Middle-aged households have lagged youngish and older households since the pandemic and the 40-to-54 cohort is worse off than it was at the end of 2019. The fragmenting of the seemingly monolithic US consumer widens the path to a…

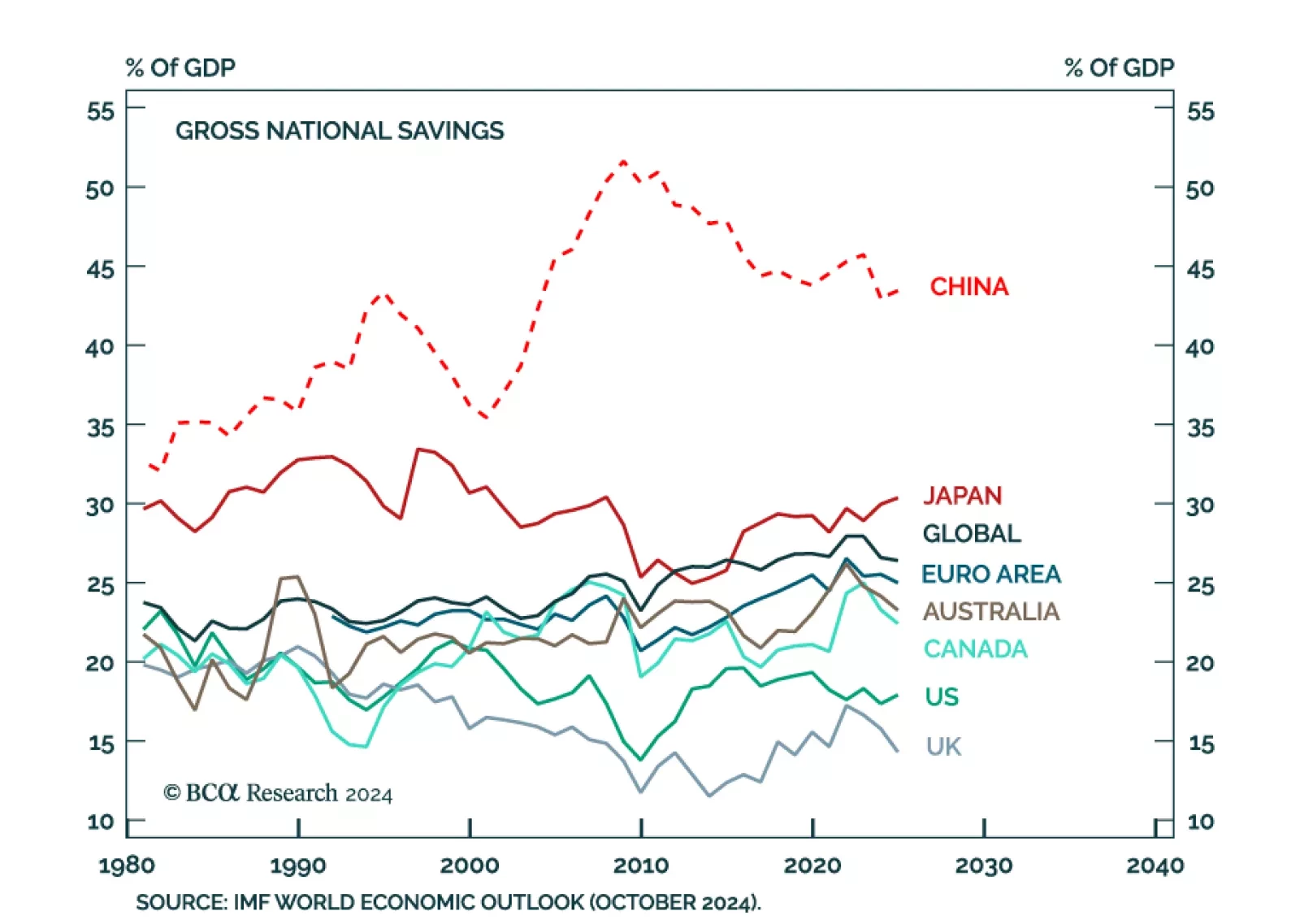

Savings must either flow into domestic investment, or abroad. Saving too much, with nowhere to funnel it, is breaking China’s economic model according to our Global Investment Strategy colleagues. As China's share of…

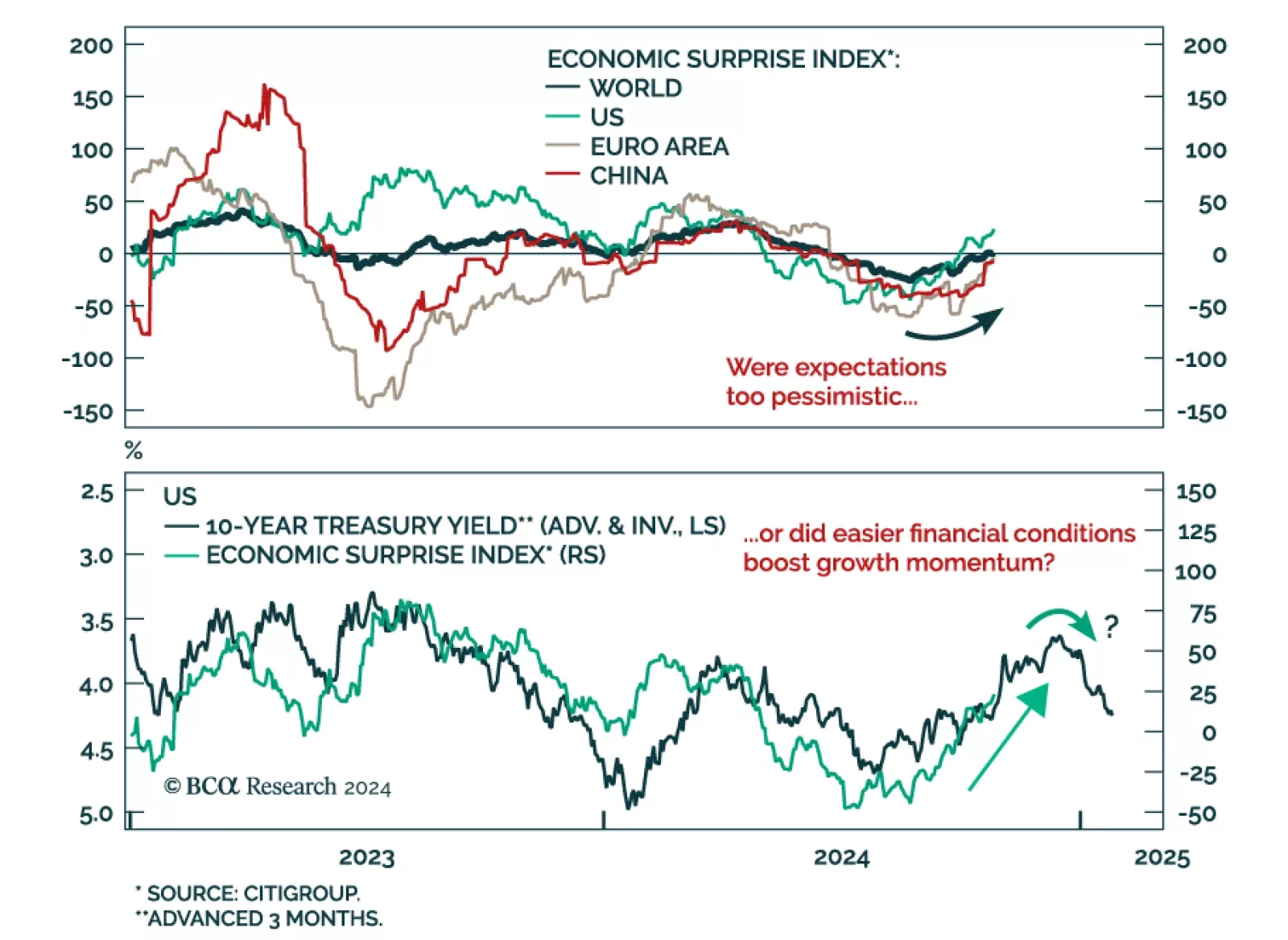

Global economic surprises have improved. Currently positive and improving in the US, they are rising from a low level in the Eurozone and China. Two explanations could explain this momentum. First, the recent easing in…

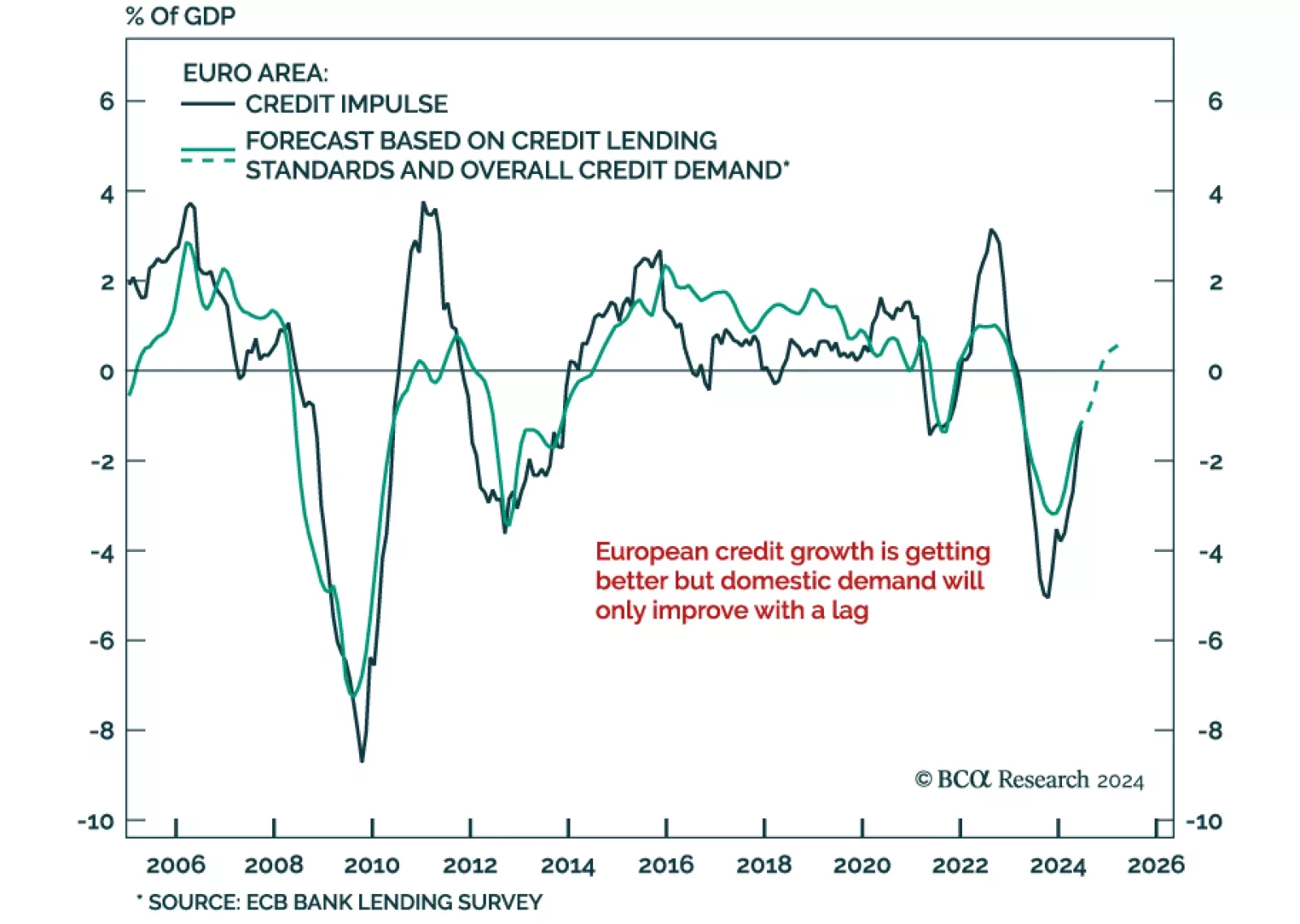

Eurozone money and credit data beat expectations, with M3 accelerating to 3.2% year-over-year in September from 2.9% a month prior. Household and corporate lending both drove the improvement. This development echoes the latest…

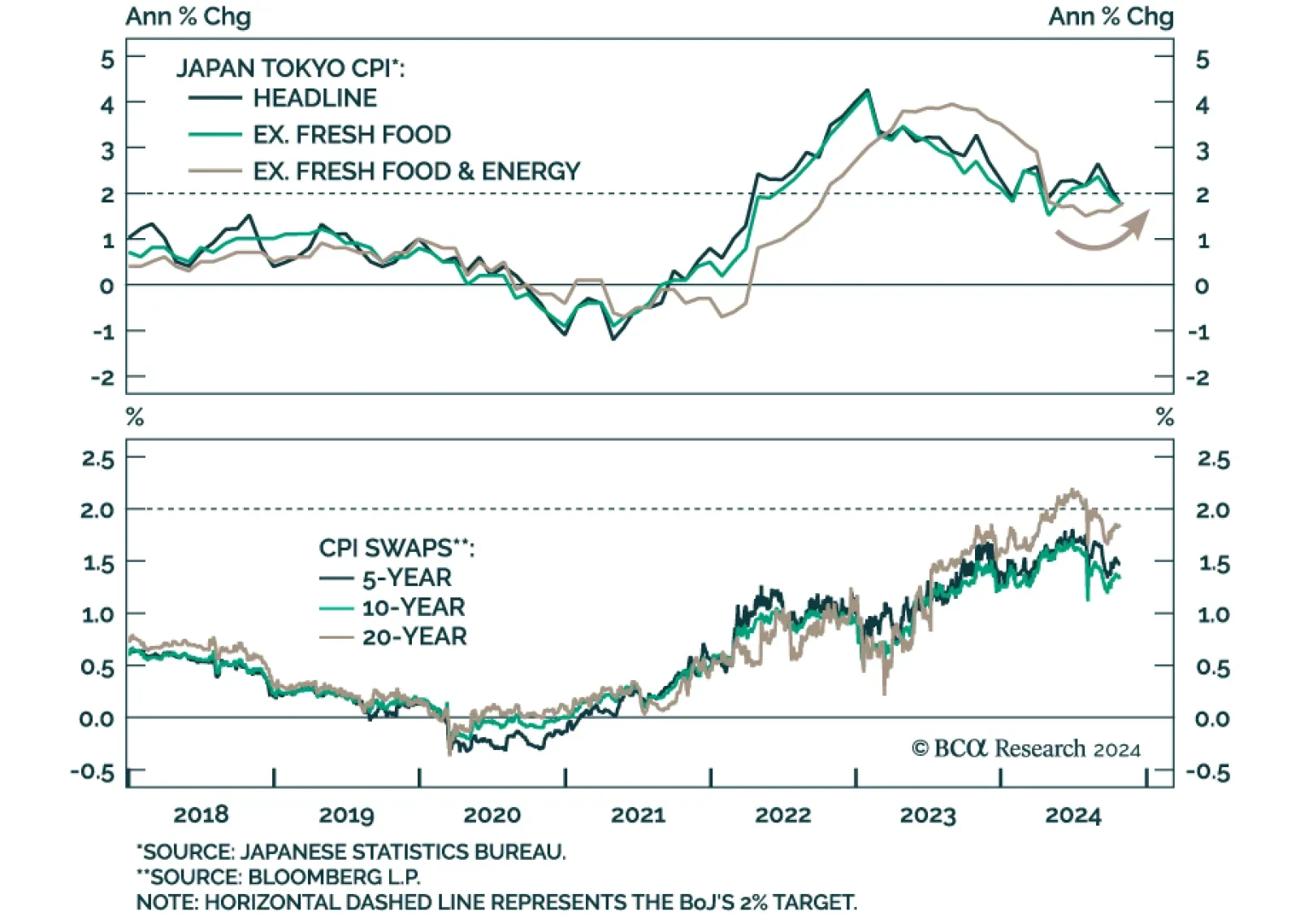

The “core core” (ex. fresh food & energy) segment of the Tokyo CPI basket beat expectations in October, printing at 1.8% year-over-year and accelerating from 1.6% in September after troughing at 1.5% in July. The…

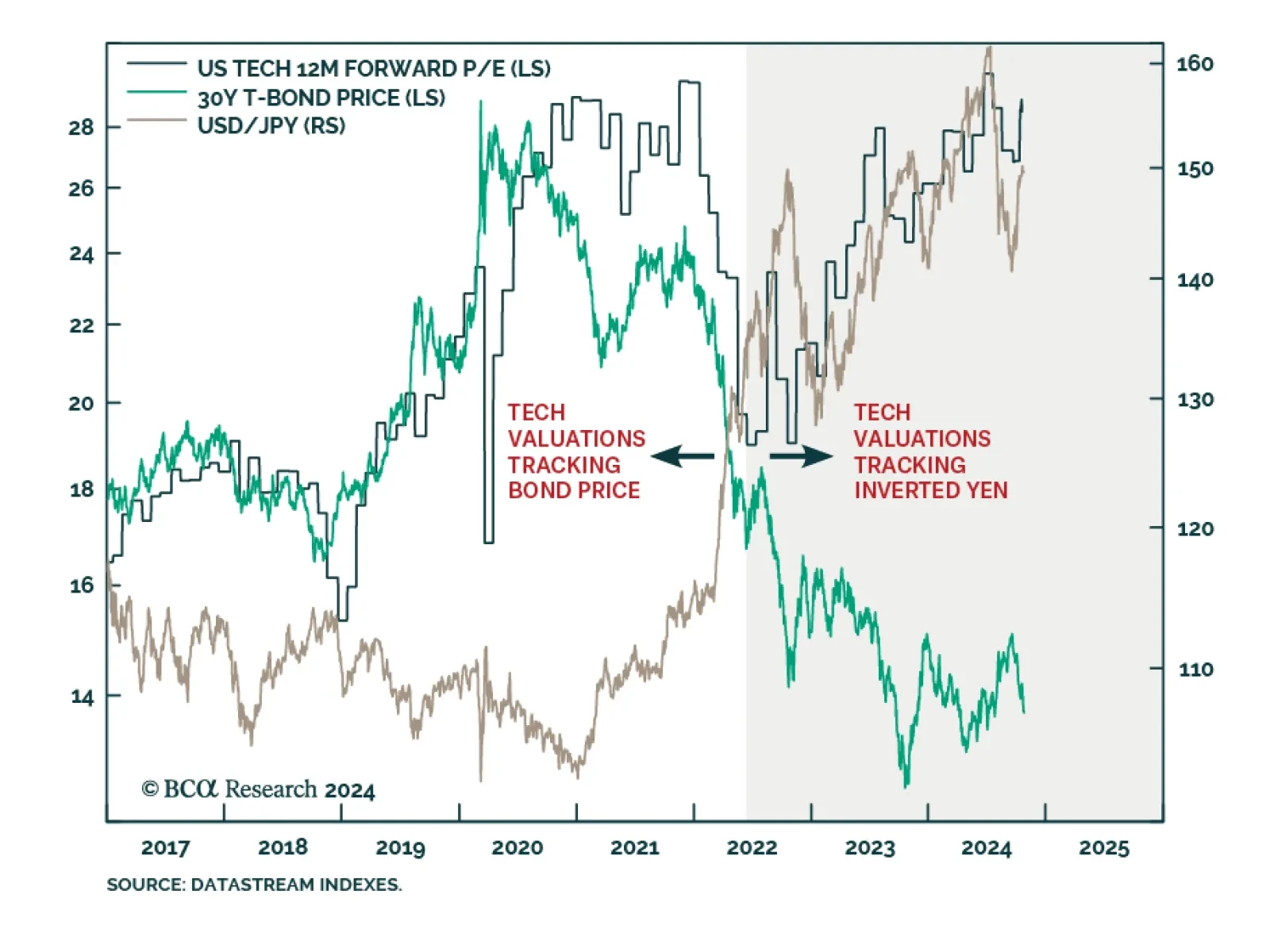

Our Counterpoint Strategy team believes the equity bull market’s biggest risk is the reversal of the divergence between Japanese and US real yields. Japan’s real policy interest rate differential versus the US…

Developed markets Flash PMIs estimates for October were mixed, with resilient US numbers and weakness elsewhere. The eurozone composite met expectations but remains below the 50-level expansion threshold. Germany…

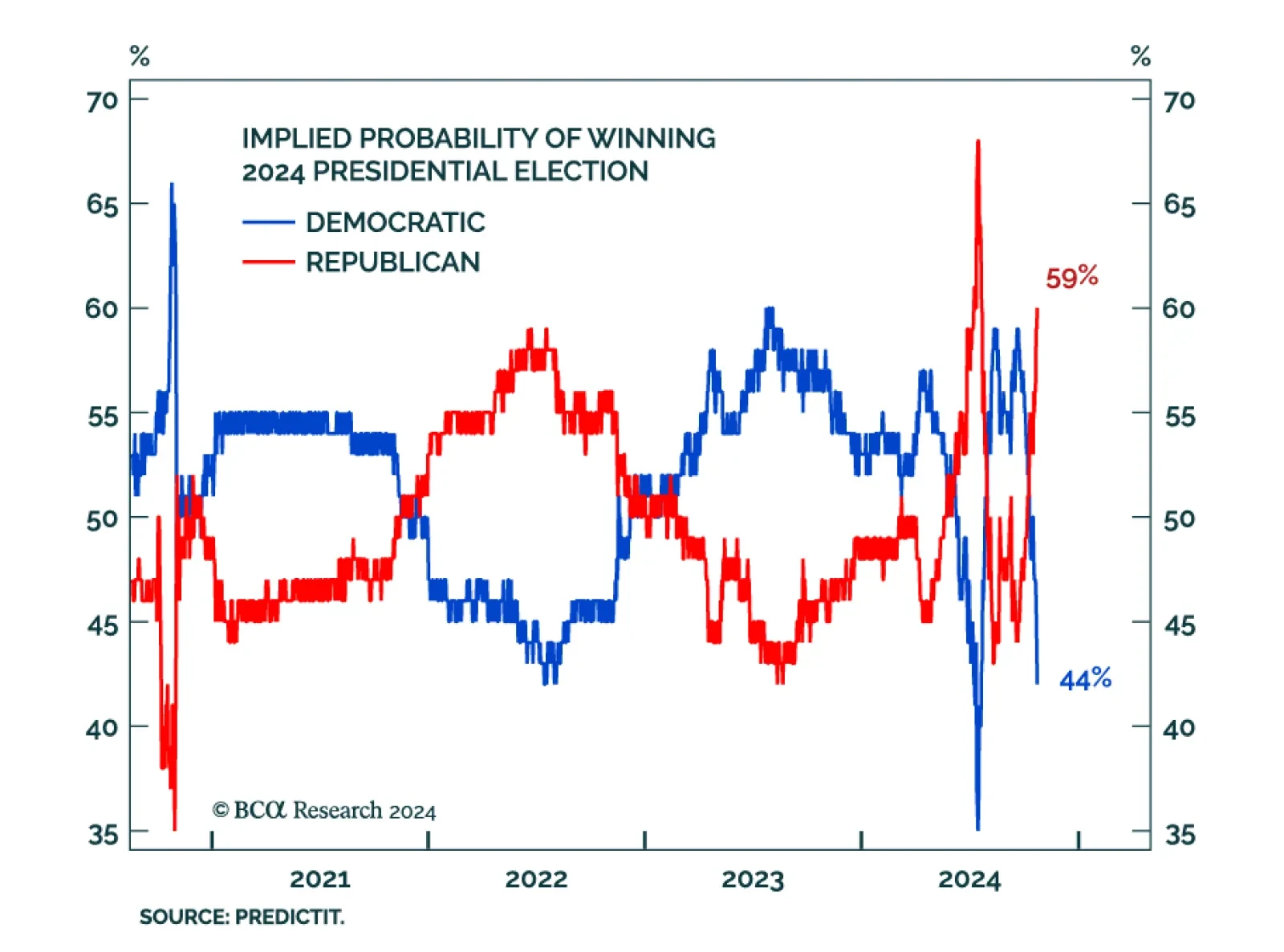

The US election is tightening in its final weeks, and the latest polls challenge our Geopolitical Strategy’s base case of a Democratic White House. The original thesis was built on the premise of a Democratic incumbent…

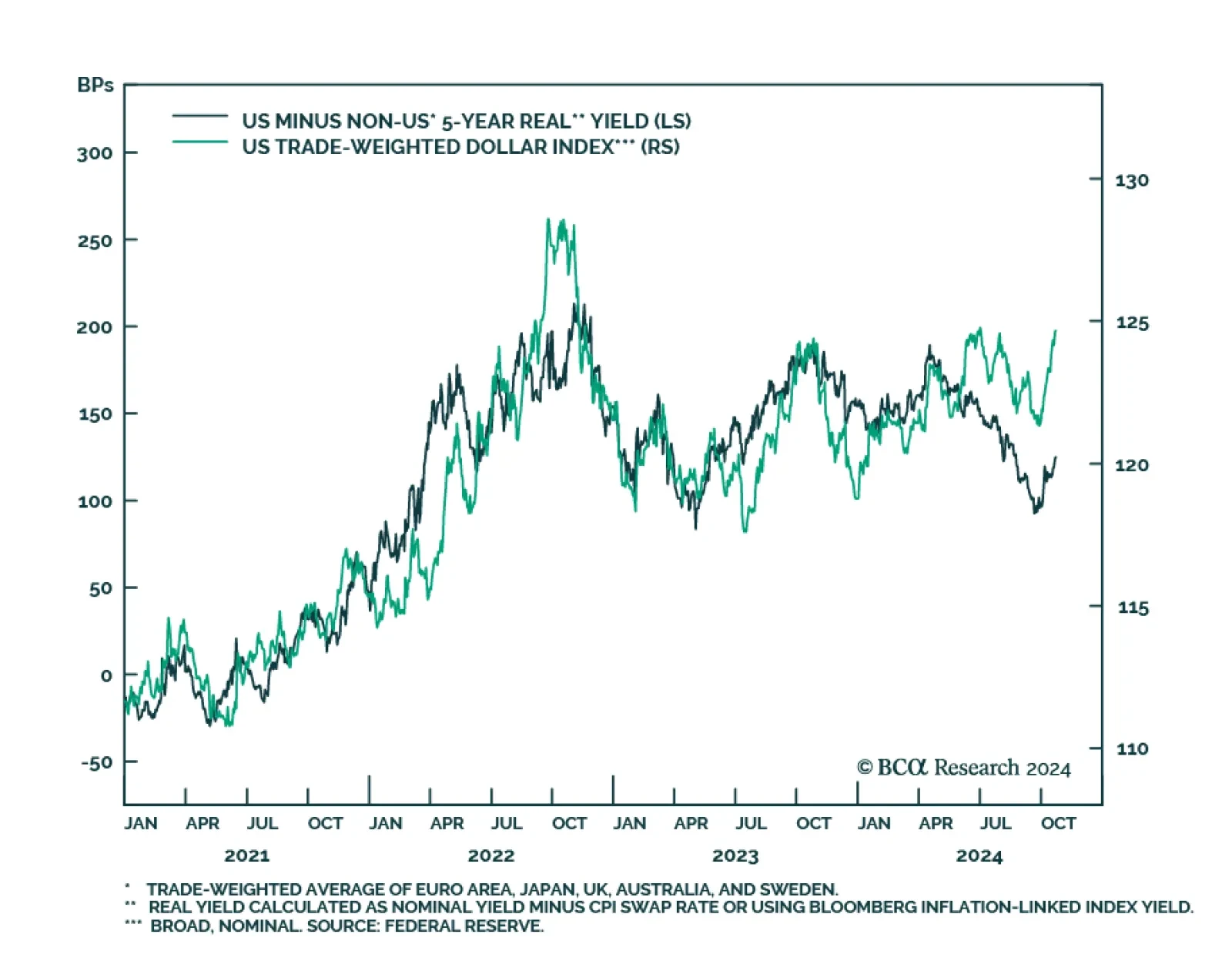

The US dollar had a strong October thus far, breaching its 20-,50- and 200-day moving averages with a 4% increase and only three trading days in the red. The DXY now sits above where it was before the August selloff in risk…