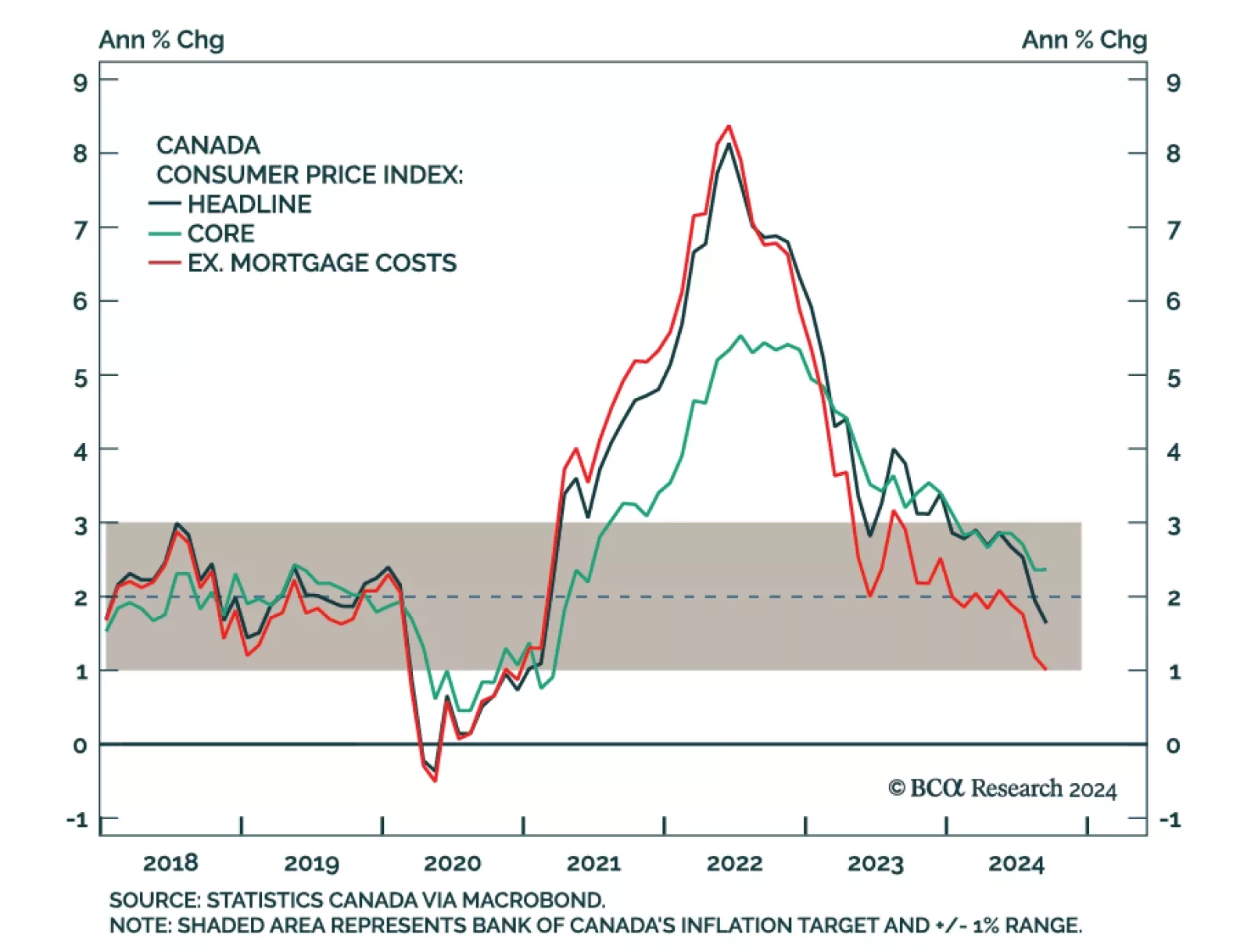

Canadian headline inflation rose 1.6% year-over-year in September, lower than the expected 1.8% and down from 2.0% in August. This was also its slowest pace since February 2021. The decrease was mainly driven by gasoline prices,…

This week, we cover the main questions we fielded during our latest client trip in Europe. Among the many topics broached are Europe’s recession odds, the impact of China’s stimulus, and the outlook for European markets.

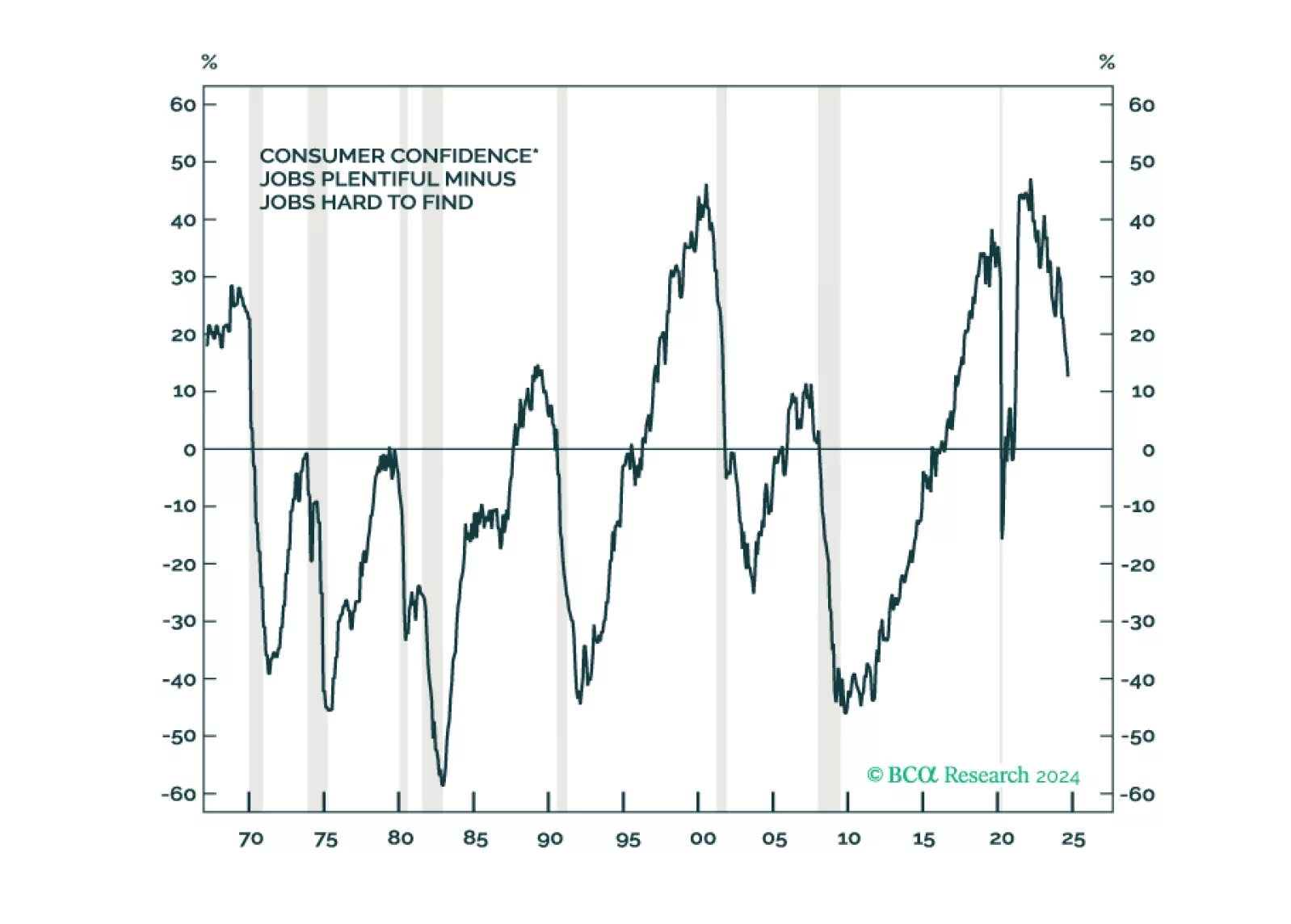

Rising stock prices and improving economic data have us re-examining our bearish thesis, but we still see deterioration in leading labor market indicators and expect it will eventually culminate in a recession. We reiterate our…

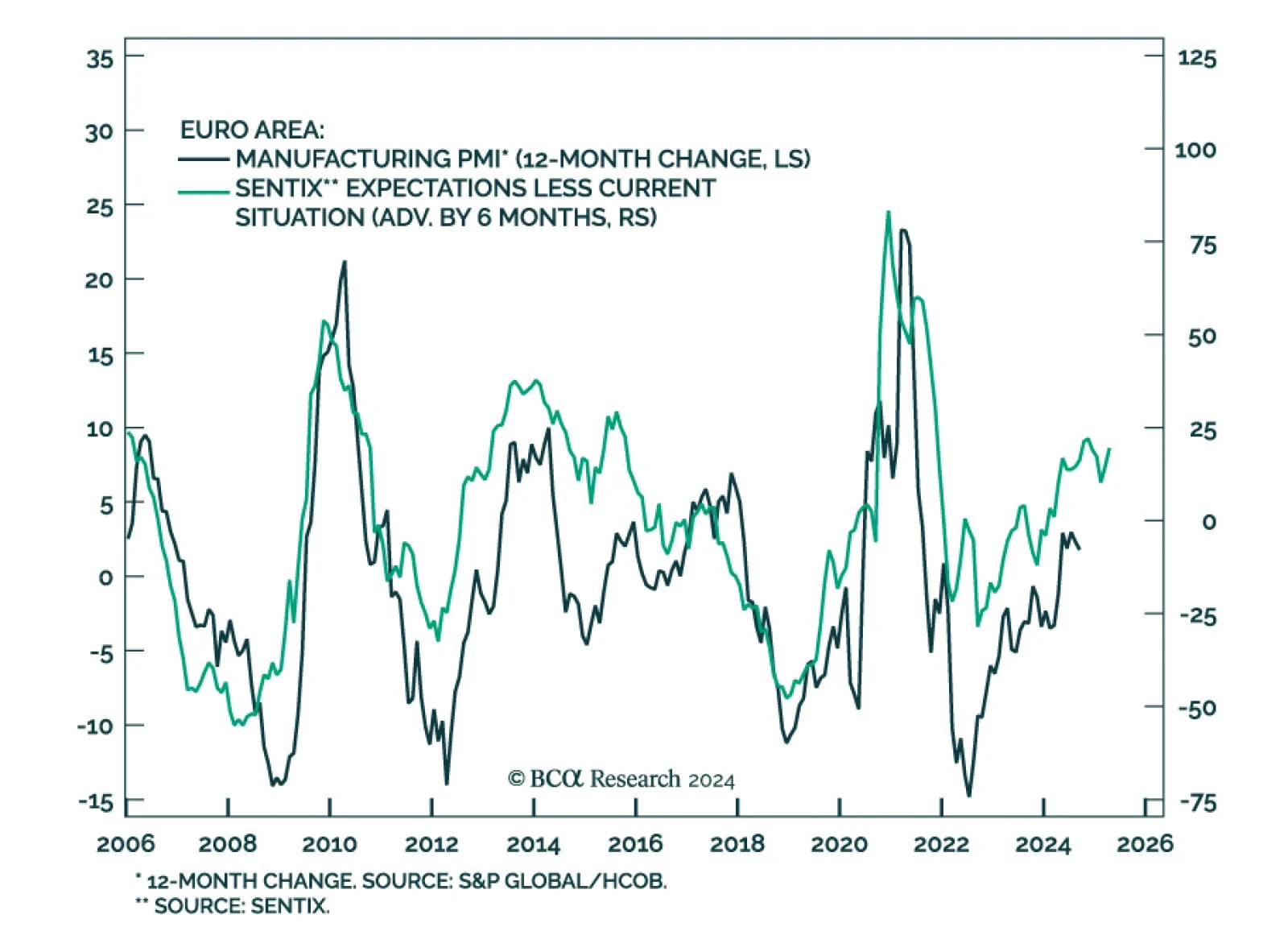

The Sentix Investor Confidence index unexpectedly improved in October from -15.4 to -13.8. A notable improvement in Expectations (from -8.0 to -3.8) drove the overall index higher, while the Current Situation subcomponent…

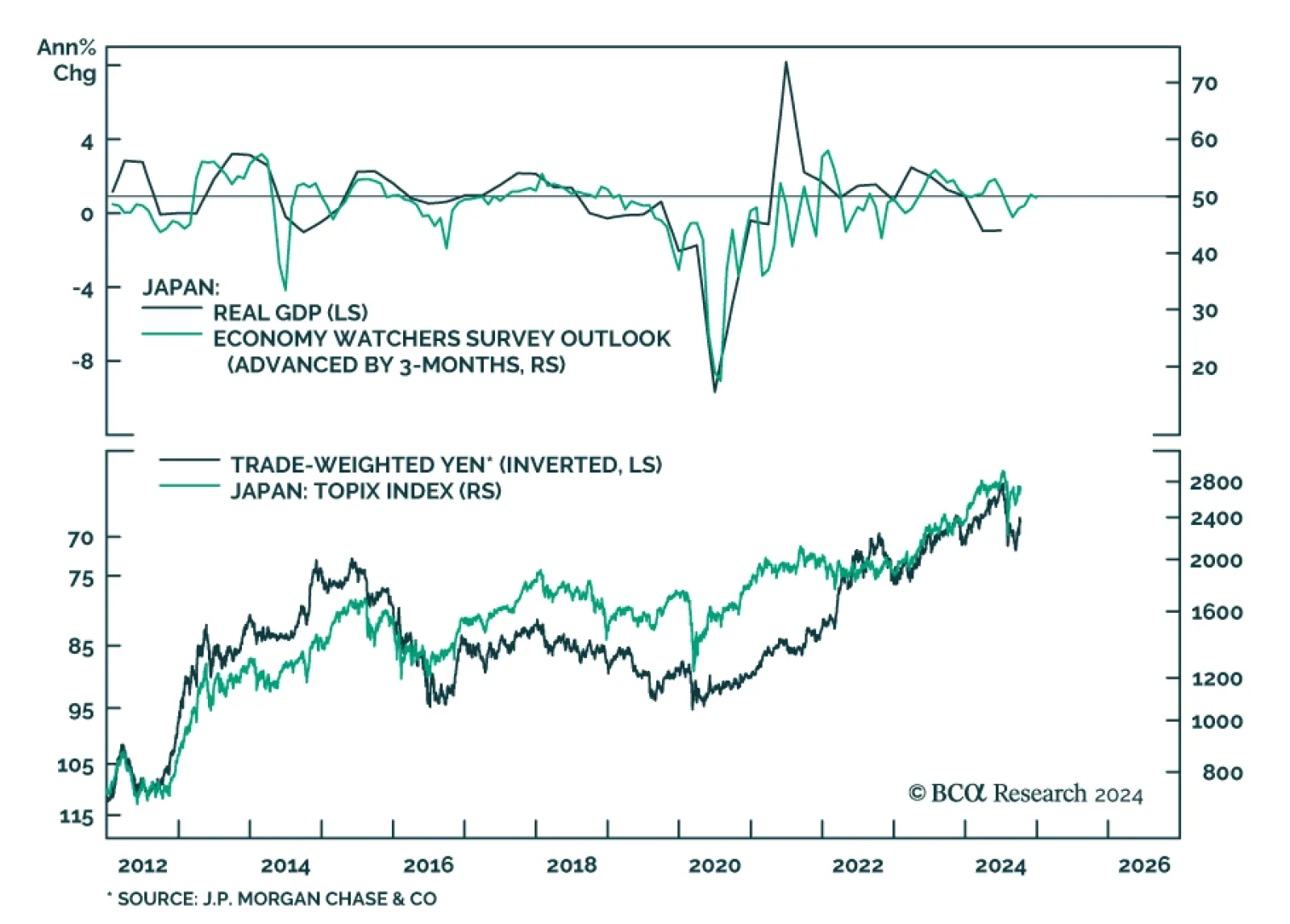

The Bank of Japan’s Economy Watchers Survey – a gauge of sentiment among business owners – disappointed in September. The Current Conditions and the Outlook indices deteriorated from 49.0 to 47.8 and from…

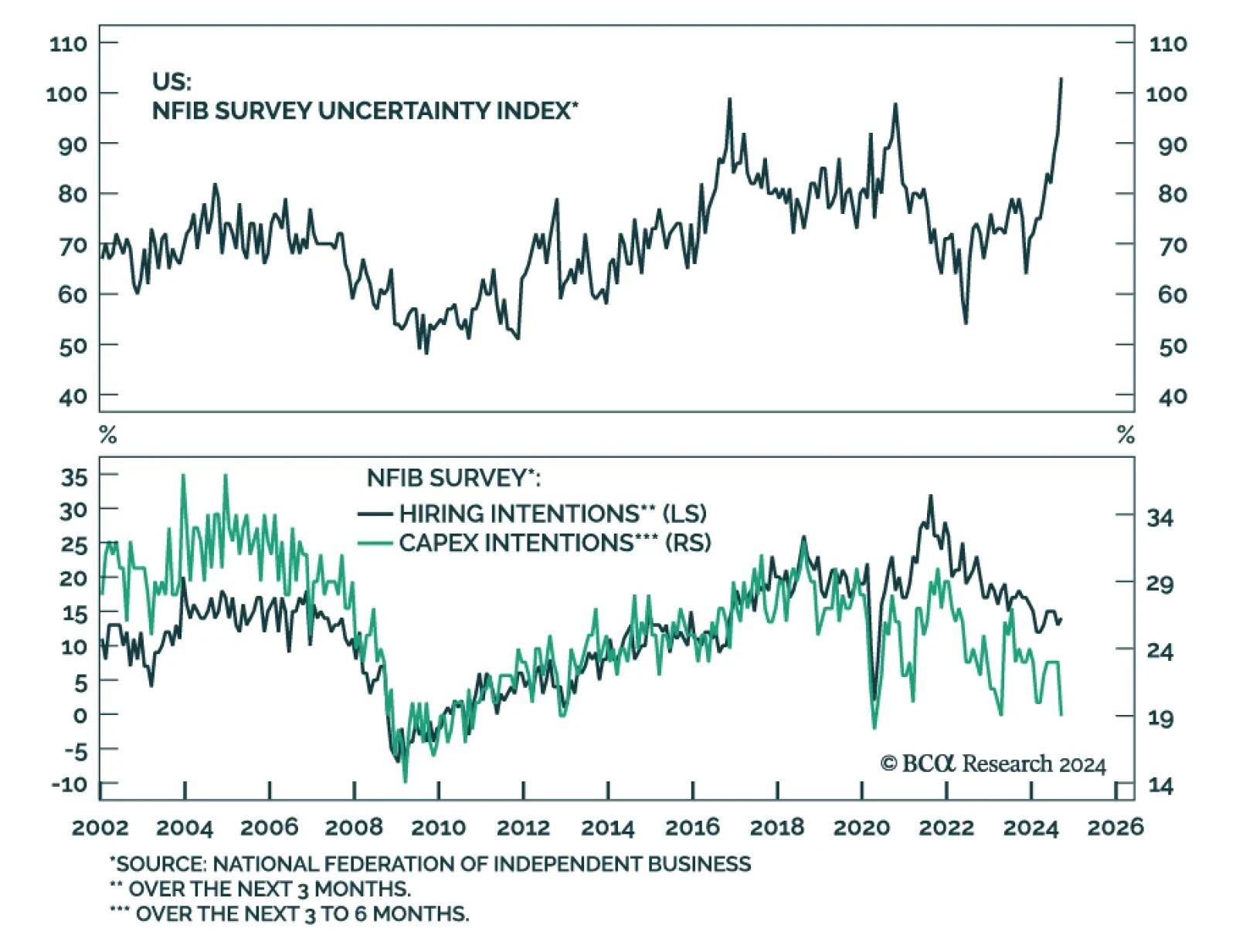

The NFIB Small Business Optimism index was mostly flat in September, ticking a mere 0.3 points higher to 91.5 in September, below expectations of a more meaningful improvement to 92.0. The NFIB Small Business Optimism has…

The month of October ahead of a US general election tends to be a volatile month with negative outcome for equities. As such, it is prudent to remain on the sidelines until after the election.

The US election underscores three long-term trends of Generational Change, Peak Polarization, and Limited Big Government. Investors should expect more volatility around the election and should assess the results before adding more…

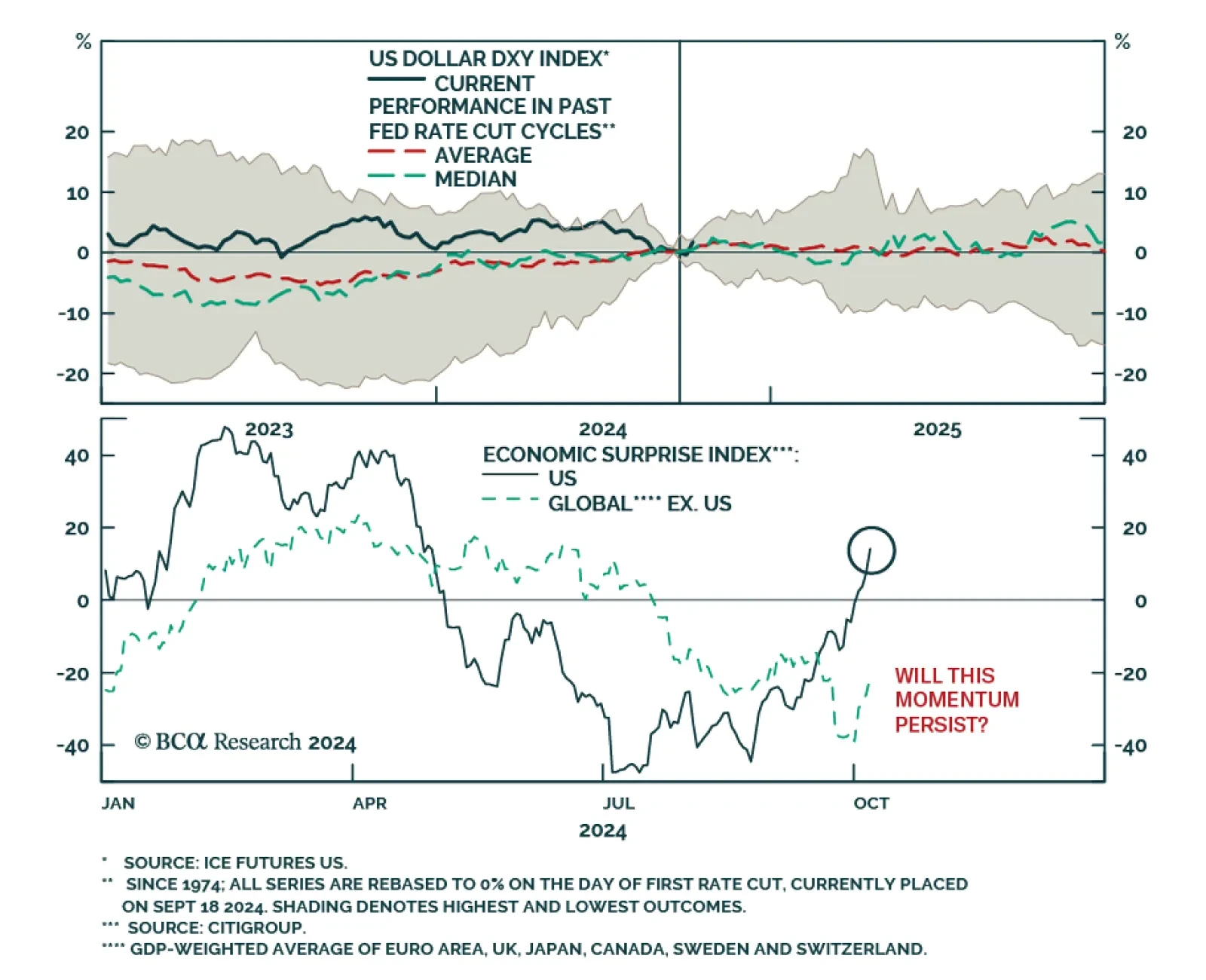

The dollar had erased all of its 2024 gains going into the fall, as markets prepared for Fed rate cuts. After a nearly 6% drawdown over the spring and summer, last week’s DXY rally brought the dollar back into the black YTD…

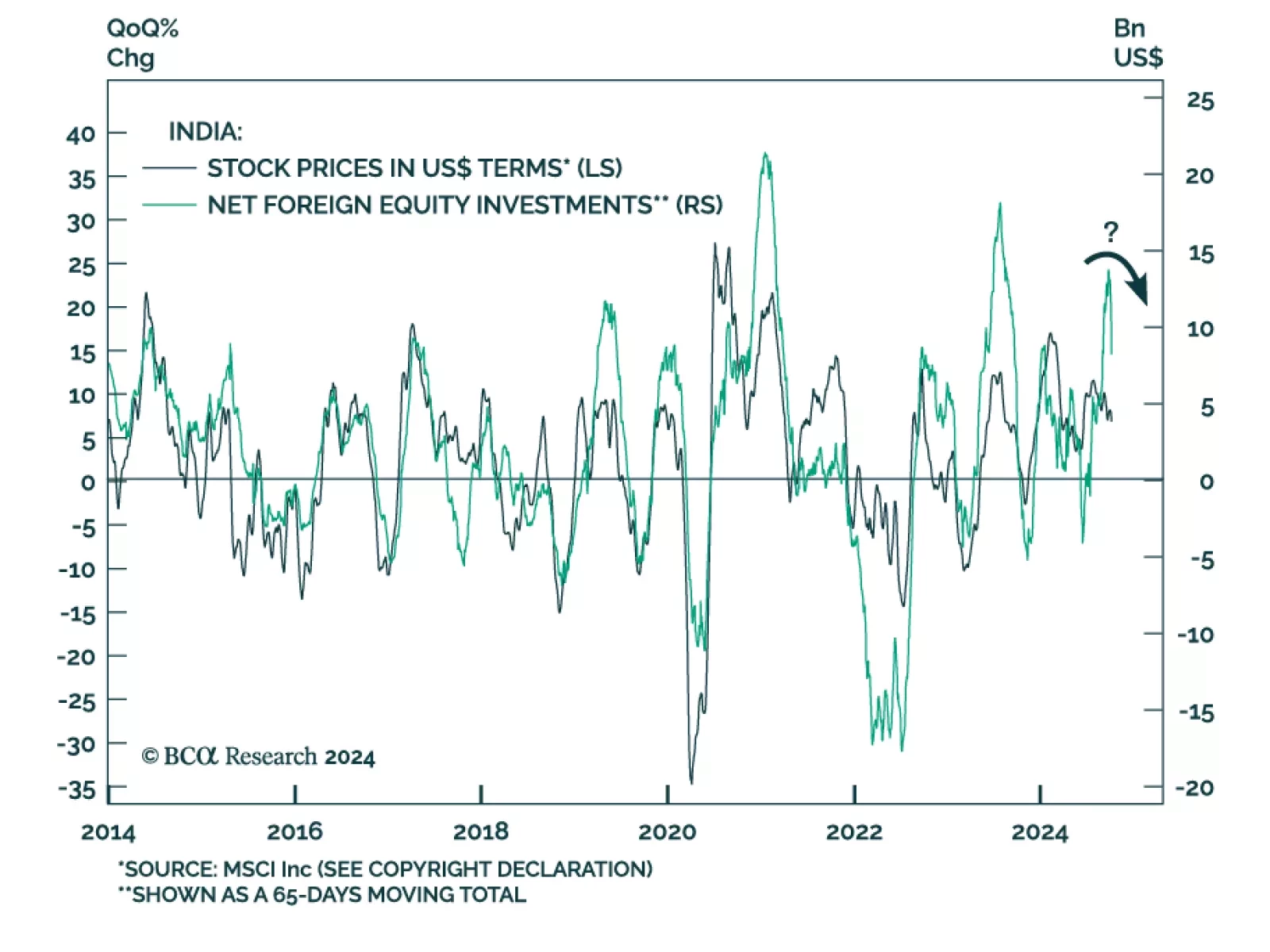

Indian equities reached new highs in late September. Our Emerging Market strategists recommend dedicated EM investors use these gains as an opportunity to reduce Indian equity allocations from neutral to underweight. They expect both…