This report looks at the likely path for the dollar and bond yields over the next 6-to-12 months.

The bond market priced out a lot of recession risk after this morning’s employment report, and the 10-year Treasury yield has moved back into the Soft Landing Zone. We assess the data and consider whether we need to change our…

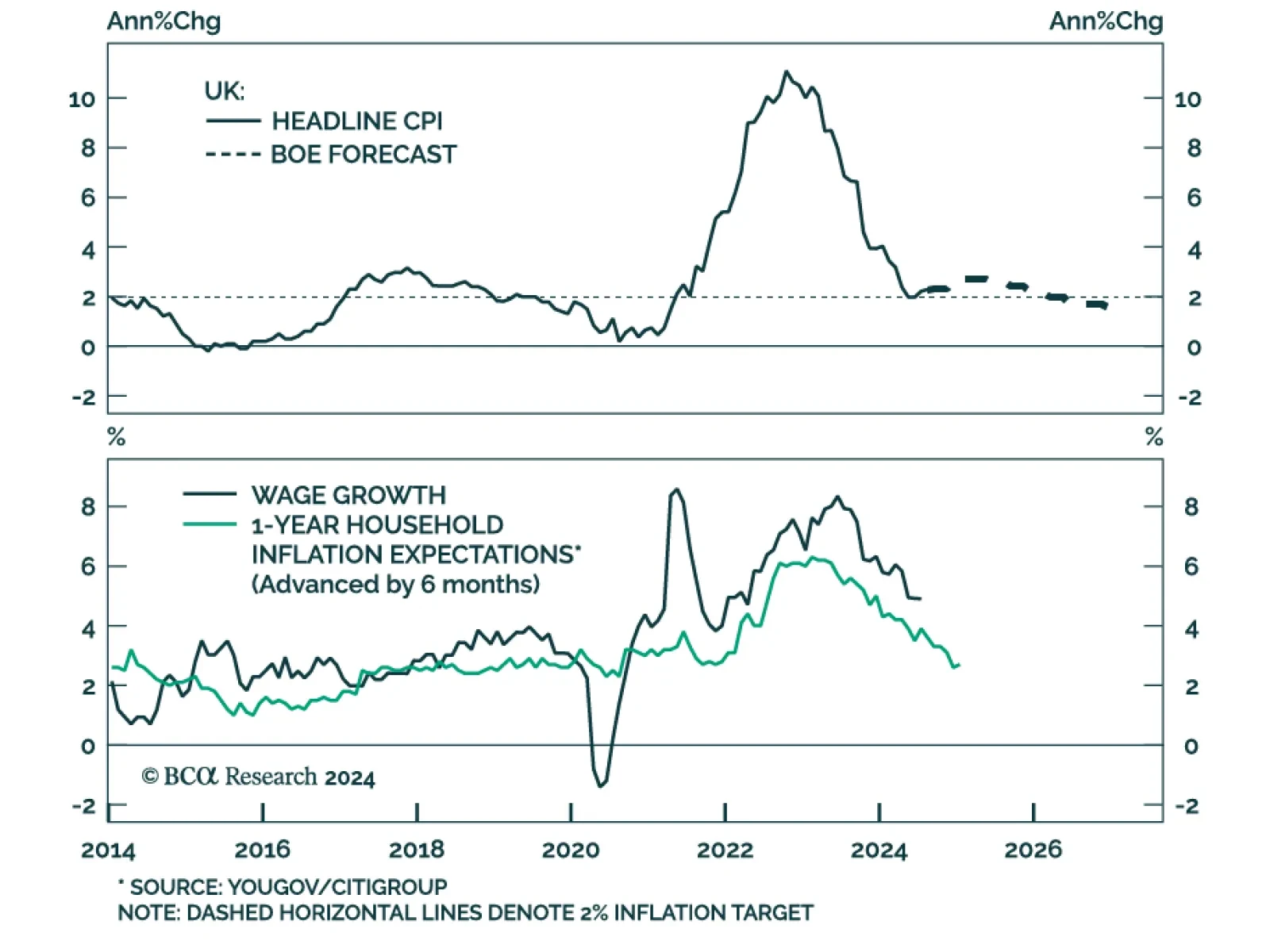

Comments from Bank of England Governor Andrew Bailey on Thursday, hinting at “a more aggressive” pace of rate cuts, marked a shift in rhetoric from previous meetings which signaled a “gradual” pace. The…

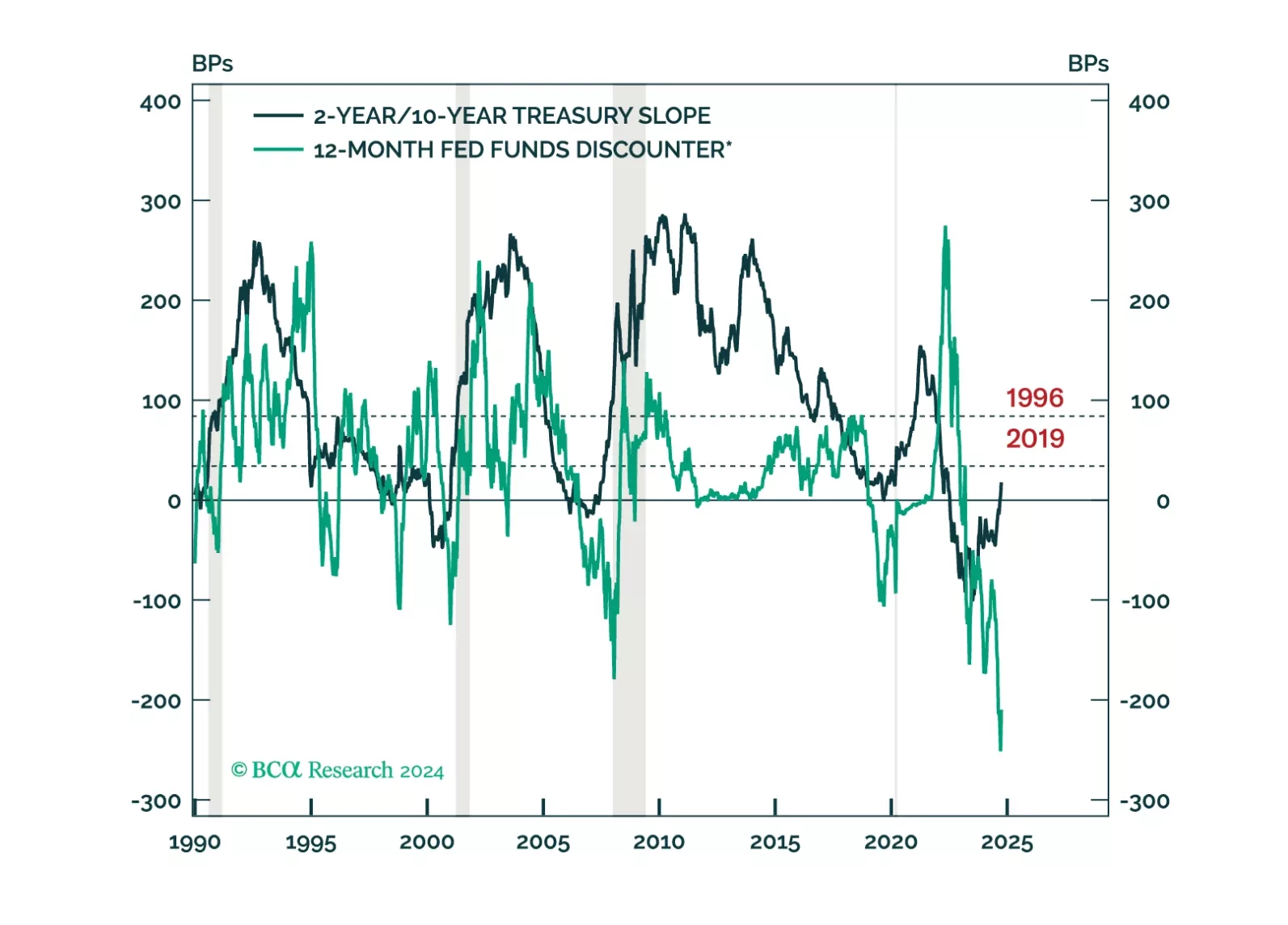

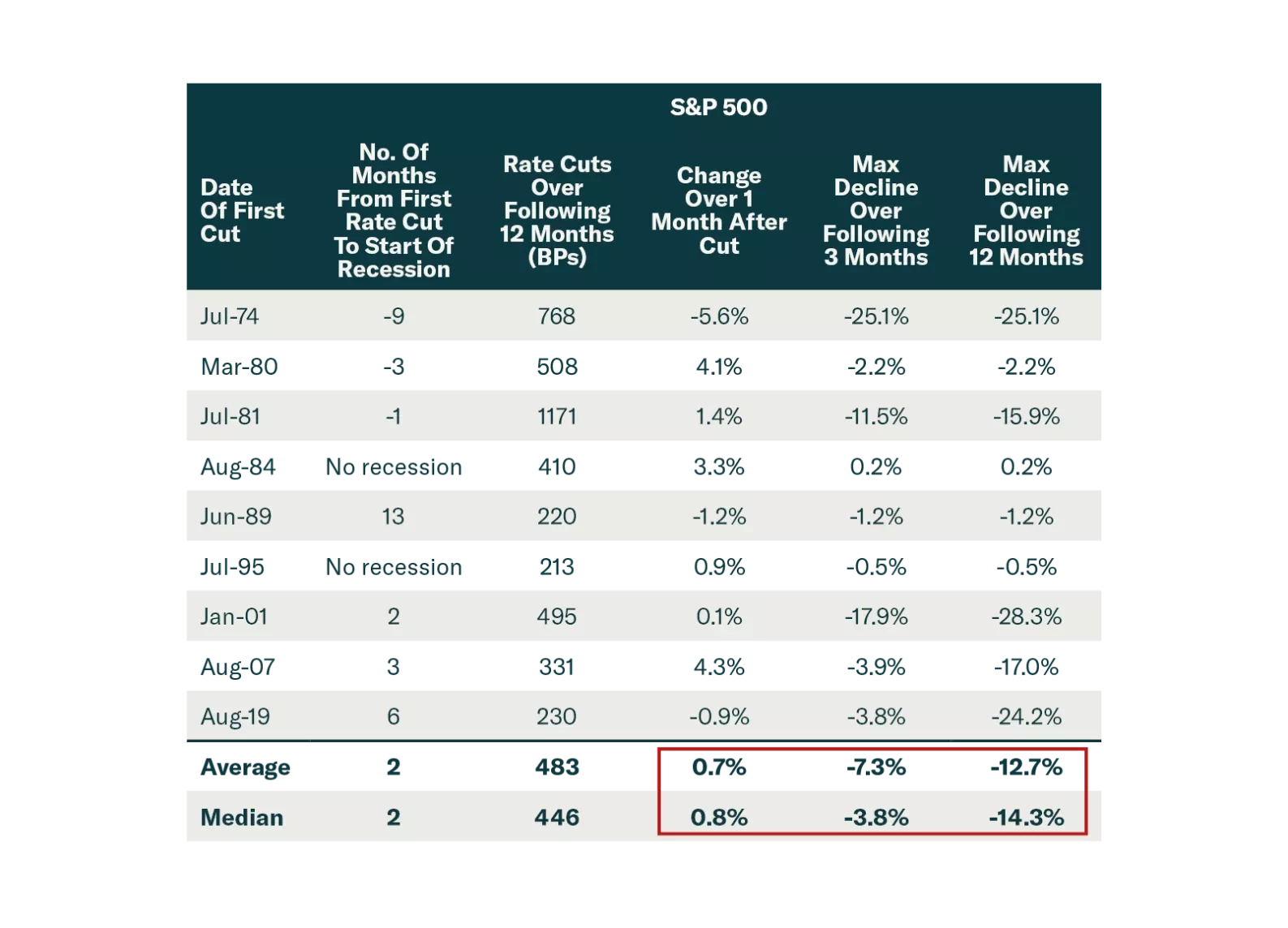

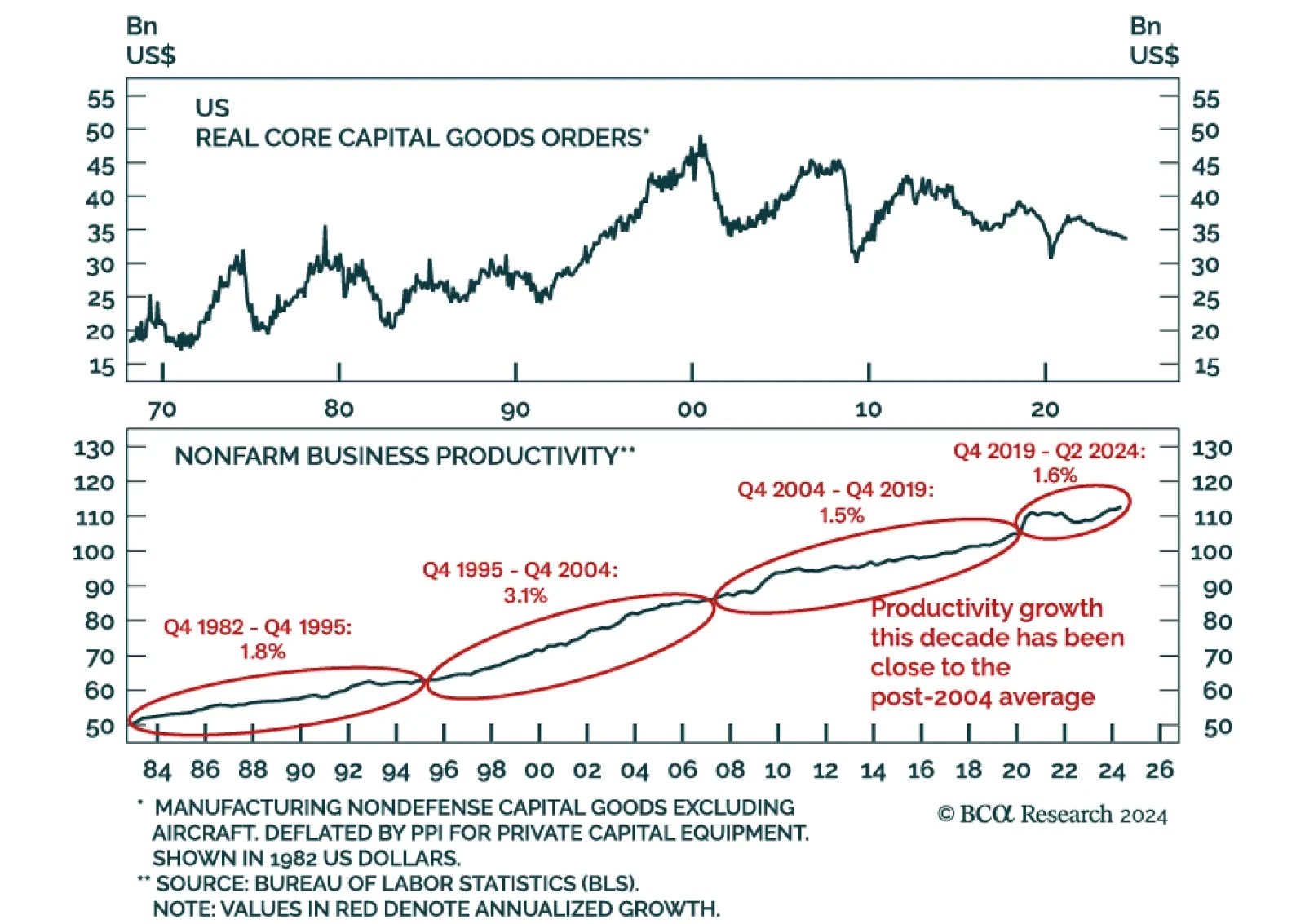

According to BCA Research’s Global Investment Strategy service, the consensus expectation of a soft landing is wishful thinking. Many investors have pointed to the mid-1990s as an example of when Fed easing paved…

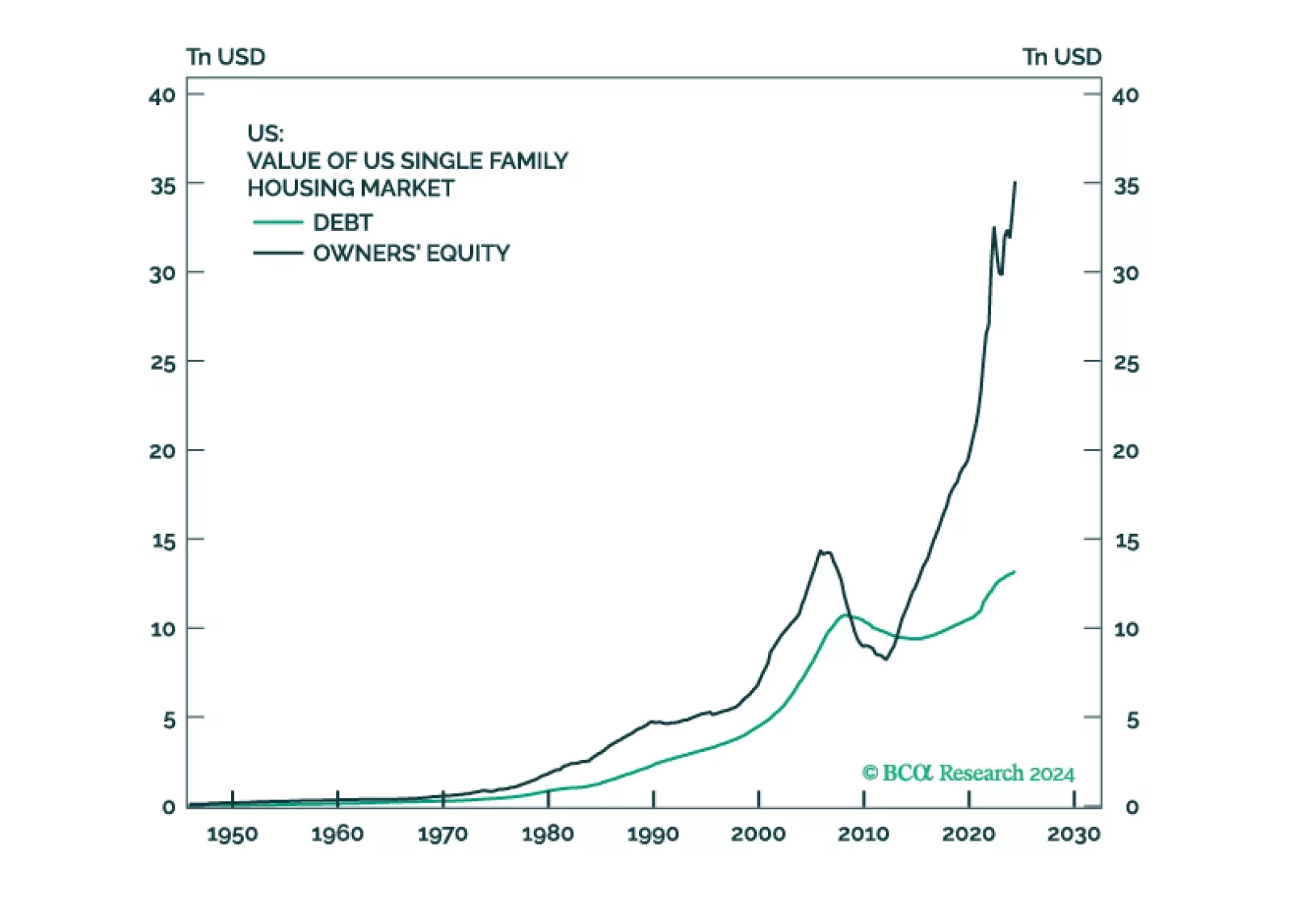

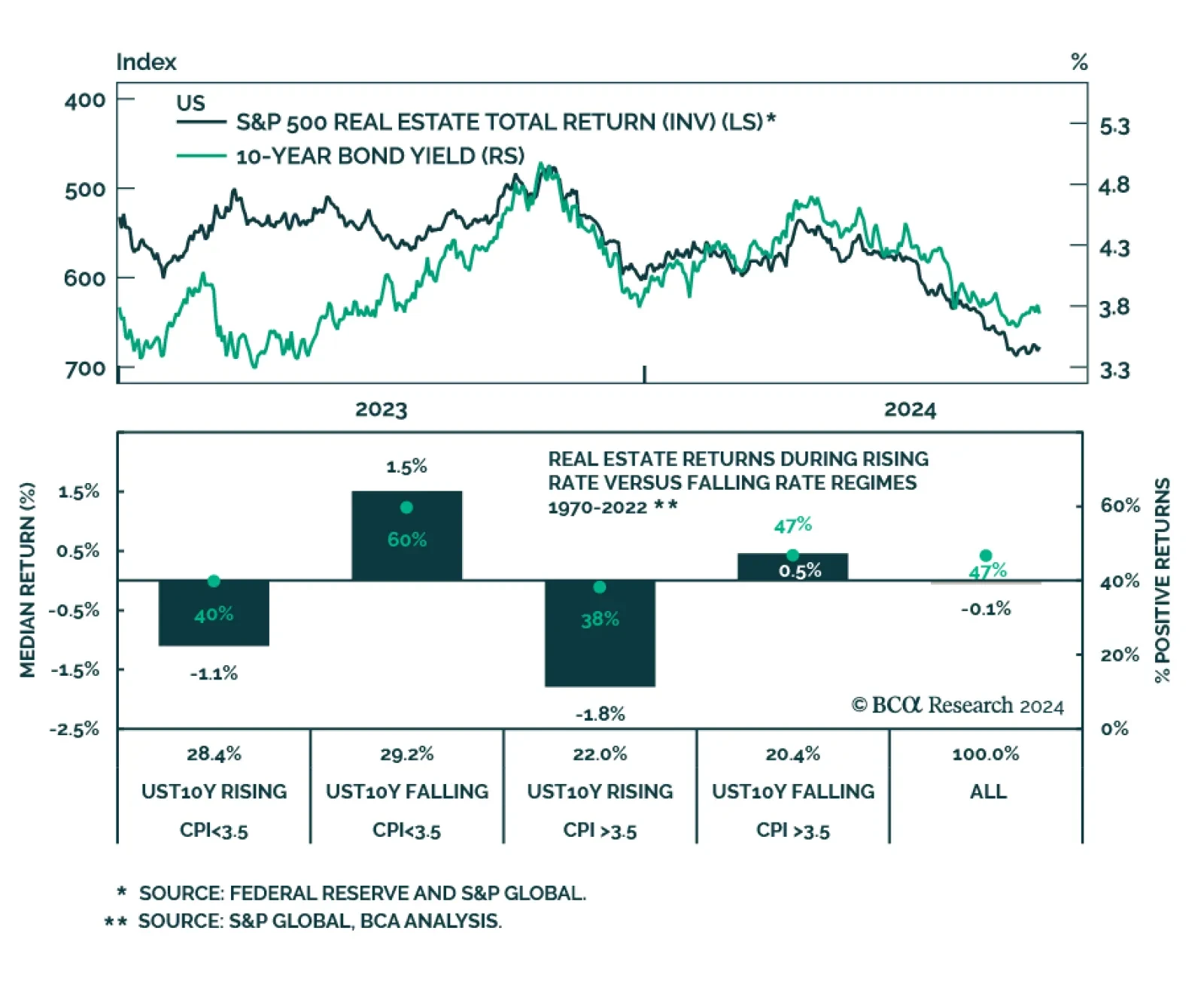

The prospects of Fed rate cuts powered the S&P 500 Real Estate index’s rally. Real estate was the best-performing sector in Q3, outperforming the S&P 500 by nearly 12%. Can this sector pursue its lead now that…

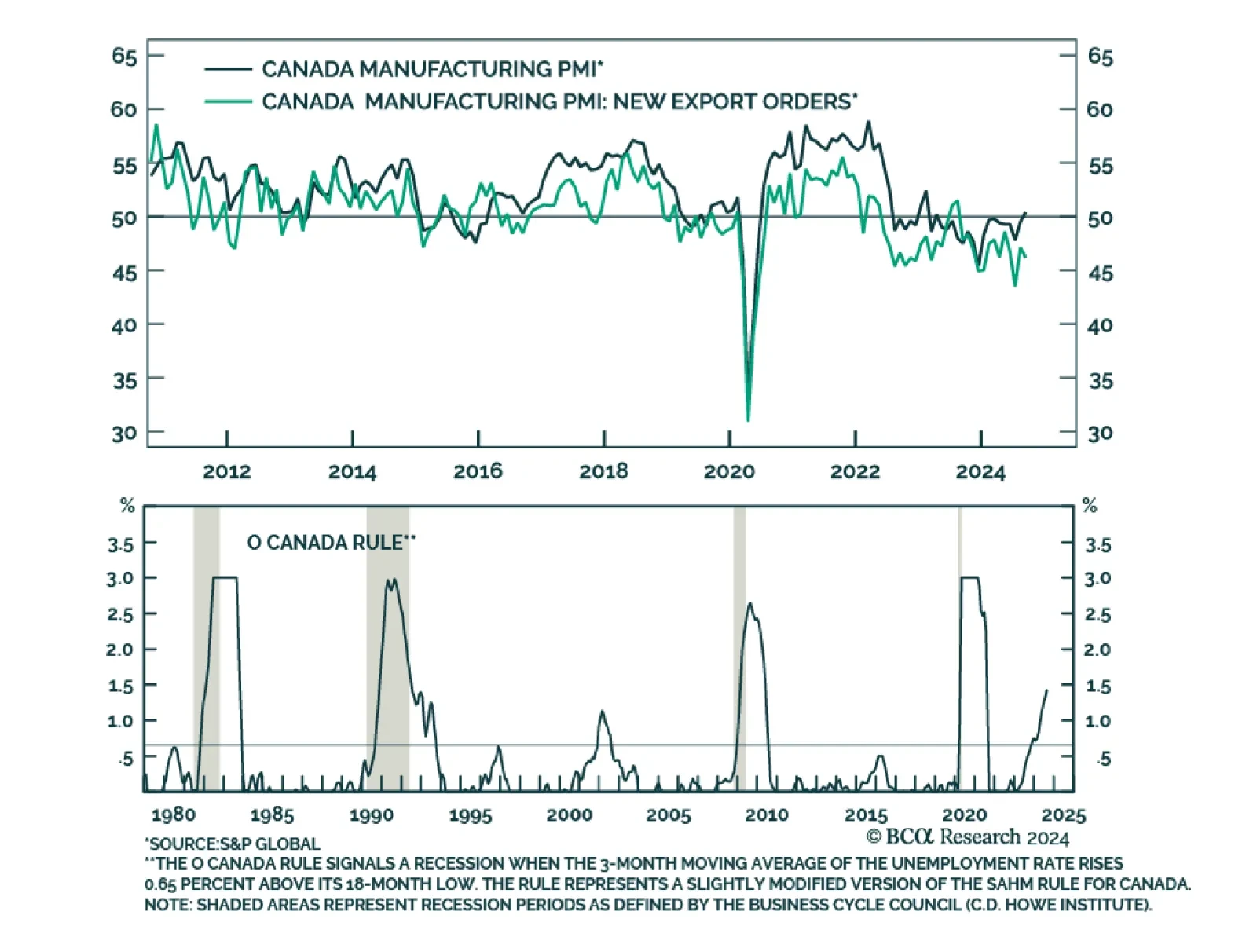

The S&P Global Canada Manufacturing PMI improved from 49.5 to 50.4 in September, breaking a 17-month contraction streak. It corroborated solid broad-based retail sales growth in July and August. Confidence in the outlook also…

October seasonality tends to be negative for stocks in an election year. That is the only thing that has stayed our hand from shifting out of our tactical underweight on US equities, initiated – poorly – in July.

But the big macro…

Our Portfolio Allocation Summary for October 2024.

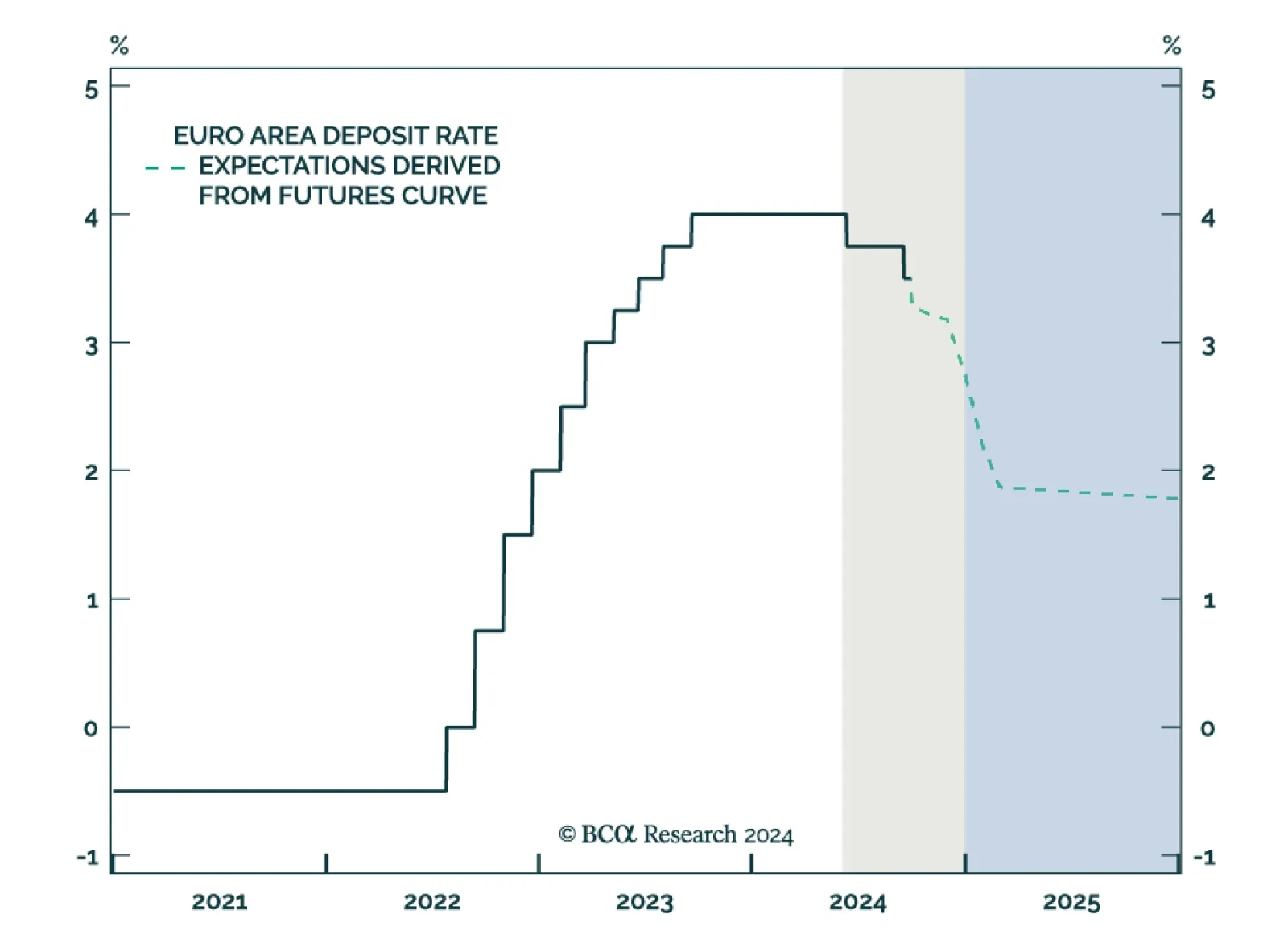

Preliminary estimates suggest that Eurozone headline and core CPI inflation decelerated from 2.2% to 1.8% y/y and from 2.8% to 2.7%, respectively, in September. The inflation data from individual Euro Area countries earlier last…

The market got excited by the 50 bps Fed cut and China stimulus. But these are a recognition that economies are slowing significantly. Stocks often rally after the first Fed cut, before falling sharply. Investors should stay…