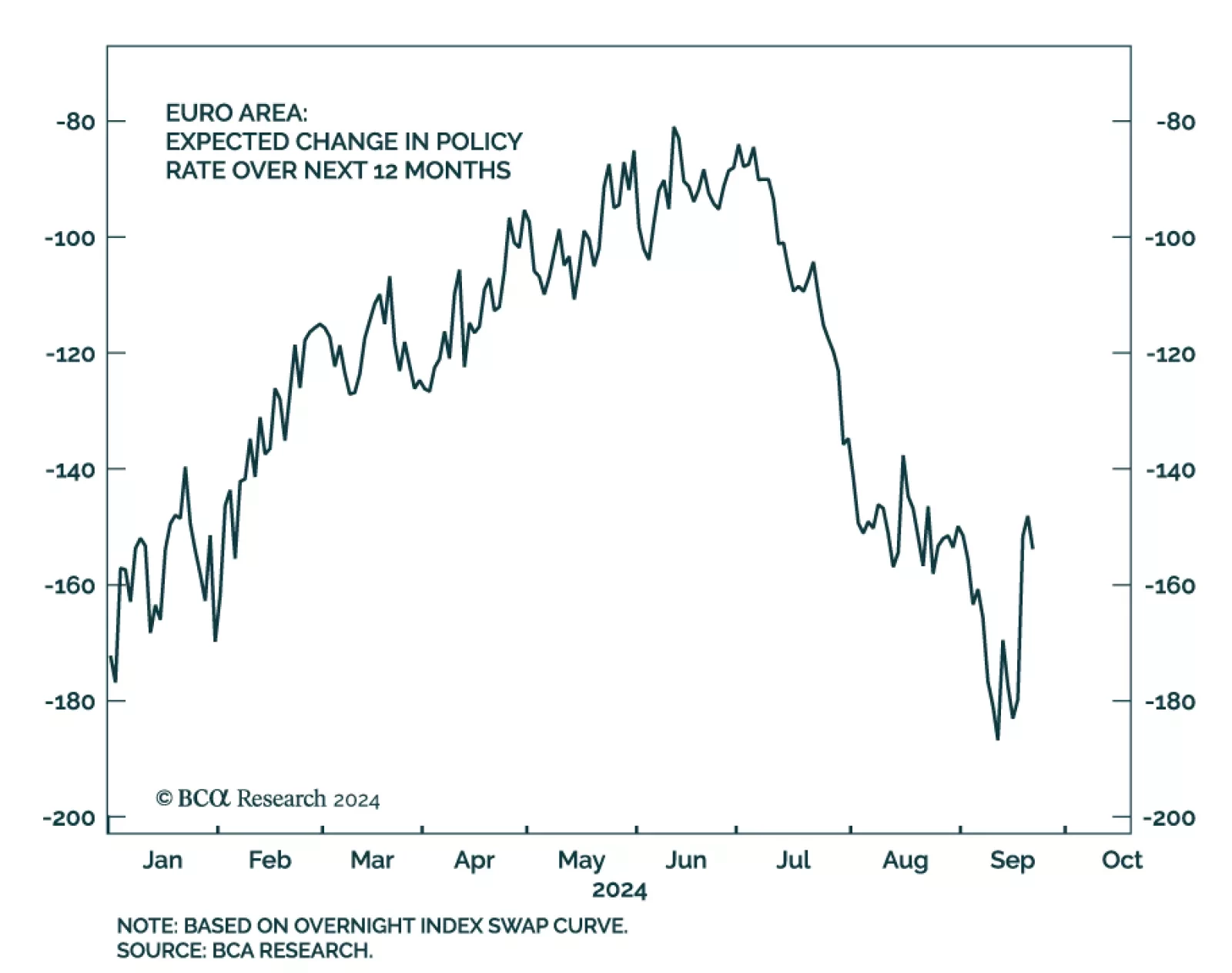

The European Central Bank (ECB) cut rates by 25 bps in September. It did not signal consecutive rate cuts and we highlighted that the short inter-meeting timeframe between September and October provides little scope for ongoing…

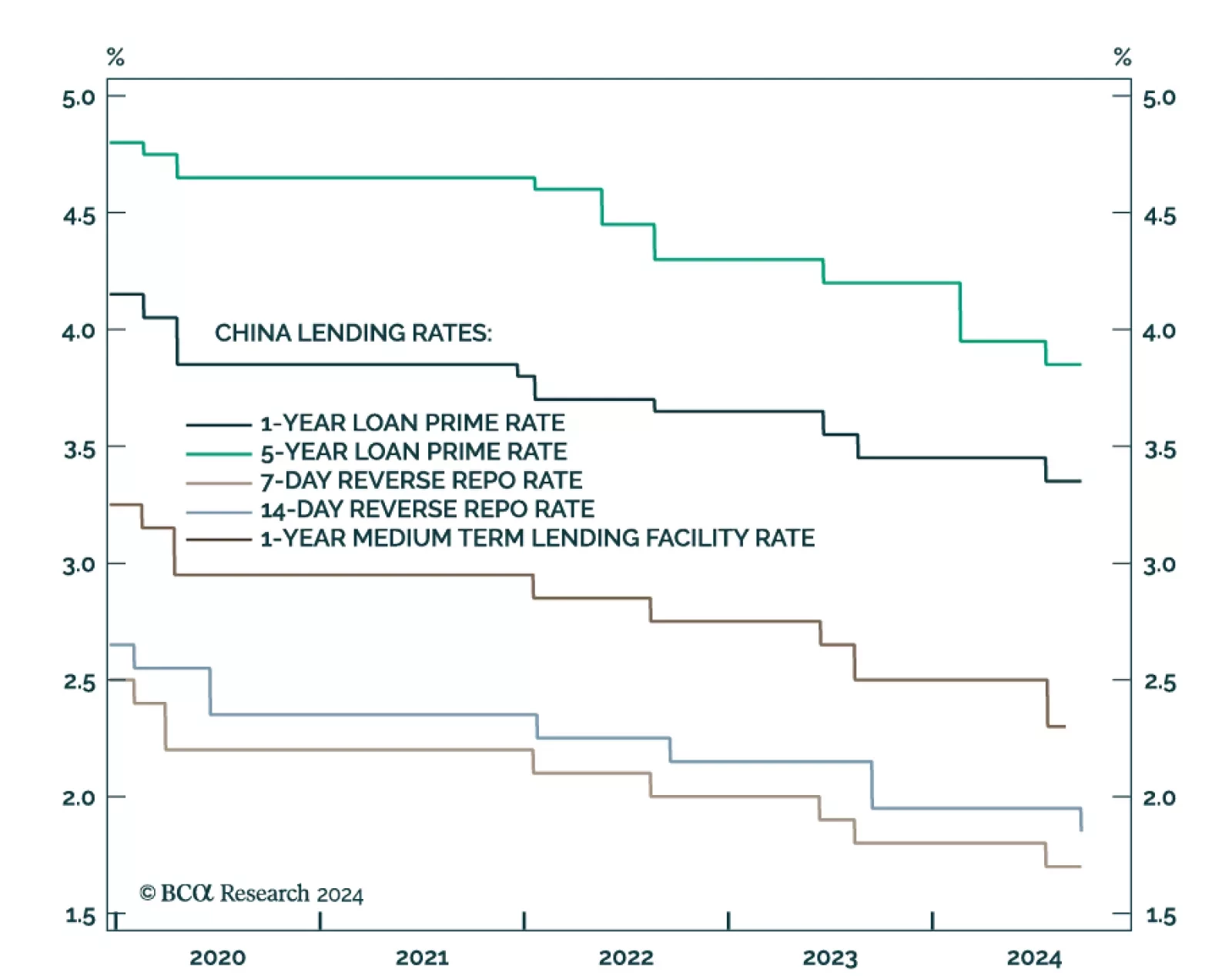

The PBoC lowered the 14-day reverse repo rate by 10 bps on Monday, a move that follows a string of easing measures in late July when the central bank lowered the 7-day reverse repo rate, several maturities of the loan prime rate…

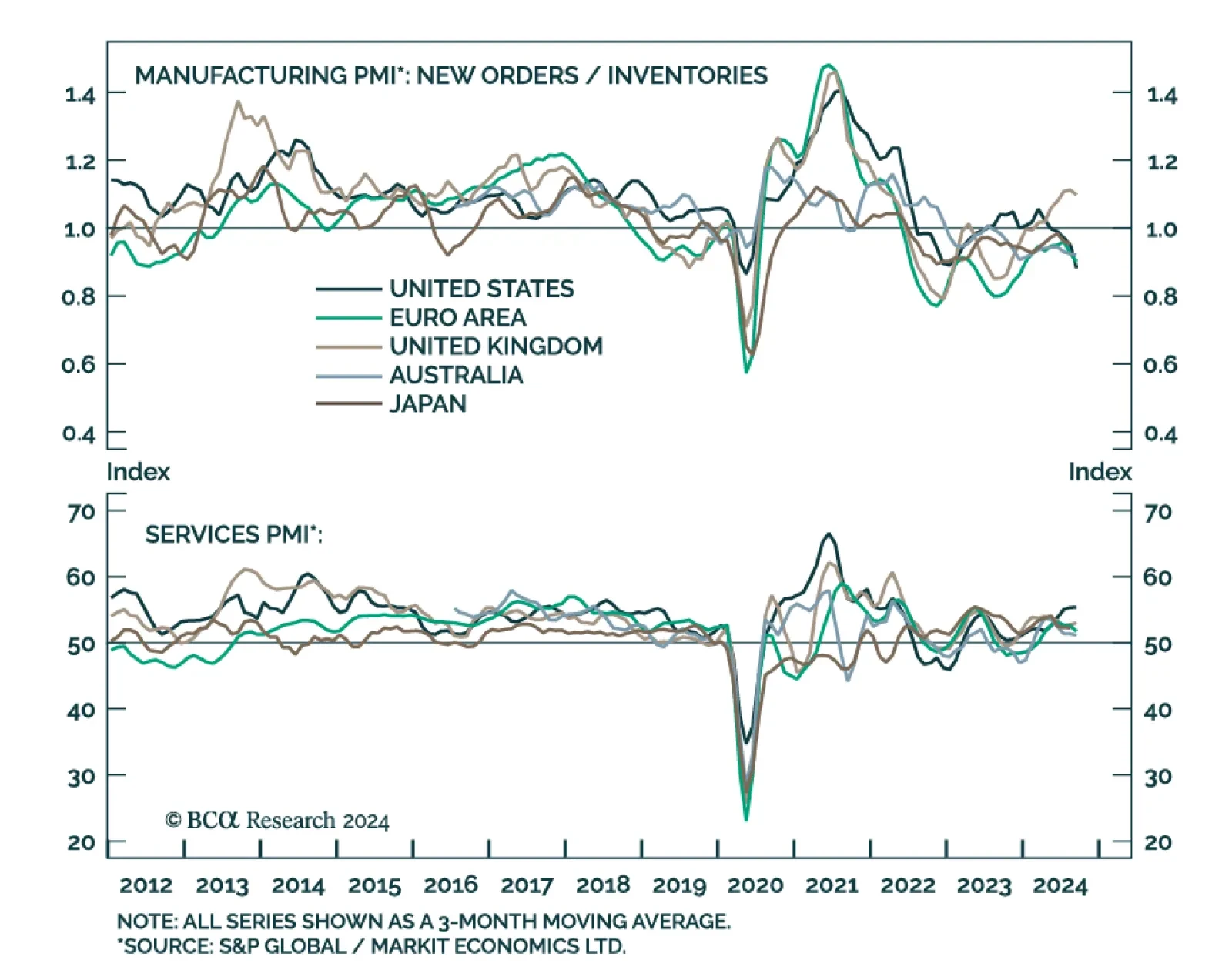

Preliminary estimates suggest that activity continued to slow across DM economies in September. Manufacturing PMIs contracted at a faster pace in the US, Eurozone, Germany, France and Australia, and grew at a slower pace in…

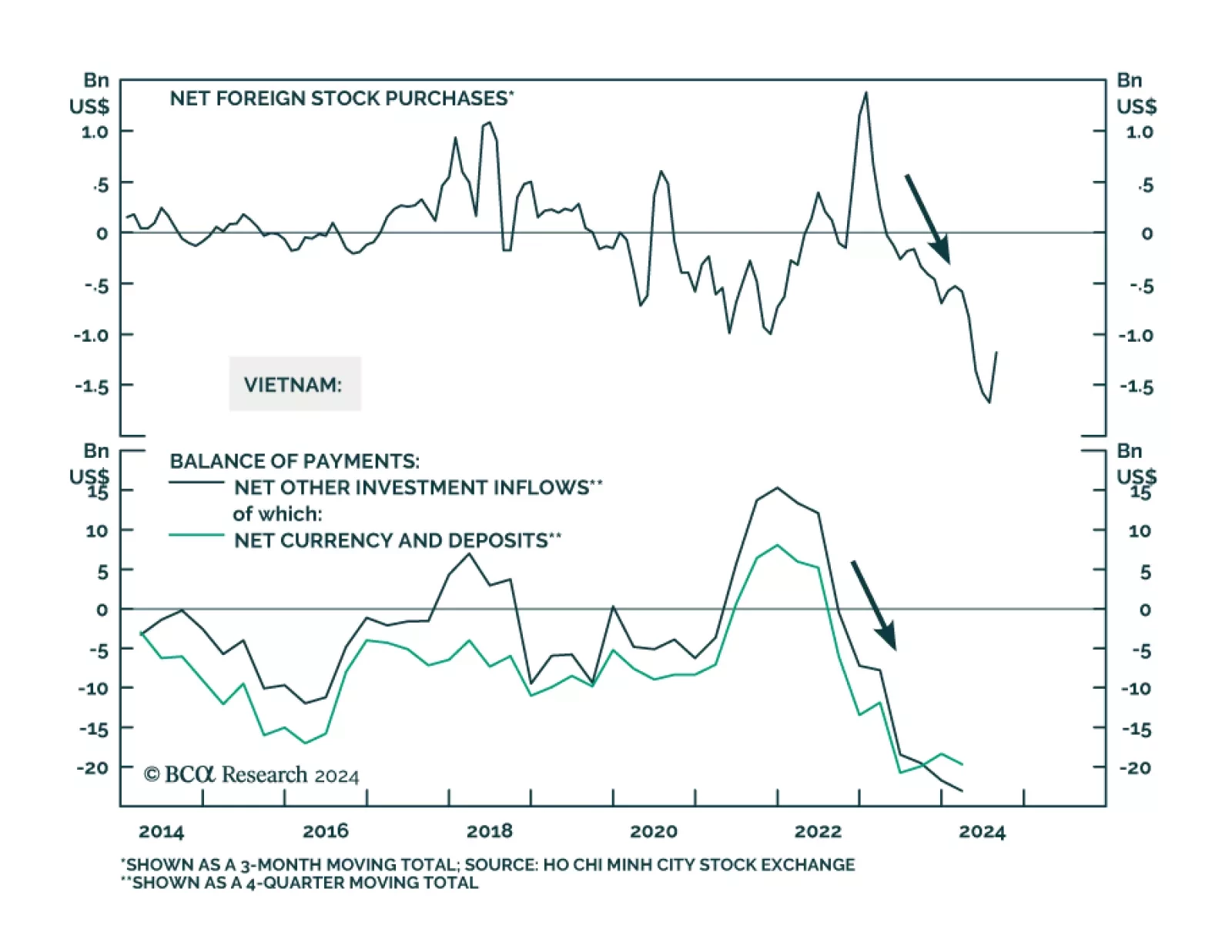

According to BCA Research’s Emerging Markets Strategy service, investor sentiment in Vietnamese markets has soured significantly since 2022, when the authorities' sweeping crackdown on alleged corruption in the real…

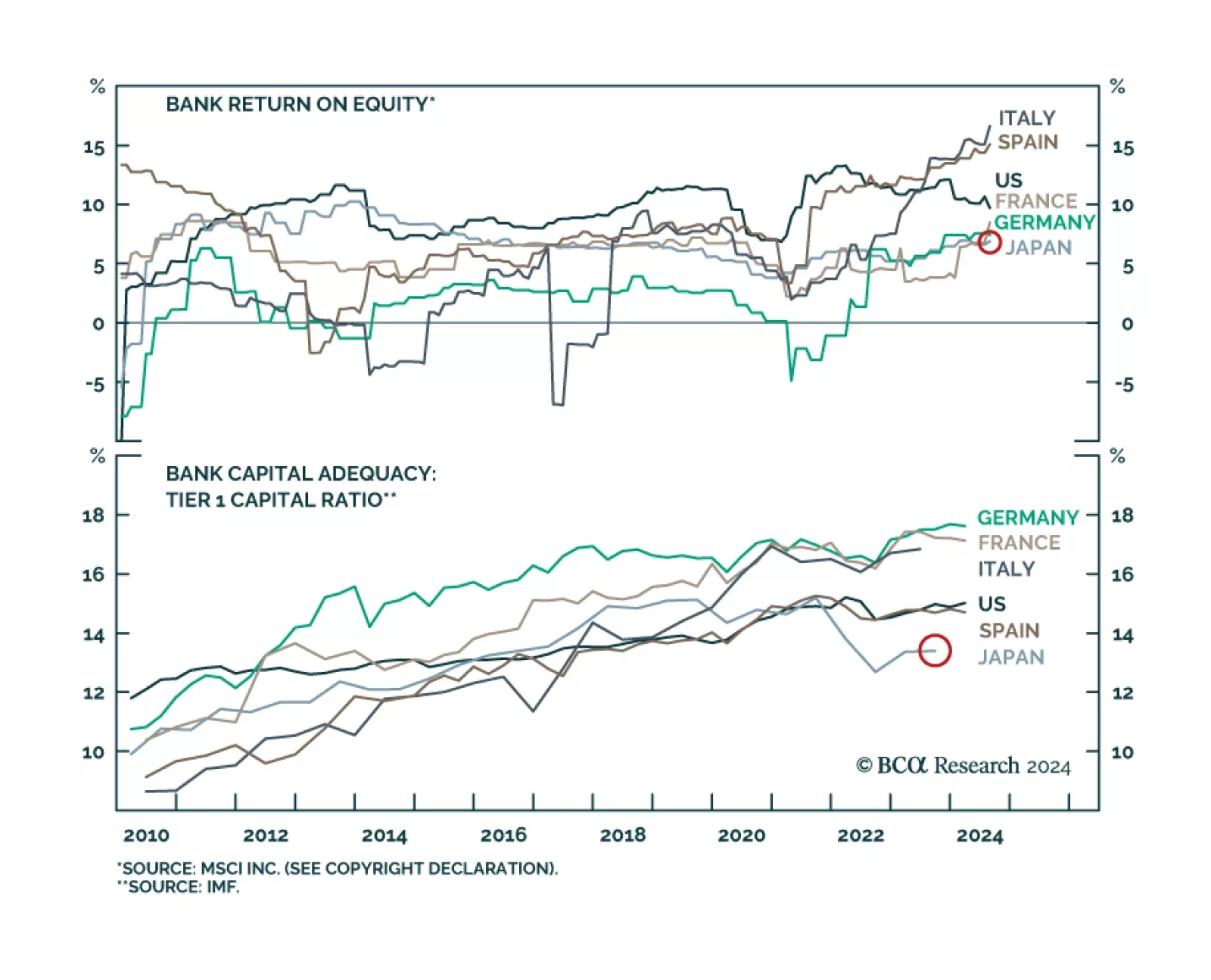

The Bank of Japan’s policy normalization has been accompanied by exceptional outperformance by Japanese banks. Japanese banks have outperformed both the country’s broader market as well as the MSCI ACW Banks index by…

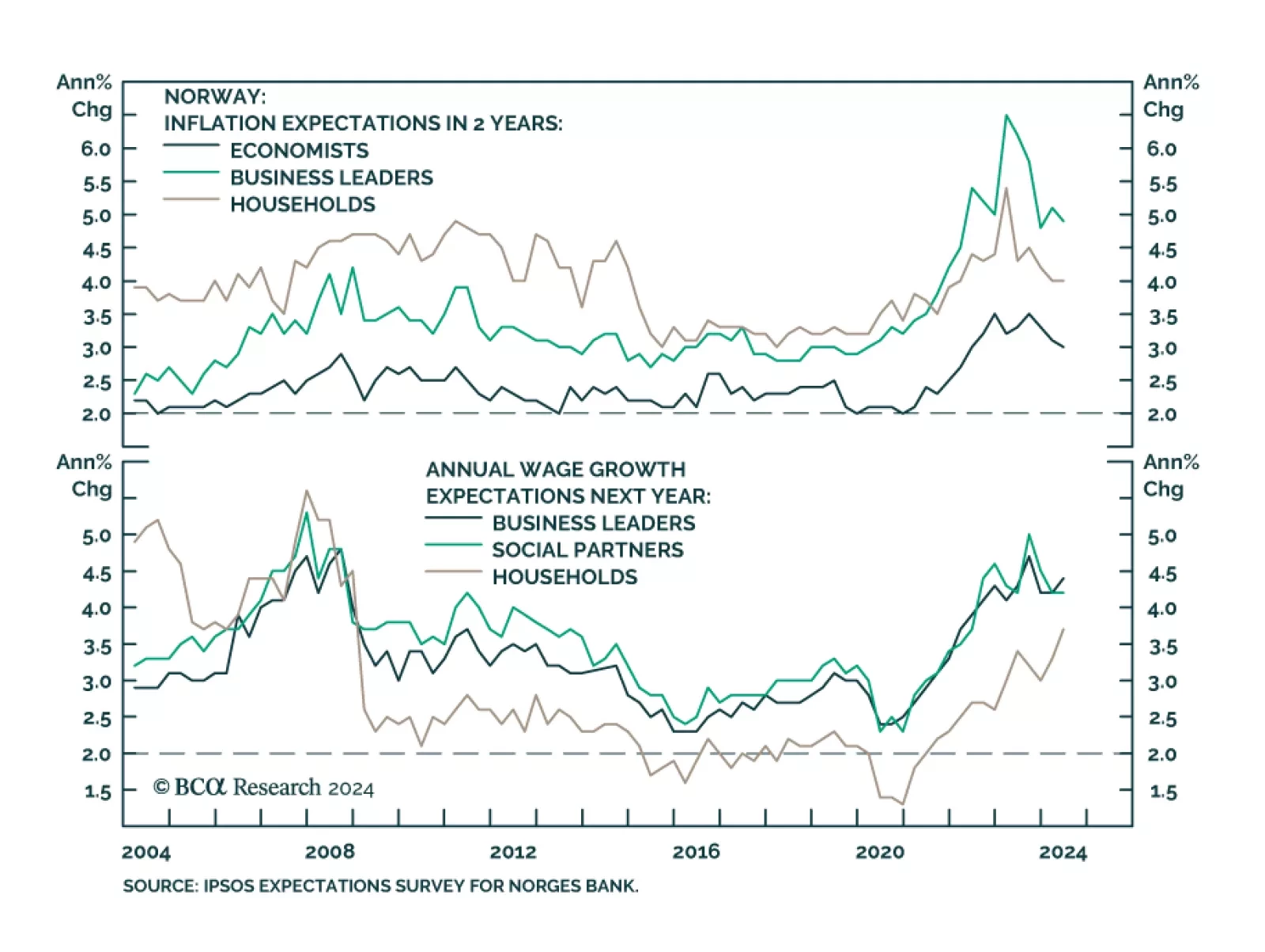

The Norges Bank kept its policy rate unchanged at 4.5% at its September meeting and signaled low odds of policy easing before the first quarter of 2025. The inflation backdrop does not warrant easing policy. Although core CPI…

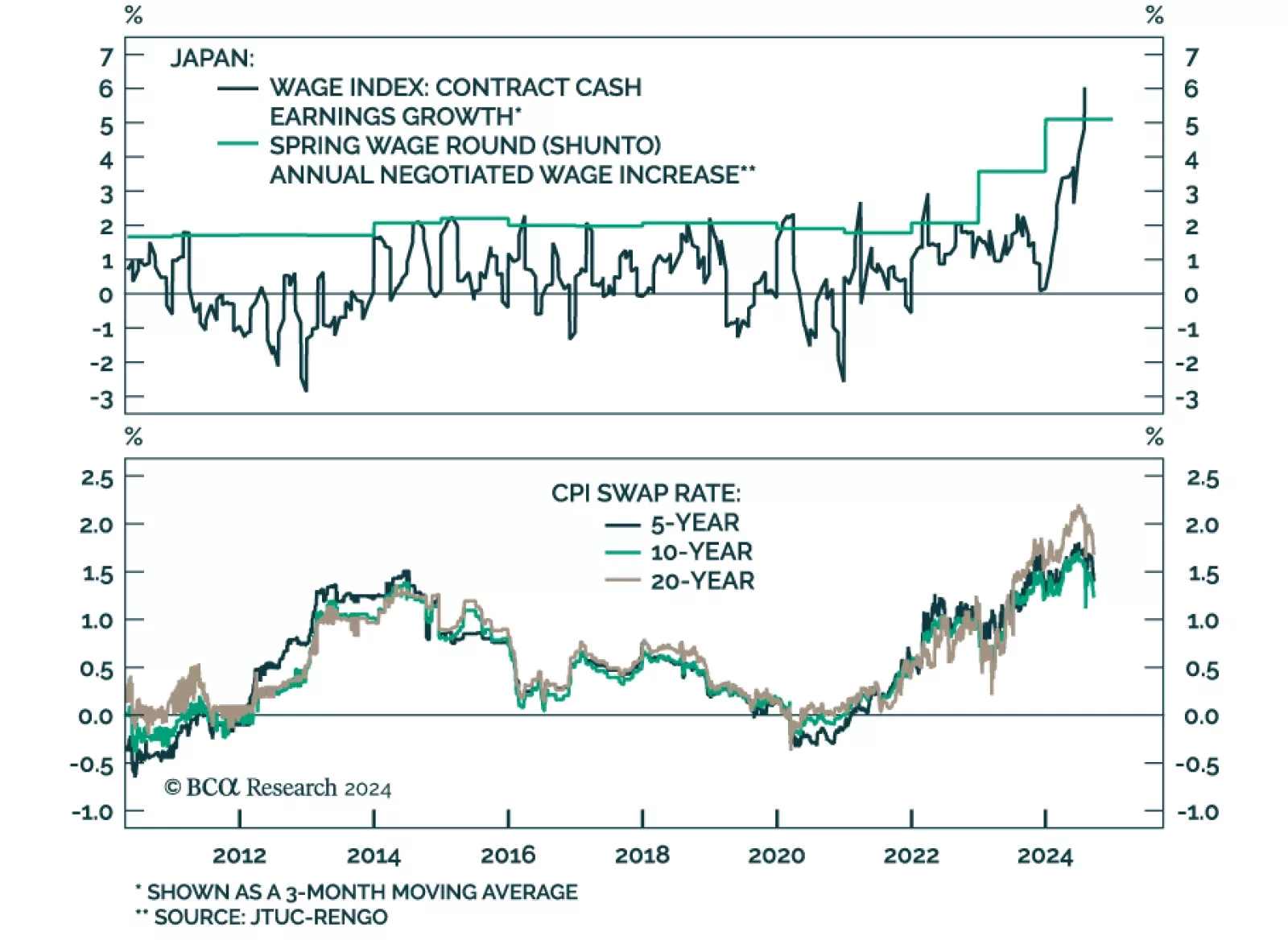

The Bank of Japan kept its policy rate unchanged at 0.25% in September and signaled it was in no rush to lift rates further. This move follows two hikes this year, one of them unanticipated. The signaling is consistent…

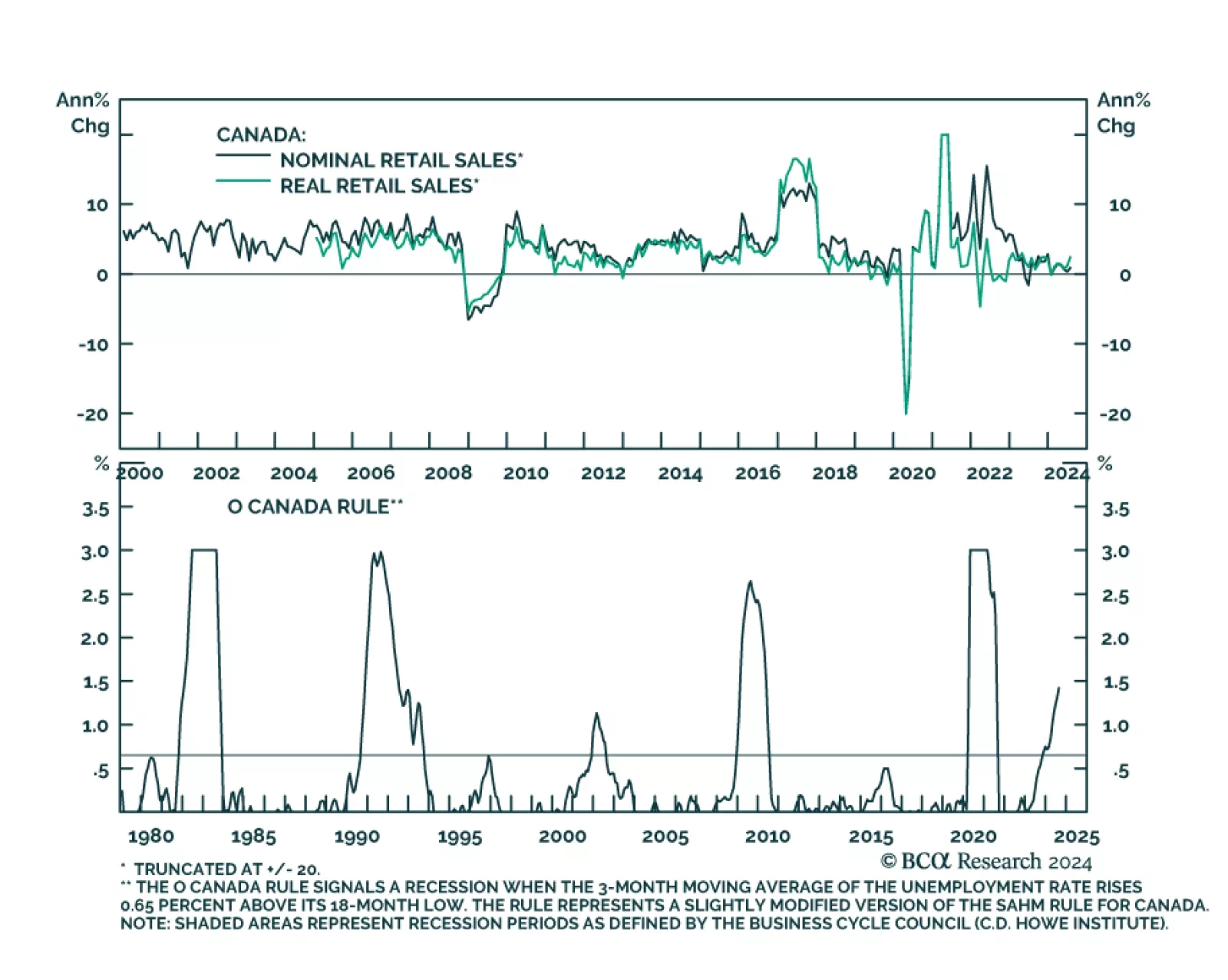

Canadian retail sales grew by a higher-than-expected 0.9% m/m in July from a 0.2% contraction in June. A 2.2% monthly rise in vehicle sales led an otherwise broad-based increase. Ex-auto retail sales also surprised positively,…

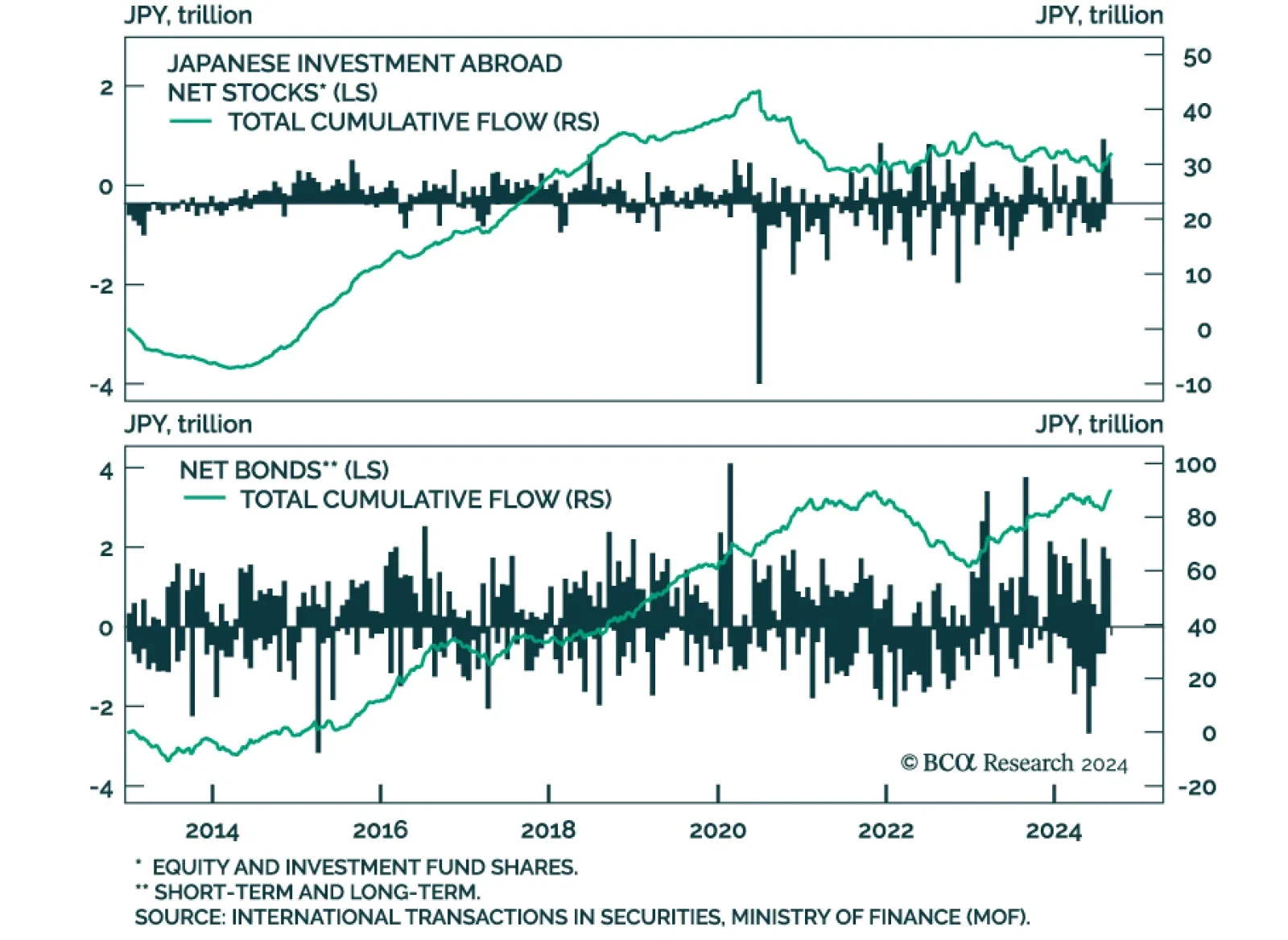

According to BCA Research’s Foreign Exchange Strategy and Global Investment Strategy services, most carry investors have covered their positions. Away from day-to-day noise, the longer-term trajectory of yen exchange rates…

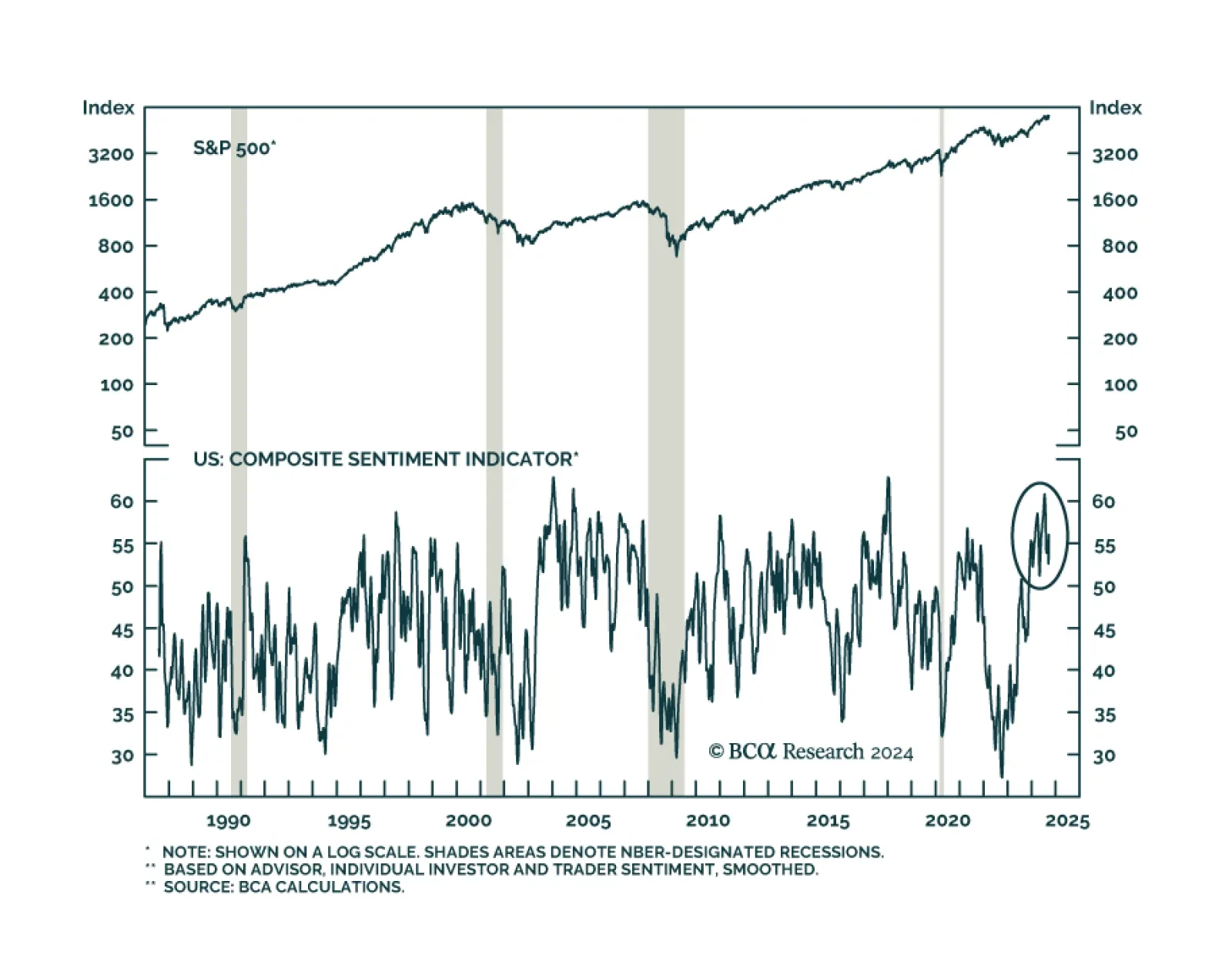

One key takeaway from Wednesday’s post-FOMC press conference is the Fed’s unshaken conviction that it can avoid a recession. A risk-on mood dominated markets on Thursday, with the S&P 500 breaching new all-time…