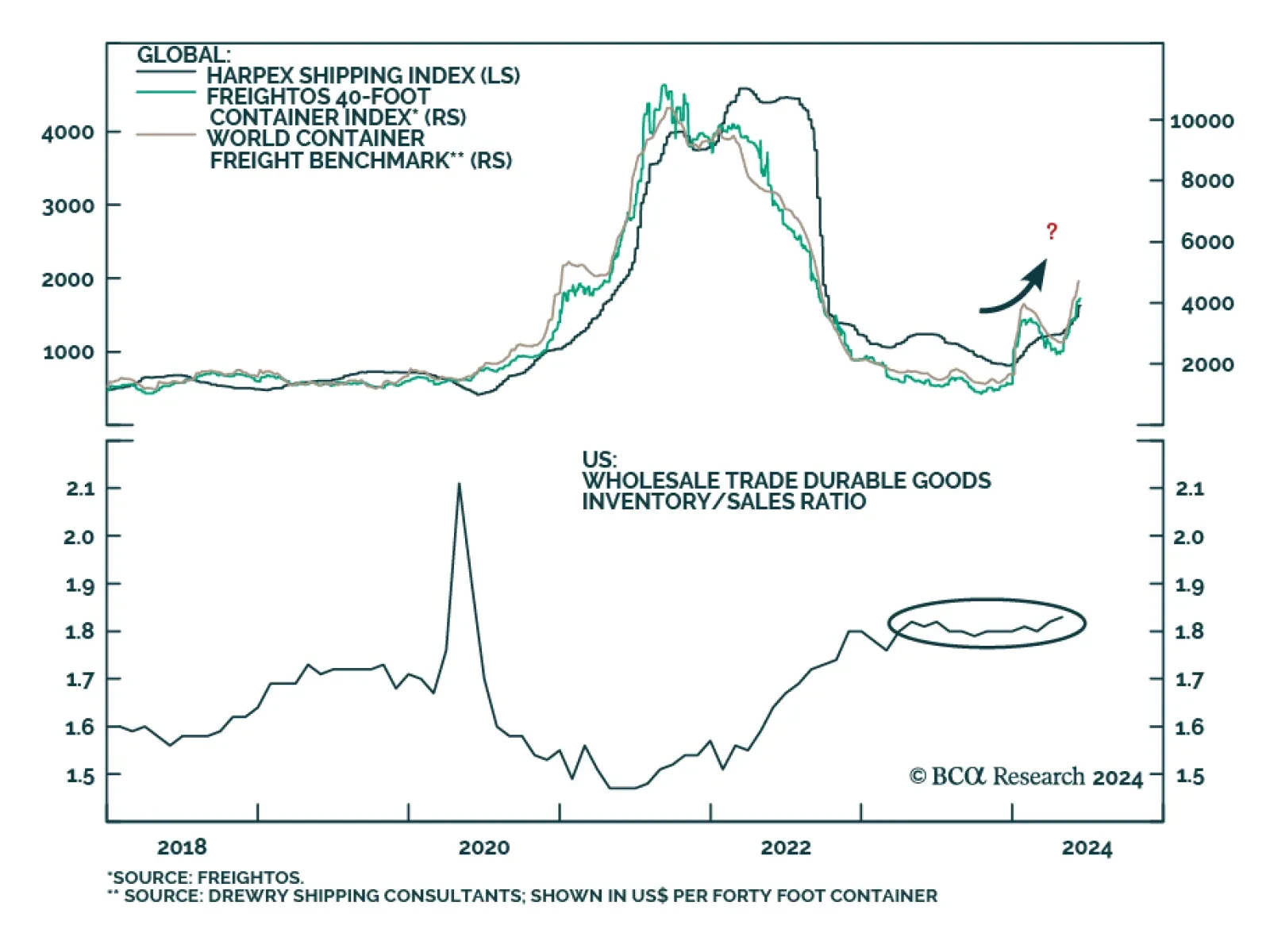

Goods prices have been normalizing following the pandemic binge on goods spending. The May CPI release indicated that durable goods and nondurable goods prices both continued to contract. Investors and policymakers have thus…

Our reaction to this morning’s CPI report and this afternoon’s FOMC meeting.

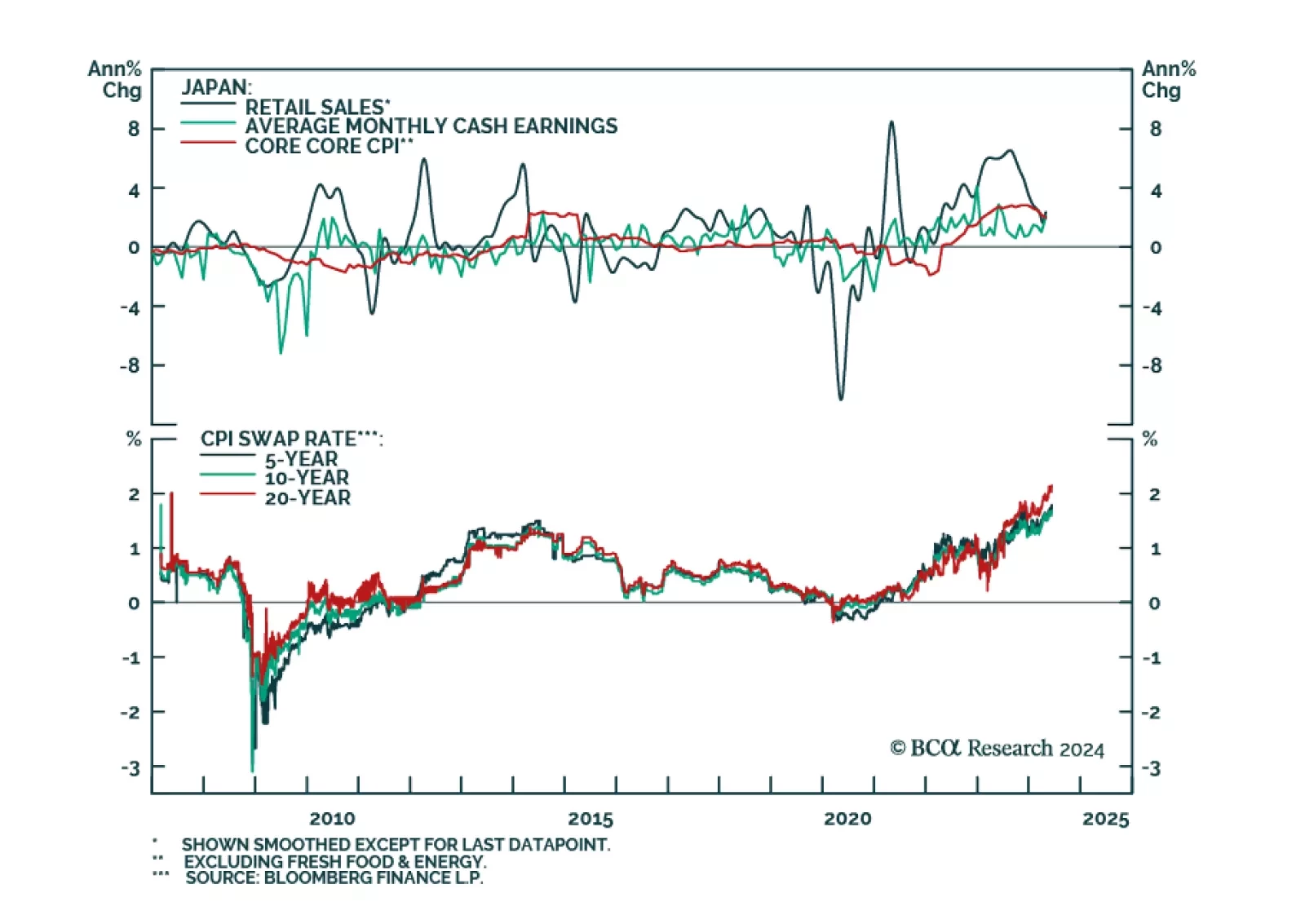

The Bank of Japan exited negative interest rate policy in March, but subsequent softer-than-expected CPI inflation prints have complicated its path towards tightening. The central bank is widely expected to stay put when it meets…

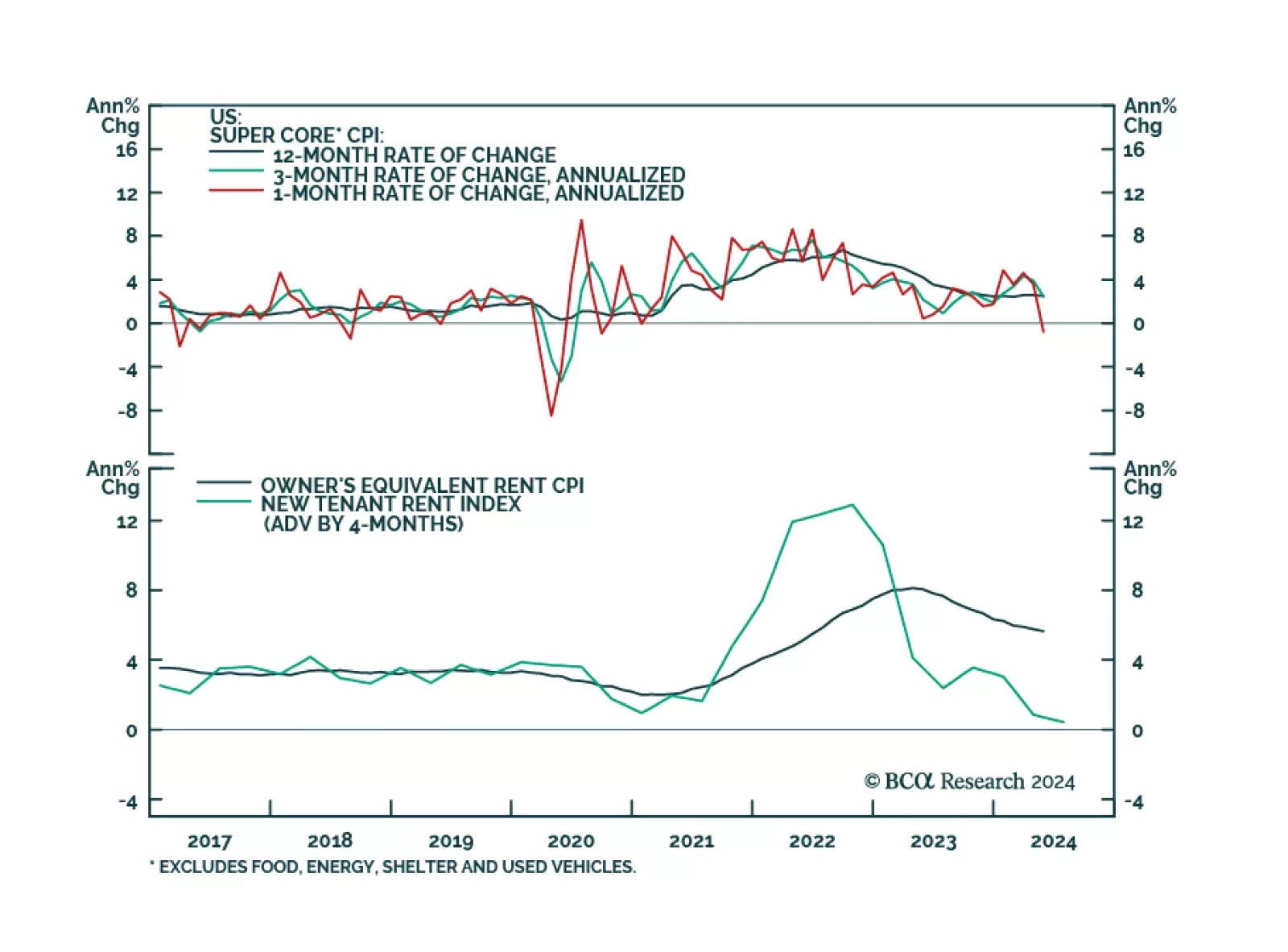

US CPI inflation continued to ease in May. Headline CPI stagnated on a month-on-month basis (3.3% y/y) in May, down from April’s 0.3% m/m (3.4% y/y), and below expectations of a more muted rate of growth. Core CPI also…

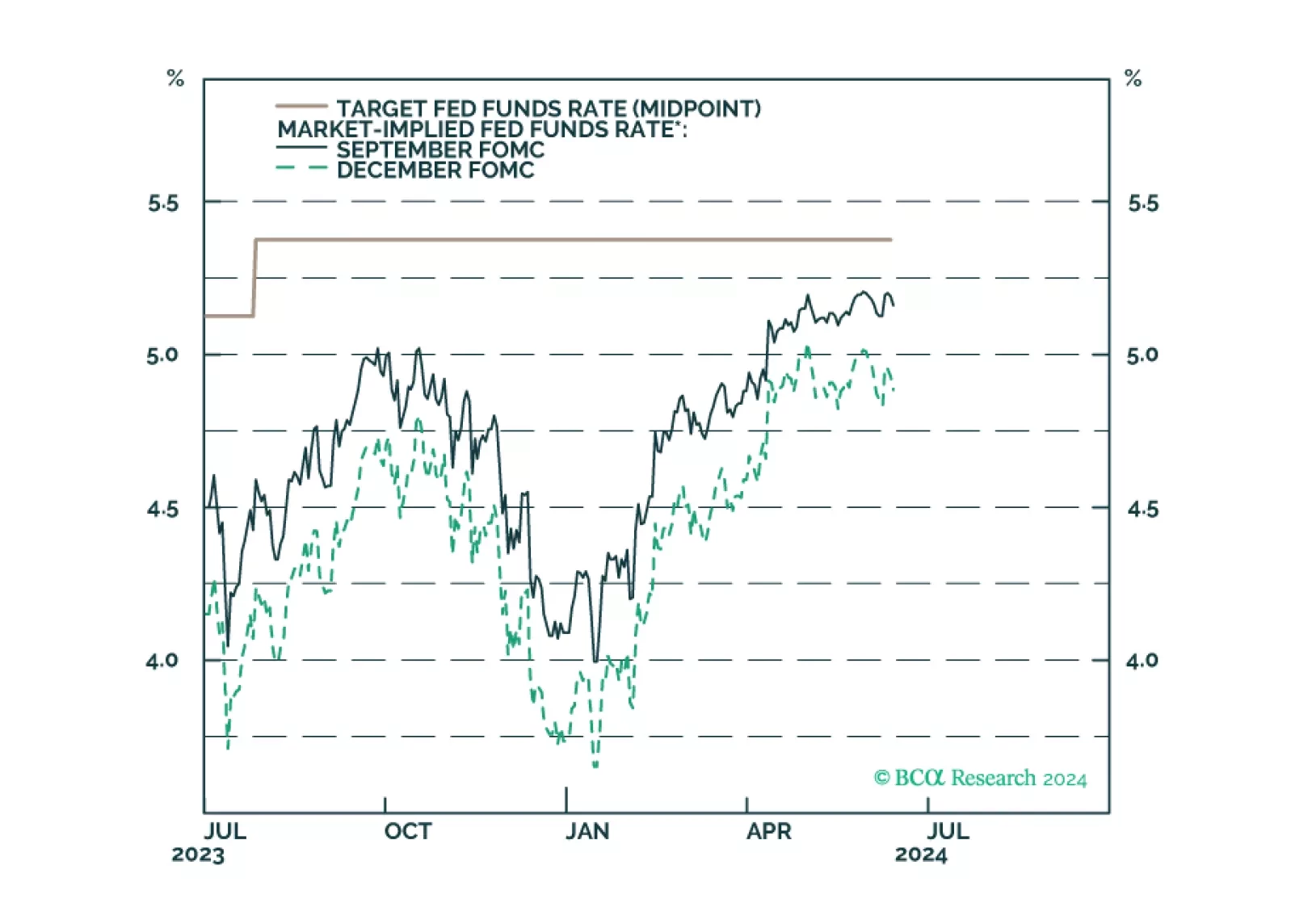

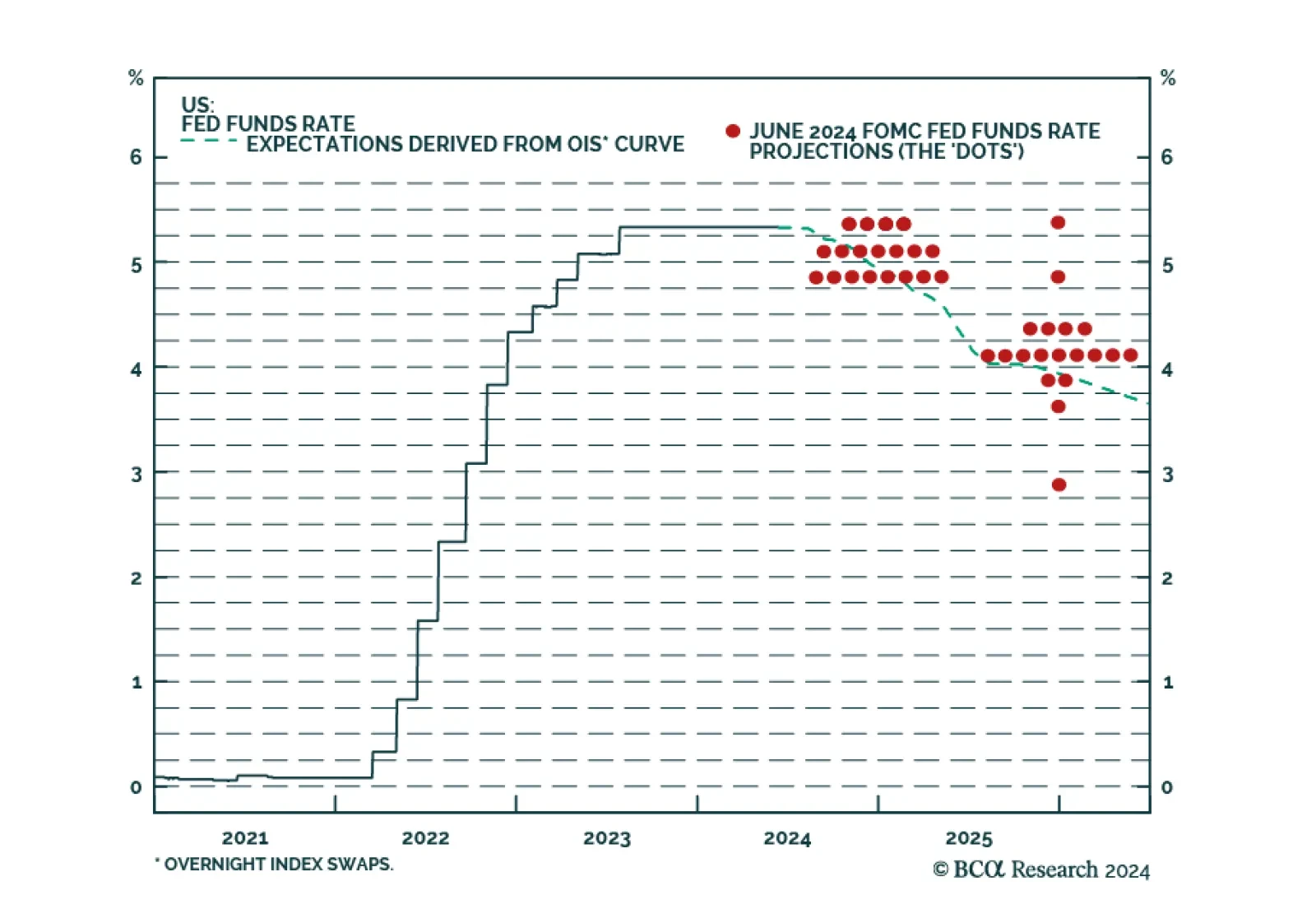

In a widely expected move, the Fed kept its policy rate unchanged within a 5.25%-5.5% range following its June 11-12 meeting. However, the median dots have moved higher for both 2024 and 2025. The median FOMC member now…

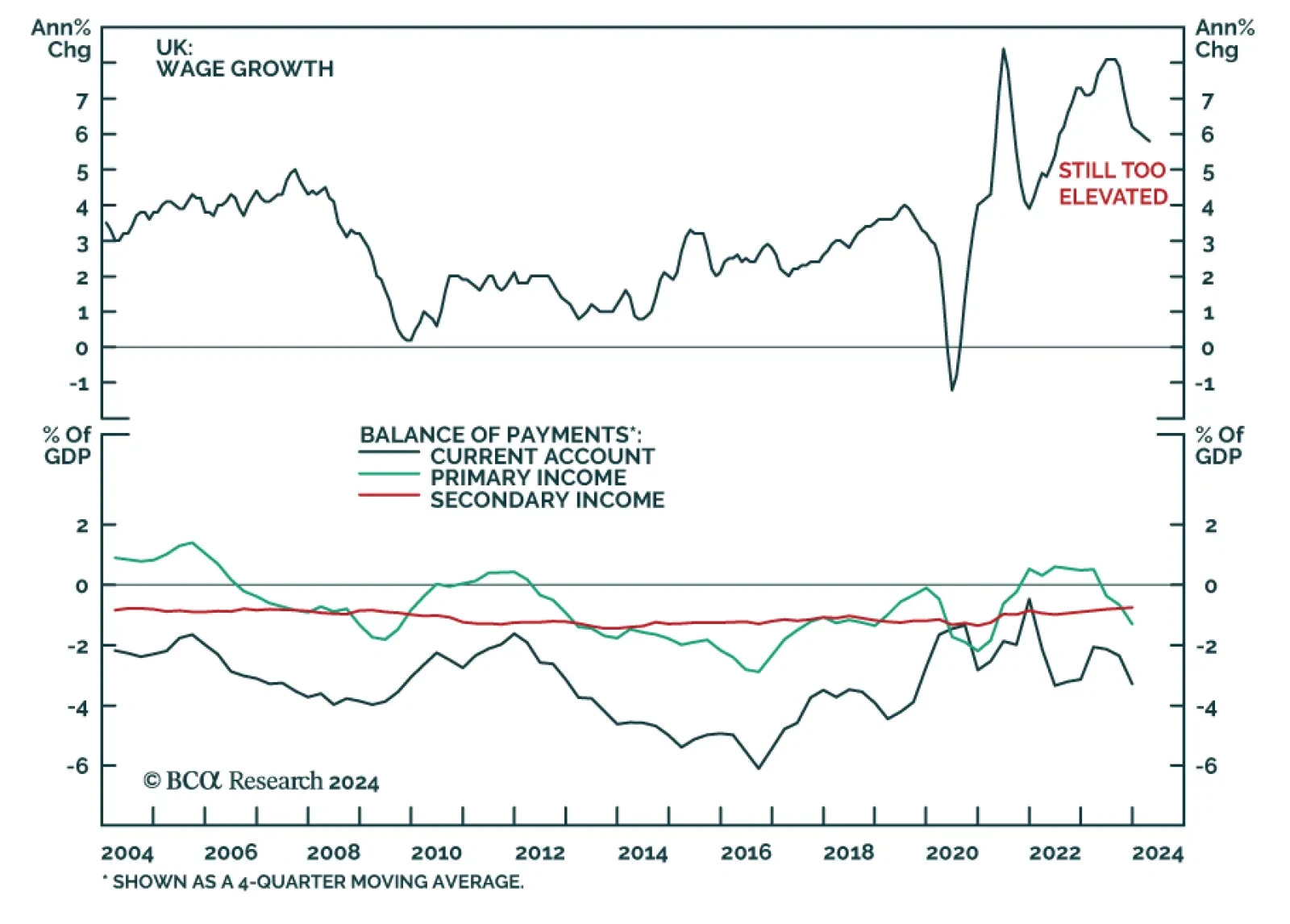

The UK unemployment rate surprised to the upside in the 3-month period ending in April, ticking up to 4.4% against expectations it would remain stable at March’s originally reported 4.3%. Concurrently, wage growth remains…

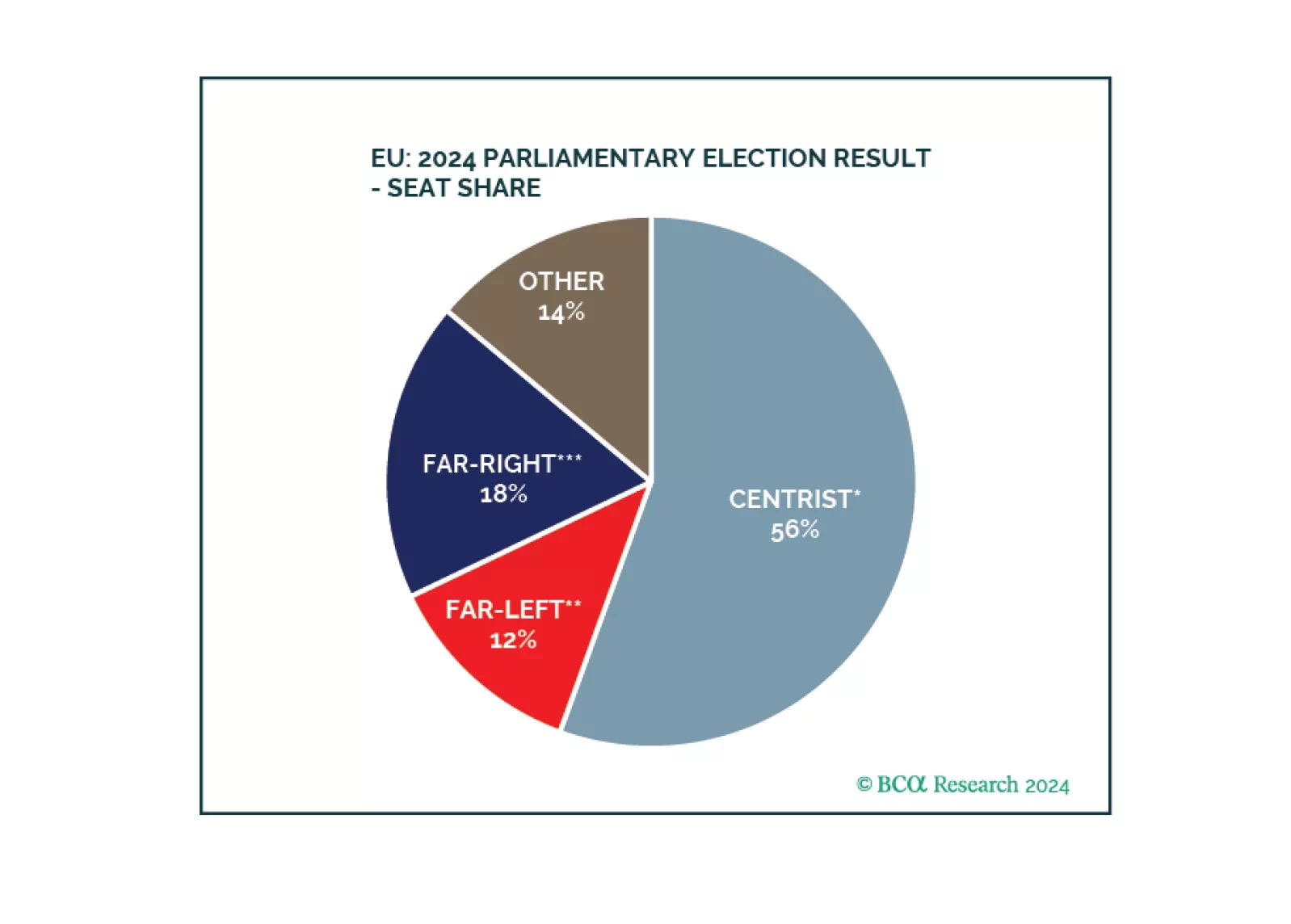

Europe did not witness a major policy reversal. Inflationary pressures are coming down, enabling the ECB to cut rates and European states to maintain soft budgets. Geopolitical challenges ensure that European parties continue to…

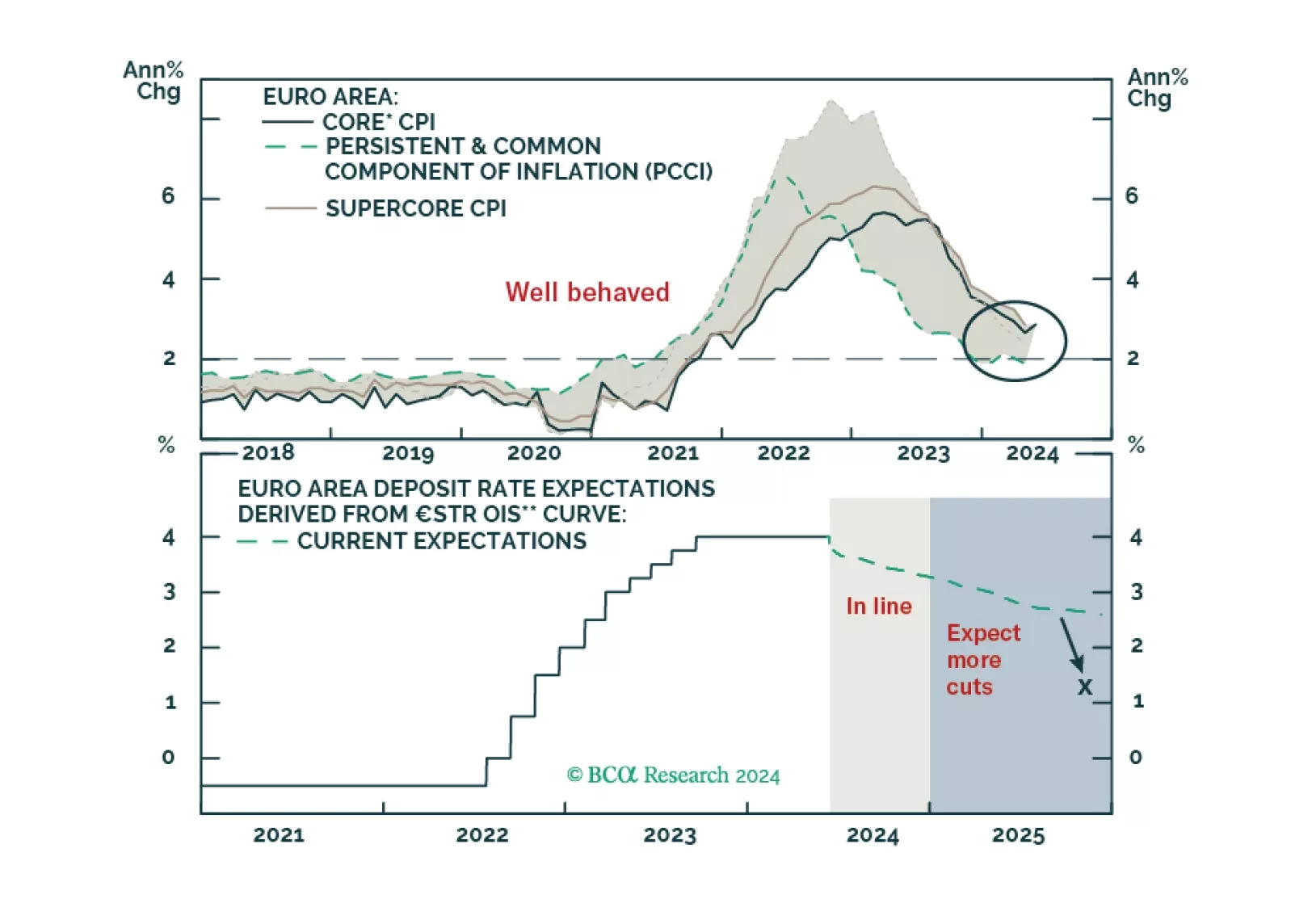

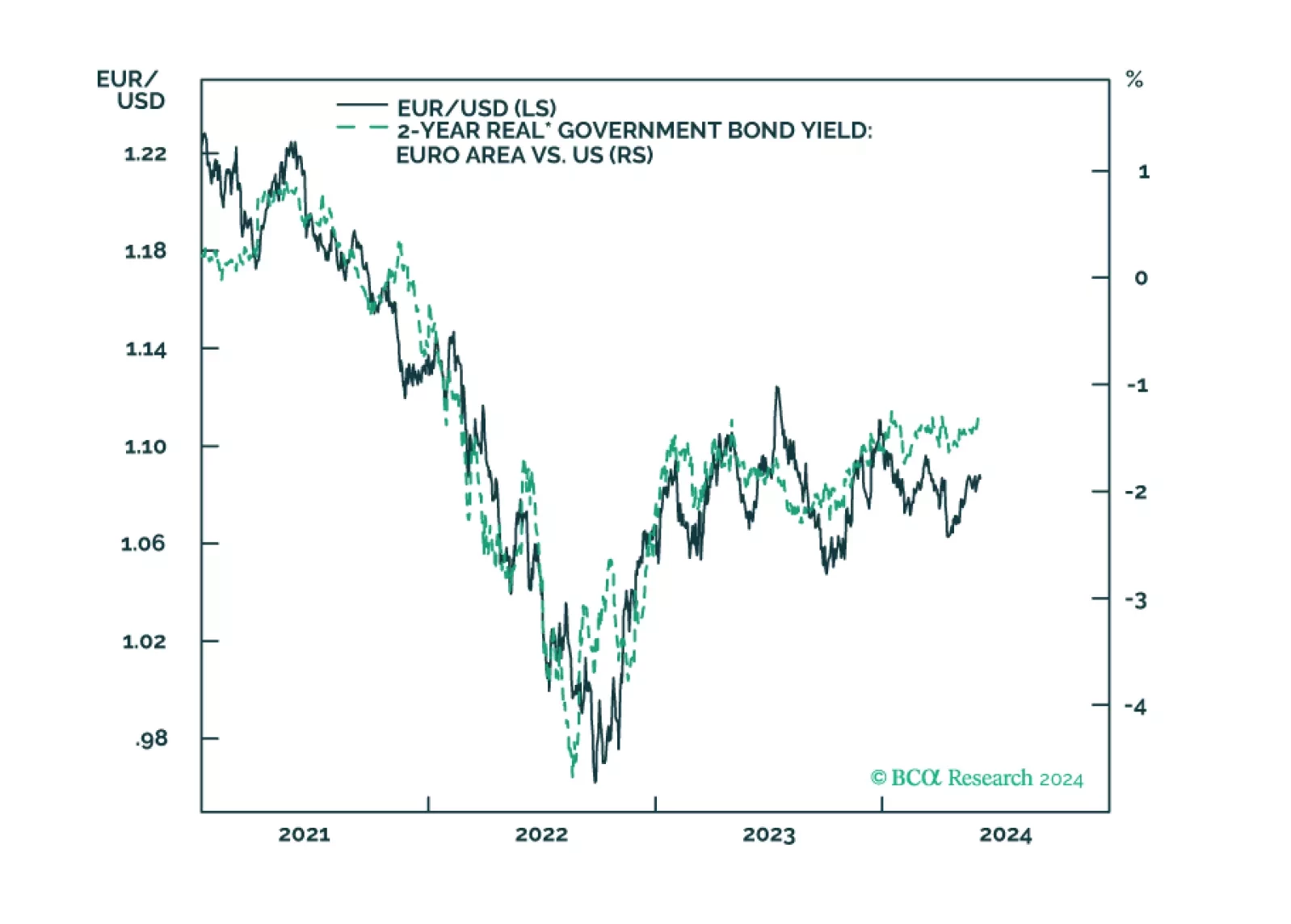

The ECB is now firmly in easing mode, even if it refuses to pre-commit to a specific rate path. What does this data dependency mean for the euro and European yields?

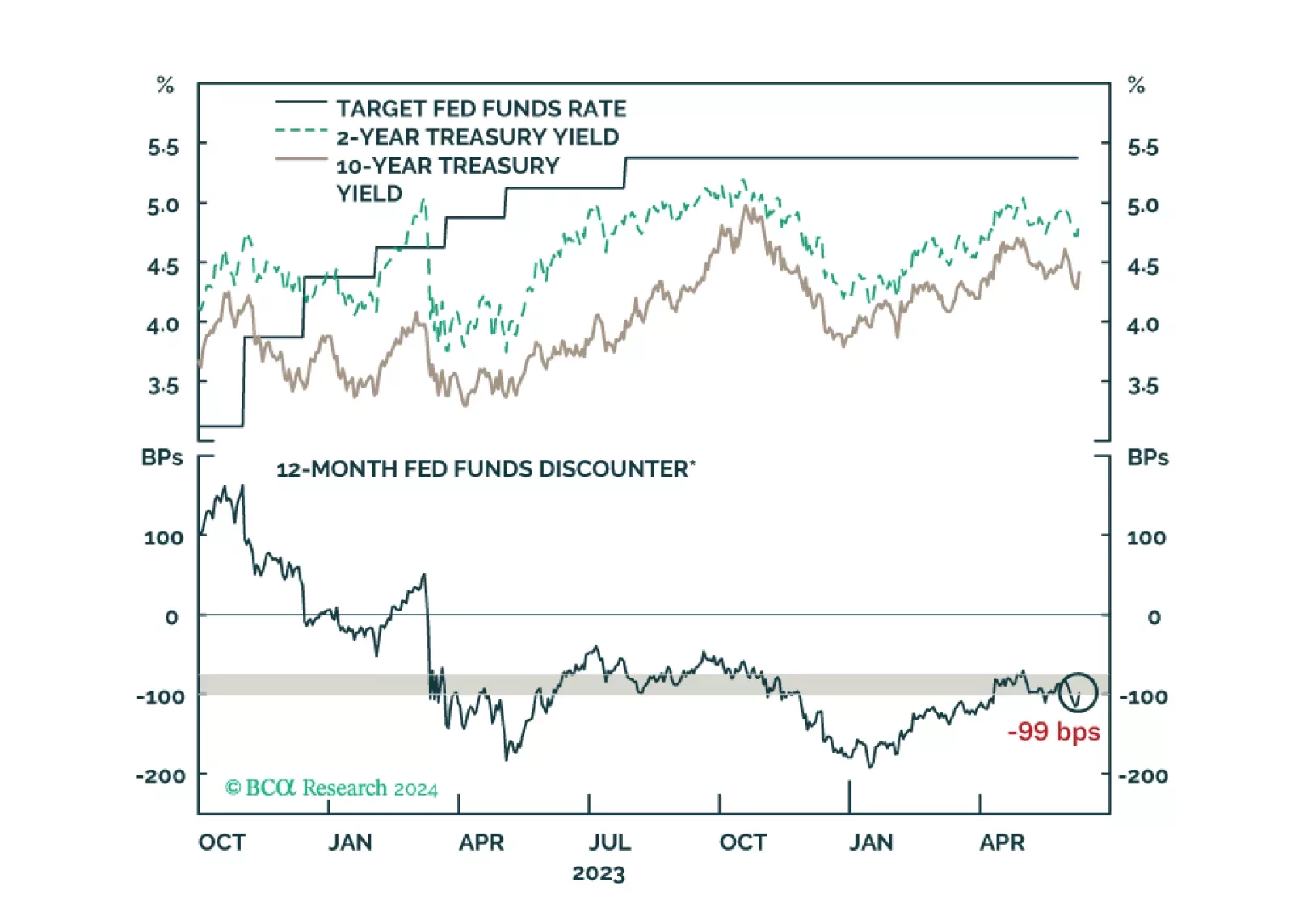

US Treasury yields bounced after this morning’s employment report. We offer our updated views about how long the recent trading range will hold.

A short insight on the ECB and near-term implications for European asset markets.