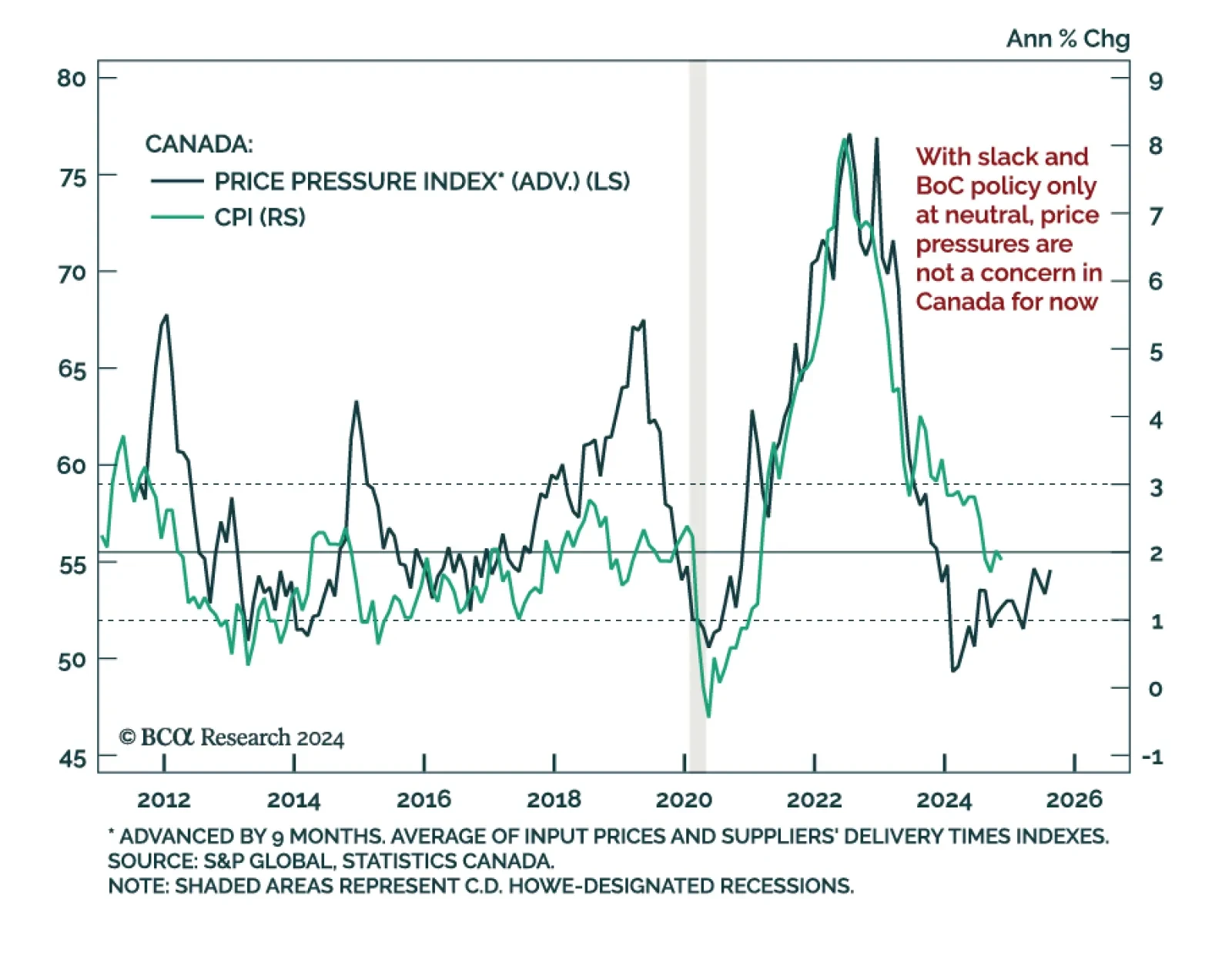

The November Canadian CPI was slightly below estimates, declining to 1.9% y/y from 2.0%, below the BoC’s 2% target but within the 1%-to-3% range. The BoC’s favored core measures, median and trim, were flat at 2.6% and…

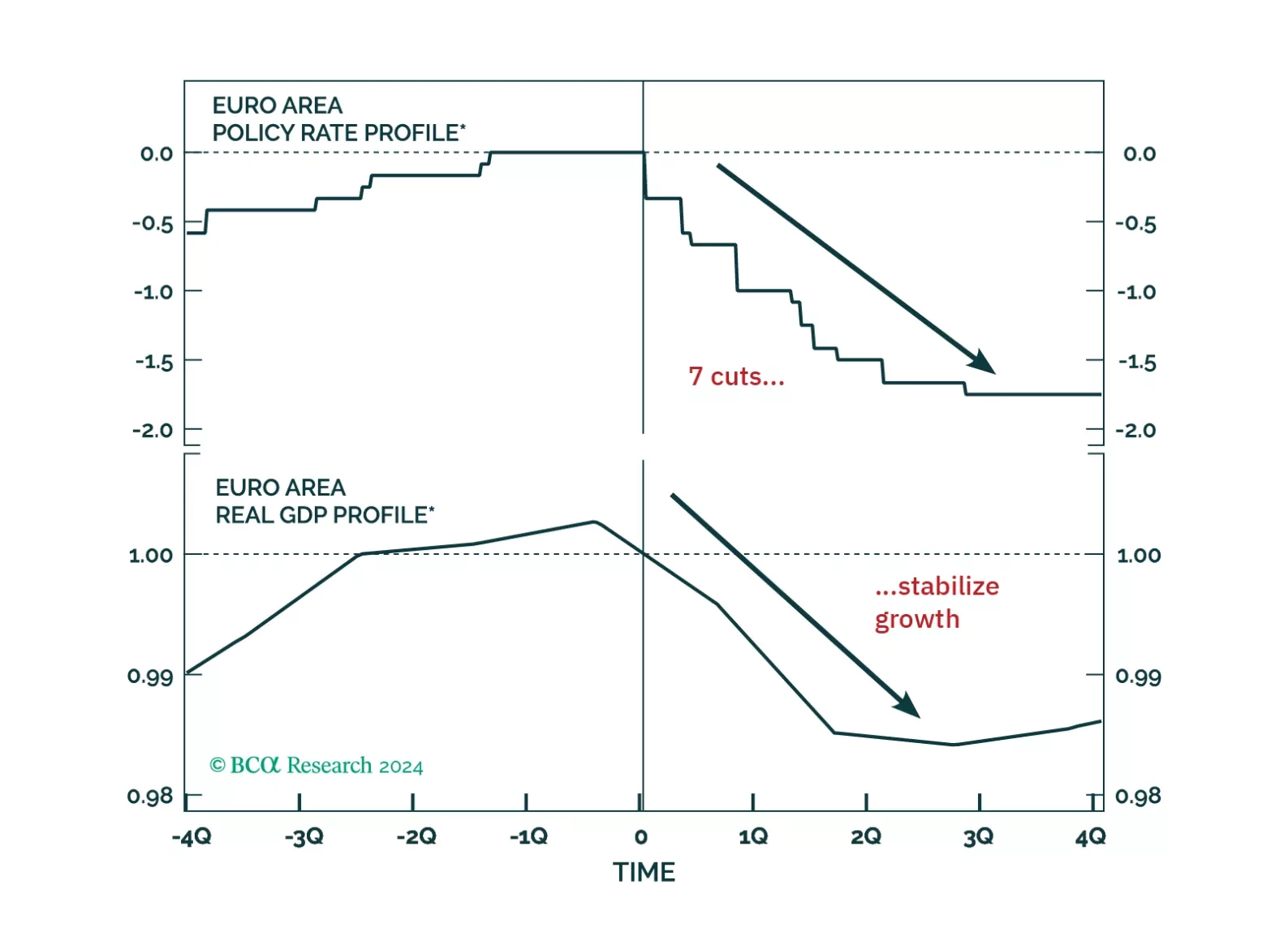

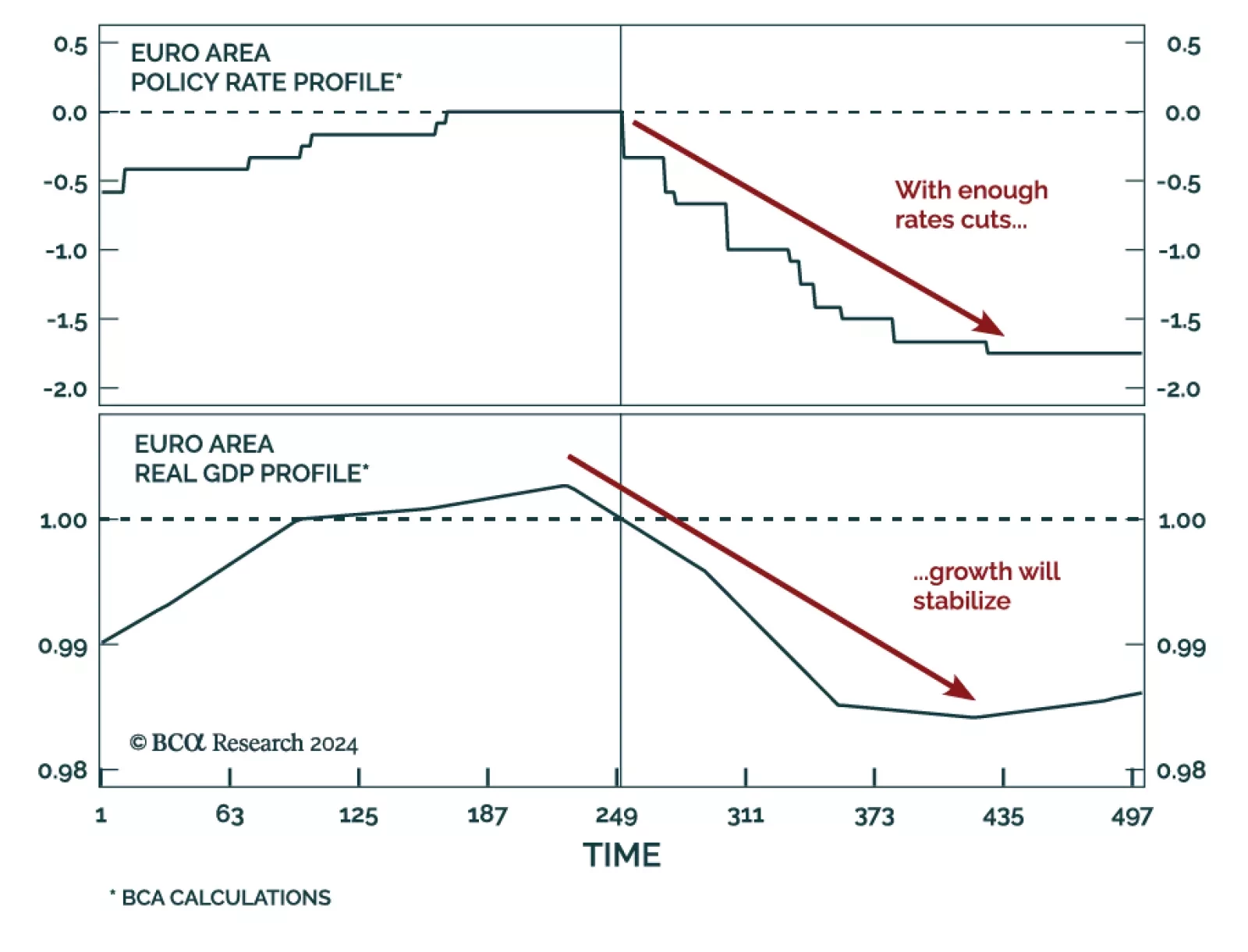

Our European Investment Strategy team published their annual outlook, outlining five key themes that will shape Europe’s economy and markets in 2025. Europe will enter a mild recession in H1 2025, but growth is…

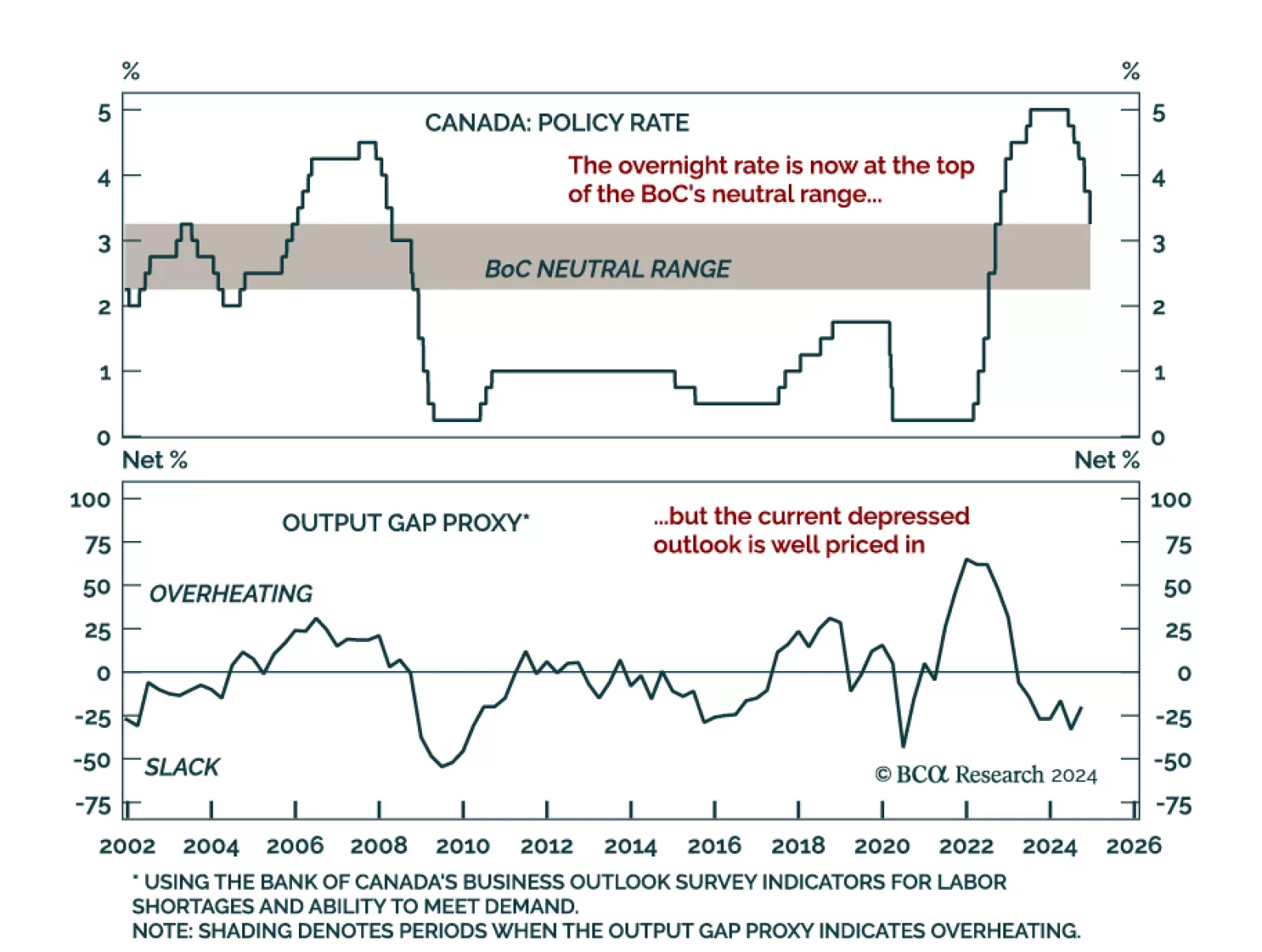

The Bank of Canada cut the overnight rate by 50 bps to 3.25%, a move predicted by economists and roughly priced in. The consecutive supersized cut brings the policy rate in the upper end of the 2.25%-to-3.25% range the BoC…

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

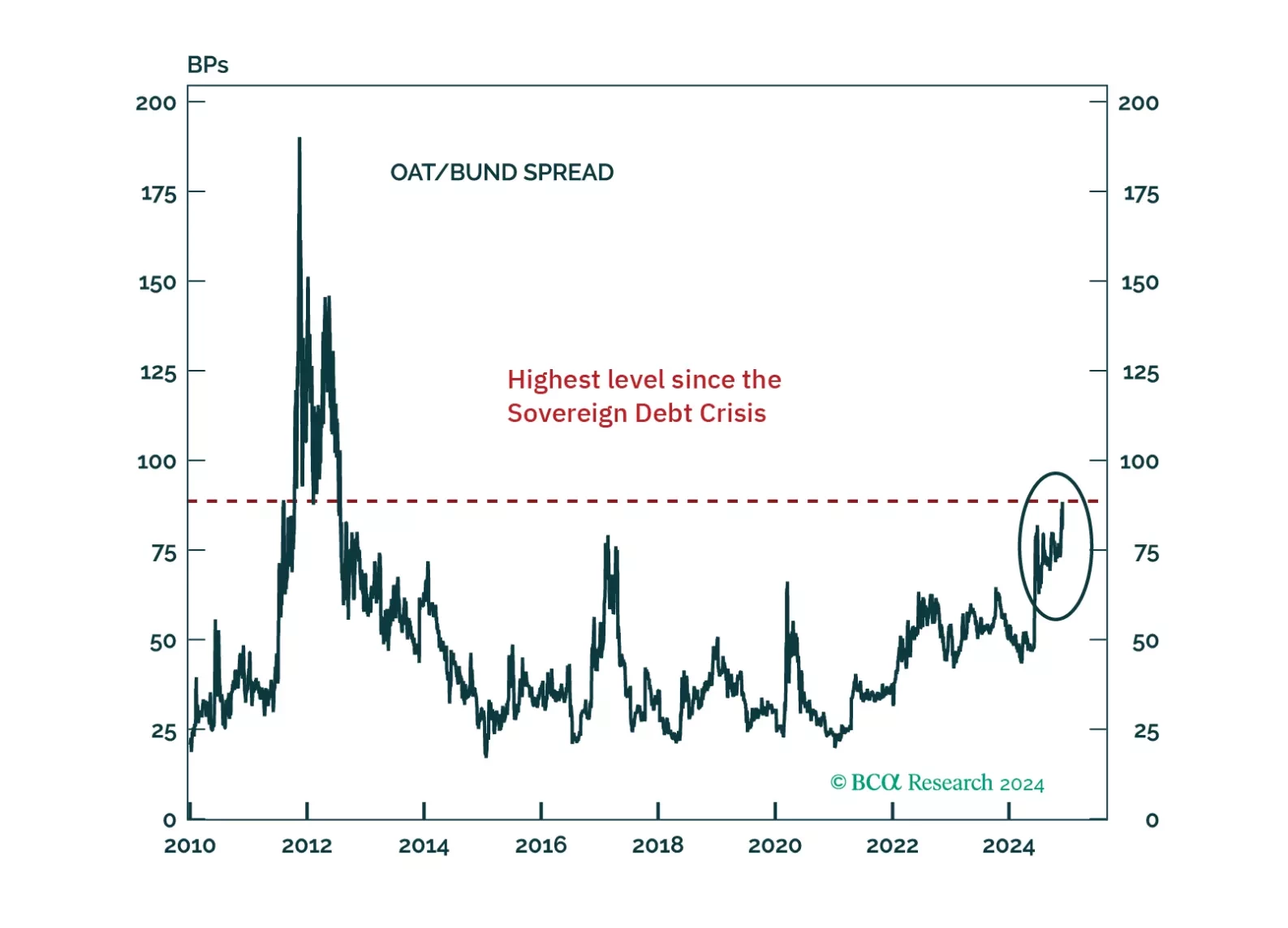

France finds itself in a unique, thorny situation. Can it heave itself out of it? And what does it mean for investors?

Our Portfolio Allocation Summary for November 2024.

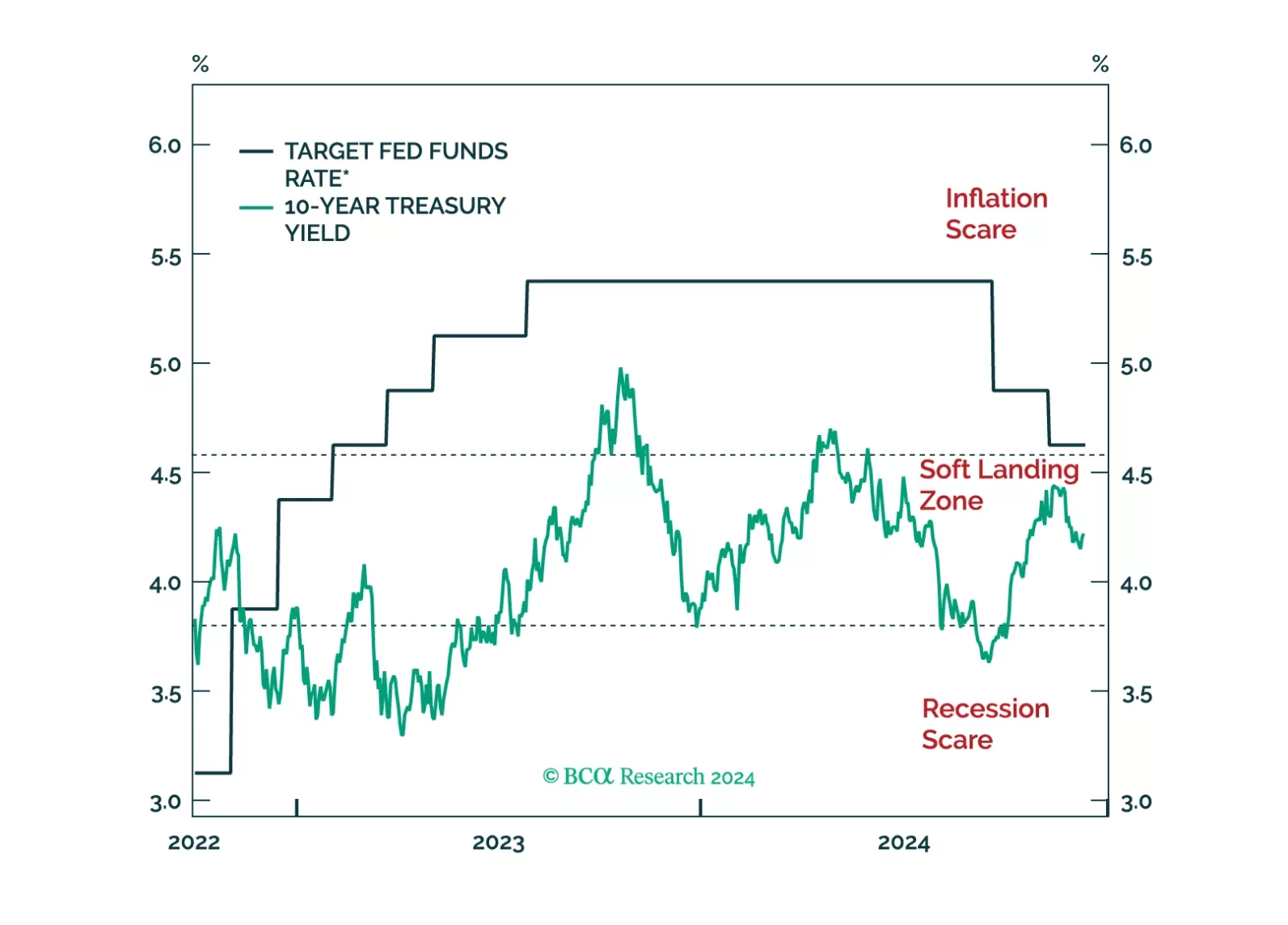

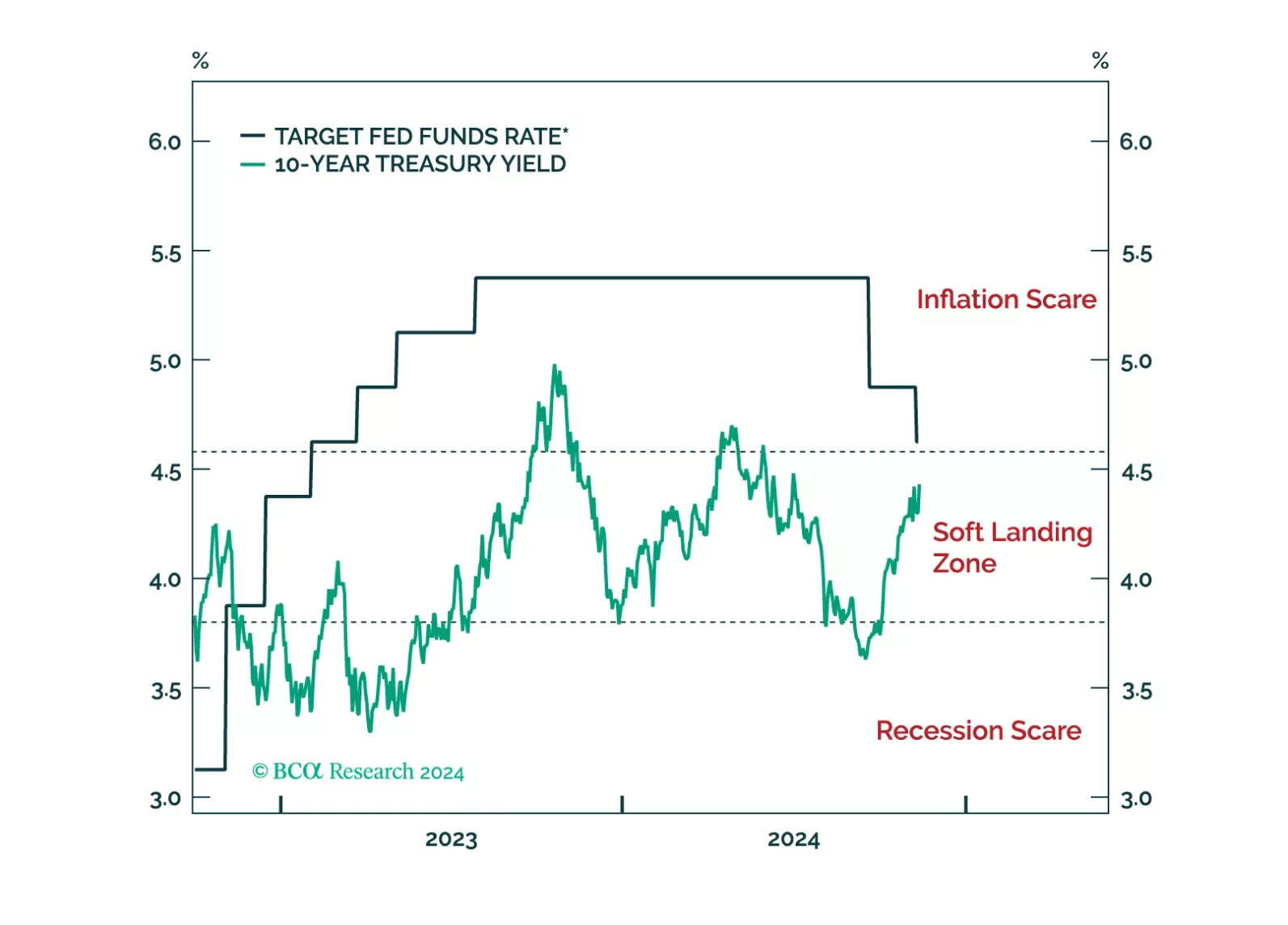

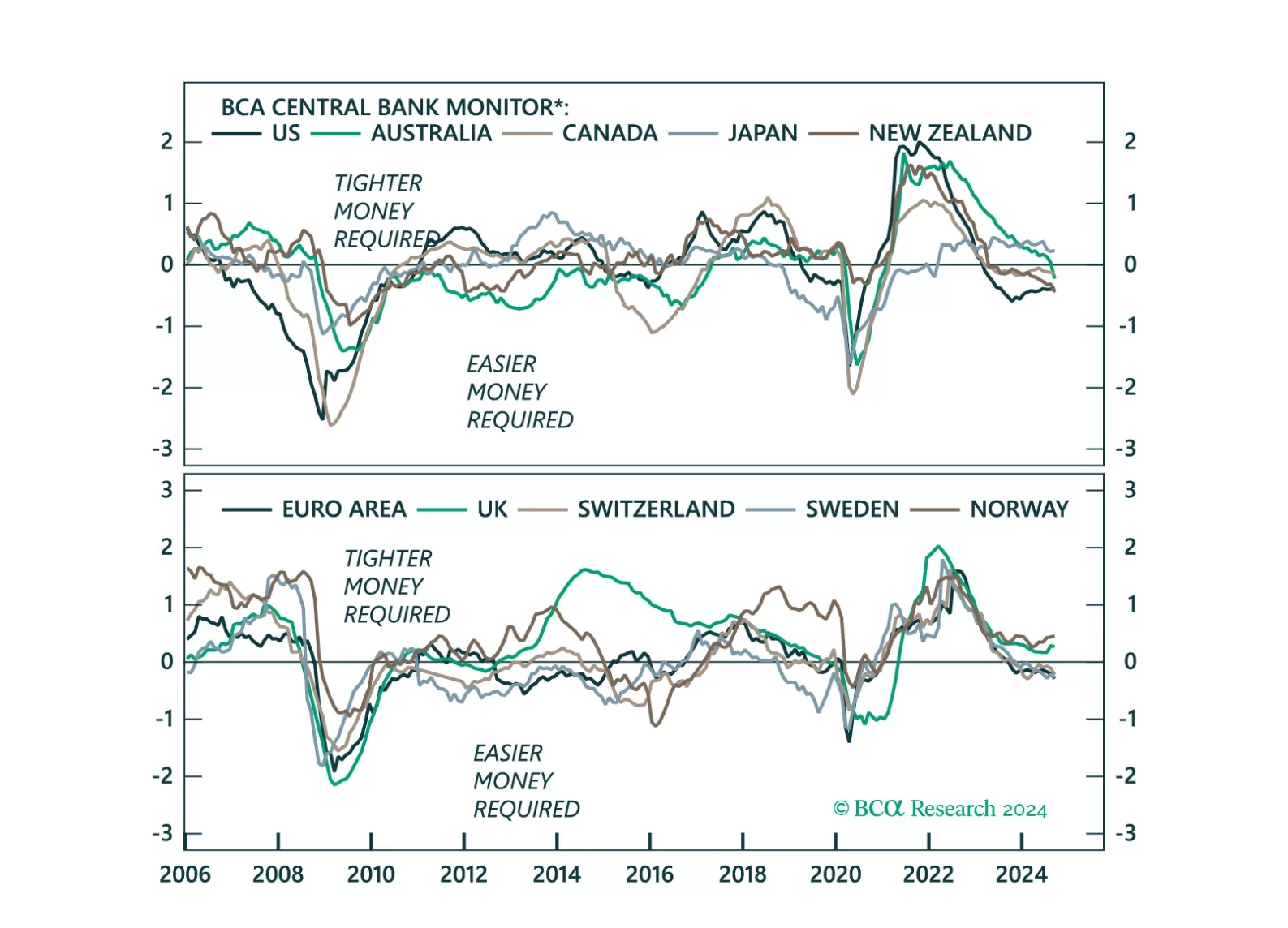

This week, we update our Central Bank Monitors (CBMs), that help us calibrate how monetary policy should be adjusted in developed-market economies. Our conclusion is that while overall, easier monetary settings are required, there a…

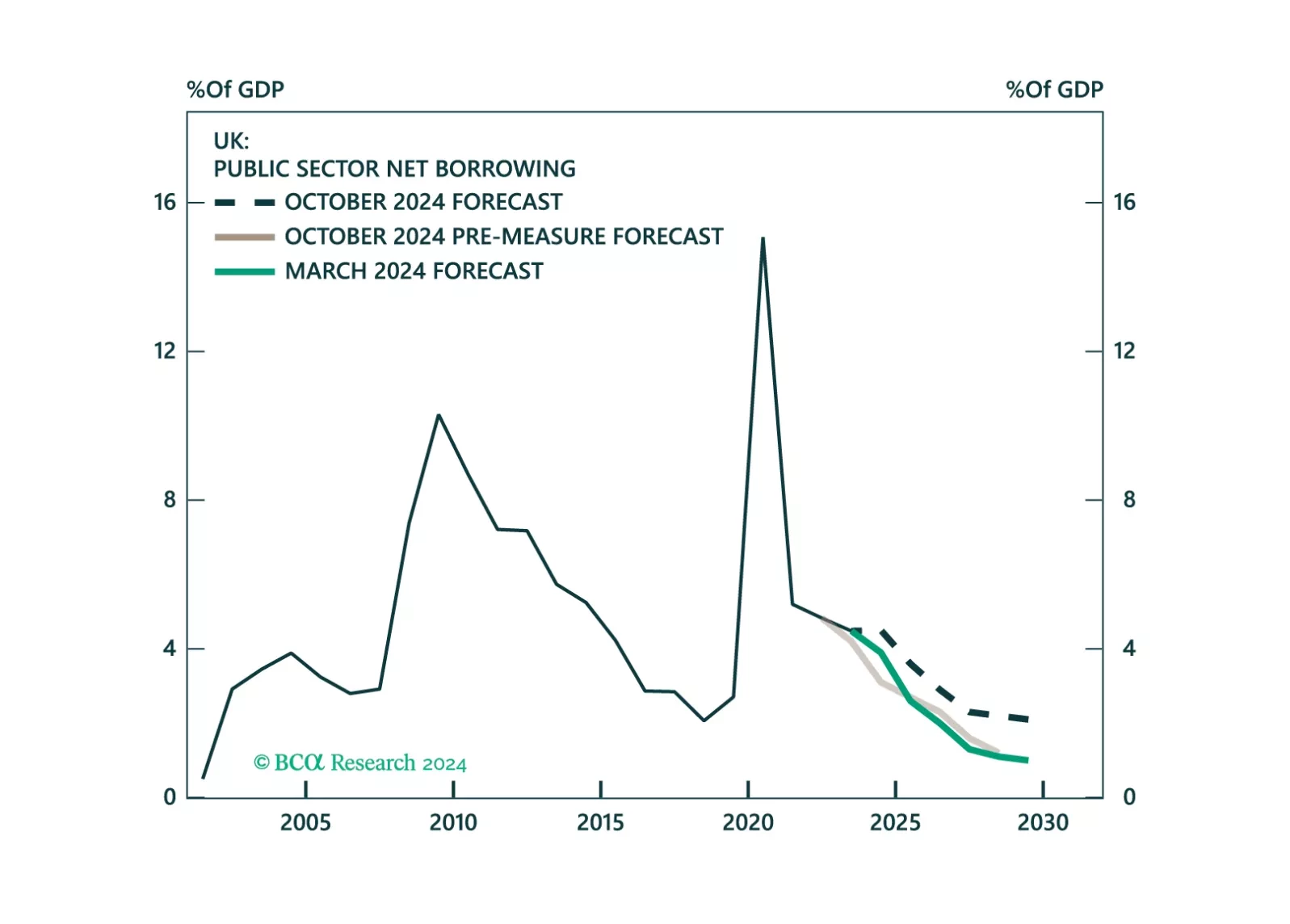

This Strategy Insight presents our view on today’s rate cut by the Bank of England as well as the budget announced by the UK government last week.