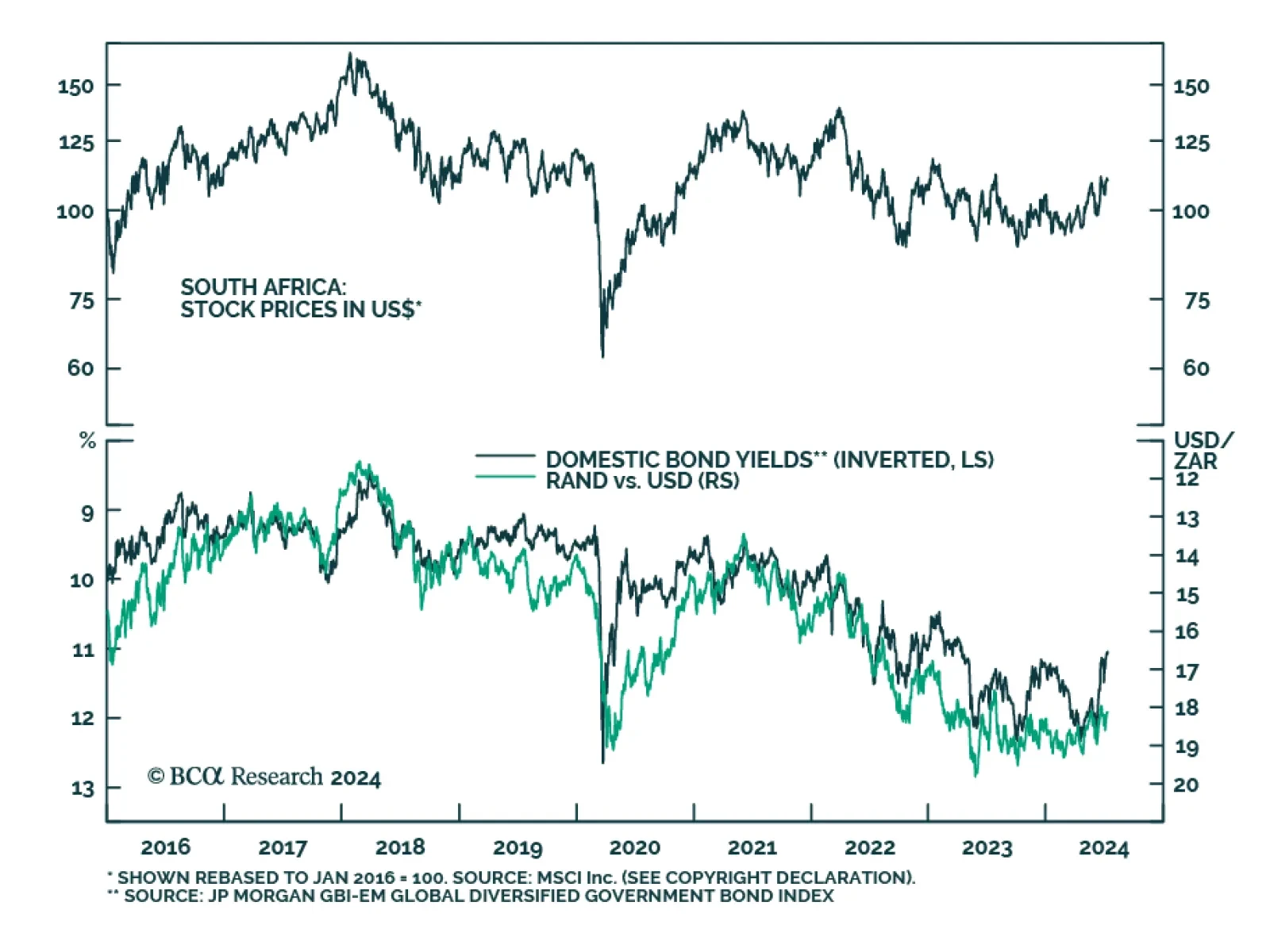

South African stocks, domestic bonds, and currency have all rallied since BCA’s Emerging Markets Strategy team upgraded South African assets last month following the formation of the new national unity government. The rally…

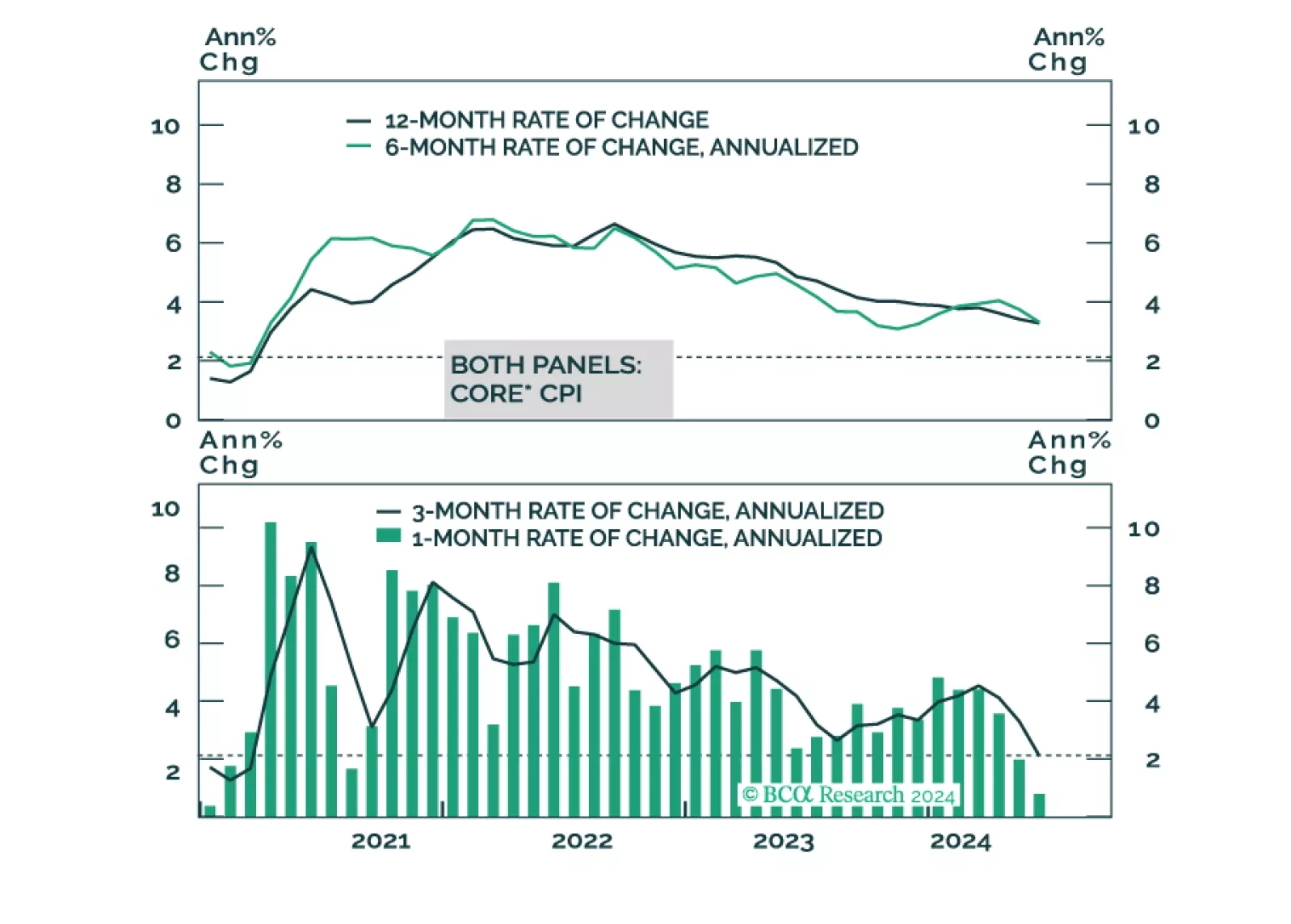

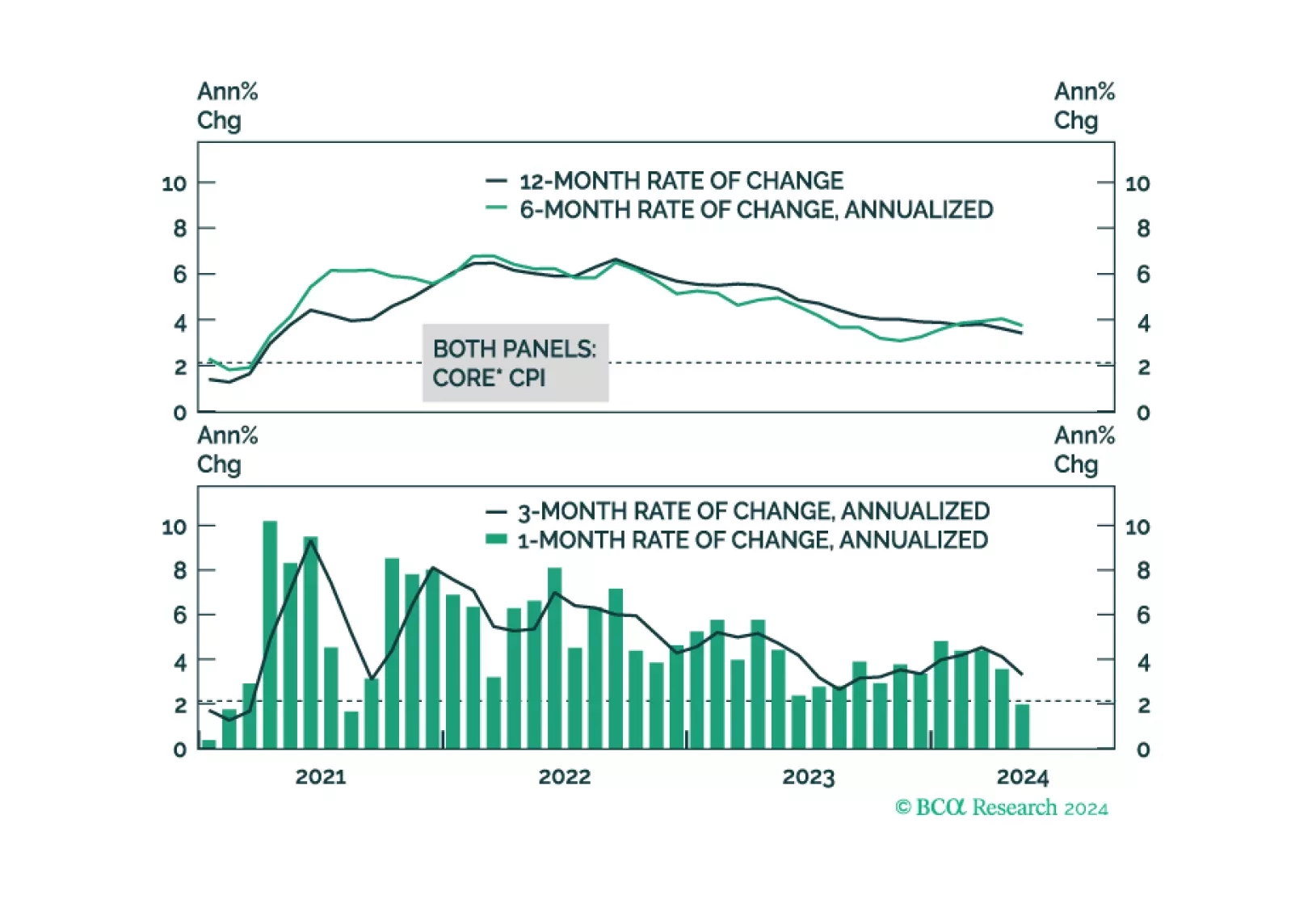

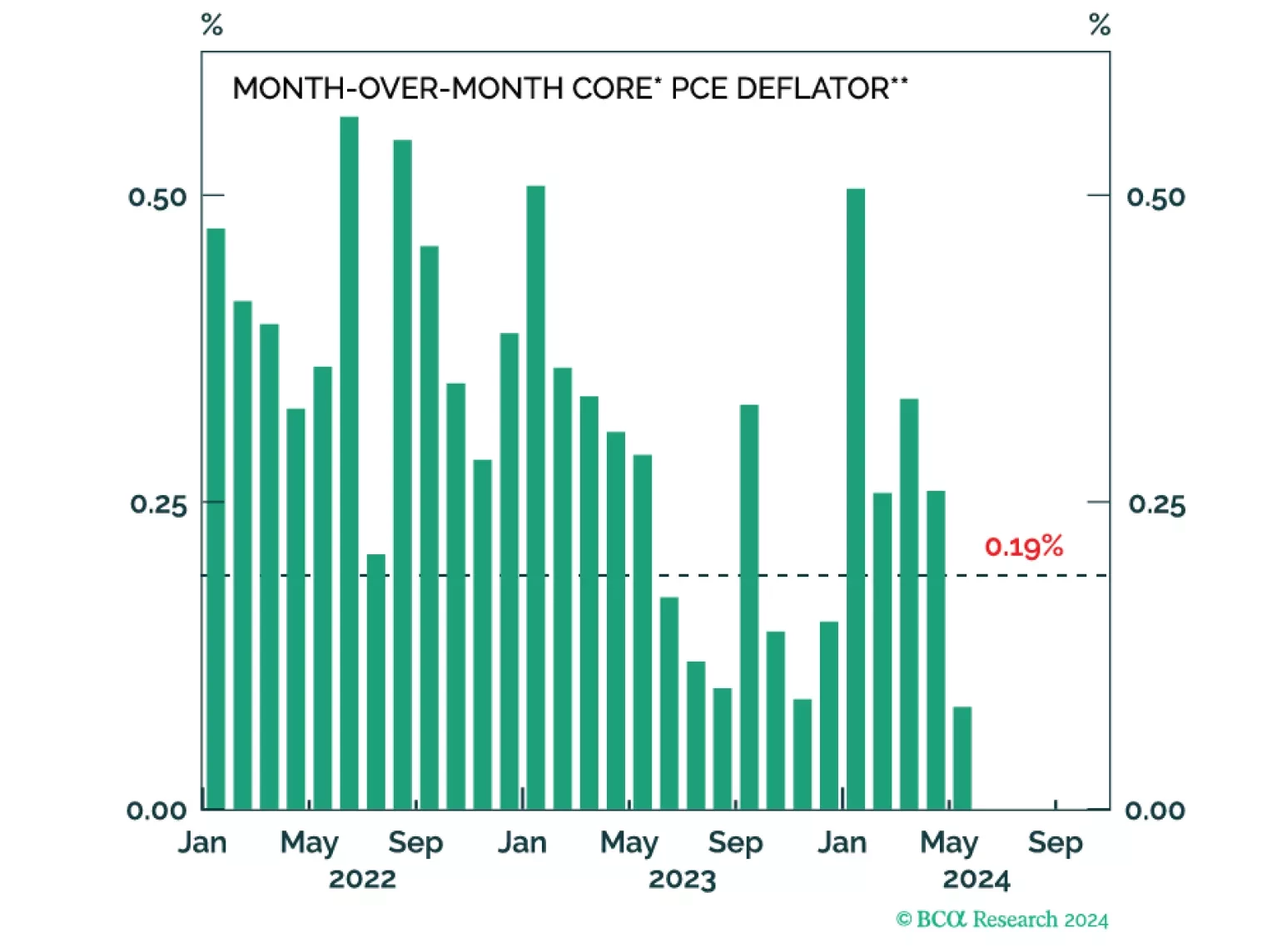

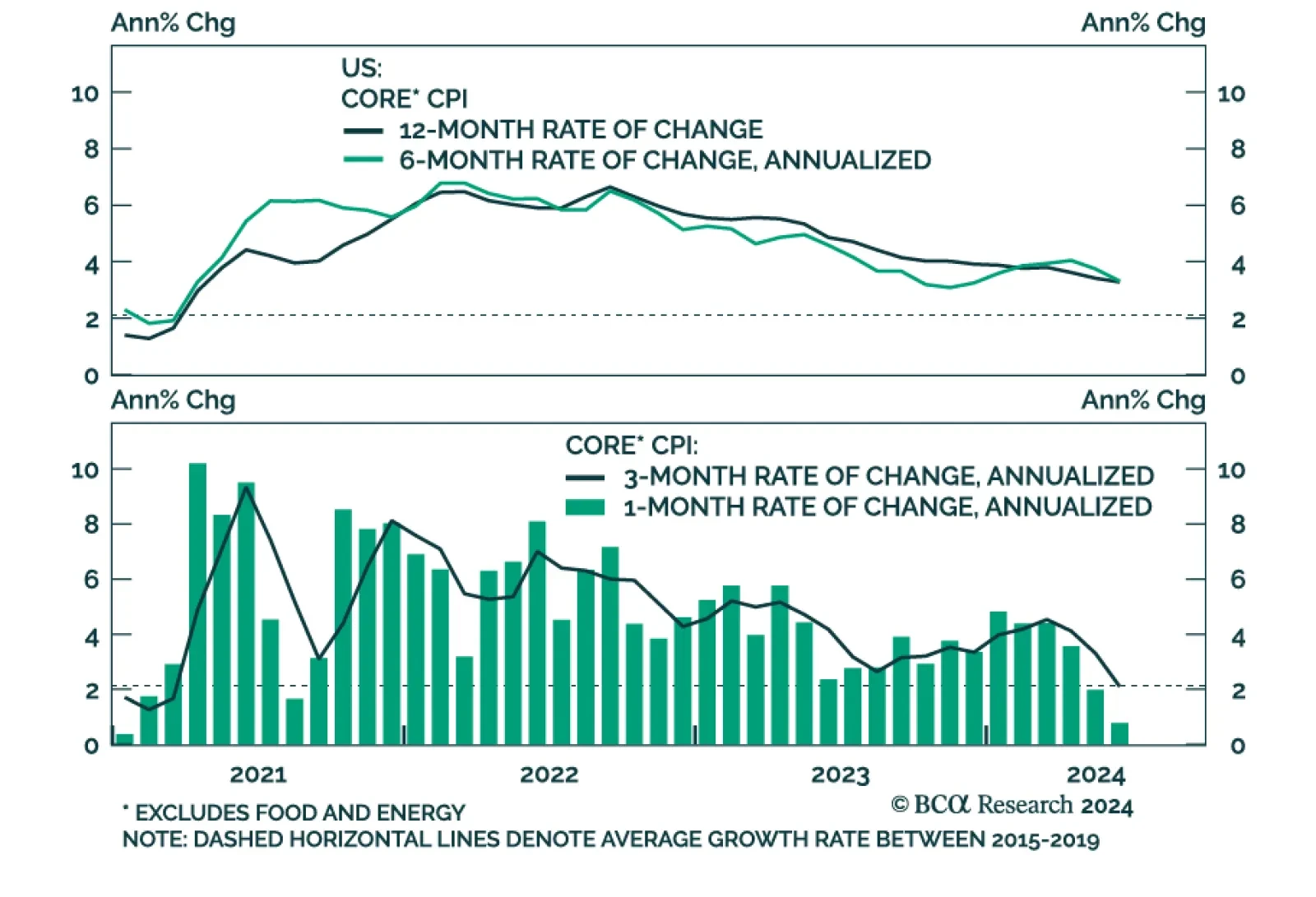

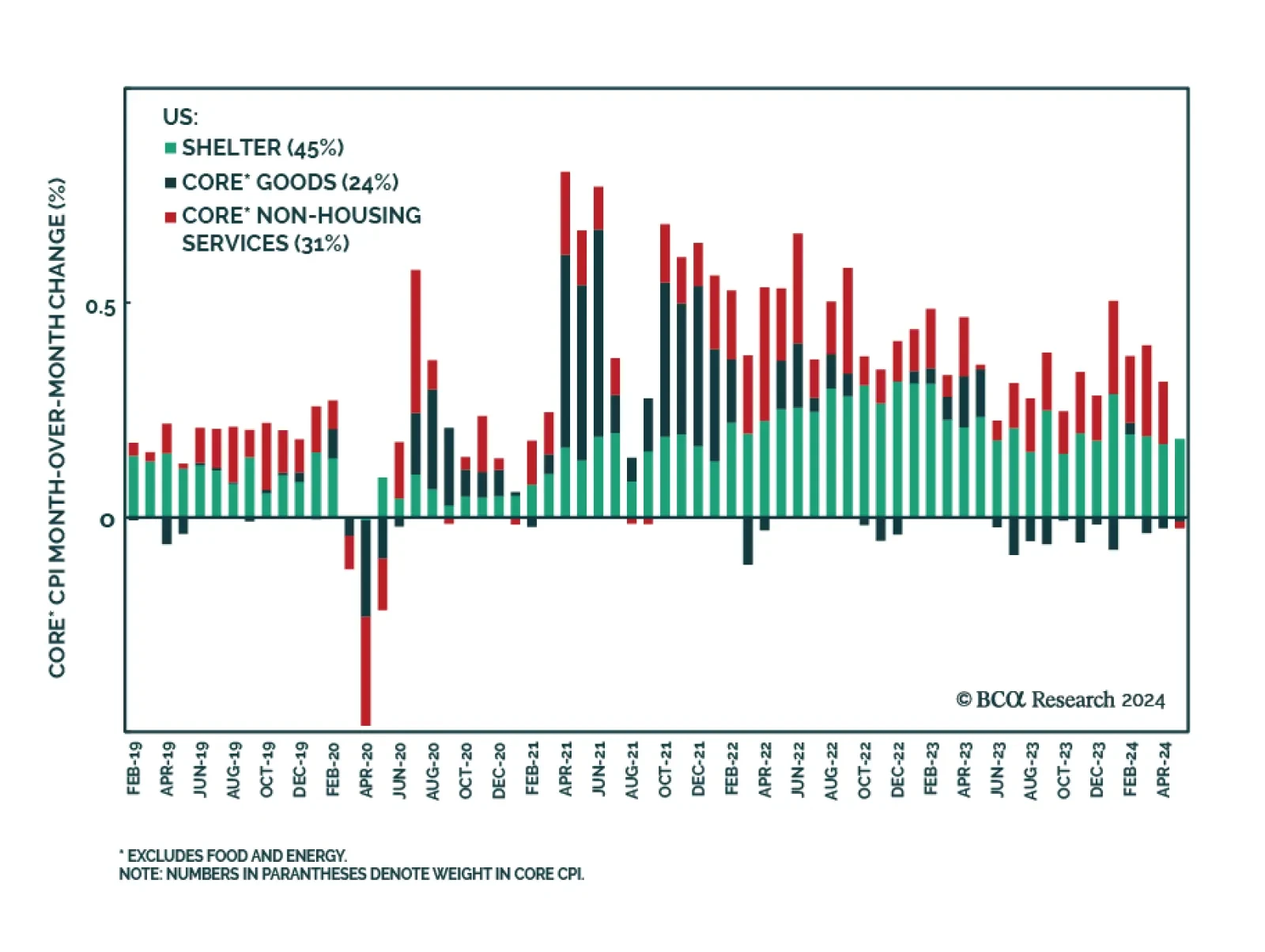

The disinflationary trend in US CPI continued in June as headline CPI dipped to 3% year-over-year, down from 3.3% in May, and core CPI declined by a tick to 3.3%. On a month-over-month basis, headline prices fell by 0.1% and core…

In light of last week’s employment report and this morning’s CPI, it’s time for the Federal Reserve to cut rates.

US Core CPI inflation has decelerated considerably from its year-over-year peak of 6.6% in September 2022 to 3.4% in May and the consensus expects it remained at 3.4% in June. The year-over-year number has come down continuously…

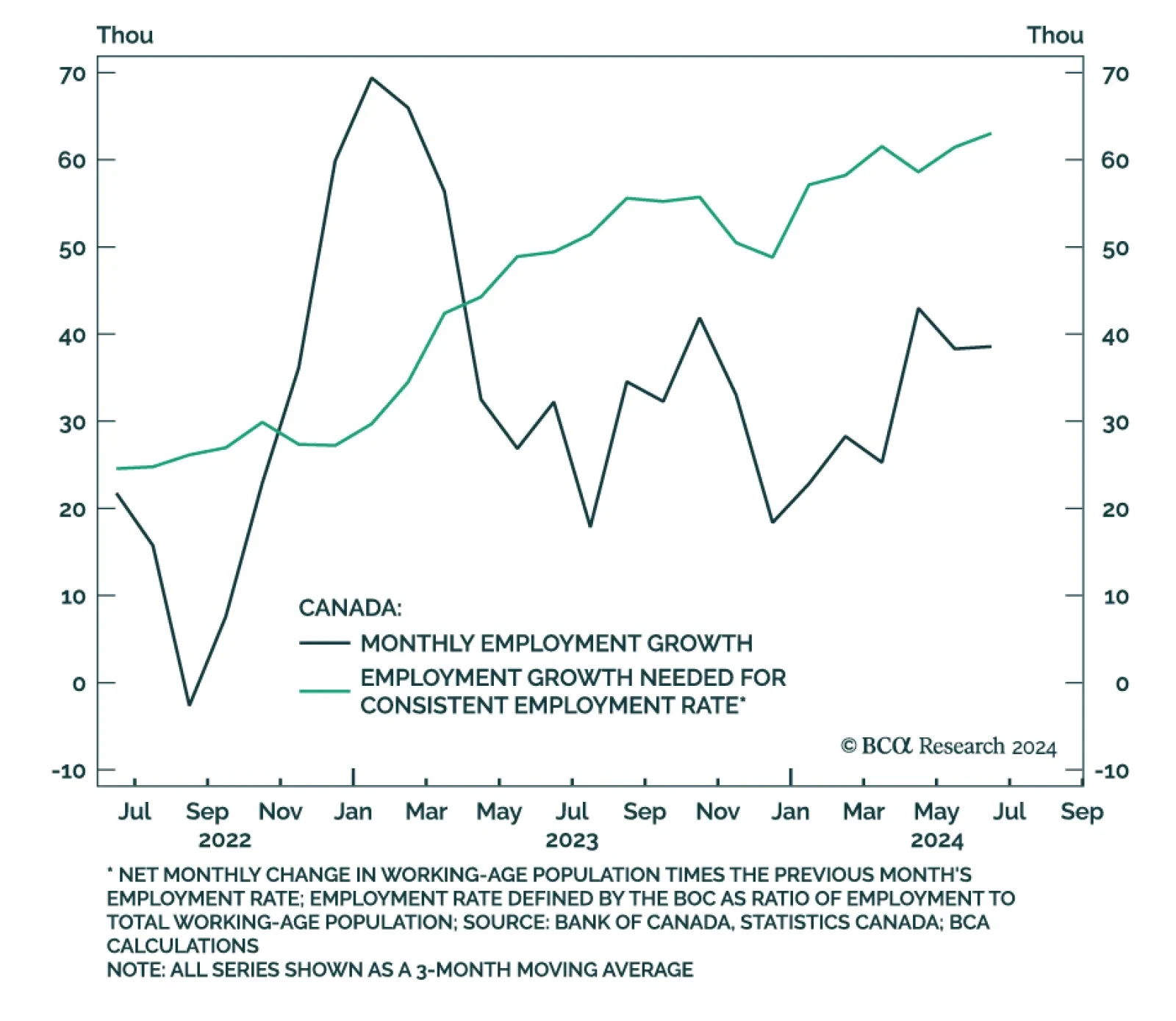

The latest release of the Canadian Labour Force Survey indicated further softening of the labor market in the Great White North. The economy experienced a net loss in total employment, shedding 1,400 jobs compared to market…

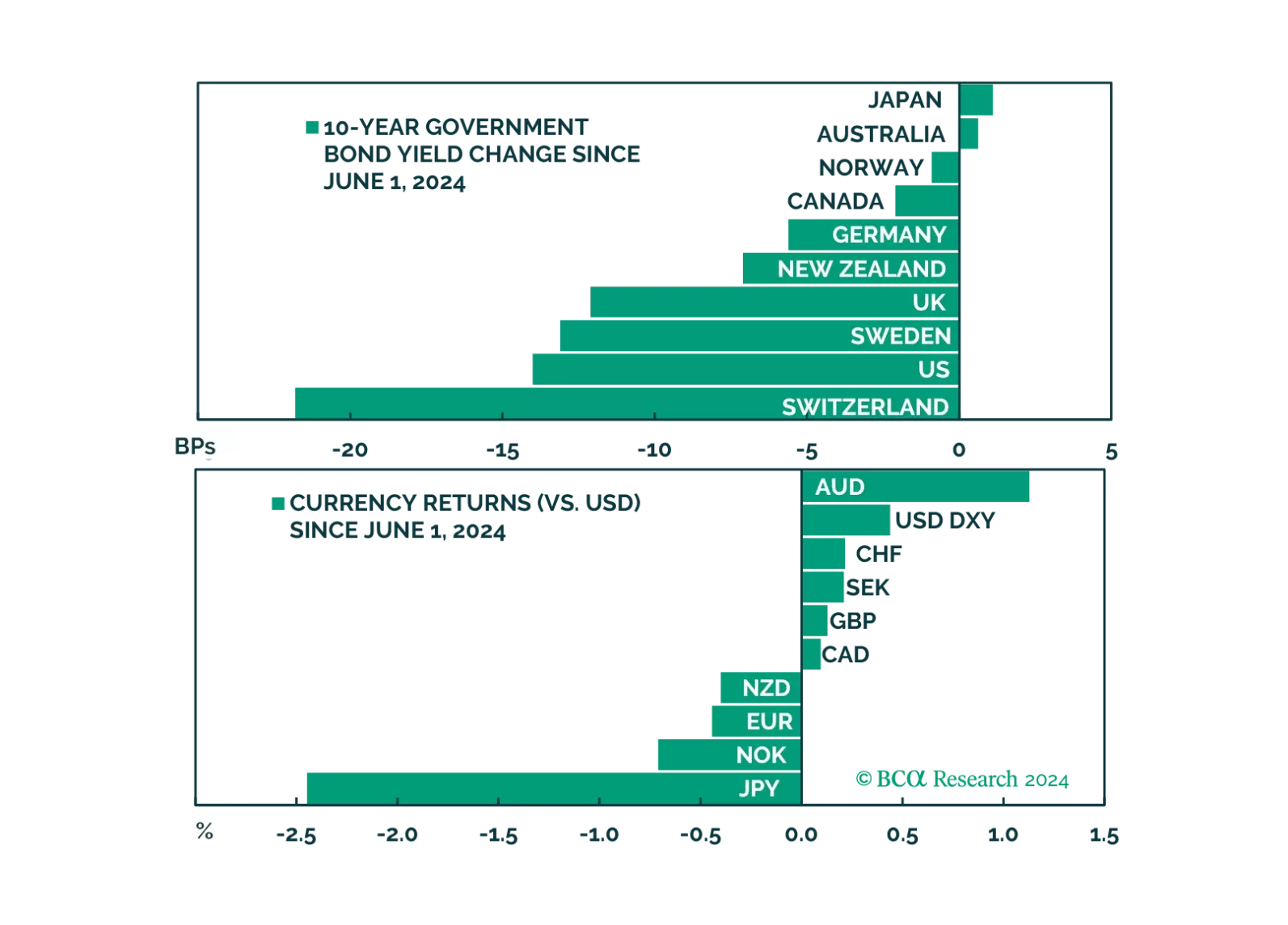

In this week's report, we review the impact of political developments, as well as incoming fundamental data, on our positioning.

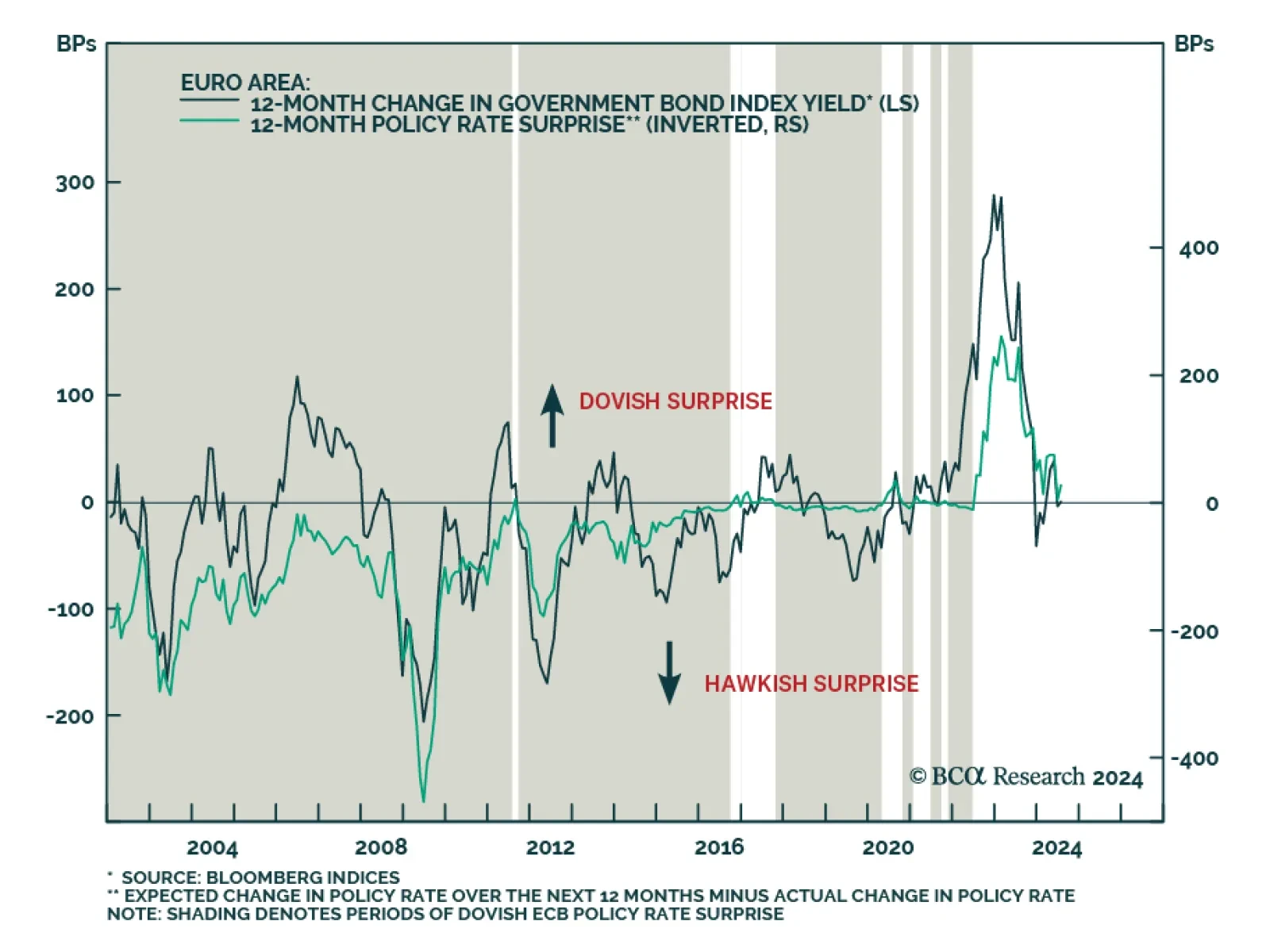

Eurozone headline inflation slowed from 2.6% y/y to 2.5% in June. Germany, its largest economy, saw price pressures ease from 2.4% to 2.2%, below expectations of 2.3% (or from 2.8% to 2.5% on an EU-Harmonized basis). However,…

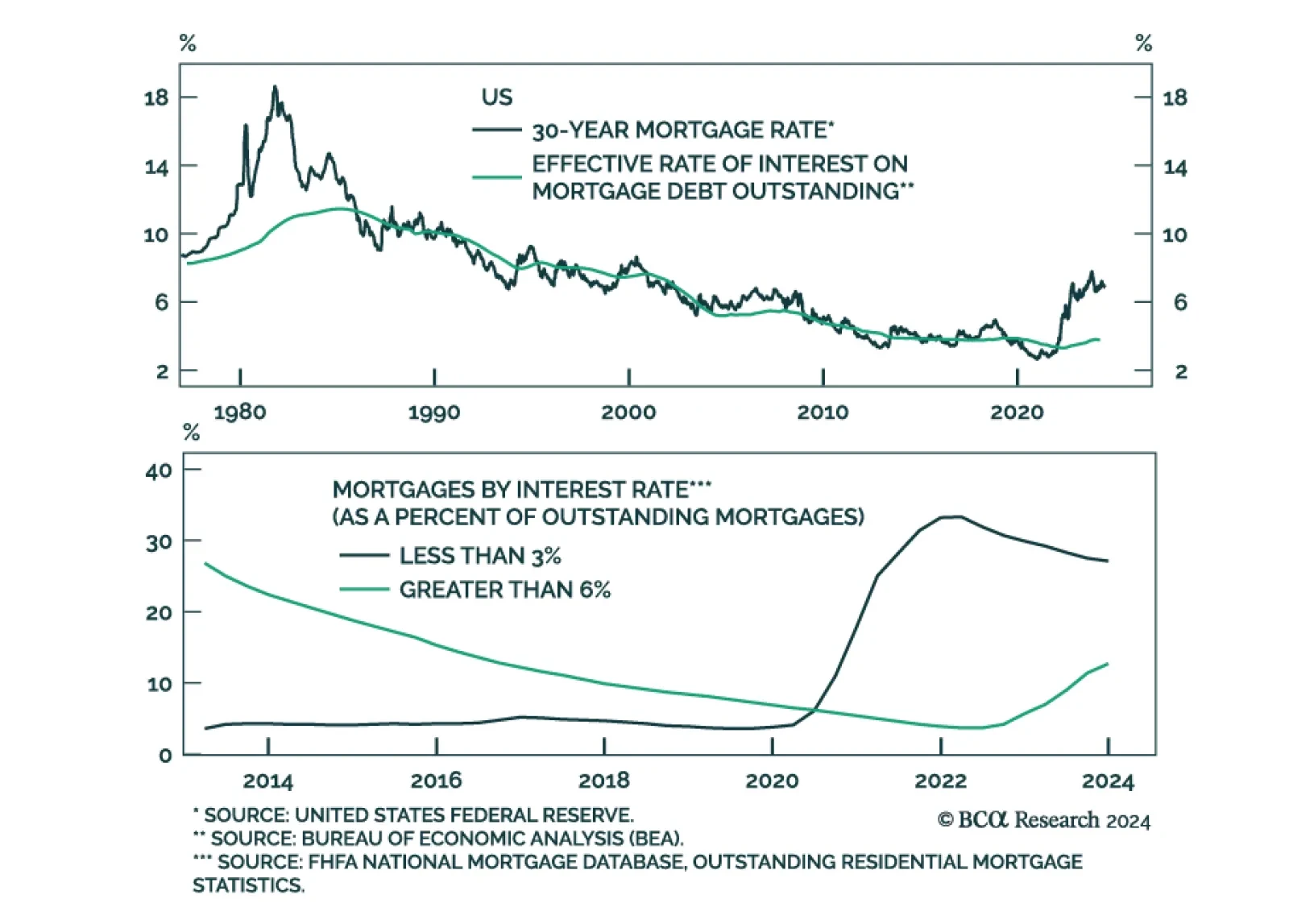

The US conventional 30-year mortgage rate climbed back above 7% in late June and drove a 2.6% weekly contraction in mortgage applications. The fixed-rate home affordability index sank to a nearly four-decade low. Housing is…

Our Portfolio Allocation Summary for July 2024.