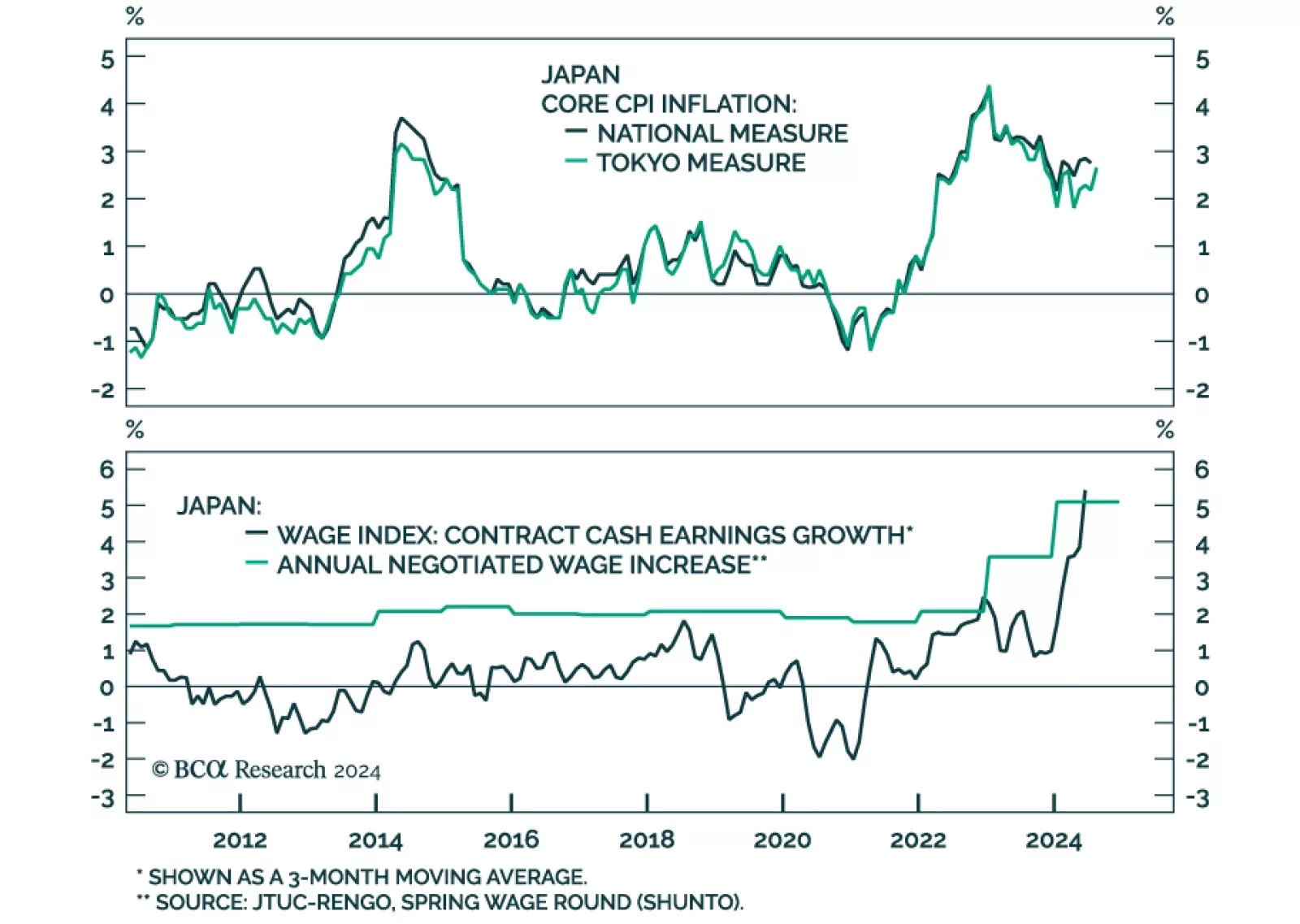

Tokyo’s CPI is a timely leading indicator of nationwide price pressures. In August, the headline, core (ex-food) and the “core core” (ex-food and energy) measures all accelerated by larger-than-expected margins…

After surprising to the upside in July on higher energy costs, Eurozone CPI resumed its deceleration in August. Headline and core CPI declined from 2.6% y/y to 2.2% and from 2.9% to 2.8%, respectively. Energy prices contracted…

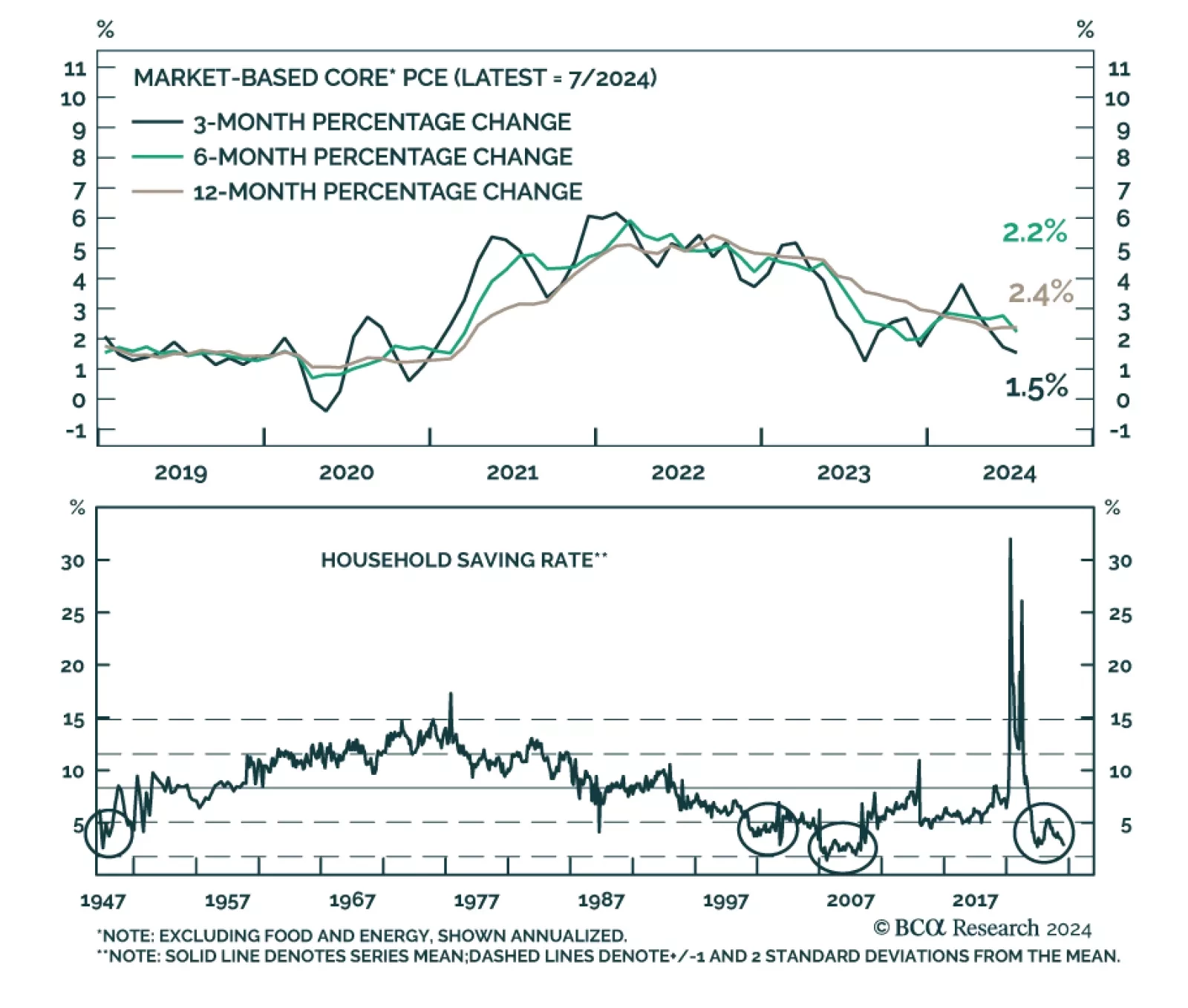

US nominal personal income growth accelerated from 0.2% m/m to 0.3% in July, faster-than-anticipated, whereas personal spending accelerated from 0.3% to 0.5%, in line with expectations. The savings rate edged lower from 3.1% to a…

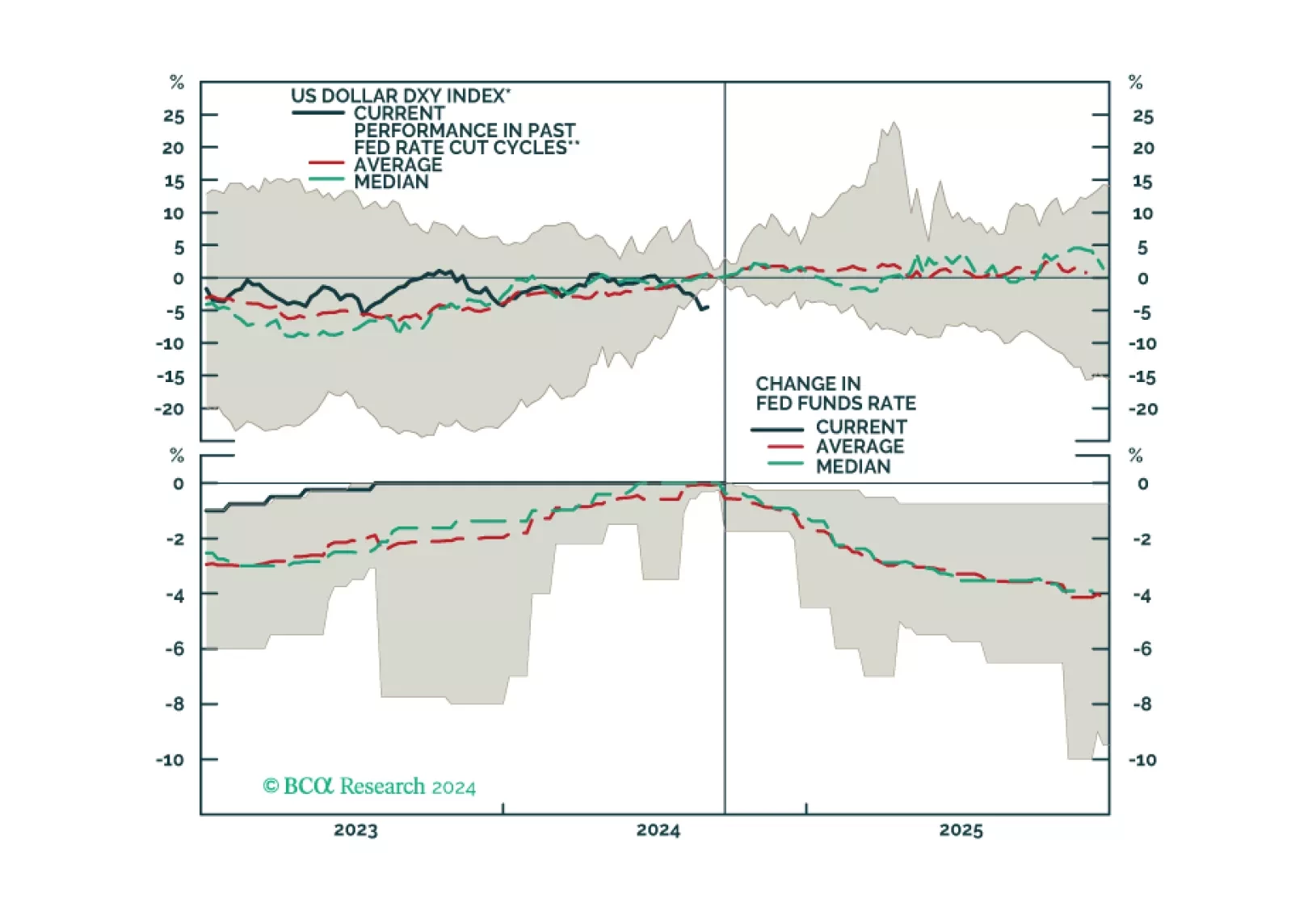

This Insight looks at potential dollar moves in the next six-to-twelve months.

According to BCA Research’s Counterpoint Strategy service, the post-pandemic US economy has inverted from its usual ‘demand-constrained’ state to a highly unusual ‘supply-constrained’ state. This…

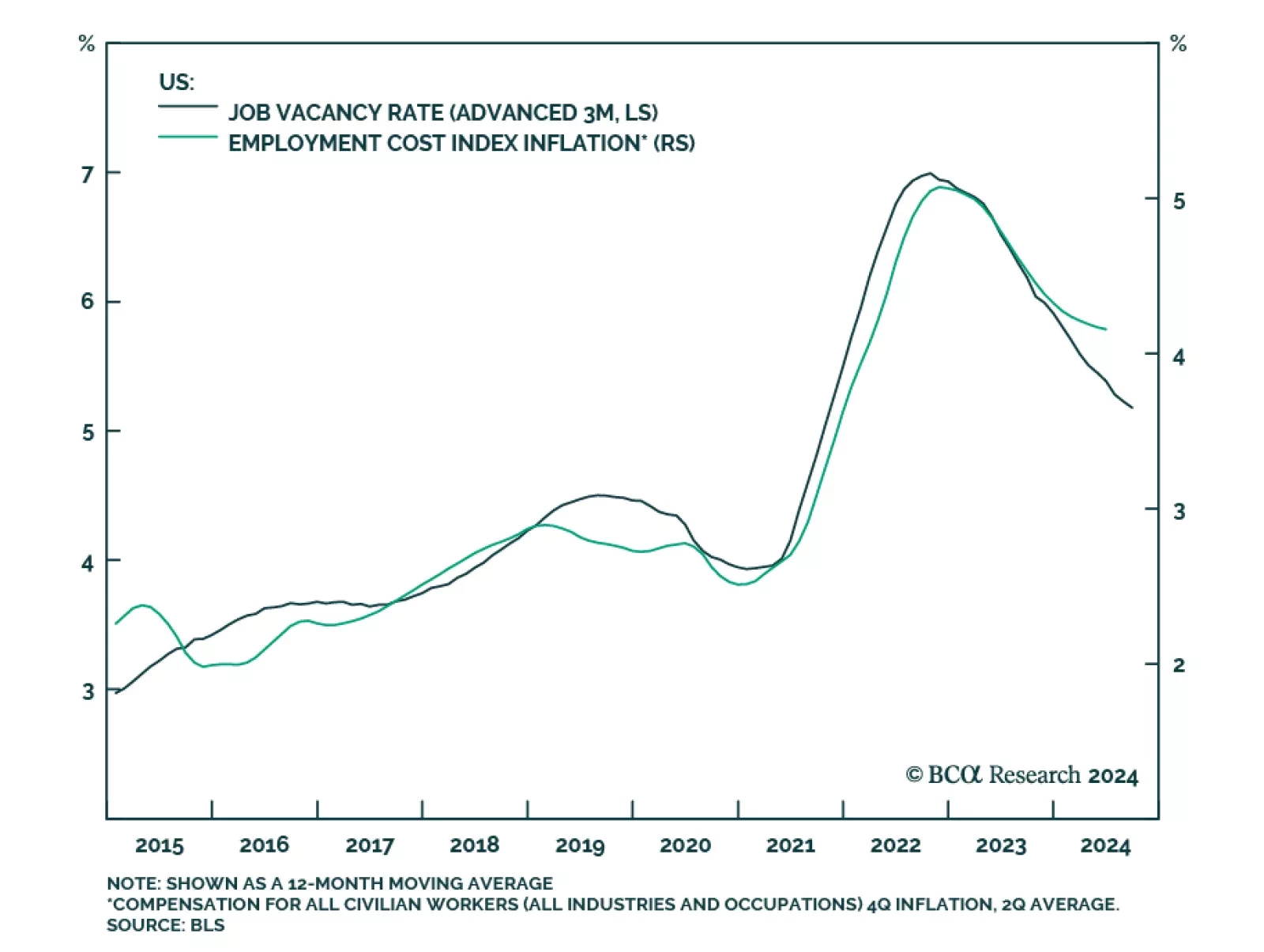

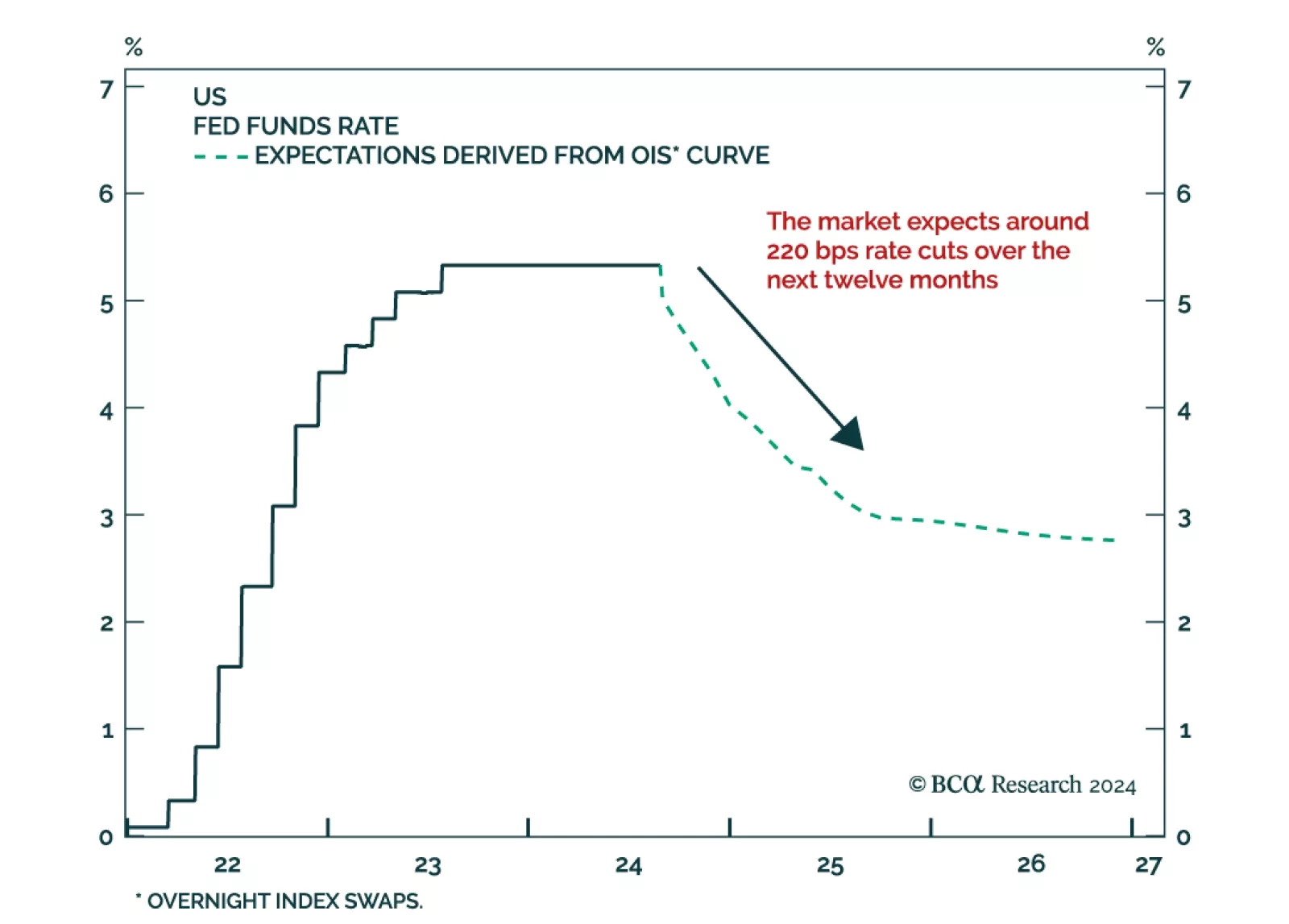

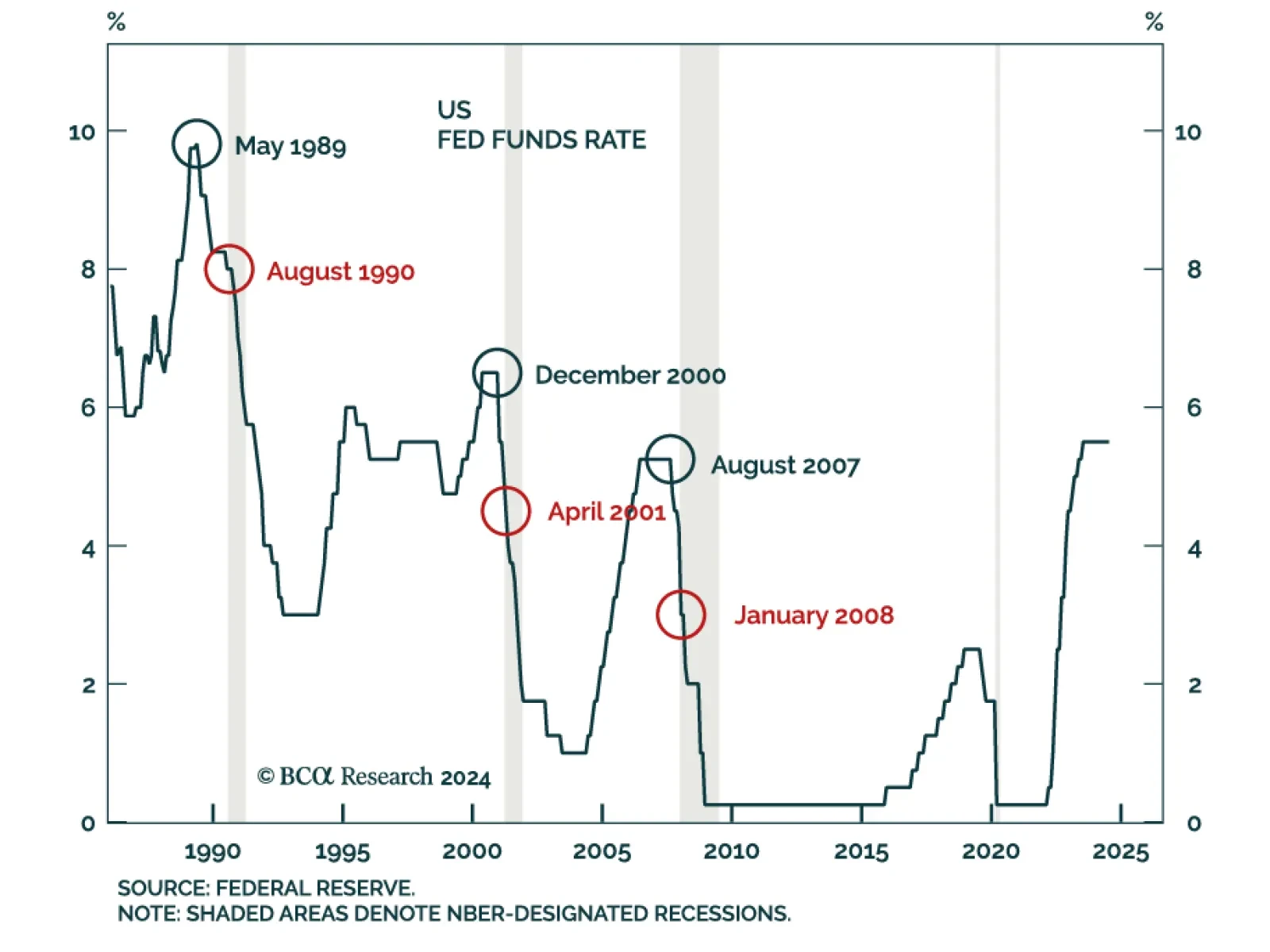

The market is currently expecting the Fed to cut rates by 100 bps over the course of 2024 and by another 120 bps throughout the first eight months of 2025. However, our Global Investment strategists expect the extent of 2024…

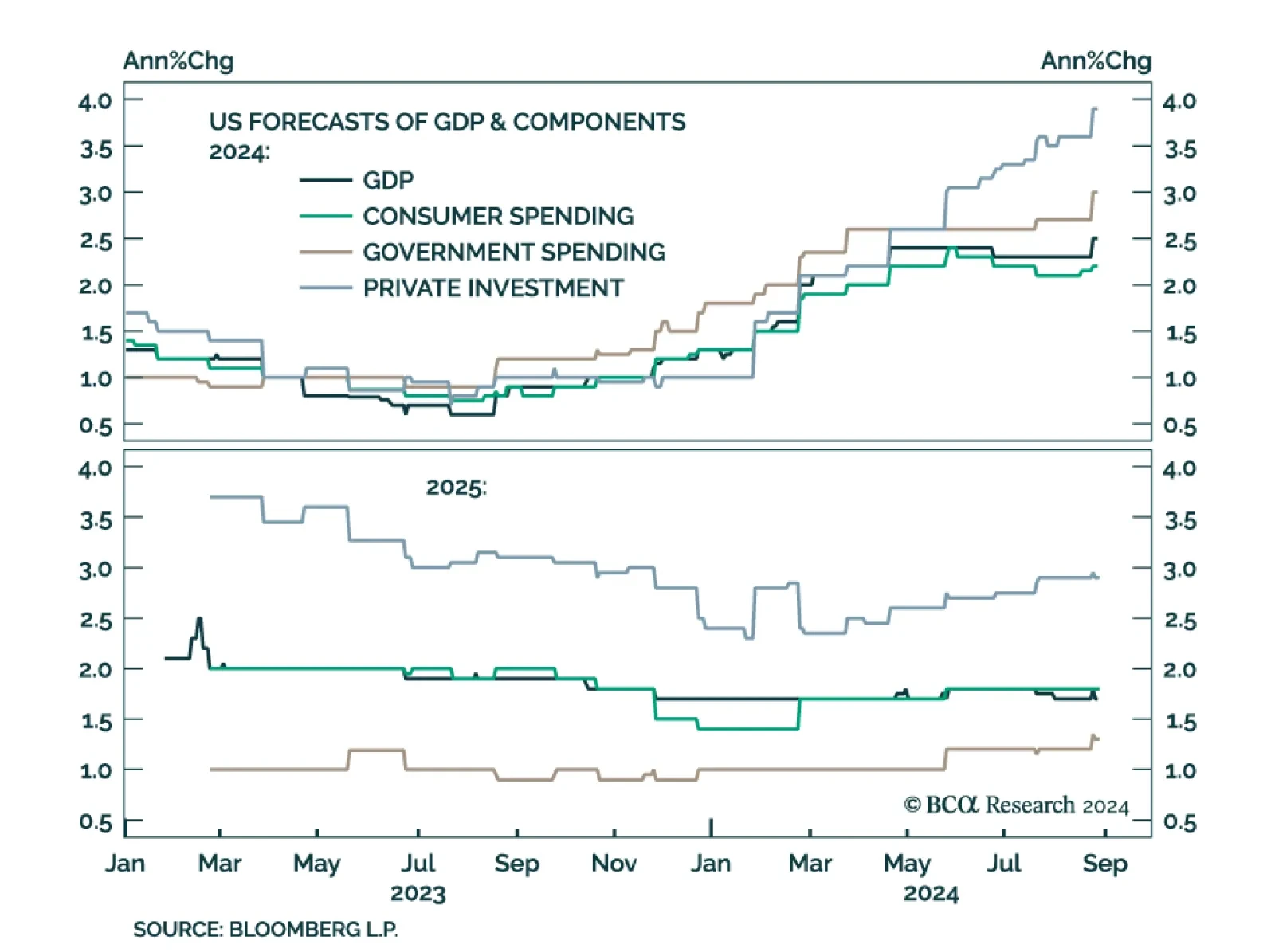

Last week, economists polled by Bloomberg revised their consensus 2024 US GDP forecasts upwards, from 2.3% to 2.5%. Government spending and private investment were both revised 0.3 ppts higher to 3.0% and 3.9%, respectively,…

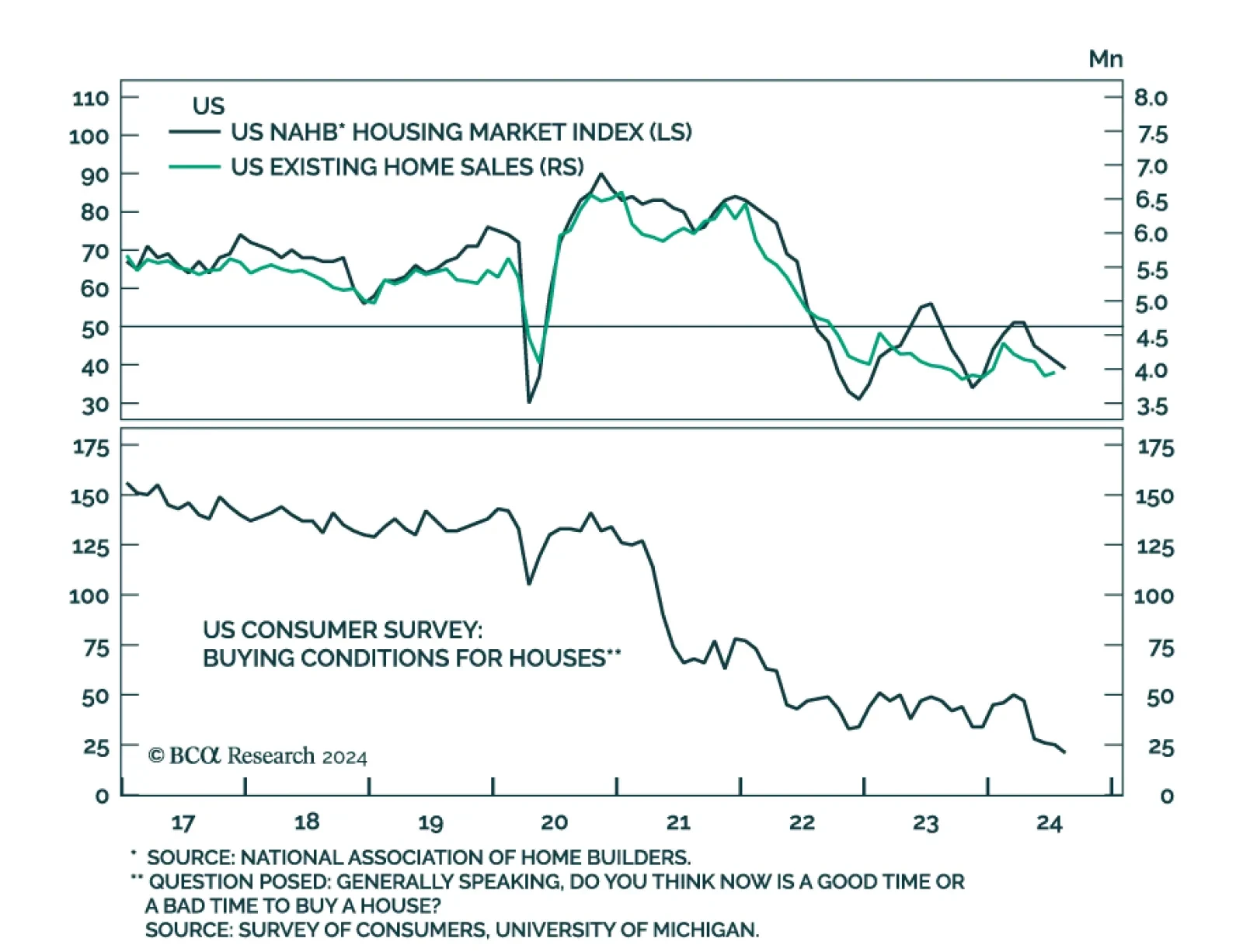

US housing market data have been mixed. In June, the FHFA House Price index unexpectedly declined 0.1% m/m and the NAHB housing market index unexpectedly eased to 39 from a 41 reading. In July, starts and permits both…

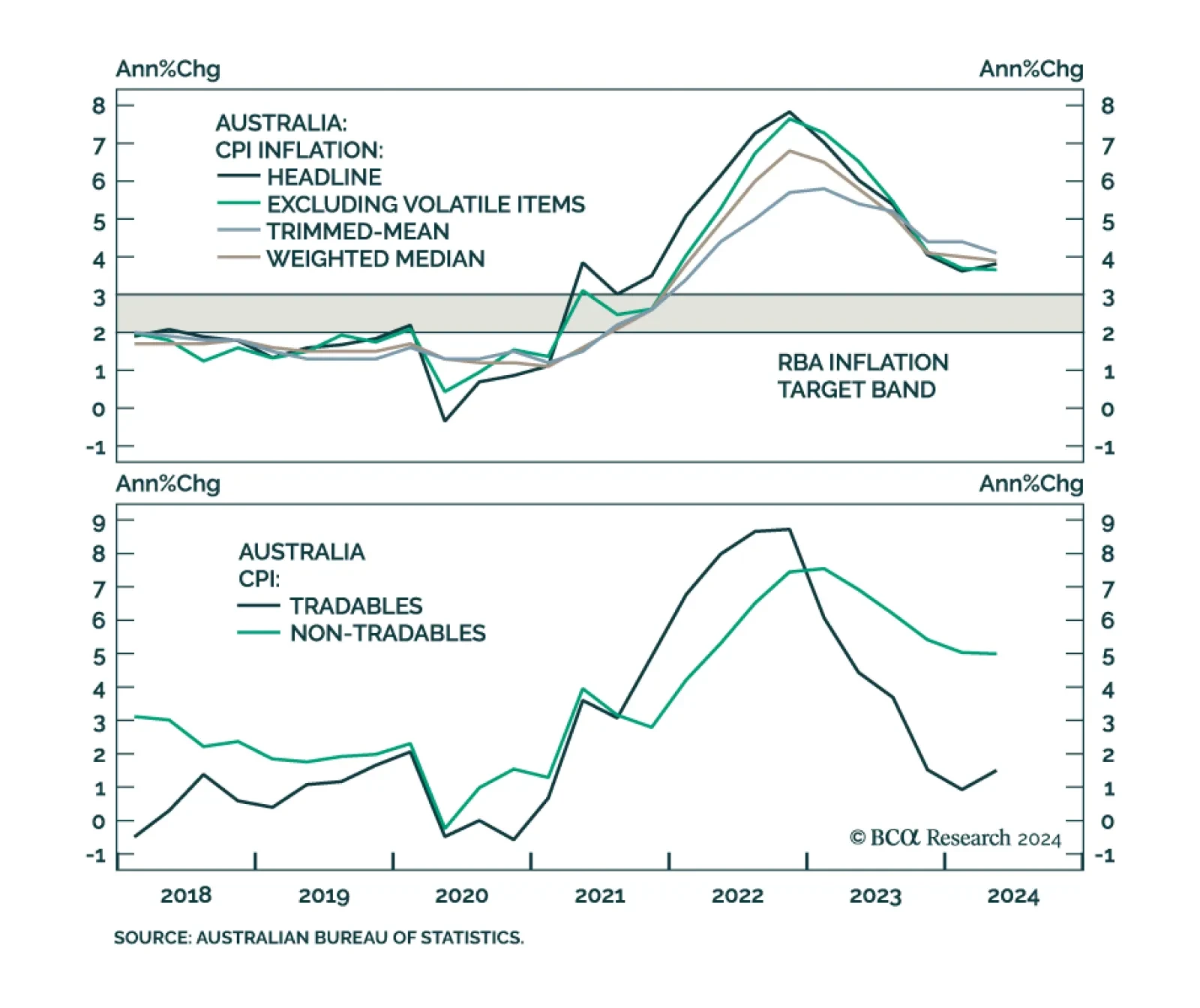

Australia’s CPI inflation eased from 3.8% y/y to a higher-than-expected 3.5% in July. The trimmed-mean measure eased from 4.1% to 3.8%. However, the Commonwealth Energy Bill Relief Fund rebates contributed to July’…

During his Jackson Hole speech, Chair Powell dispelled any remaining doubts about a September rate cut. Still, easing monetary policy is unlikely to result in a soft landing. First, recessions have historically started shortly…