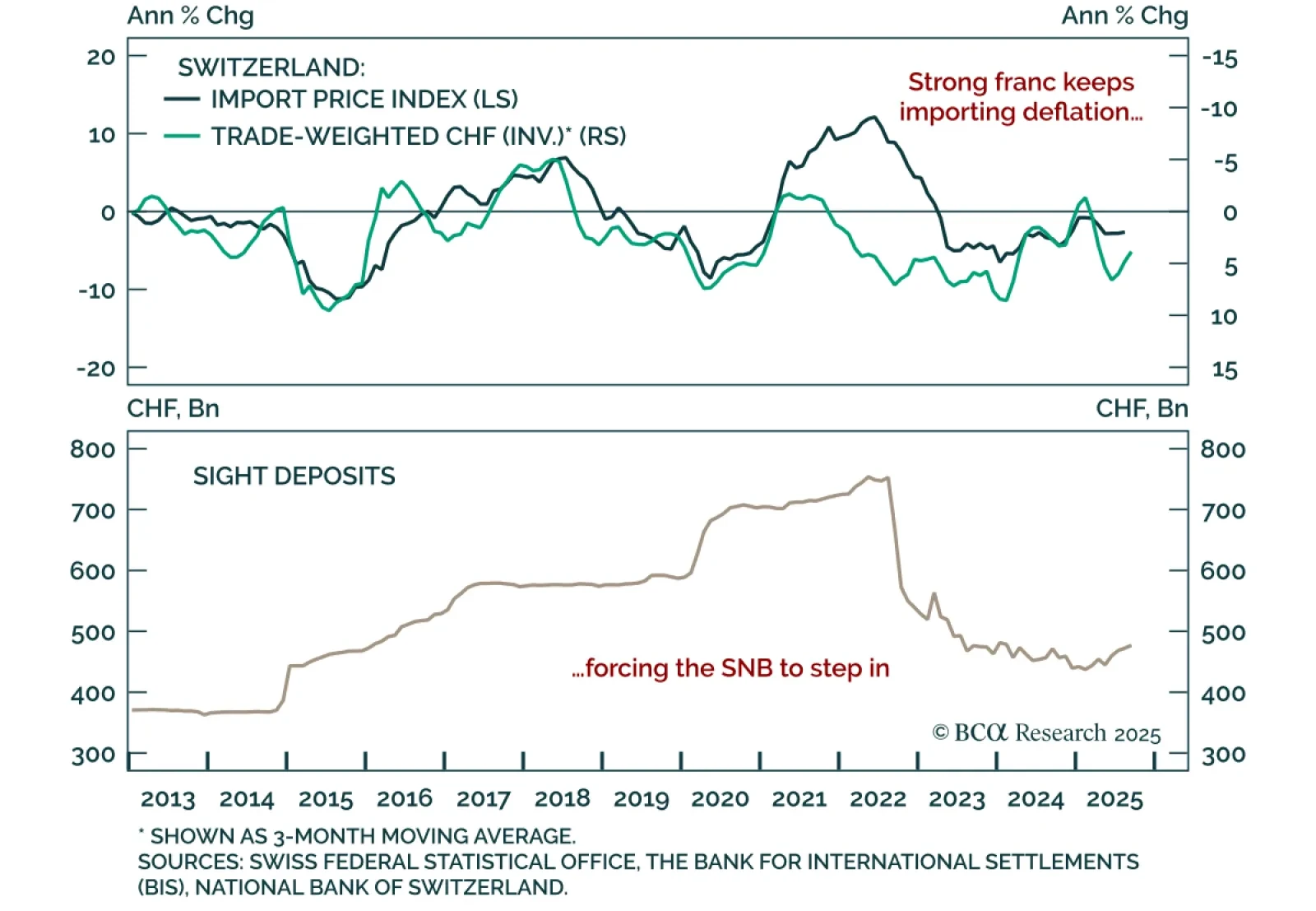

Expect greater currency interventions and negative policy rates from the Swiss National Bank (SNB), reinforcing a neutral stance on CHF and Swiss sovereign debt over the next 12 months. In recent joint statement on foreign…

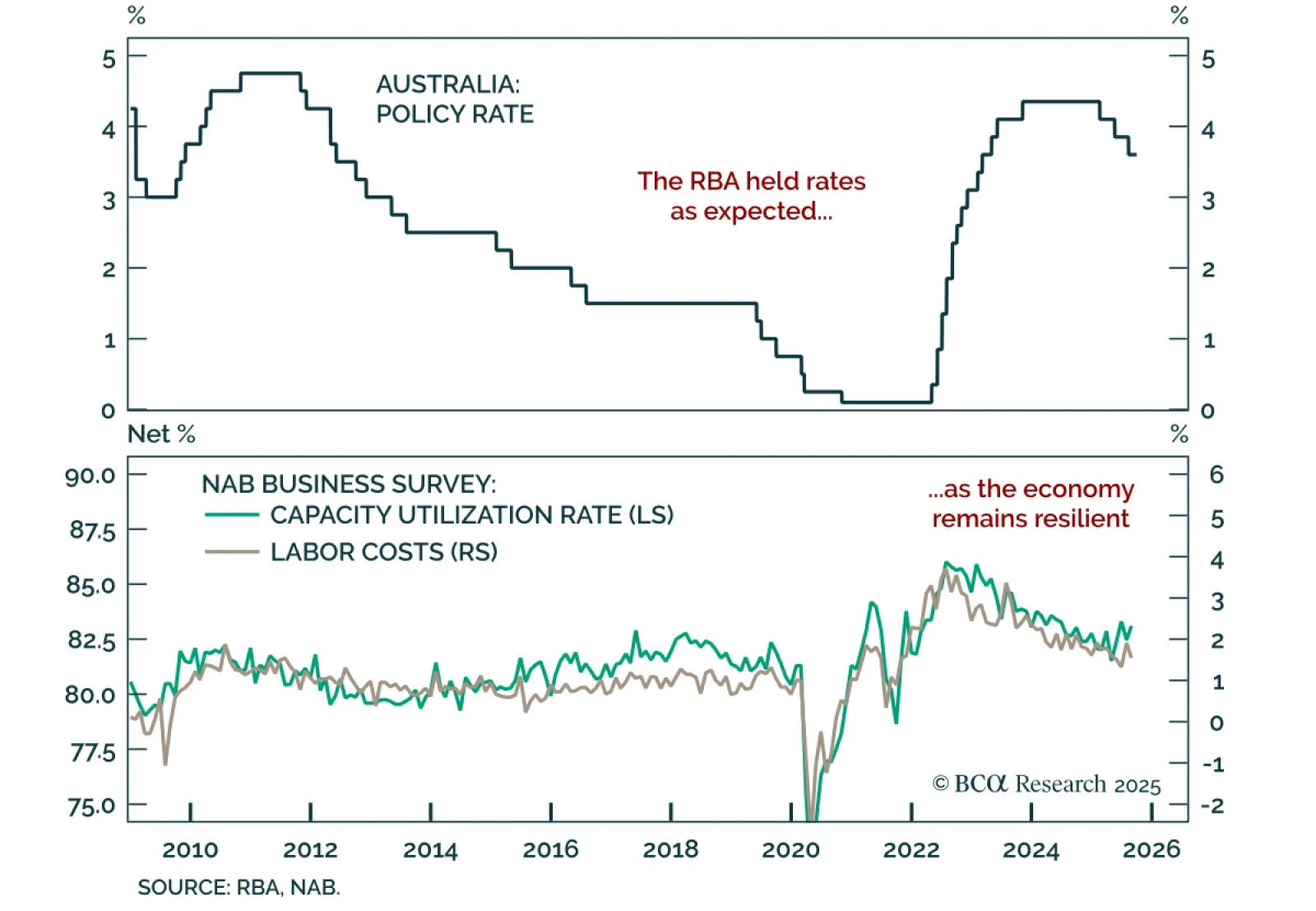

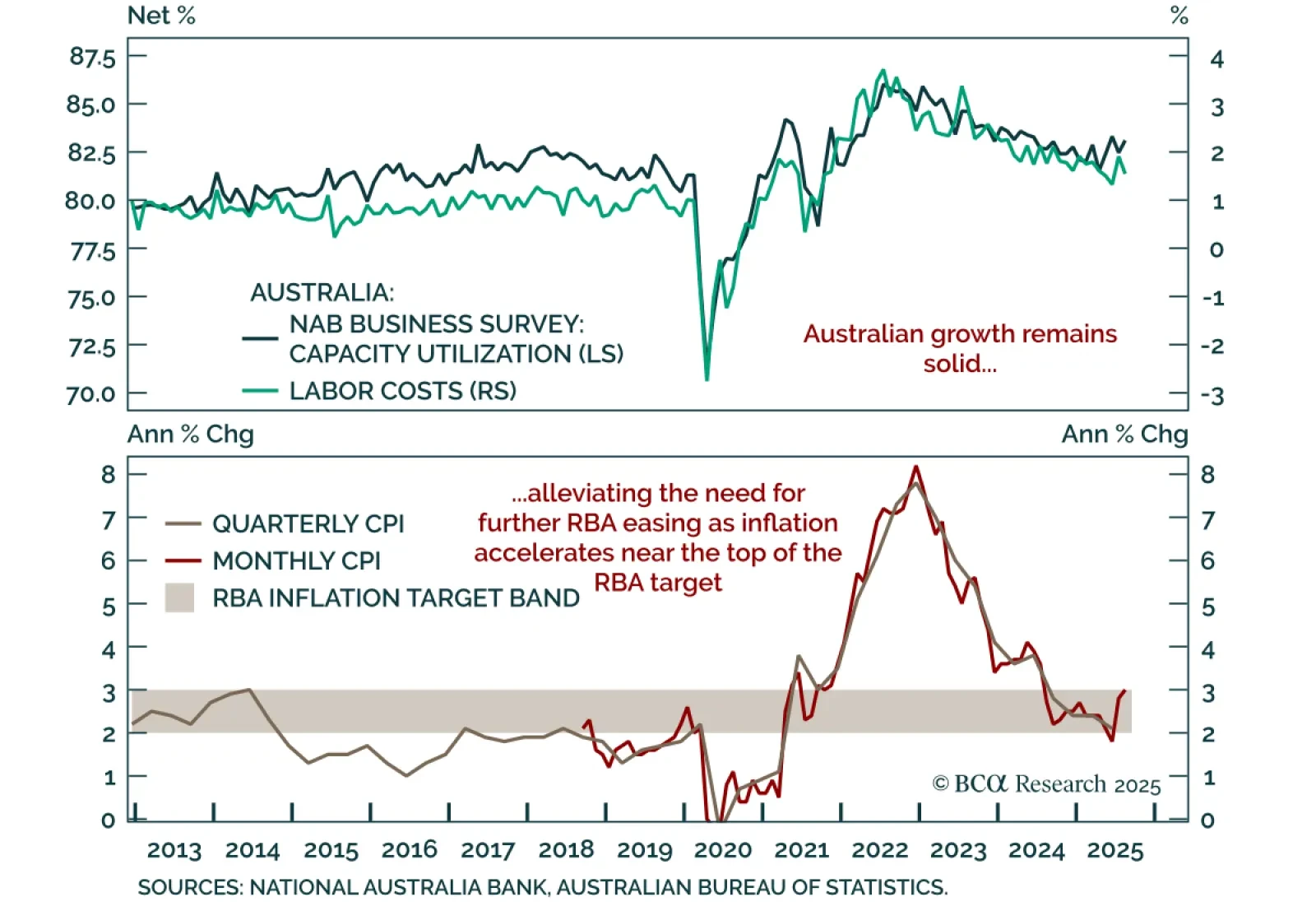

The RBA held rates at 3.6% as expected, maintaining caution as inflation could prove stronger than expected. Policy remains slightly restrictive, and at most one additional cut is on the table as the central bank has achieved a soft…

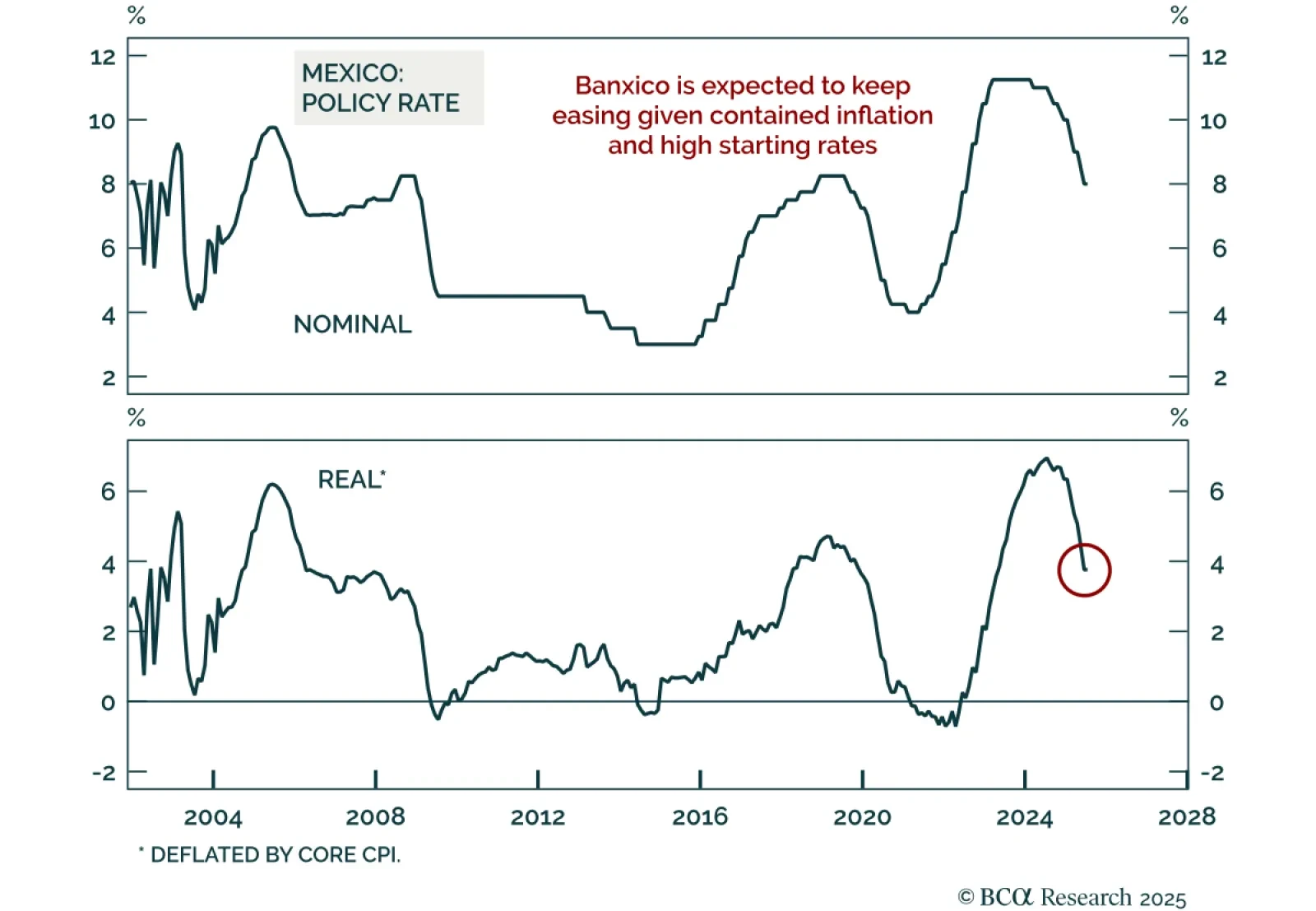

Banxico cut rates to 7.5%, reinforcing our call to go long Mexican local bonds and overweight Mexico across EM portfolios. Inflation is within target, giving policymakers space to ease. Sound fiscal management and strong external…

Our tactical framework, which tracks the reflexive loop between financial conditions and economic surprises, points to stronger near-term growth, leaving equities vulnerable if inflation re-accelerates. Data surprises move markets,…

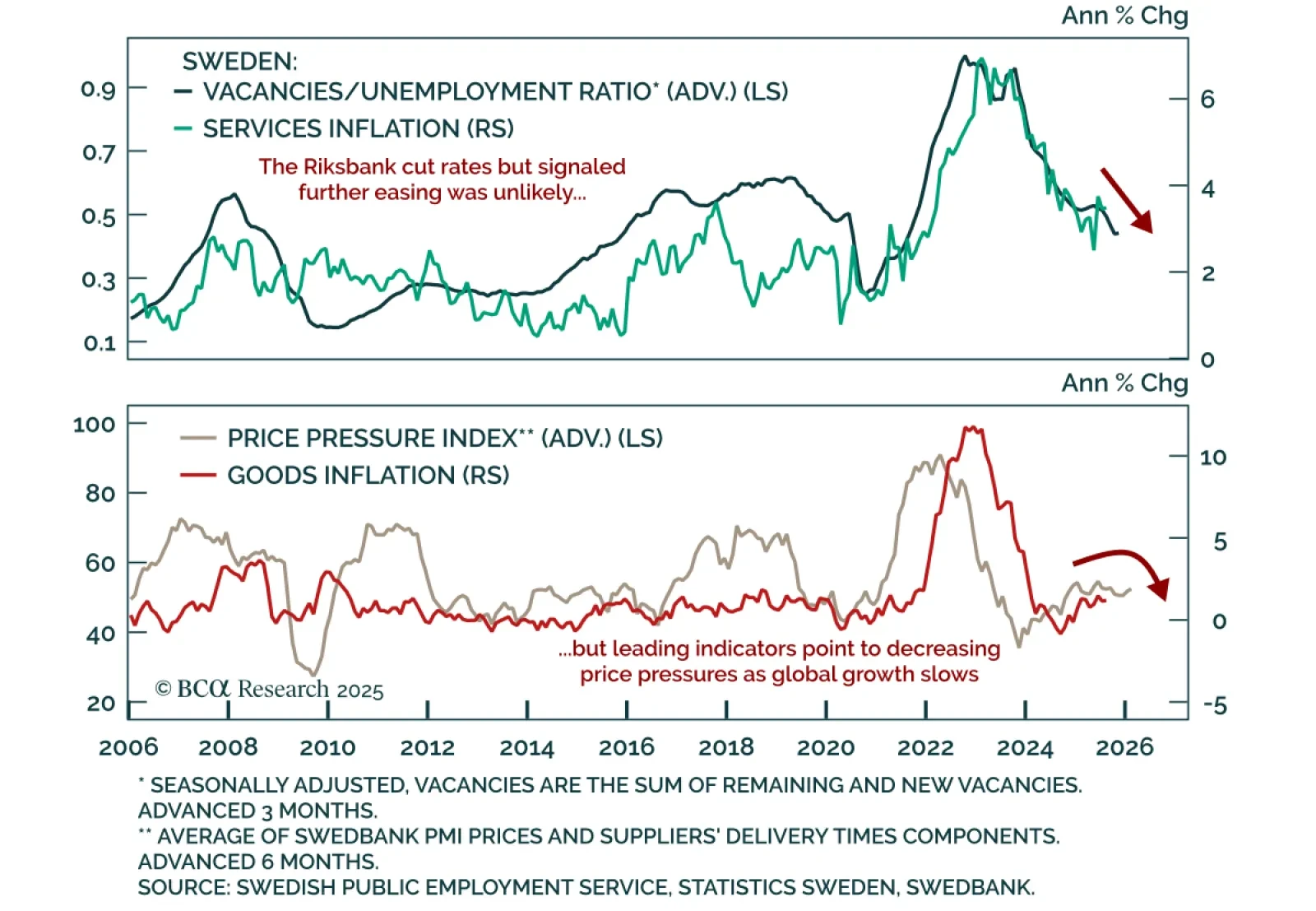

The Riksbank surprised with a 25 bps cut to 1.75%, signaling no further easing for now but keeping the door open to additional cuts as growth weakens. The move came despite recent inflation prints above the central bank’s forecasts.…

Australian inflation surprised higher in August, validating the RBA’s cautious stance and supporting an underweight on ACGBs. Headline CPI rose to 3.0% y/y from 2.8%, the highest in a year and at the top of the RBA’s 2-3% target…

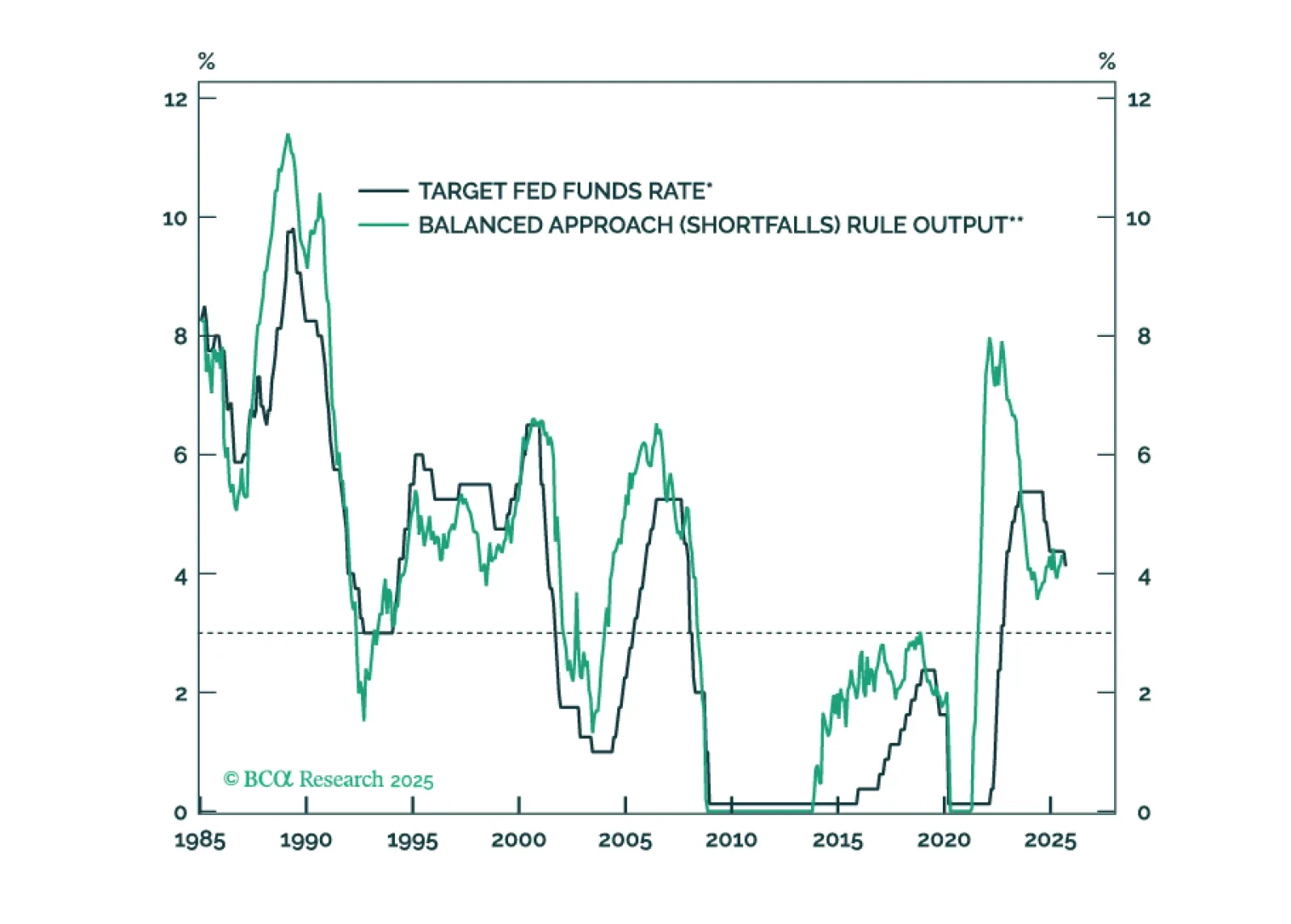

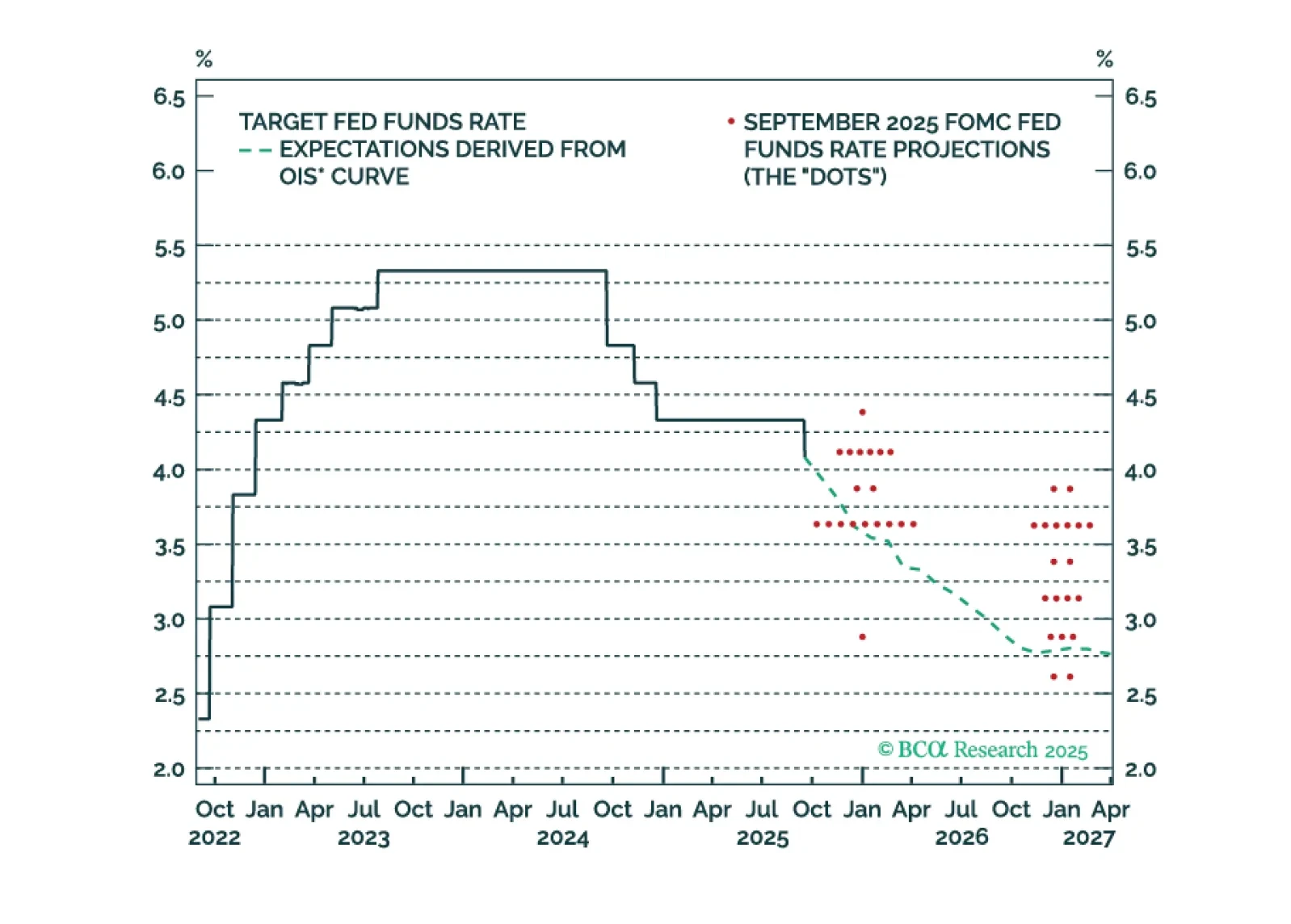

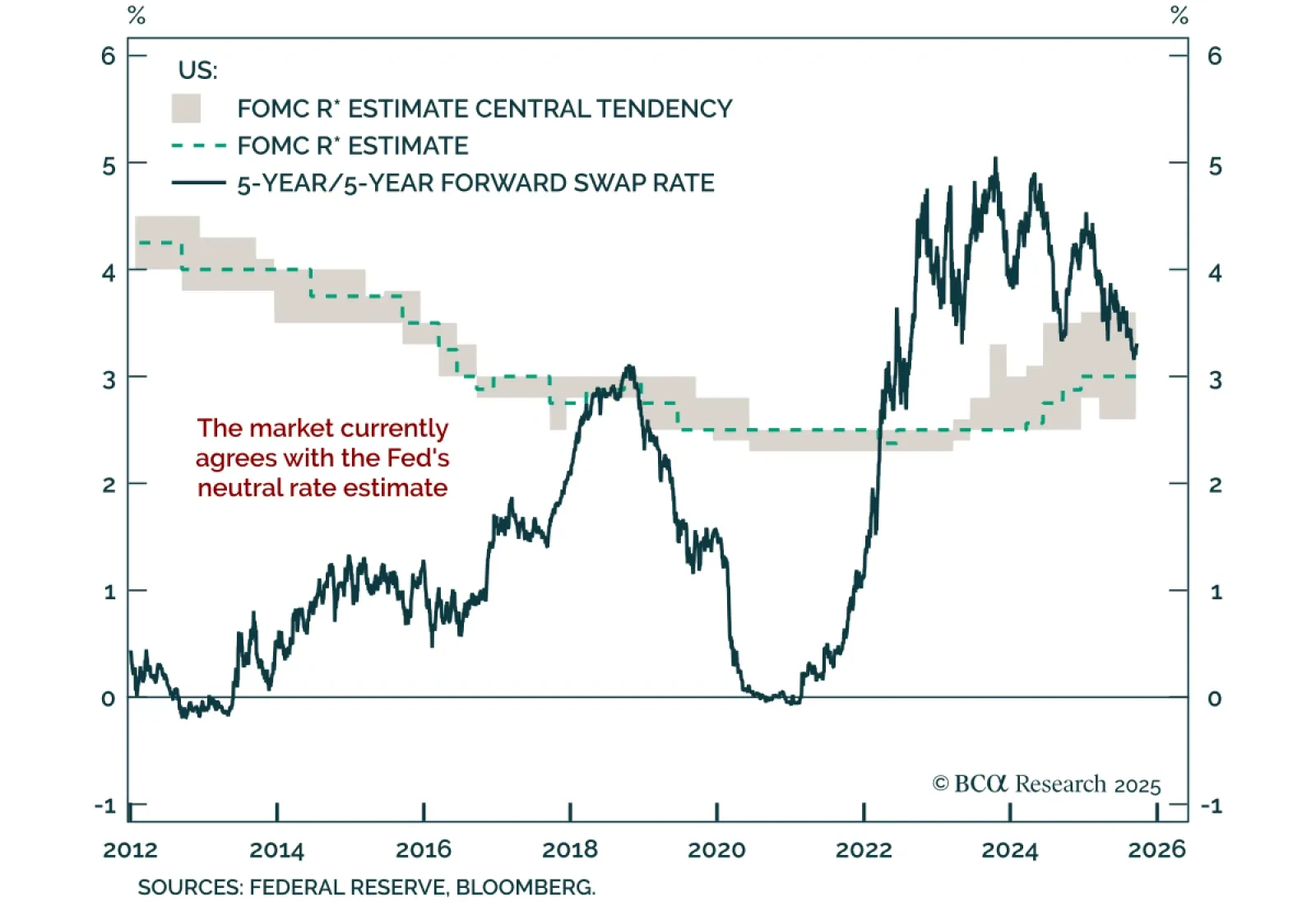

Post-FOMC speeches reveal divisions across the committee, reinforcing long duration as policy remains mildly restrictive. The September dots showed a split, with half of participants expecting at most one 25 bps cut and the rest…

Median Fed unemployment rate projections are overly optimistic. The Fed will end up cutting more in 2026 than it currently anticipates.

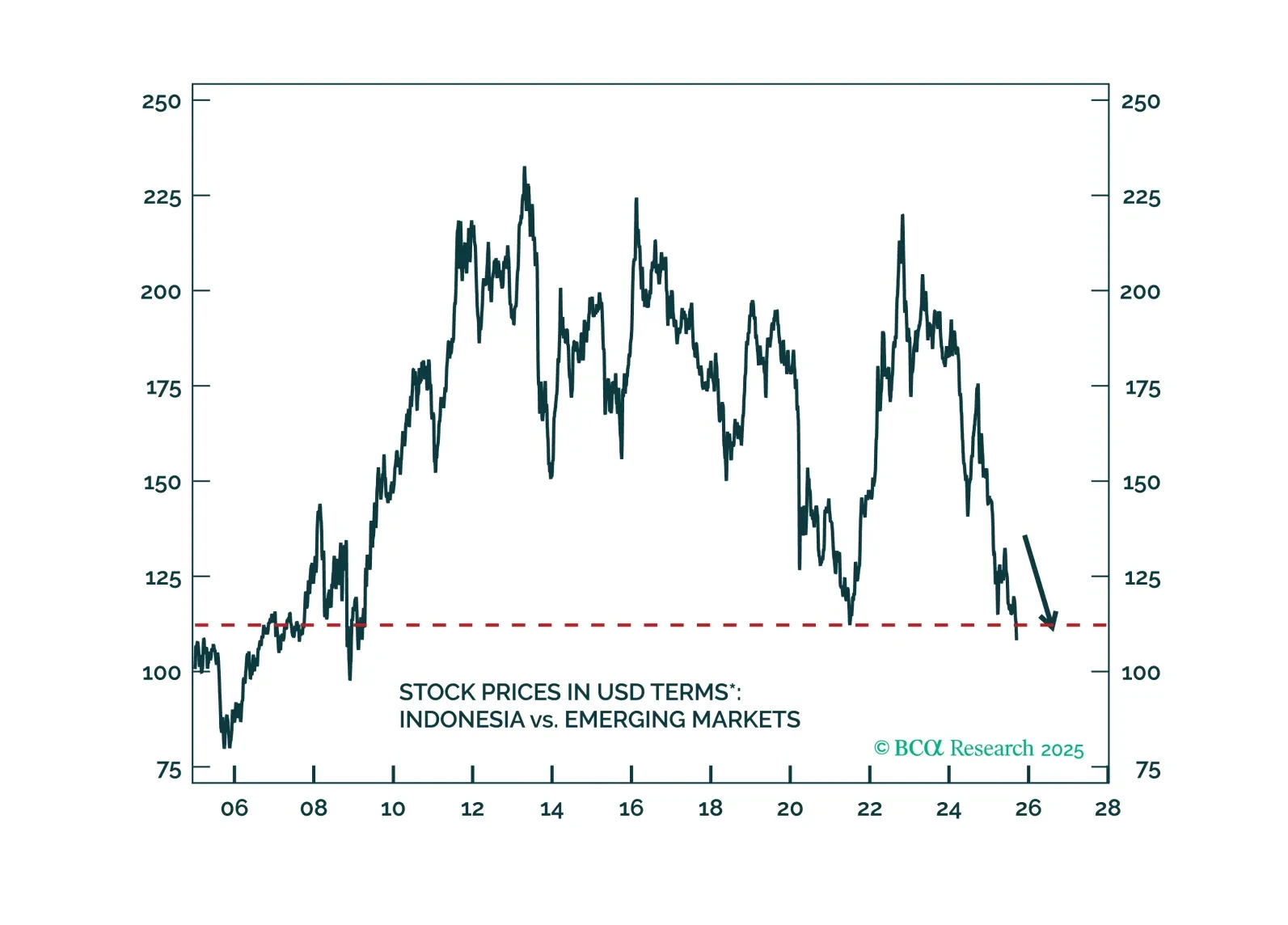

Indonesia’s policy easing will boost domestic demand, but fuel inflation. Current account deficit will widen, and the rupiah will weaken. Stay short the rupiah and go underweight Indonesian stocks, domestic bonds, and sovereign…