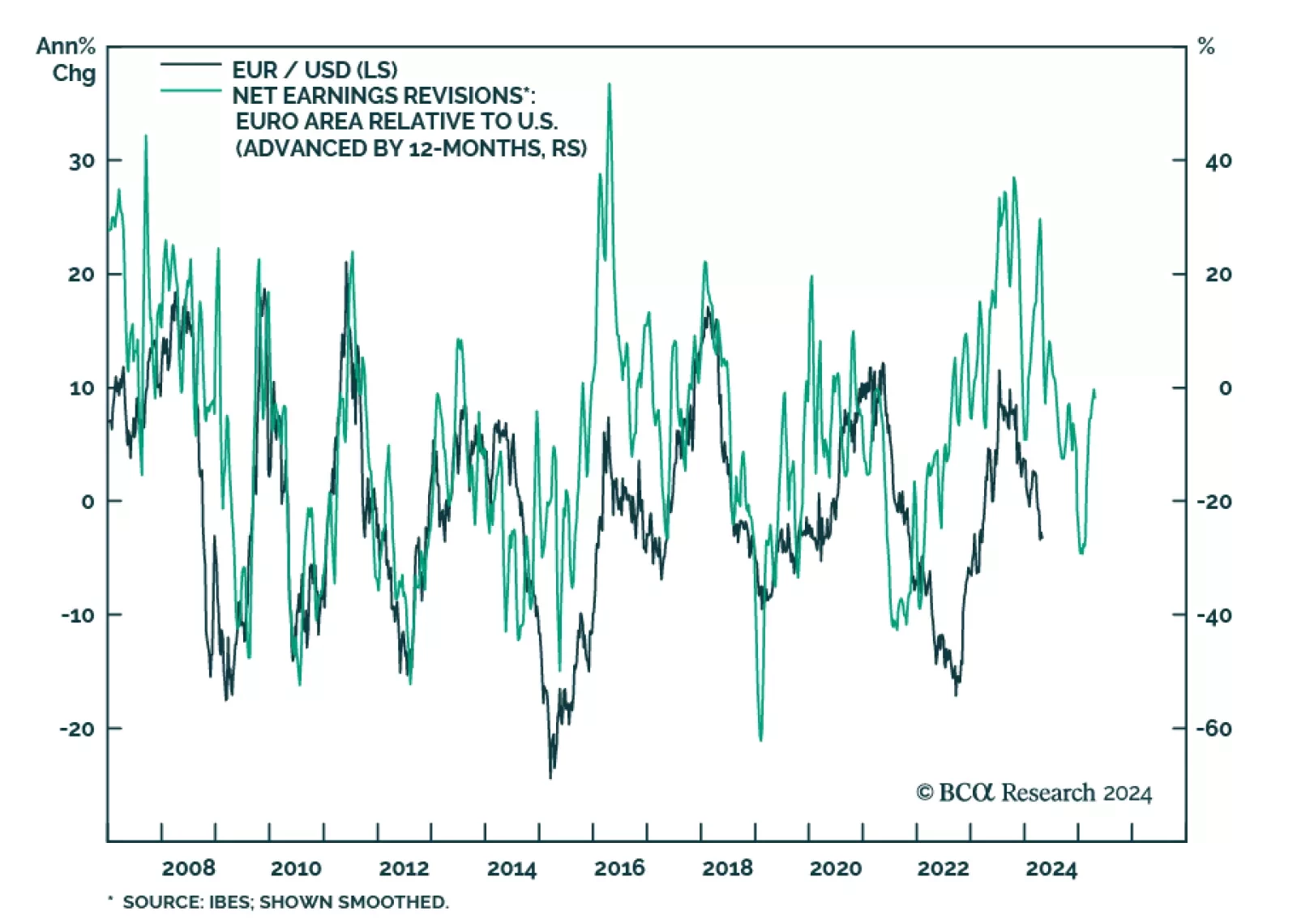

EUR/USD has fallen by almost 5% since July last year. There are fundamental reasons why this move has taken place. The US economy has shown significant more resilience than the European one. Consumption continues to be strong,…

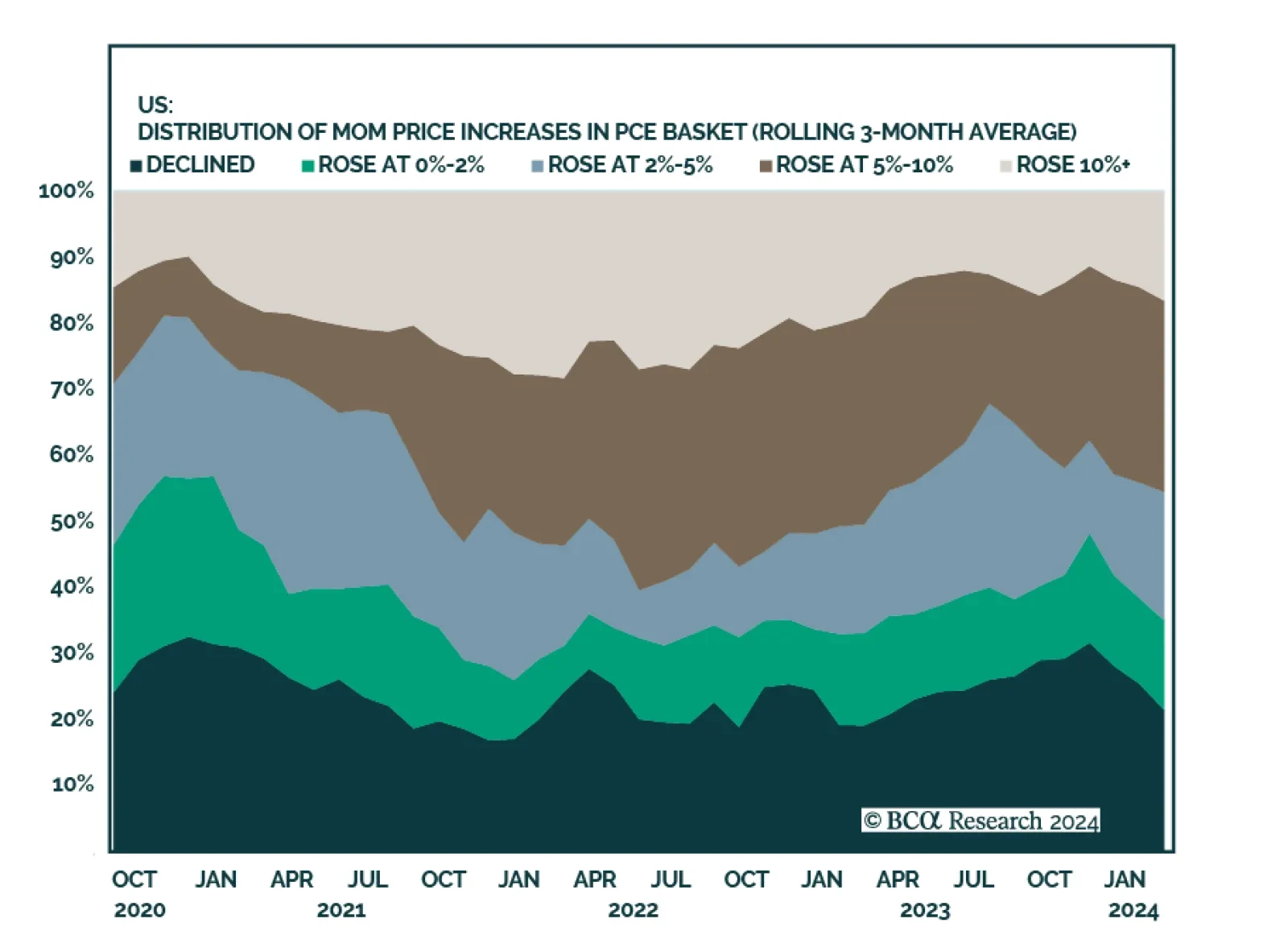

The trimmed mean PCE was released on Friday by the Dallas Fed. This measure removes the top 31% of items with the highest inflation and the bottom 25% of items with the lowest inflation within the PCE basket. Historically, it has…

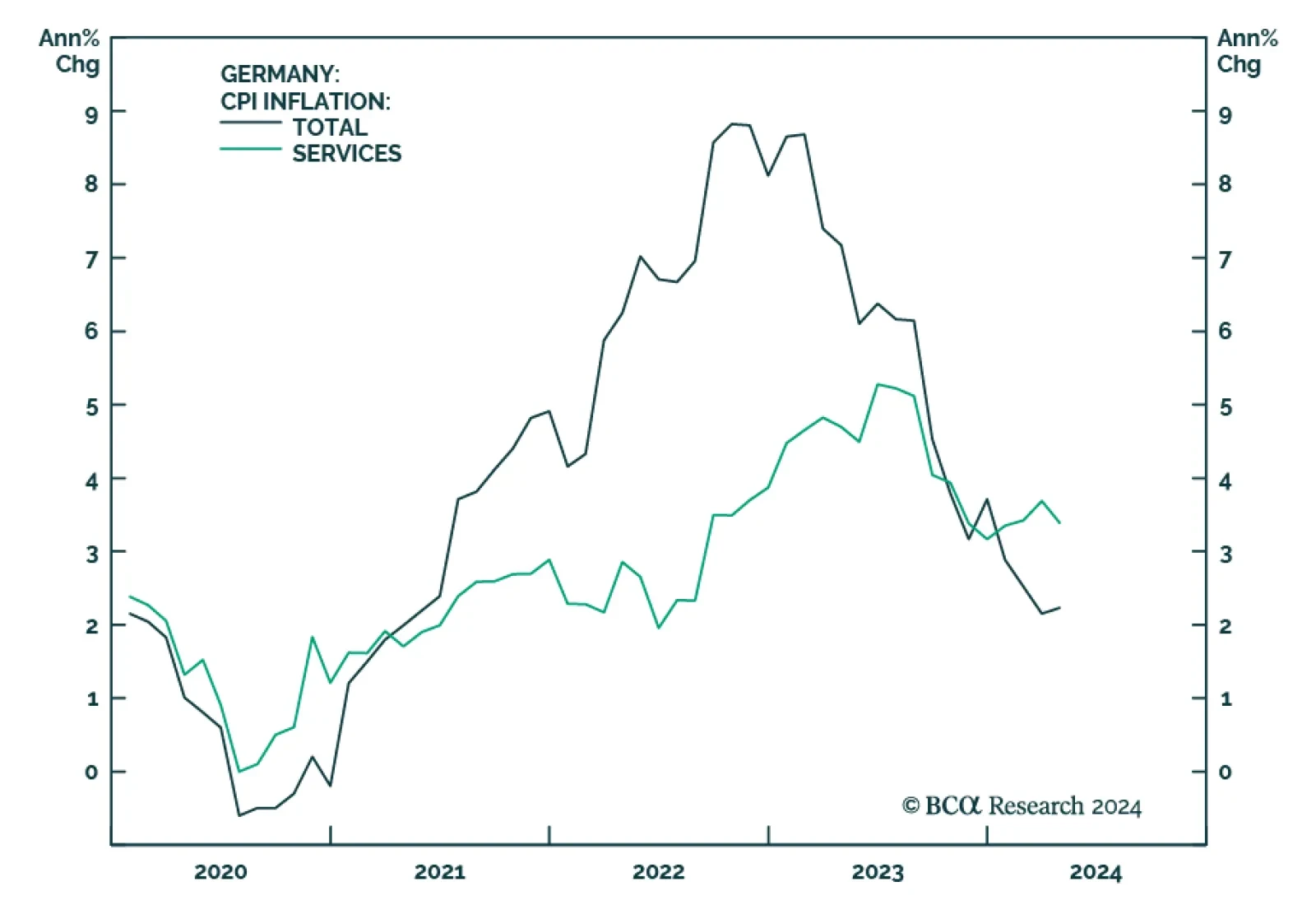

A few preliminary measures of German inflation for April were released on Monday. The month-on-month headline inflation measure came in at 0.5% an increase from last month’s reading of 0.4% but below expectations of 0.6%.…

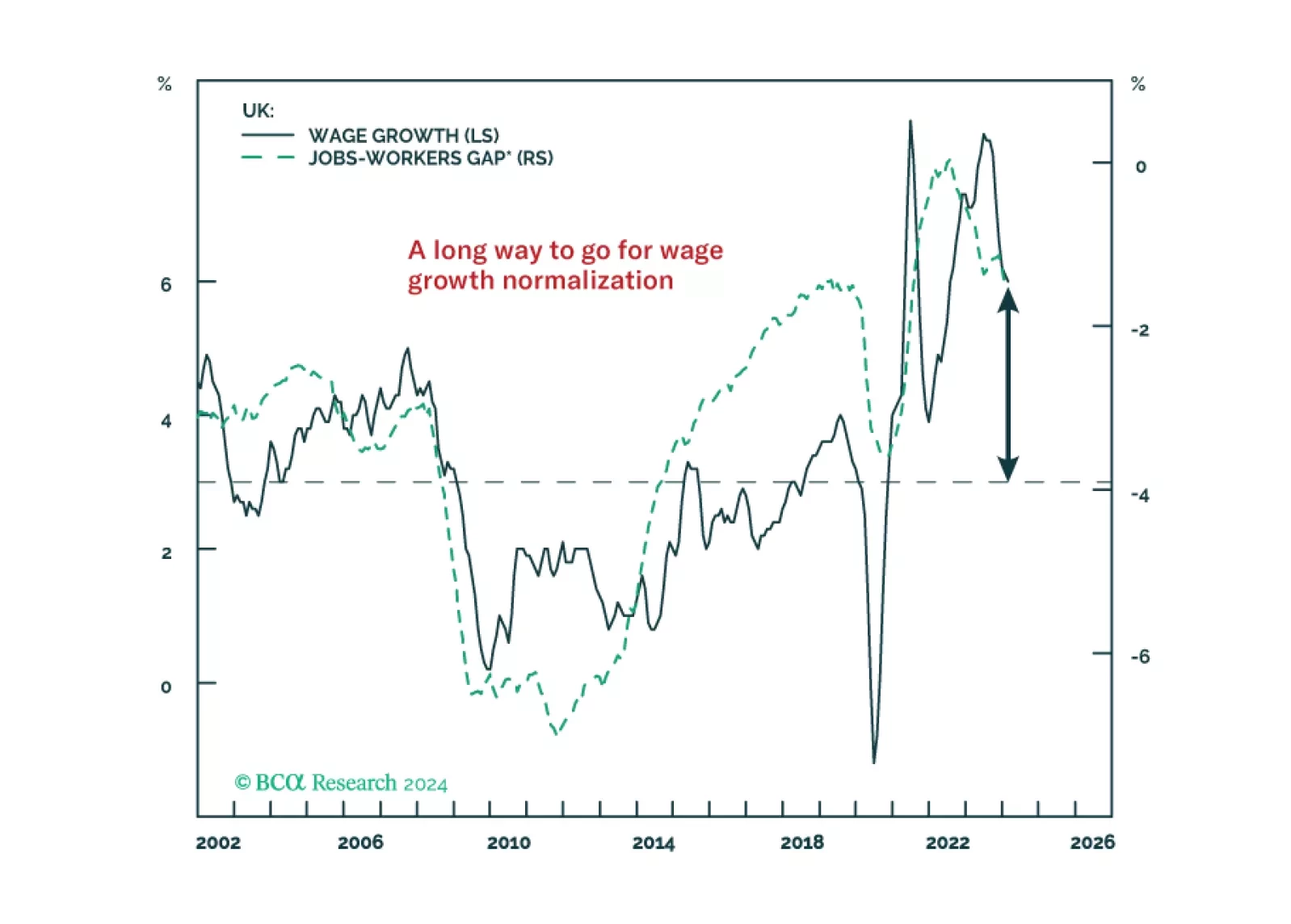

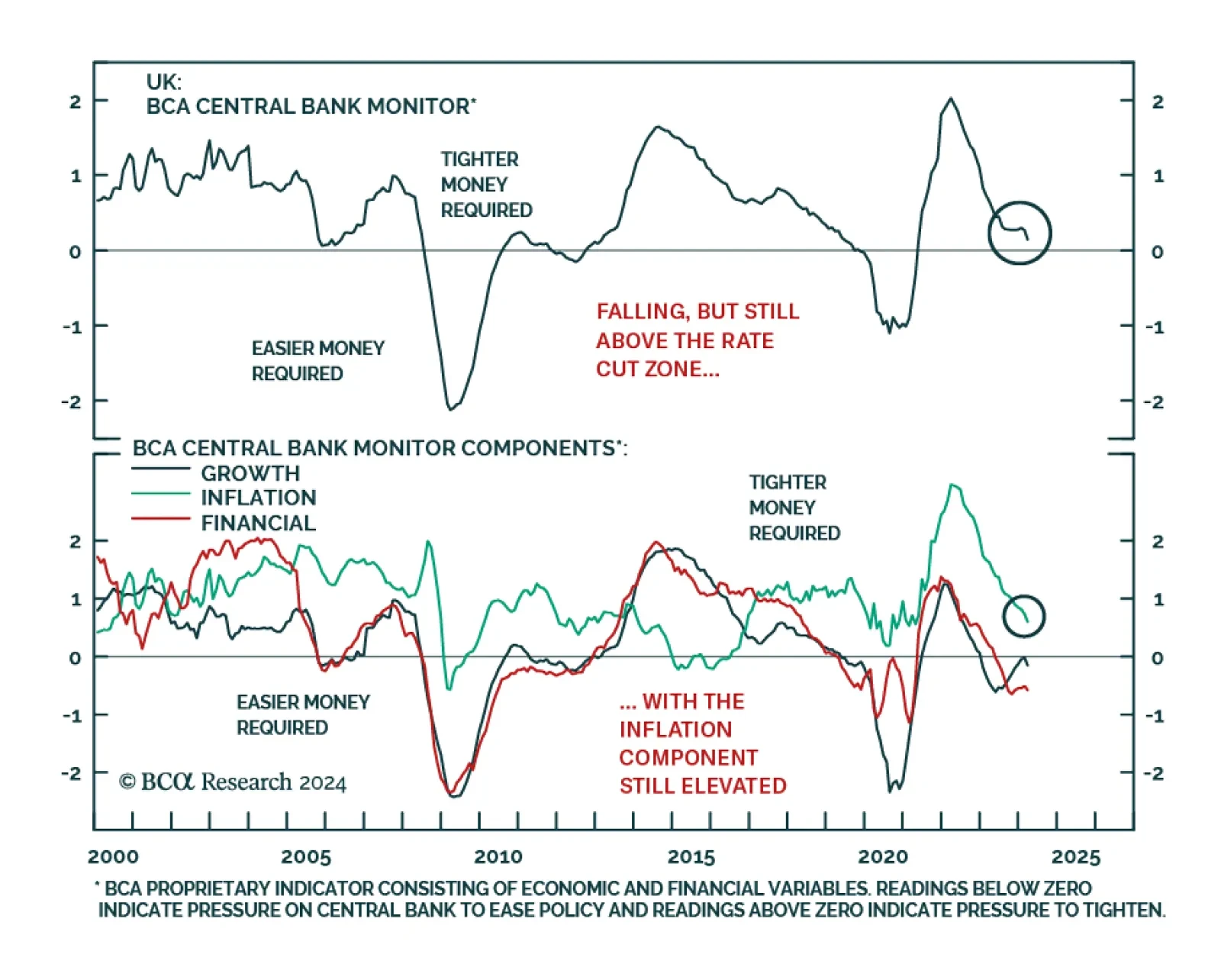

According to BCA Research’s Global Fixed Income Strategy service, a hard landing is the only way to solve the UK inflation problem. Sticky inflation and lingering inflation pressures have made the BoE’s job much…

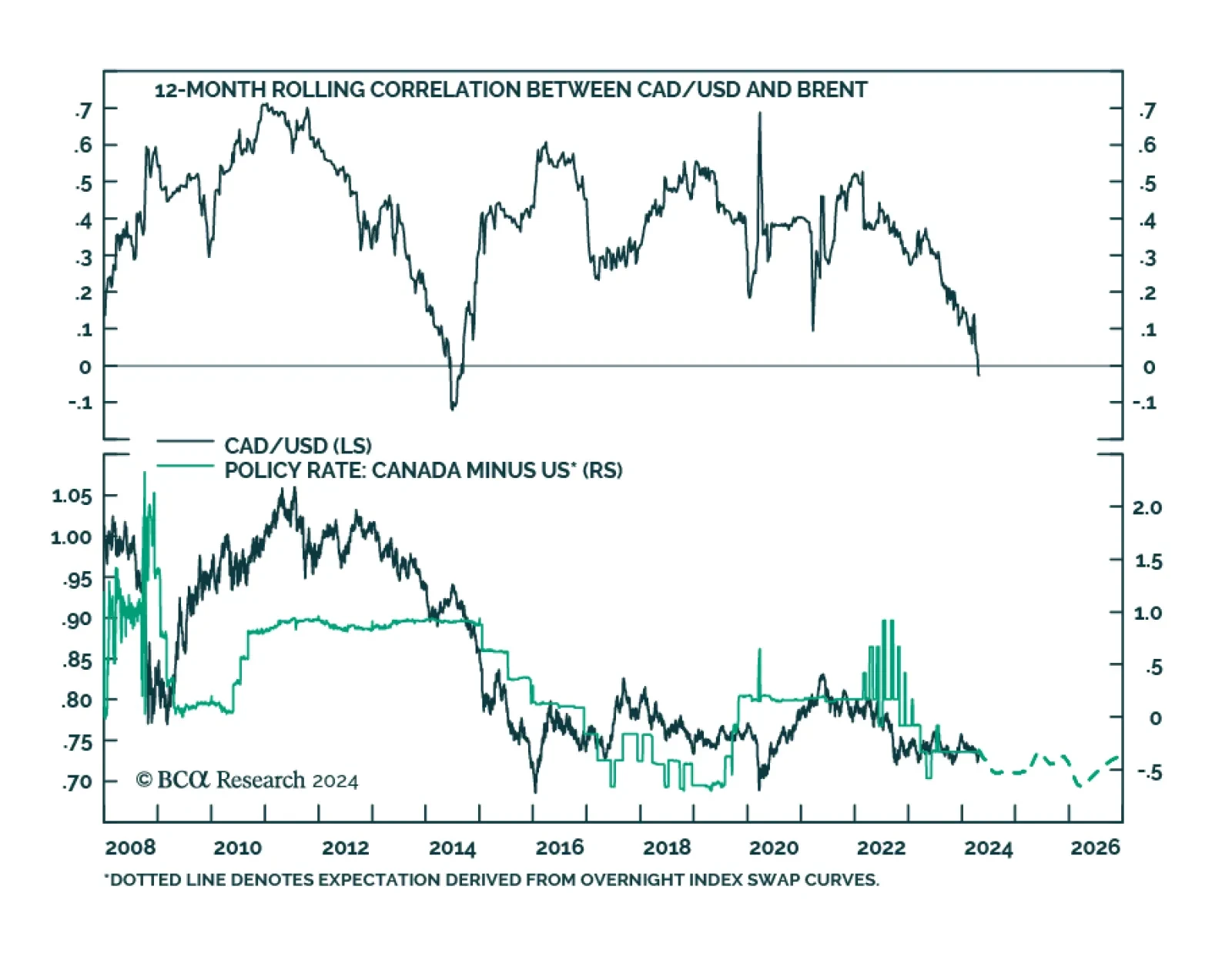

The Canadian dollar typically has two main drivers: interest rate differentials and commodity prices, especially oil prices. However, the relationship between the CAD and oil has broken down recently. As our FX strategists have…

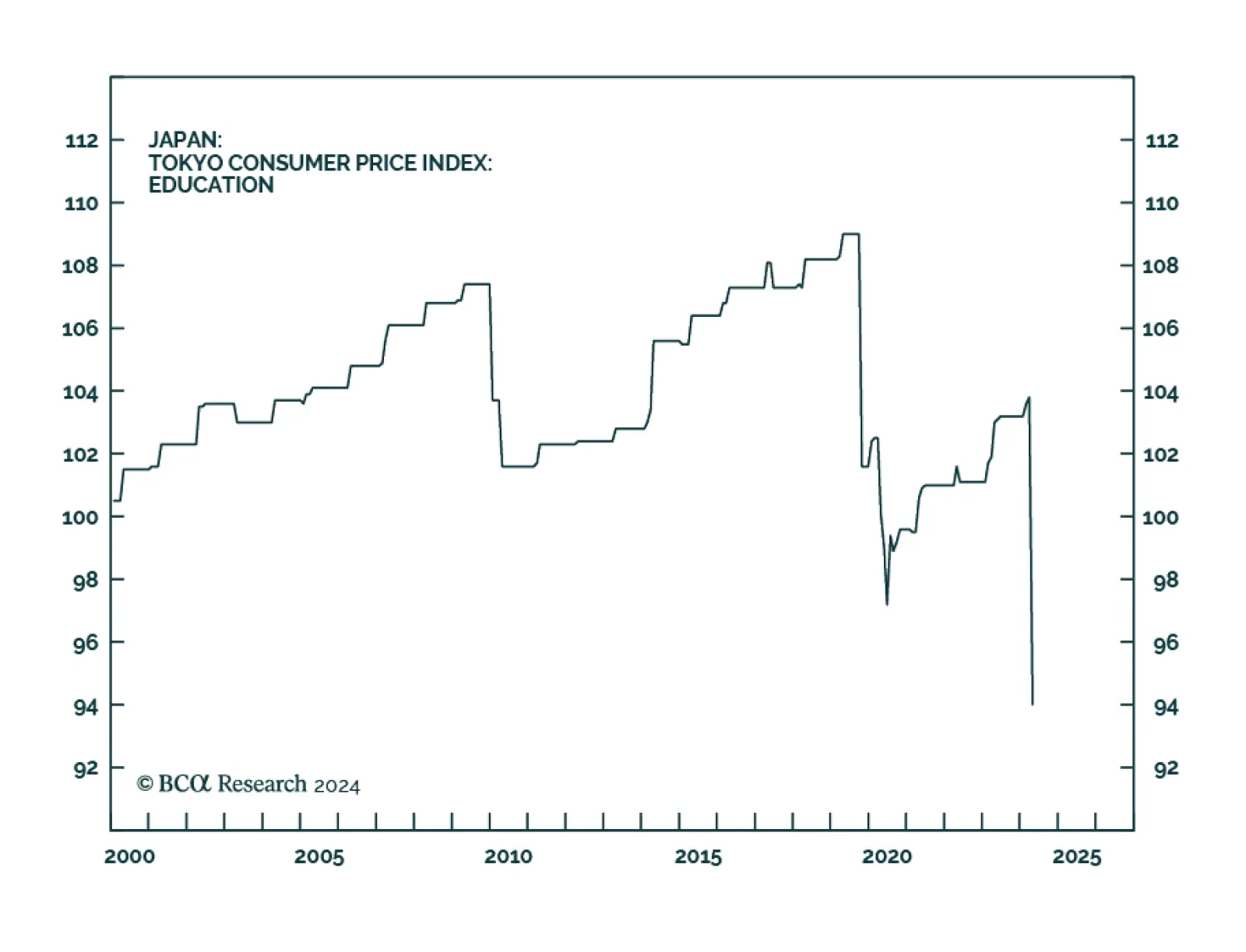

The Tokyo inflation release for April came in on the soft side on Friday, with every single metric coming in below expectations. Tokyo headline inflation declined from 2.6% y/y to 1.8% y/y, versus expectations of a much more…

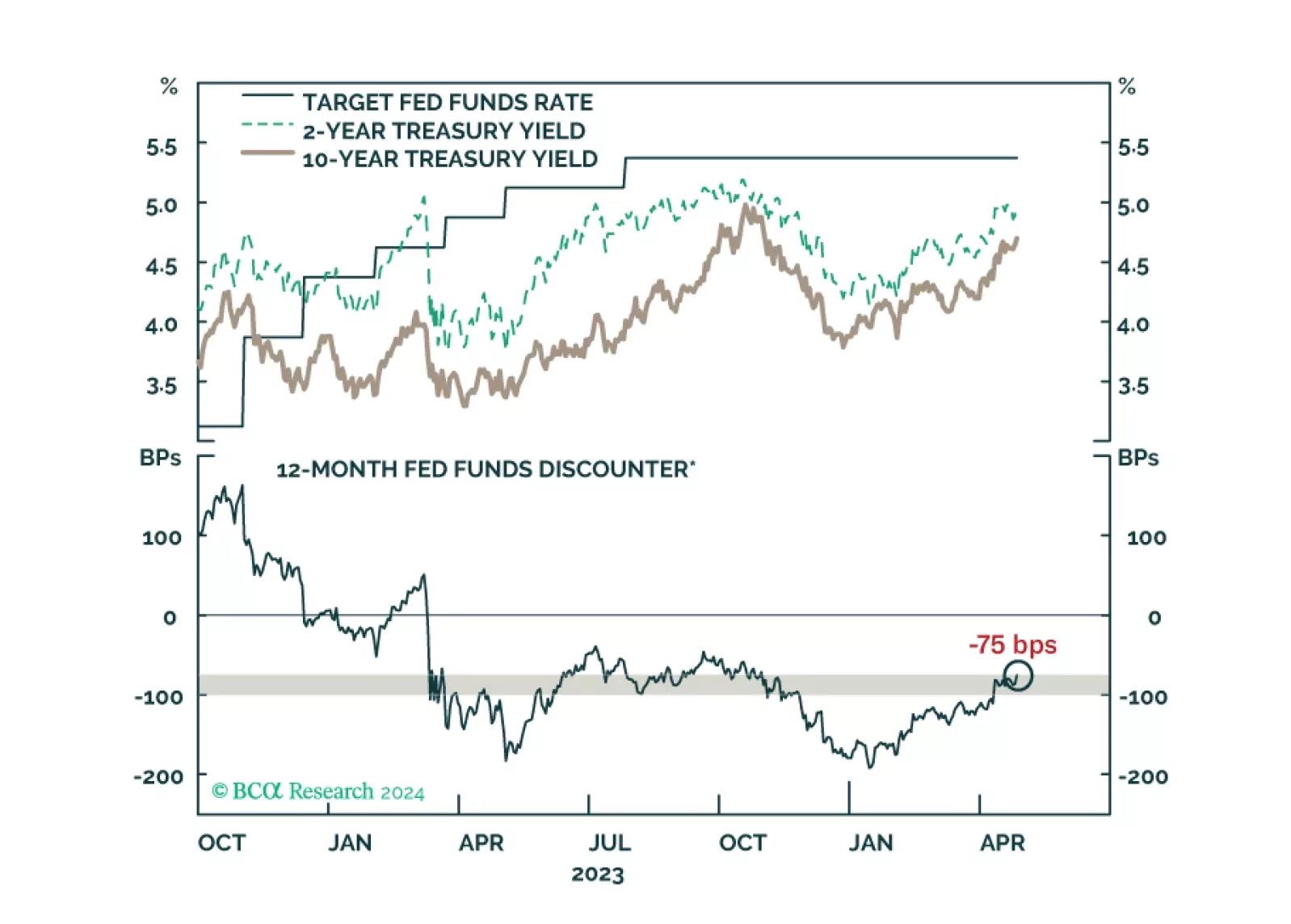

Our latest views on the recent increase in Treasury yields and some key things to watch at next week’s FOMC meeting.

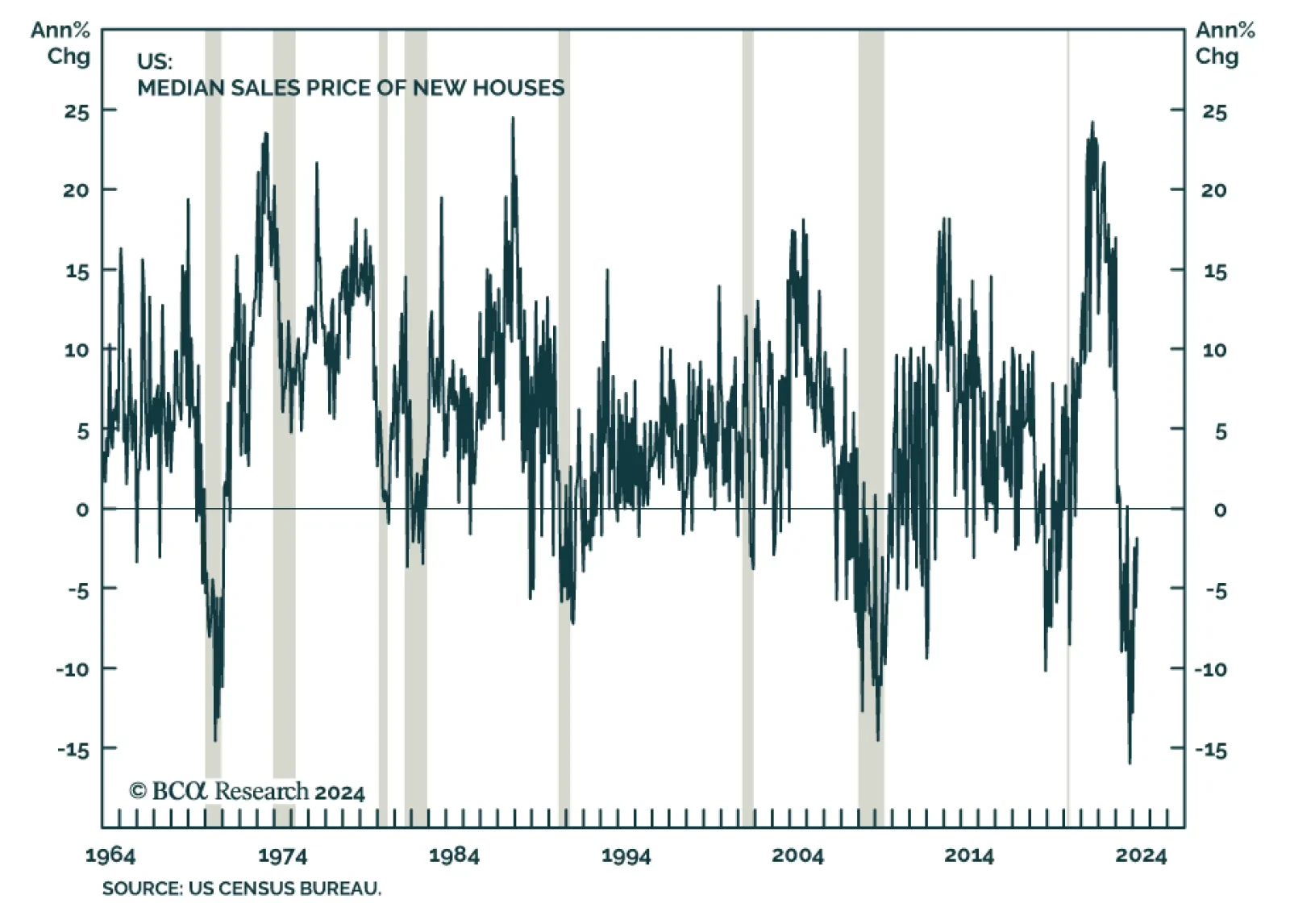

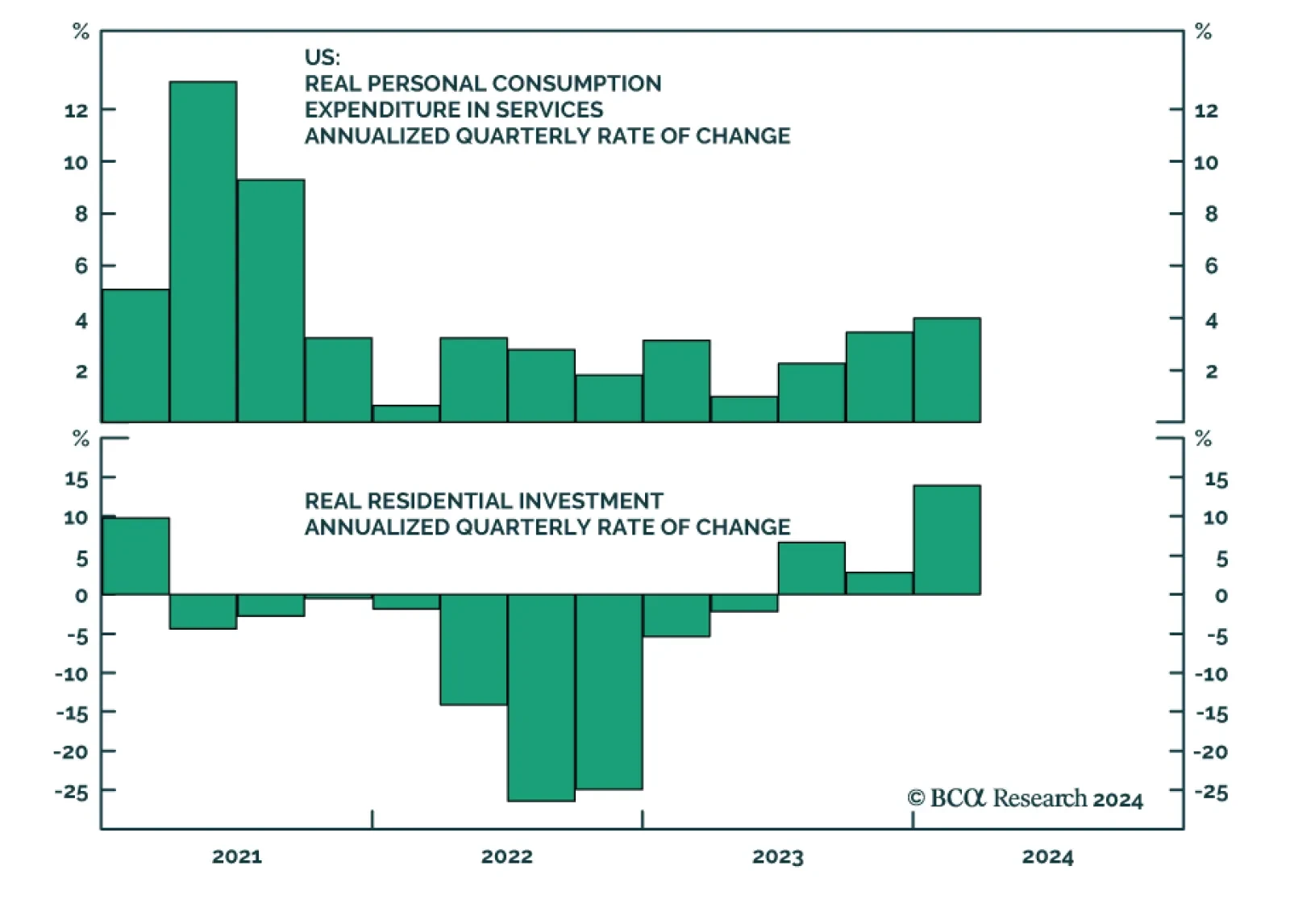

Throughout this cycle, US housing has defied expectations. Overall home prices have never fallen since the pandemic, even as the Fed has conducted its second most aggressive tightening campaign in history. Today, home price…

The advanced estimates for US real GDP suggest that economic growth slowed meaningfully from 3.4% in Q4 2023 to 1.6% in Q1 2024 on an annualized basis, significantly below expectations of 2.5%. That said, the details of the…