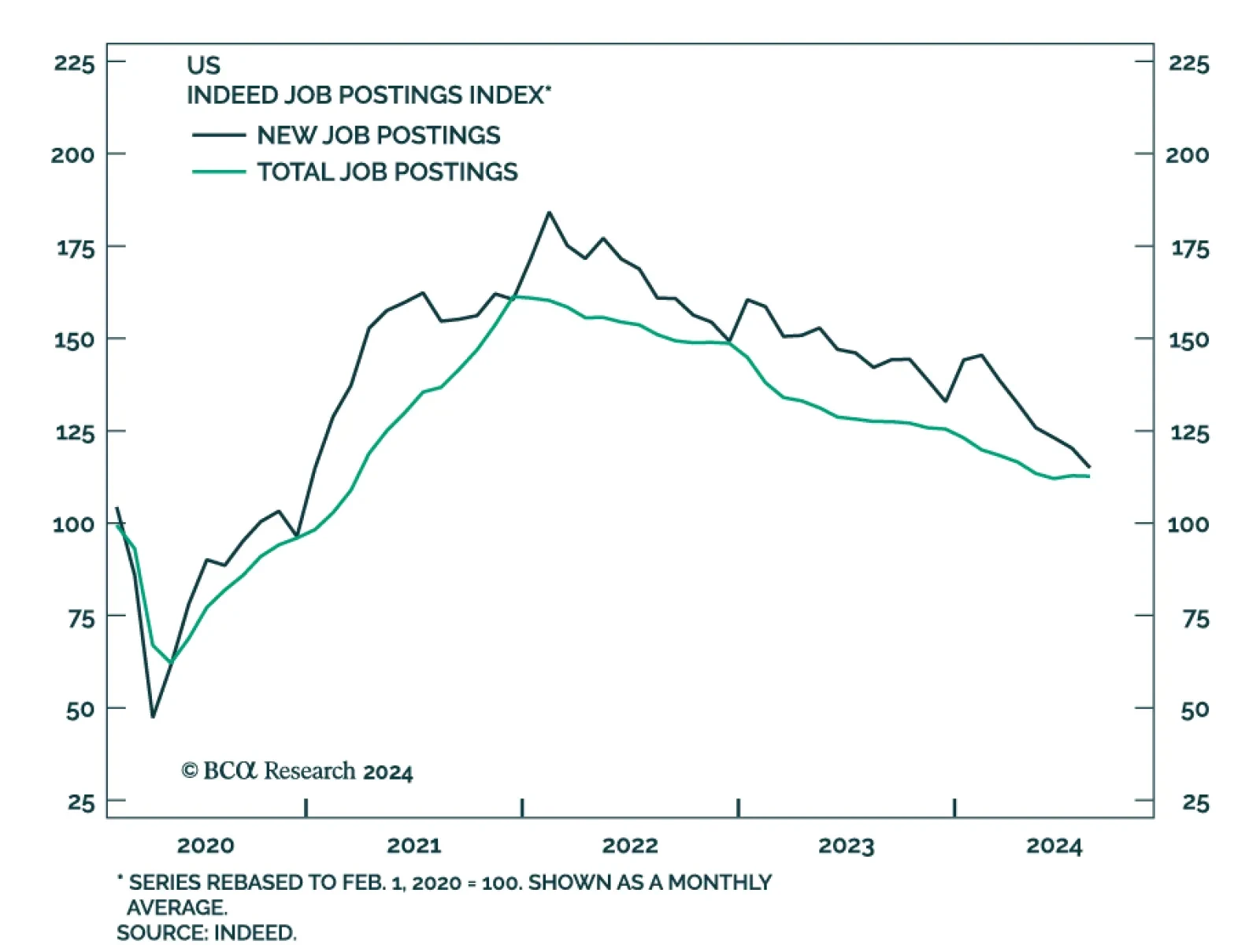

This morning's employment report, particularly the downward revisions to prior months, strengthens our conviction that the US economy is headed for recession.

Our Portfolio Allocation Summary for September 2024.

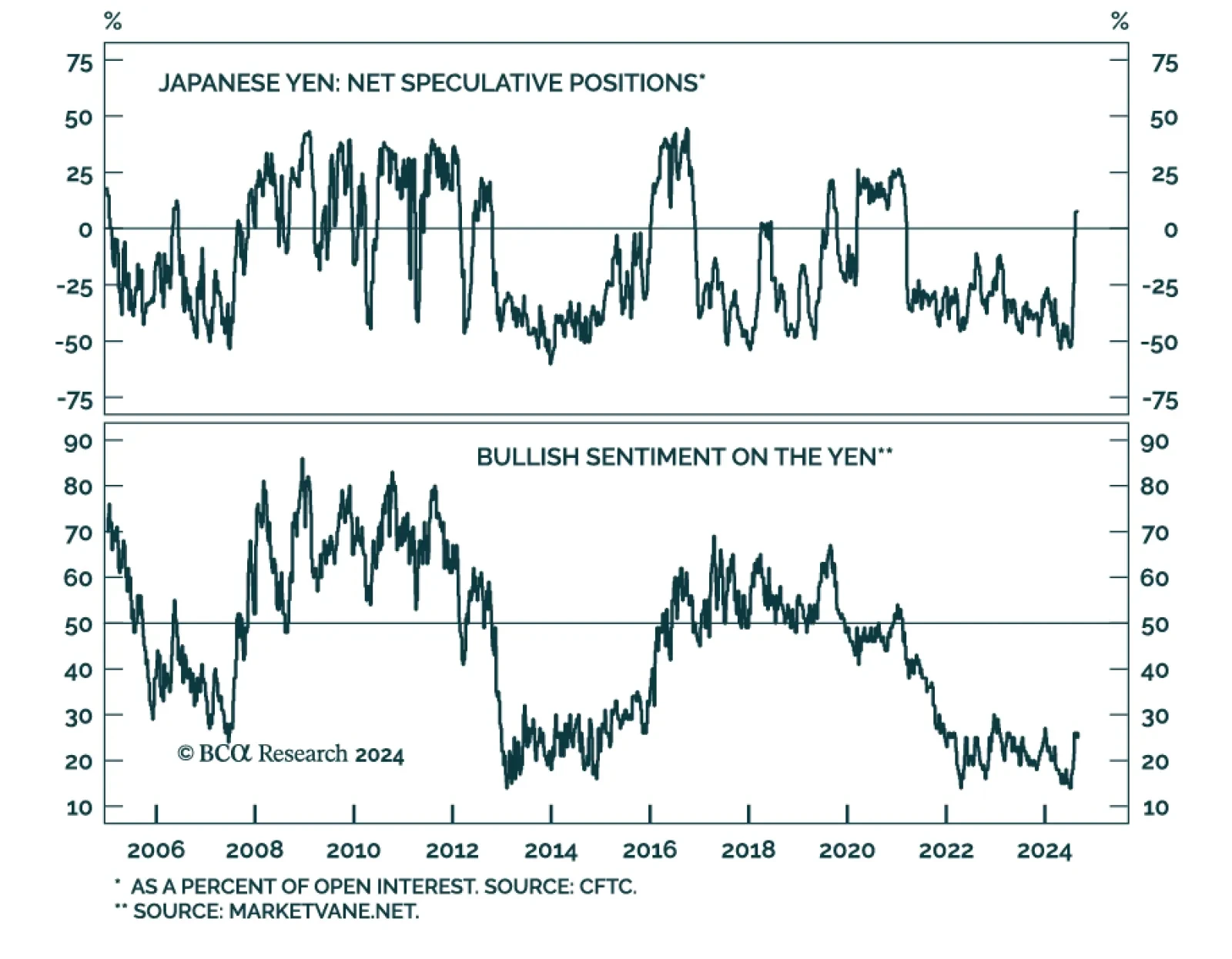

Many currencies have registered sizable gains against the US dollar over the last two months. Most notably, the yen has been one of the best G7 performers since the greenback began depreciating. It now trades at 143 against the…

The Fed’s Beige Book compiles qualitative input sourced from business and other organizational contacts in each of its 12 Districts. It precedes FOMC meetings by a couple of weeks and is meant to help participants trace the…

In a widely expected move, the Bank of Canada (BoC) cut interest rates by a quarter of a percentage point for a third consecutive month in September, lowering the benchmark overnight rate to 4.25%. Policymakers also signaled…

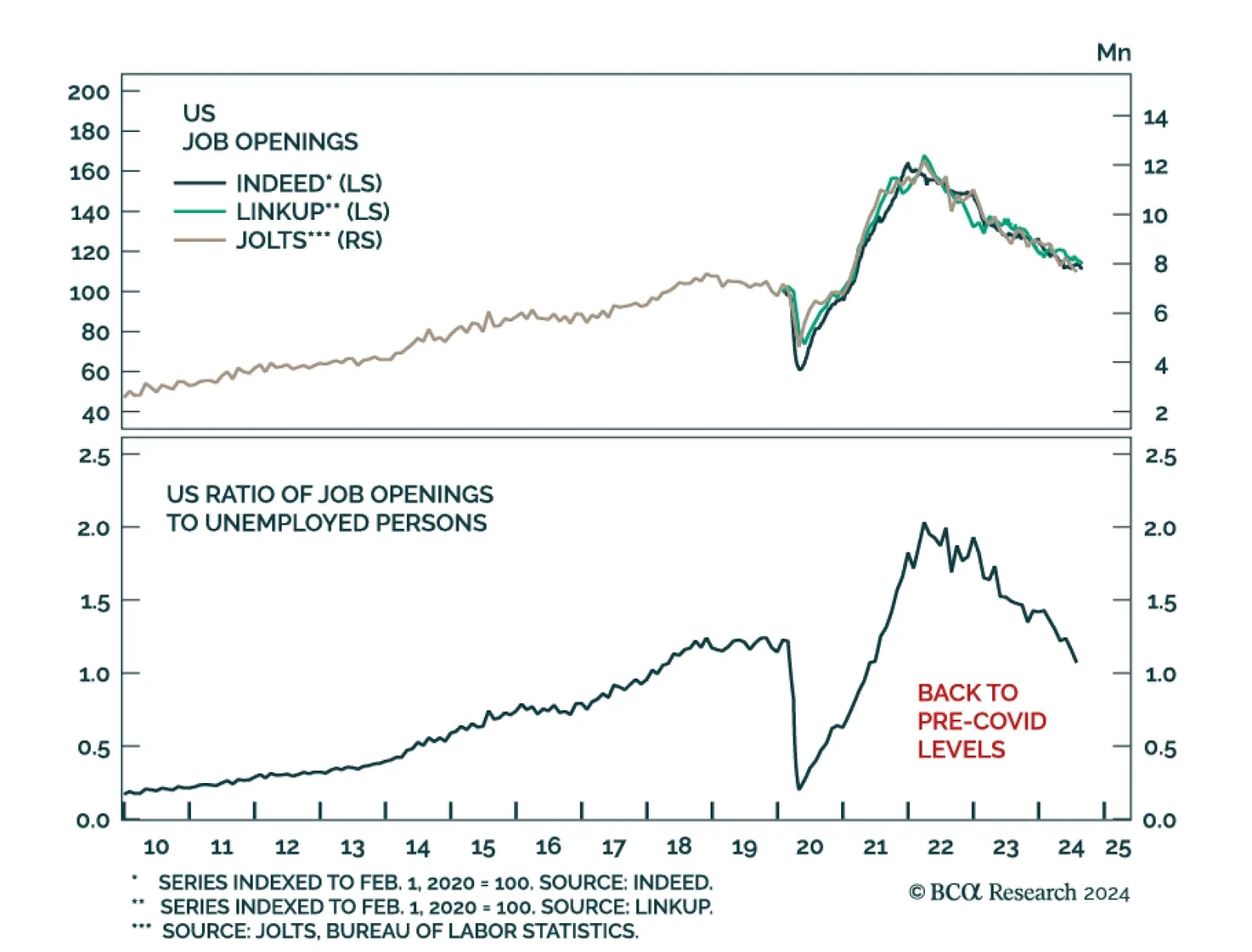

US job openings declined from a downwardly revised 7.91 million to 7.67 million in July, the lowest level since 2021 and well short of expectations of 8.1 million. The downward revision indicates that labor demand actually…

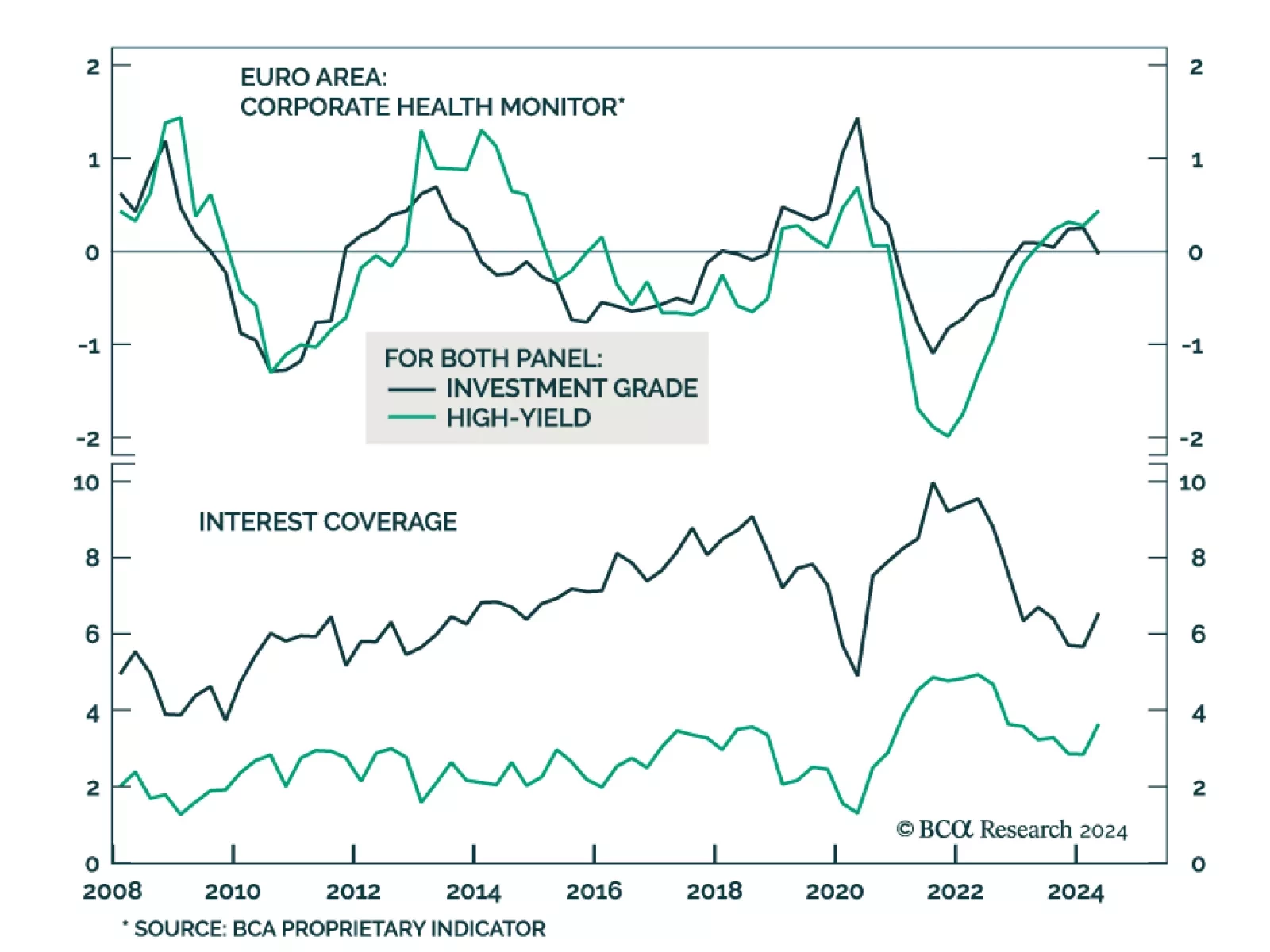

According to BCA Research’s European Investment Strategy service, an increase in borrowing costs will further weaken vulnerable corporate balance sheets. As suggested by their Corporate Health Monitors (CHMs), the health of…

Significantly stronger-than-expected consumer spending growth led to an upward revision to US GDP growth in Q2. That said, gross domestic income (GDI) has been lagging behind GDP. It increased 1.3% q/q in Q2, at the same rate as…

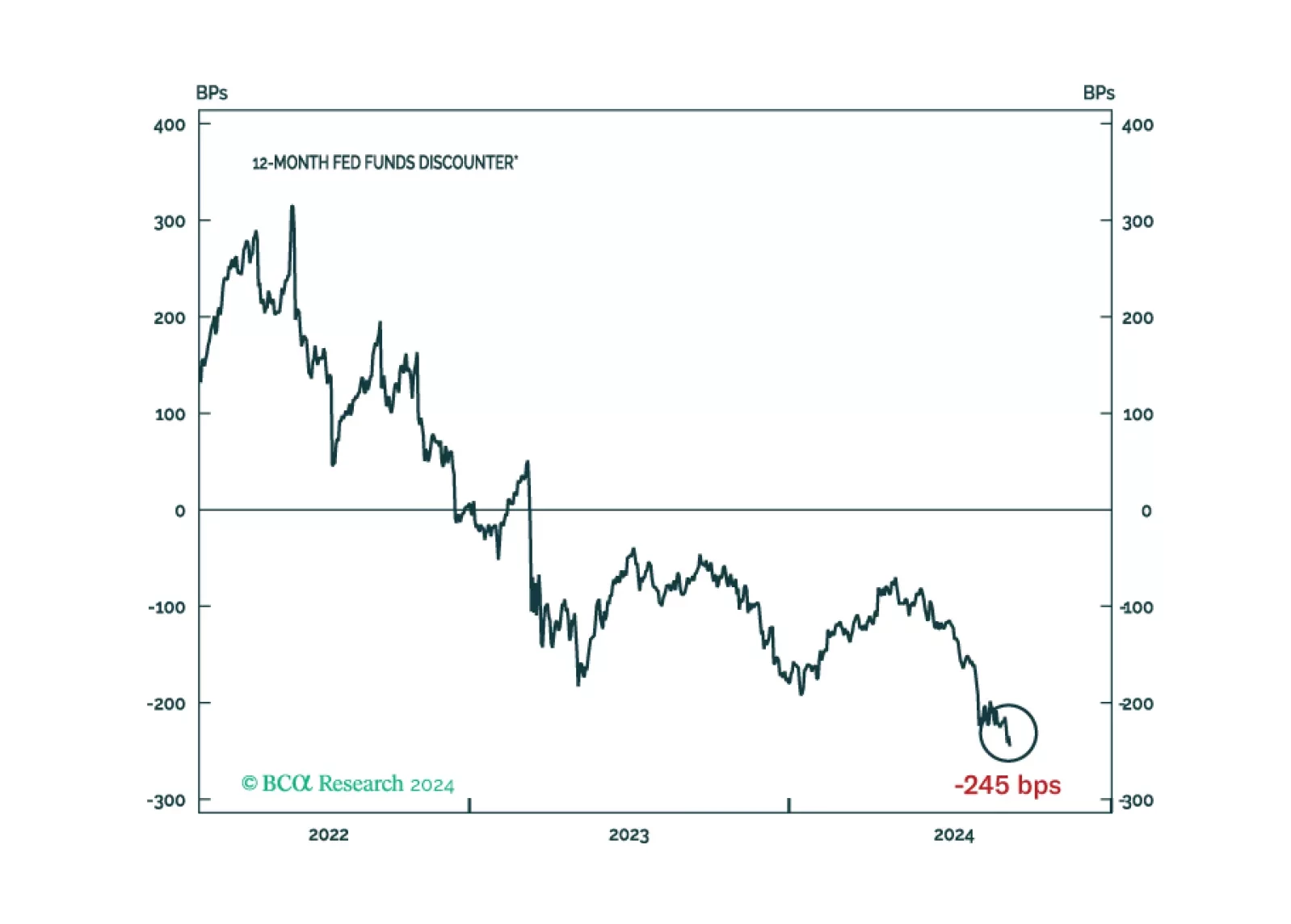

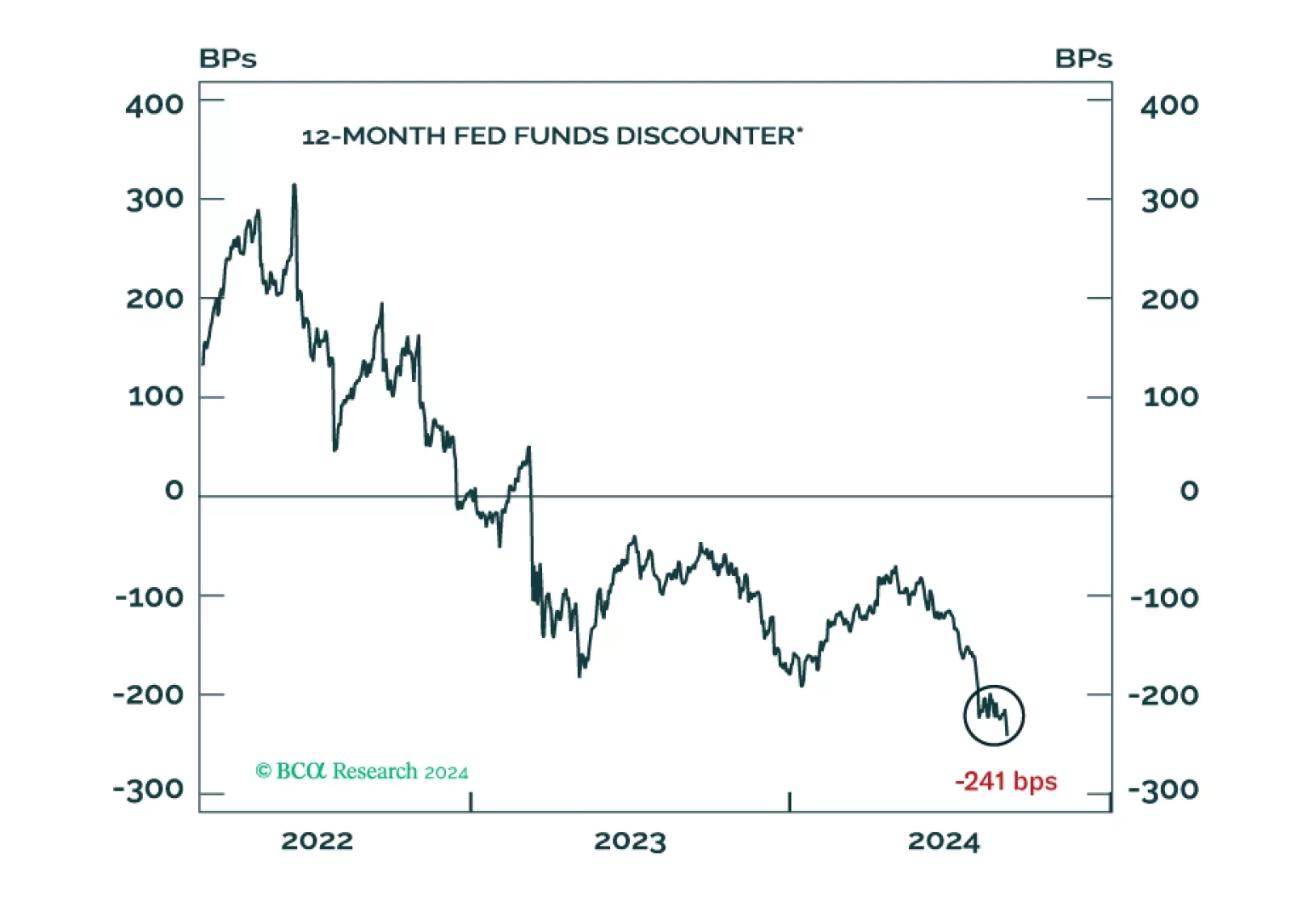

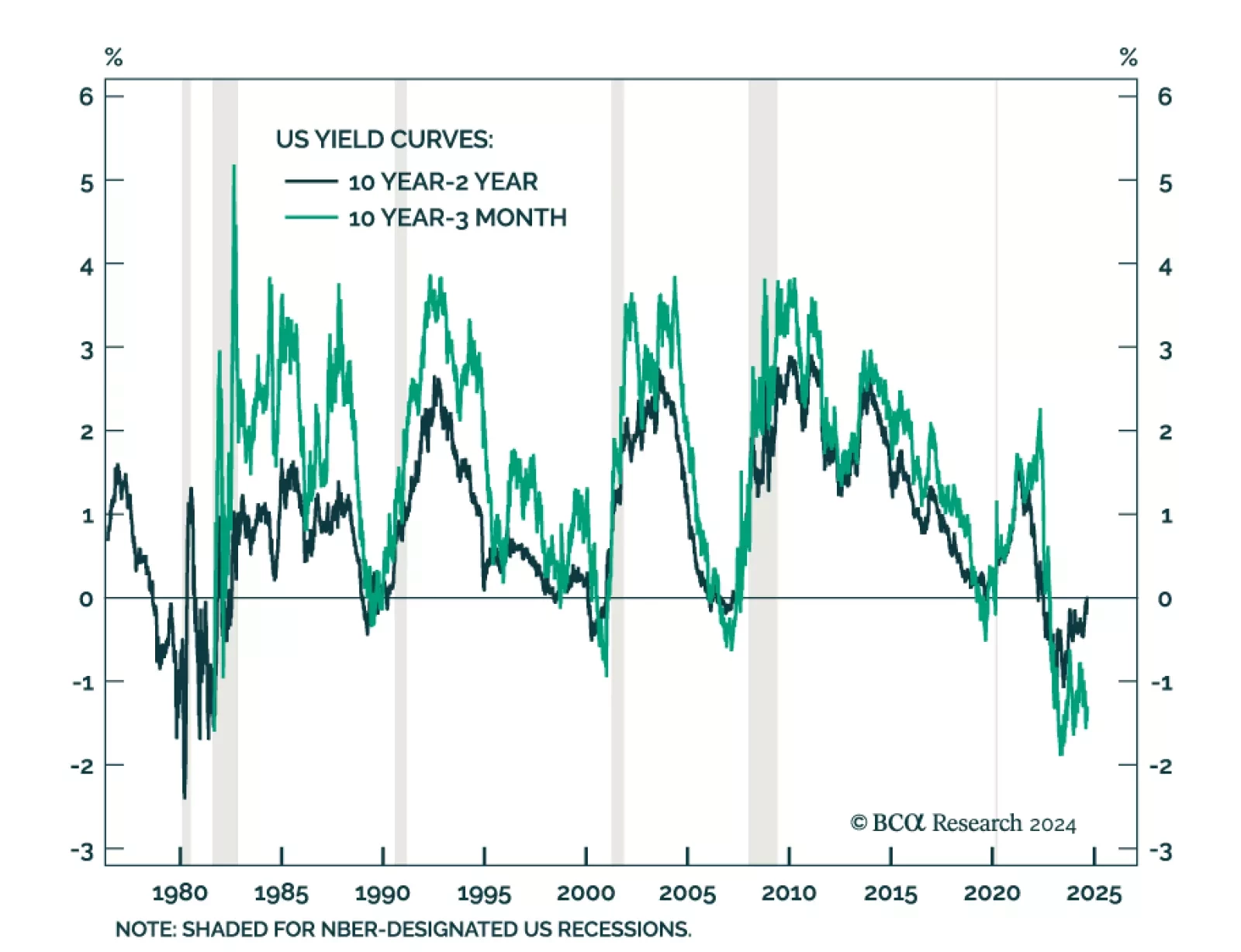

The 2Y/10Y segment of the yield curve is flirting with un-inversion. Aggressive rate cut expectations have largely driven its steepening, with the 2-year Treasury yields falling nearly 100 bps over the past couple of months.…

Even after the Fed cuts rates, policy will remain restrictive for some time. Moreover, in history, stocks have tended to fall around the first rate cut. We remain cautious on the outlook for the economy and risk assets.