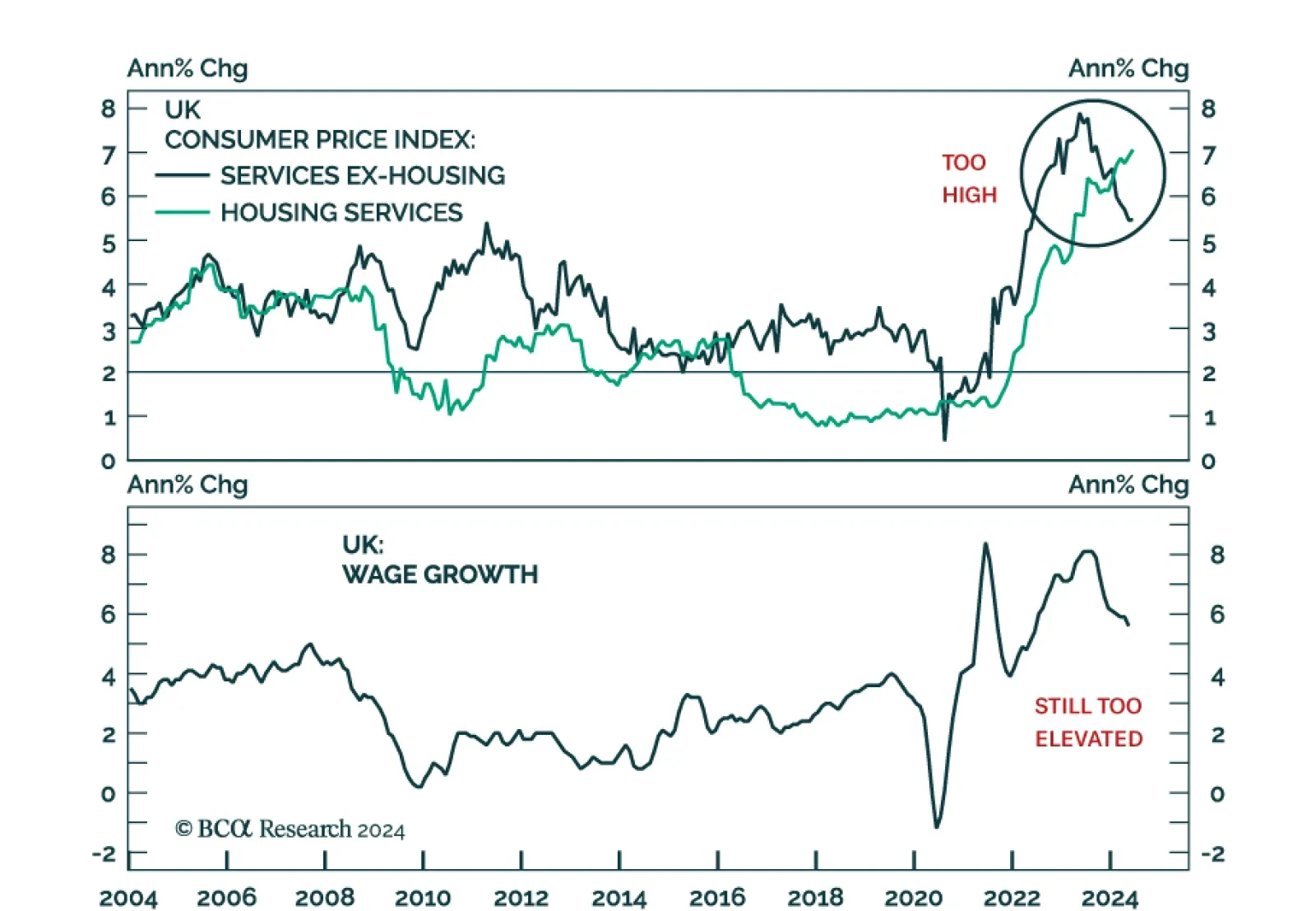

UK’s CPI growth stands right on the Bank of England’s (BoE) 2% target. However, services inflation remains sticky, growing at a constant 5.7% y/y in June. Moreover, the deceleration in wage growth remains insufficient…

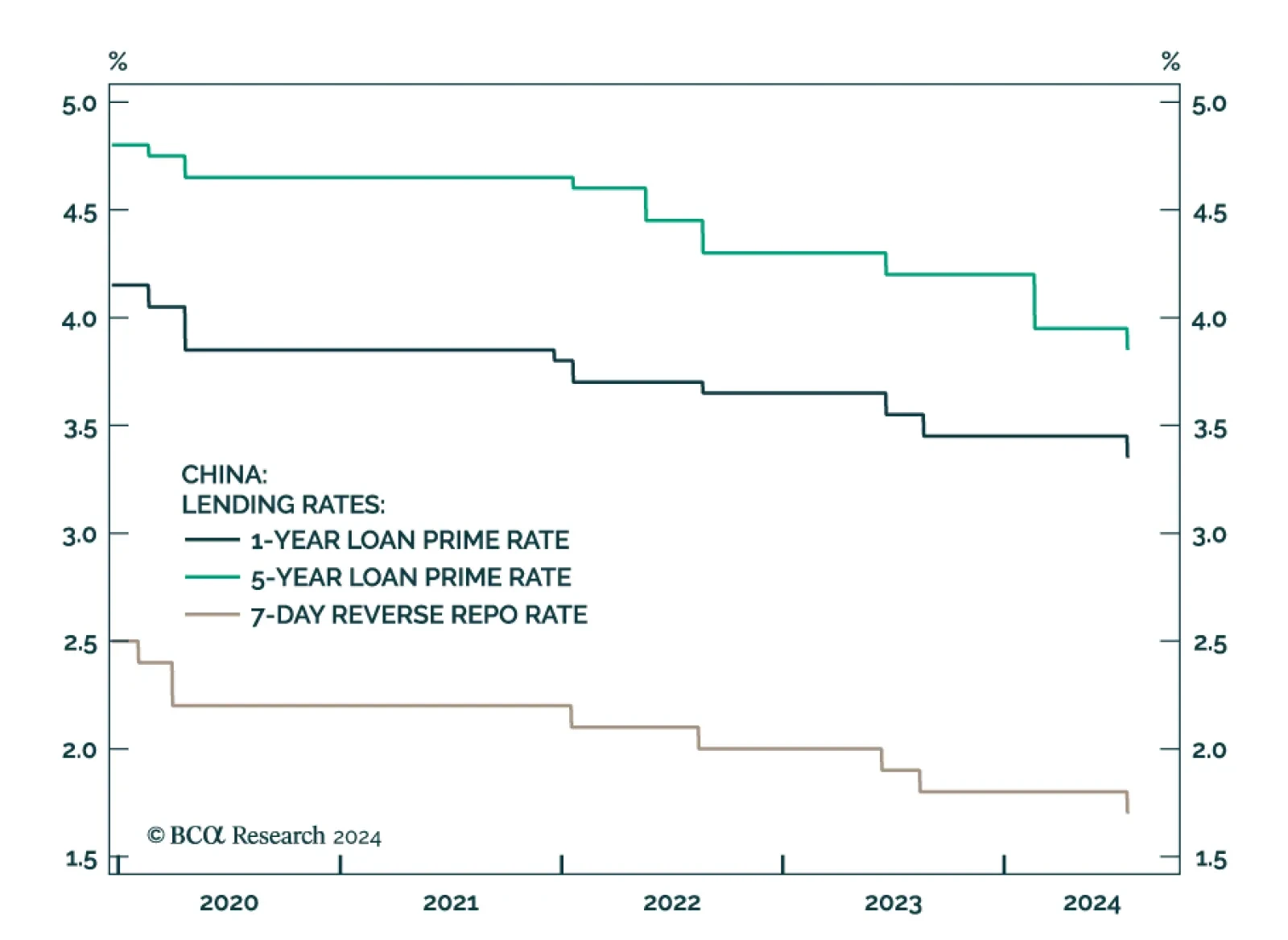

The PBoC lowered the 7-day reverse repo rate from 1.80% to 1.70% on Monday. The 5-year and 1-year loan prime rates declined by 10 basis points (bps) to 3.85% and 3.35%, respectively. However, this 10-bps cut is unlikely to…

We review some of the key data releases this week that we find have an impact on our currency strategy. Long yen positions make sense today. Long sterling and the euro bets are more of a judgment call, and we will fade any strength…

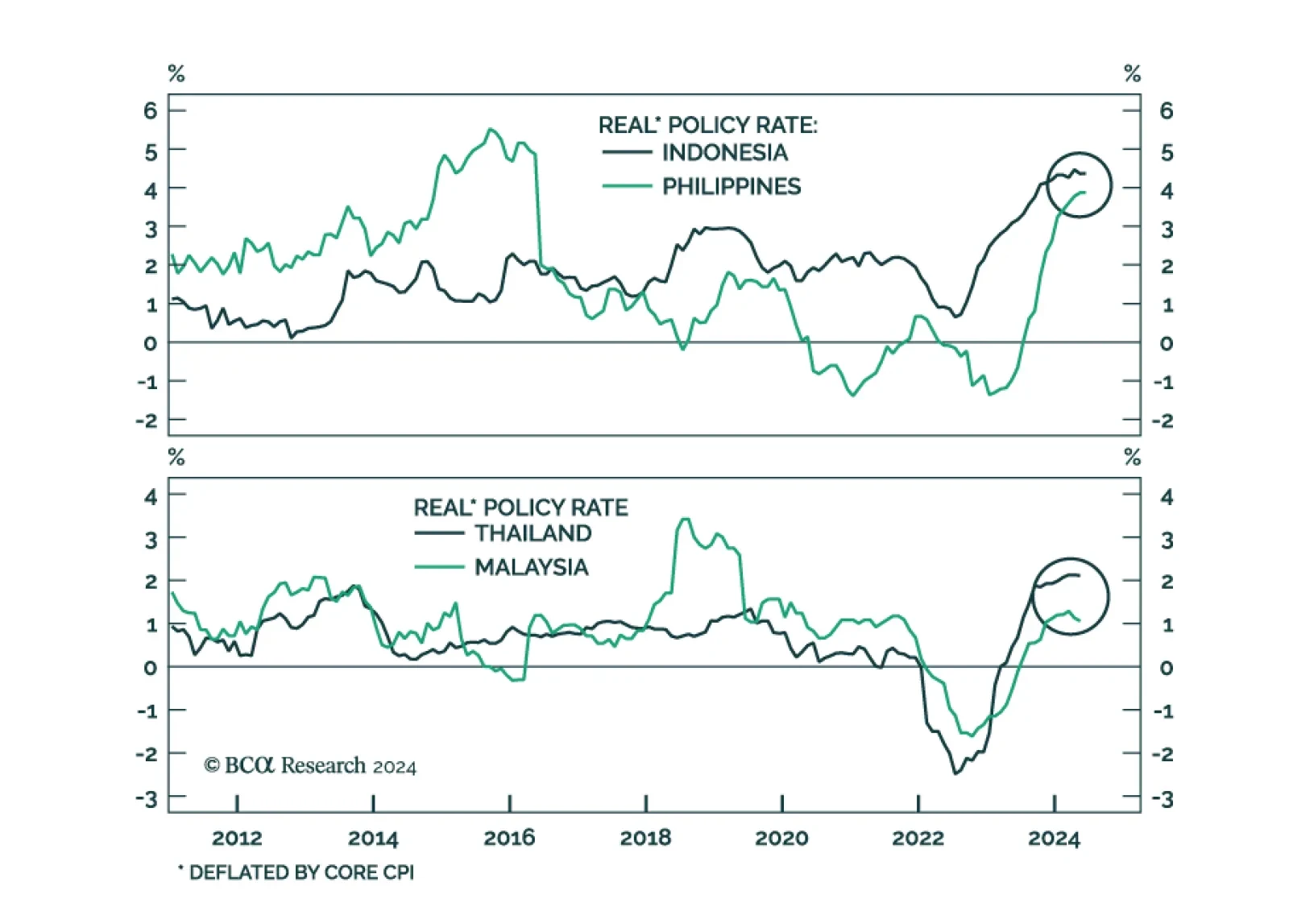

The four ASEAN stock markets (Indonesia, Malaysia, Thailand, and the Philippines) have fallen in absolute terms over the past year despite the powerful rally in the developed markets. They have also underperformed their EM…

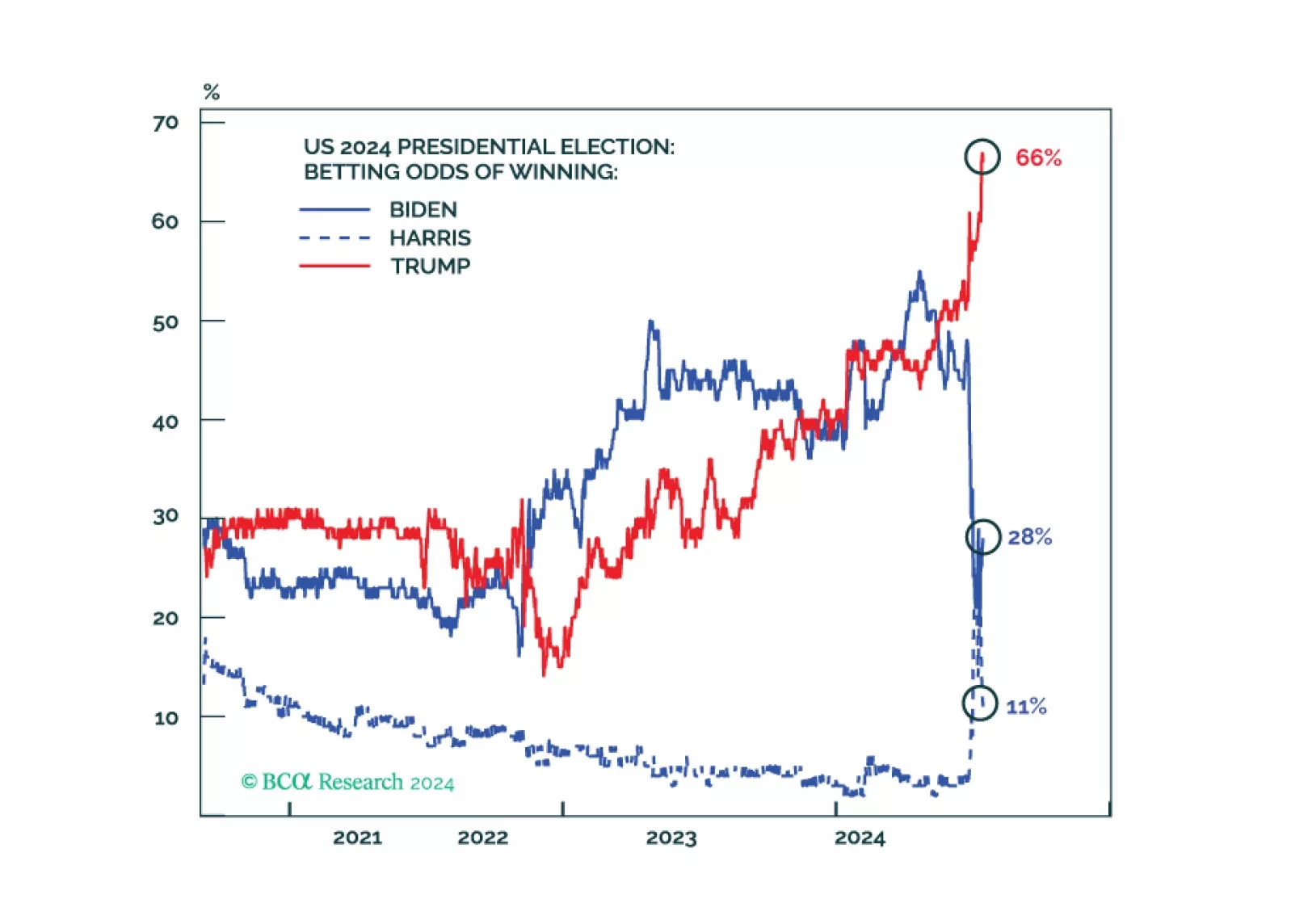

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

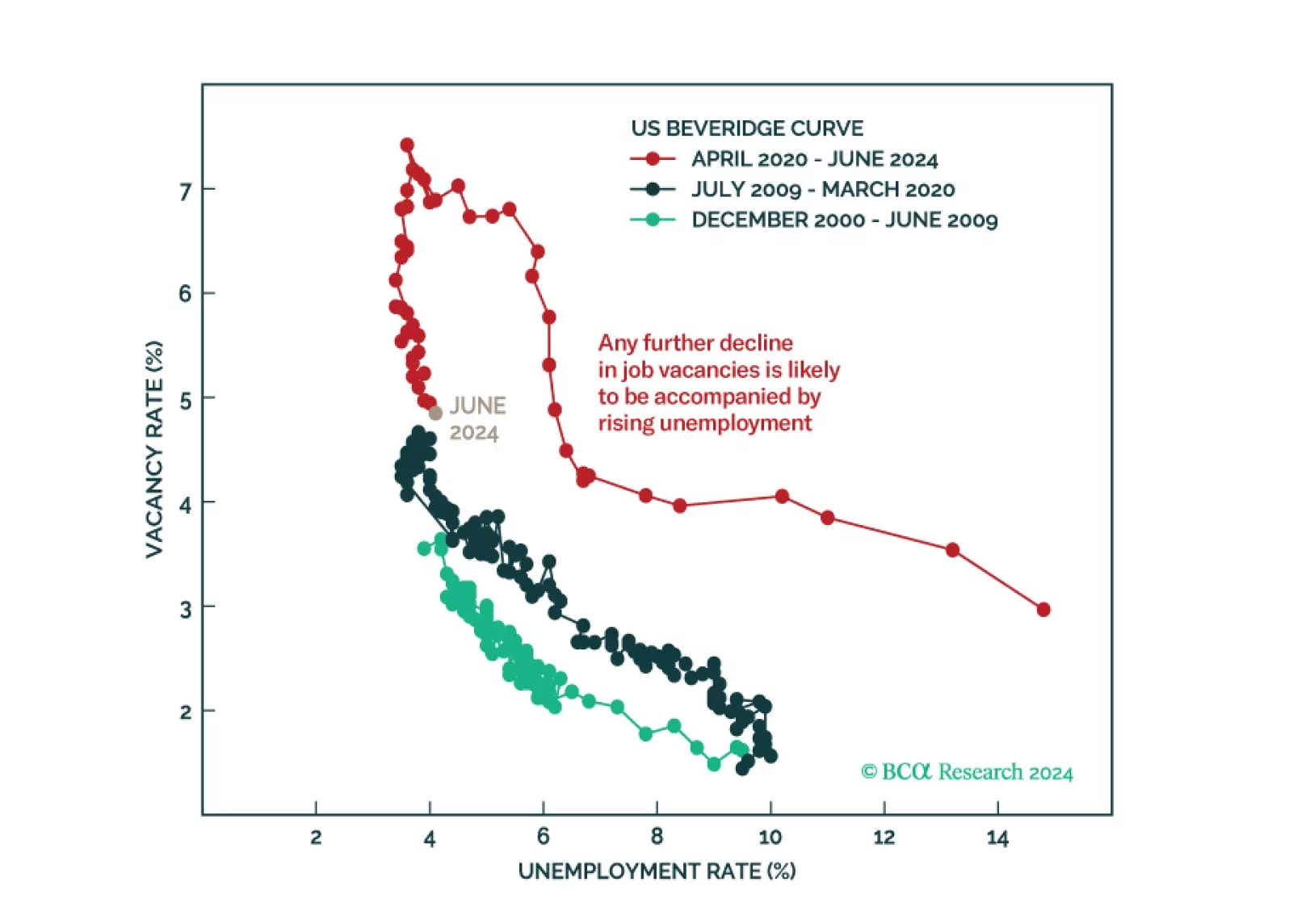

Don't buy the dip. The equity bull market is over. The US will enter a recession in late 2024 or in early 2025.

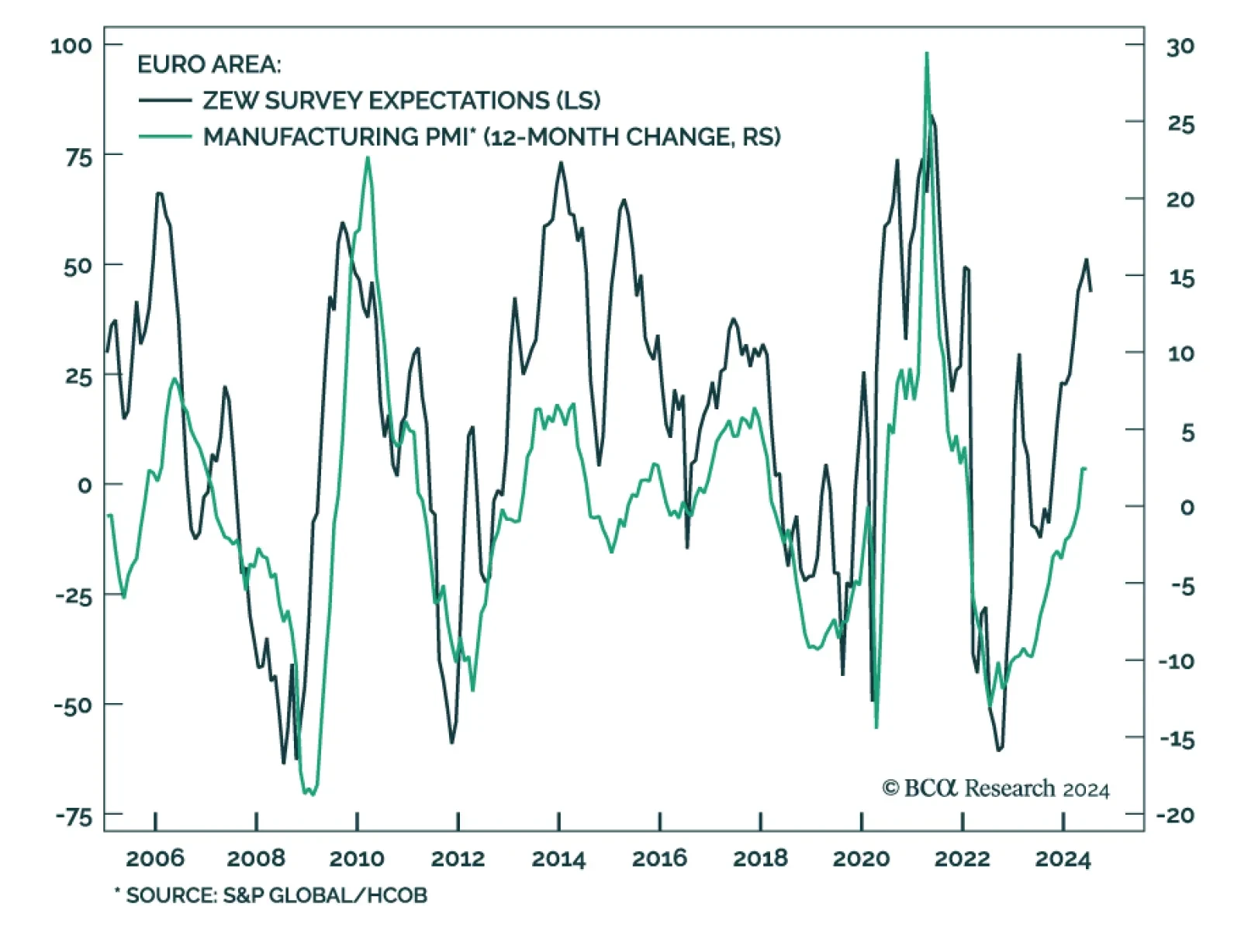

The Euro Area economy broadly surprised to the upside in the first half of 2024. Cooling inflation lifted real wages and the global late cycle amelioration benefitted the pro-cyclical Euro Area economy, but these tailwinds are…

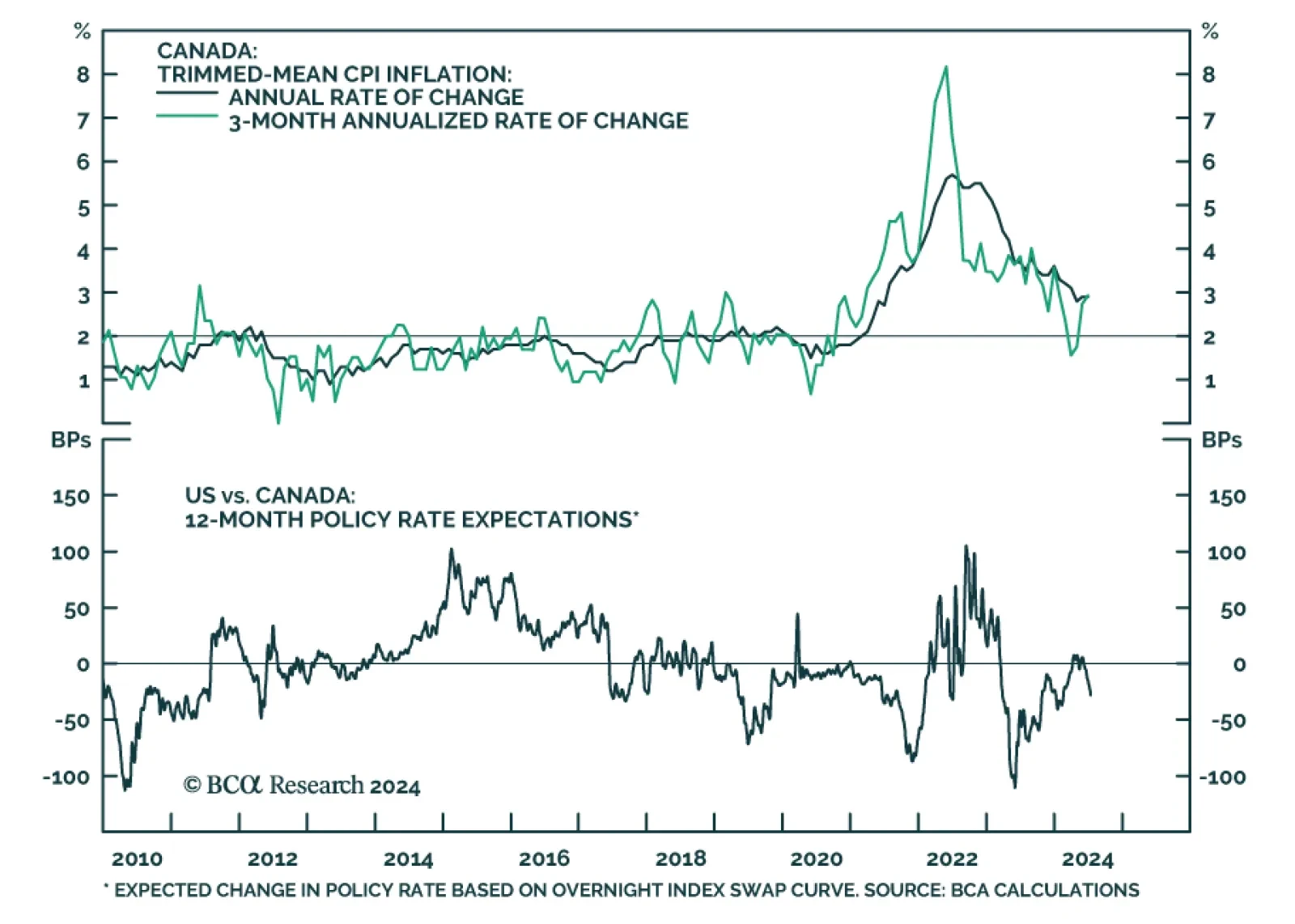

Markets had already been sussing out that the Bank of Canada (BoC) will cut rates for the second time when it meets next week, and this morning’s soft CPI report all but confirmed it. The last remaining obstacle in the…

The cyclical economy is slowing today. Republicans are now more likely to win a full sweep, crack down on immigration and trade, and at least modestly stimulate the economy. Uncertainty and volatility will rise.

The conventional wisdom is wrong: Trump is not going to substantially cut taxes once in office; he is going to raise taxes by jacking up tariffs. To the extent that this dampens economic activity, it is bad news for stocks but good…