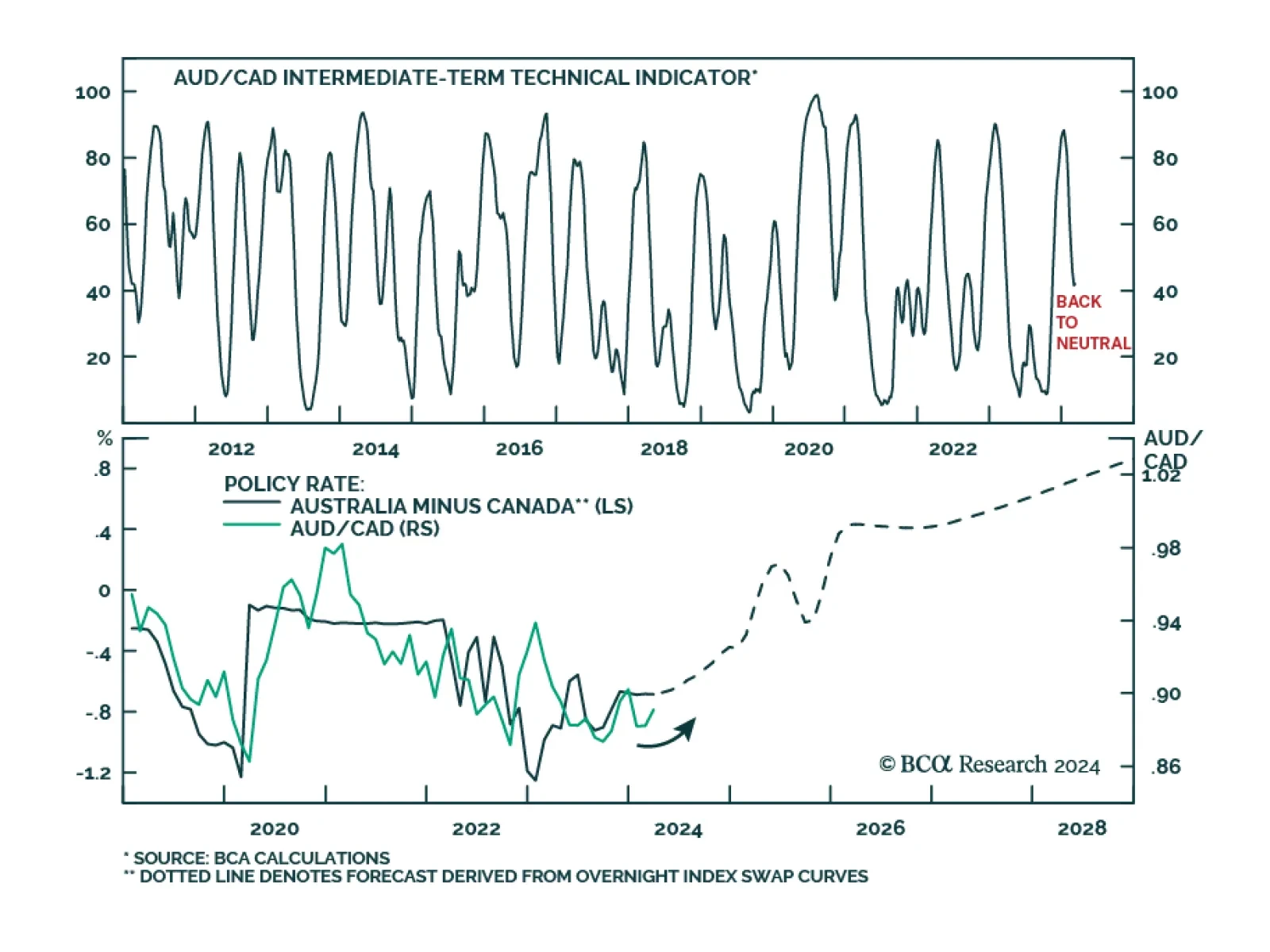

According to BCA Research’s Foreign Exchange Strategy service, Australia’s macroeconomic environment validates a long AUD position, especially at the crosses. The market expects that the RBA will cut interest rates…

In this Insight, we revisit our long AUD trades, after the upgrade from our attractiveness ranking last week.

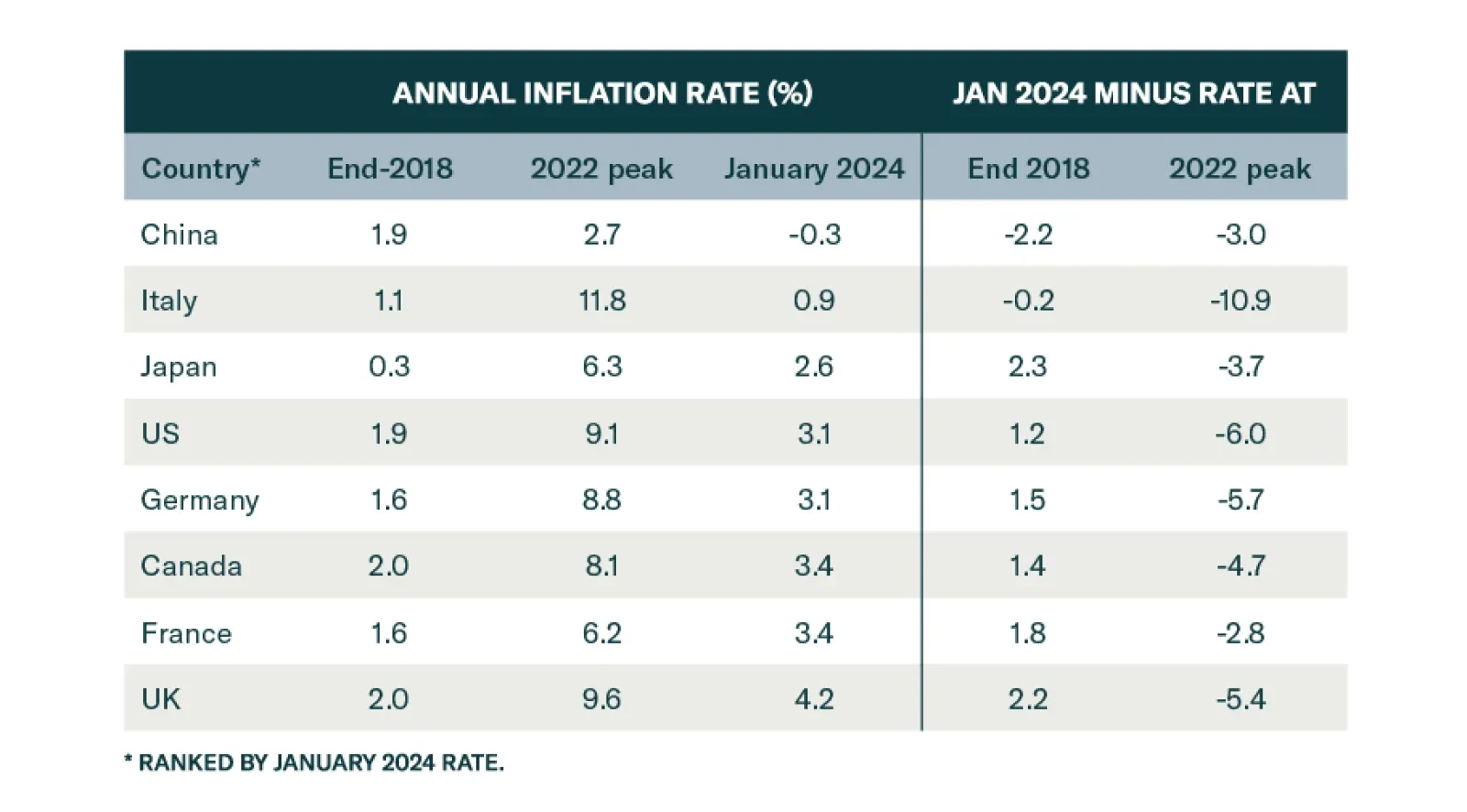

BCA Research’s Bank Credit Analyst service ranks the major economies by their economic and financial performance under various categories. In the inflation category, the surprising top award goes to Italy, a country which…

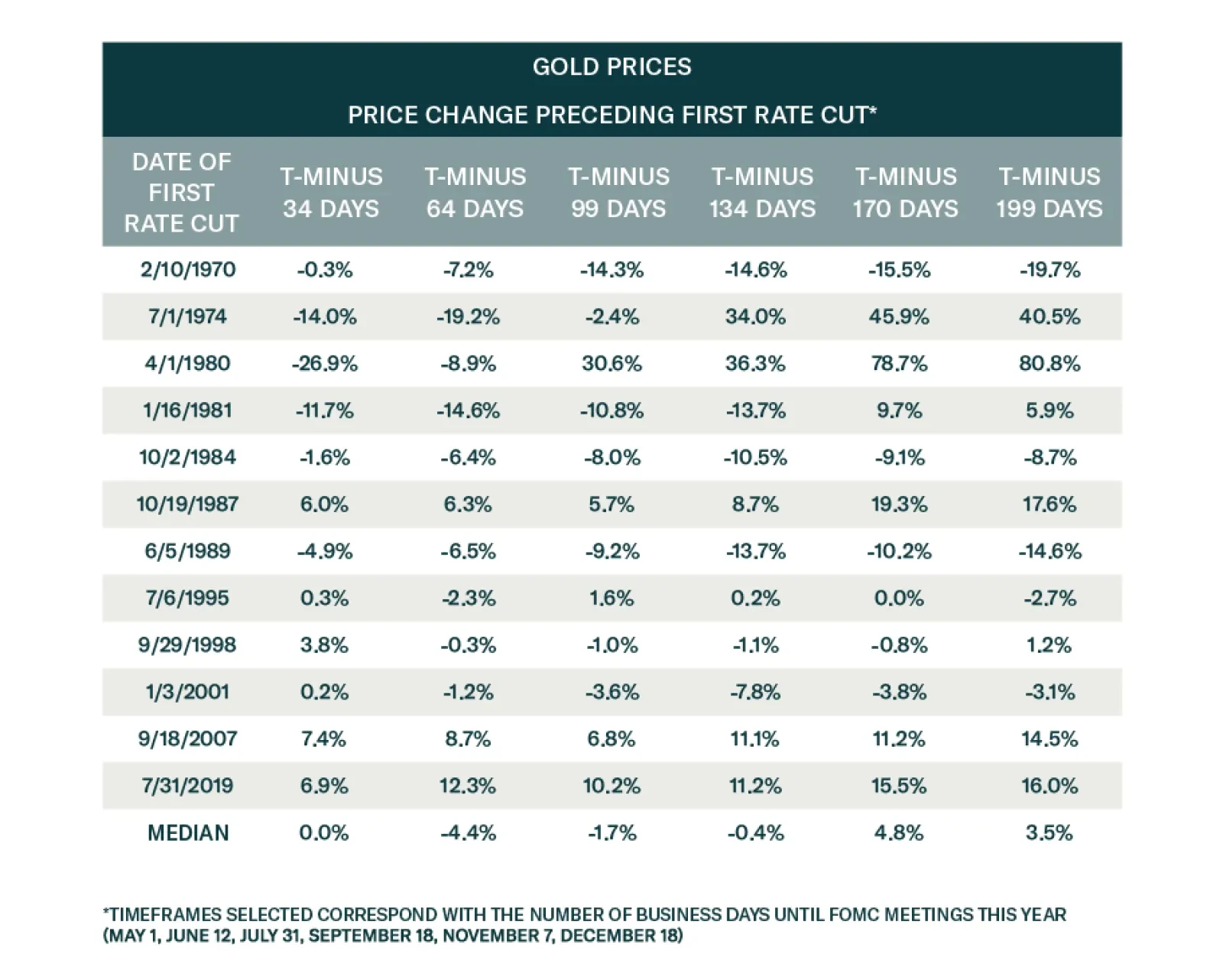

Gold has had a stunning rally over the past few weeks, gaining 9.2% since February 14 and reaching consecutive all-time highs last week before paring back some of its gains. Indeed, the drivers of gold have moved in a bullish…

The US retail sales report for February delivered a disappointing signal on Thursday. Although retail sales returned to expansion, the 0.6% m/m increase fell below anticipations of a 0.8% m/m rise. In addition, the prior month…

After briefly weakening in January, AUD/CAD has once again been moving higher over the past few weeks. Indeed, BCA’s Intermediate Term Technical Indicator is back to neutral from overbought territory, paving the way for…

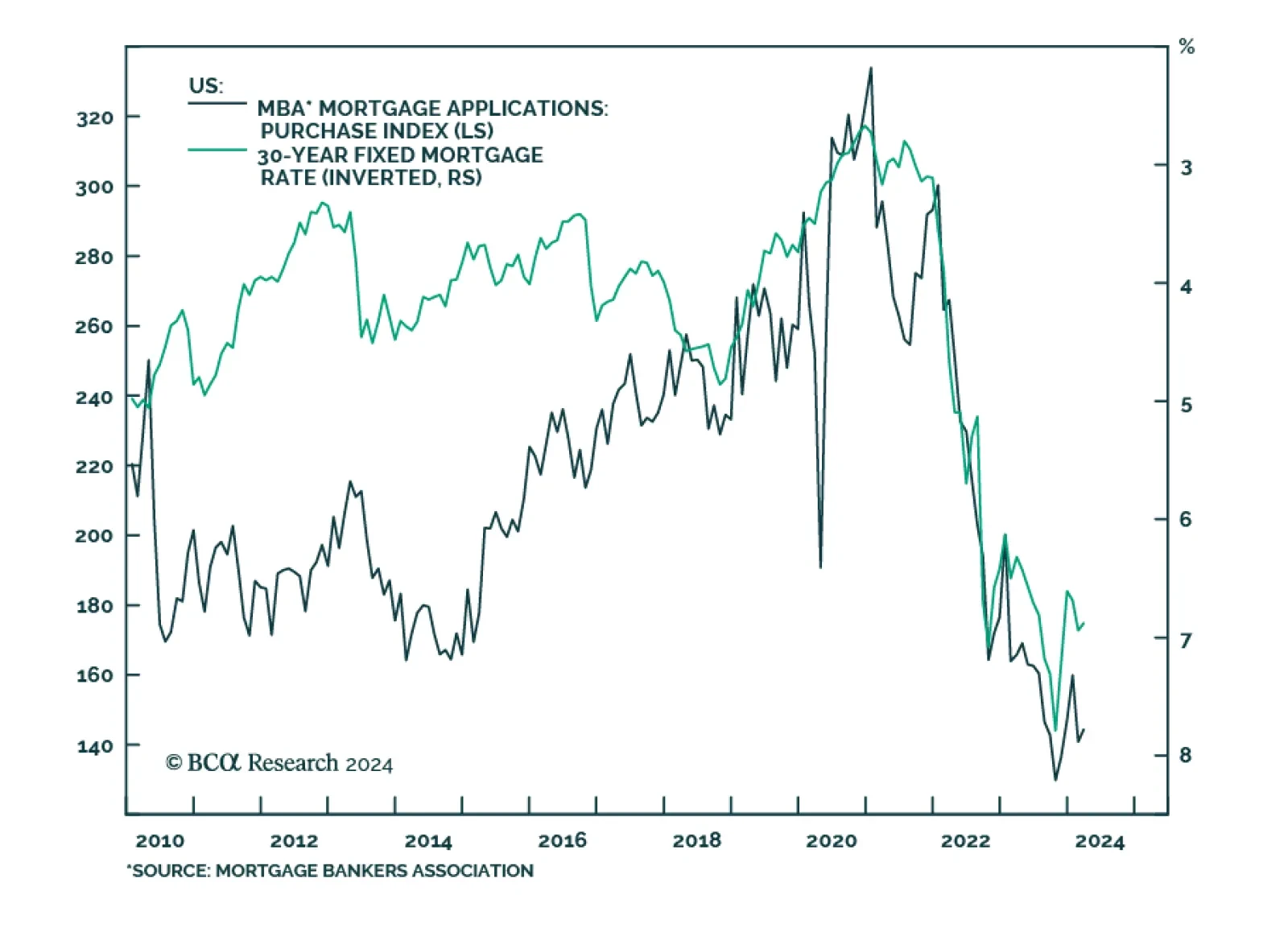

The latest MBA weekly survey shows mortgage applications rose 7.1% in the week ending March 8 on the back of a 4.7% increase in purchases and a 12.2% rise in refinancing, marking the second consecutive weekly increase. Higher…

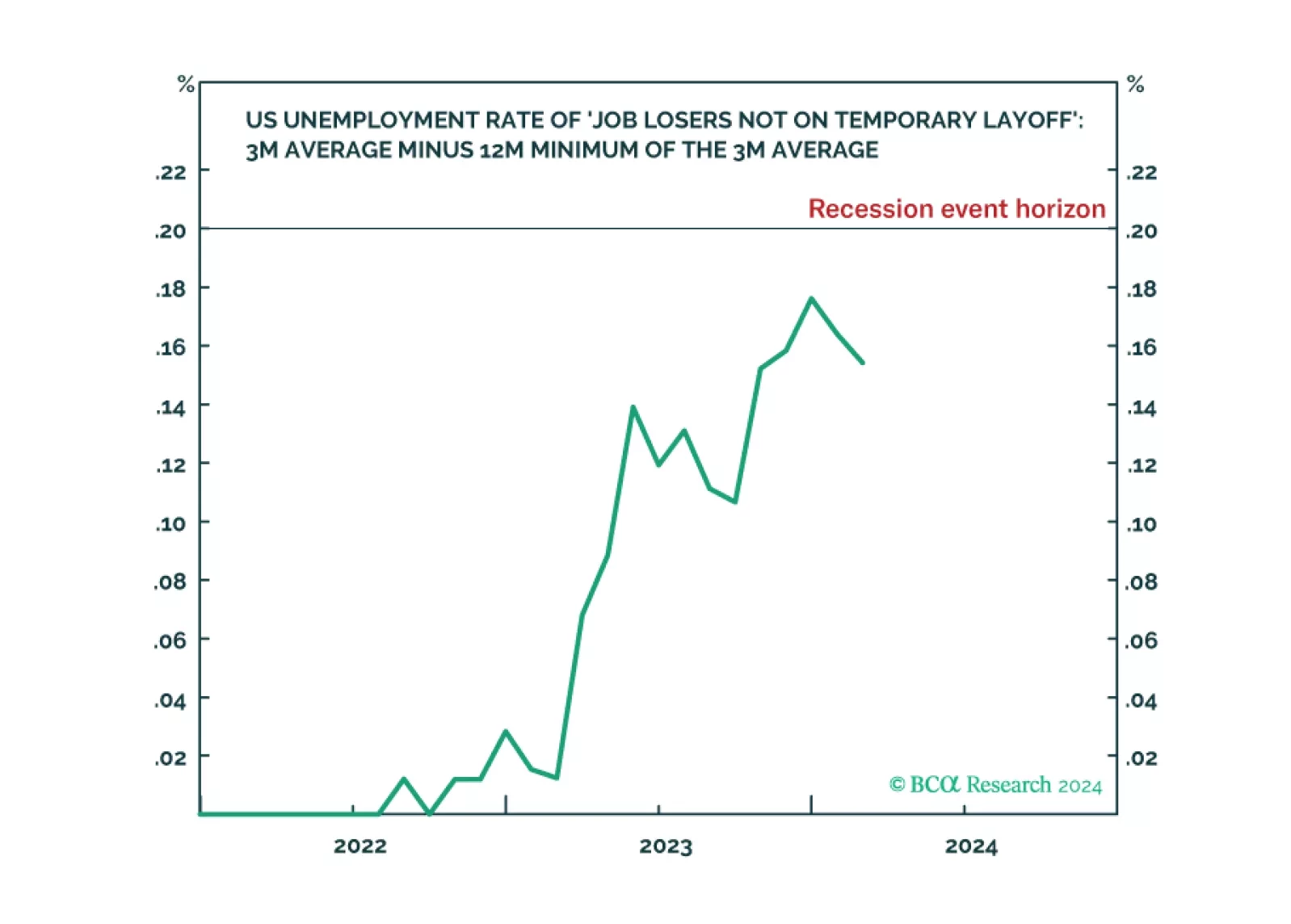

The Joshi rule real-time US recession indicator remains at an elevated 0.154 versus its recession event horizon of 0.200, indicating weakening US labour demand. With the last mile of US disinflation requiring labour demand to ‘catch…