Some thoughts on this morning’s employment report and recent trends in US economic data.

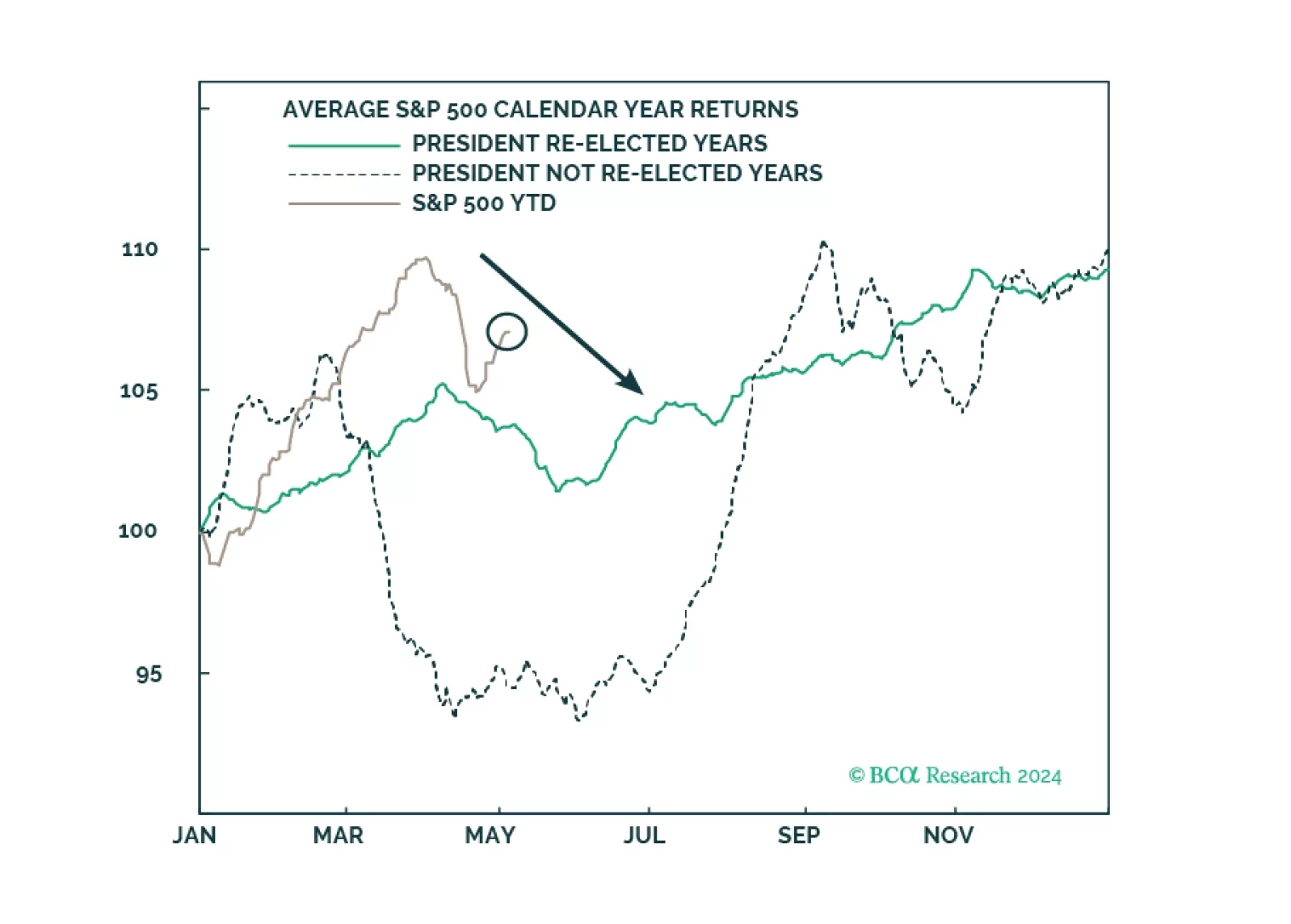

Investors should prepare for economic data to weaken even as policy uncertainty and geopolitical risk skyrocket ahead of the US election.

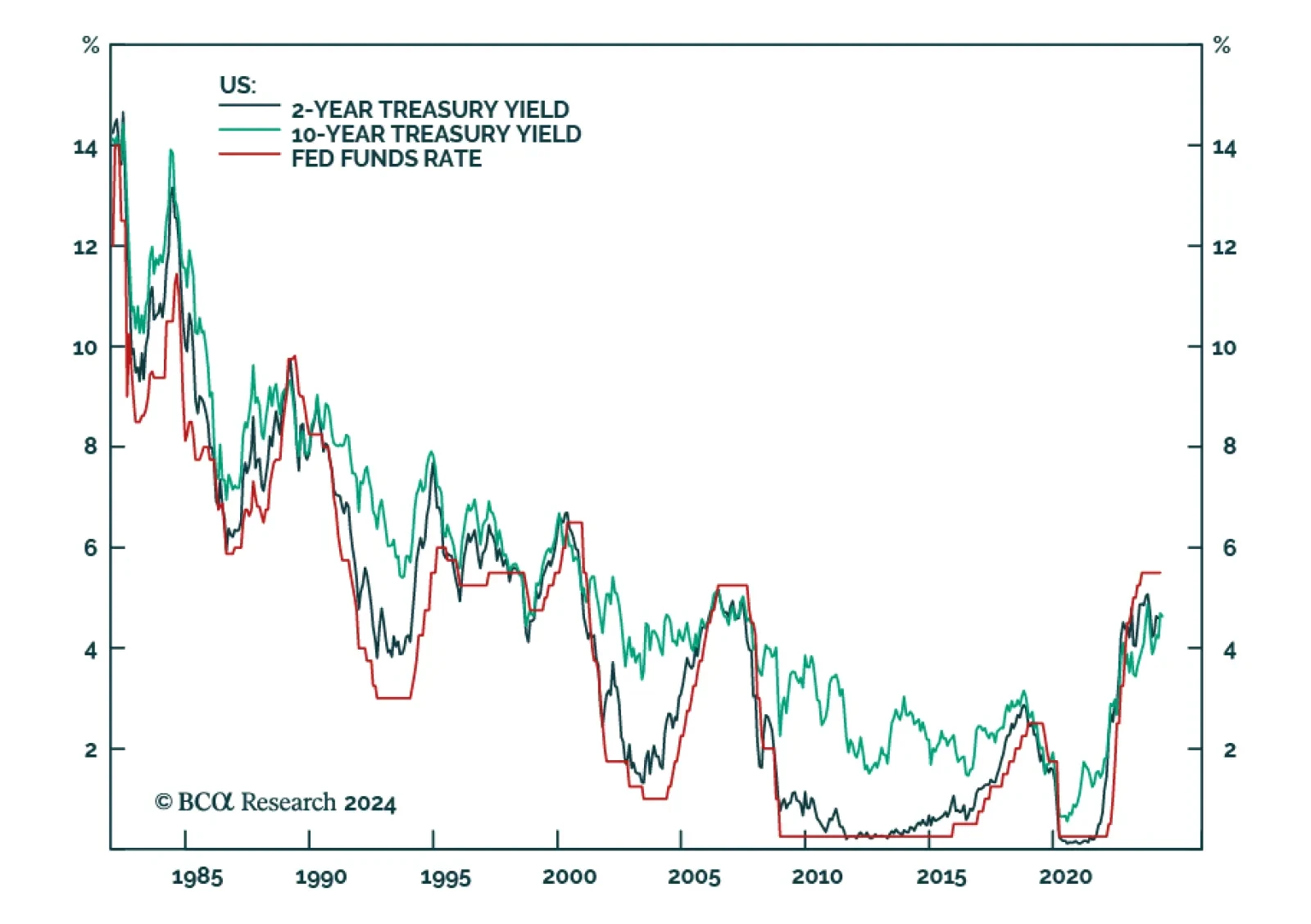

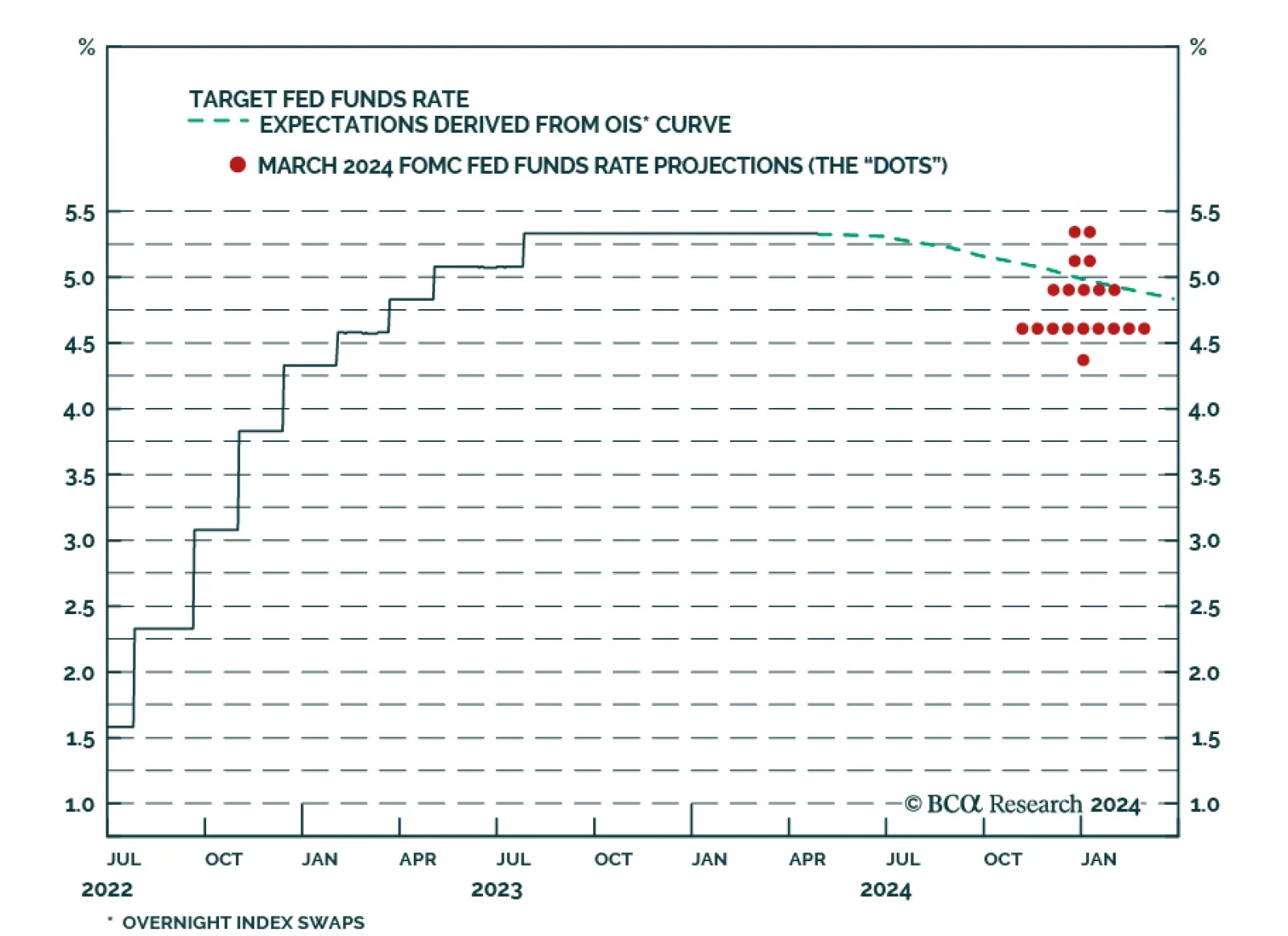

The Fed left the policy rate unchanged following its May FOMC meeting. It also announced it would slow the pace of quantitative tightening starting on June 1, from the current $60 billion per month to $25 billion per month for…

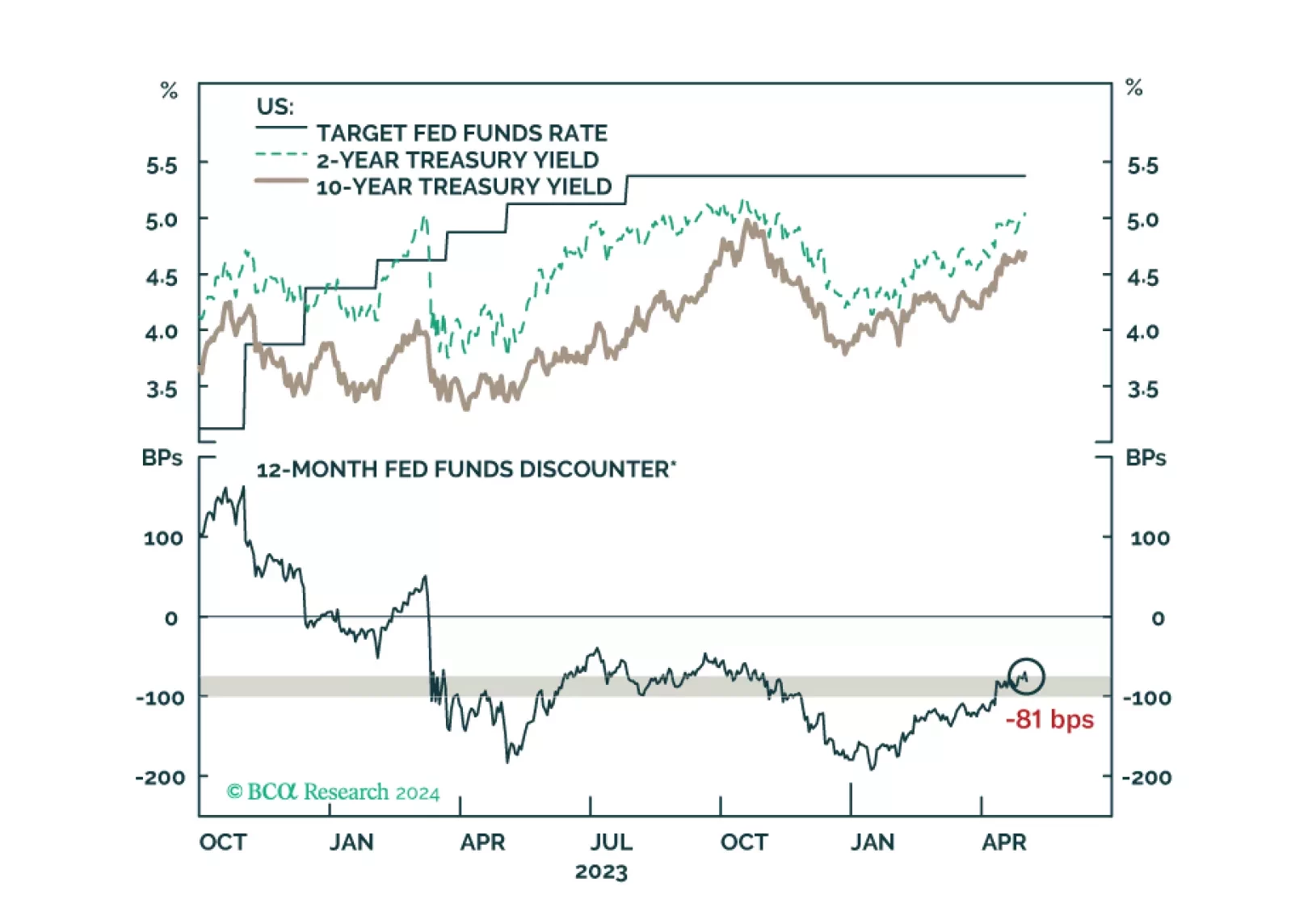

Updated views on US Treasury yields and the dollar following today’s FOMC meeting.

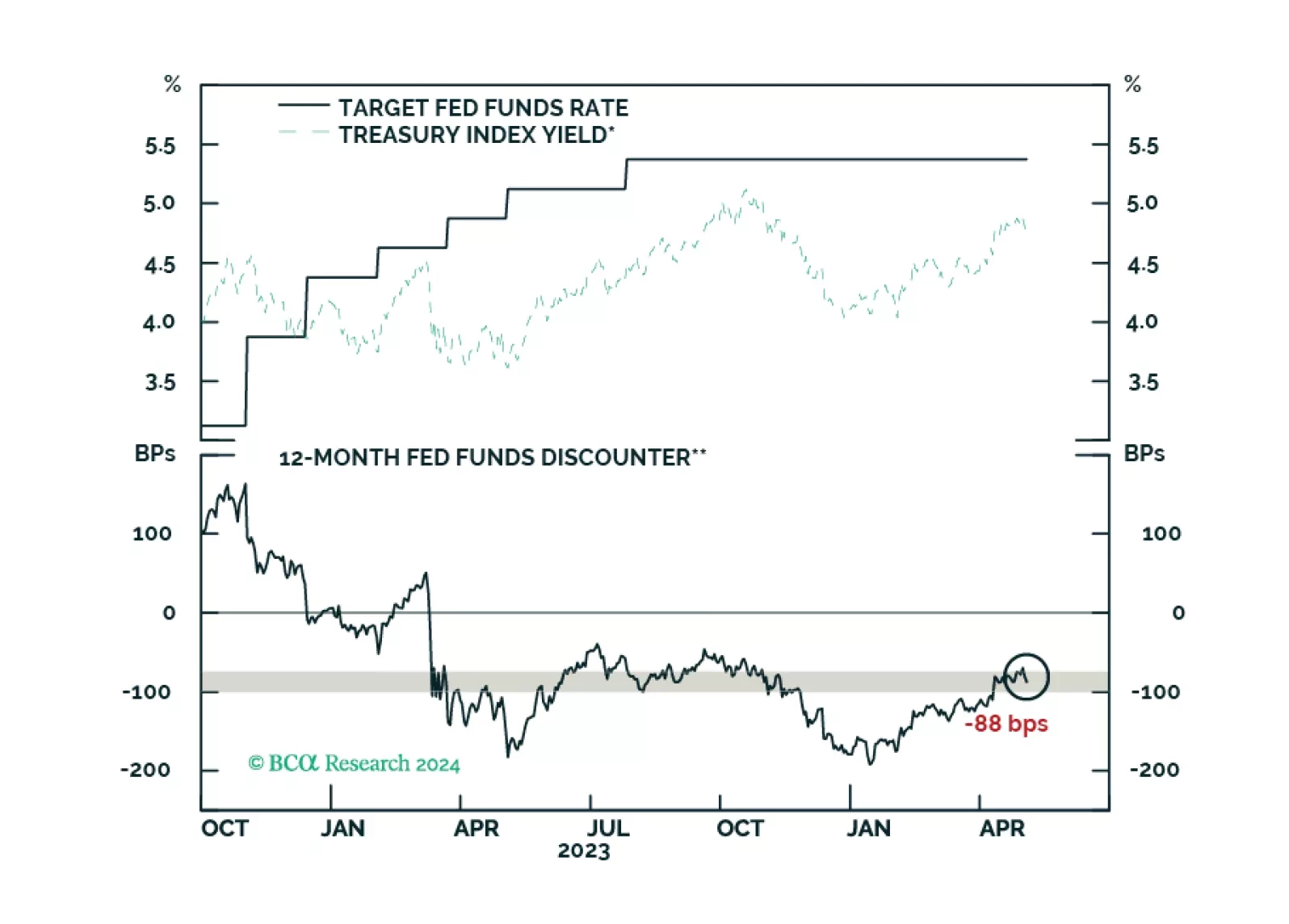

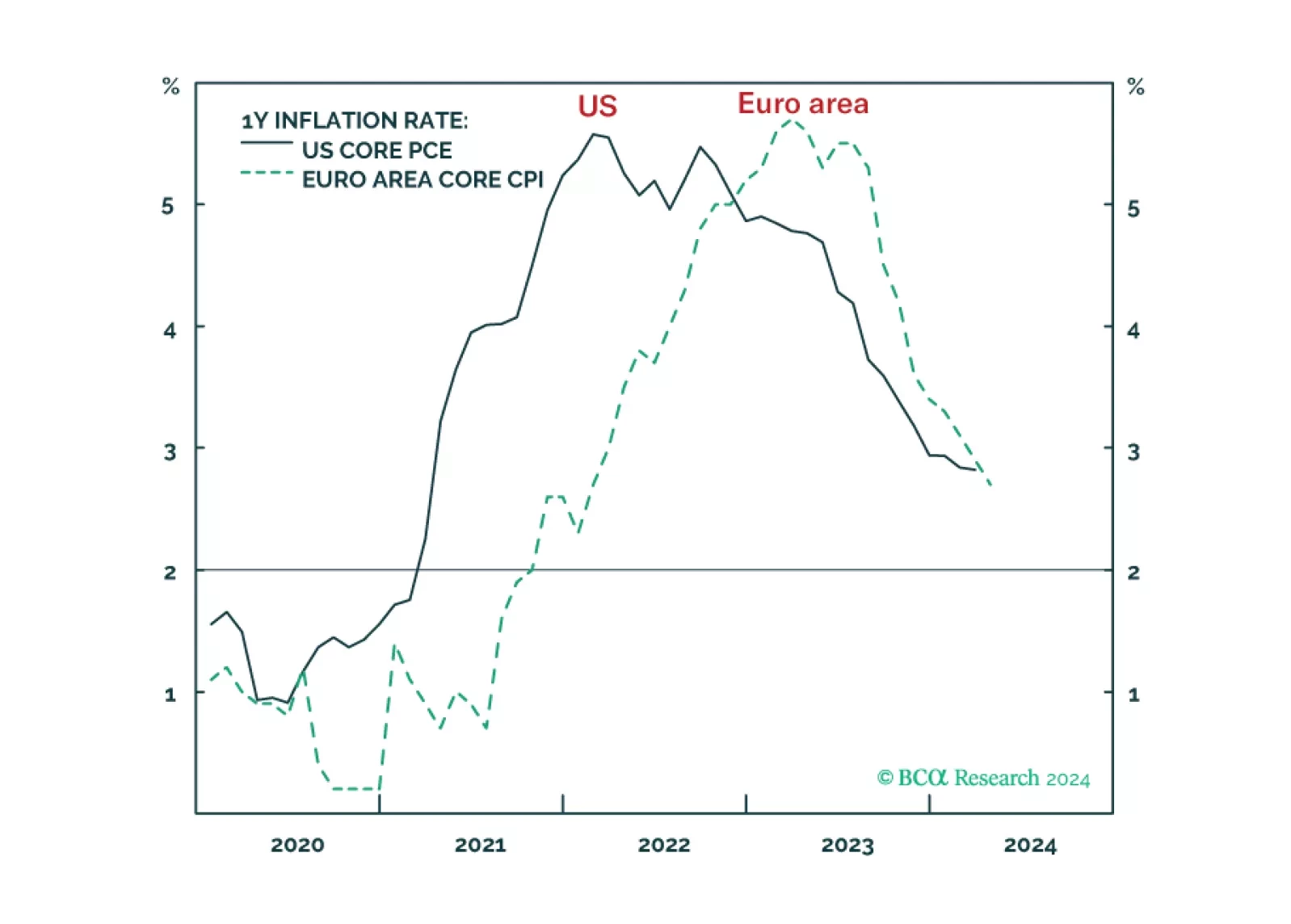

Wild hopes for US rate cuts got shattered, exactly as we predicted. But given the different incentives that the Fed and ECB now face, the relative pricing between the Fed and the ECB could widen further in the coming months. We…

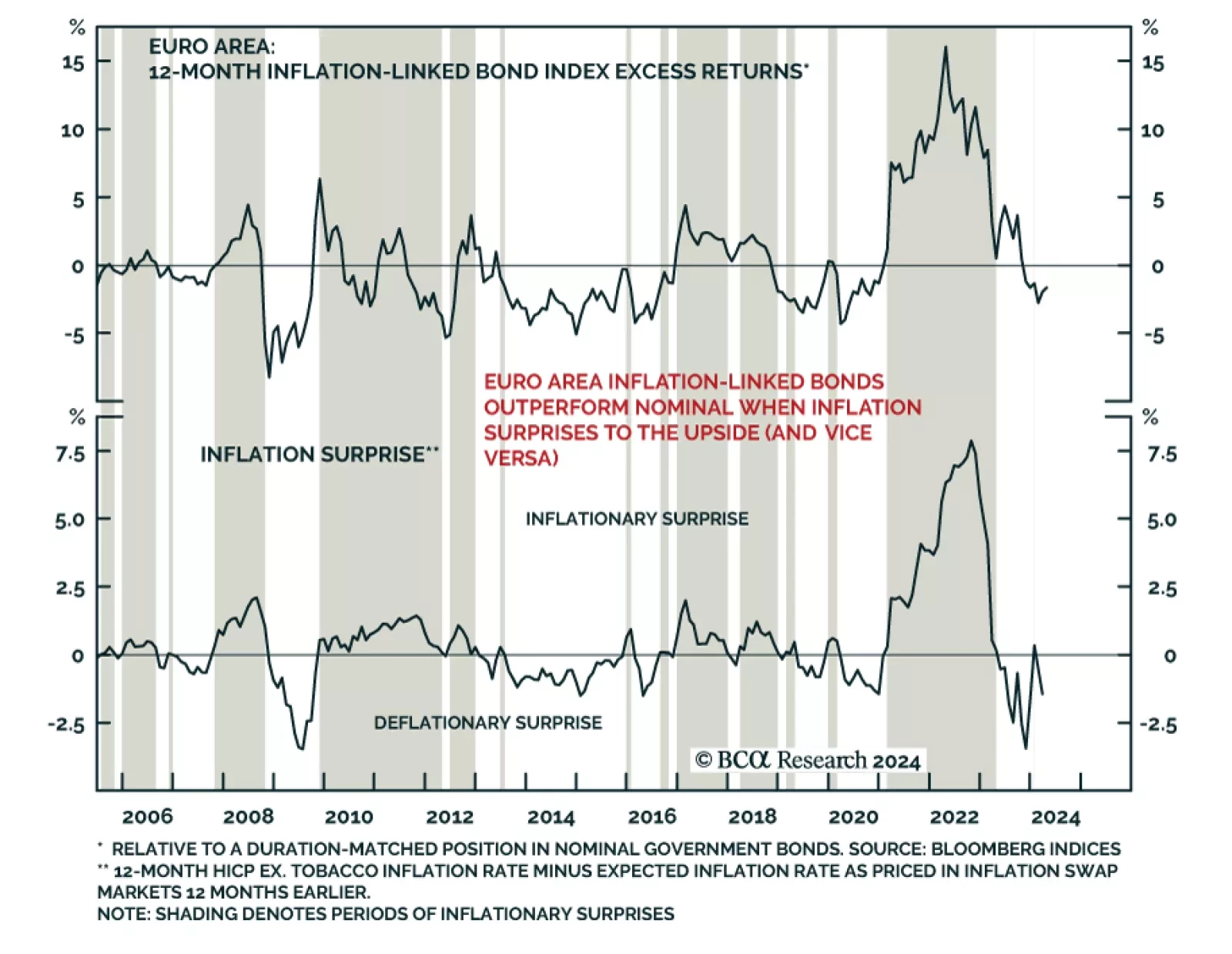

In its latest report, BCA Research’s Global Fixed Income Strategy service introduces the latest addition in its framework for investing in global inflation-linked bonds (ILB). To apply the Euro Inflation-Linked Golden…

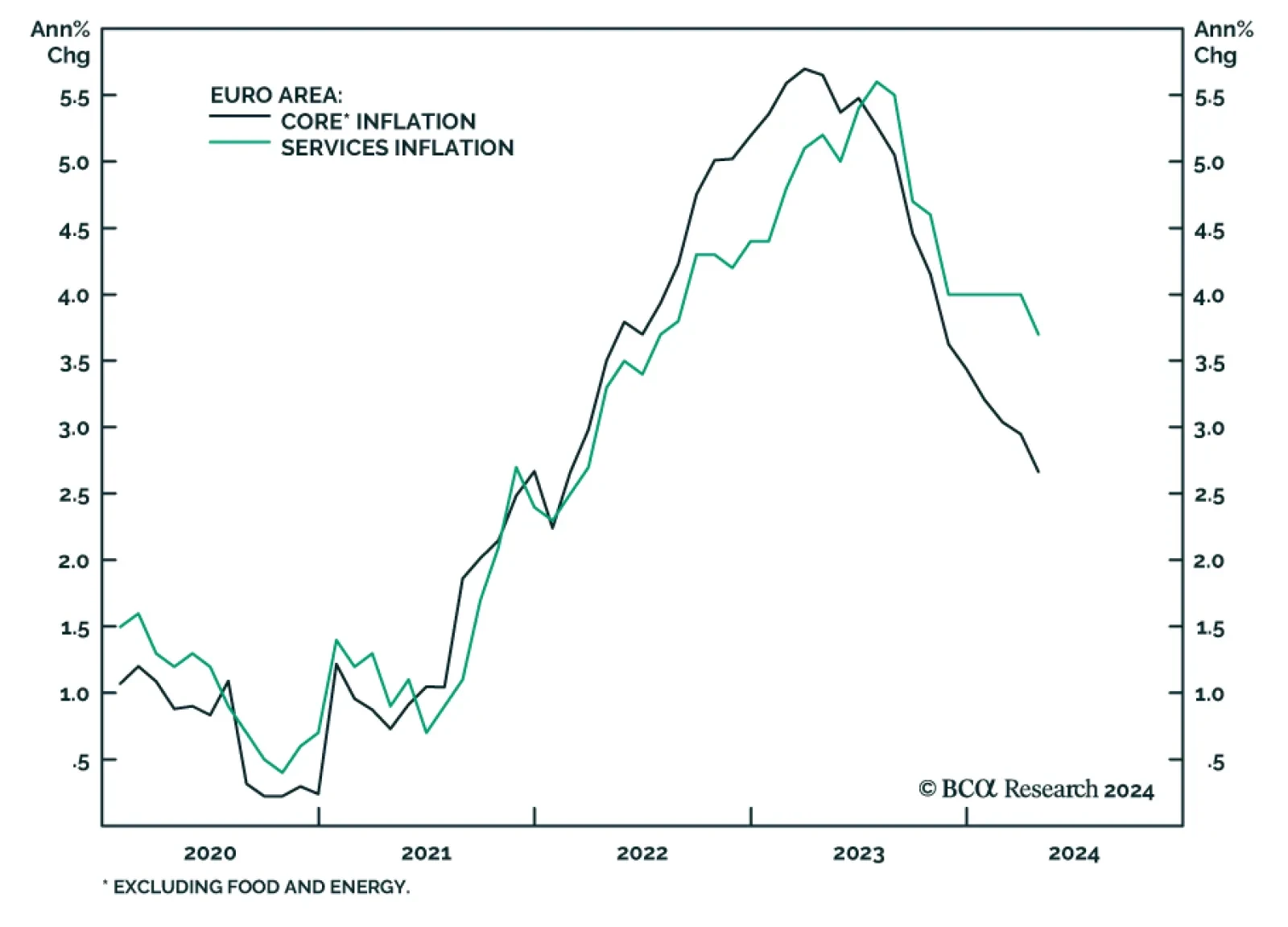

Euro area inflation and GDP numbers were released on Tuesday. The preliminary harmonized core consumer price index came in at 0.7% on a month-on-month basis, a decrease from 1.1% in March. The preliminary year-on-year core CPI…

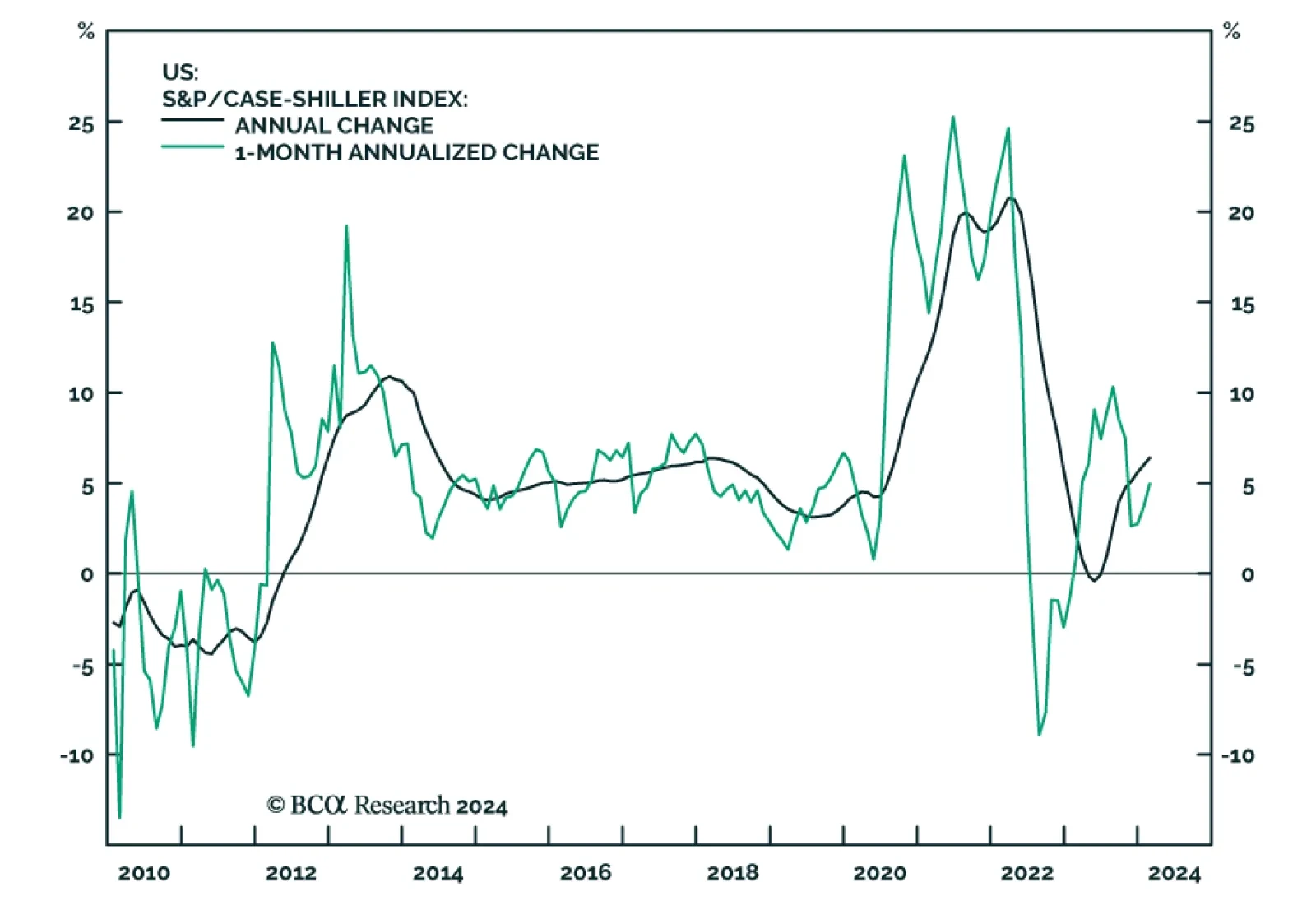

The house price index from the Federal Housing Finance Agency grew by 1.2% in February, improving from a decline of 0.1% previously, and above expectations of 0.1%. Meanwhile the S&P/Case-Shiller Home Price Index rose by 7.3…

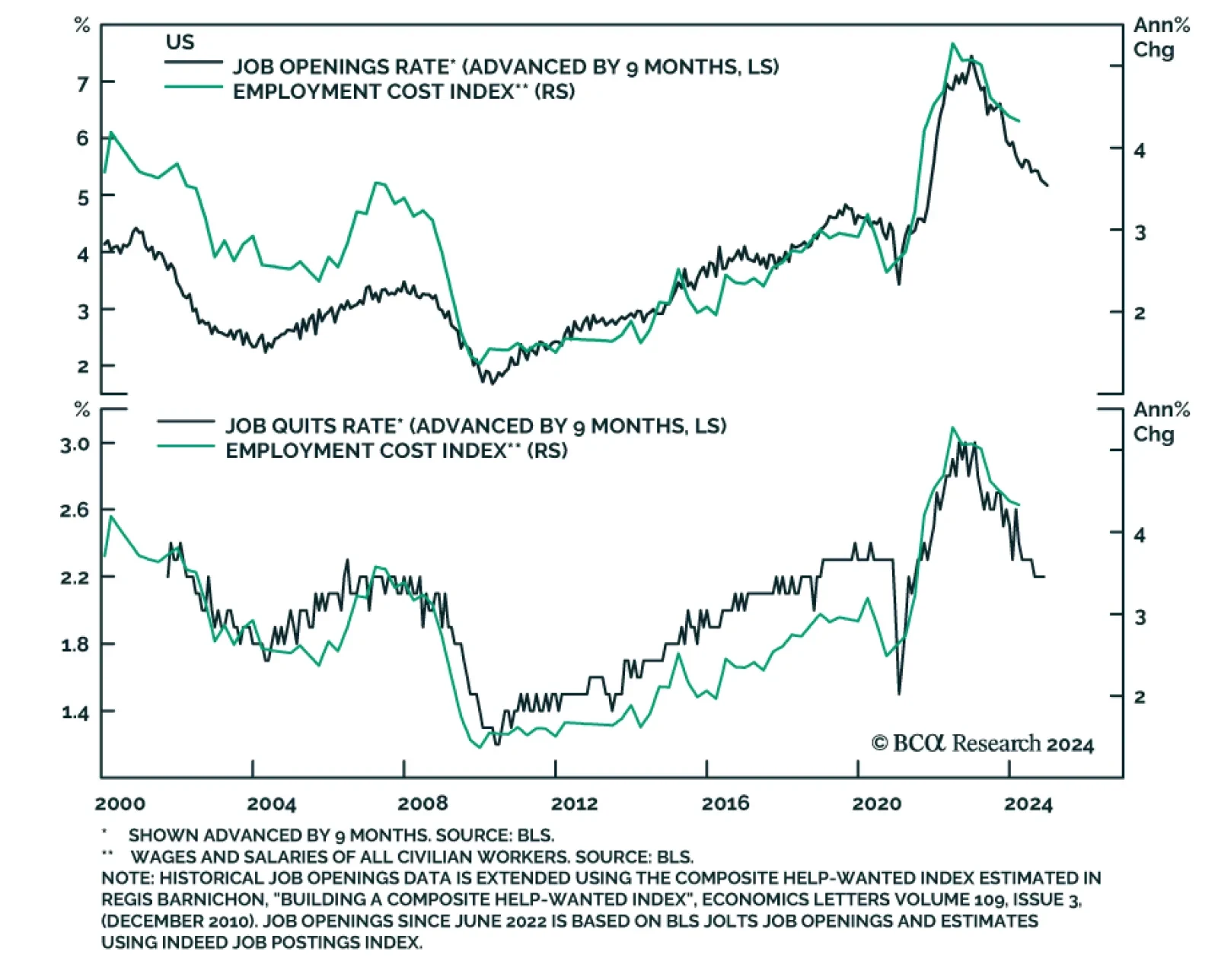

The Q1 US Employment Cost Index (ECI) accelerated at a faster-than-expected 1.2% q/q rate, from 0.9% q/q in Q4. On a year-on-year basis, it rose by 4.2% in Q1 and follows a similar annual increase in the previous quarter. The…

According to BCA Research’s US Bond Strategy service, the May FOMC meeting is unlikely to cause a stir in fixed income markets. The Fed will hold an FOMC meeting next week and while it will not update its economic or…