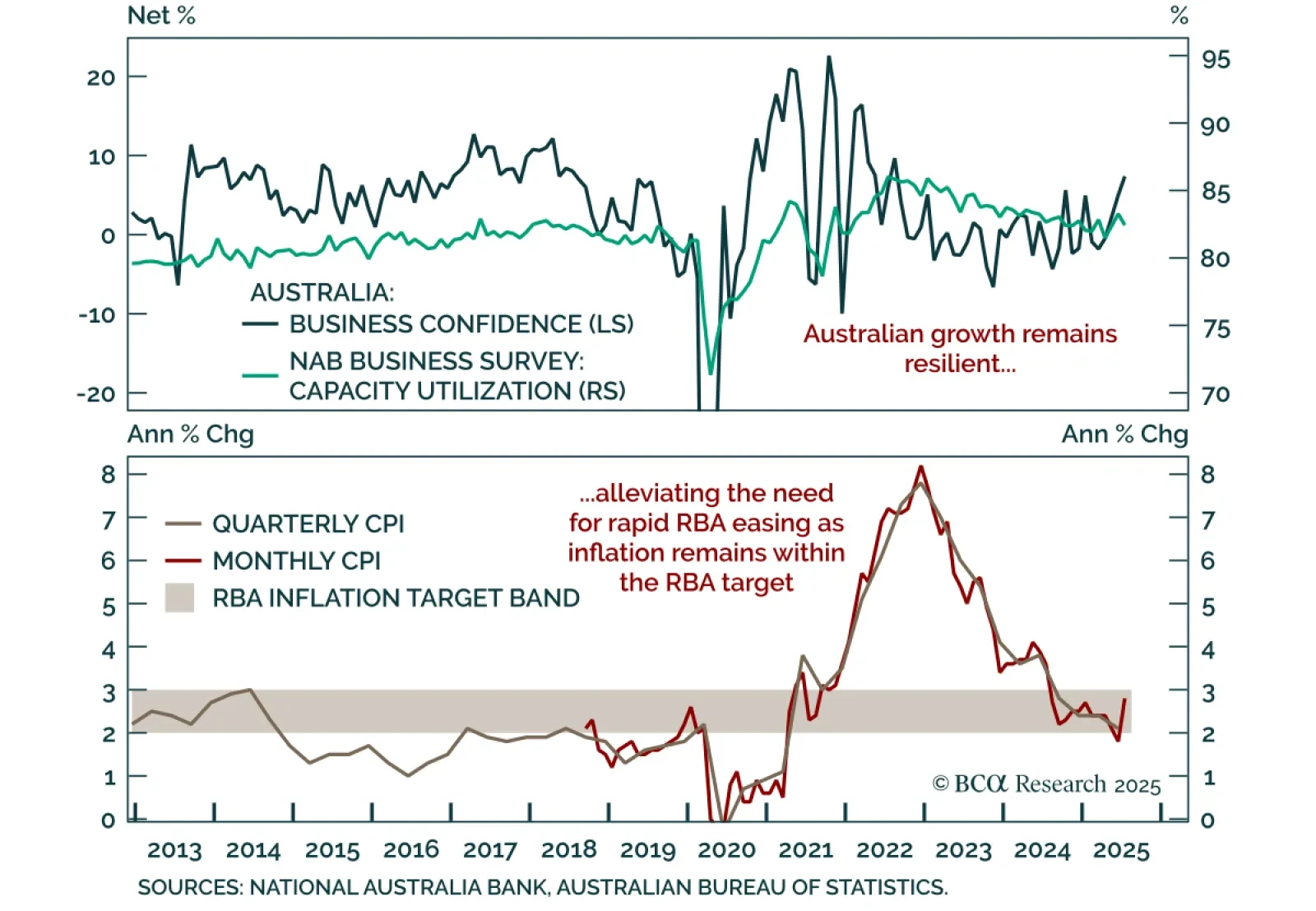

Australia’s July CPI surprise does not justify the aggressive easing priced, keeping us underweight ACGBs. Headline inflation accelerated to 2.8% y/y from 1.9% in June, with trimmed mean rising to 2.7% from 2.1%. Despite the…

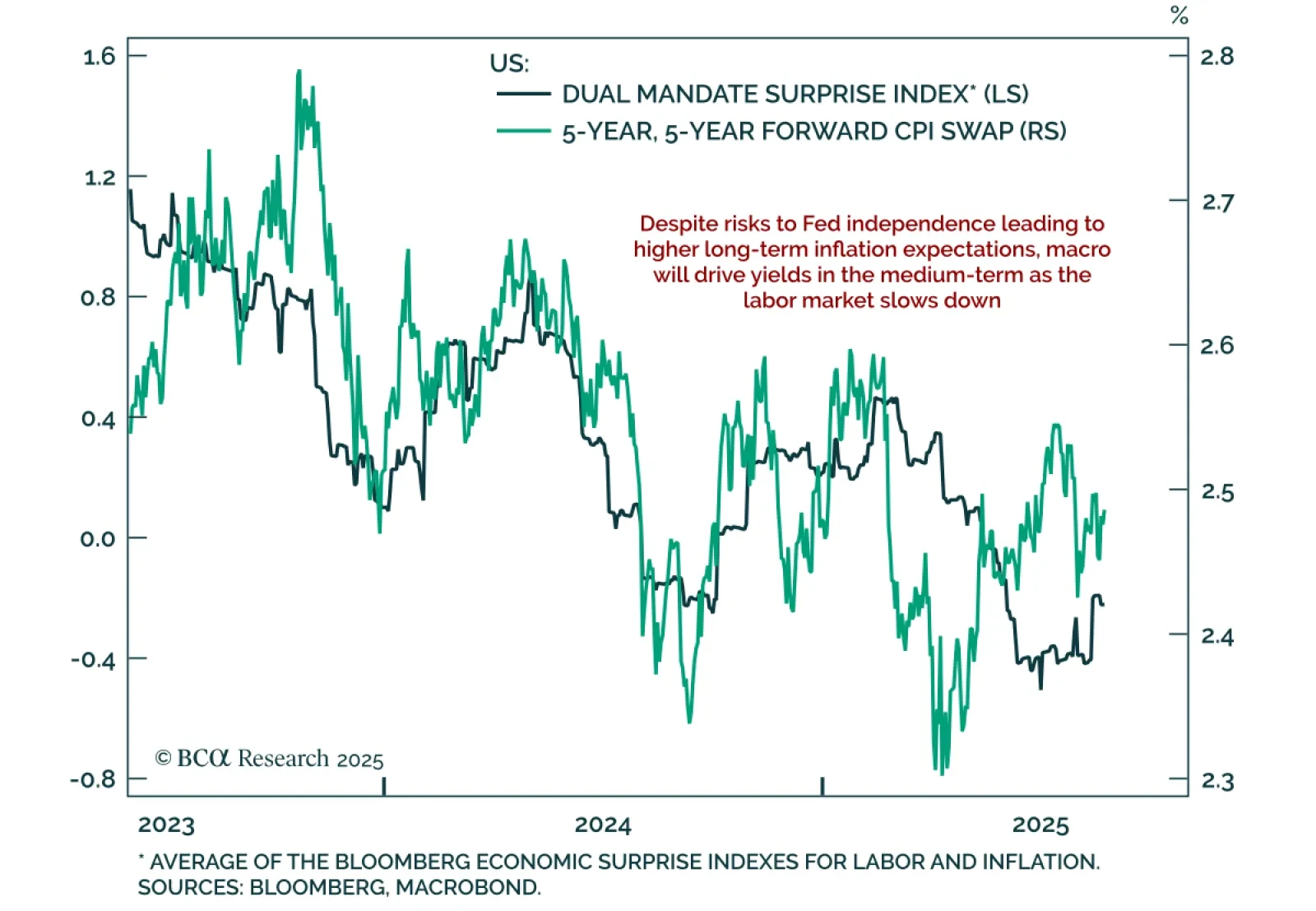

Trump’s firing of Fed Governor Cook raises Fed-independence risks, reinforcing steepener trades. The announcement, aimed at expanding presidential control over the central bank, saw equities fall and bonds initially rally on the…

Powell’s Jackson Hole speech was misread, and points to cautious dovishness. Some commentators called it hawkish, others suggested the Fed abandoned its 2% target. Neither is accurate. Central bank communication is rarely…

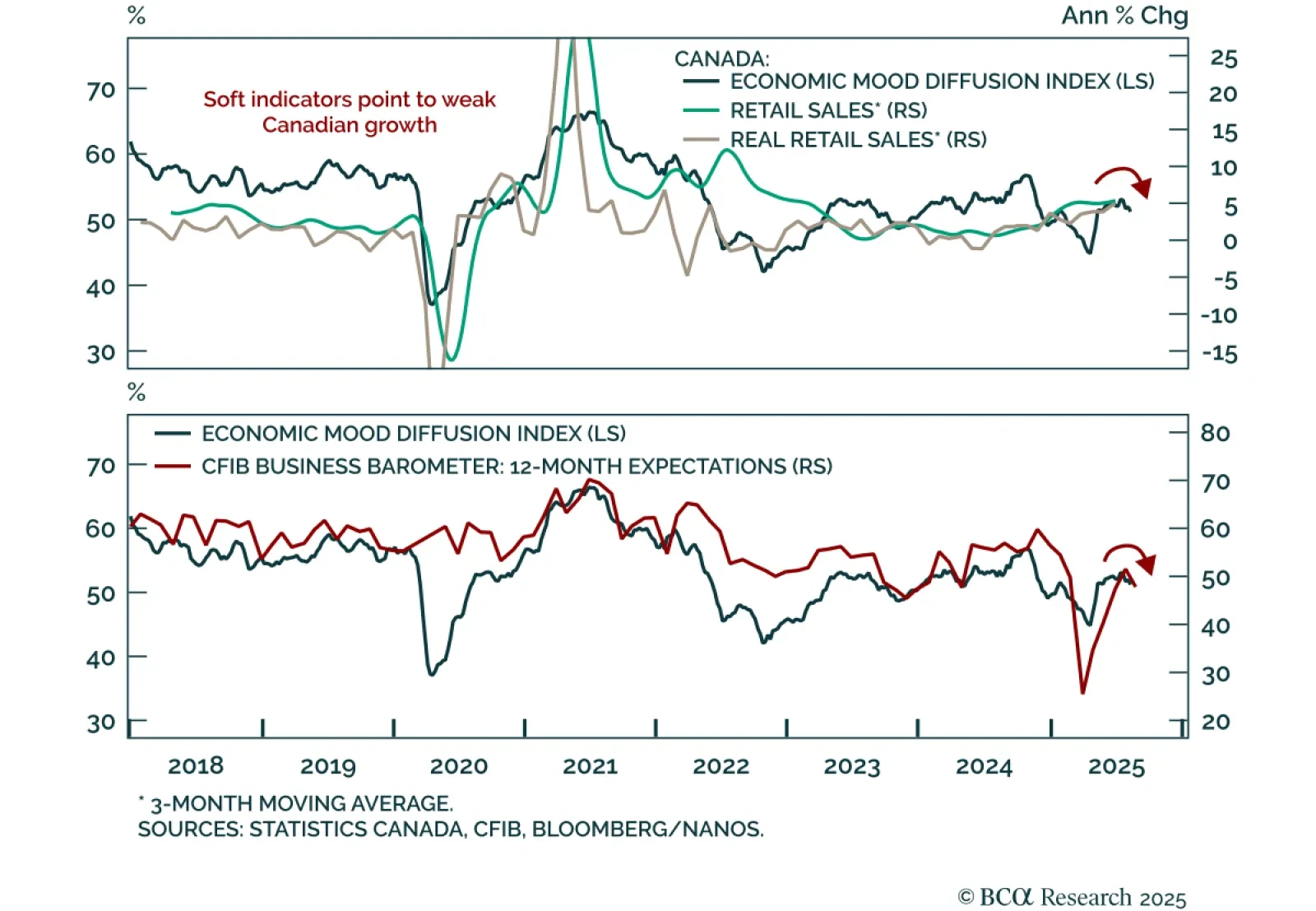

Canada’s fragile growth backdrop reinforces the case for more BoC easing than markets price. June retail sales rose 1.5% m/m, in line with expectations. Excluding autos, sales were stronger at 1.9%. However, the advance estimate…

The post-Liberation Day rally has broadened, reducing skepticism and strengthening the case for US outperformance versus Europe. The S&P 500’s climb to all-time highs has been unusually smooth, compressing realized…

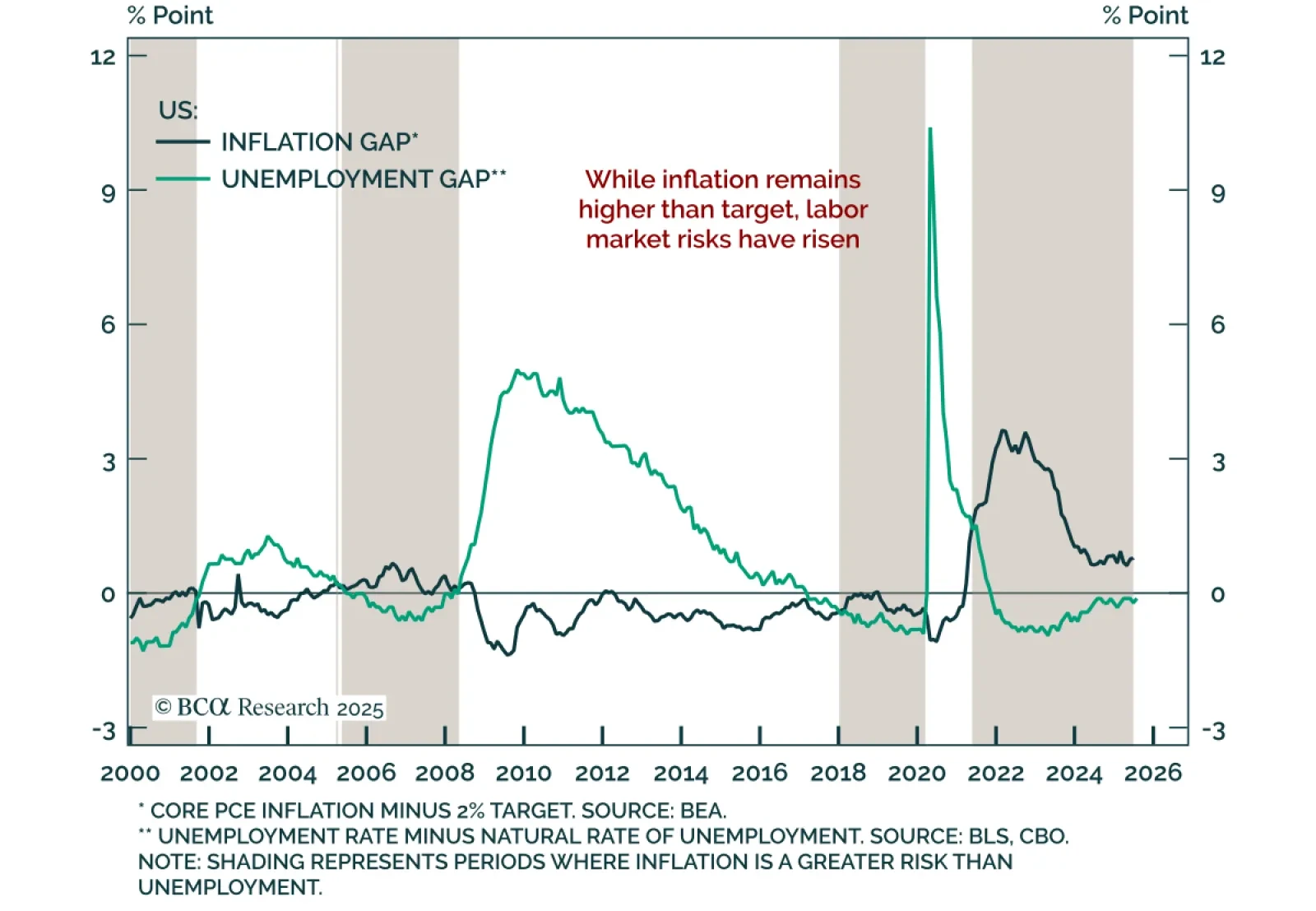

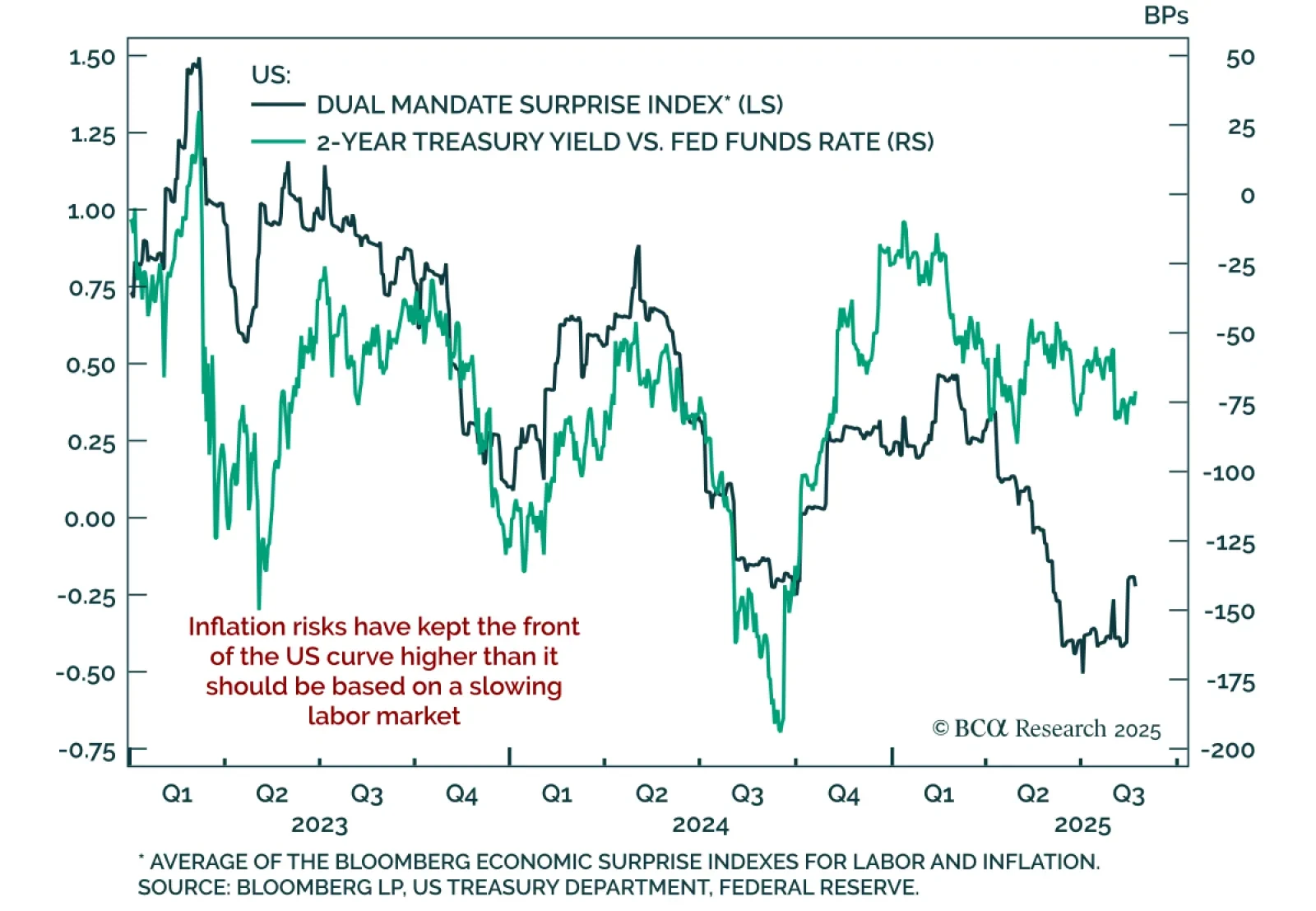

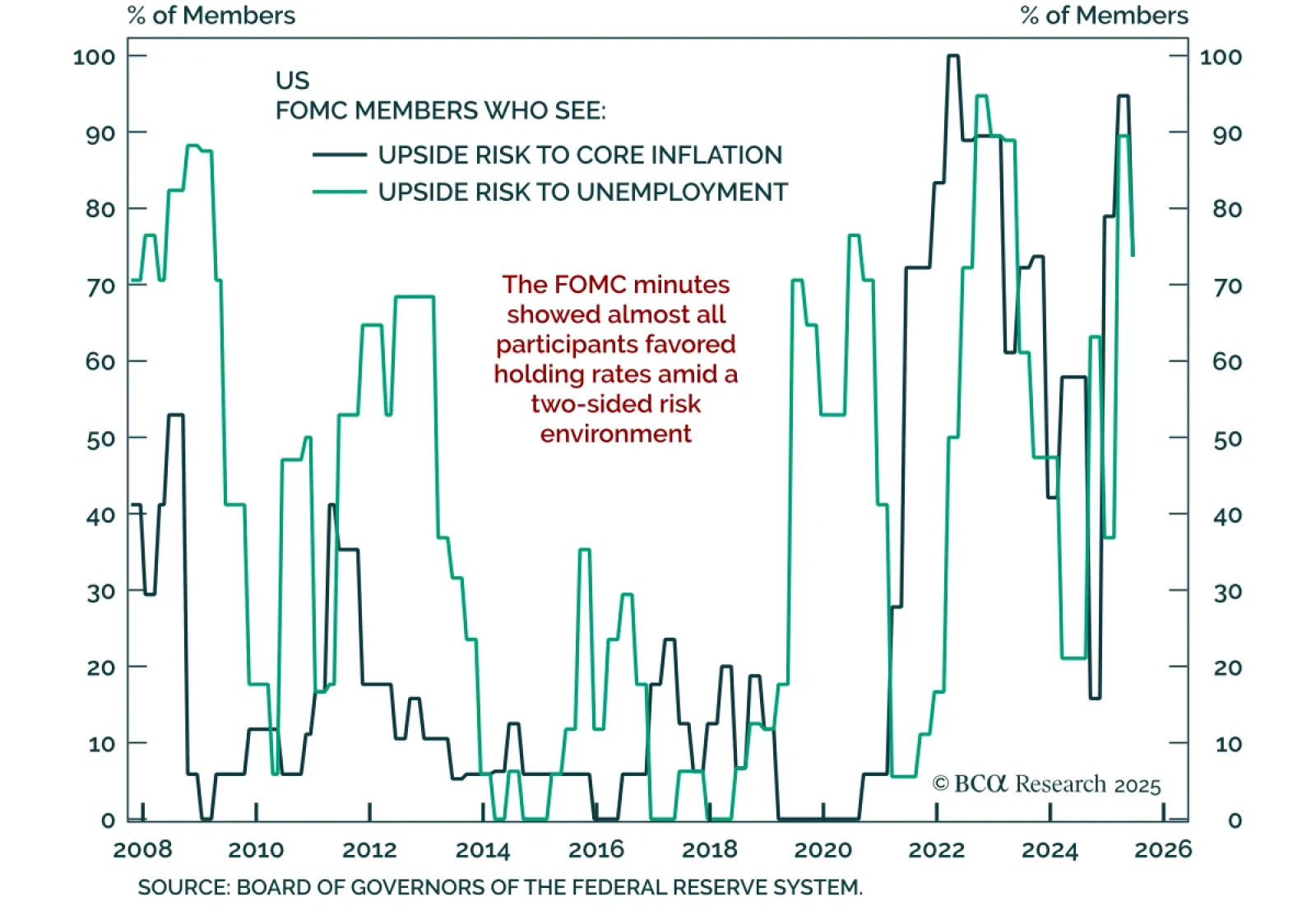

Powell’s final Jackson Hole speech signaled a dovish tilt, opening the door to a September cut. The Fed is under pressure to balance unemployment and inflation risks, with the FOMC split between “proactive” doves and “reactive” hawks…

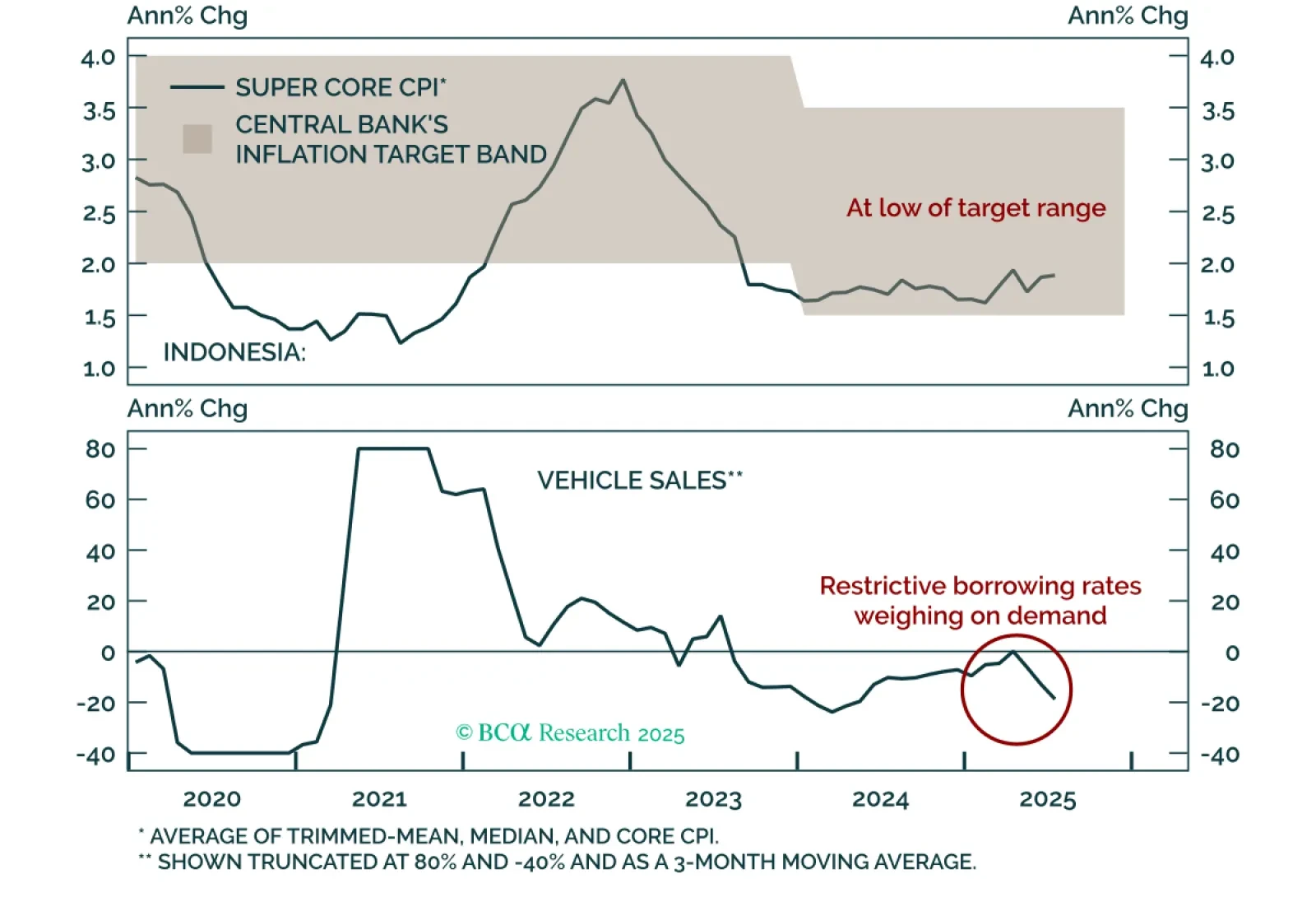

Indonesia’s surprise rate cut signals a dovish turn that will weigh on the rupiah. Bank Indonesia cut its policy rate by 25 bps to 5%, with low inflation and weak activity pointing to more easing ahead. Our Emerging Markets team…

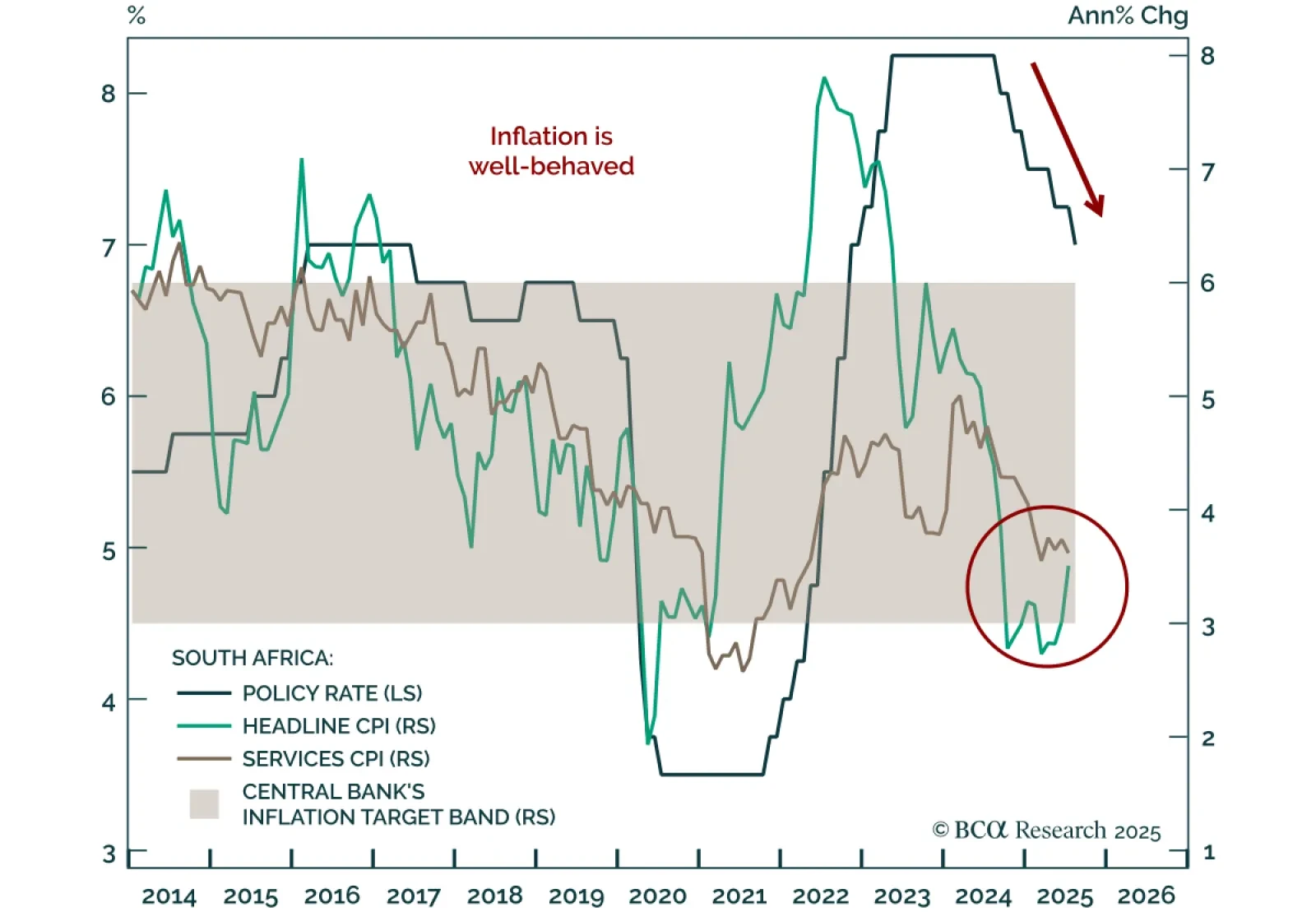

South African inflation will remain at the bottom of the SARB target range, allowing further easing. July CPI came in line with expectations at 3.5% y/y, with core at 3.0%. Our Emerging Markets strategists expect the…

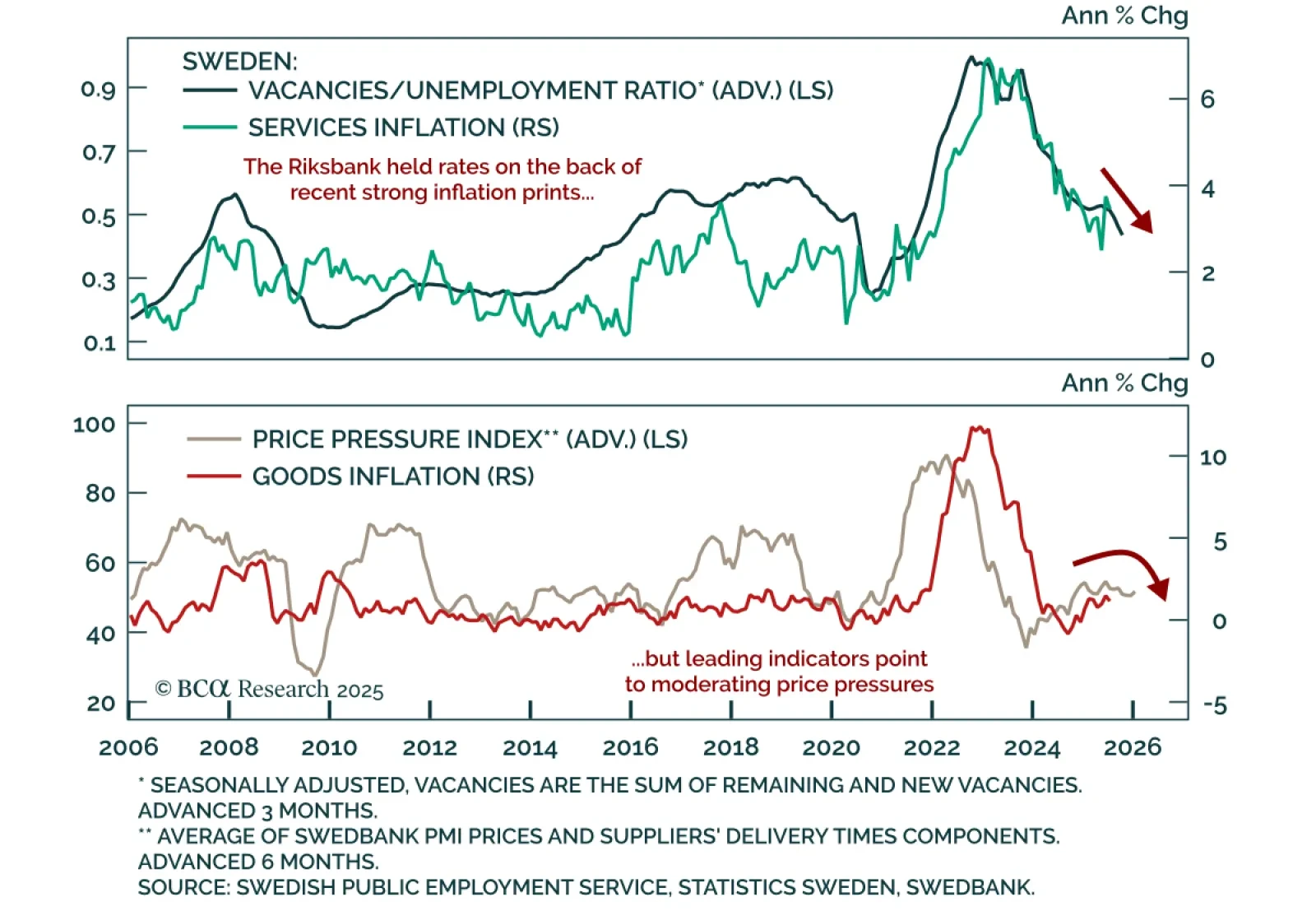

The Riksbank held at 2.0% as core inflation remains above target, though easing pressures are building. July headline inflation had slightly cooled, but core remains above both the bank’s forecast and the 1-3% target band. Inflation…

FOMC minutes showed broad support to hold in July, but the committee remains divided between proactive doves and reactive hawks. “Almost all members” favored leaving the funds rate unchanged, though two dissented for an…