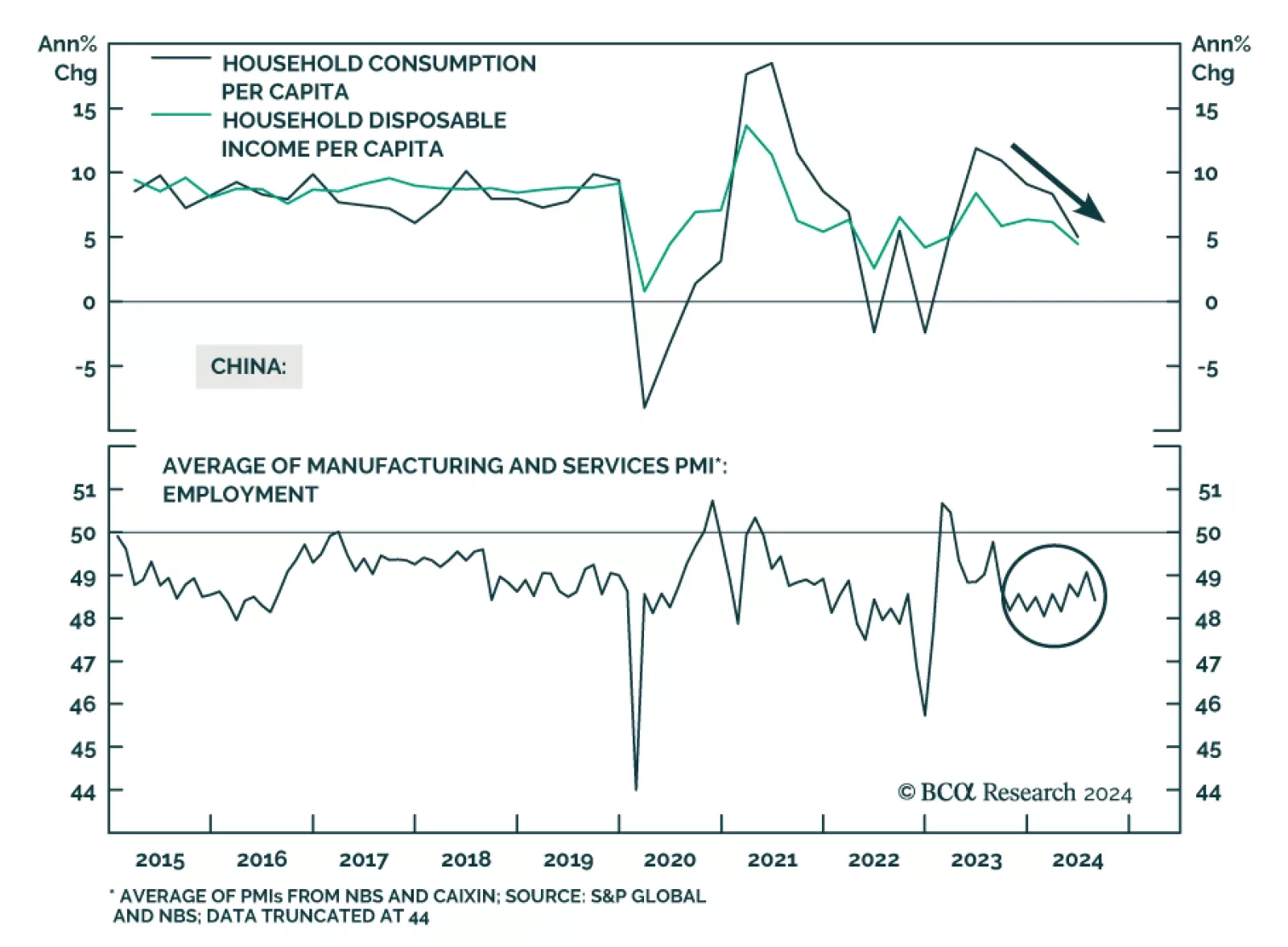

The Chinese economic data in its totality was uninspiring in August. Industrial production and retail sales growth decelerated year-on-year and corroborate the message from August’s import and credit growth data that…

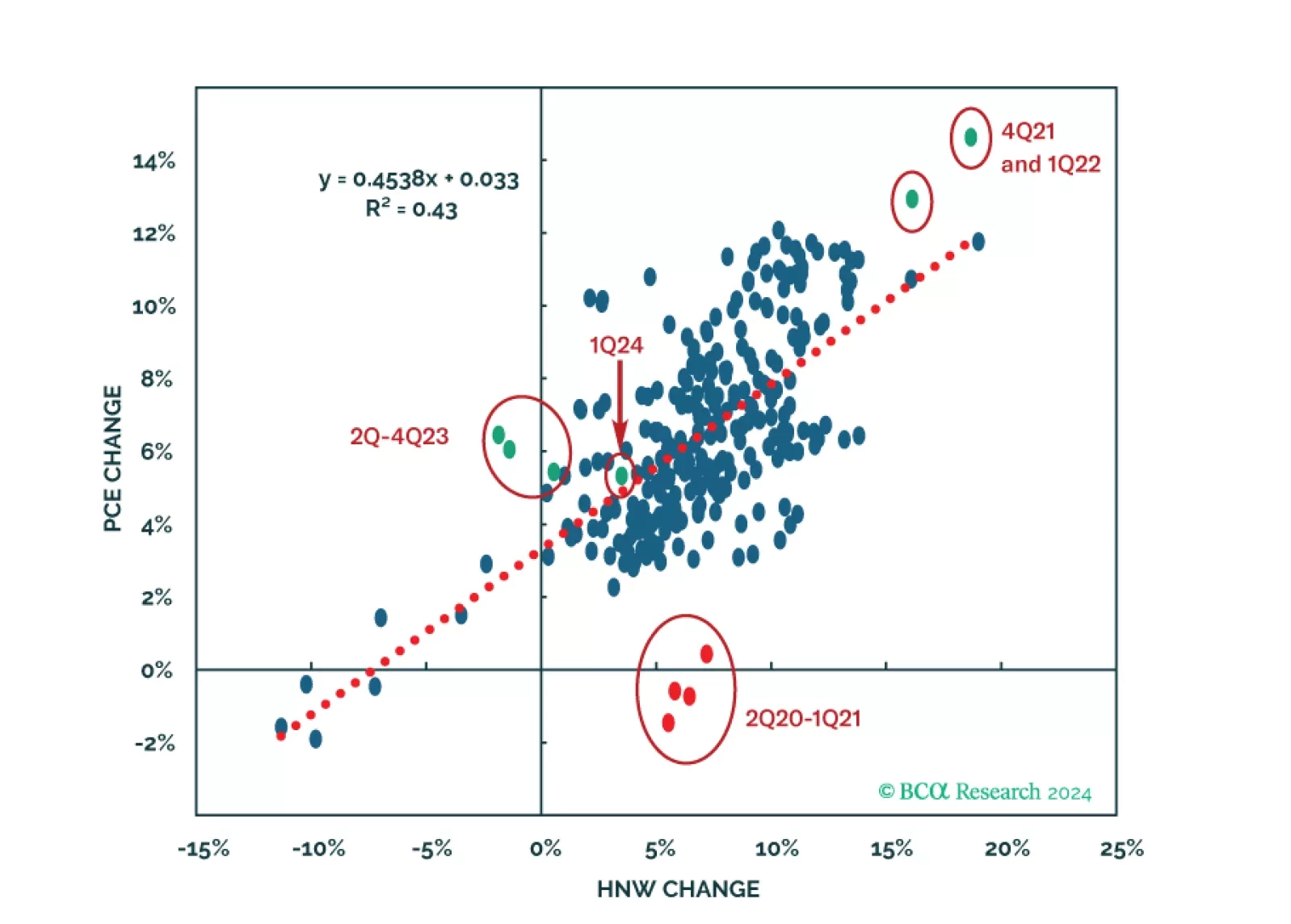

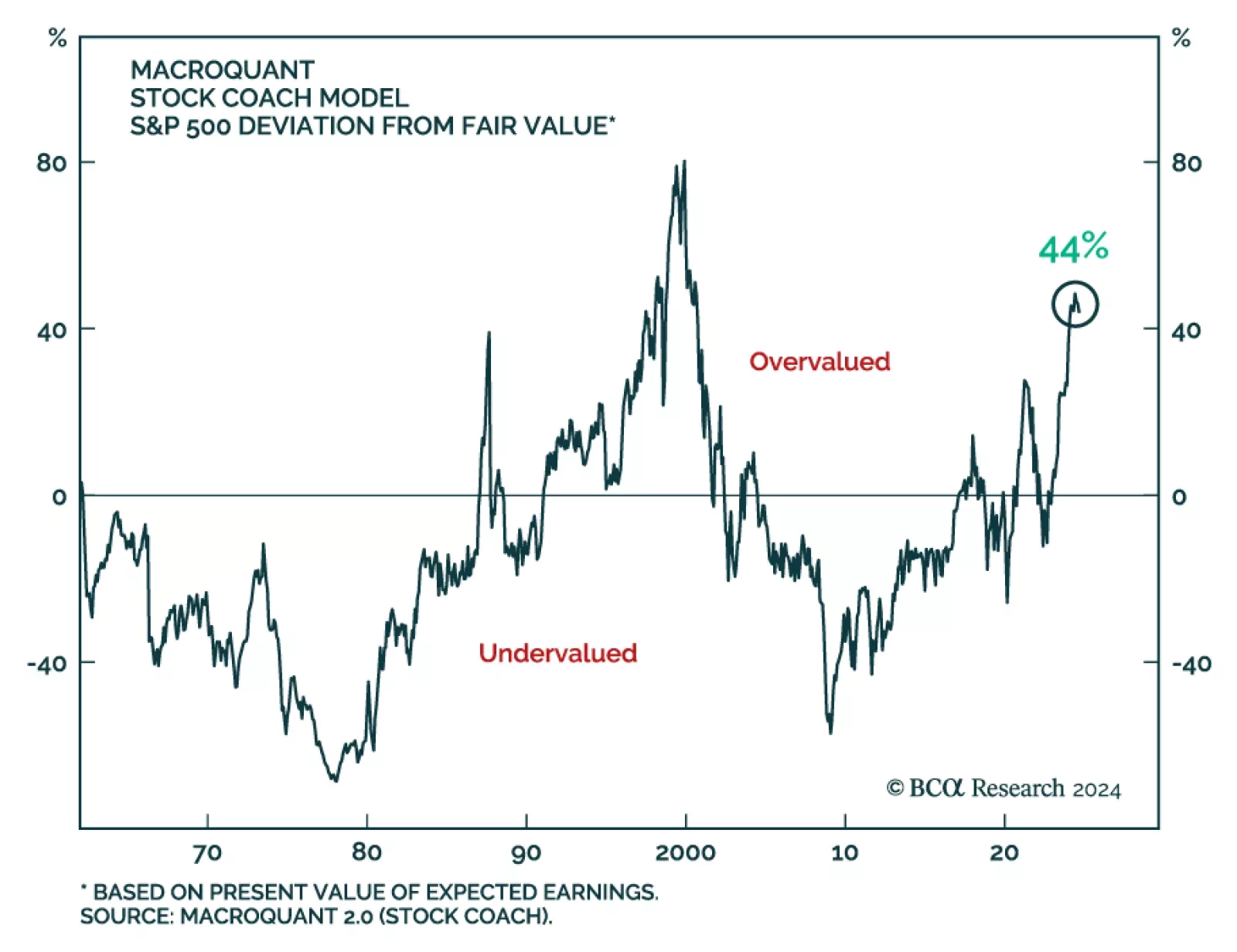

According to BCA Research’s Global Investment Strategy service, the imbalances in the US economy are sizeable enough to generate a mild recession. Unfortunately for equity investors, a mild recession would not preclude a…

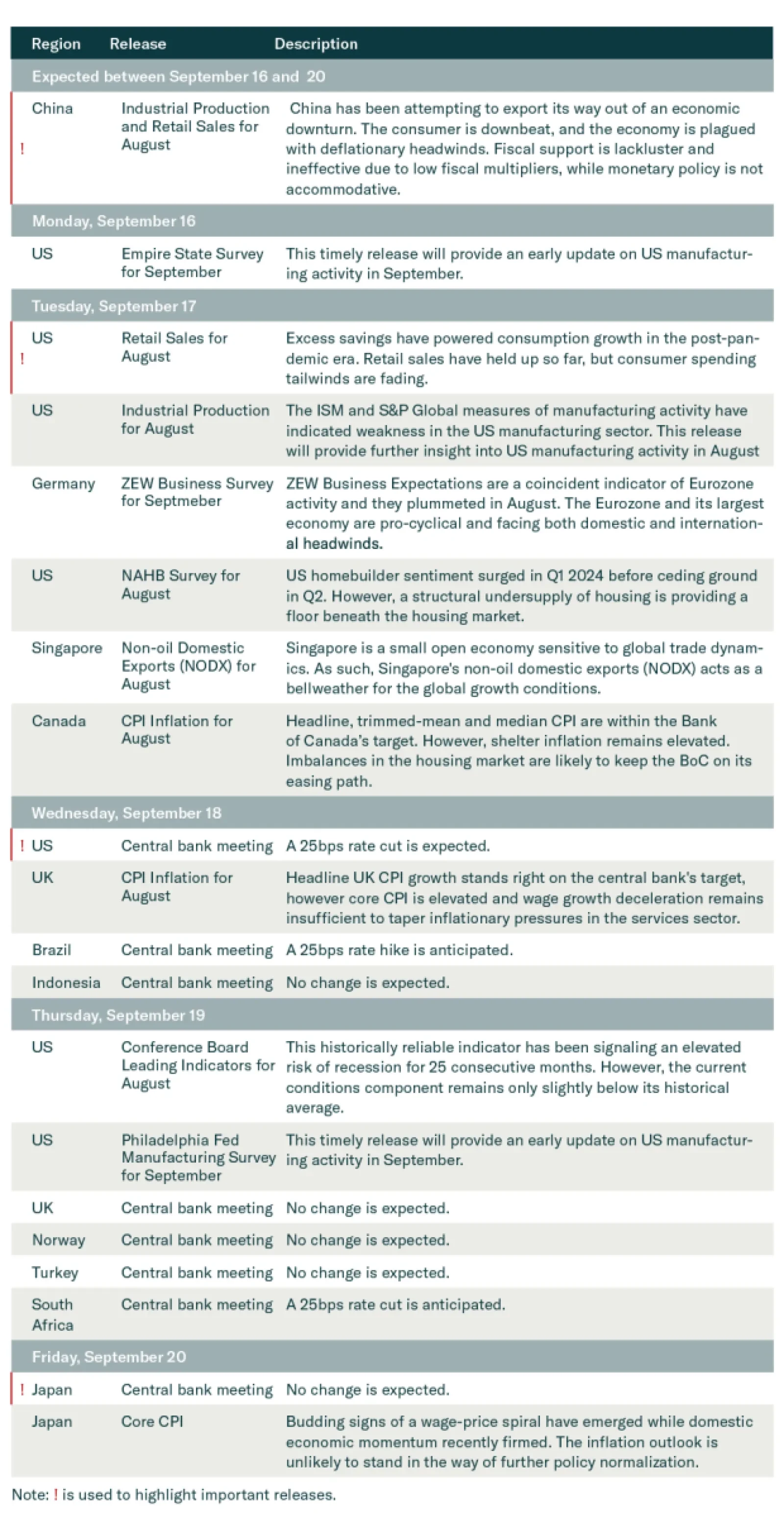

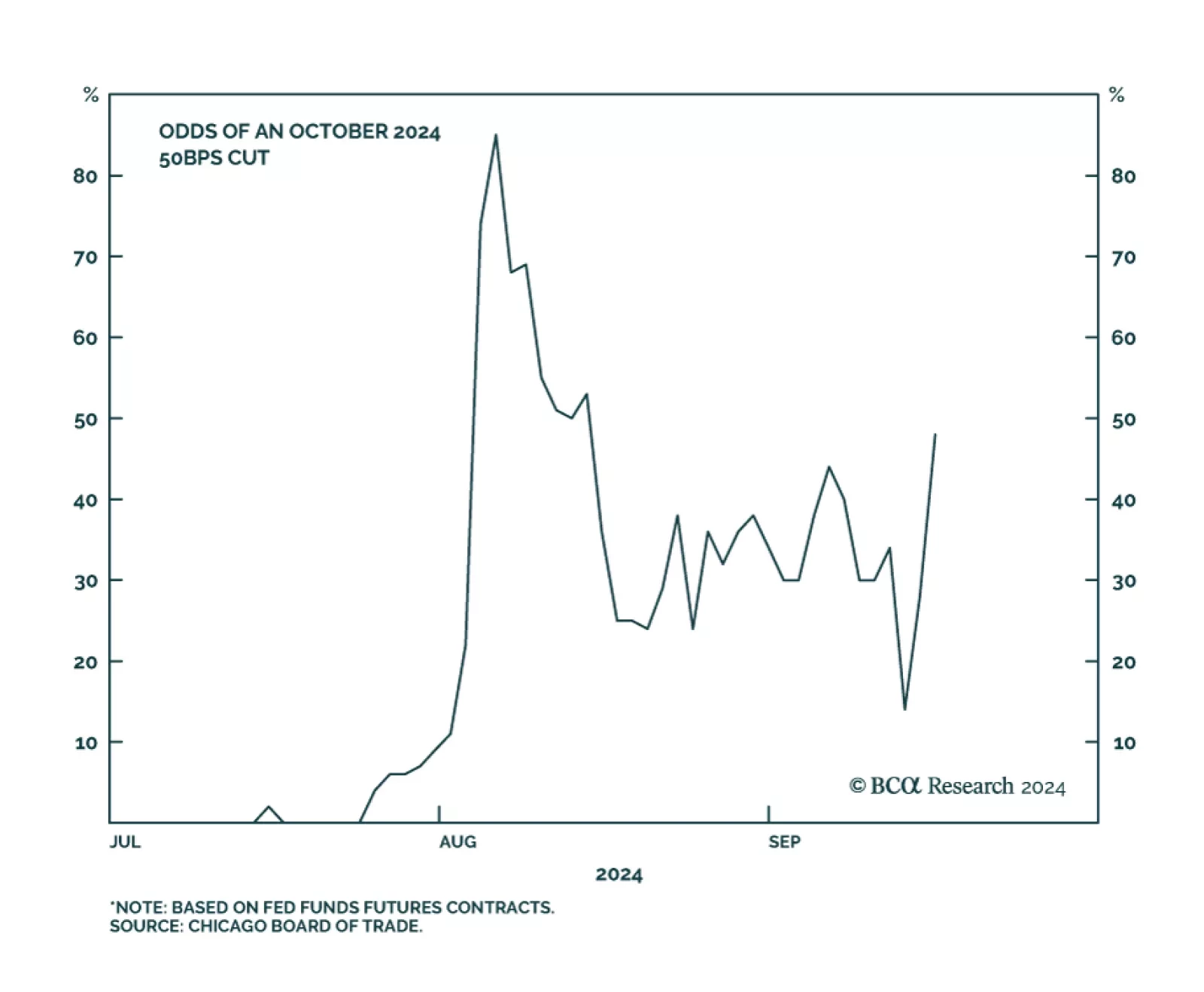

We noted earlier this month that the Fed would be unlikely to deliver a jumbo rate cut without telegraphing it first. President Williams' and Governor Waller’s September 6 speeches offered policymakers one last chance…

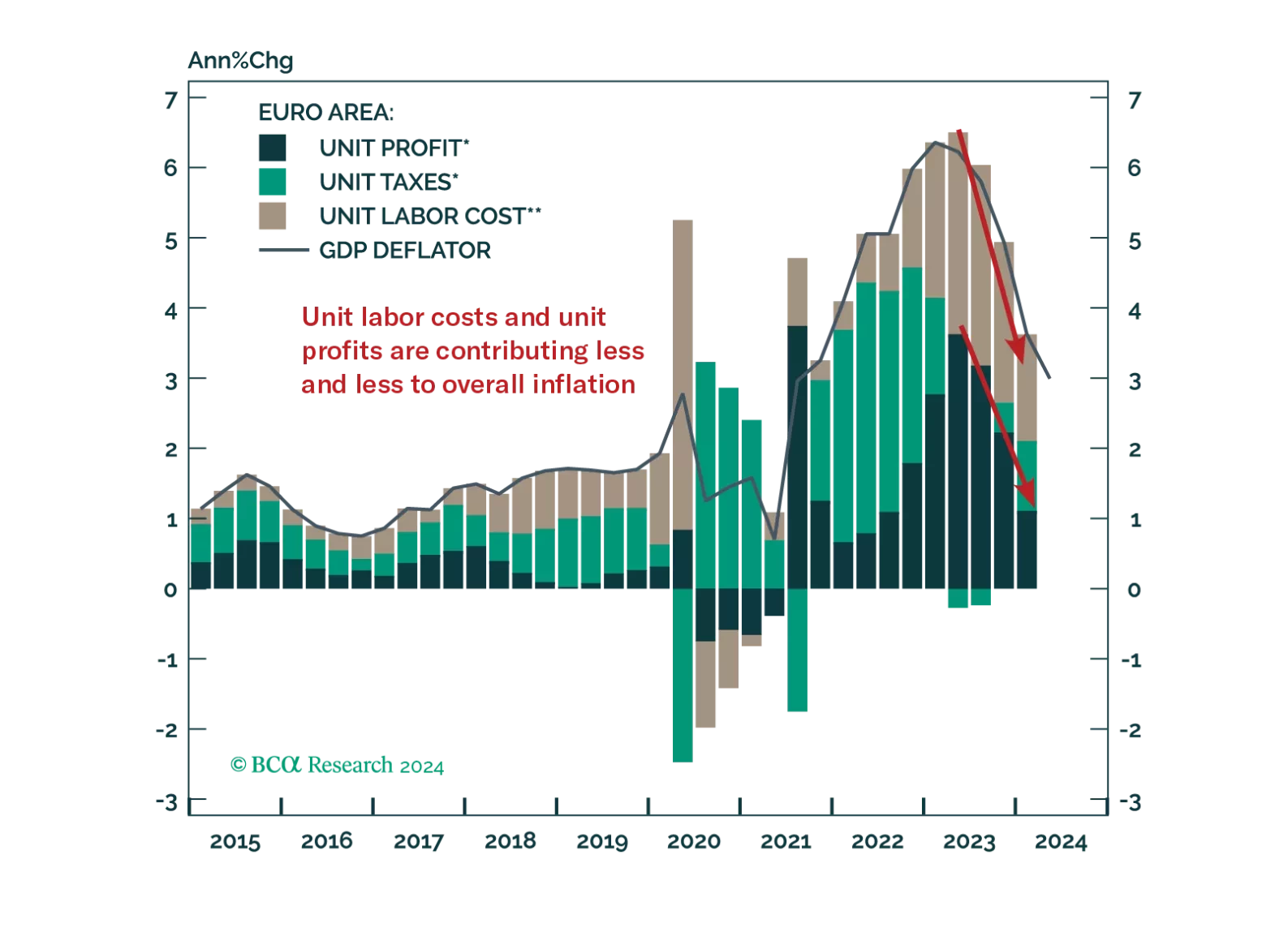

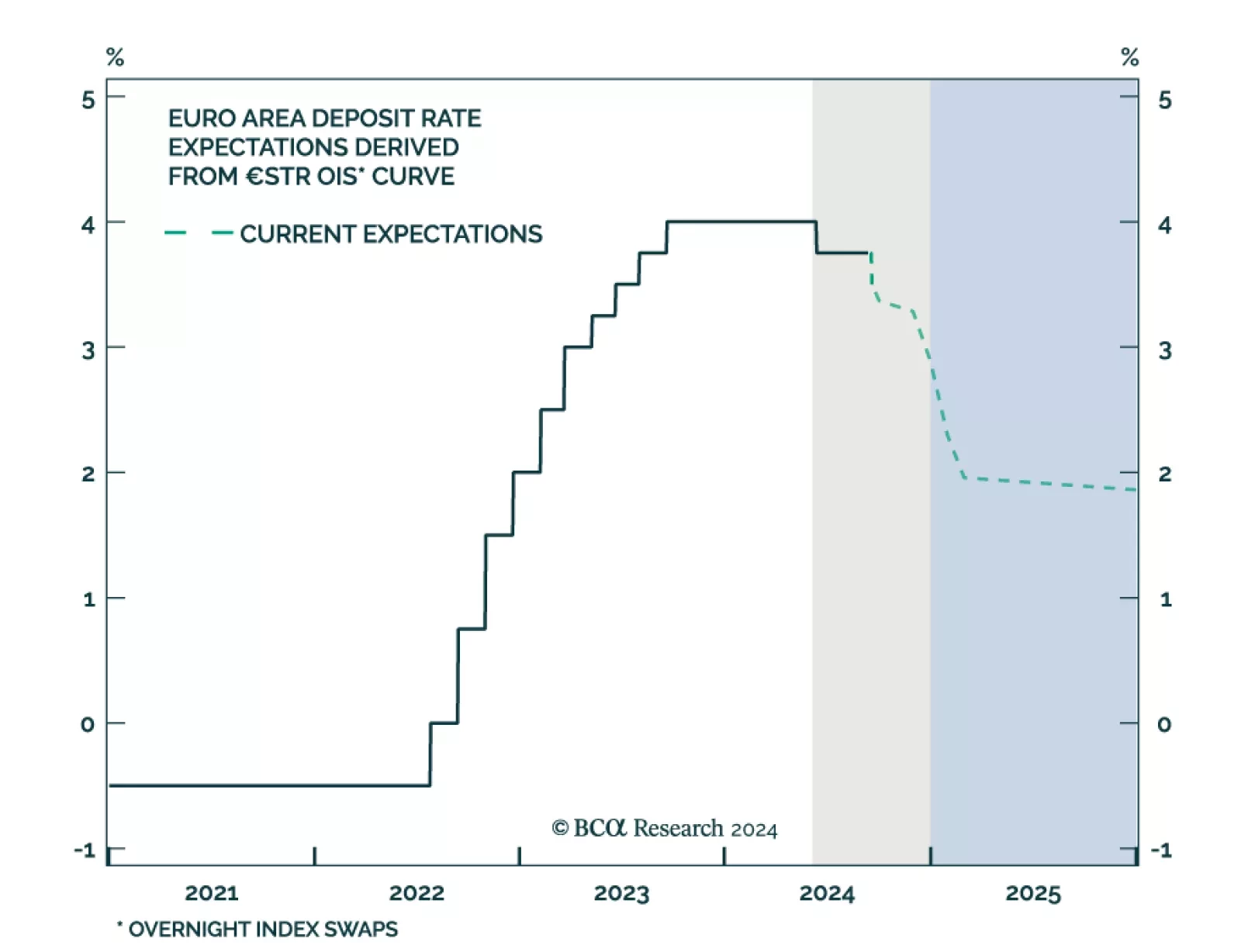

The ECB will cut rates once more this year; however, markets underprice how far it will ease next year.

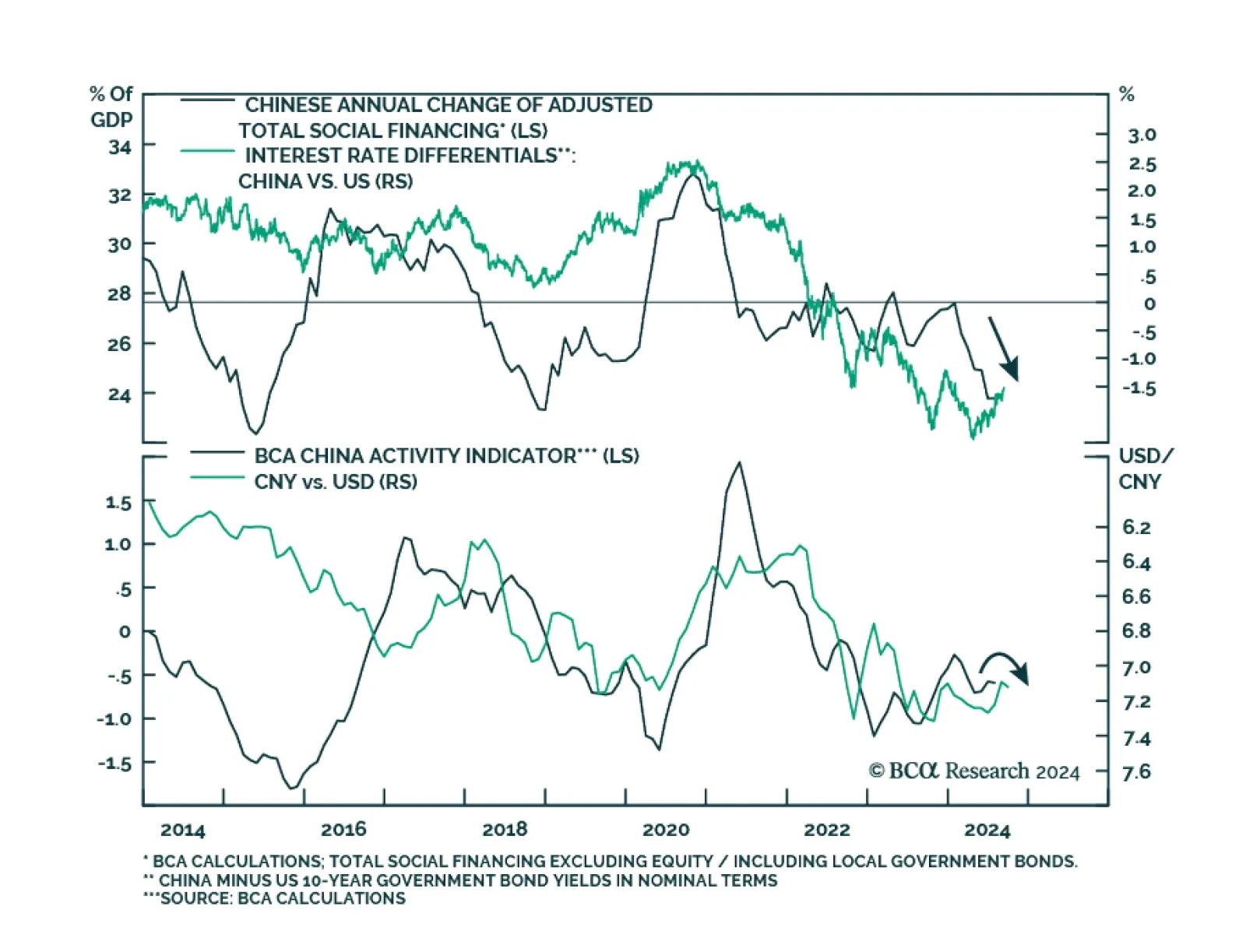

According to BCA Research’s China Investment Strategy service, the Fed’s upcoming rate cut will temporarily alleviate some of the downward pressure on the RMB, but beyond the short term the USD will likely rebound in…

ECB Governing Council members unanimously voted in favor of lowering the deposit facility rate by 25 bps to 3.50% in September, marking the second cut this year. Moreover, expectations for weaker domestic demand led the ECB to…

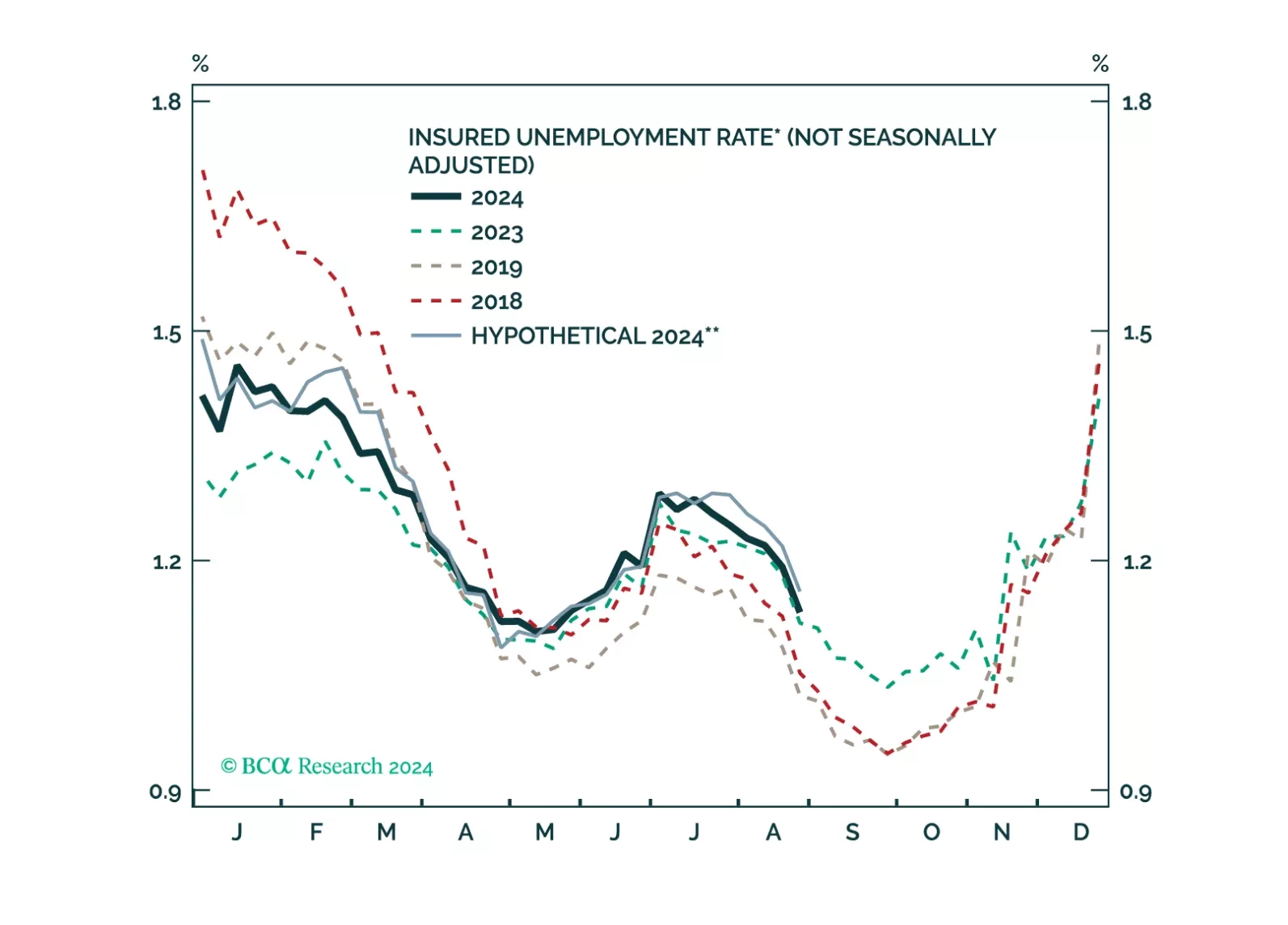

Some thoughts on this morning’s US claims report and a preview of next week’s FOMC meeting.

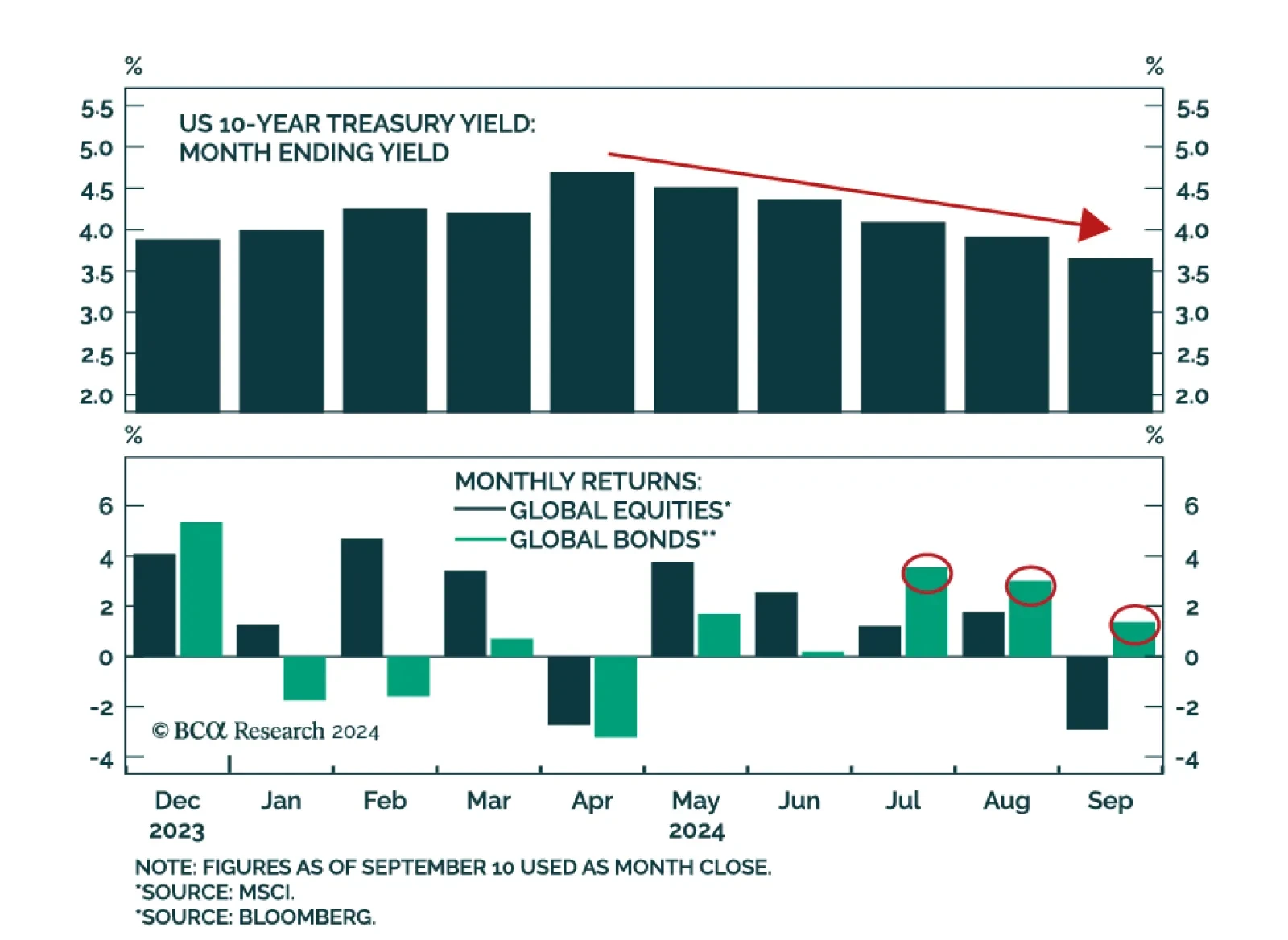

Despite global bond yields having trended lower since April, bonds have only started outperforming equities since July in US dollar terms. We expect this outperformance to persist going forward. Sentiment has largely driven…