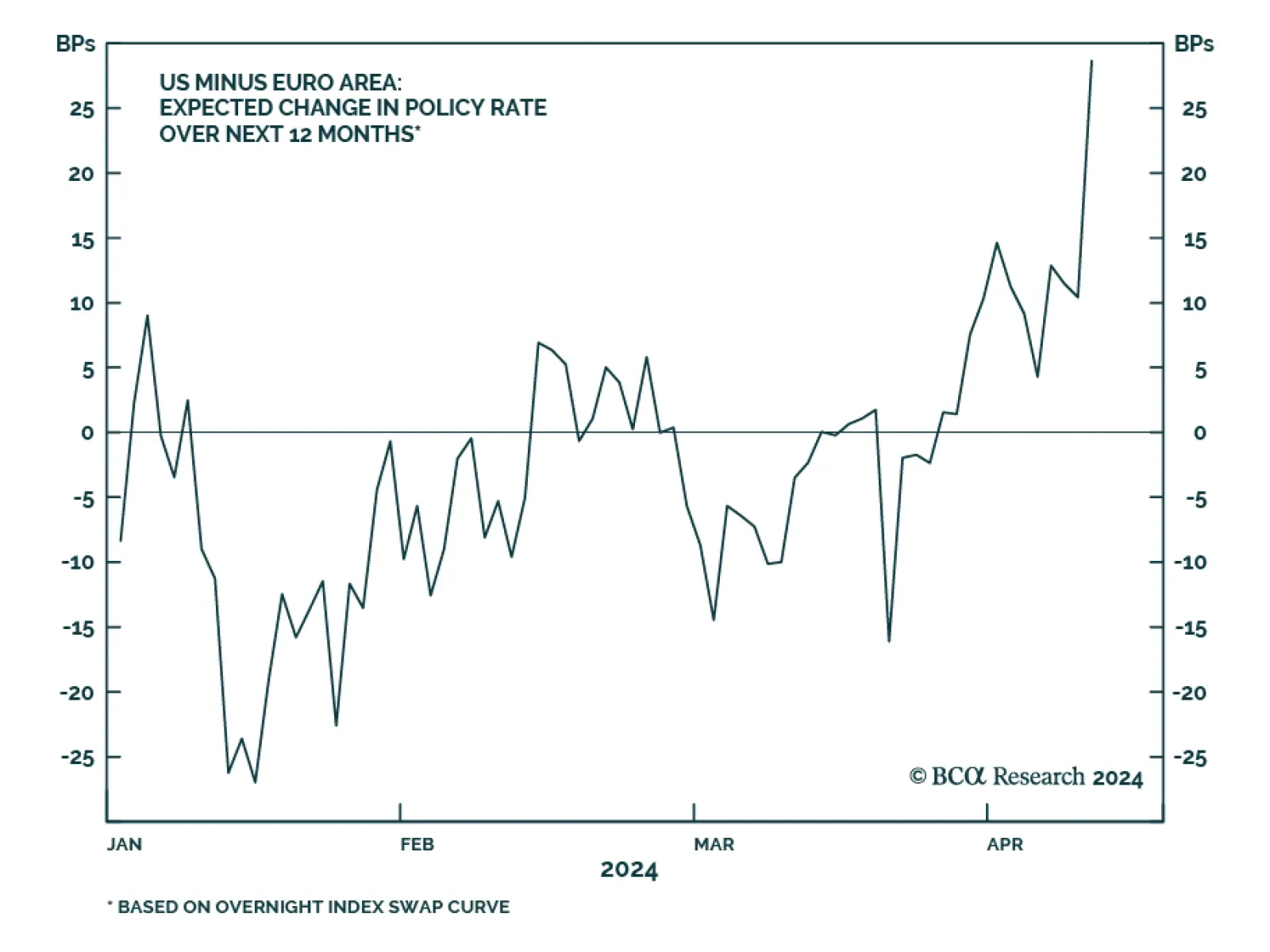

As expected, the Governing Council of the ECB kept interest rates unchanged on Thursday. In its statement, the ECB reiterated that most measures of underlying inflation were easing, wage growth was moderating, and firms were…

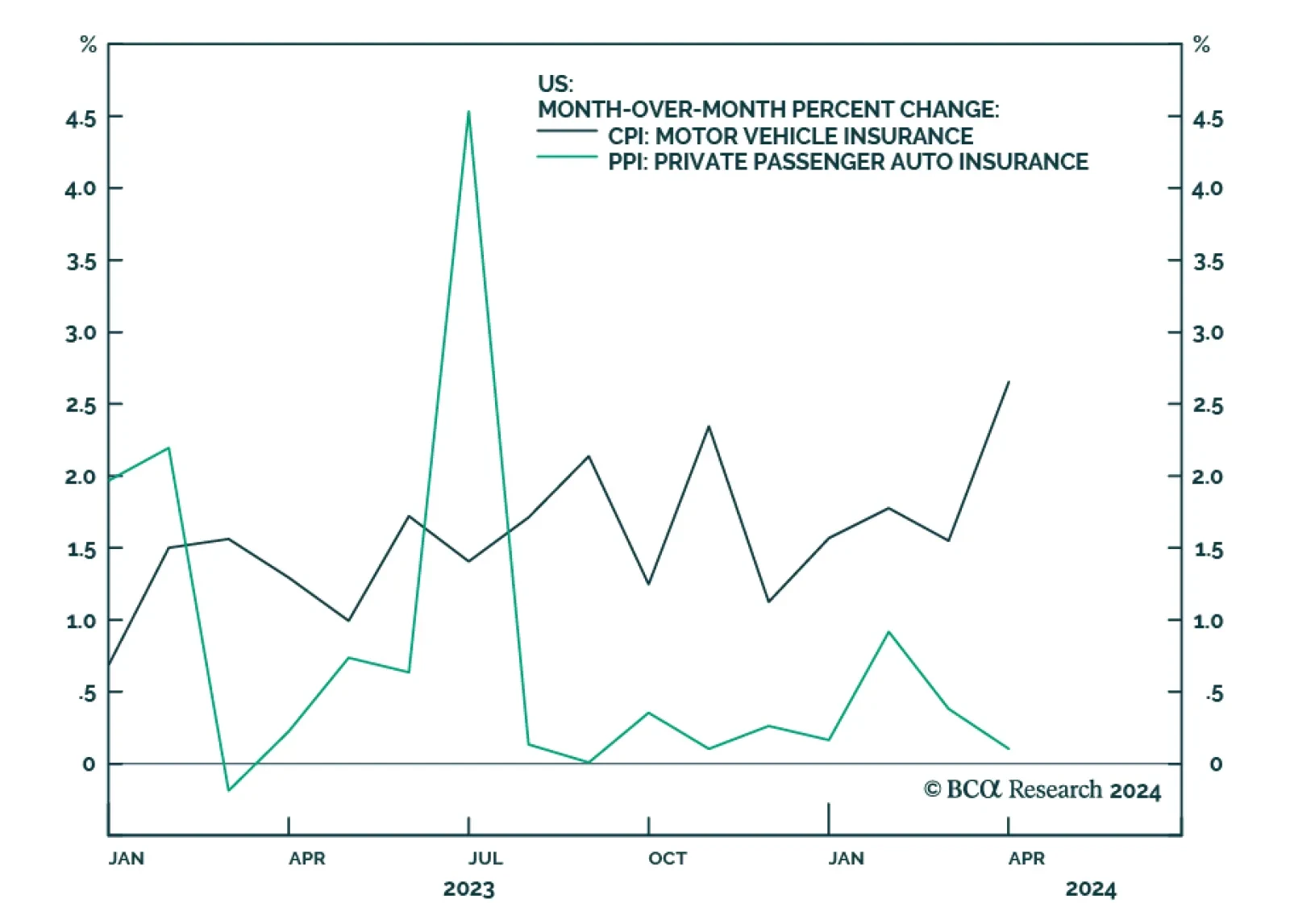

Thursday’s US Produce Price Index report for March shows headline PPI came in below expectations on both a month-over-month (0.2%) and annual (2.1%) basis. Meanwhile, PPI ex food and energy came in at 0.2% m/m (in line with…

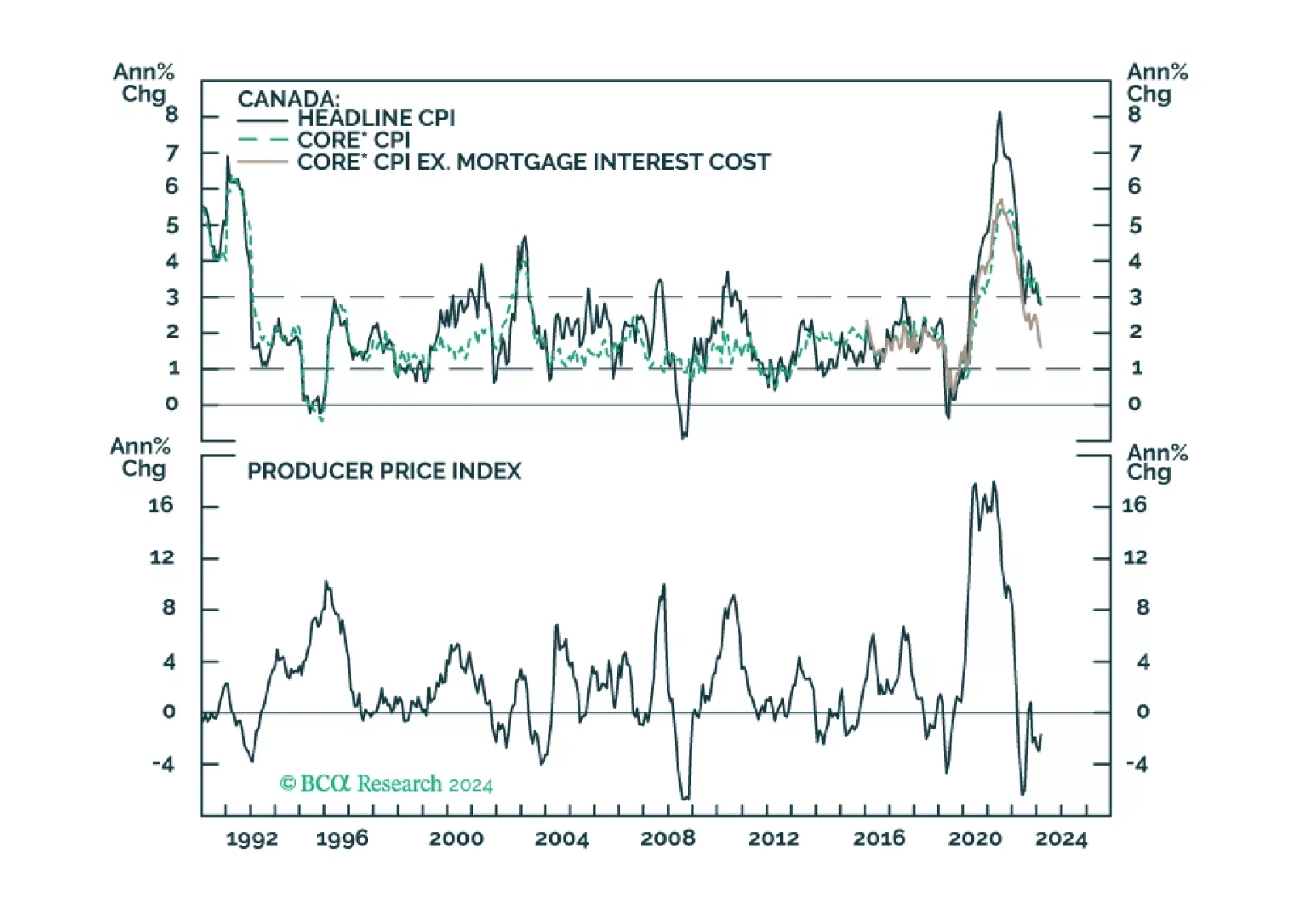

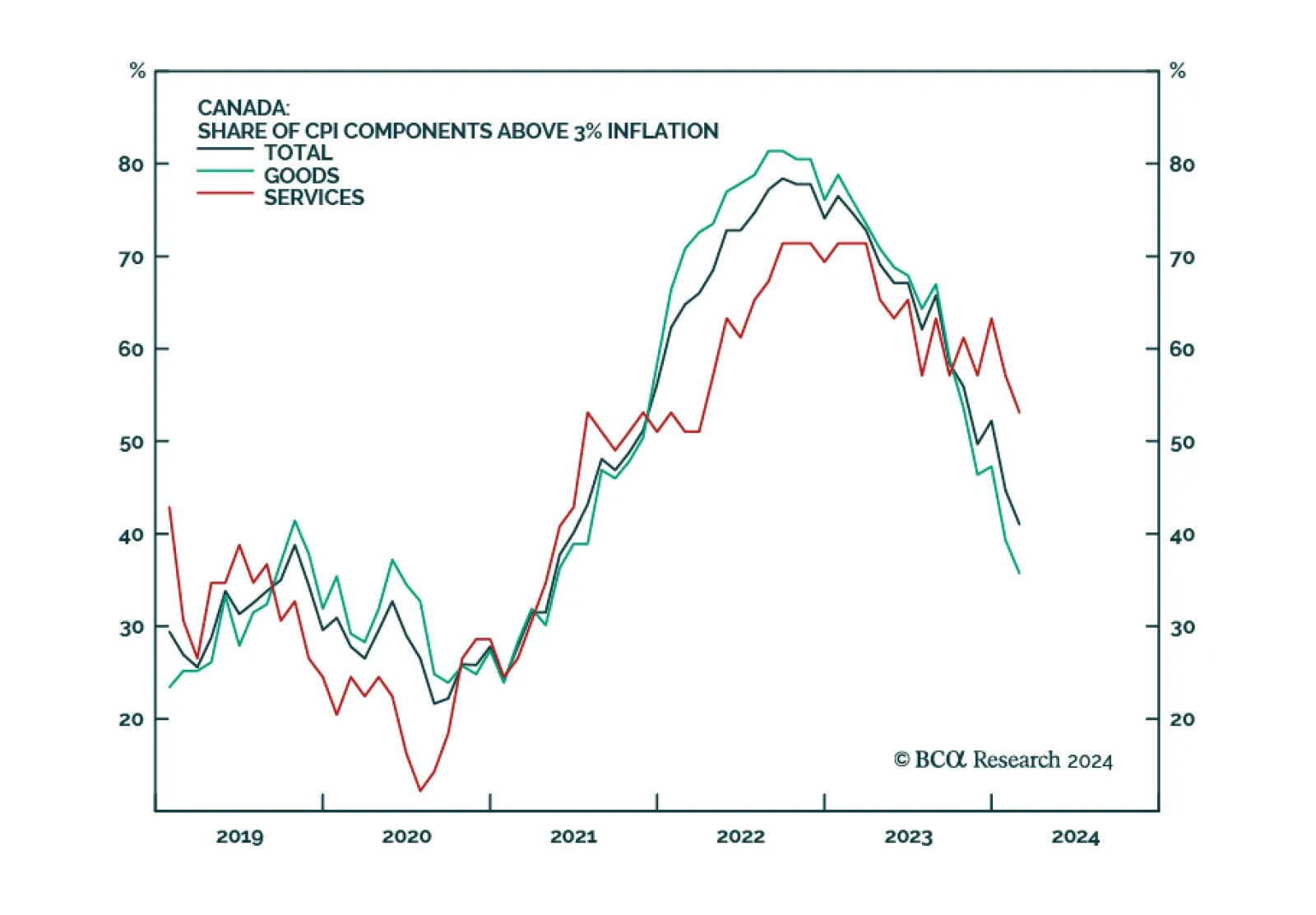

In this insight, we calibrate our investment views based on the latest Bank of Canada decision.

The Bank of Canada held its policy rate steady at 5% on Wednesday, in line with expectations. In his opening remarks following the announcement, Governor Tiff Macklem was cautiously dovish: “We don't want to leave…

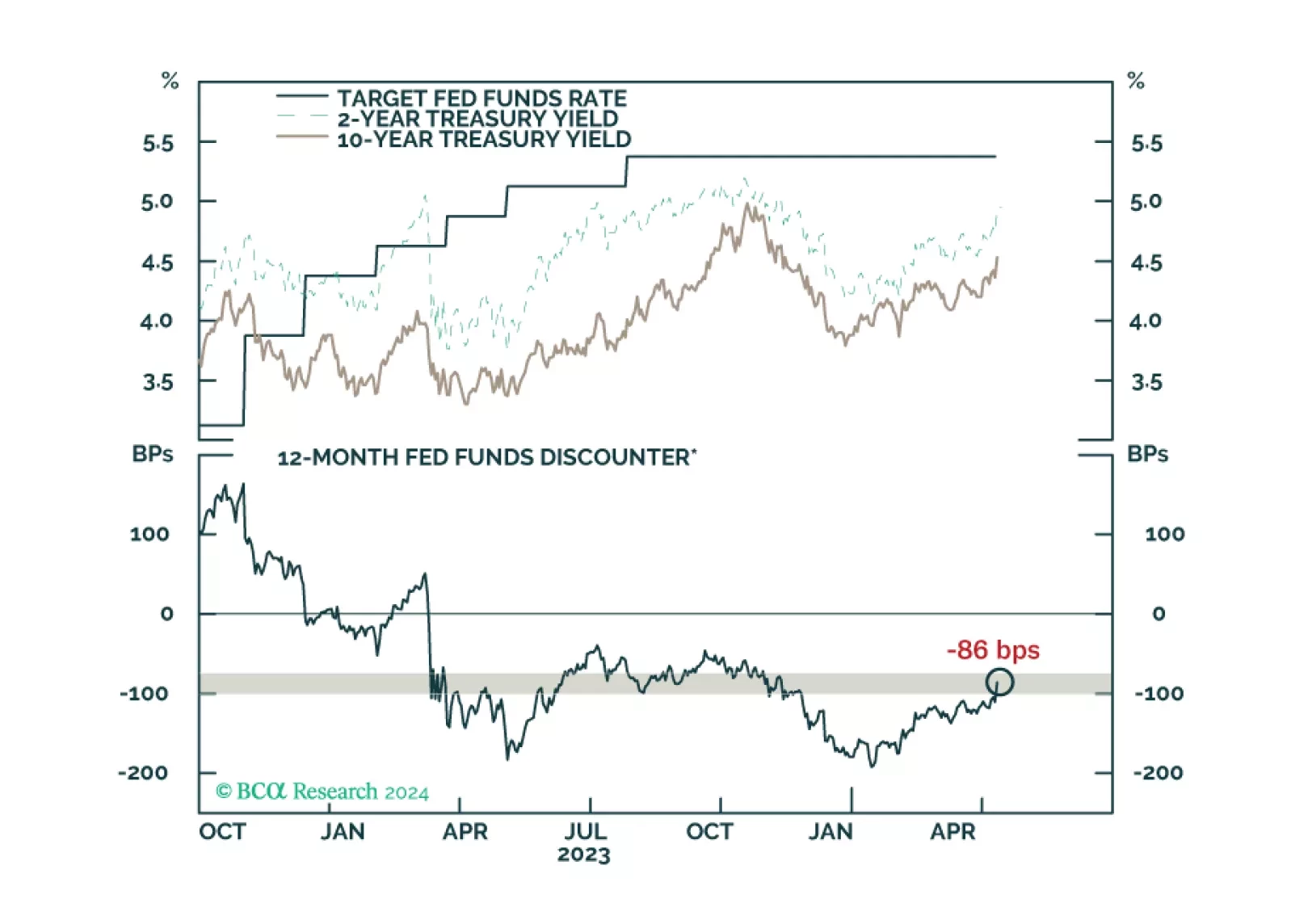

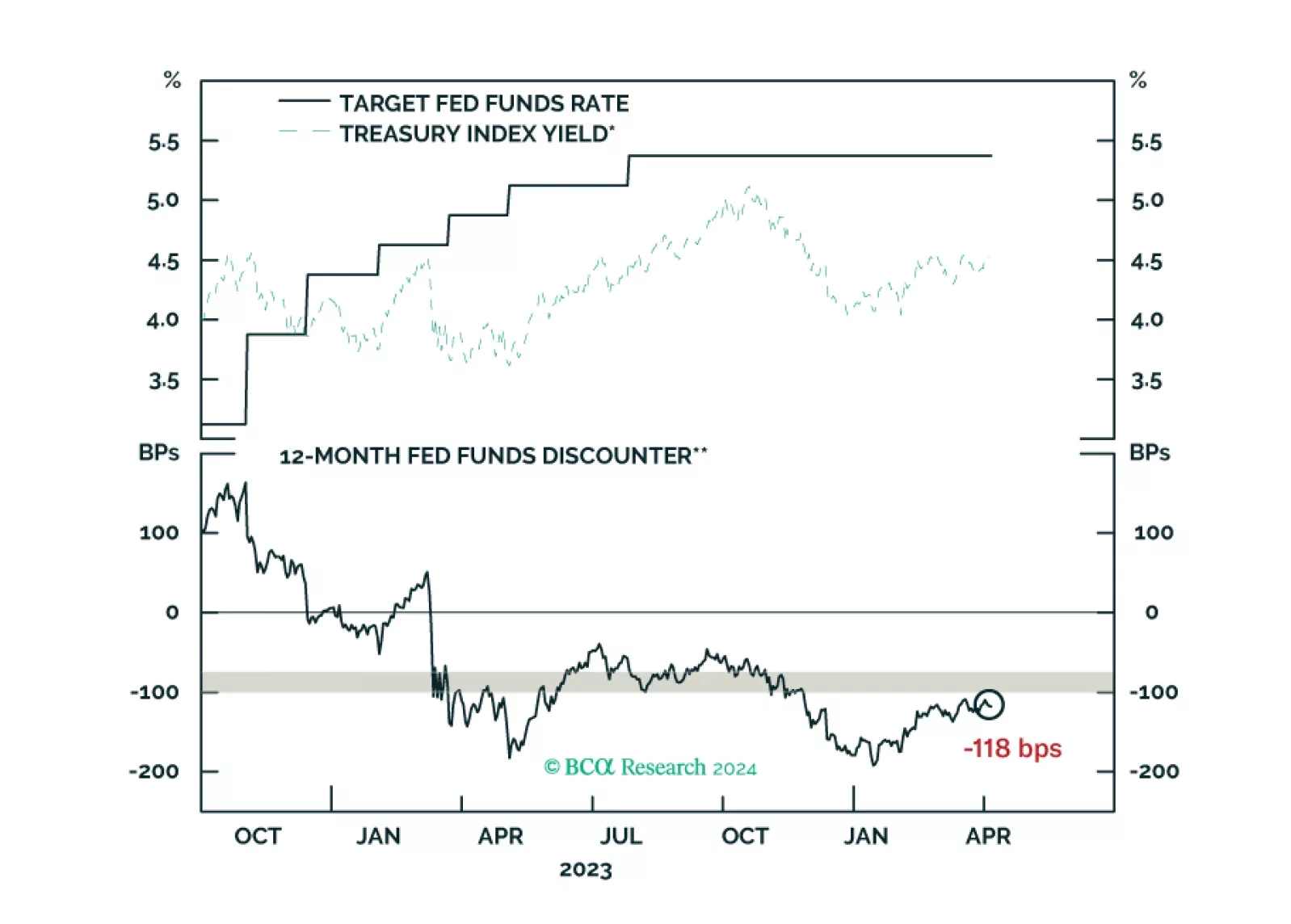

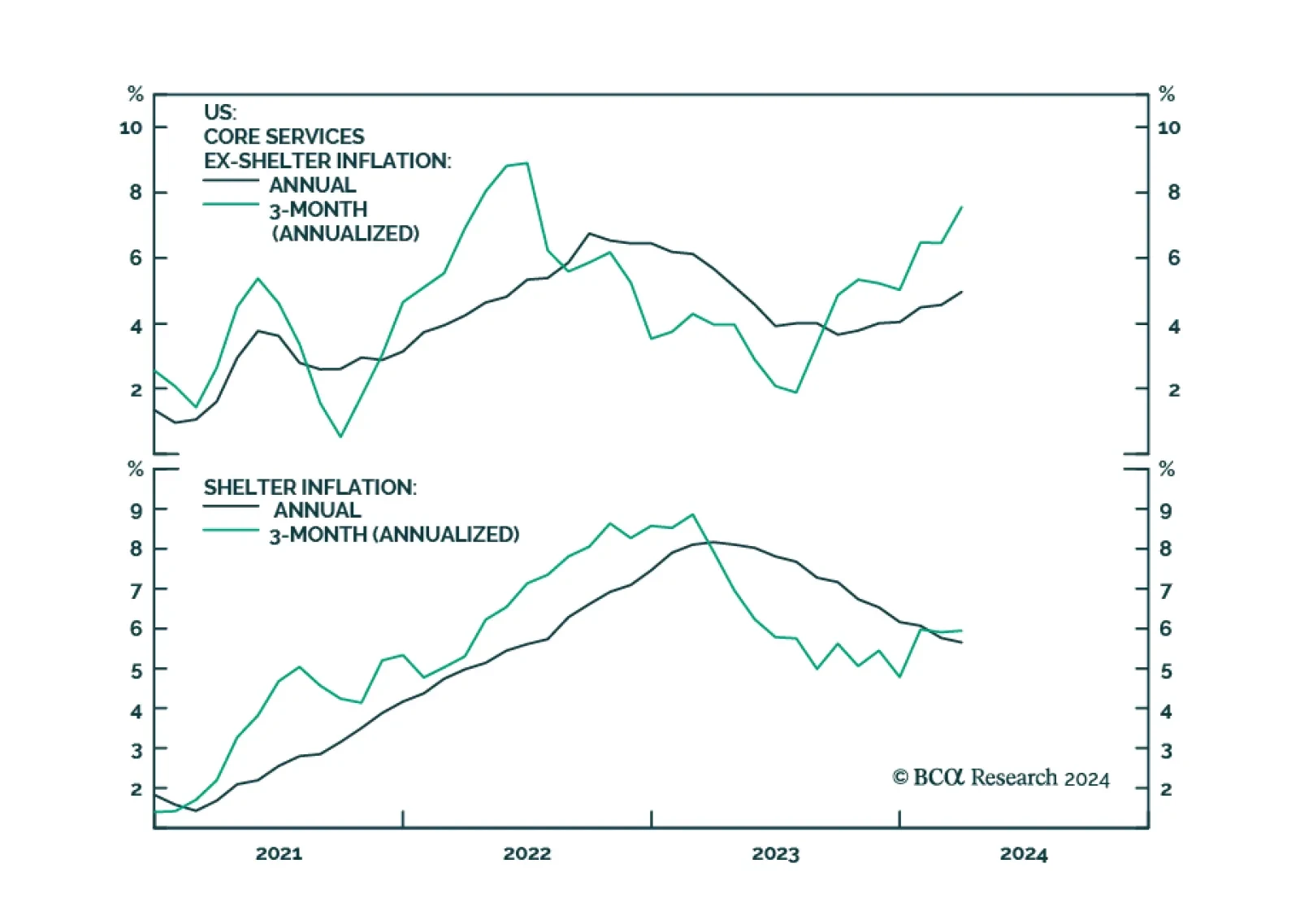

Headline inflation came in at 0.4% on a MoM basis and 3.5% on an annual basis, beating expectations of 0.3% and 3.4% respectively. Meanwhile core inflation came in at 0.4% on a MoM basis and 3.8% on an annual basis, beating…

Our reaction to this morning’s CPI report and bond market moves.

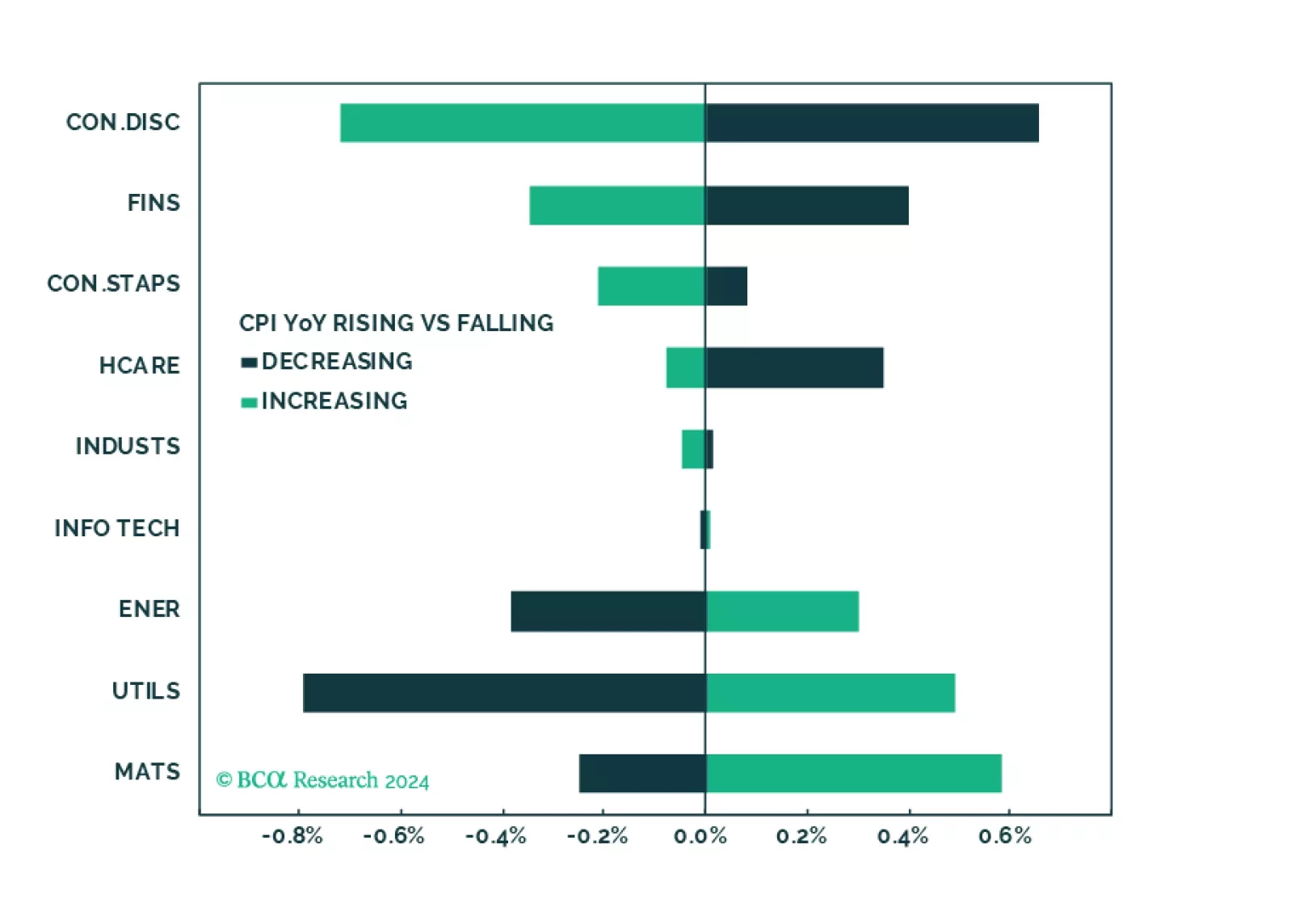

Fears of a hard landing are abating as growth has been surprising to the upside. New worries are emerging, such as the trajectory of disinflation, and the pace and timing of rate cuts. In this environment, it is important to build a…

Our reaction to this morning’s employment report and bond market moves.

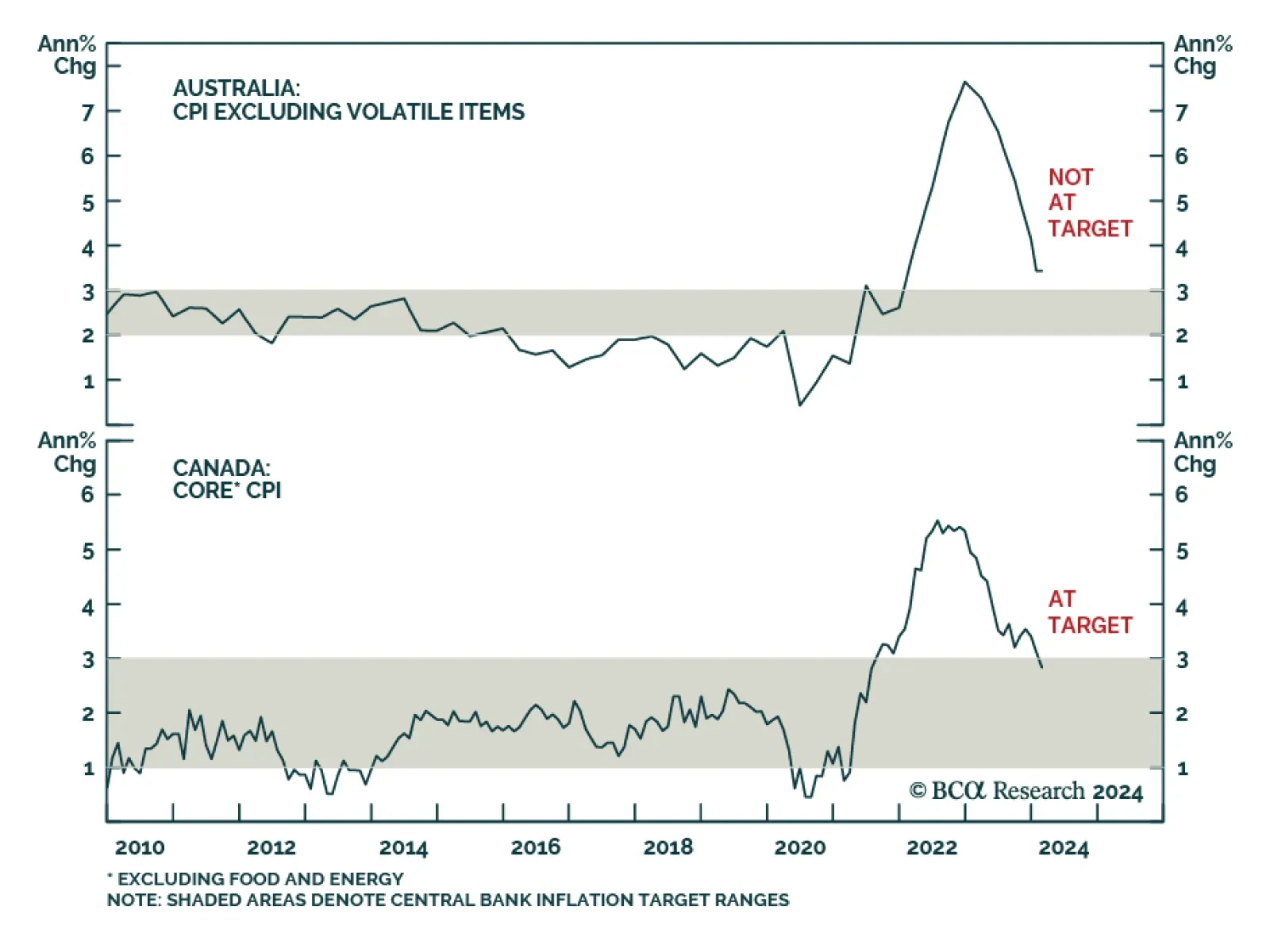

It is too early for the RBA to begin cutting rates. Inflation remains above target, with core CPI currently standing at 3.4%, one of the highest numbers amongst major economies. The labor market is also fundamentally strong.…

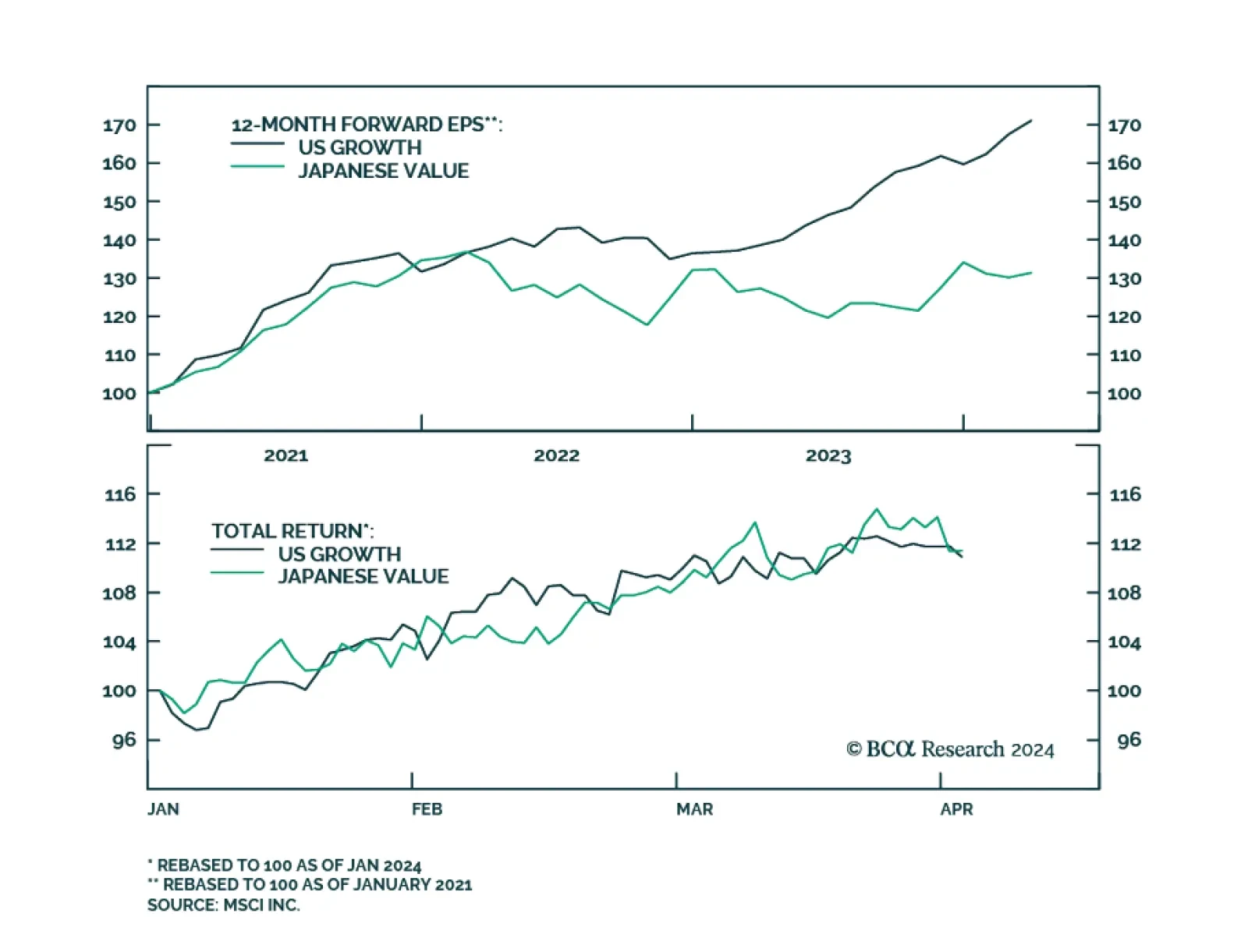

The extraordinary performance of AI companies has pushed US growth stocks to new highs. So far, the MSCI US Growth Index has returned almost 11% since the start of the year, outperforming global stocks by over 3%. No growth index…