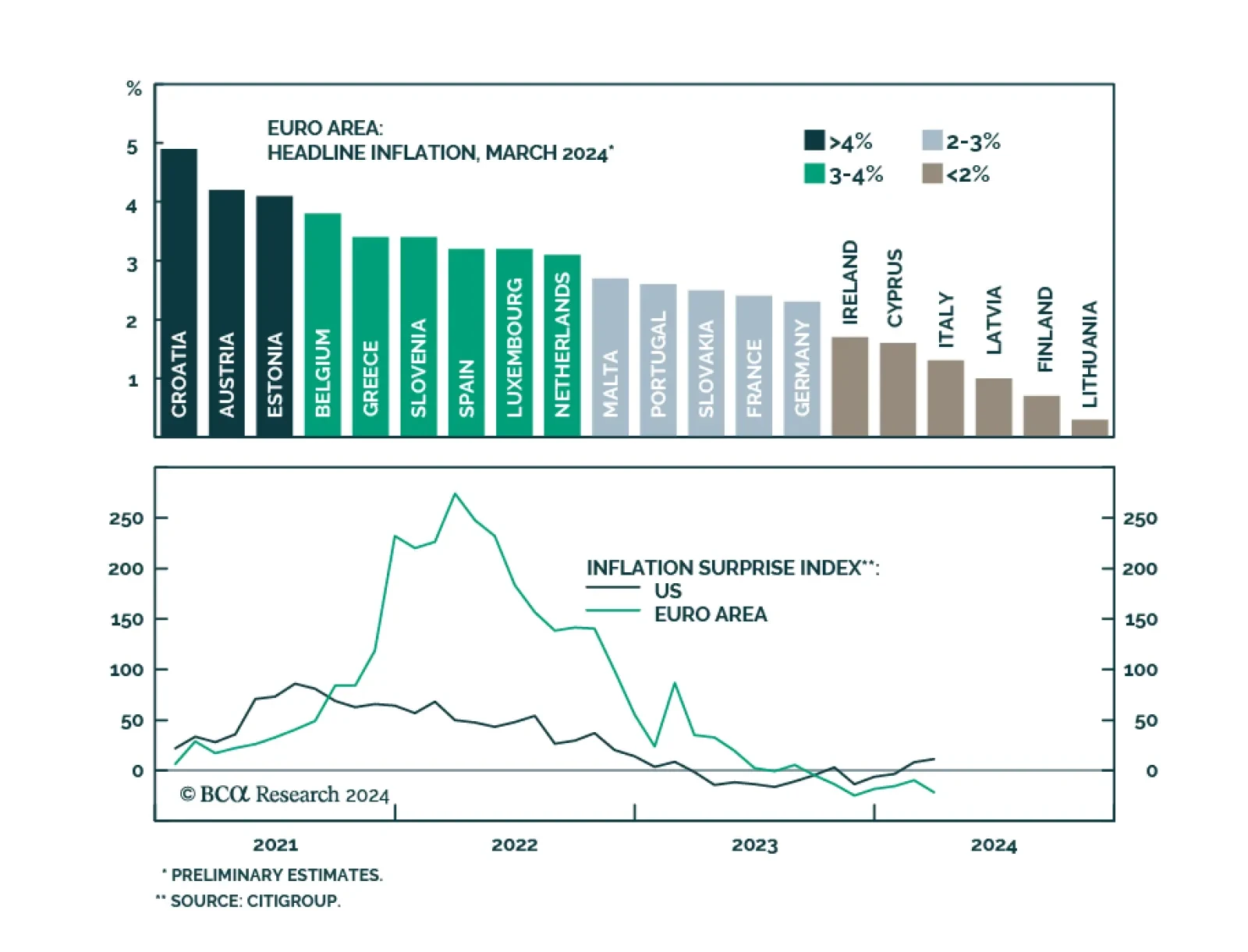

Flash estimates for Euro Area inflation in March surprised to the downside. Headline inflation slowed from 2.6% to 2.4% versus expectations of 2.5% and core inflation eased from 3.1% to 2.9% versus expectations of 3%. While the…

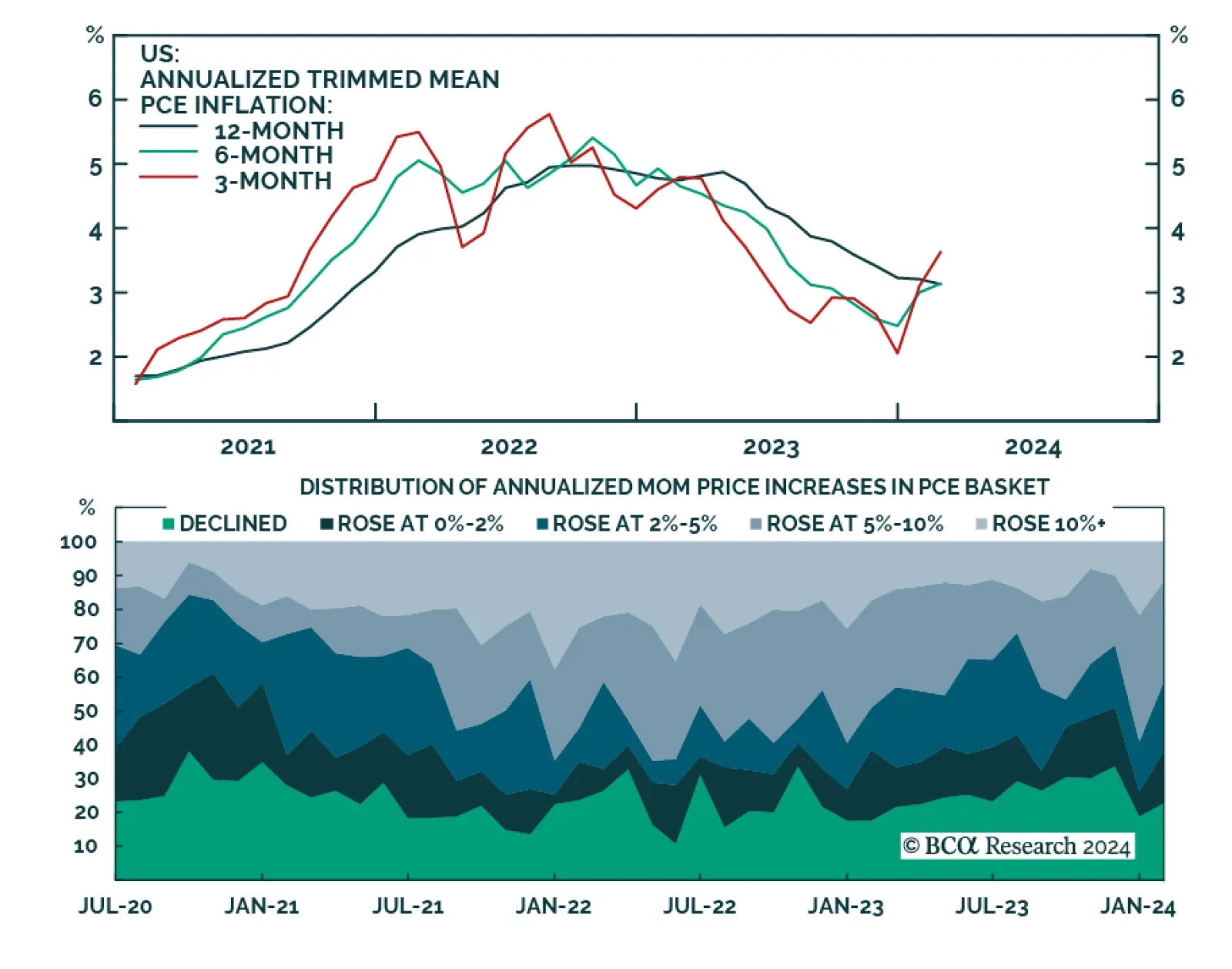

The Dallas Fed released its trimmed mean PCE inflation rate for February on Friday. The trimmed mean PCE is a measure of underlying inflation which excludes the top 31% and the bottom 25% of the PCE basket and then uses a weighted…

Our Portfolio Allocation Summary for April 2024.

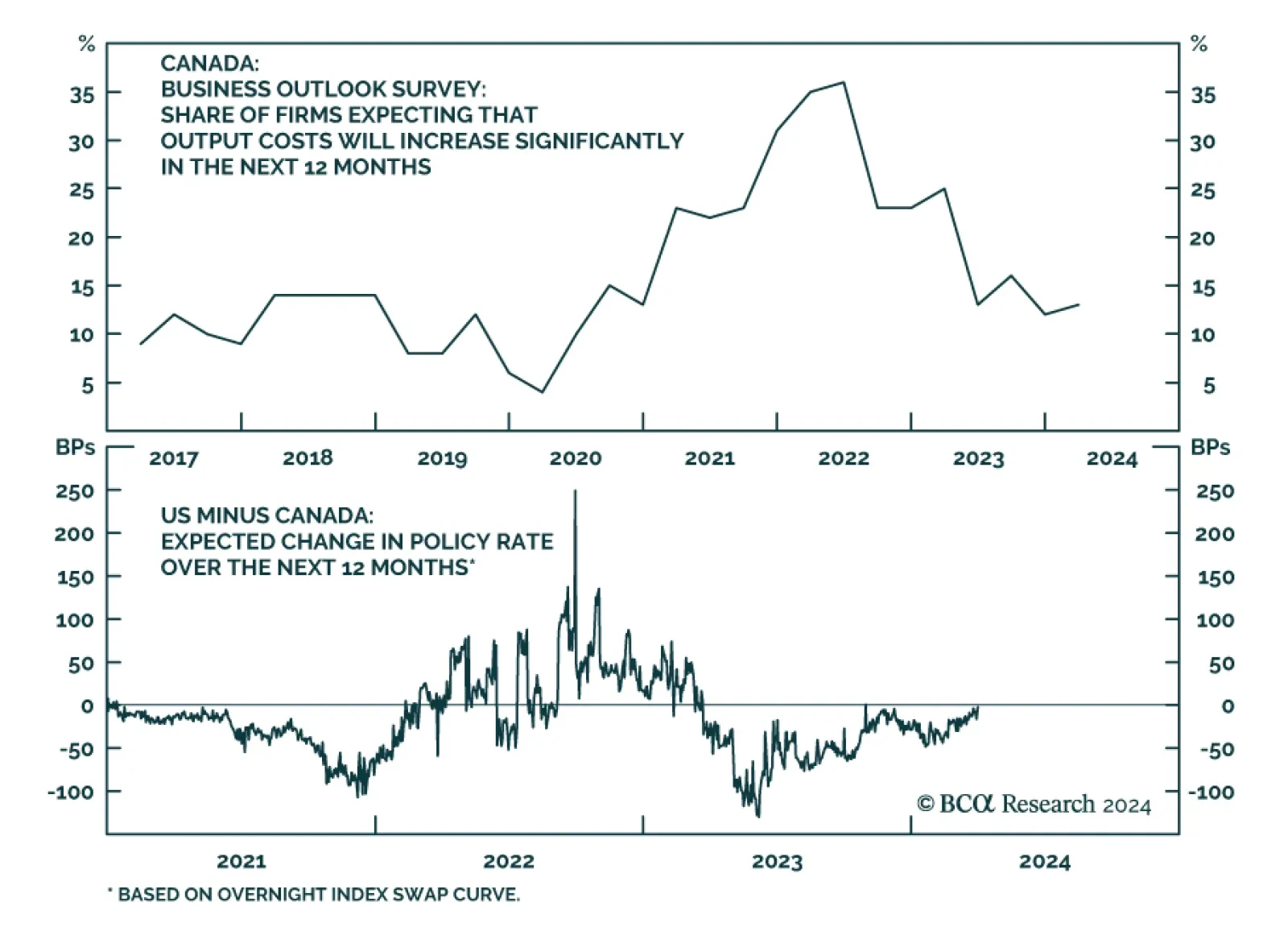

The Bank of Canada released its Business Outlook Survey for the first quarter of this year on Monday. While there are some early signs of stabilization, overall demand continues to be weak. The indicator for future sales growth…

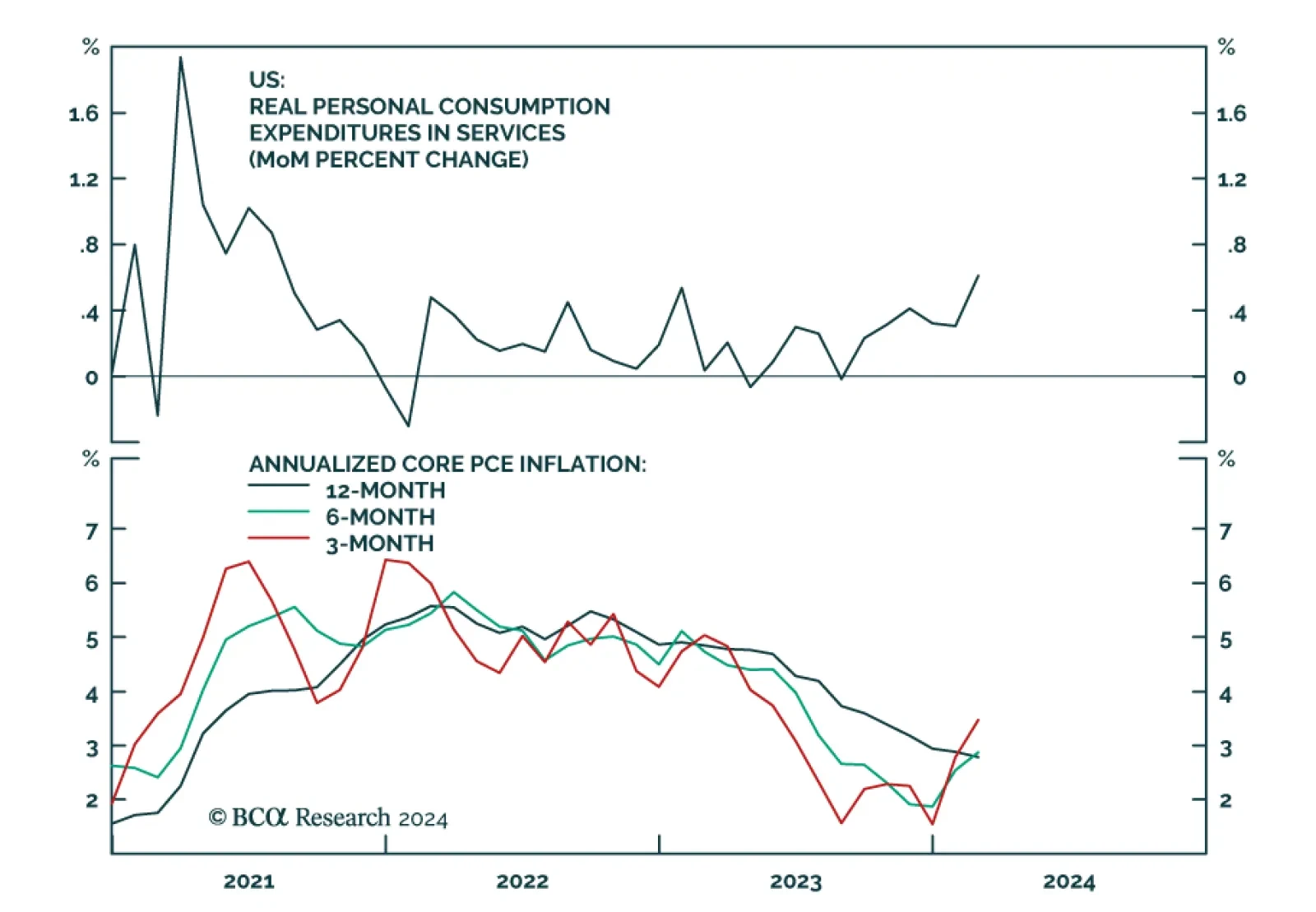

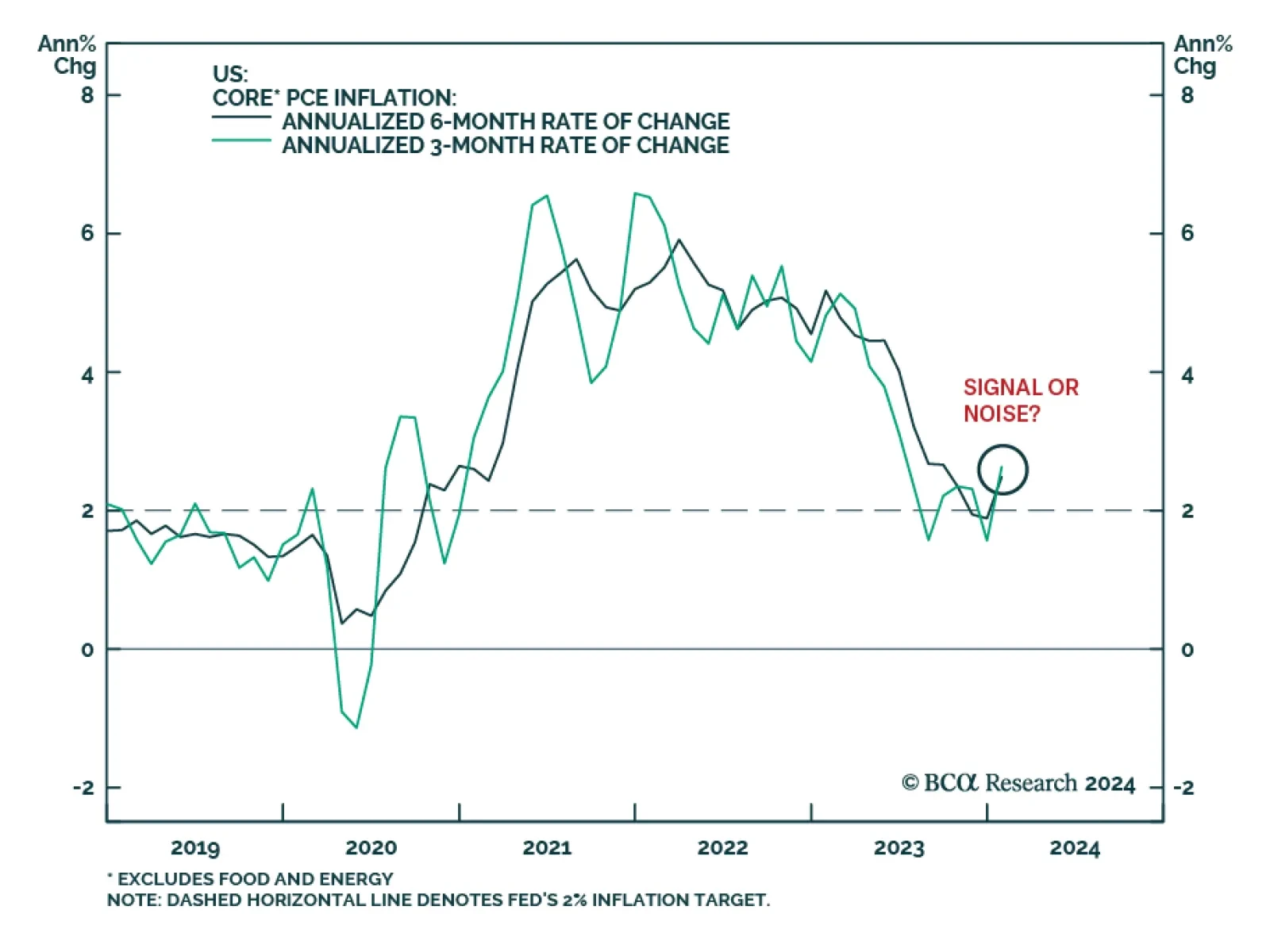

Friday’s PCE report showed a resilient US economy. Real personal consumption increased by 0.4% m/m in February, beating expectations of 0.1% m/m and remaining above its pre-pandemic trend. Both services and goods…

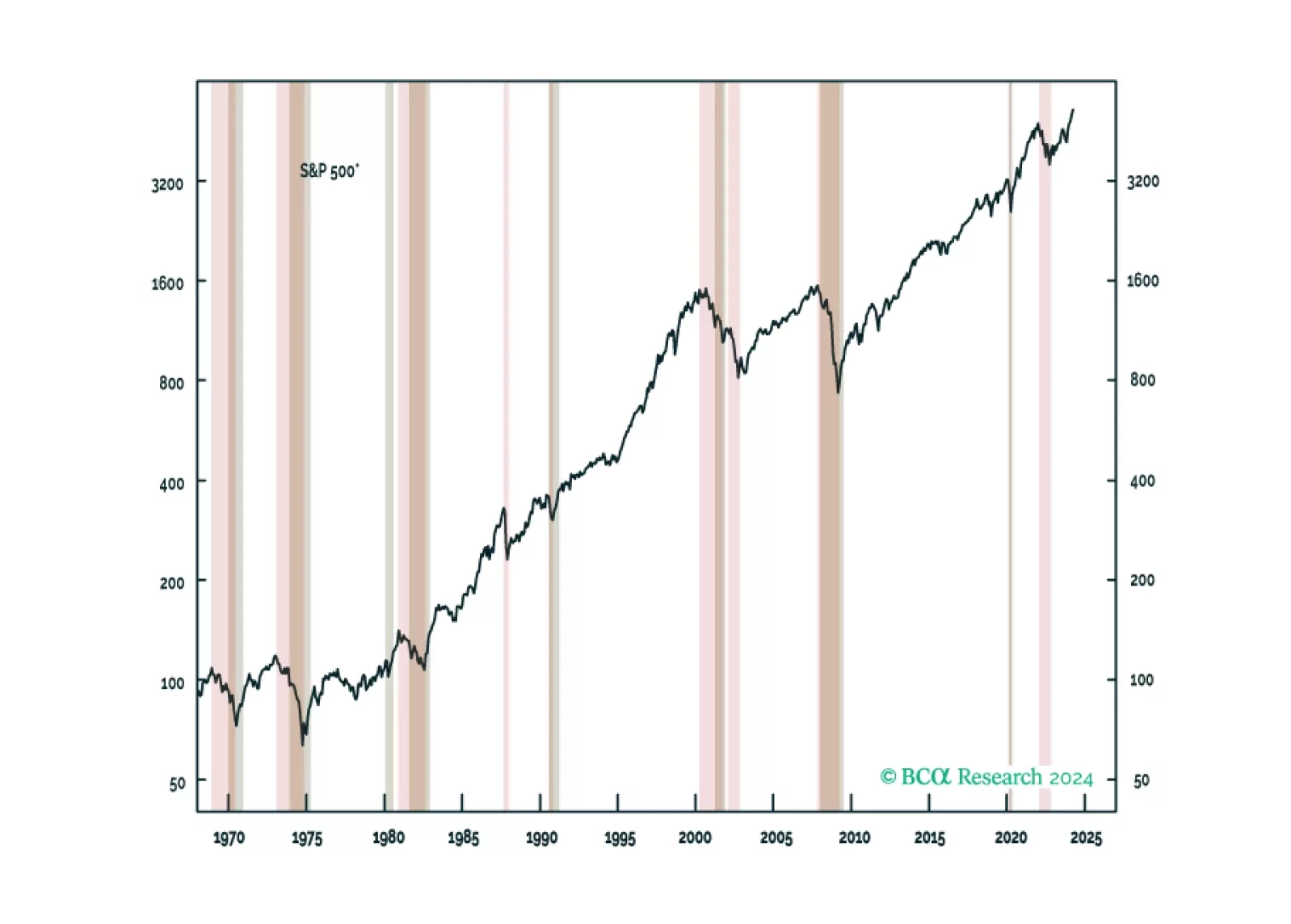

We are not yet ready to downgrade equities on a tactical basis but continue to expect we will eventually do so. We present a checklist of indicators that we are watching to determine when to de-risk.

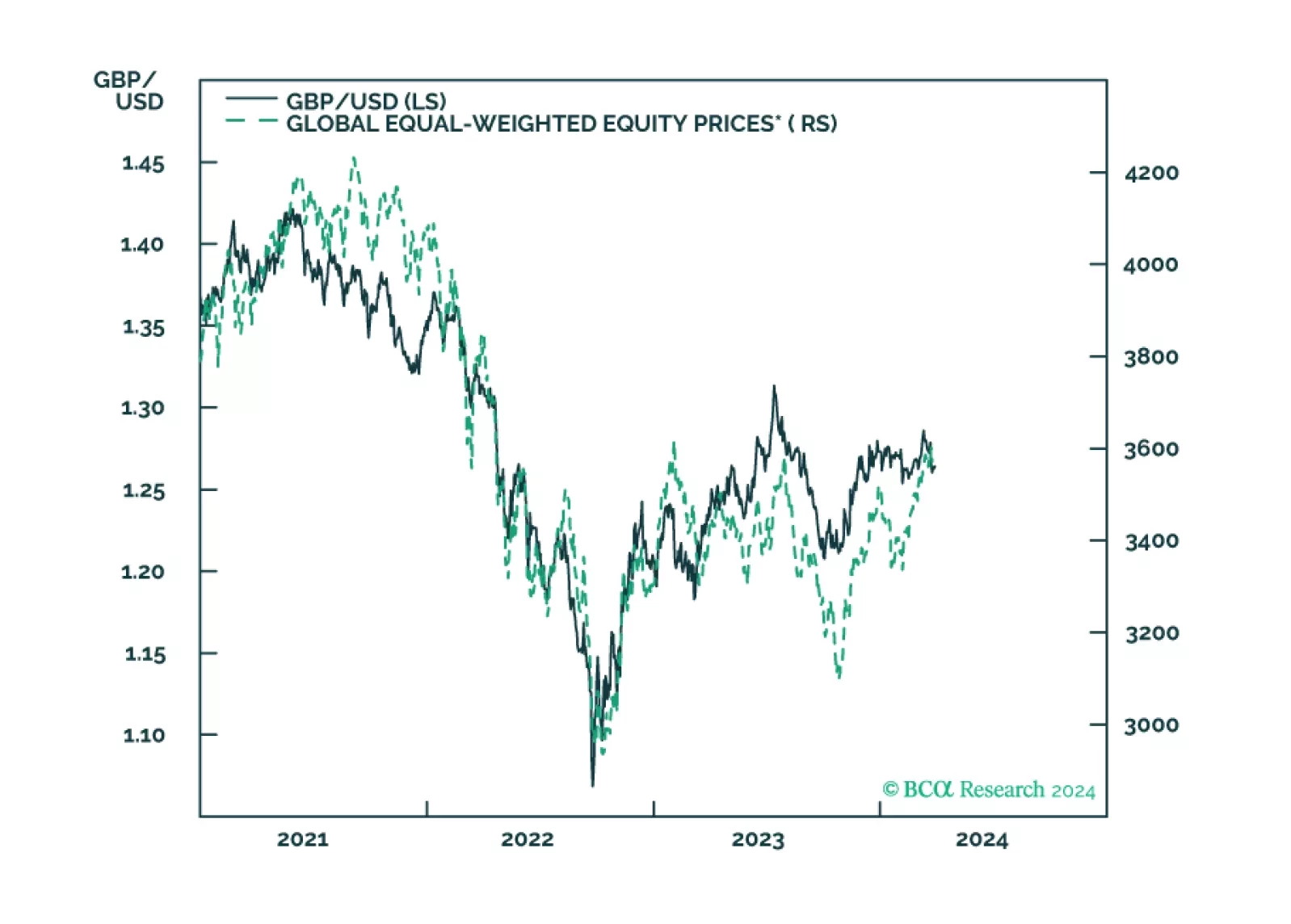

In this Insight, we discuss our rationale for a short sterling position.

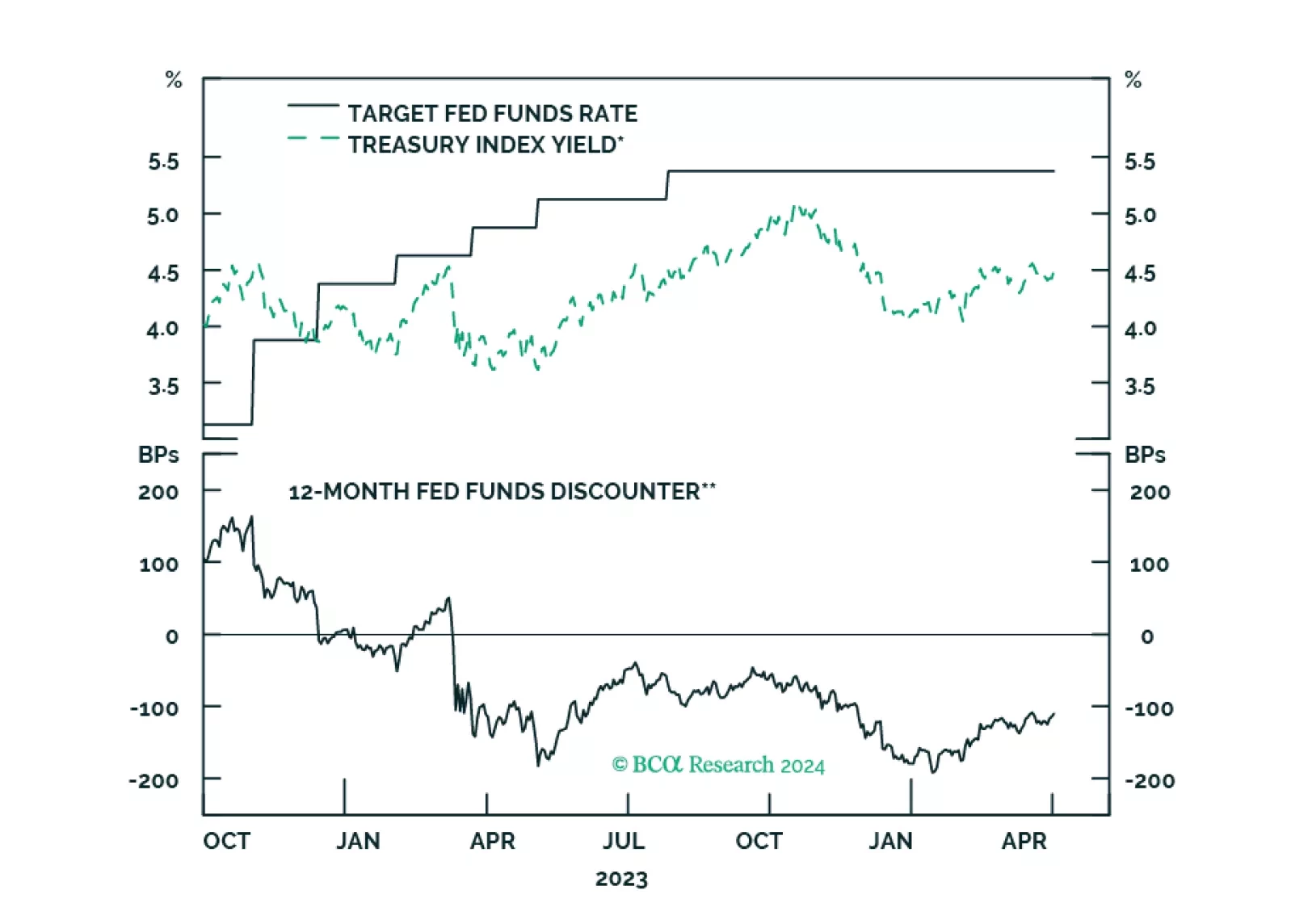

The message from Fed Governor Christopher Waller’s speech on Wednesday could not be clearer: there’s still no rush. While market participants as well as the FOMC are still pricing in three rate cuts this year, the…

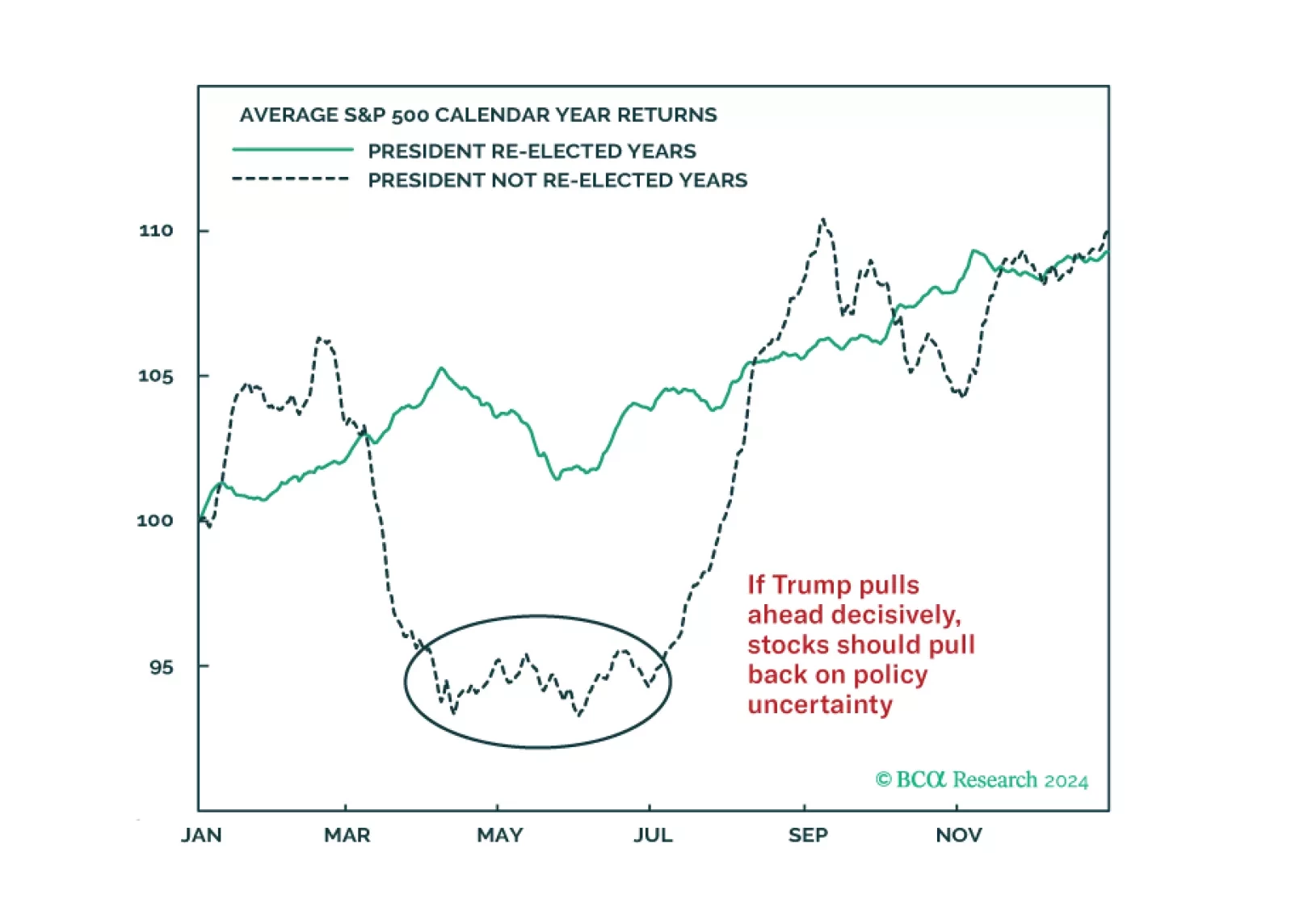

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…

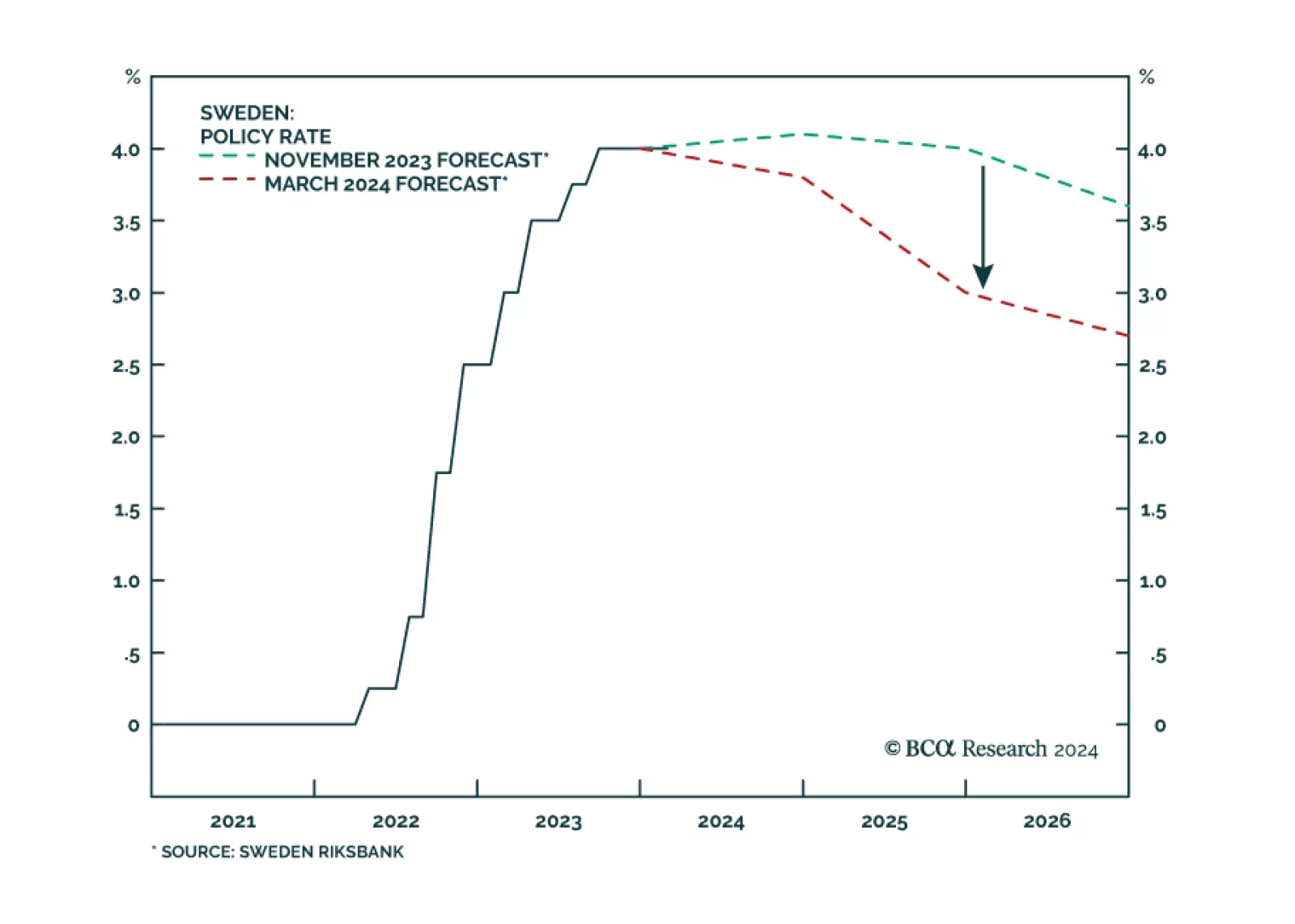

The Swedish krona was among the weakest G10 currencies on Wednesday following the Riksbank meeting. Although the central bank kept the benchmark rate unchanged as expected, the post-meeting communication was on the dovish side.…